Professional Documents

Culture Documents

Pure Equity Funds

Uploaded by

Basheer MohammadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pure Equity Funds

Uploaded by

Basheer MohammadCopyright:

Available Formats

Pure quity |und

Asset PreIi|e

1he investments in this fund will specifically exclude companies dealing

in Cambling, Contests, Liquor, Lntertainment (Pilms, 1v, etc.), Rotels,

Banks and Pinancial |nstitutions, |nvestment would be atleast 6OZ in

equities and not more than 4OZ in bank deposits and money market

instruments.

Investment DbjectIves

|ndustry 0istributien

Peturns

0isc|aimer: '1his document is for information purposes only and must not be treated as solicitation done the Company. All effort have been made to ensure accuracy of the contents of this

newsletter and the Company shall not be held liable for any errors, opinions, or projections published herein. 1he customers are requested to consult their financial advisors before investing or

deciding to invest with the Company and shall not hold the Company liable for any loss caused to the customer based on information contained herein.

Unlike a traditional product, a unit linked product(UL|P) is subject to investment risks associated with capital markets and the NAv of the unit may fluctuate based on the performance of funds.

1he insured is responsible for his or her decision. |nvestments in UL|P is subject to market risk. Past performance is not indicative of future performance.

Bajaj Allianz Life |nsurance Company Limited, CL Plaza, Airport koad, erwada, Pune- 411OO6. |k0A kegistration No.116' |nsurance is the subject matter of the solicitation.

www.ba|a|a|||anz.com

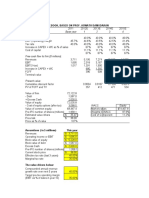

Pure EquIty Fund

Pure Stock Fund

Pure Stock PensIon Fund

AbsoIute Peturns CACP

FUN0 NAhES

3

months

6

months

1

year

2

year

Peturns sInce

InceptIon

3

year

1

month

quity |unds

quity Mid-cap |unds

Pure quity |unds

Shie|d P|us

C|0's Cemments

Asset a||ecatien Iund

0ebt Iunds

Capita| Shie|d

|und PerIermance

Cash Iunds

Max Cain

Assured return Iund

8|ue Chip quity |und

|ndex |inked (niIty] Iunds

Cuaranteed 8end |und

Crewth P|us

6.65 8.91 9.J4 11.81 9.49 4.90 1J.8J

6.62 9.09 9.90 1J.50 10.50 5.49 14.17

7.99 9.J6 10.79 1J.10 11.94 J.94 14.64

0ctober 201J

EQUITY SHARES

93.11%

Money Market

Instruments

6.89%

0.4%

1.6%

2.1%

3.2%

6.0%

6.1%

7.5%

10.7%

14.5%

14.7%

15.9%

17.3%

Cement

Banks & Financial

Electric

Chemicals

Telecommunications

Metals & Mining

Engg, Industrial & Cap Goods

FMCG

Pharmaceuticals

Technology

Oil&Gas

Auto & Ancillaries

SHARES 93.11%

Infosys Ltd. 7.25%

Reliance Industries Ltd. 7.12%

Idea Cellular Ltd. 5.22%

Aventis Pharma Ltd. 4.85%

Tata Global Beverages Ltd. 4.85%

Nestle India Ltd. 4.76%

Bosch Ltd. 4.29%

Dr. Reddys Laboratories Ltd. 3.50%

Tata Motors Ltd. 3.22%

G A I L (India) Ltd. 3.19%

Maruti Suzuki India Ltd. 3.04%

Tata Consultancy Services Ltd. 3.01%

Larsen & Toubro Ltd. 2.88%

Hindalco Industries Ltd. 2.62%

Pfizer Ltd. 2.60%

B A S F India Ltd. 2.53%

Tata Steel Ltd. 2.16%

Mahindra & Mahindra Ltd. 2.10%

Wipro Ltd. 2.06%

K S B Pumps Ltd. 2.00%

Lupin Ltd. 1.97%

Gujarat Industries Power Co. Ltd. 1.94%

Oil & Natural Gas Corpn. Ltd. 1.78%

Kansai Nerolac Paints Ltd. 1.60%

Bharat Petroleum Corpn. Ltd. 1.54%

Voltas Ltd. 1.14%

HERO MOTOCORP LIMITED 1.06%

Tech Mahindra Ltd. 1.06%

Other Shares 7.74%

Money Market Instruments 6.89%

Grand Total 100%

You might also like

- IpoDocument4 pagesIpohasratbaloch22No ratings yet

- Documentary Credit InsightDocument24 pagesDocumentary Credit InsightMamun RashidNo ratings yet

- Julia PDFDocument1 pageJulia PDFLucky LuckyNo ratings yet

- B071GTXBS3Document119 pagesB071GTXBS3Anonymous 94TBTBRks100% (2)

- Project On Sbi Retail Banking by Vivek Kumar, DarbhangaDocument47 pagesProject On Sbi Retail Banking by Vivek Kumar, Darbhangavivekkumar883377% (30)

- Statement of Purpose: Gurupdesh Kaur, A Prospective Student For Canada. I Am A Permanent Resident ofDocument3 pagesStatement of Purpose: Gurupdesh Kaur, A Prospective Student For Canada. I Am A Permanent Resident ofajayNo ratings yet

- Price To Book Value Stocks 161008Document2 pagesPrice To Book Value Stocks 161008Adil HarianawalaNo ratings yet

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainNo ratings yet

- The First Meat Sector IPO CASEDocument3 pagesThe First Meat Sector IPO CASEabiraNo ratings yet

- An Internship Report, HDFC Standard Life Insurance "Financial Analysis of HDFC Standard Life Annual Report"Document38 pagesAn Internship Report, HDFC Standard Life Insurance "Financial Analysis of HDFC Standard Life Annual Report"Pramod TakNo ratings yet

- HDFC Top 200 Fund Rating and AnalysisDocument6 pagesHDFC Top 200 Fund Rating and AnalysisSUNJOSH09No ratings yet

- Grant Thornton Dealtracker January March 2013Document0 pagesGrant Thornton Dealtracker January March 2013balakk06No ratings yet

- Technical Report 2nd August 2011Document3 pagesTechnical Report 2nd August 2011Angel BrokingNo ratings yet

- Some Relief For Bulls: Punter's CallDocument3 pagesSome Relief For Bulls: Punter's CallPrashantKumarNo ratings yet

- Technical Report 20th July 2011Document3 pagesTechnical Report 20th July 2011Angel BrokingNo ratings yet

- Exide Industries (EXIIND) : Finally, Margins Surprise "Positively"Document1 pageExide Industries (EXIIND) : Finally, Margins Surprise "Positively"prince1900No ratings yet

- ValueResearchFundcard HDFCTop200 2011aug03Document6 pagesValueResearchFundcard HDFCTop200 2011aug03ShaishavKumarNo ratings yet

- MphasisDocument4 pagesMphasisAngel BrokingNo ratings yet

- Pension Super 12Document2 pagesPension Super 12RabekanadarNo ratings yet

- Course Instructor: Prof. Jasbir Singh Matharu: Email: Jsmatharu@imtnag - Ac.in Phone Ext: 152Document21 pagesCourse Instructor: Prof. Jasbir Singh Matharu: Email: Jsmatharu@imtnag - Ac.in Phone Ext: 152Surbhi MehtaNo ratings yet

- Bnicl - Ipo NoteDocument3 pagesBnicl - Ipo NoteMostafa Noman DeepNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Investment Options Available For Investing Money: Retirement Planning Ways To Invest Your MoneyDocument12 pagesInvestment Options Available For Investing Money: Retirement Planning Ways To Invest Your Moneyshiprasrivastava1988No ratings yet

- Technical Report 28th July 2011Document3 pagesTechnical Report 28th July 2011Angel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- MAIA Financial Weekly Report 11.06Document4 pagesMAIA Financial Weekly Report 11.06sandip_dNo ratings yet

- PLTVF Factsheet February 2014Document4 pagesPLTVF Factsheet February 2014randeepsNo ratings yet

- Technical Report 5th October 2011Document3 pagesTechnical Report 5th October 2011Angel BrokingNo ratings yet

- Amanat Prospectus EnglishDocument104 pagesAmanat Prospectus EnglishAbdoKhaledNo ratings yet

- Decoding Global Financial MarketsDocument9 pagesDecoding Global Financial MarketsAKANKSHA SINGHNo ratings yet

- Technical Report 3rd January 2012Document5 pagesTechnical Report 3rd January 2012Angel BrokingNo ratings yet

- Managing Life Insurance CompaniesDocument55 pagesManaging Life Insurance CompanieshmtjnNo ratings yet

- Errata Sharekhan Pre Market 15th September 2016 ThursdayDocument25 pagesErrata Sharekhan Pre Market 15th September 2016 ThursdaySatyarthNo ratings yet

- Comparative Analysis of 5 MF Co. in India-S016Document12 pagesComparative Analysis of 5 MF Co. in India-S016mdiftekharNo ratings yet

- A Review of The Capital Requirements For Life Insurers in IndiaDocument46 pagesA Review of The Capital Requirements For Life Insurers in Indiajdchandrapal4980No ratings yet

- Insurance Year Book 2014-15Document142 pagesInsurance Year Book 2014-15Mian Muhammad Rizwan SarwarNo ratings yet

- Apra'S Prudential Standards For Adis Capital AdequacyDocument2 pagesApra'S Prudential Standards For Adis Capital AdequacycastluciNo ratings yet

- Bajaj Finance LTD PresentationDocument31 pagesBajaj Finance LTD Presentationanon_395825960100% (2)

- Bajaj Finserv LimitedDocument31 pagesBajaj Finserv LimitedDinesh Gehi DGNo ratings yet

- Technical Report 26th April 2012Document5 pagesTechnical Report 26th April 2012Angel BrokingNo ratings yet

- "ULIPS V/s Mutual Fund" As An Investment Option Among The Investors of LudhianaDocument58 pages"ULIPS V/s Mutual Fund" As An Investment Option Among The Investors of Ludhianaads110No ratings yet

- Investor Presentation Q4 FY14 1Document35 pagesInvestor Presentation Q4 FY14 1Janarthanan YadavNo ratings yet

- 17 Stocks Likely To DelistDocument1 page17 Stocks Likely To DelistRudra GoudNo ratings yet

- Insurance IndustryDocument42 pagesInsurance IndustryRabekanadarNo ratings yet

- Insurance Regulation in Cambodia 74031Document4 pagesInsurance Regulation in Cambodia 74031leekosalNo ratings yet

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Document4 pagesFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173No ratings yet

- Stempeutics Research PVT LTDDocument5 pagesStempeutics Research PVT LTDIndia Business ReportsNo ratings yet

- HARSHUDocument22 pagesHARSHUvini2710No ratings yet

- 4 Reasons of Why You Should Invest in SharesDocument8 pages4 Reasons of Why You Should Invest in SharesAdvisesure.comNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Master Limited Partnerships 101:: Understanding MlpsDocument74 pagesMaster Limited Partnerships 101:: Understanding Mlpsstrongchong00No ratings yet

- Technical Report 22nd July 2011Document3 pagesTechnical Report 22nd July 2011Angel BrokingNo ratings yet

- ICICIdirect HighDividendYieldStocks 2011Document2 pagesICICIdirect HighDividendYieldStocks 2011kprgroupNo ratings yet

- Event-Driven, Value Investing Performance and Exposure Report June 2015Document1 pageEvent-Driven, Value Investing Performance and Exposure Report June 2015nabsNo ratings yet

- 2.C - Insurance CompaniesDocument6 pages2.C - Insurance CompaniesAKANKSHA SINGHNo ratings yet

- Insurance Management AssignmentDocument9 pagesInsurance Management AssignmentRavindra SharmaNo ratings yet

- Introduction of Products and Services of LTD: SharekhanDocument15 pagesIntroduction of Products and Services of LTD: Sharekhanpraveenangel_d619No ratings yet

- ICICI Prudential Discovery Fund value investing equity fundDocument6 pagesICICI Prudential Discovery Fund value investing equity fundMohammed Khurshid GauriNo ratings yet

- Venture CapitalDocument18 pagesVenture CapitalHardik PatelNo ratings yet

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDocument4 pagesHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152No ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Your Policy Document: BrochuresDocument5 pagesYour Policy Document: BrochuresSuresh ReddyNo ratings yet

- Indus Motors LTD: EquitiesDocument2 pagesIndus Motors LTD: EquitiesShazeb NaseemNo ratings yet

- Top Stocks 2019: A Sharebuyer's Guide to Leading Australian CompaniesFrom EverandTop Stocks 2019: A Sharebuyer's Guide to Leading Australian CompaniesNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're ListeningmustafazahmedNo ratings yet

- SHG & FPG Power Delegation CircularDocument7 pagesSHG & FPG Power Delegation Circularchaitanya5121No ratings yet

- Philstocks - PH: Customer Account Information FormDocument3 pagesPhilstocks - PH: Customer Account Information FormJayson Moreto VillavicencioNo ratings yet

- Sources of Funds: Savings DepositsDocument15 pagesSources of Funds: Savings DepositsRavi D S VeeraNo ratings yet

- RHM Accounting SOP AdminstrationDocument52 pagesRHM Accounting SOP AdminstrationGianna AngelaNo ratings yet

- Maximize EPSDocument19 pagesMaximize EPSPrashant SharmaNo ratings yet

- Seminar Questions Set III A-2Document3 pagesSeminar Questions Set III A-2fanuel kijojiNo ratings yet

- Cash Course What Is Investing - Lesson Plan - Docx 1Document2 pagesCash Course What Is Investing - Lesson Plan - Docx 1Asma RihaneNo ratings yet

- Farm Animal Payment Plan AgreementDocument3 pagesFarm Animal Payment Plan AgreementRia KudoNo ratings yet

- International Finance - MG760-144 Week 4 - Chapter 5 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolDocument5 pagesInternational Finance - MG760-144 Week 4 - Chapter 5 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolKiran100% (1)

- PDF Budget Control PDFDocument18 pagesPDF Budget Control PDFjoana seixasNo ratings yet

- Finance Final222Document7 pagesFinance Final222Mohamed SalamaNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- Concept Map 2Document8 pagesConcept Map 2mike raninNo ratings yet

- CGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFDocument26 pagesCGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFkarthik kvNo ratings yet

- Topic 3 - Islamic Banking NowDocument2 pagesTopic 3 - Islamic Banking NowAndinii PirliNo ratings yet

- Key Smart Checking: Account SummaryDocument4 pagesKey Smart Checking: Account SummaryDemetrius Diamond IINo ratings yet

- Money Mischief Chapter 1Document3 pagesMoney Mischief Chapter 1Enzo MolinariNo ratings yet

- Stock Market Quotes & Financial NewsDocument4 pagesStock Market Quotes & Financial NewsSeudonim SatoshiNo ratings yet

- Lakshadweep Island-Tour Packages - APADocument2 pagesLakshadweep Island-Tour Packages - APAmanishk21No ratings yet

- Answer Key - Quizzer On AJEDocument2 pagesAnswer Key - Quizzer On AJEClarissa De GuzmanNo ratings yet

- TVOM and Equivalent Cash Flow ProblemsDocument3 pagesTVOM and Equivalent Cash Flow ProblemsAnonymous XybLZfNo ratings yet

- A Comparative Study On Investment Pattern...Document9 pagesA Comparative Study On Investment Pattern...cpmrNo ratings yet

- Naresh Axis Bank ProjectDocument44 pagesNaresh Axis Bank ProjectRuppa_Rakesh_172167% (3)

- Accounting Chapter 4Document44 pagesAccounting Chapter 4PATRICIA COLINANo ratings yet