Professional Documents

Culture Documents

Notification Final

Uploaded by

Brahmanand DasreOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notification Final

Uploaded by

Brahmanand DasreCopyright:

Available Formats

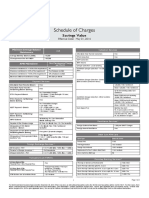

SIMPLIFIED SAVINGS ACCOUNT TARIFF STRUCTURE w.e.

f April 1, 2014

With effect from 1 April 2014, the non-maintenance of Average Quarterly Balance charge of Rs.750/- per quarter will be replaced with Service Fee of Rs.250/- per month.However the Service Fee will not be applicable if the desired Monthly Average Balance (MAB) is maintained. Our new simplified fee structure will help you to keep a track of your account better. The details of the New Tariff plan are given below for reference. Please note the following: 1. The balance maintenance criteria remain unchanged for the respective products. 2. For Future Star A/C (SBFTS) applicable service fee will be Rs.100/- per month. 3. SBSPL/SBWDN/SBPMS: AMB waivers will be based on the branch category/account report code/labels. 4. Salary Segment Discounts/waivers on any other fees will be as per the relationship/agreement with the bank. st th th st 5. With Effect from 1 April 2014, balance maintenance criteria for Savings Segments will move from 15 to 14 of Quarter to 1 th st to 30 /31 of Calendar Month th th st th st th 6. Senior Privilege (SBSPA) will move from 15 to 14 of Quarter to Calendar Quarter i.e 1 April 30 June, 1 July-30 st st st st September, 1 October-31 December and 1 January-31 Mach 2014. 1. Premium Segments (Priority, Wealth, Privee) Balance Maintenance Criteria : Priority , Wealth : Calendar Quarter, Privee - NIL Other Fees : Revised Fees, as applicable to the respective segments th st th st st 7. Krishi (SBKRI) will move from 15th-14 of Half Year to Calendar Half Year i.e 1 April- 30 September, 1 October-31 March. 8. The changes in the other charge cycles will also move to calendar monthly/quarterly charge cycle as applicable. For example: Other fees that are currently levied for transactions executed between 15th to 14th cycle will move to calendar month/quarter. Eg. Cash, DD/PO &Cheque book charges beyond fee limit which is currently under broken quarter 15th-14th of quarter/month will move to calendar month/quarter for Non-Salary segments. 9. All Inactive LIC Agent accounts under SBAGT scheme, which have not received any credits (customer induced) during the last 12 months and all Non LIC agent accounts under SBAGT scheme will continue to have an AMB requirement, and MSF will be levied if the required balance is not maintained. 10. Annual Fees for Youth (SBYTH) & Ladies First Card (SBWMN) will be Rs.400/- and Rs.300/- respectively. 11. Segments that are out of scope of the balance maintenance criteria : All scheme codes under Salary Segment (SAPPR, SAPPM, SBSDF), Basic Savings Account (SBBSA), Small Savings Account (SBSML), NRE Zero (NREZR), NRO Zero (NR0ZR), Mariners Account (SBMIA), Foreign National Account-NRO (NROFN), Foreign National Account -Resident (SBFRN), Resident Foreign Currency (SBRFC), NRI Salary (NRISL), Priority NRI Salary (NRPBS), NRE Staff (NREST), NRO Staff (NROST), Domestic Staff (SBSTF) 12. Service Tax applicable will be levied on all charges, and would be rounded off to the next Rupee. BASIC SERVICE FEE

Balance Maintenance Criteria Easy Access Savings Segment -SBEZY,SBWDN, SBSPL, SBSA3, SBSMT, SBPMS, NRO Savings Account- SBNRO, NRO PIS Account- NROPI, Womens Savings Account -SWEZY AMB (Average Monthly Balance) TRV Location/ Branch category Fees in case AMB/TRV not maintained Rs.10,000/Metro/Urban Rs.5,000/Semi Urban NA Rs.250/- Per month Rs.2,500/Future Stars Savings Account (SBFTS) Rs.2,500/Rs.1,000/Rural Relationship of Savings +Term Deposit(Tenure greater than 6 months) of Rs.25,000 or Savings + Recurring Deposit of Rs.2,000/- (Tenure greater than 12 months) Metro/Urban/Semi Urban Rural Rs.100/- Per month

st

Prime Savings Account (SBPRM) Rs.25,000/Rs.10,000/Insurance Agent Account (SBAGT)

NA

Metro / Urban Semi Urban / Rural

Rs.250/- Per month

Page 1 of 4

Rs.5,000/Rs.2,500/Prime Plus Savings Account (SBPRP) Rs.1,00,000/-

NA

Metro / Urban Semi Urban / Rural

Rs.250/- Per month

Relationship of Rs.5 lacs including Savings account balance and Fixed Deposits (Tenure greater than 6 months) TRV Relationship of Rs.1 lac including Saving account balance and Fixed Deposits(Tenure greater than 6 months) TRV NA

All Locations

Rs.250/- Per Month

Senior Privilege Savings Account (SBSPA) AQB (Average Quarterly Balance) Rs.10,000/Rs.5,000/Rs.2,500/Krishi Savings Account (SBKRI) HAB (Half Yearly Balance)

Location/ Branch category Metro / Urban Semi Urban Rural

Fees In case AQB/TRV not maintained Rs.500/- Per quarter

Location/ Branch category Urban Semi Urban / Rural

Fees In case HAB/TRV not maintained Rs.500/- half yearly

Rs.2,500/NRE Savings Account (SBNRE, NREPI) AMB (Average Monthly Balance) Rs.10,000/Rs.5,000/NRI Prime Savings Account ( NREPM, NROPM) Rs.25,000/Rs.10,000/Trust Account (SBTRS) Rs.25,000/Debit Card Fees Card Type Issuance Fees Visa Classic Rs.150/Metro/ Urban - Rs 150/Rural/ Semi urban - Rs 100/NA

TRV NA

Location/ Branch category Metro / Urban Semi Urban / Rural Metro / Urban Semi urban / Rural All Locations

Fees In case AMB/TRV not maintained Rs.250/- Per month

NA

Rs.250/- Per month

Rs.250/- per month

Annual Fees

Replacement Fees

Rs.100/-

Titanium Prime NIL Rs.150/- per year ( This will be waived on purchase of Rs.50,000 or 10 purchase transaction of any value in a anniversary year using debit card) Rs.100/-

Titanium Prime Plus NIL

Titanium Reward Rs.500/-

Rs.200/-

Rs.300/-

Rs.100/-

Rs150/-

My Design Card Issuance Fee Chequebook Issuance Fees beyond Free limit, if any (Refer Table) Segment Fee Limit Value Added SMS Alerts Account Closure Account closed <= 14 days or > 6 months from the date of account opening. Account closed >14 Days to <= 6 months from the date of account opening NetSecure with 1 Touch Other Savings schemes 1 Cheque Book

As per card variant + Rs.150/- My design card fees + taxes Rs.50/- per cheque book Prime Plus (SBPRP) 2 Cheque Books Trust(SBTRS) Unlimited

Rs.5/- per month, Trust Segment NIL

NIL Rs.500/Rs.800/- (Issuance), Rs.500/- (Replacement)

TRANSACTION FEES

Cash Transaction Fees beyond free limit, if any (Refer Table) Segment Trust (SBTRS) Prime (SBPRM) Youth (SBYTH)/ Ladies First Account Page 2 of 4 Rs.4/- per Rs.1000/- or Rs.100/-, whichever is higher Other Savings Prime Salary(SAPPM) Easy Access Salary(SAPPR)

(SBWMN) Cash Transaction Free Limit (Metro/Urban) Cash Transaction Free Limit (Semi Urban/Rural) Unlimited First 5 Transactions or Rs.25 Lacs whichever is earlier First 10 Transactions or Rs.25 Lacs whichever is earlier 4 Transactions per month 4 Transactions per month First 5 Transactions or Rs 10 lakhs whichever is earlier First 10 Transactions or Rs 10 lakhs whichever is earlier Rs.10 Lacs 5 Transactions or Rs.10 Lacs whichever is earlier 10 Transactions or Rs.10 lacs whichever is earlier

Unlimited

Rs.10 Lacs

Cash Transaction Fees for Basic Savings AccountFree Cash deposits up to a value of Rs 1 lakh and 4 free branch cash withdrawal transactions (across any Axis Bank branch) Demand Draft/ Pay order (DD/PO) Fees above free limit, if any Segment Free Limit per month Trust (SBTRS) Unlimited Prime (SBPRM) 2 YOUth (SBYTH) 1

Cash Deposit transaction- Rs.4 per Rs.1000 or Rs.100, whichever is higher, Cash Withdrawal transaction- Rs.100 per transaction

Rs.50/- Per DD/PO Other Savings 0 Fees on cash transactions beyond free limit Rs.4 per 1000 or Rs.100, whichever is higher As per card variant Upto Rs.5,000/- : Rs.25/Rs. 5,001 - 10,000: Rs.50/Rs. 10,001 1 Lakh : Rs.100/Above Rs.1 Lakh: Rs.200/Trust Segment Free for Axis Bank location, Out of pocket expenses to be recovered. Rs.1 to Rs 5 Lakhs Rs.25/- per transaction, Above 5 Lakhs Rs.50 /- per transaction Trust Segment - NIL Upto 10,000: Rs.2.5 per transaction, 10,000 1 Lakh: Rs.5 per transaction >1 Lakh 2 Lakhs: Rs.15 per transaction > 2 Lakhs: Rs.25 per transaction Trust Segment - NIL Free uptocheque amount of Rs.1 lakh. Above Rs.1 lakh- Rs.150 Unlimited As per card variant Rs.20/Rs.9.55 Rs.125/Rs.25/Prime Salary (SAPPR) 2 Easy Access Salary (SAPPR) 1 Fees on DD/PO transactions beyond free limit Rs.50/- Per DD/PO

Prime Plus Cash transaction and DD/PO Fee limits : 20 transactions across any Axis Bank branch

Daily Debit Card withdrawal limit and Shopping limit

Outstation Cheque Collection Fees:

RTGS Fees

NEFT/IMPS Fees

Speed Clearing Fees Axis Bank ATM: Free Transactions Limit Non- Axis Bank ATM: Free Transactions Limit Non-Axis ATM: Cash Withdrawal fees beyond free limit Non-Axis ATM: Balance Enquiry fees beyond limits International Cash Withdrawal fees International Balance Enquiry fees Surcharge on Railway Tickets purchased with Debit Card Fuel Surcharge Cross Currency Mark-up on International Debit Card Transactions

As per card variant

TRANSACTION FAILURE FEES

Page 3 of 4

Outward Cheque Return Inward Cheque Return Outstation Cheque Return ECS Debit Failure

Rs.100/- per cheque Rs.350/- per cheque Rs.100/- per cheque Rs.350/- per ECS return

CONVENIENCE FEES

Duplicate PIN (Non IVR request) Duplicate Passbook Duplicate Statement Stop Payment Instructions: Cheque Stop Payment Instructions: ECS DD/PO Cancellation DD/PO Duplicate DD/PO Revalidation Address Confirmation Photo Attestation Balance Certificate Signature Verification/Attestation Rs.100/Rs.100/Rs.100/Rs.100/- per Cheque with maximum of Rs.200/- irrespective of number of Cheques Rs.100/- per instance Rs.100/- per DD/PO Rs.100/- per DD/PO Rs.100/- per DD/PO Rs.100/- per request Rs.100/- per request Rs.100/- per request Rs.100/- per request

Disclaimer: The information contained in this page is subject to change. Axis Bank Limited does not warrant the accuracy, adequacy or completeness of this information and expressly disclaims liability for errors or omissions in this information. For more details Contact our Phone Banking Centre : 1800 103 5577/1800 233 5577/1800 209 5577 Walk-in to your nearest Axis Bank Branch

Page 4 of 4

You might also like

- 2022 AUSL Purples Notes Criminal Law and Practical ExercisesDocument305 pages2022 AUSL Purples Notes Criminal Law and Practical ExercisesNathalie Joy Calleja100% (6)

- The Left, The Right, and The State (Read in "Fullscreen")Document570 pagesThe Left, The Right, and The State (Read in "Fullscreen")Ludwig von Mises Institute100% (68)

- Business Dress Code Tutorial PDFDocument28 pagesBusiness Dress Code Tutorial PDFValentin BatenNo ratings yet

- Test Strategy TemplateDocument20 pagesTest Strategy TemplateRamesh VarmaNo ratings yet

- Eclipse TutorialDocument88 pagesEclipse TutorialBrahmanand DasreNo ratings yet

- Square Pharma Valuation ExcelDocument43 pagesSquare Pharma Valuation ExcelFaraz SjNo ratings yet

- Regular Saving AccountDocument92 pagesRegular Saving AccountSimu MatharuNo ratings yet

- Tutorial PDFDocument271 pagesTutorial PDFTashvi KulkarniNo ratings yet

- IB English L&L Paper 1 + 2 Tips and NotesDocument9 pagesIB English L&L Paper 1 + 2 Tips and NotesAndrei BoroianuNo ratings yet

- Selenium Quick GuideDocument60 pagesSelenium Quick GuideBrahmanand DasreNo ratings yet

- Test Plan SoftwareTestingDocument19 pagesTest Plan SoftwareTestingVineela LingaNo ratings yet

- Charges for Roaming Current Account at ICICI BankDocument3 pagesCharges for Roaming Current Account at ICICI Bankashishtiwari92100% (1)

- Account Tariff Structure Basic Savings AccountDocument1 pageAccount Tariff Structure Basic Savings Accountgaddipati_ramuNo ratings yet

- Sbi - Salary Account - DetailsDocument9 pagesSbi - Salary Account - Detailsgaurav8tcsNo ratings yet

- Chaitanya Candra KaumudiDocument768 pagesChaitanya Candra KaumudiGiriraja Gopal DasaNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- Audit of Allocations to LGUsDocument7 pagesAudit of Allocations to LGUsRhuejane Gay MaquilingNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- The Guru’s Guide to Self-Managed Super Funds: The $700 Billion (And Growing) Super Powerhouse ExplainedFrom EverandThe Guru’s Guide to Self-Managed Super Funds: The $700 Billion (And Growing) Super Powerhouse ExplainedNo ratings yet

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Document5 pagesSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNo ratings yet

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDocument13 pagesSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNo ratings yet

- RBI SERVICE CHARGES GUIDELINESDocument11 pagesRBI SERVICE CHARGES GUIDELINESJithin VijayanNo ratings yet

- Axis Bank savings account chargesDocument6 pagesAxis Bank savings account chargesArnab Nandi100% (1)

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Document15 pagesSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNo ratings yet

- Rationalization ServiceDocument5 pagesRationalization Servicesachin9984No ratings yet

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Document2 pagesParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNo ratings yet

- Crown salary account benefitsDocument2 pagesCrown salary account benefitsVikram IsgodNo ratings yet

- Schedule of Charges for No Frills Smart Salary AccountDocument2 pagesSchedule of Charges for No Frills Smart Salary AccountRupali WaliaNo ratings yet

- United Bank of India Rates and Charges GuideDocument5 pagesUnited Bank of India Rates and Charges Guidebisas_rishiNo ratings yet

- RBL Mitc FinalDocument16 pagesRBL Mitc FinalVivekNo ratings yet

- Bank Alfalah Schedule of Islamic Banking ChargesDocument16 pagesBank Alfalah Schedule of Islamic Banking Chargesfaisal_ahsan7919No ratings yet

- Rca SocDocument3 pagesRca SocKrishna Kiran VyasNo ratings yet

- Annex 2 Super Savings AccountDocument2 pagesAnnex 2 Super Savings AccountPhani BhupathirajuNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- HDFC Bank Demat Tariff SheetDocument1 pageHDFC Bank Demat Tariff SheetpanduranganraghuramaNo ratings yet

- Bank service charges guideDocument17 pagesBank service charges guideshaantnuNo ratings yet

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Document2 pagesNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741No ratings yet

- Service Charges and Fees - Credit CardDocument5 pagesService Charges and Fees - Credit Cardr.il.e.y.monro.e.60No ratings yet

- "Being Me" Savings Account: W.E.F. 1st April 2014Document2 pages"Being Me" Savings Account: W.E.F. 1st April 2014praveenpersonelNo ratings yet

- Service Charges 15-03-2011Document13 pagesService Charges 15-03-2011AnandshingviNo ratings yet

- MITCs AND FEESDocument5 pagesMITCs AND FEESLoesh WaranNo ratings yet

- Sabka Basic Savings Account Complete KYC 10-10-2013Document2 pagesSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNo ratings yet

- Bank Alfalah Islamic Banking Schedule of Charges July-Dec 2013Document14 pagesBank Alfalah Islamic Banking Schedule of Charges July-Dec 2013krishmasethiNo ratings yet

- NEW Scheme For Trading MembersDocument6 pagesNEW Scheme For Trading Membersarijit_cse123No ratings yet

- EDB Service Charges2011Document8 pagesEDB Service Charges2011Imran Ali MirNo ratings yet

- Sbi Service Charges 2014Document16 pagesSbi Service Charges 2014jangraaNo ratings yet

- New Schedule of Charges For Current AccountDocument2 pagesNew Schedule of Charges For Current AccountKishan DhootNo ratings yet

- SERVICE CHARGES AND FEES SUMMARYDocument10 pagesSERVICE CHARGES AND FEES SUMMARYBella BishaNo ratings yet

- Comparative Analysis of Aixs BankDocument7 pagesComparative Analysis of Aixs Bankpearl6988No ratings yet

- Service ChargesDocument64 pagesService ChargesAmrutaNo ratings yet

- BusinessGold ChargesDocument1 pageBusinessGold ChargesShivam VinothNo ratings yet

- KioskDocument21 pagesKioskgollamandalaappaiahNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- DEMAT TARIFF SHEET FOR INDIVIDUAL AND OTHER ACCOUNTSDocument1 pageDEMAT TARIFF SHEET FOR INDIVIDUAL AND OTHER ACCOUNTSsonamkhanchandaniNo ratings yet

- PK 4Document15 pagesPK 4Instagram OfficeNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNo ratings yet

- NRI Savings Account Tariff StructureDocument4 pagesNRI Savings Account Tariff StructureRishiNo ratings yet

- Savings Account DetailsDocument2 pagesSavings Account Detailsmysto9No ratings yet

- Value Based Current Accounts Schedule of ChargesDocument2 pagesValue Based Current Accounts Schedule of ChargesDhawan SandeepNo ratings yet

- Revised Service Charges Effective from 16th May 2011Document29 pagesRevised Service Charges Effective from 16th May 2011sekharhaldarNo ratings yet

- Super Savings NewDocument2 pagesSuper Savings NewwinnermeNo ratings yet

- PNB Suvidha Scheme (Deposits) : Categorization of Retail Lending SchemesDocument3 pagesPNB Suvidha Scheme (Deposits) : Categorization of Retail Lending Schemesnishi namitaNo ratings yet

- Cash Transaction Charges Effective 1st June 2015Document2 pagesCash Transaction Charges Effective 1st June 2015Rajesh Kumar SubramaniNo ratings yet

- Service - Charges of PNBDocument17 pagesService - Charges of PNBfreakyansumanNo ratings yet

- SOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsDocument26 pagesSOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsZeynab AbrezNo ratings yet

- CD PremiumDocument1 pageCD PremiumnelzonpouloseNo ratings yet

- Mauritius Commercial Bank Corporates RatesDocument6 pagesMauritius Commercial Bank Corporates RatesGilbert KoopoosamychettyNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Depositoryparticipants NZDocument186 pagesDepositoryparticipants NZAabhishek BeezeeNo ratings yet

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajNo ratings yet

- .Net Developer With 3 Years ExperienceDocument4 pages.Net Developer With 3 Years ExperienceBrahmanand DasreNo ratings yet

- WDKDriver Test ManagerDocument34 pagesWDKDriver Test ManagerBrahmanand DasreNo ratings yet

- SoftwareTesting ClassesDocument74 pagesSoftwareTesting ClassesBrahmanand DasreNo ratings yet

- Writing A Test Strategy: Tor StålhaneDocument32 pagesWriting A Test Strategy: Tor StålhaneJayson CeladiñaNo ratings yet

- What Made You A Leader PDFDocument44 pagesWhat Made You A Leader PDFBrahmanand DasreNo ratings yet

- UI and UX Testing Ready ReckonerDocument65 pagesUI and UX Testing Ready ReckonerganrgmaNo ratings yet

- What If A Question Every Tester Must AskDocument27 pagesWhat If A Question Every Tester Must AskganrgmaNo ratings yet

- 50 Tips To Boost Your Productivity PDFDocument25 pages50 Tips To Boost Your Productivity PDFBrahmanand DasreNo ratings yet

- The Little Black Book On Test DesignDocument32 pagesThe Little Black Book On Test DesignteijolavuaariNo ratings yet

- Invoice OD103284821495764800Document1 pageInvoice OD103284821495764800Brahmanand DasreNo ratings yet

- Software Testing With Microsoft Test Manager 2012 and Lab ManagementDocument44 pagesSoftware Testing With Microsoft Test Manager 2012 and Lab ManagementBrahmanand DasreNo ratings yet

- WebUI Test Studio QA Edition - Step by Step TutorialDocument227 pagesWebUI Test Studio QA Edition - Step by Step Tutorialvaraprasad119No ratings yet

- WebUI Test Studio QA Edition - Step by Step TutorialDocument227 pagesWebUI Test Studio QA Edition - Step by Step Tutorialvaraprasad119No ratings yet

- Nanded PuneDocument2 pagesNanded PuneBrahmanand DasreNo ratings yet

- Introduction To Test Case Management With Microsoft Test Manager 2012Document22 pagesIntroduction To Test Case Management With Microsoft Test Manager 2012Brahmanand DasreNo ratings yet

- Telerik Test Studio Quick Start GuideDocument48 pagesTelerik Test Studio Quick Start GuideBrahmanand DasreNo ratings yet

- PlantDocument1 pagePlantBrahmanand DasreNo ratings yet

- DEEP-OCEAN TSUNAMI DETECTIONDocument23 pagesDEEP-OCEAN TSUNAMI DETECTIONBrahmanand DasreNo ratings yet

- TWC All LowresDocument314 pagesTWC All LowresBrahmanand DasreNo ratings yet

- Quiz Oracles GradingDocument3 pagesQuiz Oracles GradingBrahmanand DasreNo ratings yet

- CSTE Mock Test - Part 3 - QuestionsAnswersDocument6 pagesCSTE Mock Test - Part 3 - QuestionsAnswersapi-373372650% (2)

- Most Important Terms and ConditionsDocument9 pagesMost Important Terms and ConditionsBrahmanand DasreNo ratings yet

- 04 - Management Tool (Quality Center)Document4 pages04 - Management Tool (Quality Center)Brahmanand DasreNo ratings yet

- Website Vulnerability Scanner Report (Light)Document6 pagesWebsite Vulnerability Scanner Report (Light)Stevi NangonNo ratings yet

- Pattaradday Festival: Celebrating Unity in Santiago City's HistoryDocument16 pagesPattaradday Festival: Celebrating Unity in Santiago City's HistoryJonathan TolentinoNo ratings yet

- Dr. Thi Phuoc Lai NguyenDocument3 pagesDr. Thi Phuoc Lai Nguyenphuoc.tranNo ratings yet

- Edsml Assignment SCM 2 - Velux GroupDocument20 pagesEdsml Assignment SCM 2 - Velux GroupSwapnil BhagatNo ratings yet

- Marketing, Advertising and Product SafetyDocument15 pagesMarketing, Advertising and Product SafetySmriti MehtaNo ratings yet

- Exploratory EssayDocument9 pagesExploratory Essayapi-237899225No ratings yet

- Handout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceDocument8 pagesHandout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceLEILA GRACE MALACANo ratings yet

- 2020-2021 Tuition and Fee Rates Per Semester: Georgia Institute of TechnologyDocument2 pages2020-2021 Tuition and Fee Rates Per Semester: Georgia Institute of TechnologyAurangzaib JahangirNo ratings yet

- Effecting Organizational Change PresentationDocument23 pagesEffecting Organizational Change PresentationSvitlanaNo ratings yet

- Demonstrative pronouns chartDocument3 pagesDemonstrative pronouns chartAndrea HenaoNo ratings yet

- List of Presidents of Pakistan Since 1947 (With Photos)Document4 pagesList of Presidents of Pakistan Since 1947 (With Photos)Humsafer ALiNo ratings yet

- RIZAL Childhood ScriptDocument3 pagesRIZAL Childhood ScriptCarla Pauline Venturina Guinid100% (2)

- Aristotle Model of CommunicationDocument4 pagesAristotle Model of CommunicationSem BulagaNo ratings yet

- Music Business PlanDocument51 pagesMusic Business PlandrkayalabNo ratings yet

- WADVDocument2 pagesWADVANNA MARY GINTORONo ratings yet

- A Bibliography of China-Africa RelationsDocument233 pagesA Bibliography of China-Africa RelationsDavid Shinn100% (1)

- Mathematics: Textbook For Class XIIDocument14 pagesMathematics: Textbook For Class XIIFlowring PetalsNo ratings yet

- Customer Based Brand EquityDocument13 pagesCustomer Based Brand EquityZeeshan BakshiNo ratings yet

- Tayug Rural Bank v. CBPDocument2 pagesTayug Rural Bank v. CBPGracia SullanoNo ratings yet

- Chap1 HRM581 Oct Feb 2023Document20 pagesChap1 HRM581 Oct Feb 2023liana bahaNo ratings yet

- Vivarium - Vol 37, Nos. 1-2, 1999Document306 pagesVivarium - Vol 37, Nos. 1-2, 1999Manticora VenerabilisNo ratings yet

- 50 Simple Interest Problems With SolutionsDocument46 pages50 Simple Interest Problems With SolutionsArnel MedinaNo ratings yet

- 2011 Grade Exam ResultDocument19 pages2011 Grade Exam ResultsgbulohcomNo ratings yet

- Church Sacraments SlideshareDocument19 pagesChurch Sacraments SlidesharelimmasalustNo ratings yet