Professional Documents

Culture Documents

PPI Final Demand and Commodity Market Tips

Uploaded by

sreelu42Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPI Final Demand and Commodity Market Tips

Uploaded by

sreelu42Copyright:

Available Formats

PPI Final Demand and Commodity Market Tips

Crude Oil prices in the electronic trading session are trading flattish as prices take a breather post the near 4.5% drop this week. While Asian equities continue to trade lower amidst disappointing economic cues from China, we continue to maintain a negative bias on the commodity. Wednesdays weekly inventory report too showed that total stocks rose to 370 million barrels, its highest level since December last year. Meanwhile, crude production in the US increased to 8.18 MBPD, the highest since July 1988. Today, the US PPIM data is due however, are not expecting any major boost from the same. Crude's backwardation is slowly but steadily coming down at the NYMEX, a clear indicator that the demand is reducing whereas India is taking the impact of higher interest rates. We saw the contango between the March and April contracts rising by nearly Rs 20 yesterday. While we had already recommended a buying in this spread on declines, we feel some more profit potential is possible in this spread ahead of the expiry. For the day, our local MCX prices could take some impact from the rupees deprecation and thus, we might see a little bit of divergence between the NYMEX and MCX prices for the day. Nevertheless, we maintain a selling bias on the commodity and recommend selling from the higher levels. Global market analysis: A lot of events occurred overnight. Russian tensions escalated, equities in the US fell by more than a percent while its bonds rallied. The ECB's president Draghis comments on managing the deflation pulled the euro back to trading down from its biggest gain and is now trading at $1.3860. This morning, the Asian markets have slumped and are trading down by more than a percent. Coming to commodities, no major change is expected in the trend and, it is managing to stay at the same levels. Coming to crude oil, WTI Oil traded ranged yesterday and the Brent fell despite tracking the negative cues in Ukraine. This morning, WTI is seen trading at $98.17 for the WTI oil futures contract. We hold a bearish view on oil for the day but believe that the losses may not be significant. In the next week, it may extend its losses owing to the higher crude stockpiles in the US and oil, taking no cues from the Brent and the Russian tensions. For the day, we hold a bearish view on oil and expect that, due to the weakness in the equity markets, the losses in the global market may extend while the losses may be lower at the domestic market due to the currency depreciation. We suggest remaining on the selling side in natural gas for the day.

Commodity Market Tips

SELL NATURAL GAS MCX MAR NEAR 272 SL 276.5 TGT 267 SELL MENTAH OIL MCX APR NEAR 847 SL 585 TGT 837 Today Economic Data Indicators:

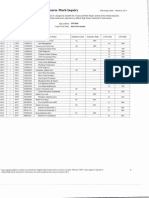

DATE TIME Region Indicator Period Survey Prior

14.03.14 14.03.14 14.03.14 14.03.14 14.03.14 14.03.14 14.03.14 14.03.14 14.03.14

12:30 12:30 12:30 15:00 15:30 15:30 18:00 18:00 03/18

IN GE GE UK UK EC EC US US

Wholesale Prices YoY CPI MoM CPI YoY Construction Output SA MoM Construction Output SA YoY Employment QoQ Employment YoY PPI Final Demand MoM Univ. of Michagan Confidence

Feb Feb F Feb F Jan Jan 4Q 4Q Feb Mar

4.9% 0.5% 1.2% -------0.2% 81.7

5.1% 0.5% 1.2% 2.0% 6.3% 0.0% -0.8 0.2% 81.6

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Mission and VisionDocument5 pagesMission and VisionsanjedNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Computer System Validation - Definition and Requirements - MustRead PDFDocument3 pagesComputer System Validation - Definition and Requirements - MustRead PDFtraining validNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 220245-MSBTE-22412-Java (Unit 1)Document40 pages220245-MSBTE-22412-Java (Unit 1)Nomaan ShaikhNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- SafetyRelay CR30Document3 pagesSafetyRelay CR30Luis GuardiaNo ratings yet

- Img 20201010 0005Document1 pageImg 20201010 0005Tarek SalehNo ratings yet

- Magic Bullet Theory - PPTDocument5 pagesMagic Bullet Theory - PPTThe Bengal ChariotNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Genil v. Rivera DigestDocument3 pagesGenil v. Rivera DigestCharmila SiplonNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Mueller Hinton Agar (M-H Agar) : CompositionDocument2 pagesMueller Hinton Agar (M-H Agar) : CompositionRizkaaulyaaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- PM Jobs Comp Ir RandDocument9 pagesPM Jobs Comp Ir Randandri putrantoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grade 8 Science - Second GradingDocument5 pagesGrade 8 Science - Second GradingMykelCañete0% (1)

- Optimized Maximum Power Point Tracker For Fast Changing Environmental ConditionsDocument7 pagesOptimized Maximum Power Point Tracker For Fast Changing Environmental ConditionsSheri ShahiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Total Physical Response (G4)Document3 pagesTotal Physical Response (G4)Aq Nadzrul LarhNo ratings yet

- Alfa Week 1Document13 pagesAlfa Week 1Cikgu kannaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- DIR-819 A1 Manual v1.02WW PDFDocument172 pagesDIR-819 A1 Manual v1.02WW PDFSerginho Jaafa ReggaeNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Enlightened ExperimentationDocument8 pagesEnlightened ExperimentationRaeed HassanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Been There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerDocument8 pagesBeen There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerNanis DimmitrisNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Ch-10 Human Eye Notes FinalDocument27 pagesCh-10 Human Eye Notes Finalkilemas494No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Mcdaniel Tanilla Civilian Resume Complete v1Document3 pagesMcdaniel Tanilla Civilian Resume Complete v1api-246751844No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2Document8 pages2Eduardo Antonio Comaru Gouveia75% (4)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- PDFDocument3 pagesPDFAhmedraza123 NagdaNo ratings yet

- Quotation of Suny PDFDocument5 pagesQuotation of Suny PDFHaider KingNo ratings yet

- Hele Grade4Document56 pagesHele Grade4Chard Gonzales100% (3)

- Lightning Arrester Lightningcontroller MC 125-B/Npe: Operation and Fields of ApplicationDocument2 pagesLightning Arrester Lightningcontroller MC 125-B/Npe: Operation and Fields of ApplicationAnas BasarahNo ratings yet

- Soft Skills & Personality DevelopmentDocument62 pagesSoft Skills & Personality DevelopmentSajid PashaNo ratings yet

- SG110CX: Multi-MPPT String Inverter For SystemDocument2 pagesSG110CX: Multi-MPPT String Inverter For SystemKatherine SmithNo ratings yet

- Grade 7 Nap MayDocument6 pagesGrade 7 Nap Mayesivaks2000No ratings yet

- Loctite 586 PDFDocument9 pagesLoctite 586 PDForihimieNo ratings yet

- Conducting Focus GroupsDocument4 pagesConducting Focus GroupsOxfam100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivoDocument2 pages2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivopasferacosNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)