Professional Documents

Culture Documents

Adv FM

Uploaded by

naveengeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv FM

Uploaded by

naveengeCopyright:

Available Formats

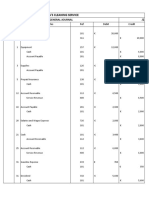

AFM University Question

Page 1

1.Problems & rationale associated with disinvestment of PSU in India

DEFINITION: Disinvestment refers to the action of an organization or the government in selling or liquidating an asset or subsidiary. In simple words, disinvestment is the withdrawal of capital from a country or corporation. Some of the salient features of disinvestment are:

private investors.

ownership. While privatization refers to the transfer of ownership from government to private investors.

PROBLEMS OF PUBLIC SECTOR UNDERTAKINGS: The most important criticism levied against public sector undertakings has been that in relation to the capital employed, the level of profits has been too low. Even the government has criticized the public sector undertakings on this count. Of the various factors responsible for low profits in the public sector Undertakings, the following are particularly important:-

REASONS FOR DISINVESTMENT The public sector in India at present is at cross roads. The new economic policy initiated in July 1991, clearly indicated that the public sector undertakings have shown a very negative rate of return on capital employed. On account of this phenomenon many public sector undertakings have become burden to the government. They are in fact turning out to be liabilities to the government rather than being assets. This is a sector which the government clearly wants to get rid off. In this direction the government has adopted a new approach to reform and improve the public sector undertakings performance i.e. Disinvestment policy'. This has gained lot of importance especially in latter part of 90s. At present the government seriously perceives the

disinvestment policy as inactive tool to reduce the burden to financing the public sector

AFM University Question

Page 2

OBJECTIVE OF THE DISINVESTMENT: Privatization intended to achieve the following:

the public debt

ity MAJOR ISSUES IN DISINVESTMENT 1) Profitability: The return on investment in PSEs, at least for the last two decades, has been quite poor. The PSE survey shows PSEs as a whole, never earned post tax profit that exceeds 5% of total sales or 6% of capital employed , which is at least 3% points below the interest paid by the government on its borrowings. 2) Recurring budgetary support to PSEs: Despite huge investment in the public sector, the Government is required to provide more funds every year that go into maintaining of the unviable/week PSEs 3) Industrial sickness in PSUs: To save the PSUs from sickness, the government has been sanctioning restructuring packages from time to time. 4) Employees issue: Of the 1.6 million jobs added in the organized sector 1 million, or two third, were added in the private sector during the year 1991 to 2000. Page 3

AFM University Question

This indicates that the private sector has become the major sources for incremental employment in the organized sector of the economy over the last decades.

2.Procedure of IPO?

An initial public offering (IPO) or stock market launch is a type of public offering where shares of stock in a company are sold to the general public, on a securities exchange, for the first time. Through this process, a private company transforms into a public company. Initial public offerings are used by companies to raise expansion capital, to possibly monetize the investments of early private investors, and to become publicly traded enterprises. A company selling shares is never required to repay the capital to its public investors. After the IPO, when shares trade freely in the open market, money passes between public investors. Although an IPO offers many advantages, there are also significant disadvantages. Chief among these are the costs associated with the process, and the requirement to disclose certain information that could prove helpful to competitors, or create difficulties with vendors. Details of the proposed offering are disclosed to potential purchasers in the form of a lengthy document known as a prospectus. Most companies undertaking an IPO do so with the assistance of an investment banking firm acting in the capacity of an underwriter. Underwriters provide a valuable service, which includes help with correctly assessing the value of shares (share price), and establishing a public market for shares (initial sale). Alternative methods, such as the dutch auction have also been explored. In terms of size and public participation, the most notable example of this method is the Google IPO. China has recently emerged as a major IPO market, with several of the largest IPO's taking place in that country. Procedure IPOs generally involve one or more investment banks known as "underwriters". The company offering its shares, called the "issuer", enters into a contract with a lead underwriter to sell its shares to the public. The underwriter then approaches investors with offers to sell those shares. The sale (allocation and pricing) of shares in an IPO may take several forms. Common methods include: Best efforts contract Firm commitment contract All-or-none contract Bought deal A large IPO is usually underwritten by a "syndicate" of investment banks, the largest of which take the position of "lead underwriter". Upon selling the shares, the underwriters retain a portion of the proceeds as their fee. This fee is called an underwriting spread. The spread is calculated as a discount from the price of the shares sold (called the gross spread). Components of an underwriting spread in an initial public offering (IPO) typically include the following (on a per share basis): Manager's fee, Underwriting feeearned by members of the syndicate, and the Concessionearned by the broker-dealer selling the shares. The Manager would be entitled to the entire underwriting spread. A member of the

syndicate is entitled to the underwriting fee and the concession. A broker dealer who is not a member of the Page 4

AFM University Question

syndicate but sells shares would receive only the concession, while the member of the syndicate who provided the shares to that broker dealer would retain the underwriting fee. Usually, the managing/lead underwriter, also known as the bookrunner, typically the underwriter selling the largest proportions of the IPO, takes the highest portion of the gross spread, up to 8% in some cases.

3.SEBI (Short Note)

The Securities and Exchange Board of India (SEBI) is the regulatory authority in India established under Section 3 of SEBI Act, 1992. SEBI Act, 1992 provides for establishment of Securities and Exchange Board of India (SEBI) with statutory powers for (a) protecting the interests of investors in securities (b) promoting the development of the securities market and (c) regulating the securities market. Its regulatory jurisdiction extends over corporates in the issuance of capital and transfer of securities, in addition to all intermediaries and persons associated with securities market. SEBI has been obligated to perform the aforesaid functions by such measures as it thinks fit. In particular, it has powers for: Regulating the business in stock exchanges and any other securities markets Registering and regulating the working of stock brokers, sub-brokers etc. Promoting and regulating self-regulatory organizations Prohibiting fraudulent and unfair trade practices Calling for information from, undertaking inspection, conducting inquiries and audits of the stock exchanges, intermediaries, self regulatory organizations, mutual funds and other persons associated with the securities market.

4.Book building process

The process by which an underwriter attempts to determine at what price to offer an IPO based on demand from institutional investors. An underwriter "builds a book" by accepting orders from fund managers indicating the number of shares they desire and the price they are willing to pay. Book Building is a process by which corporates determine the demand and the price of a proposed issue of securities through public bidding. The objective is to determine the quantum of the issue on the basis of the price book built. Once the price and the quantum of issue has been determined by the issuer, the issue may either be offered under the private placement of the public offer category, or both, as per the requirement of the SEBI regulations. Characteristics: Tendering Process Book building involves inviting subscriptions to a public offer of securities, essentially through a tendering process. Eligible investors are required to place their bids for the number of shares to be issued and the price at which they are willing to invest, with the lead

manager running the book. At the end of the cut off period, the lead manager determines the response Page 5

AFM University Question

to the issue in terms of the quantum of shares and the highest price at which demand is sufficient to match the size of the issue. Floor Price: Floor price is the minimum price set by the lead manager in consultation with the issuer. This is the price at which the issue is open for subscription. Investors are free to place a bid at any price higher than the floor price. Price Band: The range of price (the highest and the lowest price) at which offer for the subscription of securities is made is known as price band. Investors are free to bid any price within in the price band. Bid: The investor can place a bid with the authorized lead manager merchant banker. In the case of equity shares, usually several brokers in the stock exchange are also authorized by the lead manager. The investor fills up a bid-cum-application form, which gives a choice to bid for up to three optional prices. The price and demand options submitted by the bidder are treated as optional demands and are not cumulated. Allotment: The lead manager, in consultation with the issuer, decides the price at which the issue will be subscribed and proceeds to allot shares to investors who have bid at or above the fixed price. All investors are allotted shares at the same fixed price. For any allottee, therefore the price would be equal to or less than the price bid. Participants: Generally, all investors, including individuals, eligible to invest in a particular issue of securities can participate in the book building process. However, if the issue is restricted to qualified institutional, as in the case of government securities, then, only those eligible can participate. The Process: The procedures relating to the book building process depend on the level at which it is to be taken up by a corporate entity. According to the SEBI, there are two options available to a company either 75 percent or 100 percent book building process. Each of these methods is discussed briefly below: 75 percent Book Building: The 75 percent book building option of securities is offered on a firm basis where a minimum of 25 percent of the securities is offered to the public. The following steps are involved in this process: 1) Eligibility: All corporates eligible for public shares are also eligible for raising capital through the book building process. 2) Earmarking securities: Where a decision is taken by a corporate to issue shares through the book building process, the securities to be used should be separately earmarked as the Page 6

AFM University Question

placement portion category in the prospectus. The balance securities must be stated as net offer to the public category. 3) Draft prospectus: A draft prospectus containing all the information except price of the issue must be filed with the SEBI. Although no precise mention is made, a price band indicating the price range within which securities are being offered for subscription should be indicated. The prospectus is to be filed with the ROC within two days of the issue price being finalized. 4) Appointment of book runner: The issuing company appoints a merchant banker as the book runner, which mentioned in the prospectus. The book runner circulates a copy of the draft prospectus among the institutional buyers who are eligible for firm allotment and to the intermediaries who are eligible to act as underwriters, inviting them to subscribe to the issue of securities. The book runner maintains a record of the names and number of securities ordered by intermediary buyers and the price at which they are willing to subscribe the issue under the placement portion. The book runner collects information about the subscriptions received from underwriters and other intermediaries. After a stipulated time period, the book runner aggregates the subscription so received. The underwriters are required to make a payment of the total amount for the subscription of issues.

5.Sources of rising finance for long term projects in India

Finance is the money available to spend on business needs. Right from the moment someone thinks of a business idea, there needs to be cash. As the business grows there are inevitably greater calls for more money to finance expansion. The day to day running of the business also needs money. EQUITY CAPITAL Equity shares are those shares which are ordinary in the course of company's business. They are also called as ordinary shares. These shareholders do not enjoy preference regarding payment of dividend and repayment of capital. Equity shareholders are paid dividend out of the profits made by a company. Higher the profits, higher will be the dividend and lower the profits, lower will be the dividend. The value of equity capital is computed by estimating the current market value of everything owned by the company from which the total of all liabilities is subtracted. On the balance sheet of the company, equity capital is listed as stockholders' equity or owners' equity. Also called equity financing or share capital. Essentially, equity capital is money that is invested into a company in exchange for an ownership interest in that company. Traditionally, equity capital unlike debt is not intended to be repaid according to a specific schedule and is not secured (or guaranteed) by the company's assets. Instead, an equity investor (i.e., the individual or entity that supplies the company with the money) expects that, within a certain time frame, the ownership percentage she holds will be worth more than the original amount she invested.

AFM

University Question

Page 7

INTERNAL ACCRUAL PREFERENCE CAPITAL Page 8

AFM University Question

TERM LOAN A term loan is a monetary loan that is repaid in regular payments over a set period of time. Term loans usually last between one and ten years, but may last as long as 30 years in some cases. A term loan usually involves an unfixed interest rate that will add additional balance to be repaid. Term loans can be given on an individual basis but are often used for small business loans. The ability to repay over a long period of time is attractive for new or expanding enterprises, as the assumption is that they will increase their profit over time. Term loans are a good way of quickly increasing capital in order to raise a business supply capabilities or range. For instance, some new companies may use a term loan to buy company vehicles or rent more space for their operations. DEBENTURE A debenture is a document that either creates a debt or acknowledges it, and it is a debt without collateral. In corporate finance, the term is used for a medium-to long-term debt instrument used by large companies to borrow money. In some countries the term is used interchangeably with bond, loan stock or note. A debenture is thus like a certificate of loan or a loan bond evidencing the fact that the company is liable to pay a specified amount with interest and although the money raised by the debentures becomes a part of the company's capital structure, it does not become share capital. Senior debentures get paid before subordinate debentures, and there are varying rates of risk and payoff for these categories. Debentures are generally freely transferable by the debenture holder. Debenture holders have no rights to vote in the company's general meetings of shareholders, but they may have separate meetings or votes e.g. on changes to the rights attached to the debentures. The interest paid to them is a charge against profit in the company's financial statements.

6.Sources of financing long term projects in India?

Venture capital Venture capital (VC) is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT, software, etc. The typical venture capital investment occurs after the seed funding round as growth funding round (also referred to as Series A round) in the interest of generating a return through an eventual realization event, such as an IPO or trade sale of the company. Venture capital is a subset of private equity. Therefore, all venture capital is private equity, but not all private equity is venture capital.

AFM University Question

Page 9

Initial public offer (IPO) An initial public offering (IPO) or stock market launch is a type of public offering where shares of stock in a company are sold to the general public, on a securities exchange, for the first time. Through this process, a private company transforms into a public company. Initial public offerings are used by companies to raise expansion capital, to possibly monetize the investments of early private investors, and to become publicly traded enterprises. A company selling shares is never required to repay the capital to its public investors. After the IPO, when shares trade freely in the open market, money passes between public investors. Although an IPO offers many advantages, there are also significant disadvantages. Chief among these are the costs associated with the process, and the requirement to disclose certain information that could prove helpful to competitors, or create difficulties with vendors. Details of the proposed offering are disclosed to potential purchasers in the form of a lengthy document known as a prospectus. Most companies undertaking an IPO do so with the assistance of an investment banking firm acting in the capacity of an underwriter. Underwriters provide a valuable service, which includes help with correctly assessing the value of shares (share price), and establishing a public market for shares (initial sale). Alternative methods, such as the dutch auction have also been explored. In terms of size and public participation, the most notable example of this method is the Google IPO. China has recently emerged as a major IPO market, with several of the largest IPO offerings taking place in that country. Secondary Public offer The issuance of new stock for public sale from a company that has already made its initial public offering (IPO). Usually, these kinds of public offerings are made by companies wishing to refinance, or raise capital for growth. Money raised from these kinds of secondary offerings goes to the company, through the investment bank that underwrites the offering. Investment banks are issued an allotment, and possibly an overallotment which they may choose to exercise if there is a strong possibility of making money on the spread between the allotment price and the selling price of the securities. Rights Offering (Issue) Issuing rights to a company's existing shareholders to buy a proportional number of additional securities at a given price (usually at a discount) within a fixed period. Preferential Allotment When a listed company doesn't want to go for further public issue and the objective is to raise huge capital by issuing bulk of shares to selected group of people, preferential allotment is a good option. A private placement is an issue of shares or of convertible securities by a company to a select group of persons under Section 81 of the Companies Act, 1956, which is neither a rights issue nor a public issue. This is a faster way for a company to raise equity capital.

AFM University Question

Page 10

Dilution A reduction in earnings per share of common stock that occurs through the issuance of additional shares or the conversion of convertible securities. Term Loan A loan from a bank for a specific amount that has a specified repayment schedule and a floating interest rate. Term loans almost always mature between one and 10 years. Private Placement Agreement Private placement refers to sale of equity or equity related instruments of an unlisted company or sale of Debenture of a listed or unlisted company. Private Placement and preferential allotment involve sale of securities to a limited number of sophisticated investors such as financial institution, mutual funds, venture capital funds, banks, and so on. Private placement or private investment capital, is money invested in your company usually from private investors in the form of stocks and sometimes bonds. In the United States, private placement often does not need to be registered with the Securities Exchange Commission. Regulation D is the most popular form of non-public private placement.

7.Project appraisal techniques

Project appraisal is the analysis of a proposed project to determine its merit and acceptability in accordance with established criteria. This is the final step before a project is agreed for financing. It checks that the project is feasible against the Situation on the ground that the objectives set remain appropriate and that costs are reasonable. Methods of Project Appraisal Pay-Back Period Method -Back Period is the lengthof time required to recover the initial outlay on the project or it is the time required to recover the original investment through income generated from the project. Pay-Back Period= Original Cost of Investment Annual Cash inflow or saving Pros:a) It is easy to operate and simple to understand.b) It is best suited where the project has shorter gestation period and project cost is also less.c) It enables entrepreneur to select an investment which yields quick returns of funds. Cons:AFM University Question Page 11

a) It Emphasize more on liquidity rather than profitability. b) It does not cover the earnings beyond the payback period, which may result in wrongselection of investment project.c) It suitable for only small projects requiring less investment and time.d) This method ignores the cost of capital which is very important factor in making sound investment decision. Decision Rule: A project which gives the shortest payback period, is considered to be the most acceptable. Accounting Rate of Return Method This method is considered better than pay back method because it considers project during its full economic life. This method is also known as Return On investment. It is mainly expressed in terms of percentage. ARR or ROI = Average annual earnings after tax *100 Average book investment after depreciation Pros:a) It is simple to calculate and easy to understand.b) It considers earning of the project during the entire operative life.c) It help in comparing the projects which differ widely. Cons:a) It ignores time value of money.b) It lays more emphasis on profit and less on cash flows. Decision Rules: In ARR a project is to be accepted when if actual ARR is higher than the rate of returns. Otherwise it is rejected. NPV (Net Present Value) This method mainly considers the time value of money. It is the sum of the aggregate present values of all the cash flows, AFM University Question Page 12

NPV = PV of net cash inflow PV of cash outflow Pros:a) It is conceptually sound.b) It considers time value of money.c) It facilitates ranking of project which help in the selection of project.Cons:a) It is vulnerable to different interpretations.b) Its computation process is complex. Decision rule:If NPV is positive, accept If NPV is negative, reject If NPV is 0 then apply payback period method. IRR (Internal Rate of Return) This method is known by various other namelike Yield on Investment or Rate of Return. It is used when the cost of investment and the annual cash inflow are known and rate of return is to be calculated. It take into account time value of the money by discounting inflow and cash flow. Pros:a) Itconsiders the profitability of the project for its entire economic life and hence enables evaluation of true profitability.b) It recognizes the time value of moneyCons:a) it is most difficult method of evaluation of investment proposals.b) It is based upon the assumption that the earning isreinvested.c) It may result in incorrect decision in comparing the Mutually Exclusive project Decision Rule:In the case of an Independent Investment accept the project if its IRR is greater than the required rate of return and if it is lower than reject.

8.International Capital Budgeting

Nobody can really guarantee the future. The best we can do is size up the chances, calculate the risks involved, estimate our ability to deal with them, and then make our plans with confidence. ---Henry Ford II AFM Page 13

University Question

A foreign project that is profitable when valued on its own may not be profitable otherwise. Foreign investment decision process may be viewed as an integral unit of many elements that are interrelated. Foreign Investment Decision Process * The decision to search for foreign investment * An assessment of the political climate in the host country * Examination of the overall strategy * Cash Flow Analysis * Required Rate of Return * Economic Evaluation * Selection * Risk Analysis * Implementation * Expenditure Control * Post Audit Companys Overall Strategy The analyst must assess the usefulness of each alternative within the companys overall strategy to determine how foreign operations may perpetuate current strengths or offset weaknesses. Cost of Capital Discount Rate Required Rate Minimum Rate The cost of capital is in effect the MAGIC NUMBER used to decide whether a proposed foreign investment will increase or decrease the firms stock price. Economic Evaluation Once cash flows and cost of capital are known process of evaluating investment projects. * Pay back period * ARR * NPV * IRR Which is Good Selection * Accept Reject decision * Mutually Exclusive Choice * Capital Rationing Adjusted Present Value : PV Technique Discounts different cash flows at different rates depending upon risk associated with each cash flow. What makes International Capital Budgeting different from domestic Capital Budgeting AFM Page 14

University Question

* Project Cash Flows and Cash Flows to the Parent Company * Factor of Political Risk * Inflation & Exchange Rate changes Financial Tools No doubt Financial Tools such as pay back, NPV or IRR can be used. But considering the additional issues involved that affect both the cash flows and the risk (discount rate) make these techniques insufficient.

9.Explain the important functions of either CRISIL or CARE?

CRISIL is acronym for Credit Rating Information Services of India Limited. CRISIL is India's leading Ratings, Financial News, Risk and Policy Advisory company. Since 1987 when CRISIL was incorporated, CRISIL has played an integral role in India's development milestones. CRISIL's majority shareholder is Standard & Poor's, the world's foremost provider of independent credit ratings, indices, risk evaluation, investment research and data. CRISIL's association with Standard & Poor's, a division of The McGraw-Hill Companies, dates back to 1996 when both companies started working together on rating methodologies and joint projects. CRISIL Ratings is the only ratings agency in India to operate on the basis of sectoral specialisation. CRISIL Ratings plays a leading role in the development of the debt markets in India. CRISIL has also spearheaded the formation of the CRISIL, the world's first regional credit rating agency. The main functions of CRISIL can be classified into following subheads: 1. Ratings CRISIL Ratings: It is the only ratings agency in India with sectoral specialization It has played a critical role in the development of the debt markets in India. The agency has developed new ratings methodologies for debt instruments and innovative structures across sectors. CRISIL Ratings provides technical know-how to clients all over the world and has helped set up ratings agencies in Malaysia (RAM), Israel (MAALOT) and in the Caribbean. 2. Research CRISIL Research: It provides research, analysis and forecasts on the Indian economy, industries and companies to over 500 Indian and international clients across financial, corporate, consulting and public sectors. CRISIL FundServices: It provides fund evaluation services and risk solutions to the mutual fund industry. The Centre for Economic Research: It applies economic principles to live business applications and provide benchmarks and analyses for India's policy and business decision makers. AFM Page 15

University Question

Investment Research Outsourcing: CRISIL added equity research to its wide bouquet of services, by acquiring Irevna, a leading global equity research and analytics company. Irevna offers investment research services to the world's leading investment banks and financial institutions. 3. Advisory CRISIL Infrastructure Advisory: It provides policy, regulatory and transaction level advice to governments and leading organisations across sectors. Investment and Risk Management Services: CRISIL Risk Solutions offers integrated risk management solutions and advice to Banks and Corporates by leveraging the experience and skills of CRISIL in the areas of credit and market risk.

10.Limitations of credit rating?

Rating agencies all across the world have often been accused of not being able to predict future problems. In part, the problem lies in the rating process itself, which relies heavily on past numerical data and standard ratios with relatively lower usage of judgment and understanding of the underlying business or the country economics. Data does not always capture all aspects of the situation especially in the complex financial world of today. An excellent example of the meaningless over reliance on numbers is the poor country rating given to India. Major rating agencies site one of the reasons for this as the low ratio Indias exports to foreign currency indebtedness. This completely ignores two issues firstly, India gets a very high quantum of foreign currency earnings through remittances from Indians working abroad and also services exports in the form of software exports which are not counted as "merchandise" exports. These two flows along with other "invisible" earnings accounted for almost US$11bn in FY 99. Secondly, since India has tight control on foreign currency transactions, there is very little error possible in the foreign currency borrowing figure. As against this, for a country like Korea, the figure for foreign currency borrowing increased by US$50bn after the exchange crisis began. This was on account of hidden forward liabilities through swaps and other derivative products. In general, Indian rating agencies have lost some amount of their credibility in the last two years due to their inability to predict defaults in many companies, which they had rated quite highly. Sometimes, some of the agencies had an investment grade rating in place when the company in question had already defaulted to some of the fixed deposit holders. Further, rating agencies resorted to mass downgrading of 50-100 companies as a reaction to public criticism, which further eroded their credibility. The major reasons for these downgrades are as follows : 1) Biased rating and misrepresentation: In the absence of quality ratings , credit rating is a curse for capital market industry. To avoid biased rating ,the expert in rating agency ,carrying out detailed analysis of the company , AFM University Question Page 16

should have no links with the company or the persons interested din the company so that they can make their report impartial and judicious recommendation for rating committee. 2) Static study : Rating is done on the present and the past historical data of the company and this is only a static study. prediction of the company health through rating is momentary and anything can happen after assignment of rating symbols to the company .dependence for the future result on the rating, therefore defeat the vary purpose of the risk indicative of the rating. 3) Concealment of material information: Rating company might conceal material information from the investigating team of the credit rating company, in such cases quality of rating suffer and renders the rating reliable. 4) Rating is no guarantee for soundness of the company: Rating is done for a particular instrument to assess the credit risk but it should not be considered as a certificate for matching quality of the company or its management. 5) Human bias: Finding of the investigation team at times may suffer from with the human bias for unavoidable personal weakness of the staff and might affect the rating. 6) Down grade: Once the company has been rated and if it is not able to maintain its working result and performance, credit rating agency would review the grade or downgrade the rating resulting into impairing the image of the company. 7) Validity of rating Validity of the rating ends with the maturity of a debt instrument and its no longer subsequently benefits the issuer company because the rating is valid for the life time of the debt instrument being rated . 8) Difference in rating of two agencies: Rating done by two different credit rating agencies for the same instrument of the same issuer company in many cases would not be identical. Such difference is likely to occur because of the because of the value judgment differences on qualitative aspect of the analysis in two different rating agencies whereas quantitative analysis might be the same and identical .

11.Rating process of financial instruments

RATING METHODOLOGY Rating is a search for long-term fundamentals and the probabilities for changes in the fundamentals. Each agency's rating process usually includes fundamental analysis of public and private issuer-specific data, 'industry analysis, and presentations by theissuer's senior executives, statistical classification models, and judgment. Typically, the rating Agency is

AFM University Question

Page 17

privy to the issuer's short and long-range plans and budgets. The analytical framework followed for rating methodology is divided into two interdependent segments. The first segment deals with operational characteristics and the second one with the financial characteristics. Besides, quantitative and objective factors; qualitative aspects, like assessment of management capabilities play a very important role in arriving at the rating for an instrument. The relative importance of qualitative and quantitative components of the analysis varies with the type of issuer. Key areas considered in a rating include the following: i) Business Risk : To ascertain business risk, the rating agency considers Industry's characteristics, performance and outlook, operating position (capacity, market share, distribution system, marketing network, etc.), technological aspects, business cycles, size and capital intensity. ii) Financial Risk : To assess financial risk, the rating agency takes into account various aspects of its Financial Management (e.g. capital structure, liquidity position, financial flexibility and cash flow adequacy, profitability, leverage, interest coverage), projections with particular emphasis on the components of cash flow and claims thereon, accounting policies and practices with particular reference to practices of providing depreciation, income recognition, inventory valuation, off-balance sheetclaims and liabilities, amortization of intangible assets, foreign currency transactions, etc. iii) Management Evaluation:Management evaluation includes consideration of the background and history of the issuer, corporate strategy and philosophy, organisational structure, quality of management and management capabilities under stress, personnel policies etc. iv) Business Environmental Analysis : This includes regulatory environment, operating environment, national economic outlook, areas of special significance to the company, pending litigation, tax status, possibility of default risk under a variety of scenarios. Rating is not based on a predetermined formula, which specifies the relevant variables as well as weights attached to each one of them. Further, the emphasis on different aspects varies from agency to agency. Broadly, the rating agency assures itself that there is a good congruence between assets and liabilities of a company and downgrades the rating if the quality of assets depreciates. The rating agency employs qualified professionals to ensure consistency and reliability. Reputation of the Credit Rating Agency creates confidence in the investor. Rating Agency earns its reputation by assessing the client's operational performance, managerial competence, management and organizational set-up and financial structure. It should be an independent company with its own identity. It should have no government interference. Rating of an instrument does not give any fiduciary status to the credit rating agency. It is desirable that the rating be done by more than one agency for the same kind of instrument. This will attract investor's confidence in the rating symbol given. A rating is a quality label that conveniently summarizes the default risk of an issuer. The credibility of the issuer's, proposed payment schedule is complemented by thecredibility of the rating agency. Rating agencies perform this certification role by exploiting the economies of scale in processing information and monitoring the issuer.There is an ongoing debate AFM University Question Page 18

about whether the rating agencies performan information role in addition to a certification role. Whether agencies have access to superior (private) information, or if agencies are superior processors of information; security Iratings provide information to investors, rather than merely summarizing existing information. Empirical research confirms the information role of rating agencies byi demonstrating that news of actual and proposed rating changes affects the price of issuer's securities. Most studies I document numerically larger price elfects for downgrades than for upgrades, consistent with the perceived predilection ,of management fordelaying bad news.

12.Due diligence (short note) ?

Due Diligence is the process by which confidential legal, financial and other material information is exchanged, reviewed and appraised by the parties to a business transaction, which is done prior to the transaction. Due diligence is an analysis and risk assessment of an impending business transaction. It is the careful and methodological investigation of a business or persons, or the performance of an act with a certain standard of care to ensure that information is accurate, and to uncover information that may affect the outcome of the transaction. It is basically a background check to make sure that the parties to the transaction have the required information they need, to proceed with the transaction. Due diligence is used to investigate and evaluate a business opportunity. The term due diligence describes a general duty to exercise care in any transaction. As such, it spans investigation into all relevant aspects of the past, present, and predictable future of the business of a target company. Due diligence report should provide information and insight on aspects such as the risks of a transaction, the value at which a transaction should be undertaken, the warranties and indemnities that needs be obtained from the vendor etc. Due Diligence

business opportunity.

13.Rising of money through private placement?

RAISING FUND THROUGH PRIVATE PLACEMENT The one constant in the life of your small business will be the need for a cash infusion to jump start sales, expand into new markets, or continue to sustain growth. While there are a multitude of financing sources of funding available to small business owners, each source has its limitations and requirements. Page 19

AFM University Question

For instance, commercial bank loans are often intended for businesses that have been around and have shown a steady stream of profitability. Private placements are an attractive alternative for growing companies. What is Private Placement? Private placement or private investment capital is money invested in your company usually from private investors in the form of stocks and sometimes bonds. In the United States, private placement often does not need to be registered with the Securities Exchange Commission. Regulation D is the most popular form of non-public private placement. According to Thompson Financial, over 416 billion was issued in the private placement market for 2002. As good as it sounds, the majority of those dollars came from pension funds, investment pools, banks and insurance companies amounting to just over 2,000 deals. However, private placement does exist for the small business owner and is often less expensive and easier than taking your company public. Benefits of Private Placement -20 million with combinations of debt, equity, or debt and equity capital.

investments over a longer term of 5 to 10 years.

an IPO (Initial Public Offering).

Who is a Candidate for Private Stock Offerings? The ideal small business candidate is a company in the third stage of finance and is looking for growth or expansion funding. Small business owners might think private placement applies to start-ups when your company has completed product development, conducted a market-feasibility study and business planning but start-up funding often comes from angel investors. Where to Find Private Placements? The money from private placements will come from accredited investors defined by the SEC Rule 501 under Regulation D as:

Connect with bankers, attorneys, and accountants who can network your small business with a private investor. What is required for Private Placements?

AFM University Question

Page 20

business

With the limited infusion of capital into the stock market, the private investor market is an attractive alternative for investors and small businesses. Private placement offers a viable form of business financing without the constraints of taking a company public and conceding control.

14.Overseas sources of funds?

Funds can also be collected from foreign sources, which usually consists of:Foreign Collaborators:If approved by the Government of India, the Indian companies may secure capital from abroad through the subscription of foreign collaborator to their share capital or by way of supply of technical knowledge, patents, drawings and designs of plants or supply of machinery. International Financial Institutions:Like World Bank and International Finance Corporation (IFC) provide long-term funds for the industrial development all over the world. The World Bank grants loans only to the Governments of member countries or private enterprises with guarantee of the concerned Government. IFC was set up to assist the private undertakings without the guarantee of the member countries. It also provides them risk capital. Non-Resident Indians:Persons of Indian origin and nationality living abroad are also permitted to subscribe to the shares and debentures issued by the companies in India. Retained Profits or Reinvestment of Profits An important source of long-term finance for on-going profitable companies is the amount of profit which is accumulated as general reserve from year to year. To the extent profits are not distributed as dividend to the shareholders, the retained amount can be reinvested for expansion or diversification of business activities. Retained profit is an internal source of finance. Hence it does not involve any cost of floatation which has to be incurred to raise finance from external sources.

15.Venture capitalist funding ways

Venture capital Venture capital (VC) is financial capital provided to early-stage, high-potential, high risk, growth start-up companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT, software, etc. The typical venture capital investment occurs after the seed funding round as growth funding round (also referred to as

AFM University Question

Page 21

Series A round) in the interest of generating a return through an eventual realization event, such as an IPO or trade sale of the company. Venture capital is a subset of private equity. Therefore, all venture capital is private equity, but not all private equity is venture capital.

16.International Funding options

Same as Question 14

17.Key financial intermediaries

Money needs to be circulated for an economy to be productive. If all savings are hoarded, the surpluses of the community will not be available for investments and this in turn would lead to economic stagnation. Financial intermediaries play an important economic function by facilitating a productive use of the community's surplus money. There are various types of financial intermediaries and their structure comprises of both organized and unorganized sectors. The dominance in terms of financial flows handled by these sectors differs from country to country. In India, the players in the unorganized sector are: Money lenders Indigenous bankers Chit funds Nidhis or mutual benefit funds Self Help Groups In the current scenario, there is no estimate of the volume of business handled by the unorganized sector. While the volume of business handled in the urban sector may be small, their role in rural India is very significant. One of the negative effects of the sway of the unorganized sector is that it reduces the efficacy of a country's monetary policy. A lot of initiatives have been undertaken over the years both by central and state governments to reduce the adverse impact. Some of these initiatives are: Is]

All India Development Financial Institutions The following are the various institutions covered under all India DFIs:

AFM

University Question

Page 22

Industrial Finance Corporation of India [IFCI] Industrial Development Bank of India [IDBI], which merged with IDBI Bank in 2004 Industrial Credit and Investment Corporation of India [ICICI], which merged with ICICI Bank in 2002 Industrial Investment Bank of India [IIBI]. The former Industrial Reconstruction Corporation of India was converted into Industrial Reconstruction Corp of India [IRCI] and was later converted into IIBI in 1995 Small Industries Development Bank of India [SIDBI], which is a wholly owned subsidiary of IDBI curved out through an act of parliament in 1990. State Level Financial Corporations These are state level bodies that mainly concentrate on industrial development in a state. They are legal bodies created under the State Finance Corporations Act, 1951 and are funded through an issue of shares in which the state governments, banks, financial institutions, and private investors participate. SFCs are also permitted to raise funds through the issue of bonds and debentures. The main focus of SFCs is financing the local industrial units, which are usually small and medium units, situated in backward regions of the state. Insurance Companies Insurance companies concentrate on fulfilling the insurance needs of the community, both for life and non life insurance. With the globalization of the Indian economy, a large number of private players have entered into this field, offering products that allow investors to select the kind of policies to suit their financial planning needs. Many of these organizations are formed as subsidiaries of banks that enable the banks to cross sell insurance products to their existing customers. Banks benefit by way of fee income through referrals and enhanced relationships with insurance companies for their banking needs. Mutual Funds These organizations satisfy the needs of individual investors through pooling resources from a large number with similar investment goals and risk appetite. The resources collected are invested in the capital market and money market securities and the returns generated are distributed to investors. The fund managers of MFs are specialists in the fields of investment analysis and are able to diversify and even out risks through portfolio mix. MFs offer a wide variety of schemes, such as, growth funds, income funds, balanced funds, money market funds and equity related funds designed to cater to the different needs of investors. AFM University

Question

Page 23

Non Banking Finance Corporations NBFCs are commonly known as finance companies and are corporate bodies, which concentrate mainly on lending activities in a well-defined area. The Reserve bank of India [RBI] Amendment Act, 1997 defines an NBFC as a financial institution or non-banking institution, which has its principal business of receiving deposits under any scheme or arranging and lending in any manner. There are 4 broad categories of NBFCs:

18.Regulation of Financial Markets in India

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the integrity of the financial system. This may be handled by either a government or nongovernment organization. The overall responsibility of development, regulation and supervision of the financial market rests with the Securities & Exchange Board of India (SEBI), which was formed in 1992 as an independent authority. Since then, SEBI has consistently tried to lay down market rules in line with the best market practices. It enjoys vast powers of imposing penalties on market participants, in case of a breach. Aims of regulation The objectives of financial regulators are usually market confidence to maintain confidence in the financial system financial stability -contributing to the protection and enhancement of stability of the financial system consumer protection -securing the appropriate degree of protection for consumers. reduction of financial crime -reducing the extent to which it is possible for a regulated business to be used for a purpose connected with financial crime. Structure of supervision Acts empowers organizations, government or non-government, to monitor activities and enforce actions. There are various setups and combinations in place for the financial regulatory structure around the global. Leaf parts are in any case:

AFM University

Question

Page 24

Supervision of stock exchanges Exchange acts ensure that trading on the exchanges is conducted in a proper manner. Most prominent the pricing process, execution and settlement of trades, direct and efficient trade monitoring. Supervision of listed companies Financial regulators ensures that listed companies and market participants comply with various regulations under the trading acts. The trading acts demands that listed companies publish regular financial reports, ad hoc notifications or directors' dealings. Whereas market participants are required to publish major shareholder notifications. The objective of monitoring compliance by listed companies with their disclosure requirements is to ensure that investors have access to essential and adequate information for making an informed assessment of listed companies and their securities. Supervision of anti-money laundering The anti-money laundering supervision ensures that criminal activities does not threaten the reputation and financial strength of an institution, or also endanger the integrity and stability of the whole financial market. All companies concerned need to have policies in place which prevents transactions with criminal background. Supervision of investment management Asset management supervision or investment acts ensures the frictionless operation of those vehicles. Supervision of banks and financial services providers Banking acts lays down rules for banks which they have to observe when they are being established and when they are carrying on their business. These rules are designed to prevent unwelcome developments that might disrupt the smooth functioning of the banking system. Thus ensuring a strong and efficient banking system.

19.Functions of Investment Banking

Investment Banking An investment bank is a financial institution which raises capital, trades securities, and manages corporate mergers and acquisitions. Another term used for investment banking is corporate finance. Investment banks work for companies and governments, and profit from them by raising money through the issuance and selling of securities in capital markets (both equity and debt) and insuring bonds (for example selling credit default swaps), and providing the necessary advice on transactions such as mergers and acquisitions. Most of investment banks provide strategic advisory services for mergers, acquisitions, divestiture or other financial services for AFM Page 25

University Question

clients, like the trading of derivatives, commodity, fixed income, foreign exchange, and equity securities. Investment banking is a form of banking which finances the capital requirements of enterprises. Investment banking assists as it performs IPOs, private placement and bond offerings, acts as broker and helps in carrying out mergers and acquisitions. An Investment Banker can be considered as a total solutions provider for any corporate, desirous of mobilizing its capital. The services provided range from investment research to investor service on the one hand and from preparation of the offer documents to legal compliances & post issue monitoring on the other. A long lasting relationship exists between the Issuer Company and the Investment Banker. Functions of Investment Banking: Investment banks carry out multilateral functions. Some of the most important functions of investment banking are as follows: Investment banking helps public and private corporations in issuance of securities in the primary market. They also act as intermediaries in trading for clients. Investment banking provides financial advice to investors and helps them by assisting in purchasing and trading securities as well as managing financial assets Investment banking differs from commercial banking as investment banks don't accept deposits neither do they grant retail loans. Small firms which provide services of investment banking are called boutiques. They mainly specialize in bond trading, providing technical analysis or program trading as well as advising for mergers and acquisitions

20.International trade finance options

Letters of Credit A letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. Letters of credit are often used in international transactions to ensure that payment will be received. Due to the nature of international dealings including factors such as distance, differing laws in each country and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade. The bank also acts on behalf of the buyer (holder of letter of credit) by ensuring that the supplier will not be paid until the bank receives a confirmation that the goods have been shipped.

AFM

University Question

Page 26

Banker's Acceptances A short-term debt instrument issued by a firm that is guaranteed by a commercial bank. Banker's acceptances are issued by firms as part of a commercial transaction. These instruments are similar to T-Bills and are frequently used in money market funds. Banker's acceptances are traded at a discount from face value on the secondary market, which can be an advantage because the banker's acceptance does not need to be held until maturity. Banker's acceptances are regularly used financial instruments in international trade. Documentary Collections International trade procedure in which a bank in the importer's country acts on behalf of an exporter for collecting and remitting payment for a shipment. The exporter presents the shipping and collection documents to his or her bank (in own country) which sends them to its correspondent bank in the importer's country. The foreign bank (called the presenting bank) hands over shipping and title documents (required for taking delivery of the shipment) to the importer in exchange for cash payment (in case of 'documents against payment' instructions) or a firm commitment to pay on a fixed date (in case of 'documents against acceptance' instructions). The banks involved in the transaction act only in a fiduciary capacity to collect the payment but (unlike in documentary credit) make no guaranties. They are liable only for correctly carrying out the exporter's collection instructions and may, if so instructed, sue the non-paying or non-accepting importer on the exporter's behalf (see protest). Trade Finance The science that describes the management of money, banking, credit, investments and assets for international trade transactions. Companies involved with trade finance include importers and exporters, financiers, insurers and other service providers.

21.Financial derivatives (Short note)

A security whose price is dependent upon or derived from one or more underlying assets. The derivative itself is merely a contract between two or more parties. Its value is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Most derivatives are characterized by high leverage. Financial derivatives are financial instruments that are linked to a specific financial instrument or indicator or commodity, and through which specific financial risks can be traded in financial markets in their own right. Transactions in financial derivatives should be treated as separate transactions rather than as integral parts of the value of underlying transactions to which they may be linked. The value of a financial derivative derives from the price of an underlying item, such as an asset or index. Unlike debt instruments, no principal amount is advanced to be repaid and no investment income accrues. Financial derivatives are used for a number of purposes including risk management, hedging, arbitrage between markets, and speculation. AFM University Question Page 27

22.Explain currency SWAPS

A swap that involves the exchange of principal and interest in one currency for the same in another currency. It is considered to be a foreign exchange transaction and is not required by law to be shown on a company's balance sheet. For example, suppose a U.S.-based company needs to acquire Swiss francs and a Swissbased company needs to acquire U.S. dollars. These two companies could arrange to swap currencies by establishing an interest rate, an agreed upon amount and a common maturity date for the exchange. Currency swap maturities are negotiable for at least 10 years, making them a very flexible method of foreign exchange. Currency swaps were originally done to get around exchange controls. Purpose of Currency Swaps An American multinational company (Company A) may wish to expand its operations into Brazil. Simultaneously, a Brazilian company (Company B) is seeking entrance into the U.S. market. Financial problems that Company A will typically face stem from Brazilian banks' unwillingness to extend loans to international corporations. Therefore, in order to take out a loan in Brazil, Company A might be subject to a high interest rate of 10%. Likewise, Company B will not be able to attain a loan with a favourable interest rate in the U.S. market. The Brazilian Company may only be able to obtain credit at 9%. While the cost of borrowing in the international market is unreasonably high, both of these companies have a competitive advantage for taking out loans from their domestic banks. Company A could hypothetically take out a loan from an American bank at 4% and Company B can borrow from its local institutions at 5%. The reason for this discrepancy in lending rates is due to the partnerships and on-going relations that domestic companies usually have with their local lending authorities. Setting Up the Currency Swap Based on the companies' competitive advantages of borrowing in their domestic markets, Company A will borrow the funds that Company B needs from an American bank while Company B borrows the funds that Company A will need through a Brazilian Bank. Both companies have effectively taken out a loan for the other company. The loans are then swapped. Assuming that the exchange rate between Brazil (BRL) and the U.S (USD) is 1.60BRL/1.00 USD and that both Companys require the same equivalent amount of funding, the Brazilian company receives $100 million from its American counterpart in exchange for 160 million real; these notional amounts are swapped. Company A now holds the funds it required in real while Company B is in possession of USD. However, both companies have to pay interest on the loans to their respective domestic banks in the original borrowed currency. Basically, although Company B swapped BRL for USD, it still must satisfy its obligation to the Brazilian bank in real. Company A faces a similar situation with its domestic bank. As a result, both companies will incur interest AFM Page 28

University Question

payments equivalent to the other party's cost of borrowing. This last point forms the basis of the advantages that a currency swap provides. Advantages of the Currency Swap Rather than borrowing real at 10% Company A will have to satisfy the 5% interest rate payments incurred by Company B under its agreement with the Brazilian banks. Company A has effectively managed to replace a 10% loan with a 5% loan. Similarly, Company B no longer has to borrow funds from American institutions at 9%, but realizes the 4% borrowing cost incurred by its swap counterparty. Under this scenario, Company B actually managed to reduce its cost of debt by more than half. Instead of borrowing from international banks, both companies borrow domestically and lend to one another at the lower rate. The diagram below depicts the general characteristics of the currency swap. Figure 1: Characteristics of a Currency Swap

You might also like

- Free Online BooksDocument5 pagesFree Online BooksChan Dru100% (4)

- ServicesDocument21 pagesServicesnaveengeNo ratings yet

- C.S.PDF COMPANY LAWDocument49 pagesC.S.PDF COMPANY LAWnaveengeNo ratings yet

- Corporate ResponsibilityDocument57 pagesCorporate ResponsibilitynaveengeNo ratings yet

- Corporate ResponsibilityDocument57 pagesCorporate ResponsibilitynaveengeNo ratings yet

- Made Easy: Project ManagementDocument57 pagesMade Easy: Project ManagementnaveengeNo ratings yet

- C.S.PDF COMPANY LAWDocument49 pagesC.S.PDF COMPANY LAWnaveengeNo ratings yet

- Company LawDocument29 pagesCompany LawnaveengeNo ratings yet

- Company LawDocument58 pagesCompany LawnaveengeNo ratings yet

- Adv FMDocument33 pagesAdv FMnaveengeNo ratings yet

- Company LawDocument29 pagesCompany LawnaveengeNo ratings yet

- Company LawDocument58 pagesCompany LawnaveengeNo ratings yet

- Strategic ManagementDocument173 pagesStrategic Managementjirufeleke1428100% (2)

- Research Methodology .1.Document36 pagesResearch Methodology .1.naveengeNo ratings yet

- What Is The Greenhouse Effect (Article)Document2 pagesWhat Is The Greenhouse Effect (Article)Nishi MuthooraNo ratings yet

- Strategic Management For Senior Leaders: A Handbook For ImplementationDocument119 pagesStrategic Management For Senior Leaders: A Handbook For ImplementationnaveengeNo ratings yet

- Research MethodologyDocument41 pagesResearch MethodologyRomit Machado83% (6)

- Research MethodologyDocument41 pagesResearch MethodologyRomit Machado83% (6)

- Effects of Global Warming On IndiaDocument4 pagesEffects of Global Warming On IndianaveengeNo ratings yet

- Research MethodologyDocument41 pagesResearch MethodologyRomit Machado83% (6)

- Research MethodologyDocument41 pagesResearch MethodologyRomit Machado83% (6)

- What Is Global WarmingDocument1 pageWhat Is Global WarmingnaveengeNo ratings yet

- Global Warming PresentationDocument16 pagesGlobal Warming PresentationnaveengeNo ratings yet

- Climate Solutions: Owning The WeatherDocument3 pagesClimate Solutions: Owning The WeathernaveengeNo ratings yet

- Climate Impacts: The Oceans' SOS: Save Our SeasDocument3 pagesClimate Impacts: The Oceans' SOS: Save Our SeasnaveengeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tradeoff Between Risk and ReturnDocument19 pagesTradeoff Between Risk and Returnanna100% (1)

- Chapter 31 Practical Acctg 1 ValixDocument10 pagesChapter 31 Practical Acctg 1 ValixloiseNo ratings yet

- Synopsis of Customer Acquisition and Retention StrategyDocument9 pagesSynopsis of Customer Acquisition and Retention StrategyGopi Krishnan.nNo ratings yet

- Financial Statement (Balance Sheet, Trading Account, Profit and Loss Account), Ratio AnalysisDocument52 pagesFinancial Statement (Balance Sheet, Trading Account, Profit and Loss Account), Ratio AnalysisRkred237No ratings yet

- 4-1 The Responsibilities and AccountabilitiesDocument39 pages4-1 The Responsibilities and AccountabilitiesAlvin Reynoso LumabanNo ratings yet

- AFIN1Document6 pagesAFIN1Abs PangaderNo ratings yet

- Francis Nicholson, Richard Meek, Andrew Sherratt CIM Coursebook Managing MarketingDocument284 pagesFrancis Nicholson, Richard Meek, Andrew Sherratt CIM Coursebook Managing MarketingRicky FernandoNo ratings yet

- Advertising Appropriation Methods & Emerging Forms of AdvertisingDocument106 pagesAdvertising Appropriation Methods & Emerging Forms of Advertisingchetanprakash077No ratings yet

- DAYAG Advac SolutionChapter6Document21 pagesDAYAG Advac SolutionChapter6N JoNo ratings yet

- First Topic: Unilateral Free TradeDocument12 pagesFirst Topic: Unilateral Free TrademagareataNo ratings yet

- What Is Amazon's Customer Value Proposition? (What Are The Merits of This Proposition? Has It Changed Over Time? How Should It Evolve in The Future?)Document9 pagesWhat Is Amazon's Customer Value Proposition? (What Are The Merits of This Proposition? Has It Changed Over Time? How Should It Evolve in The Future?)Surbhi JainNo ratings yet

- Chapter One Intro To Logistics ManagementDocument47 pagesChapter One Intro To Logistics ManagementAzer 2111No ratings yet

- BBBBBDocument163 pagesBBBBBMark Lord Morales BumagatNo ratings yet

- Case Analysis For Alpen BankDocument7 pagesCase Analysis For Alpen BankKhalil AhmadNo ratings yet

- Principles of Marketing Chapter 4 Developing The Marketing MixDocument9 pagesPrinciples of Marketing Chapter 4 Developing The Marketing MixAnghelica Eunice88% (8)

- Solutions For Economics Review QuestionsDocument28 pagesSolutions For Economics Review QuestionsDoris Acheng67% (3)

- Executive SummaryDocument2 pagesExecutive Summaryapi-258982553No ratings yet

- Cost Volume Profit AnalysisDocument15 pagesCost Volume Profit AnalysisxxpinkywitchxxNo ratings yet

- Cbmec 2 (Chapter 10 Reviewer)Document8 pagesCbmec 2 (Chapter 10 Reviewer)Shiella marie VillaNo ratings yet

- SWOT Analysis TemplatesDocument10 pagesSWOT Analysis Templatesshubham agarwalNo ratings yet

- Aircraft ValuationDocument4 pagesAircraft Valuationdjagger1No ratings yet

- Acca Ma2Document18 pagesAcca Ma2Nguyễn Vũ Linh Ngọc100% (4)

- Anya's Cleaning ServiceDocument22 pagesAnya's Cleaning ServiceArya HerdiansyahNo ratings yet

- Business Plan For A Smart WatchDocument3 pagesBusiness Plan For A Smart WatchNayeem RajaNo ratings yet

- Income Statement 1Document4 pagesIncome Statement 1Mhaye Aguinaldo0% (1)

- InstructionsDocument36 pagesInstructionsjhouvan50% (6)

- Managerial Economics Assignment Question Spring 21Document1 pageManagerial Economics Assignment Question Spring 21farhan Momen100% (2)

- Strategy - Multiple Choice QuestionsDocument7 pagesStrategy - Multiple Choice QuestionsWolf's RainNo ratings yet

- Case Study On App: Didi TaxiDocument4 pagesCase Study On App: Didi TaxiUpmanyu KrishnaNo ratings yet

- Malomatia Internal AnalysisDocument10 pagesMalomatia Internal AnalysisHatem OmarNo ratings yet