Professional Documents

Culture Documents

2011 Supreme Court Decisions On Commercial Law

Uploaded by

Martin MartelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 Supreme Court Decisions On Commercial Law

Uploaded by

Martin MartelCopyright:

Available Formats

2011 Supreme Court Decisions on Commercial Law

June: Bank secrecy; foreign currency deposits. Republic Act No. 1405 was enacted for the purpose of giving encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized loans to assist in the economic development of the country. It covers all bank deposits in the Philippines and no distinction was made between domestic and foreign deposits. Thus, Republic Act No. 1405 is considered a law of general application. On the other hand, Republic Act No. 6426 was intended to encourage deposits from foreign lenders and investors. It is a special law designed especially for foreign currency deposits in the Philippines. A general law does not nullify a specific or special law. Generalia specialibus non derogant. Therefore, it is beyond cavil that Republic Act No. 6426 applies in this case. Applying Section 8 of Republic Act No. 6426, absent the written permission from Domsat, Westmont Bank cannot be legally compelled to disclose the bank deposits of Domsat, otherwise, it might expose itself to criminal liability under the same act. Government Service Insurance System vs. Court of Appeals, et al., G.R. No. 189206. June 8, 2011. Trademark; Harvard. There is no question then, and this Court so declares, that Harvard is a well-known name and mark not only in the United States but also internationally, including the Philippines. The mark Harvard is rated as one of the most famous marks in the world. It has been registered in at least 50 countries. It has been used and promoted extensively in numerous publications worldwide. It has established a considerable goodwill worldwide since the founding of Harvard University more than 350 years ago. It is easily recognizable as the trade name and mark of Harvard University of Cambridge, Massachusetts, U.S.A., internationally known as one of the leading educational institutions in the world. As such, even before Harvard University applied for registration of the mark Harvard in the Philippines, the mark was already protected under Article 6bis and Article 8 of the Paris Convention. Again, even without applying the Paris Convention, Harvard University can invoke Section 4(a) of R.A. No. 166 which prohibits the registration of a mark which may disparage or falsely suggest a connection with persons, living or dead, institutions, beliefs x x x. Fredco Manufacturing Corporation vs. President and Fellows of Harvard College (Harvard University), G.R. No. 185917, June 1, 2011.

July:

Insurance; effectivity of bonds. Lagman anchors his defense on two (2) arguments: 1) the 1989 Bonds have expired and 2) the 1990 Bond novates the 1989 Bonds. The Court of Appeals

held that the 1989 bonds were effective only for one (1) year, as evidenced by the receipts on the payment of premiums. The Supreme Court did not agree. The official receipts in question serve as proof of payment of the premium for one year on each surety bond. It does not, however, automatically mean that the surety bond is effective for only one (1) year. In fact, the effectivity of the bond is not wholly dependent on the payment of premium. Section 177 of the Insurance Code expresses: Sec. 177. The surety is entitled to payment of the premium as soon as the contract of suretyship or bond is perfected and delivered to the obligor. No contract of suretyship or bonding shall be valid and binding unless and until the premium therefor has been paid, except where the obligee has accepted the bond, in which case the bond becomes valid and enforceable irrespective of whether or not the premium has been paid by the obligor to the surety:Provided, That if the contract of suretyship or bond is not accepted by, or filed with the obligee, the surety shall collect only reasonable amount, not exceeding fifty per centum of the premium due thereon as service fee plus the cost of stamps or other taxes imposed for the issuance of the contract or bond: Provided, however, That if the non-acceptance of the bond be due to the fault or negligence of the surety, no such service fee, stamps or taxes shall be collected. Country Bankers Insurance Corporation v. Antonio Lagman, G.R. No. 165487, July 13, 2011. Limited liability rule; availability. With respect to petitioners position that the Limited Liability Rule under the Code of Commerce should be applied to them, the argument is misplaced. The said rule has been explained to be that of the real and hypothecary doctrine in maritime law where the shipowner or ship agents liability is held as merely co -extensive with his interest in the vessel such that a total loss thereof results in its extinction. In this jurisdiction, this rule is provided in three articles of the Code of Commerce. These are: Art. 587. The ship agent shall also be civilly liable for the indemnities in favor of third persons which may arise from the conduct of the captain in the care of the goods which he loaded on the vessel; but he may exempt himself therefrom by abandoning the vessel with all her equipment and the freight it may have earned during the voyage. Art. 590. The co-owners of the vessel shall be civilly liable in the proportion of their interests in the common fund for the results of the acts of the captain referred to in Art. 587. Each co-owner may exempt himself from this liability by the abandonment, before a notary, of the part of the vessel belonging to him. Art. 837. The civil liability incurred by shipowners in the case prescribed in this section, shall be understood as limited to the value of the vessel with all its appurtenances and freightage served during the voyage. Article 837 specifically applies to cases involving collision which is a necessary consequence of the right to abandon the vessel given to the shipowner or ship agent under the first provision Article 587. Similarly, Article 590 is a reiteration of Article 587, only this time the situation is that the vessel is co-owned by several persons. Obviously, the forerunner of the Limited Liability Rule under the Code of Commerce is Article 587. Now, the latter is quite clear on which indemnities may be confined or restricted to the value of the vessel pursuant to the said Rule, and these are the indemnities in favor of third persons which may arise from the conduct of the captain in the care of the goods which he loaded on the vessel. Thus, what is contemplated is the

liability to third persons who may have dealt with the shipowner, the agent or even the charterer in case of demise or bareboat charter. The only person who could avail of this is the shipowner, Concepcion. He is the very person whom the Limited Liability Rule has been conceived to protect. The petitioners cannot invoke this as a defense. Agustin P. Dela Torre v. The Hon. Court of Appeals, et al./Philippine Trigon Shipyard Corporation, et al. v. Crisostomo G. Concepcion, et al., G.R. No. 160088/G.R. No. 160565, July 13, 2011 Charterer and sub-charterer; liability. In the present case, the charterer and the subcharterer through their respective contracts of agreement/charter parties, obtained the use and service of the entire LCT-Josephine. The vessel was likewise manned by the charterer and later by the sub-charterers people. With the complete and exclusive relinquishment of possession, command and navigation of the vessel, the charterer and later the sub-charterer became the vessels owner pro hac vice. Now, and in the absence of any showing that the vessel or any part thereof was commercially offered for use to the public, the above agreements/charter parties are that of a private carriage where the rights of the contracting parties are primarily defined and governed by the stipulations in their contract. Although certain statutory rights and obligations of charter parties are found in the Code of Commerce, these provisions as correctly pointed out by the RTC, are not applicable in the present case. Indeed, none of the provisions found in the Code of Commerce deals with the specific rights and obligations between the real shipowner and the charterer obtaining in this case. Necessarily, the Court looks to the New Civil Code to supply the deficiency. Thus, Roland, who, in his personal capacity, entered into the Preliminary Agreement with Concepcion for the dry-docking and repair of LCT-Josephine, is liable under Article 1189 of the New Civil Code. There is no denying that the vessel was not returned to Concepcion after the repairs because of the provision in t he Preliminary Agreement that the same should be used by Roland for the first two years. Before the vessel could be returned, it was lost due to the negligence of Agustin to whom Roland chose to sub-charter or sublet the vessel. PTSC is liable to Concepcion under Articles 1665 and 1667 of the New Civil Code. As the charterer or lessee under the Contract of Agreement dated June 20, 1984, PTSC was contractbound to return the thing leased and it was liable for the deterioration or loss of the same. Agustin, on the other hand, who was the sub-charterer or sub-lessee of LCT-Josephine, is liable under Article 1651 of the New Civil Code. Although he was never privy to the contract between PTSC and Concepcion, he remained bound to preserve the chartered vessel for the latter. Despite his non-inclusion in the complaint of Concepcion, it was deemed amended so as to include him because, despite or in the absence of that formality of amending the complaint to include him, he still had his day in court as he was in fact impleaded as a third-party defendant by his own son, Roland the very same person who represented him in the Contract of Agreement with Larrazabal. In any case, all three petitioners are liable under Article 1170 of the New Civil Code. Agustin P. Dela Torre v. The Hon. Court of Appeals, et al./Philippine Trigon Shipyard Corporation, et al. v. Crisostomo G. Concepcion, et al., G.R. No. 160088/G.R. No. 160565, July 13, 2011

August:

Securities Regulation Code; public company . The Philippine Veterans Bank (the Bank) argued that it is not a public company subject to the reportorial requirements under Section 17.1 of the SRC because its shares can be owned only by a specific group of people, namely, World War II veterans and their widows, orphans and compulsory heirs, and is not open to the investing public in general. The Bank also requested the Court to take into consideration the financial impact to the cause of veteranism; compliance with the reportorial requirements under the SRC, if the Bank would be considered a public company, would compel the Bank to spend approximately P40 million just to reproduce and mail the Information Statement to its 400,000 shareholders nationwide. Rule 3(1)(m) of the Amended Implementing Rules and Regulations of the SRC defines a public company as any corporation with a class of equity securities listed on an Exchange or with assets in excess of Fifty Million Pesos (P50,000,000.00) and having two hundred (200) or more holders, at least two hundred (200) of which are holding at least one hundred (100) shares of a class of its equity securities. From these provisions, it is clear that a public company, as contemplated by the SRC, i s not limited to a company whose shares of stock are publicly listed; even companies like the Bank, whose shares are offered only to a specific group of people, are considered a public company, provided they meet the requirements enumerated above. The records establish, and the Bank does not dispute, that the Bank has assets exceeding P50,000,000.00 and has 395,998 shareholders. It is thus considered a public company that must comply with the reportorial requirements set forth in Section 17.1 of the SRC. Philippine Veterans Bank vs. Justina Callangan, etc. and/or the Securities and Exchange Commission G.R. No. 191995, August 3, 2011.

September:

Banks; degree of diligence required. The General Banking Law of 2000 requires of banks the highest standards of integrity and performance. The banking business is impressed with public interest. Of paramount importance is the trust and confidence of the public in general in the banking industry. Consequently, the diligence required of banks is more than that of a Roman pater familias or a good father of a family. The highest degree of diligence is expected. Philippine Commercial Bank vs. Antonio B. Balmaceda and Rolando N. Ramos, G.R. No. 158143, September 21, 2011. Banks; unilateral freezing of bank account. We also find that PCIB acted illegally in freezing and debiting Ramos bank account. In BPI Family Bank v. Franco, we cautioned against the unilateral freezing of bank accounts by banks, noting that: More importantly, [BPI Family Bank] does not have a unilateral right to freeze the accounts of Franco based on its mere suspicion that the funds therein were proceeds of the multi-million peso scam Franco was allegedly involved in. To grant [BPI Family Bank], or any bank for that matter, the right to take whatever action it pleases on deposits which it supposes are derived from shady transactions, would open the floodgates of public distrust in the banking industry. We see no legal merit in PCIBs claim that legal compensation took place between it and Ramos, thereby warranting the automatic deduction from Ramos bank account. For legal compensation to take place, two persons, in their own right, must first be creditors and debtors of

each other. While PCIB, as the depositary bank, is Ramos debtor in the amount of his deposits, Ramos is not PCIBs debtor under the evidence the PCIB adduced. PCIB thus had no basis, in fact or in law, to automatically debit from Ramos bank account. Philippine Commercial Bank vs. Antonio B. Balmaceda and Rolando N. Ramos, G.R. No. 158143, September 21, 2011. Checks; crossed checks. A crossed check is one where two parallel lines are drawn across its face or across its corner. Based on jurisprudence, the crossing of a check has the following effects: (a) the check may not be encashed but only deposited in the bank; (b) the check may be negotiated only once to the one who has an account with the bank; and (c) the act of crossing the check serves as a warning to the holder that the check has been issued for a definite purpose and he must inquire if he received the check pursuant to this purpose; otherwise, he is not a holder in due course. In other words, the crossing of a check is a warning that the check should be deposited only in the account of the payee. When a check is crossed, it is the duty of the collecting bank to ascertain that the check is only deposited to the payees account. In complete disregard of this duty, PCIBs systems allowed Balmaceda to encash 26 Managers checks which were all crossed checks, or checks payable to the payees account only. Philippine Commercial Bank vs. Antonio B. Balmaceda and Rolando N. Ramos, G.R. No. 158143, September 21, 2011. Payment; foreign currency. A stipulation of payment in dollars is not prohibited by any prevailing law or jurisprudence at the time the loans were taken. In this regard, Article 1249 of the Civil Code provides: Art. 1249. The payment of debts in money shall be made in the currency stipulated, and if it is not possible to deliver such currency, then in the currency which is legal tender in the Philippines. Although the Civil Code took effect on August 30, 1950, jurisprudence had upheld the continued effectivity of Republic Act No. 529, which took effect earlier on June 16, 1950. Pursuant to Section 1 of Republic Act No. 529, any agreement to pay an obligation in a currency other than the Philippine currency is void; the most that could be demanded is to pay said obligation in Philippine currency to be measured in the prevailing rate of exchange at the time the obligation was incurred. On June 19, 1964, Republic Act No. 4100 took effect, modifying Republic Act No. 529 by providing for several exceptions to the nullity of agreements to pay in foreign currency. On April 13, 1993, Central Bank Circular No. 1389 was issued, lifting foreign exchange restrictions and liberalizing trade in foreign currency. In cases of foreign borrowings and foreign currency loans, however, prior Bangko Sentral approval was required. On July 5, 1996, Republic Act No. 8183 took effect, expressly repealing Republic Act No. 529 in Section 2 thereof. The same statute also explicitly provided that parties may agree that the obligation or transaction shall be settled in a currency other than Philippine currency at the time of payment. Although the Credit Line Agreement between the spouses Tiu and Union Bank was entered into on November 21, 1995, when the agreement to pay in foreign currency was still considered void under Republic Act No. 529, the actual loans, as shown in the promissory notes, were taken out from September 22, 1997 to March 26, 1998, during which time Republic Act No. 8183 was already in effect. Union Bank of the Philippines vs. Spouses Rodolfo T. Tiu and Victoria N. Tiu, G.R. Nos. 173090-91. September 7, 2011.

October:

Check; issuance for consideration. Upon issuance of a check, in the absence of evidence to the contrary, it is presumed that the same was issued for valuable consideration which may consist either in some right, interest, profit or benefit accruing to the party who makes the contract, or some forbearance, detriment, loss or some responsibility, to act, or labor, or service given, suffered or undertaken by the other side. Under the Negotiable Instruments Law, it is presumed that every party to an instrument acquires the same for a consideration or for value. As petitioner alleged that there was no consideration for the issuance of the subject checks, it devolved upon him to present convincing evidence to overthrow the presumption and prove that the checks were in fact issued without valuable consideration. Sadly, however, petitioner has not presented any credible evidence to rebut the presumption, as well as North Stars assertion, that the checks were issued as payment for the US$85,000 petitioner owed. Engr. Jose E. Cayanan vs. North Star International Travel, Inc. G.R. No. 172954. October 5, 2011 Rehabilitation receiver; role. As an officer of the court and an expert, the rehabilitation receiver plays an important role in corporate rehabilitation proceedings. In Pryce Corporation v. Court of Appeals, the Court held that, the purpose of the law in directing the appointment of receivers is to protect the interests of the corporate investors and creditors. Section 14 of the Interim Rules of Procedure on Corporate Rehabilitation enumerates the powers and functions of the rehabilitation receiver: (1) verify the accuracy of the petition, including its annexes such as the schedule of debts and liabilities and the inventory of assets submitted in support of the petition; (2) accept and incorporate, when justified, amendments to the schedule of debts and liabilities; (3) recommend to the court the disallowance of claims and rejection of amendments to the schedule of debts and liabilities that lack sufficient proof and justification; (4) submit to the court and make available for review by the creditors a revised schedule of debts and liabilities; (5) investigate the acts, conduct, properties, liabilities, and financial condition of the debtor, the operation of its business and the desirability of the continuance thereof, and any other matter relevant to the proceedings or to the formulation of a rehabilitation plan; (6) examine under oath the directors and officers of the debtor and any other witnesses that he may deem appropriate; (7) make available to the creditors documents and notices necessary for them to follow and participate in the proceedings; (8) report to the court any fact ascertained by him pertaining to the causes of the debtors proble ms, fraud, preferences, dispositions, encumbrances, misconduct, mismanagement, and irregularities committed by the stockholders, directors, management, or any other person; (9) employ such person or persons such as lawyers, accountants, appraisers, and staff as are necessary in performing his functions and duties as rehabilitation receiver; (10) monitor the operations of the debtor and to immediately report to the court any material adverse change in the debtors business; (11) evaluate the existing assets and liabilities, earnings and operations of the debtor; (12) determine and recommend to the court the best way to salvage and protect the interests of the creditors, stockholders, and the general public; (13) study the rehabilitation plan proposed by the debtor or any rehabilitation plan submitted during the proceedings, together with any comments made thereon; (14) prohibit and report to the court any encumbrance, transfer, or disposition of the debtors property outside of the ordinary course of business or what is allowed by the court; (15) prohibit and report to the court any payments outside of the ordinary course of business; (16) have unlimited access to the debtors employees, premises, books, records, and financial documents during business hours; (17) inspect, copy, photocopy, or photograph any document, paper, book, account, or letter, whether in the possession of the debtor or other persons; (18) gain entry into any property for the purpose of inspecting, measuring, surveying, or photographing it or any designated relevant object or operation thereon; (19) take possession,

control, and custody of the debtors assets; (20) notify the parties and the court as to contracts that the debtor has decided to continue to perform or breach; (21) be notified of, and to attend all meetings of the board of directors and stockholders of the debtor; (22) recommend any modification of an approved rehabilitation plan as he may deem appropriate; (23) bring to the attention of the court any material change affecting t he debtors ability to meet the obligations under the rehabilitation plan; (24) recommend the appointment of a management committee in the cases provided for under Presidential Decree No. 902-A, as amended; (25) recommend the termination of the proceedings and the dissolution of the debtor if he determines that the continuance in business of such entity is no longer feasible or profitable or no longer works to the best interest of the stockholders, parties-litigants, creditors, or the general public; and (26) apply to the court for any order or directive that he may deem necessary or desirable to aid him in the exercise of his powers. Siochi Fishery Enterprises, Inc., et al. vs. Bank of the Philippine Islands, G.R. No. 193872. October 19, 2011. Rehabilitation; rehabilitation plan. The rehabilitation plan is an indispensable requirement in corporate rehabilitation proceedings. Section 5 of the Rules enumerates the essential requisites of a rehabilitation plan: The rehabilitation plan shall include (a) the desired business targets or goals and the duration and coverage of the rehabilitation; (b) the terms and conditions of such rehabilitation which shall include the manner of its implementation, giving due regard to the interests of secured creditors; (c) the material financial commitments to support the rehabilitation plan; (d) the means for the execution of the rehabilitation plan, which may include conversion of the debts or any portion thereof to equity, restructuring of the debts, dacion en pago, or sale of assets or of the controlling interest; (e) a liquidation analysis that estimates the proportion of the claims that the creditors and shareholders would receive if the debtors properties were liquidated; and (f) such other relevant information to enable a reasonable investor to make an informed decision on the feasibility of the rehabilitation plan. The Court notes that petitioners failed to include a liquidation analysis in their rehabilitation plan. Siochi Fishery Enterprises, Inc., et al. vs. Bank of the Philippine Islands, G.R. No. 193872. October 19, 2011.

November:

Corporations; piercing the corporate veil. Piercing the veil of corporate fiction is warranted only in cases when the separate legal entity is used to defeat public convenience, justify wrong, protect fraud, or defend crime, such that in the case of two corporations, the law will regard the corporations as merged into one. As succinctly discussed by the Court in Velarde v. Lopez, Inc.: Petitioner argues nevertheless that jurisdiction over the subsidiary is justified by piercing the veil of corporate fiction. Piercing the veil of corporate fiction is warranted, however, only in cases when the separate legal entity is used to defeat public convenience, justify wrong, protect fraud, or defend crime, such that in the case of two corporations, the law will regard the corporations as merged into one. The rationale behind piercing a corporations identity is to remove the barrier between the corporation from the persons comprising it to thwart the fraudulent and illegal schemes of those who use the corporate personality as a shield for undertaking certain proscribed activities.

In applying the doctrine of piercing the veil of corporate fiction, the following requisites must be established: (1) control, not merely majority or complete stock control; (2) such control must have been used by the defendant to commit fraud or wrong, to perpetuate the violation of a statutory or other positive legal duty, or dishonest acts in contravention of plaintiffs legal rights; and (3) the aforesaid control and breach of duty must proximately cause the injury or unjust loss complained of. (Citations omitted.) Nowhere, however, in the pleadings and other records of the case can it be gathered that respondent has complete control over Sky Vision, not only of finances but of policy and business practice in respect to the transaction attacked, so that Sky Vision had at the time of the transaction no separate mind, will or existence of its own. The existence of interlocking directors, corporate officers and shareholders is not enough justification to pierce the veil of corporate fiction in the absence of fraud or other public policy considerations. Hacienda Luisita Incorporated vs. Presidential Agrarian Reform Council , G.R. No. 171101, November 22, 2011. Corporations; piercing the corporate veil. Absent any allegation or proof of fraud or other public policy considerations, the existence of interlocking directors, officers and stockholders is not enough justification to pierce the veil of corporate fiction as in the instant case. Hacienda Luisita Incorporated vs. Presidential Agrarian Reform Council, G.R. No. 171101, November 22, 2011. Mark; infringement. A mark is any visible sign capable of distinguishing the goods (trademark) or services (service mark) of an enterprise and shall include a stamped or marked container of goods. In McDonalds Corporation and McGeorge Food Industries, Inc. v. L.C. Big Mak Burger, Inc., this Court held: To establish trademark infringement, the following elements must be shown: (1) the validity of plaintiffs mark; (2) the plaintiffs ownership of the mark; and (3) the use of the mark or its colorable imitation by the alleged infringer results in likelihood of confusion. Of these, it is the element of likelihood of confusion that is the gravamen of trademark infringement. A mark is valid if it is distinctive and not barred from registration. Once registered, not only the marks validity, but also the registrants ownership of the mark is prima facie presumed. Gemma Ong a.k.a. Ma. Theresa Gemma Catacutan vs. People of the Philippines, G.R. No. 169440,. November 23, 2011.

December:

Corporation; contracts before incorporation. With respect to petitioners contention that the Management Contract executed between respondent and petitioner Lucila has no binding effect on petitioner corporation for having been executed way before its incorporation, this Court finds the same meritorious. Logically, there is no corporation to speak of prior to an entitys incorporation. And no contract entered into before incorporation can bind the corporation. March II Marketing, Inc. and Lucila V. Joson vs. Alfredo M. Joson, G.R. No. 171993, December 12, 2011.

Corporation; corporate officers. In the context of Presidential Decree No. 902-A, corporate officers are those officers of a corporation who are given that character either by the Corporation Code or by the corporations by-laws. Section 25 of the Corporation Code specifically enumerated who are these corporate officers, to wit: (1) president; (2) secretary; (3) treasurer; and (4) such other officers as may be provided for in the by-laws. With the given circumstances and in conformity with Matling Industrial and Commercial Corporation v. Coros, this Court rules that respondent was not a corporate officer of petitioner corporation because his position as General Manager was not specifically mentioned in the roster of corporate officers in its corporate by-laws. The enabling clause in petitioner corporations by laws empowering its Board of Directors to create additional officers, i.e., General Manager, and the alleged subsequent passage of a board resolution to that effect cannot make such position a corporate office. Matling clearly enunciated that the board of directors has no power to create other corporate offices without first amending the corporate by-laws so as to include therein the newly created corporate office. Though the board of directors may create appointive positions other than the positions of corporate officers, the persons occupying such positions cannot be viewed as corporate officers under Section 25 of the Corporation Code. In view thereof, this Court holds that unless and until petitioner corporations by -laws is amended for the inclusion of General Manager in the list of its corporate officers, such position cannot be considered as a corporate office within the realm of Section 25 of the Corporation Code. March II Marketing, Inc. and Lucila V. Joson vs. Alfredo M. Joson, G.R. No. 171993, December 12, 2011.

You might also like

- United States v. Parker, 4th Cir. (2002)Document3 pagesUnited States v. Parker, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- AcceptanceDocument10 pagesAcceptanceSita Sowmya MunagalaNo ratings yet

- United States v. Tarik Ali Bey A/K/A Warren L. Williams, 499 F.2d 194, 3rd Cir. (1974)Document14 pagesUnited States v. Tarik Ali Bey A/K/A Warren L. Williams, 499 F.2d 194, 3rd Cir. (1974)Scribd Government DocsNo ratings yet

- Lighting the Way: Federal Courts, Civil Rights, and Public PolicyFrom EverandLighting the Way: Federal Courts, Civil Rights, and Public PolicyNo ratings yet

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithFrom EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNo ratings yet

- Indemnity BondDocument2 pagesIndemnity BondAditya sharmaNo ratings yet

- Compilation On Quasi Contract PDFDocument70 pagesCompilation On Quasi Contract PDFutkarshNo ratings yet

- HR Cases (Search and Seizure)Document33 pagesHR Cases (Search and Seizure)Jim Jorjohn SulapasNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument8 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- US-UK Treaty of Amity, Commerce and NavigationDocument25 pagesUS-UK Treaty of Amity, Commerce and NavigationWalkinLANo ratings yet

- Contract Law - Formation - Ending Contractual Obligations - Vitiating Factors and DischargeDocument30 pagesContract Law - Formation - Ending Contractual Obligations - Vitiating Factors and DischargeMhz SherNo ratings yet

- The Historical Relation of Law and ReligionDocument22 pagesThe Historical Relation of Law and Religionsolution4theinnocentNo ratings yet

- Mary Goldstein Criminal ComplaintDocument17 pagesMary Goldstein Criminal ComplaintGary DetmanNo ratings yet

- 41 Response Show CauseDocument17 pages41 Response Show CauseLash L0% (1)

- Petition For Writ of Habeus CorpusDocument9 pagesPetition For Writ of Habeus CorpusJuan VicheNo ratings yet

- Handbook On Learning LawDocument16 pagesHandbook On Learning LawLohgabaalan RajayaindranNo ratings yet

- Capitalization Rules: Buildings, Streets, Parks, Statues, MonumentsDocument6 pagesCapitalization Rules: Buildings, Streets, Parks, Statues, MonumentsRezza AnugerahNo ratings yet

- Bailbond 2Document5 pagesBailbond 2romnickNo ratings yet

- Demurrer To OAG Petition For Writ of Quo WarrantoDocument5 pagesDemurrer To OAG Petition For Writ of Quo WarrantoJames Renwick Manship, Sr.100% (1)

- Brinkerhoff-Posse Comitatus 2002Document9 pagesBrinkerhoff-Posse Comitatus 2002James V. DeLongNo ratings yet

- Black Diamond SS Corp. v. Robert Stewart & Sons, LTD., 336 U.S. 386 (1949)Document17 pagesBlack Diamond SS Corp. v. Robert Stewart & Sons, LTD., 336 U.S. 386 (1949)Scribd Government DocsNo ratings yet

- Evans Answer To Forfeiture ComplaintDocument22 pagesEvans Answer To Forfeiture ComplaintJames PilcherNo ratings yet

- Indigenous Peoples' Right to Land Recognized in International LawDocument24 pagesIndigenous Peoples' Right to Land Recognized in International LawIvar Jesus Calixto PeñafielNo ratings yet

- Counsel For Trimont Real Estate Advisors, Inc. As Special ServicerDocument3 pagesCounsel For Trimont Real Estate Advisors, Inc. As Special ServicerChapter 11 DocketsNo ratings yet

- Police Code: General Manual of The Criminal LawDocument244 pagesPolice Code: General Manual of The Criminal LawBrilar2KNo ratings yet

- Defining Treason 1918Document20 pagesDefining Treason 1918wbalsonNo ratings yet

- United States v. Lujan, 10th Cir. (2010)Document12 pagesUnited States v. Lujan, 10th Cir. (2010)Scribd Government DocsNo ratings yet

- Tom Lawler FCUSA CriminalDocument28 pagesTom Lawler FCUSA CriminalMike FarellNo ratings yet

- Steffel v. Thompson, 415 U.S. 452 (1974)Document26 pagesSteffel v. Thompson, 415 U.S. 452 (1974)Scribd Government DocsNo ratings yet

- TheRomanLawofSuccession AnOverviewDocument28 pagesTheRomanLawofSuccession AnOverviewOriolNo ratings yet

- The Artificial Dictionary of Secret Words, Secret Code and License Plate Game and Old English: Also Helps with SpellingFrom EverandThe Artificial Dictionary of Secret Words, Secret Code and License Plate Game and Old English: Also Helps with SpellingNo ratings yet

- Collins v. Colvin, 10th Cir. (2016)Document7 pagesCollins v. Colvin, 10th Cir. (2016)Scribd Government DocsNo ratings yet

- Jurisdiction and Role of Defense CounselDocument2 pagesJurisdiction and Role of Defense CounselShubhaNo ratings yet

- HON ANG: WordsDocument45 pagesHON ANG: WordsakashNo ratings yet

- Court rules on homeowners association disputeDocument190 pagesCourt rules on homeowners association disputeGrace TrinidadNo ratings yet

- Affidavit: Fuonsbtstionet Felersl Fiotttl GLRDocument6 pagesAffidavit: Fuonsbtstionet Felersl Fiotttl GLRelio bohechio elNo ratings yet

- Using An Affidavit of Identity in California Judgment CollectionsDocument3 pagesUsing An Affidavit of Identity in California Judgment CollectionsStan BurmanNo ratings yet

- Abuse of Court ProcessDocument1 pageAbuse of Court ProcessGervas GeneyaNo ratings yet

- Holton v. Reed, 193 F.2d 390, 10th Cir. (1951)Document7 pagesHolton v. Reed, 193 F.2d 390, 10th Cir. (1951)Scribd Government DocsNo ratings yet

- Brophy CounterclaimDocument21 pagesBrophy CounterclaimemergerNo ratings yet

- Gpo-Conan-1992 The Constitution Analysis and InterpretationDocument2,466 pagesGpo-Conan-1992 The Constitution Analysis and InterpretationAlex VaubelNo ratings yet

- Was Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceFrom EverandWas Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceNo ratings yet

- Qualifications For President and The "Natural Born" Citizenship Eligibility RequirementDocument53 pagesQualifications For President and The "Natural Born" Citizenship Eligibility RequirementDoctor ConspiracyNo ratings yet

- Legal System Vs Law SystemDocument1 pageLegal System Vs Law SystemFreeman LawyerNo ratings yet

- Affidavit of Identifying WitnessDocument2 pagesAffidavit of Identifying Witnessdouglas jonesNo ratings yet

- Strangers to the Constitution: Immigrants, Borders, and Fundamental LawFrom EverandStrangers to the Constitution: Immigrants, Borders, and Fundamental LawNo ratings yet

- Ashwander v. TVA, 297 U.S. 288 (1936)Document45 pagesAshwander v. TVA, 297 U.S. 288 (1936)Scribd Government DocsNo ratings yet

- The Oaths Act, 1873 PDFDocument4 pagesThe Oaths Act, 1873 PDFrashid001No ratings yet

- 12cv260 SurreplyMTDDocument6 pages12cv260 SurreplyMTDfndoomedNo ratings yet

- Exercitii Vocabular Drept 2011 Sem 2Document25 pagesExercitii Vocabular Drept 2011 Sem 2norica_feliciaNo ratings yet

- Human Rights ReadingsDocument73 pagesHuman Rights ReadingsPaul Arman MurilloNo ratings yet

- Vitol, S.A. v. Capri Marine, LTD., 4th Cir. (2013)Document36 pagesVitol, S.A. v. Capri Marine, LTD., 4th Cir. (2013)Scribd Government DocsNo ratings yet

- 19 AMJUR TRIALS On Suing A Decedants EstateDocument93 pages19 AMJUR TRIALS On Suing A Decedants EstateDUTCH551400No ratings yet

- Trustees of Philadelphia Baptist Assn. v. Hart's Executors, 17 U.S. 1 (1819)Document44 pagesTrustees of Philadelphia Baptist Assn. v. Hart's Executors, 17 U.S. 1 (1819)Scribd Government DocsNo ratings yet

- Alabama Court of The Judiciary Rules For ProcedureDocument7 pagesAlabama Court of The Judiciary Rules For ProcedureBen CulpepperNo ratings yet

- Open Letter To Karen Hudes From Anna Von ReitzDocument2 pagesOpen Letter To Karen Hudes From Anna Von ReitzFranz DipNo ratings yet

- Administrative Law: WritsDocument8 pagesAdministrative Law: WritsZeesahnNo ratings yet

- Innocent Owner Defense in Forfeiture Cases (Texas)Document5 pagesInnocent Owner Defense in Forfeiture Cases (Texas)Charles B. "Brad" FryeNo ratings yet

- Bailbond 2Document2 pagesBailbond 2Martin MartelNo ratings yet

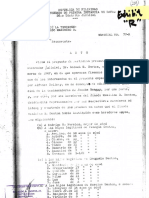

- Compliance With Explanation: Republic of The Philippines Department of Labor and EmploymentDocument1 pageCompliance With Explanation: Republic of The Philippines Department of Labor and EmploymentMartin MartelNo ratings yet

- Lease Contract SummaryDocument4 pagesLease Contract SummaryMartin MartelNo ratings yet

- Complaint - MiguelDocument2 pagesComplaint - MiguelMartin MartelNo ratings yet

- Release and Cancellation of MortgageDocument1 pageRelease and Cancellation of MortgageMartin MartelNo ratings yet

- Witness Affidavit Coconut Theft CaseDocument2 pagesWitness Affidavit Coconut Theft CaseMartin MartelNo ratings yet

- RELEASE AND CANCELLATION OF MortgageDocument2 pagesRELEASE AND CANCELLATION OF MortgageMartin MartelNo ratings yet

- Release and Cancellation of MortgageDocument1 pageRelease and Cancellation of MortgageMartin MartelNo ratings yet

- Affidavit of Non OperationDocument1 pageAffidavit of Non OperationMartin Martel50% (2)

- Exhibit RDocument3 pagesExhibit RMartin MartelNo ratings yet

- Affidavit of Witness: Jestoni TiwoDocument2 pagesAffidavit of Witness: Jestoni TiwoMartin MartelNo ratings yet

- Affidavit of Witness: Jestoni TiwoDocument2 pagesAffidavit of Witness: Jestoni TiwoMartin MartelNo ratings yet

- SPADocument8 pagesSPAMartin MartelNo ratings yet

- Entry of AppearanceDocument3 pagesEntry of AppearanceMartin MartelNo ratings yet

- Demand Letter Sample FormDocument3 pagesDemand Letter Sample FormMartin MartelNo ratings yet

- Affidavit of Business RetirementDocument1 pageAffidavit of Business RetirementMartin Martel100% (2)

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNo ratings yet

- Petition Change BirthdateDocument2 pagesPetition Change BirthdateMartin MartelNo ratings yet

- Motion To WithdrawDocument2 pagesMotion To WithdrawMartin MartelNo ratings yet

- Motion To Render Judgment - FormDocument3 pagesMotion To Render Judgment - FormMartin Martel100% (1)

- Motion To Declare Defendant in Default - FormDocument2 pagesMotion To Declare Defendant in Default - FormMartin Martel100% (1)

- Affidavit of Witness - FilmixDocument2 pagesAffidavit of Witness - FilmixMartin MartelNo ratings yet

- 2018 Pointers in Corporation Law and SRC As of Nov 16 2108Document20 pages2018 Pointers in Corporation Law and SRC As of Nov 16 2108Martin MartelNo ratings yet

- Compliance - FormDocument1 pageCompliance - FormMartin MartelNo ratings yet

- Davao Occidental kidnapping case extensionDocument2 pagesDavao Occidental kidnapping case extensionMartin MartelNo ratings yet

- Desistance - SampleDocument1 pageDesistance - SampleMartin MartelNo ratings yet

- Non TenancyDocument1 pageNon TenancyMartin MartelNo ratings yet

- Investment PrimerDocument39 pagesInvestment PrimerMartin MartelNo ratings yet

- Manual of Regulations On Foreign Exchange TransactionsDocument104 pagesManual of Regulations On Foreign Exchange TransactionsmisakiNo ratings yet

- Template For Consortium AgreementDocument3 pagesTemplate For Consortium Agreementcatherine teaceNo ratings yet

- New Mexico V Steven Lopez - Court RecordsDocument13 pagesNew Mexico V Steven Lopez - Court RecordsMax The Cat0% (1)

- San Miguel vs. MacedaDocument5 pagesSan Miguel vs. MacedanathNo ratings yet

- Legal English Inheritance Law Property Law (Mgr. Kołakowska)Document2 pagesLegal English Inheritance Law Property Law (Mgr. Kołakowska)KonradAdamiakNo ratings yet

- Kisan Vikas Patra Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodaraDocument9 pagesKisan Vikas Patra Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodarabhanupalavarapuNo ratings yet

- Teachers Workweek Plan LeveeDocument5 pagesTeachers Workweek Plan LeveeMahayahay ES KapataganNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Vsa 17 ADocument2 pagesVsa 17 AJustin WilliamsNo ratings yet

- CBSE Class 9 Social Science Important Questions on Working of InstitutionsDocument4 pagesCBSE Class 9 Social Science Important Questions on Working of InstitutionsIX-I 35 Yash KanodiaNo ratings yet

- Taxation Law PDFDocument10 pagesTaxation Law PDFAnonymous tgYJENIk3No ratings yet

- Lady Gaga LawsuitDocument19 pagesLady Gaga LawsuitDarren Adam HeitnerNo ratings yet

- Atty. Monna Lissa C. Monje-Viray: Are Hereto Attached As Annex "A" and "A-1"Document6 pagesAtty. Monna Lissa C. Monje-Viray: Are Hereto Attached As Annex "A" and "A-1"MarianoFloresNo ratings yet

- En Banc (B.M. NO. 1222: February 4, 2004) Re: 2003 Bar Examinations ResolutionDocument8 pagesEn Banc (B.M. NO. 1222: February 4, 2004) Re: 2003 Bar Examinations ResolutionAndree MorañaNo ratings yet

- Criminology Board Exam ReviewerDocument391 pagesCriminology Board Exam ReviewerEy Ar JieNo ratings yet

- Tiu Vs CA CaseDocument1 pageTiu Vs CA CasemarwantahsinNo ratings yet

- People v. Decena: Self-Defense CaseDocument79 pagesPeople v. Decena: Self-Defense CaseCharlene Hatague100% (1)

- VakalatnamaDocument1 pageVakalatnamaAadil KhanNo ratings yet

- Goa Buildings Lease, Rent and Eviction Control Act SummaryDocument40 pagesGoa Buildings Lease, Rent and Eviction Control Act SummaryJay KothariNo ratings yet

- Removal of Director Under Companies Act, 2013Document3 pagesRemoval of Director Under Companies Act, 2013Madhav MathurNo ratings yet

- NLRB: IATSE Hiring Hall Rules UnlawfulDocument8 pagesNLRB: IATSE Hiring Hall Rules UnlawfulLaborUnionNews.comNo ratings yet

- Test Sample 3 Law On SalesDocument10 pagesTest Sample 3 Law On SalesDarlene SarcinoNo ratings yet

- Quasi ContractDocument20 pagesQuasi ContractAgniv Das100% (1)

- Group B (Moot Court Project 1)Document20 pagesGroup B (Moot Court Project 1)Amogha GadkarNo ratings yet

- Williams v. Mayor of Baltimore, 289 U.S. 36 (1933)Document9 pagesWilliams v. Mayor of Baltimore, 289 U.S. 36 (1933)Scribd Government DocsNo ratings yet

- Saro Releases As of December 29 2017 PDFDocument1,288 pagesSaro Releases As of December 29 2017 PDFTeodolfo Cordero JrNo ratings yet

- Angel Pereda Complaint 21 Mag 6595 0Document8 pagesAngel Pereda Complaint 21 Mag 6595 0Periódico CentralNo ratings yet

- UK Supreme Court and Parliament relationship under Human Rights ActDocument7 pagesUK Supreme Court and Parliament relationship under Human Rights ActAaqib IOBMNo ratings yet

- Malaysian Airlines dismissal case heard by Industrial CourtDocument20 pagesMalaysian Airlines dismissal case heard by Industrial CourtShaharizan SallehNo ratings yet

- Prejudicial QuestionDocument8 pagesPrejudicial QuestioncaseskimmerNo ratings yet

- DLSU 2015 Consti Law OutlineDocument13 pagesDLSU 2015 Consti Law OutlineMico Maagma CarpioNo ratings yet

- LAWS2201 Administrative Law 1 Semester 2011: How To Use This ScriptDocument10 pagesLAWS2201 Administrative Law 1 Semester 2011: How To Use This ScriptThanvinNo ratings yet