Professional Documents

Culture Documents

Ijebea14 113

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ijebea14 113

Copyright:

Available Formats

International Association of Scientific Innovation and Research (IASIR)

(An Association Unifying the Sciences, Engineering, and Applied Research)

ISSN (Print): 2279-0020 ISSN (Online): 2279-0039

International Journal of Engineering, Business and Enterprise Applications (IJEBEA) www.iasir.net The Determinant Factor of Dividend Policy at Non Finance Listed Companies

Farah Margaretha Leon1 & Pradana Maulana Putra Faculty of Economics, Trisakti University, Jakarta Indonesia Abstract: This paper aims to investigate the determinant factor of dividend policy. Sample that use in this paper are non-finance company which listed in Indonesian Stock Exchange on 2006-2009 period. This paper use profitability, cash flow, sales growth, tax, debt equity ratio, dan market to book ratio as independent variable. The variables dependent of this study is dividend payout ratio, and it is measured by standard dividend payout ratio and adjusted dividend payout ratio. The purposive sampling was used to determine which acceptable company to support this paper. Method that used is ordinary least square regression. According to value of significance of the regression, profitability is the factor that affect dividend payout ratio on all measurement, then sales growth is the factor that affect dividend payout ratio only measured by adjusted dividend. The other variables are found that they are not the determinant factors of dividend payment. This result indicate that management should pay attention to profitability and sales growth when makes dividend policy. Keywords: adjusted dividend payout ratio, cash flow, debt equity ratio, market to book ratio, profitability, sales growth, standard dividend payout ratio, tax.

I. Introduction Dividend policy is really important for investors and company. Dividend payment is one of the investorss purpose when investing their money for the stock. Firm uses dividend to attract investor and to maximize shareholders wealth. Dividend payout has been a subject of debate in financial literature. Many researches revealed factors that company should consider while make dividend policy. In this study, dividend policy is policy that manager made for determine amount of distributable earning for shareholder. Modgliani and Miller (1958, 1961) conclude that in perfect market, firms value is not affected by payment of dividend. Based on their researches, firms value is determined by ability of firm to obtain earning. Their researches assume no taxes, no floatation cost, and investor has same information as manager has. But at recent, many researches find contradictive evidence and conclude that dividend policy could affect firms value. Firms earning can be invested into operating assets, to acquire securities, to retire debt, or distributed to shareholder. There are many reasons firm should pay or no pay dividend. For example, dividend is important for investor, because it provide information of companys income. Dividend can be used to manage stock price, but when company retained its earning, that money can be reinvested. Since as many researches find that firms value can be affected by dividend policy, many factors came up to be considered while make dividend policy. Research studied by Gill et al.(2010) used standard dividend payout ratio and adjusted dividend payout ratio as proxy of dividend payout. Different between two is depreciation is used on formula of adjusted dividend payout ratio. Based from the background, the purpose of this study is to analysis the impact of profitability cash flow, corporate tax, sales growth, market to book ratio and debt equity ratio with dividend payout ratio. II. Literature and Hypothesis Profitabilty has always become mayor factor when determines dividend policy (Gill et al., 2010). Amidu and Abor (2006) found that firm with high profitability tend to pay high dividend. Then profitability has positive influence to dividend payout ratio. Same result founded by Pruit and Gitman (1991), that profitability affect dividen positively. They conclude firms earning at current year and last year can affect dividend payment. Al -

IJEBEA 14-113; 2014, IJEBEA All Rights Reserved

Page 22

Farah Margaretha Leon et al., International Journal of Engineering, Business and Enterprise Applications, 7(1), December 2013- February 2014, pp. 22-26

Nazzar also found positive relation between profitability and dividend payout ratio, higher profitability makes higher dividend payout ratio. Good cash flow position means good liquidity of firm. Alli et al.(1993) found positive relation between cash flow and dividend payout ratio. According to their study, cash flow is better than profitability to describe dividend payout ratio . The reason is because profitabilty is affected by accounting practices. Amidu and Abor (2006) found cash flow has positive relation to dividend payout ratio. They conclude firm will raise it dividend when has a good liquidity position, also firm with stable cash flow tend to pay higher dividend. Same result also founded by Anil and Kapoor (2008), that cash flow affected dividend payout ratio positively and cash flow is an important factor to determine dividend. Modigliani and Miller (1961) argues that high tax liabilities will raise payment of dividend. They found positive relation between tax and dividend payout ratio. Their study assumes high tax liabilities are effect of high profitability. While high profitability has positive relation to dividend payout ratio. Amidu and Abor (2006) found positive relation between tax and dividend payout ratio. This result also found by Gill et al.(2010), that tax affected dividend payout ratio positively. Sales growth can affect dividend payout ratio. Firm with high growth will retained their earning to reinvest it rather than to ditribute as dividend. Then high growth means high needs of funding or money, so it can reduce the payment of dividend (Myers, 1984). Amidu and Abor (2006) found negative relation between sales growth and dividend payout ratio. Same result also founded by Gill et al. (2010), which conclude sales growth affect dividend payout ratio negatively. Good market assestment means firm has better future growth. Firm that has good growth will reduce their payment of dividend, because its need of fund (DSouza and Saxon, 1999). They found negative relation between market to book ratio and dividend payout ratio. Amidu and Abor (2006) also found negative relation between market to book ratio and dividend payout ratio. They conclude when firm has high growth, it will retained more earning thus reduce their dividend. According to Gill et al.(2010) debt to equity ratio can be refer as gearing or leverage or risk. Pruit and Gitman (1991) conclude that debt can affect dividend payout ratio. Firm with higher debt will reduce its dividend paymetnt. This can happen because firm tend to pay its liabilities (debt) than to pay dividend, thus there is a negative relation between debt equity ratio and dividend payout ratio. DSouza and Saxon (1999) found leverage affect dividend payout ratio negatively. Same result also founded by Al-Nazzar (2009), firm with higher debt tend to reduce their dividend. III. Hypothesis Based from the literature review the hypothesis at this study are: H1 : Profitability has influence relation to dividend payout ratio H2 : Cash flow has positive influence between cash flow and dividend payout ratio H3 : Tax has positive influence to dividend payout ratio H4 : Sales growth has negative influence to dividend payout ratio H5 : Market to book ratio has negative influence to dividend payout ratio H6 : Debt to equity ratio has negative influence to dividend payout ratio IV. Data and Methodology Samples in this study are non finance company which listed in INDONESIAN STOCK EXCHANGE, from 2006 to 2009. The sample should have complete financial report which require in this study. Based from this criteria there are twenty six companies as a sample. This study is using ordinary least square regression as data analysis method. STANDARD PAYOUTi = b0 + b1 PROFi + b2CASHi + b3TAXi + b4GROWi + b5MTBVi + b6D/Ei + i,t ADJUSTED PAYOUTi = b0 + b1 PROFi + b2CASHi + b3TAXi + b4GROWi + b5MTBVi + b6D/Ei + i,t STANDARD PAYOUT = standard deviation of dividend payout ratio ADJSUTED PAYOUT = adjusted dividend payout ratio PROF = profitability CASH = cash flow TAX = tax rate GROW = sales growth MTBV = market to book ratio D/E = debt to equity ratio = error

IJEBEA 14-113; 2014, IJEBEA All Rights Reserved

Page 23

Farah Margaretha Leon et al., International Journal of Engineering, Business and Enterprise Applications, 7(1), December 2013- February 2014, pp. 22-26

V. Result and Discussion Companies in Indonesia pay their dividend on second quartile of the year. This is occurred because the time lag from making annual reports of the company. The annual reports must meet all the terms, conditions, and other administration requirements from IFRS. That is why the annual reports is done a year after the current fiscal year. Meanwhile, dividend policy is based on the annual reports of the firms. Therefore the dividend policy must be postponed by the making of annual reports. The detail data can be seen at table 2. Profitability has positive influence to dividend payout ratio-which measured by standard dividend payout ratio and adjusted dividend payout ratio. This result also found by Gill et al. (2010), Pruit and Gitman (1991), and AlNazzar (2009). Higher profitability may make firm has more money. More money makes firm able to pay dividend and also to retain their earning. Therefore higher profitability tend firm pay more dividend. There is no influence of cash flow to dividend payout ratio. This result is contradi ct with Amidu and Abors (2006). They found a positive influence for cash flow to dividend payout ratio. However, this result is similar with Gill et al. (2010). No influence of cash flow might happen because the firm do not hang dividend policy in cash flow, but in profitability. This research shows there is no influence from tax to dividend payout ratio (table 3). The result is contradict with Amidu and Abor (2006) and Gill et al. (2010). The different between tax policy in Indonesia with another country may be the reason behind this. Sales growth has no influence to standard dividend payout ratio (table 3). This is contrast with Amidu and Abor (2006) and Gill et al. (2010). However sales growth has negative influence to adjusted dividend payout ratio (table 4), which is in line with result from Gill et al. (2010). Gill et al. (2010) said that this might happen because different measurement used by standard dividend payout ratio and adjusted dividend payout ratio, which is use of depreciation. Adjusted dividend payout ratio does not use depreciation when calculate net income, but standard dividend payout ratio use it. Sales growth has no influence to dividend is supported by dividend residual theory. The theory says firm will pay its dividend until all earning has been funded all acceptable investment. So as long as company still needs earning, dividend may not be paid. Based on this research there is no influence from market to book ratio to standard dividend payout ratio which contradict to result from Amidu and Abor (2006) but same with Gill et al. (2010). Moreover, market to book ratio also has no influence to adjusted dividend payout ratio (table 4) which contrast with result from Amidu and Abor (2006) but same as DSouza and Saxena (1999). These results might happen because there is no relation between share price to dividend, as described in dividend irrelevance. Meanwhile measurement of market to book ratio uses share price. Debt to equity ratio has no influence to dividend payout ratio in this research. This result similar to Gill et al. (2010) and Afza and Amirza (2010), but contrast to Al-Nazzar (2009). The reason is may because firm does not use debt to pay their dividend and to settle their dividend policy. This research shows that profitability is used to pay and settle dividend of the firm instead of debt. VI. Conclusion Purpose of this study is to find any influence between dividend payout ratio with profitability, cash flow, tax, sales growth, market to book ratio, and debt to equity ratio in non-financial firms which listed in Indonesian Stock Exchange year 2006-2009. Based on results and analysis, profitability has positive influence to dividend payout ratio. Sales growth has negative influence to dividend payout ratio which measured by adjusted dividend payout ratio. Variables cash flow, tax, market to book ratio, and debt equity ratio has no influence to dividend payout ratio. Based on this research, firms can use profitability and sales growth when make dividend policy. Higher profitability makes firm has more money, so firm can pay more dividend. Higher sales growth makes firm needs more money, so it can lower payment of dividend. Profitability and sales growth can be used for investor, in their effort for dividend purposes. VII. References

1. 2. 3. 4. Afza, Talat and Mirza, Hammad Hassan. (2010). Ownership Strucuture and Cash Flow as Determinant of Dividend Policy in Pakistan, International Business Research, 3(3) :210-223. Al-Najjar, Basil. (2009). Dividend Behaviour and Smothing New Evidence from Jordanian Panel Data, Studies in Economics and Finance, 26(3): 182-197. Alli, Kasim L.; Khan, A.Qayyum and Ramirez, Gabriel G. (1993). Determinants of Corporate Dividend Policy: a Factorial Analysis, The Financial Review, 28(4): 523-547. Aivazian, Varouj; Booth, Lawrence. and Cleary, Sean. (2003). Do emerging market firms follow different dividend policies from US firms?, Journal of Financial Research, 26(3): 371-387.

IJEBEA 14-113; 2014, IJEBEA All Rights Reserved

Page 24

Farah Margaretha Leon et al., International Journal of Engineering, Business and Enterprise Applications, 7(1), December 2013- February 2014, pp. 22-26

5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22.

Amidu,Mohammed and Abor,Joshua. (2006). Determinants of Dividen Payout Ratios in Ghana, The Journal of Risk Finance, 7(2): 136-145. Anil,K. and Kapoor, S. (2008). Determinants of Dividend Payout Ratios-A Study of Indian Information Technology Sector, International Research Journal of Finance and Economics, 15: 64-71. Baker,H.Kent.; Farrelly,Gail E. and Edelman,Richard,B.(1986). A Survey of Management Views on Dividend Policy, Financial Mangement,14(3): 78-84. Brigham, Eugene F. and Erhardt, Michael C. (2005). Financial Management: Theory and Practice(11th ed.), USA, Thomson: Southwestern DSouza, Juliet and Saxena,Atul T. (1999). Agency cost, market risk, investment opportunities and dividend policy: an International Perspective, Manajerial Finance, 25(6): 35-43. Fairfield, Patricia M. and Harris, Trevor S. (1993). Price-earnings and price-to-book anomalies: Tests of an intrinsic value explanation, Contemporary Accounting Research, 9(2) : 590-610. Gill, Amarjit; Biger, Nahum. and Tiberwala, Rajendra. (2010). Determinant of Dividend Payout Ratios : Evidence from United States, The Open Business Journal,3: 8-14. Gitman, Lawrence J. (2009), Principle of Managerial Finance, (11 th edition). Pearson Education .Inc. Jensen, Michael C. and Meckling, William. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure , Journal of Financial Economics, 3: 305360. Masulis, Ronald W. and Trueman,Brett. (1988). Corporate Investment and Dividend Decisions Under Differential Personal Taxation, Journal of Financial and Quantitative Analysis, 23(4): 369-384 Miller, Merton H. and Rock, Kevin. (1985). Dividend Policy under Asymmetric Information, The Journal of Finance, 40(4): 10311051. Modigliani, Franco. and Miller, Merton H. (1958). The Cost of Capital, Corporate Finance, and The Theory of Investment, The American Economic Review, 48(3): 261-280. Modigliani, Franco. and Miller, Merton H. 1961). Dividend Policy, Growth, and the Valuation of Shares. The Journal of Business, 34(4): 411-433. Myers, Stewart C.(1984). The Capital Structure Puzzle, The Journal of Finance. 39(3): 575-592. Myers, Stewart C. and Majluf, Nicholas S.(1984). Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have, Journal of Financial Economics, 13: 187-221. Pruitt, Stephen W. and Gitman, Lawrence J.(1991). The Interactions Between the Investment, Financing, and Dividend Decisions of Major U.S. Firms, 26(3): 409-430. Shahjahanpour,A. ; Ghalambor,H. and Aflatooni,A.(2010). The Determinant of Capital Structure Choice in the Iranian Companies, International Research Journal of Finance and Economics,56: 167-175. Zeng, Tao. (2003). What Determines Dividend Policy : a Comperhensive test, Journal of American Academy of Business, 2 (2): 304310.

Table 1: Variable and Measurement

Variable Dependent 1. Standard deviation of dividend payout ratio S= xi = payout ratio = mean of payout ratio 2. Adjusted dividend payout ratio Adj DPR = Profitability = Cash flow = Log cash flow from operation activities Tax rate = Sales growth = Taken from summary report of Indonesian Stock Exchange Taken from summary report of Indonesian Stock Exchange Measurement

Independent 1. Profitability 2. 3. 4. 5. 6. Cash flow (CF) Tax Sales growth Market to book ratio Debt to equity ratio

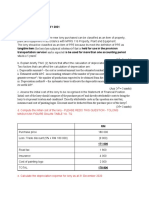

Table 2 : Statistic Descriptive

Variables Standard deviation of dividend payout ratio Adjusted dividend payout ratio Profitability Cash Flow Tax Sales Growth Debt equity ratio Market to book ratio Minimum Maximum Mean Standard Deviation 0,01 0,01 0,02 3,37 -1,32 -0,201 0,10 0,22 1,57 1,05 0,56 7,02 3,53 1,133 8,44 22,79 0,4650 0,3240 0,1928 5,4966 0,3127 0,0505 0,9177 3,4232 0,30759 0,24541 0,13006 0,80213 0,40888 0,1686 1,13243 4,22817

IJEBEA 14-113; 2014, IJEBEA All Rights Reserved

Page 25

Farah Margaretha Leon et al., International Journal of Engineering, Business and Enterprise Applications, 7(1), December 2013- February 2014, pp. 22-26

Table 3 : Regression of Standard Dividend Payout Ratio

Independent Variables Profitability Cash Flow Tax Sales growth Debt to equity ratio Market to book ratio R square = 0,187 Coeffecient of Regression 0,414 -0,102 -0,121 -0,167 0,112 0,081 F-value = 3,727 Significance 0,015 0,358 0,218 0,101 0,429 0,601 sig = 0,002

Table 4 : Regression of Adjusted Dividend Payout Ratio

Variable Independence Profitability Cash Flow Tax Sales growth Debt to equity ratio Market to book ratio R square = 0.465 Coeffecient of Regression 0,687 -0,077 -0,121 -0,234 -0,008 0,098 F-value = 14.050 Significance 0,000 0,392 0,131 0,005 0,924 0,433 sig = 0.000

IJEBEA 14-113; 2014, IJEBEA All Rights Reserved

Page 26

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Laser Field Characteristics Investigation in The Chemisorption Process For The System Na/WDocument12 pagesLaser Field Characteristics Investigation in The Chemisorption Process For The System Na/WInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Effect of On Parenting Styles On Academic Achievement and Adjustment Problem of TeenageDocument10 pagesEffect of On Parenting Styles On Academic Achievement and Adjustment Problem of TeenageInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Design, Analysis of Flow Characteristics of Exhaust System and Effect of Back Pressure On Engine PerformanceDocument5 pagesDesign, Analysis of Flow Characteristics of Exhaust System and Effect of Back Pressure On Engine PerformanceInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Seismic Analysis of Tall TV Tower Cosidering Different Bracing SystemsDocument7 pagesSeismic Analysis of Tall TV Tower Cosidering Different Bracing SystemsInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- High Rated Integrated Solar Dryer and CookerDocument8 pagesHigh Rated Integrated Solar Dryer and CookerInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- An Overview of Changing Trend of Traditional Retailing To I-Retail in IndiaDocument7 pagesAn Overview of Changing Trend of Traditional Retailing To I-Retail in IndiaInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Survey Paper On Image Retrieval AlgorithmsDocument4 pagesSurvey Paper On Image Retrieval AlgorithmsInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 164Document4 pagesIjebea14 164vishalr245No ratings yet

- Ijebea14 149Document5 pagesIjebea14 149International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Implementation of Human Resource in Total Quality ManagementDocument6 pagesImplementation of Human Resource in Total Quality ManagementInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Implementation of Coherent Optical Digital Communication Systems Using Digital Signal Processor & FPGADocument6 pagesImplementation of Coherent Optical Digital Communication Systems Using Digital Signal Processor & FPGAInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 147Document5 pagesIjebea14 147International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 157Document6 pagesIjebea14 157International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 141Document7 pagesIjebea14 141International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 105Document10 pagesIjebea14 105International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 145Document5 pagesIjebea14 145International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 127Document9 pagesIjebea14 127International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 116Document5 pagesIjebea14 116International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Holographic Projections Using Sixth SenseDocument4 pagesHolographic Projections Using Sixth SenseInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Ijebea14 134Document6 pagesIjebea14 134International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Does Long Memory Matter in Oil Price Volatility Forecasting?Document8 pagesDoes Long Memory Matter in Oil Price Volatility Forecasting?International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Wind Energy Penetration Into Grid To Mitigate The Ui Impact On UtilitiesDocument8 pagesWind Energy Penetration Into Grid To Mitigate The Ui Impact On UtilitiesInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Spatial Integration of Maize Marketing in NigeriaDocument11 pagesSpatial Integration of Maize Marketing in NigeriaInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Entrepreneurial Opportunities in Sericulture IndustryDocument5 pagesEntrepreneurial Opportunities in Sericulture IndustryInternational Association of Scientific Innovations and Research (IASIR)67% (3)

- FFM: A Muscle Fatigue Index Extraction by Utilizing Fuzzy Network and Mean Power FrequencyDocument11 pagesFFM: A Muscle Fatigue Index Extraction by Utilizing Fuzzy Network and Mean Power FrequencyInternational Association of Scientific Innovations and Research (IASIR)100% (1)

- Investigations On The Effect of Moisture Content and Variety Factors On Some Physical Properties of Pumpkin Seed (Cucurbitaceae SPP)Document5 pagesInvestigations On The Effect of Moisture Content and Variety Factors On Some Physical Properties of Pumpkin Seed (Cucurbitaceae SPP)International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Reverse Engineering of Business Processes in Brake Manufacturing Unit: A Mutual Attitude.Document5 pagesReverse Engineering of Business Processes in Brake Manufacturing Unit: A Mutual Attitude.International Association of Scientific Innovations and Research (IASIR)No ratings yet

- INCREASED NITRIC OXIDE SYNTHASE ACTIVITY in GASTRIC FUNDAL MUSCLES From RATS With DIABETESDocument7 pagesINCREASED NITRIC OXIDE SYNTHASE ACTIVITY in GASTRIC FUNDAL MUSCLES From RATS With DIABETESInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- Investigations On The Effects of Moisture Content and Variety Factors On Some Mechanical Properties of Pumpkin Seed (Cucurbitaceae SPP)Document6 pagesInvestigations On The Effects of Moisture Content and Variety Factors On Some Mechanical Properties of Pumpkin Seed (Cucurbitaceae SPP)International Association of Scientific Innovations and Research (IASIR)No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Solution - Problem 13-18Document45 pagesSolution - Problem 13-18Angelika Delosreyes VergaraNo ratings yet

- Mediclinic Group 2023 ResultsDocument17 pagesMediclinic Group 2023 ResultsBack To NatureNo ratings yet

- Capital Structure Theory 2Document39 pagesCapital Structure Theory 2sanjupatel333No ratings yet

- Alliance Bank: ResearchDocument4 pagesAlliance Bank: ResearchZhi_Ming_Cheah_8136No ratings yet

- Ch04 Cost Volume Profit AnalysisDocument21 pagesCh04 Cost Volume Profit AnalysisYee Sook Ying0% (1)

- Found-ENG-L6-Basic - Financial - Plan - Template - With ExplanationDocument5 pagesFound-ENG-L6-Basic - Financial - Plan - Template - With ExplanationNone TwoNo ratings yet

- 3a Far210 Topic 3 - Discussion of Tutorial QuestionsDocument5 pages3a Far210 Topic 3 - Discussion of Tutorial QuestionsniklynNo ratings yet

- Exercise 4 Shareholders EquityDocument9 pagesExercise 4 Shareholders EquityNimfa SantiagoNo ratings yet

- Final Examination in Accounting For Business CombinationDocument9 pagesFinal Examination in Accounting For Business CombinationJasmin Dela CruzNo ratings yet

- Chart of Accounts: Appendix UDocument3 pagesChart of Accounts: Appendix Ujawadr218No ratings yet

- Discussion 8 SolutionsDocument3 pagesDiscussion 8 Solutionsairene davidNo ratings yet

- Report Audit PT Greenwood Sejahtera TBK 2020Document100 pagesReport Audit PT Greenwood Sejahtera TBK 2020NYansyahNo ratings yet

- FSA Midterm Exam FormattedDocument8 pagesFSA Midterm Exam Formattedkarthikmaddula007_66No ratings yet

- Gilbert Company-WPS OfficeDocument17 pagesGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- CH 10 PPT Examples Relaxing Credit Standards QnssolnsDocument8 pagesCH 10 PPT Examples Relaxing Credit Standards QnssolnsRiri FahraniNo ratings yet

- List of Members DYSAS 2010-2011Document24 pagesList of Members DYSAS 2010-2011jaymark canayaNo ratings yet

- Corporate Finance Case 2 ამხოსნაDocument3 pagesCorporate Finance Case 2 ამხოსნაIrakli SaliaNo ratings yet

- Cost Theory & Analysis (CH 5)Document20 pagesCost Theory & Analysis (CH 5)sandeepanNo ratings yet

- Intermediate Accounting: Assignment 2Document2 pagesIntermediate Accounting: Assignment 2Putri SerlyNo ratings yet

- 21U 2093 H Quiz 1Document6 pages21U 2093 H Quiz 1Akshit GoyalNo ratings yet

- Chapter 10 - : Chapter 10 - Cash Flows and Other Topics in Capital BudgetingDocument91 pagesChapter 10 - : Chapter 10 - Cash Flows and Other Topics in Capital BudgetingMichael S. HabibNo ratings yet

- Accounts Question PaperDocument50 pagesAccounts Question PapersonalNo ratings yet

- RJR Nabisco ValuationDocument33 pagesRJR Nabisco ValuationKrishna Chaitanya KothapalliNo ratings yet

- Chapter 2 AnswersDocument62 pagesChapter 2 AnswersMachelMDotAlexanderNo ratings yet

- Analisis Pengaruh DAN Untuk Memprediksi Kondisi (Studi Pada Sektor Industri Perdagangan, Jasa, DAN Investasi Yang Terdaftar DI BEI Tahun 2014-2018)Document15 pagesAnalisis Pengaruh DAN Untuk Memprediksi Kondisi (Studi Pada Sektor Industri Perdagangan, Jasa, DAN Investasi Yang Terdaftar DI BEI Tahun 2014-2018)Michelle ChristabelNo ratings yet

- May 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeDocument28 pagesMay 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeJoseph PhaustineNo ratings yet

- Chapter 10 Manufacturing AccountDocument12 pagesChapter 10 Manufacturing AccountDoreen OngNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaNo ratings yet

- Ratio Analysis of Dangote Cement PLCDocument8 pagesRatio Analysis of Dangote Cement PLCnoemaguma970No ratings yet

- 08 Audit of InvestmentsDocument10 pages08 Audit of InvestmentsAryando Mocali TampubolonNo ratings yet