Professional Documents

Culture Documents

Derivatives

Uploaded by

Shiva KonarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives

Uploaded by

Shiva KonarCopyright:

Available Formats

SIES

DERIVATIVES MARKET

INTRODUCTION

A Derivative is a financial instrument whose value depends on other, more basic, underlying variables. The variables underlying could be prices of traded securities and stock, prices of gold or copper. Derivatives have become increasingly important in the field of finance, Options and Futures are traded actively on many exchanges, Forward contracts, wap and different types of options are regularly traded outside exchanges by financial intuitions, banks and their corporate clients in what are termed as over!the!counter markets " in other words, there is no single market place or organi#ed exchanges.

OBJECTIVES OF THE STUDY

To understand the concept of the Derivatives and Derivative Trading. To know different types of Financial Derivatives To know the role of derivatives trading in $ndia. To analyse the performance of Derivatives Trading since %&&'with special reference to Futures ( Options

Page '

SIES

DERIVATIVES MARKET

RESARCH METHODOLOGY

)ethod of data collection*!

econdary sources*! $t is the data which has already been collected by some one or an organi#ation for some other purpose or research study .The data for study has been collected from various sources* +ooks ,ournals )aga#ines $nternet sources

Page %

SIES

DERIVATIVES MARKET

-O.-/0T

%. D/1$2AT$2/ D/F$./D A derivative is a product whose value is derived from the value of one or more underlying variables or assets in a contractual manner. The underlying asset can be e3uity, forex, commodity or any other asset. $n our earlier discussion, we saw that wheat farmers may wish to sell their harvest at a future date to eliminate the risk of change in price by that date. uch a transaction is an example of a derivative. The price of this derivative is driven by the spot price of wheat which is the 4underlying5 in this case. The Forwards -ontracts 61egulation7 Act, '89%, regulates the forward:futures contracts in commodities all over $ndia. As per this the Forward )arkets -ommission 6F)-7 continues to have ;urisdiction over commodity futures contracts. <owever when derivatives trading in securities was introduced in %&&', the term 4security5 in the ecurities -ontracts 61egulation7 Act, '89= 6 -1A7, was amended to include derivative contracts in securities. -onse3uently, regulation of derivatives came under the purview of ecurities /xchange +oard of $ndia 6 /+$7. >e thus have separate regulatory authorities for securities and commodity derivative markets. Derivatives are securities under the -1A and hence the trading of derivatives is governed by the regulatory framework under the 61egulation7 Act, '89= defines 4derivative5 to include! A security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract differences or any other form of security. A contract which derives its value from the prices, or index of prices, of underlying securities. -1A. The ecurities -ontracts

Page ?

SIES

DERIVATIVES MARKET ?. T@0/ OF D/1$2AT$2/ )A1A/T

/xchange Traded Derivatives

Over The -ounter Derivatives

.ational tock /xchange

+ombay tock /xchange

.ational -ommodity ( Derivative /xchange

$ndex Future tock future

$ndex option

tock option

Figure.' Types of Derivatives )arket

B. T@0/ OF D/1$2AT$2/

Derivatives

Future

Option

Forward

waps

Figure.% Types of Derivatives

Page B

SIES

DERIVATIVES MARKET

6i7

FO1>A1D -O.T1A-T

A forward contract is an agreement to buy or sell an asset on a specified date for a specified price. One of the parties to the contract assumes a long position and agrees to buy the underlying asset on a certain specified future date for a certain specified price. The other party assumes a short position and agrees to sell the asset on the same date for the same price. Other contract details like delivery date, price and 3uantity are negotiated bilaterally by the parties to the contract. The forward contracts are n o r m a l l y traded outside the exchanges.

+A $- F/ATC1/ OF FO1>A1D -O.T1A-T

D D They are bilateral contracts and hence exposed to counter!party risk. si#e,

/ach contract is custom designed, and hence is uni3ue in terms of contract expiration date and the asset type and 3uality. D D The contract price is generally not available in public domain. On the expiration date, the contract has to be settled by delivery of the asset.

$f the party wishes to reverse the contract, it has to compulsorily go to the same counter!party, which often results in high prices being charged. <owever forward contracts in in the case of foreign certain exchange, markets have becomevery standardi#ed, as thereby reducing transaction costs and

increasing transactions volume. This process of standardi#ation reaches its limit in the organi#ed futures market. Forward contracts are often confused with futures contracts. The confusion is primarily because both serve essentially th e same economic functions of allocating risk in the presence of future price uncertainty. <owever futures are a significant improvement over the forward contracts as they eliminate counterparty risk and offer more li3uidity.

6ii7

FCTC1/ -O.T1A-T

$n finance, a futures contract is a standardi#ed contract, traded on a futures exchange, to buy or sell a certain underlying instrument at a certain date in the future, at a pre!set

Page 9

SIES

DERIVATIVES MARKET

price. The future date is called the delivery date or final settlement date. The pre!set price is called the futures price. The price of the underlying asset on the delivery date is called the settlement price. The settlement price, normally, converges towards the futures price on the delivery date. A futures contract gives the holder the right and the obligation to buy or sell, which differs from an options contract, which gives the buyer the right, but not the obligation, and the option writer 6seller7 the obligation, but not the right. To exit the commitment, the holder of a futures position has to sell his long position or buy back his short position, effectively closing out the futures position and its contract obligations. Futures contracts are exchange traded derivatives. The exchange acts as counterparty on all contracts, sets margin re3uirements, etc.

+A $- F/ATC1/ OF FCTC1/ -O.T1A-T

1. Standardization Futures contracts ensure their li3uidity by being highly standardi#ed, usually by specifying* The underlying. This can be anything from a barrel of sweet crude oil to a short term interest rate. The type of settlement, either cash settlement or physical settlement. The amount and units of the underlying asset per contract. This can be the notional amount of bonds, a fixed number of barrels of oil, units of foreign currency, the notional amount of the deposit over which the short term interest rate is traded, etc. The currency in which the futures contract is 3uoted. The grade of the deliverable. $n case of bonds, this specifies which bonds can be delivered. $n case of physical commodities, this specifies not only the 3uality of the underlying goods but also the manner and location of delivery. The delivery month. The last trading date. Other details such as the tick, the minimum permissible price fluctuation.

Page =

SIES

DERIVATIVES MARKET

!. Mar"in Although the value of a contract at time of trading should be #ero, its price constantly fluctuates. This renders the owner liable to adverse changes in value, and creates a credit risk to the exchange, who always acts as counterparty. To minimi#e this risk, the exchange demands that contract owners post a form of collateral, commonly known as )argin re3uirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position. Initia# Mar"in is paid by both buyer and seller. $t represents the loss on that contract, as determined by historical price changes, which is not likely to be exceeded on a usual dayEs trading. $t may be 9F or '&F of total contract price. Mar$ to %ar$&t Mar"in +ecause a series of adverse price changes may exhaust the initial margin, a further margin, usually called variation or maintenance margin, is re3uired by the exchange. This is calculated by the futures contract, i.e. agreeing on a price at the end of each day, called the GsettlementG or mark!to!market price of the contract. To understand the original practice, consider that a futures trader, when taking a position, deposits money with the exchange, called a GmarginG. This is intended to protect the exchange against loss. At the end of every trading day, the contract is marked to its present market value. $f the trader is on the winning side of a deal, his contract has increased in value that day, and the exchange pays this profit into his account. On the other hand, if he is on the losing side, the exchange will debit his account. $f he cannot pay, then the margin is used as the collateral from which the loss is paid. '. S&tt#&%&nt ettlement is the act of consummating the contract, and can be done in one of two ways, as specified per type of futures contract* ()*+i,a# d&#i-&r* . the amount specified of the underlying asset of the contract is delivered by the seller of the contract to the exchange, and by the exchange to the buyers of the contract. $n practice, it occurs only on a minority of contracts. )ost are cancelled out by purchasing a covering position ! that is, buying a contract to cancel out an earlier

Page H

SIES

DERIVATIVES MARKET

sale 6covering a short7, or selling a contract to li3uidate an earlier purchase 6covering a long7. Ca+) +&tt#&%&nt . a cash payment is made based on the underlying reference rate, such as a short term interest rate index such as /uribor, or the closing value of a stock market index. A futures contract might also opt to settle against an index based on trade in a related spot market. E/0ir* is the time when the final prices of the future are determined. For many e3uity index and interest rate futures contracts, this happens on the Iast Thursday of certain trading month. On this day the tJ% futures contract becomes the t forward contract. (RICING OF FUTURE CONTRACT $n a futures contract, for no arbitrage to be possible, the price paid on delivery 6the forward price7 must be the same as the cost 6including interest7 of buying and storing the asset. $n other words, the rational forward price represents the expected future value of the underlying discounted at the risk free rate. Thus, for a simple, non!dividend paying asset, the value of the future:forward, value at time to maturity , will be found by discounting the present

by the rate of risk!free return .

This relationship may be modified for storage costs, dividends, dividend yields, and convenience yields. Any deviation from this e3uality allows for arbitrage as follows. $n the case where the forward price is higher* 1. The arbitrageur sells the futures contract and buys the underlying today 6on the spot market7 with borrowed money. !. On the delivery date, the arbitrageur hands over the underlying, and receives the agreed forward price. '. <e then repays the lender the borrowed amount plus interest. 1. The difference between the two amounts is the arbitrage profit. $n the case where the forward price is lower* 1. The arbitrageur buys the futures contract and sells the underlying today 6on the spot market7K he invests the proceeds. !. On the delivery date, he cashes in the matured investment, which has appreciated at the risk free rate.

Page L

SIES

DERIVATIVES MARKET

'.

<e then receives the underlying and pays the agreed forward price using the matured investment. M$f he was short the underlying, he returns it now.N 1. The difference between the two amounts is the arbitrage profit.

Page 8

SIES

DERIVATIVES MARKET

TA+I/ '! D$ T$.-T$O. +/T>//. FCTC1/ A.D FO1>A1D -O.T1A-T FEATURE O0&rationa# M&,)ani+% FOR2ARD CONTRACT FUTURE CONTRACT

Traded directly between two Traded on the exchanges. parties 6not traded on the exchanges7.

Contra,t S0&,i3i,ation+ Co4nt&r.0art* ri+$

Differ from trade to trade.

-ontracts are standardi#ed contracts.

/xists.

/xists. <owever, assumed by the clearing corp., which becomes the counter party to all the trades or unconditionally guarantees their settlement.

Li54idation (ro3i#&

Iow, as contracts are tailor <igh, needs of the needs of the parties.

as contracts

are

standardi#ed

made contracts catering to the exchange traded contracts.

(ri,& di+,o-&r*

.ot efficient, as markets are /fficient, as markets are centrali#ed and scattered. all buyers and sellers come to a common platform to discover the price.

E/a%0#&+

-urrency market in $ndia.

-ommodities, futures, $ndex Futures and $ndividual stock Futures in $ndia.

Page '&

SIES

DERIVATIVES MARKET

O0T$O. !

A derivative transaction that gives the option holder the right but not the obligation to buy or sell the underlying asset at a price, called the strike price, during a period or on a specific date in exchange for payment of a premium is known as OoptionP. Cnderlying asset refers to any asset that is traded. The price at which the underlying is traded is called the Ostrike priceP. There are two types of options i.e., CALL O(TION 6 (UT O(TION. -AII O0T$O.* A contract that gives its owner the right but not the obligation to buy an underlying asset! stock or any financial asset, at a specified price on or before a specified date is known as a O-all optionP. The owner makes a profit provided he sells at a higher current price and buys at a lower future price. 0CT O0T$O.* A contract that gives its owner the right but not the obligation to sell an underlying asset! stock or any financial asset, at a specified price on or before a specified date is known as a O0ut optionP. The owner makes a profit provided he buys at a lower current price and sells at a higher future price. <ence, no option will be exercised if the future price does not increase. 0ut and calls are almost always written on e3uities, although occasionally preference shares, bonds and warrants become the sub;ect of options.

>A0 !

waps are transactions which obligates the two parties to the contract to exchange a series of cash flows at specified intervals known as payment or settlement dates. They can be regarded as portfolios of forwardEs contracts. A contract whereby two parties agree to exchange 6swap7 payments, based on some notional principle amount is called as a

Page ''

SIES

DERIVATIVES MARKET

O >A0P. $n case of swap, only the payment flows are exchanged and not the principle amount. The two commonly used swaps are* INTEREST RATE S2A(S $nterest rate swaps is an arrangement by which one party agrees to exchange his series of fixed rate interest payments to a party in exchange for his variable rate interest payments. The fixed rate payer takes a short position in the forward contract whereas the floating rate payer takes a long position in the forward contract. CURRENCY S2A(S -urrency swaps is an arrangement in which both the principle amount and the interest on loan in one currency are swapped for the principle and the interest payments on loan in another currency. The parties to the swap contract of currency generally hail from two different countries. This arrangement allows the counter parties to borrow easily and cheaply in their home currencies. Cnder a currency swap, cash flows to be exchanged are determined at the spot rate at a time when swap is done. uch cash flows are supposed to remain unaffected by subse3uent changes in the exchange rates. FINANCIAL S2A( Financial swaps constitute a funding techni3ue which permit a borrower to access one market and then exchange the liability for another type of liability. $t also allows the investors to exchange one type of asset for another type of asset with a preferred income stream.

7. OTHER 8INDS OF DERIVATIVES

T)& ot)&r $ind o3 d&ri-ati-&+9 :)i,) ar& not9 %4,) 0o04#ar ar& a+ 3o##o:+

+A A/T !

+askets options are option on portfolio of underlying asset. /3uity $ndex Options are most popular form of baskets.

Page '%

SIES

DERIVATIVES MARKET

I/A0 !

.ormally option contracts are for a period of ' to '% months. <owever, exchange may introduce option contracts with a maturity period of %!? years. These long!term option contracts are popularly known as Ieaps or Iong term /3uity Anticipation ecurities.

>A11A.T !

Options generally have lives of up to one year, the ma;ority of options traded on options exchanges having a maximum maturity of nine months. Ionger!dated options are called warrants and are generally traded over!the!counter.

>A0T$O. !

waptions are options to buy or sell a swap that will become operative at the expiry of the options. Thus a swaption is an option on a forward swap. 1ather than have calls and puts, the swaptions market has receiver swaptions and payer swaptions. A receiver swaption is an option to receive fixed and pay floating. A payer swaption is an option to pay fixed and receive floating.

Page '?

SIES

DERIVATIVES MARKET

$.D$A. D/1$2AT$2/ )A1A/T

tarting from a controlled economy, $ndia has moved towards a world where prices fluctuate every day. The introduction of risk management instruments in $ndia gained momentum in the last few years due to liberalisation process and 1eserve +ank of $ndiaPs 61+$7 efforts in creating currency forward market. Derivatives are an integral part of liberalisation process to manage risk. . / gauging the market re3uirements initiated the process of setting up derivative markets in $ndia. $n ,uly '888, derivatives trading commenced in $ndia Table %. -hronology of instruments '88' Iiberalisation process initiated 'B December '889 . / asked /+$ for permission to trade index futures. 'L .ovember '88= /+$ setup I.-.Qupta -ommittee to draft a policy framework '' )ay '88L H ,uly '888 %B )ay %&&& %9 )ay %&&& 8 ,une %&&& '% ,une %&&& %9 eptember %&&& % ,une %&&' for index futures. I.-.Qupta -ommittee submitted report. 1+$ gave permission for OT- forward rate agreements 6F1As7 and interest rate swaps. $)/R chose .ifty for trading futures and options on an $ndian index. /+$ gave permission to . / and + / to do index futures trading. Trading of + / ensex futures commenced at + /. Trading of .ifty futures commenced at . /. .ifty futures trading commenced at QR. $ndividual tock Options ( Derivatives

6'7 .eed for derivatives in $ndia today $n less than three decades of their coming into vogue, derivatives markets have become the most important markets in the world. Today, derivatives have become part and parcel of the day!to!day life for ordinary people in ma;or part of the world.

Page 'B

SIES

DERIVATIVES MARKET

Cntil the advent of . /, the $ndian capital market had no access to the latest trading methods and was using traditional out!dated methods of trading. There was a huge gap between the investorsP aspirations of the markets and the available means of trading. The opening of $ndian economy has precipitated the process of integration of $ndiaPs financial markets with the international financial markets. $ntroduction of risk management instruments in $ndia has gained momentum in last few years thanks to 1eserve +ank of $ndiaPs efforts in allowing forward contracts, cross currency options etc. which have developed into a very large market. 6%7 )yths and realities about derivatives $n less than three decades of their coming into vogue, derivatives markets have become the most important markets in the world. Financial derivatives came into the spotlight along with the rise in uncertainty of post!'8H&, when C announced an end to the +retton >oods ystem of fixed exchange rates leading to introduction of currency derivatives followed by other innovations including stock index futures. Today, derivatives have become part and parcel of the day!to!day life for ordinary people in ma;or parts of the world. >hile this is true for many countries, there are still apprehensions about the introduction of derivatives. There are many myths about derivatives but the realities that are different especially for /xchange traded derivatives, which are well regulated with all the safety mechanisms in place. >hat are these myths behind derivativesS Derivatives increase speculation and do not serve any economic purpose $ndian )arket is not ready for derivative trading Disasters prove that derivatives are very risky and highly leveraged instruments. Derivatives are complex and exotic instruments that $ndian investors will find difficulty in understanding $s the existing capital market safer than DerivativesS 6i7 Derivatives increase speculation and do not serve any economicpurpose* .umerous studies of derivatives activity have led to a broad consensus, both in the private and public sectors that derivatives provide numerous and substantial benefits to the users. Derivatives are a low!cost, effective method for users to hedge and manage their exposures to interest rates, commodity prices or exchange rates. The need for

Page '9

SIES

DERIVATIVES MARKET

derivatives as hedging tool was felt first in the commodities market. Agricultural futures and options helped farmers and processors hedge against commodity price risk. After the fallout of +retton wood agreement, the financial markets in the world started undergoing radical changes. This period is marked by remarkable innovations in the financial markets such as introduction of floating rates for the currencies, increased trading in variety of derivatives instruments, on!line trading in the capital markets, etc. As the complexity of instruments increased many folds, the accompanying risk factors grew in gigantic proportions. This situation led to development derivatives as effective risk management tools for the market participants.

Iooking at the e3uity market, derivatives allow corporations and institutional investors to effectively manage their portfolios of assets and liabilities through instruments like stock index futures and options. An e3uity fund, for example, can reduce its exposure to the stock market 3uickly and at a relatively low cost without selling off part of its e3uity assets by using stock index futures or index options.

+y providing investors and issuers with a wider array of tools for managing risks and raising capital, derivatives improve the allocation of credit and the sharing of risk in the global economy, lowering the cost of capital formation and stimulating economic growth. .ow that world markets for trade and finance have become more integrated, derivatives have strengthened these important linkages between global markets, increasing market li3uidity and efficiency and facilitating the flow of trade and finance 6ii7 $ndian )arket is not ready for derivative trading Often the argument put forth against derivatives trading is that the $ndian capital market is not ready for derivatives trading. <ere, we look into the pre!re3uisites, which are needed for the introduction of derivatives, and how $ndian market fares* TABLE '. 01/!1/TC$ $T/ Iarge market -apitalisation $.D$A. -/.A1$O $ndia is one of the largest market!capitalised countries in Asia with a market capitalisation of more than

Page '=

SIES

DERIVATIVES MARKET 1s.H=9&&& crores.

<igh Ii3uidity underlying

in

the The daily average traded volume in $ndian capital market today is around H9&& crores. >hich means on an average every month 'BF of the countryPs )arket capitalisation gets traded. These are clear indicators of high li3uidity in the underlying. The first clearing corporation guaranteeing trades has become fully functional from ,uly '88= in the form of .ational ecurities -learing -orporation 6. --I7. . --I is responsible for guaranteeing all open positions on the .ational tock /xchange 6. /7 for which it does the clearing. .ational ecurities Depositories Iimited 6. DI7 which started functioning in the year '88H has revolutionalised the security settlement in our country. $n the $nstitution of /+$ 6 ecurities and /xchange +oard of $ndia7 today the $ndian capital market en;oys a strong, independent, and innovative legal guardian who is helping the market to evolve to a healthier place for trade practices.

Trade guarantee

A trong Depository

A Qood legal guardian

6?7 -omparison of .ew ystem with /xisting ystem )any people and brokers in $ndia think that the new system of Futures ( Options and banning of +adla is disadvantageous and introduced early, but $ feel that this new system is very useful especially to retail investors. $t increases the no of options investors for investment. $n fact it should have been introduced much before and . / had approved it but was not active because of politici#ation in /+$. The figure ?.?a "?.?d shows how advantages of new system 6implemented from ,une %&&&'7 v:s the old system i.e. before ,une %&&' .ew ystem 2s /xisting ystem for )arket 0layers

Fi"4r& '.'a

peculators

Page 'H

SIES

DERIVATIVES MARKET

/xisting A00roa,)

'7 Deliver based Trading, margin trading ( carry forward transactions. %7 +uy $ndex Futures hold till expiry.

@ T/) (&ri# 6(riz&

'7 +oth profit ( loss to extent of price change.

.ew (&ri# 6(riz&

A00roa,)

'7+uy ( ell stocks '7)aximum on delivery basis loss possible %7 +uy -all (0ut to premium by paying paid premium

Advantages

Qreater Ieverage as to pay only the premium. Qreater variety of strike price options at a given time.

Fi"4r& '.';

Arbitrageurs

/xisting A00roa,) @ T/) (&ri# 6(riz& A00roa,) .ew (&ri# 6(riz&

'7 +uying tocks in '7 )ake money '7 + Qroup more '7 1isk free one and selling in whichever way promising as still game. another exchange. the )arket moves. in weekly settlement forward transactions. %7 -ash (-arry %7 $f Future -ontract arbitrage continues more or less than Fair price Fair 0rice U -ash 0rice J -ost of -arry.

Fi"4r& '.',

<edgers

/xisting @ T/) .ew

Page 'L

SIES

DERIVATIVES MARKET

Approach (0ri#e

0eril (0ri#e

Approach

0eril

'7 Difficult to '7 .o Ieverage offload holding available risk during adverse reward dependant market conditions on market prices as circuit filters limit to curtail losses.

'7Fix price today to buy '7 Additional latter by paying premium. cost is only %7For Iong, buy AT) 0ut premium. Option. $f market goes up, long position benefit else exercise the option. ?7 ell deep OT) call option with underlying shares, earn premium J profit with increase prcie

Advantages

Availability of Ieverage Fi"4r& '.'d

mall $nvestors

/xisting Approach (0ri#e

'7 $f +ullish buy stocks else sell it.

@ T/) 0eril (0ri#e

'7 0lain +uy: ell implies unlimited profit:loss.

.ew Approach 0eril

'7 Downside remains protected ( upside unlimited.

'7 +uy -all:0ut options based on market outlook %7 <edge position if holding underlying stock

Advantages

Iosses 0rotected.

Page '8

SIES

DERIVATIVES MARKET

B. /xchange!traded vs. OT- derivatives markets The OT- derivatives markets have witnessed rather sharp growth over the last few years, which has accompanied the moderni#ation of commercial and investment banking and globalisation of financial activities. The recent developments in information technology have contributed to a great extent to these developments. >hile both exchange!traded and OT- derivative contracts offer many benefits, the former have rigid structures compared to the latter. $t has been widely discussed that the highly leveraged institutions and their OT- derivative positions were the main cause of turbulence in financial markets in '88L. These episodes of turbulence revealed the risks posed to market stability originating in features of OT- derivative instruments and markets. The OT- derivatives markets have the following features compared to exchange!traded derivatives* 1. !. '. 1. 7. The management of counter!party 6credit7 risk is decentrali#ed and located within individual institutions, There are no formal centrali#ed limits on individual positions, leverage, or margining, There are no formal rules for risk and burden!sharing, There are no formal rules or mechanisms for ensuring market stability and integrity, and for safeguarding the collective interests of market participants, and The OT- contracts are generally not regulated by a regulatory authority and the exchangePs self!regulatory organi#ation, although they are affected indirectly by national legal systems, banking supervision and market surveillance. ome of the features of OT- derivatives markets embody risks to financial market stability. The following features of OT- derivatives markets can give rise to instability in institutions, markets, and the international financial system* 6i7 the dynamic nature of gross credit exposuresK 6ii7 information asymmetriesK 6iii7 the effects of OT- derivative activities on available aggregate creditK 6iv7 the high concentration of OT- derivative

Page %&

SIES

DERIVATIVES MARKET

activities in ma;or institutionsK and 6v7 the central role of OT- derivatives markets in the global financial system. $nstability arises when shocks, such as counter!party credit events and sharp movements in asset prices that underlie derivative contracts, occur which significantly alter the perceptions of current and potential future credit exposures. >hen asset prices change rapidly, the si#e and configuration of counter!party exposures can become unsustainably large and provoke a rapid unwinding of positions. There has been some progress in addressing these risks and perceptions. <owever, the progress has been limited in implementing reforms in risk management, including counter!party, li3uidity and operational risks, and OT- derivatives markets continue to pose a threat to international financial stability. The problem is more acute as heavy reliance on OT- derivatives creates the possibility of systemic financial events, which fall outside the more formal clearing house structures. )oreover, those who provide OTderivative products, hedge their risks through the use of exchange traded derivatives. $n view of the inherent risks associated with OT- derivatives, and their dependence on exchange traded derivatives, $ndian law considers them illegal. 9. FA-TO1 -O.T1$+CT$.Q TO T</ Q1O>T< OF D/1$2AT$2/ * Factors contributing to the explosive growth of derivatives are price volatility, globalisation of the markets, technological developments and advances in the financial theories. A.< (RICE VOLATILITY = A price is what one pays to ac3uire or use something of value. The ob;ects having value maybe commodities, local currency or foreign currencies. The concept of price is clear to almost everybody when we discuss commodities. There is a price to be paid for the purchase of food grain, oil, petrol, metal, etc. the price one pays for use of a unit of another persons money is called interest rate. And the price one pays in onePs own currency for a unit of another currency is called as an exchange rate.

Page %'

SIES

DERIVATIVES MARKET

0rices are generally determined by market forces. $n a market, consumers have OdemandP and producers or suppliers have OsupplyP, and the collective interaction of demand and supply in the market determines the price. These factors are constantly interacting in the market causing changes in the price over a short period of time. uch changes in the price are known as Oprice volatilityP. This has three factors* the speed of price changes, the fre3uency of price changes and the magnitude of price changes. The changes in demand and supply influencing factors culminate in market ad;ustments through price changes. These price changes expose individuals, producing firms and governments to significant risks. The break down of the +1/TTO. >OOD agreement brought and end to the stabilising role of fixed exchange rates and the gold convertibility of the dollars. The globalisation of the markets and rapid industrialisation of many underdeveloped countries brought a new scale and dimension to the markets. .ations that were poor suddenly became a ma;or source of supply of goods. The )exican crisis in the south east!Asian currency crisis of '88&Ps has also brought the price volatility factor on the surface. The advent of telecommunication and data processing bought information very 3uickly to the markets. $nformation which would have taken months to impact the market earlier can now be obtained in matter of moments. /ven e3uity holders are exposed to price risk of corporate share fluctuates rapidly. These price volatility risks pushed the use of derivatives like futures and options increasingly as these instruments can be used as hedge to protect against adverse price changes in commodity, foreign exchange, e3uity shares and bonds. B.< GLOBALISATION OF MAR8ETS = /arlier, managers had to deal with domestic economic concernsK what happened in other part of the world was mostly irrelevant. .ow globalisation has increased the si#e of markets and as greatly enhanced competition .it has benefited consumers who cannot obtain better 3uality goods at a lower cost. $t has also exposed the modern business to significant risks and, in many cases, led to cut profit margins

Page %%

SIES

DERIVATIVES MARKET

$n $ndian context, south /ast Asian currencies crisis of '88H had affected the competitiveness of our products vis!V!vis depreciated currencies. /xport of certain goods from $ndia declined because of this crisis. teel industry in '88L suffered its worst set back due to cheap import of steel from south /ast Asian countries. uddenly blue chip companies had turned in to red. The fear of china devaluing its currency created instability in $ndian exports. Thus, it is evident that globalisation of industrial and financial activities necessitates use of derivatives to guard against future losses. This factor alone has contributed to the growth of derivatives to a significant extent. C.< TECHNOLOGICAL ADVANCES = A significant growth of derivative instruments has been driven by technological breakthrough. Advances in this area include the development of high speed processors, network systems and enhanced method of data entry. -losely related to advances in computer technology are advances in telecommunications. $mprovement in communications allow for instantaneous worldwide conferencing, Data transmission by satellite. At the same time there were significant advances in software programmes without which computer and telecommunication advances would be meaningless. These facilitated the more rapid movement of information and conse3uently its instantaneous impact on market price. Although price sensitivity to market forces is beneficial to the economy as a whole resources are rapidly relocated to more productive use and better rationed overtime the greater price volatility exposes producers and consumers to greater price risk. The effect of this risk can easily destroy a business which is otherwise well managed. Derivatives can help a firm manage the price risk inherent in a market economy. To the extent the technological developments increase volatility, derivatives and risk management products become that much more important. D.< ADVANCES IN FINANCIAL THEORIES = Advances in financial theories gave birth to derivatives. $nitially forward contracts in its traditional form, was the only hedging tool available. Option pricing models developed by +lack and choles in '8H? were used to determine prices of call and put options. $n

Page %?

SIES

DERIVATIVES MARKET

late '8H&Ps, work of Iewis /deington extended the early work of ,ohnson and started the hedging of financial price risks with financial futures. The work of economic theorists gave rise to new products for risk management which led to the growth of derivatives in financial markets. The above factors in combination of lot many factors led to growth of derivatives instruments D/2/IO0)/.T OF D/1$2AT$2/ )A1A/T $. $.D$A The first step towards introduction of derivatives trading in $ndia was the promulgation of the ecurities Iaws 6Amendment7 Ordinance, '889, which withdrew the prohibition on options in securities. The market for derivatives, however, did not take off, as there was no regulatory framework to govern trading of derivatives. /+$ set up a %B"member committee under the -hairmanship of Dr.I.-.Qupta on .ovember 'L, '88= to develop appropriate regulatory framework for derivatives trading in $ndia. The committee submitted its report on )arch 'H, '88L prescribing necessary pre"conditions for introduction of derivatives trading in $ndia. The committee recommended that derivatives should be declared as OsecuritiesP so that regulatory framework applicable to trading of OsecuritiesP could also govern trading of securities. /+$ also set up a group in ,une '88L under the -hairmanship of 0rof.,.1.2arma, to recommend measures for risk containment in derivatives market in $ndia. The report, which was submitted in October '88L, worked out the operational details of margining system, methodology for charging initial margins, broker net worth, deposit re3uirement and real"time monitoring re3uirements. The ecurities -ontract 1egulation Act 6 -1A7 was amended in December '888 to include derivatives within the ambit of OsecuritiesP and the regulatory framework were developed for governing derivatives trading. The act also made it clear that derivatives shall be legal and valid only if such contracts are traded on a recogni#ed stock exchange, thus precluding OT- derivatives. The government also rescinded in )arch %&&&, the three decade old notification, which prohibited forward trading in securities. Derivatives trading commenced in $ndia in ,une %&&& after /+$ granted the final approval to this effect in )ay %&&'. /+$ permitted the derivative segments of two stock exchanges,

Page %B

SIES

DERIVATIVES MARKET

. / and + /, and their clearing house:corporation to commence trading and settlement in approved derivatives contracts. To begin with, /+$ approved trading in index futures contracts based on (0 -.R .ifty and + /"?& 6 ense7 index. This was followed by approval for trading in options based on these two indexes and options on individual securities. The trading in + / ensex options commenced on ,une B, %&&' and the trading in

options on individual securities commenced in ,uly %&&'. Futures contracts on individual stocks were launched in .ovember %&&'. The derivatives trading on . / commenced with (0 -.R .ifty $ndex futures on ,une '%, %&&&. The trading in index options commenced on ,une B, %&&' and trading in options on individual securities commenced on ,uly %, %&&'. ingle stock futures were launched on .ovember 8, %&&'. The index futures and options contract on . / are based on (0 -.R Trading and settlement in derivative contracts is done in accordance with the rules, byelaws, and regulations of the respective exchanges and their clearing house:corporation duly approved by /+$ and notified in the official ga#ette. Foreign $nstitutional $nvestors 6F$$s7 are permitted to trade in all /xchange traded derivative products. The following are some observations based on the trading statistics provided in the . / report on the futures and options 6F(O7* D ingle!stock futures continue to account for a si#able proportion of the F(O

segment. $t constituted H& per cent of the total turnover during ,une %&&%. A primary reason attributed to this phenomenon is that traders are comfortable with single!stock futures than e3uity options, as the former closely resembles the erstwhile badla system. D On relative terms, volumes in the index options segment continue to remain poor.

This may be due to the low volatility of the spot index. Typically, options are considered more valuable when the volatility of the underlying 6in this case, the index7 is high. A related issue is that brokers do not earn high commissions by recommending index options to their clients, because low volatility leads to higher waiting time for round!trips.

Page %9

SIES

DERIVATIVES MARKET

0ut volumes in the index options and e3uity options segment have increased since

,anuary %&&%. The call!put volumes in index options have decreased from %.L= in ,anuary %&&% to '.?% in ,une. The fall in call!put volumes ratio suggests that the traders are increasingly becoming pessimistic on the market. D Farther month futures contracts are still not actively traded. Trading in e3uity

options on most stocks for even the next month was non!existent. D Daily option price variations suggest that traders use the F(O segment as a less

risky alternative 6read substitute7 to generate profits from the stock price movements. The fact that the option premiums tail intra!day stock prices is evidence to this. $f calls and puts are not looked as ;ust substitutes for spot trading, the intra!day stock price variations should not have a one!to!one impact on the option premiums. The spot foreign exchange market remains the most important segment but the

derivative segment has also grown. $n the derivative market foreign exchange swaps account for the largest share of the total turnover of derivatives in $ndia followed by forwards and options. ignificant milestones in the development of derivatives market have been 6i7 permission to banks to undertake cross currency derivative transactions sub;ect to certain conditions 6'88=7 6ii7 allowing corporates to undertake long term foreign currency swaps that contributed to the development of the term currency swap market 6'88H7 6iii7 allowing dollar rupee options 6%&&?7 and 6iv7 introduction of currency futures 6%&&L7. $ would like to emphasise that currency swaps allowed companies with /-+s to swap their foreign currency liabilities into rupees. <owever, since banks could not carry open positions the risk was allowed to be transferred to any other resident corporate. .ormally such risks should be taken by corporates who have natural hedge or have potential foreign exchange earnings. +ut often corporate assume these risks due to interest rate differentials and views on currencies.

Page %=

SIES

DERIVATIVES MARKET

This period has also witnessed several relaxations in regulations relating to forex markets and also greater liberalisation in capital account regulations leading to greater integration with the global economy. -ash settled exchange traded currency futures have made foreign currency a

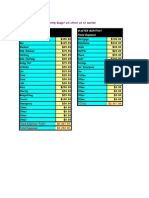

separate asset class that can be traded without any underlying need or exposure a n d on a leveraged basis on the recogni#ed stock exchanges with credit risks being assumed by the central counterparty ince the commencement of trading of currency futures in all the three exchanges, the value of the trades has gone up steadily from 1s 'H, B%8 crores in October %&&L to 1s B9, L&? crores in December %&&L. The average daily turnover in all the exchanges has also increased from 1sLH' crores to 1s %,'L' crores during the same period. The turnover in the currency futures market is in line with the international scenario, where $ understand the share of futures market ranges between % " ? per cent. Table B.'Forex)arketActivity AprilP&9! Total turnover 6C D billion7 $nter!bank to )erchant ratio pot:Total Turnover 6F7 Forward:Total Turnover 6F7 wap:Total Turnover 6F7 Source: RBI )arP&= B,B&B %.=*' 9&.9 '8.& ?&.9 AprilP&=! )arP&H =,9H' %.H*' 9'.8 'H.8 ?&.' AprilP&H! )arP&L '%,?&B %.?H* ' B8.H '8.? ?'.' AprilP&L! DecP&L 8,=%' %.==*' B9.8 %'.9 ?%.H

Page %H

SIES

DERIVATIVES MARKET

+/./F$T OF D/1$2AT$2/ Derivative markets help investors in many different ways* 1.> RIS8 MANAGEMENT = Futures and options contract can be used for altering the risk of investing in spot market. For instance, consider an investor who owns an asset. <e will always be worried that the price may fall before he can sell the asset. <e can protect himself by selling a futures contract, or by buying a 0ut option. $f the spot price falls, the short hedgers will gain in the futures market, as you will see later. This will help offset their losses in the spot market. !.> imilarly, if the spot price falls below the exercise price, the put option can always be exercised. (RICE DISCOVERY = 0rice discovery refers to the markets ability to determine true e3uilibrium prices. Futures prices are believed to contain information about future spot prices and help in disseminating such information. As we have seen, futures markets provide a low cost trading mechanism. Thus information pertaining to supply and demand easily percolates into such markets. Accurate prices are essential for ensuring the correct allocation of resources in a free market economy. Options markets provide information about the volatility or risk of the underlying asset. '.> O(ERATIONAL ADVANTAGES = As opposed to spot markets, derivatives markets involve lower transaction costs. econdly, they offer greater li3uidity. Iarge spot transactions can often lead to significant price changes. <owever, futures markets tend to be more li3uid than spot markets, because herein you can take large positions by depositing relatively small margins. -onse3uently, a large position in derivatives markets is relatively easier to take and has less of a price impact as opposed to a transaction of the same magnitude in the spot market. Finally, it is easier to take a short position in derivatives markets than it is to sell short in spot markets. 1.> MAR8ET EFFICIENCY =

Page %L

SIES

DERIVATIVES MARKET

The availability of derivatives makes markets more efficientK spot, futures and options markets are inextricably linked. ince it is easier and cheaper to trade in derivatives, it is possible to exploit arbitrage opportunities 3uickly and to keep prices in alignment. <ence these markets help to ensure that prices reflect true values. 7.> EASE OF S(ECULATION =

Derivative markets provide speculators with a cheaper alternative to engaging in spot transactions. Also, the amount of capital re3uired to take a comparable position is less in this case. This is important because facilitation of speculation is critical for ensuring free and fair markets. peculators always take calculated risks. A speculator will accept a level of risk only if he is convinced that the associated expected return is commensurate with the risk that he is taking. The derivative market performs a number of economic functions. The prices of derivatives converge with the prices of the underlying at the expiration of derivative contract. Thus derivatives help in discovery of future as well as current prices. An important incidental benefit that flows from derivatives trading is that it acts as a catalyst for new entrepreneurial activity. Derivatives markets help increase savings and investment in the long run. Transfer of risk enables market participants to expand their volume of activity. Nationa# E/,)an"&+ $n enhancing the institutional capabilities for futures trading the idea of setting up of .ational -ommodity /xchange6s7 has been pursued since '888. Three such /xchanges, vi#, .ational )ulti!-ommodity /xchange of $ndia Itd., 6.)-/7, Ahmedabad, .ational -ommodity ( Derivatives /xchange 6.-D/R7, )umbai, and )ulti -ommodity /xchange 6)-R7, )umbai have become operational. 4.ational tatus5 implies that these exchanges would be automatically permitted to conduct futures trading in all commodities sub;ect to clearance of byelaws and contract specifications by the F)-. >hile the .)-/, Ahmedabad commenced futures trading in .ovember %&&%,

Page %8

SIES

DERIVATIVES MARKET

)-R and .-D/R, )umbai commenced operations in October: December %&&? respectively. MC? )-R 6)ulti -ommodity /xchange of $ndia Itd.7 an independent and de! mutulised multi commodity exchange has permanent recognition from Qovernment of $ndia for facilitating online trading, clearing and settlement operations for commodity futures markets across the country. Aey shareholders of )-R are Financial Technologies 6$ndia7 Itd., +ank of tate +ank of $ndia, <DF- +ank, $ndia, +ank of +aroda, tate +ank of $ndore, tate +ank of <yderabad, tate +ank of aurashtra, +$ Iife $nsurance -o. Itd., Cnion +ank of $ndia, -anera +ank, -orporation +ank

<ead3uartered in )umbai, )-R is led by an expert management team with deep domain knowledge of the commodity futures markets. Today )-R is offering spectacular growth opportunities and advantages to a large cross section of the participants including 0roducers : 0rocessors, Traders, -orporate, 1egional Trading -anters, $mporters, /xporters, -ooperatives, $ndustry Associations, amongst others )-R being nation!wide commodity exchange, offering multiple commodities for trading with wide reach and penetration and robust infrastructure.

)-R, having a permanent recognition from the Qovernment of $ndia, is an independent and demutualised multi commodity /xchange. )-R, a state!of!the!art nationwide, digital /xchange, facilitates online trading, clearing and settlement operations for a commodities futures trading.

NMCE .ational )ulti -ommodity /xchange of $ndia Itd. 6.)-/7 was promoted by -entral >arehousing -orporation 6->-7, .ational Agricultural -ooperative )arketing Federation of $ndia 6.AF/D7, Qu;arat Agro!$ndustries -orporation Iimited 6QA$-I7,

Page ?&

SIES

DERIVATIVES MARKET

Qu;arat tate Agricultural )arketing +oard 6Q A)+7, .ational $nstitute of Agricultural )arketing 6.$A)7, and .eptune Overseas Iimited 6.OI7. >hile various integral aspects of commodity economy, vi#., warehousing, cooperatives, private and public sector marketing of agricultural commodities, research and training were ade3uately addressed in structuring the /xchange, finance was still a vital missing link. 0un;ab .ational +ank 60.+7 took e3uity of the /xchange to establish that linkage. /ven today, .)-/ is the only /xchange in $ndia to have such investment and technical support from the commodity relevant institutions. .)-/ facilitates electronic derivatives trading through robust and tested trading platform, Derivative Trading ettlement ystem 6DT 7, provided by -)-. $t has robust delivery mechanism making it the most suitable for the participants in the physical commodity markets. $t has also established fair and transparent rule!based procedures and demonstrated total commitment towards eliminating any conflicts of interest. $t is the only -ommodity /xchange in the world to have received $ O 8&&'*%&&& certification from +ritish tandard $nstitutions 6+ $7. .)-/ was the first commodity exchange to provide trading facility through internet, through 2irtual 0rivate .etwork 620.7. .)-/ follows best international risk management practices. The contracts are marked to market on daily basis. The system of upfront margining based on 2alue at 1isk is followed to ensure financial security of the market. $n the event of high volatility in the prices, special intra!day clearing and settlement is held. .)-/ was the first to initiate process of demateriali#ation and electronic transfer of warehoused commodity stocks. The uni3ue strength of .)-/ is its settlements via a Delivery +acked sound and reliable >arehouse 1eceipt settlement. ystem, an imperative in the commodity trading business. These deliveries are executed through a ystem, leading to guaranteed clearing and

Page ?'

SIES

DERIVATIVES MARKET NCDE? .ational -ommodity and Derivatives /xchange Itd 6.-D/R7 is a technology driven commodity exchange. $t is a public limited company registered under the -ompanies Act, '89= with the 1egistrar of -ompanies, )aharashtra in )umbai on April %?,%&&?. $t has an independent +oard of Directors and professionals not having any vested interest in commodity markets. $t has been launched to provide a world!class commodity exchange platform for market participants to trade in a wide spectrum of commodity derivatives driven by best global practices, professionalism and transparency.

Forward )arkets -ommission regulates .-D/R in respect of futures trading in commodities. +esides, .-D/R is sub;ected to various laws of the land like the -ompanies Act, tamp Act, -ontracts Act, Forward -ommission 61egulation7 Act and various other legislations, which impinge on its working. $t is located in )umbai and offers facilities to its members in more than ?8& centres throughout $ndia. The reach will gradually be expanded to more centres. .-D/R currently facilitates trading of thirty six commodities ! -ashew, -astor eed, -hana, -hilli, -offee, -otton, -otton eed Oilcake, -rude 0alm Oil, /xpeller eed ,1aw ,ute, 1+D )ustard Oil, Qold, Quar gum, Quar eeds, Qur, ,eera, ,ute sacking bags, )ild teel $ngot, )ulberry Qreen -ocoons, 0epper, 1apeseed ! )ustard 0almolein, 1efined oy Oil, 1ice, 1ubber, esame eeds, oybean )eal. ilk, ilver, oy +ean, ugar,

Tur, Turmeric, Crad 6+lack )atpe7, >heat, @ellow 0eas, @ellow 1ed )ai#e ( @ellow

Page ?%

SIES

DERIVATIVES MARKET

F$.D$.Q ( -O.-IC $O.

From the above analysis it can be concluded that* 1. Derivative market is growing very fast in the $ndian /conomy. The turnover of Derivative )arket is increasing year by year in the $ndiaPs largest stock exchange . /. $n the case of index future there is a phenomenal increase in the number of contracts. +ut whereas the turnover is declined considerably. $n the case of stock future there was a slow increase observed in the number of contracts whereas a decline was also observed in its turnover. $n the case of index option there was a huge increase observed both in the number of contracts and turnover. !. After analy#ing data it is clear that the main factors that are driving the growth of Derivative )arket are )arket improvement in communication facilities as well as long term saving ( investment is also possible through entering into Derivative -ontract. o these factors encourage the Derivative )arket in $ndia. '. $t encourages entrepreneurship in $ndia. $t encourages the investor to take more risk ( earn more return. o in this way it helps the $ndian /conomy by developing entrepreneurship. Derivative )arket is more regulated ( standardi#ed so in this way it provides a more controlled environment. $n nutshell, we can say that the rule of <igh risk ( <igh return apply in Derivatives. $f we are able to take more risk then we can earn more profit under Derivatives.

Page ??

SIES

DERIVATIVES MARKET

1/-O))/.DAT$O. ( CQQ/ T$O.

1+$ should play a greater role in supporting derivatives. Derivatives market should be developed in order to keep it at par with other derivative markets in the world. peculation should be discouraged. There must be more derivative instruments aimed at individual investors. /+$ should conduct seminars regarding the use of derivatives to educate individual investors.

After study it is clear that Derivative influence our $ndian /conomy up to much extent. o, /+$ should take necessary steps for improvement in Derivative )arket so that more investors can invest in Derivative market. There is a need of more innovation in Derivative )arket because in today scenario even educated people also fear for investing in Derivative )arket +ecause of high risk involved in Derivatives.

Page ?B

SIES

DERIVATIVES MARKET

+$+I$OQ1A0<@

Boo$+ r&3&rr&d Options Futures, and other Derivatives by ,ohn - <ull Derivatives FAT by A;ay hah . /Ps -ertification in Financial )arkets* ! Derivatives -ore module Financial )arkets ( ervices by Qordon ( .atara;an

2&;+it&+ -i+it&d www.nse!india.com www.bseindia.com www.sebi.gov.in www.ncdex.com www.google.com www.derivativesindia.com

Page ?9

You might also like

- Opec PDFDocument32 pagesOpec PDFShiva Konar100% (1)

- The Global Capital Markets Rely Heavily On The Quality of Financial StatementsDocument2 pagesThe Global Capital Markets Rely Heavily On The Quality of Financial StatementsShiva KonarNo ratings yet

- Corporategovernanceproject 110201062752 Phpapp01Document26 pagesCorporategovernanceproject 110201062752 Phpapp01Vikranth CmNo ratings yet

- Audit CommitteesDocument43 pagesAudit CommitteesShiva Konar100% (1)

- Corporategovernanceproject 110201062752 Phpapp01Document26 pagesCorporategovernanceproject 110201062752 Phpapp01Vikranth CmNo ratings yet

- A Project Report OnDocument38 pagesA Project Report OnShiva KonarNo ratings yet

- Audit CommitteesDocument43 pagesAudit CommitteesShiva Konar100% (1)

- DerivativesDocument35 pagesDerivativesShiva KonarNo ratings yet

- Content in PDFDocument8 pagesContent in PDFShiva KonarNo ratings yet

- IntroductionDocument127 pagesIntroductionShiva KonarNo ratings yet

- CRR SLRDocument14 pagesCRR SLRSharanyan IyengarNo ratings yet

- Foreign Exchange Markets in IndiaDocument46 pagesForeign Exchange Markets in IndiaRooma ChoudharyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2016 Arkan Roa Der PerDocument14 pages2016 Arkan Roa Der PerBunga DarajatNo ratings yet

- Modify Monthly Budget TemplateDocument32 pagesModify Monthly Budget TemplateMohammed TetteyNo ratings yet

- Presentation of Expertise Training CourseDocument74 pagesPresentation of Expertise Training CourseOmnia HassanNo ratings yet

- Made By:-Sarthak Gupta Group No: - 1080zDocument22 pagesMade By:-Sarthak Gupta Group No: - 1080zSimranAhluwaliaNo ratings yet

- MCDC Strat PlanDocument4 pagesMCDC Strat PlanRosamae ZapantaNo ratings yet

- C01 Exam Practice KitDocument240 pagesC01 Exam Practice Kitlesego100% (2)

- 7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLDocument11 pages7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLAani RashNo ratings yet

- Is Services India's Growth EngineDocument42 pagesIs Services India's Growth EngineDivya SreenivasNo ratings yet

- Action Plan and Contribution LogDocument30 pagesAction Plan and Contribution LogdasunNo ratings yet

- Fybcom Acc PDFDocument441 pagesFybcom Acc PDFaayush rathi100% (1)

- Solution To Worksheet - Modified-2Document25 pagesSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Reporting and Analyzing Operating IncomeDocument59 pagesReporting and Analyzing Operating IncomeHazim AbualolaNo ratings yet

- CSR-NFP: Exploring corporate social responsibility in not-for-profit organizationsDocument15 pagesCSR-NFP: Exploring corporate social responsibility in not-for-profit organizationsJames Alden MagbanuaNo ratings yet

- Tax Invoice Details for Mobile Phone PurchaseDocument1 pageTax Invoice Details for Mobile Phone PurchaseNiraj kumarNo ratings yet

- Exercise 2Document2 pagesExercise 2Michael DiputadoNo ratings yet

- Regulatory Framework For Hospitality Industry in Nigeria 3Document35 pagesRegulatory Framework For Hospitality Industry in Nigeria 3munzali67% (3)

- Deferred TaxDocument141 pagesDeferred TaxLorena BallaNo ratings yet

- Lean As A Universal Model of Excellence: It Is Not Just A Manufacturing Tool!Document8 pagesLean As A Universal Model of Excellence: It Is Not Just A Manufacturing Tool!Mona SayedNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2020Hajeera BicsNo ratings yet

- Financial Management ObjectivesDocument36 pagesFinancial Management ObjectiveschandoraNo ratings yet

- NMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYDocument46 pagesNMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYPayal AroraNo ratings yet

- Iare TKM Lecture NotesDocument106 pagesIare TKM Lecture Notestazebachew birkuNo ratings yet

- Private & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeDocument1 pagePrivate & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeIrfhaenmahmoedChildOfstandaloneNo ratings yet

- Lecture 5 - Technology ExploitationDocument21 pagesLecture 5 - Technology ExploitationUsmanHaiderNo ratings yet

- Inner Circle Trader Ict Forex Ict NotesDocument110 pagesInner Circle Trader Ict Forex Ict NotesBurak AtlıNo ratings yet

- Aizenman y Marion - 1999Document23 pagesAizenman y Marion - 1999Esteban LeguizamónNo ratings yet

- Revenue Reconigtion Principle - ExamplesDocument4 pagesRevenue Reconigtion Principle - Examplesmazjoa100% (1)

- Fundamentals of AccountingDocument56 pagesFundamentals of AccountingFiza IrfanNo ratings yet

- Books On Africa and Related Issues Published by The UNU: Library@hq - Unu.eduDocument29 pagesBooks On Africa and Related Issues Published by The UNU: Library@hq - Unu.eduPawar SachinNo ratings yet

- The Global EconomyDocument22 pagesThe Global EconomyАнастасия НамолованNo ratings yet