Professional Documents

Culture Documents

Ijems V3 (3) 5

Uploaded by

Jayashree ChatterjeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ijems V3 (3) 5

Uploaded by

Jayashree ChatterjeeCopyright:

Available Formats

I.J.E.M.S., VOL.

3(3) 2012: 280-283

ISSN 2229-600X

FOREIGN DIRECT INVESTMENT IN INDIAN RETAIL SECTOR: ISSUES AND IMPLICATIONS

1

Kulkarni Keerti, 2 Kulkarni Ramakant & 3Kulkarni Gururaj A. 1,2Global Business School,Karnatak University, Dharwad 3Department of Physics, SDMCET, Dharwad

ABSTRACT Foreign direct investment (FDI) is an integral part of an open and effective international economic system, which acts as a major catalyst in the development of a country through up-gradation of technology, managerial skills and capabilities in various sectors. Indian retail industry is one of the sunrise sectors with huge growth potential. However, in spite of the recent developments in retail sector and its immense contribution to the economy, it continues to be the least evolved industries in India when compared to rest of the world. Undoubtedly, this dismal situation of the retail sector, despite the ongoing wave of incessant liberalization and globalization, stems from the absence of FDI encouraging policy in the Indian retail sector. In this context, the present paper attempts to review the issues and implications of FDI inflows into the Indian retail sector, which include single brand and multi-brand retail sectors. KEYWORDS: Foreign Direct Investment, Retail Sector, Single Brand and Multi-Brand Retail Sectors INTRODUCTION The advent of FDI in India was witnessed during the end of 1990s when the Indian national government announced a number of reforms which aimed at helping in the process of liberalization and deregulation of the Indian economy. Since its inception there has been a remarkable surge in FDI inflows in the country. The total amount of FDI in India came to around US$ 42.3 billion in 2001, in 2002 this figure stood at US$ 54.1 billion, in 2003 this figure came to US$ 75.4 billion, and in 2004 this figure increased to US$ 113 billion. This shows that the flow of foreign direct investment in India has grown at a very fast pace over the last few years.1 Today, India is perceived as one of the most favorable global investment destinations. In the wake of liberalization, even the Indian retail sector has scaled an impressive growth curve over the last decade, with considerable consumer acceptance for organized retailing formats, particularly in the urban areas. Notwithstanding the above performance, the organized retail segment is still in a nascent stage with global retailers entering India only in the last few years, constrained by regulations allowing entry primarily through cash and carry operations. Complex corporate structures and the fact that intermediaries obtain a disproportionate share of value in the supply chain have always deterred foreign investments in the retail arena. 2 The Indian retail industry is the fifth largest in the world. Comprising of organized and unorganized sectors, retail industry is one of the fastest growing industries in India, especially over the last few years. With growing market demand, the industry is expected to grow at a pace of 25-30% annually. The Indian retail industry is expected to grow from Rs. 35,000 crore in 2004-05 to Rs. 1,09,000 crore by the year 2010 and hence is the most promising emerging market for investment. In 2007, the retail trade in India had a share of 8-10% in the GDP (Gross Domestic Product) of the 280 country, while it rose to 12% in 2009 and reached 22% by 2010. Unorganized retailing is by far the prevalent form of trade in India constituting 98% of total trade, while organized trade accounts only for the remaining 2% and this is projected to increase to 15-20 per cent by 2010.3 Nonetheless the organized sector is expected to grow faster than GDP growth in next few years driven by favorable demographic patterns, changing lifestyles, and strong income growth. In this context the present paper attempts to review the issues and implications of FDI inflows in to the Indian retail sector.

Question of FDI in Indian Retail Sector: Should it be allowed?

Issues and Implications of FDI in Indian retailing sector India is a nation of shopkeepers. The country has around 12 million stores, which means one store for every 100 customers. Retailing in India is at a very interesting era as various factors are bringing about the big bang effect to retail. The creation of malls across the country and new high-streets had suddenly urged traditional retailers to modernize themselves. Development of retail is happening across tier 1, 2 and 3 cities and this makes chain store retail interesting. Now with FDI in retail likely to become a reality, the shopkeepers landscape will change even further. Its only imperative that the Indian retail has benchmarks of excellence that will catapult the industry into the global arena.4 The main fear of FDI in retail trade is that it will certainly disrupt the livelihood of the poor people engaged in this trade. The opening up of big markets to foreignsponsored departmental outlets will not necessarily absorb them; rather they may try to establish the monopoly power in the country.5 The 51% foreign direct investment (FDI) will obviously have a negative impact on small retailers, but it will benefit the consumers as they will have wider choices

Foreign direct investment in Indian retail sector: Issues and implications at competitive prices. It will accelerate the retail market growth and provide more employment opportunities. The FDI Bill will definitely have a positive impact on the retail industry and the country by attracting more foreign investments. With big retail giants coming to India, it will surely improve our back-end storage and procurement process. Once these multi-chain retailers establish themselves, they will create infrastructure facilities, which will also propel the existing infrastructure. The farmers will be benefited from FDI as they will be able to get better prices for their products. The elimination of the intermediate channels in the procurement process will lead to reduction of prices for consumers. By allowing 51% foreign investments in the Indian market, it will teach the local retailers about real competition and help in insuring that they give better service to Indian consumers. It is obviously good for local competition. The impact on local kirana shops will not be affected. The kirana stores operate in a different environment catering to a certain set of customers and they will continue to find new ways to retain them.6 There is ambiguity in the interpretation of the term single brand. The existing policy does not clearly codify whether retailing of goods with sub-brands bunched under a major parent brand can be considered as single-brand retailing, and accordingly eligible for 51 percent FDI. Additionally, the question on whether co-branded goods (specifically branded as such at the time of manufacturing) would qualify as single brand retail trading remains unanswered. results in a win-win situation for India. This can be done by integrating into the rules and regulations for FDI in multibrand retailing certain inbuilt safety valves. For example FDI in multi brand retailing can be allowed in a calibrated manner with social safeguards so that the effect of possible labor dislocation can be analyzed and policy fine tuned accordingly. To ensure that the foreign investors make a genuine contribution to the development of infrastructure and logistics, it can be stipulated that a percentage of FDI should be spent towards building up of back end infrastructure, logistics or agro processing units. One of the justifications for introducing FDI in multi-brand retailing is to transform the poverty stricken and stagnating rural sphere into a forward moving and prosperous rural sphere. To actualize this goal it can be stipulated that at least 50% of the jobs in the retail outlet should be reserved for rural youth and that a certain amount of farm produce be procured from the poor farmers. Similarly, to develop the small and medium enterprise (SME), it can also be stipulated that a minimum percentage of manufactured products be sourced from the SME sector in India. Public Distribution System is still in many ways the life line of the people living below the poverty line. To ensure that the system is not weakened the government may reserve the right to procure a certain amount of food grains for replenishing the buffer. The government may also put in place an exclusive regulatory framework to protect the interest of small retailers. It will ensure that the retailing giants do resort to predatory pricing or acquire monopolistic tendencies. Besides, the government and RBI need to evolve suitable policies to enable the retailers in the unorganized sector to expand and improve their efficiencies. The Industrial policy 1991 had crafted a trajectory of change whereby every sectors of Indian economy at one point of time or the other would be embraced by liberalization, privatization and globalization. FDI in multibrand retailing is in that sense a steady progression of that trajectory. But the government has by far cushioned the adverse impact of the change that has ensued in the wake of the implementation of Industrial Policy 1991 through safety nets and social safeguards. But the change that the movement of retailing sector into the FDI regime would bring about will require more involved and informed support from the government. One hopes that the government would stand up to its responsibility, because what is at stake is the stability of the vital pillars of the economy- retailing, agriculture, and manufacturing. In short, the socio economic equilibrium of the entire country.7

FDI in Single and Multi-Brand Retail Sectors

Foreign Direct Investment under the Industrial Policy 1991 and thereafter under different Foreign Trade Policies is being allowed in different sectors of the economy in different proportion under either the Government route or Automatic Route. In Retailing, presently 51 per cent FDI is allowed in single brand retail through the Government Approval route while 100 per cent FDI is allowed in the cash-and-carry (wholesale) formats under the Automatic route. Under the Government Approval route, proposal for FDI in Single Brand Product Retailing are received in the Department of Industrial Policy and Promotion, Ministry of Commerce & Industry. Automatic route dispenses with the need of multiple approvals from Government and/or regulatory agencies (Government of India or the RBI). Of late, the Government of India has expressed its desire to bring the Multi-Brand retailing within the ambit of FDI, and in the process has put in train a debate on its possible outcome. Unlike FDI in single brand retailing which pertains to brand loyal and a relatively small high income clientele, FDI in multi-brand retailing would have direct impact on a vast spectrum of population and thus a sensitive issue. Left alone foreign capital will seek ways through which it can only multiply itself, and unthinking application of capital for profit, given our peculiar socio-economic conditions, may spell doom and deepen the hiatus between the rich and the poor. Thus the proliferation of foreign capital into multibrand retailing needs to be anchored in such a way that it 281

Rationale Behind Allowing FDI in Retail Sector

FDI can be a powerful catalyst to spur competition in the retail industry, due to the current scenario of low competition and poor productivity. The policy of single-brand retail was adopted to allow Indian consumers access to foreign brands. Since Indians spend a lot of money shopping abroad, this policy enables them to spend the same money on the same goods in India. FDI in single-brand retailing was permitted in 2006, up to 51 per cent of ownership. Between then and May 2010, a total of 94 proposals have been received. Of these, 57 proposals have

I.J.E.M.S., VOL.3(3) 2012: 280-283

ISSN 2229-600X

been approved. An FDI inflow of US$196.46 million under the category of single brand retailing was received between April 2006 and September 2010, comprising 0.16 per cent of the total FDI inflows during the period. Retail stocks rose by as much as 5%. Shares of Pantaloon Retail (India) Ltd ended 4.84% up at Rs 441 on the Bombay Stock Exchange. Shares of Shoppers Stop Ltd rose 2.02% and Trent Ltd, 3.19%. The exchanges key index rose 173.04 points, or 0 .99%, to 17,614.48. But this is very less as compared to what it would have been had FDI up to 100% been allowed in India for single brand.8 The policy of allowing 100% FDI in single brand retail can benefit both the foreign retailer and the Indian partner foreign players get local market knowledge, while Indian companies can access global best management practices, designs and technological knowhow. By partially opening this sector, the government was able to reduce the pressure from its trading partners in bilateral/multilateral negotiations and could demonstrate Indias intentions in liberalizing this sector in a phased manner.9 Permitting foreign investment in food-based retailing is likely to ensure adequate flow of capital into the country, & its productive use in a manner likely to promote the welfare of all sections of society, particularly farmers and consumers. It would also help bring about improvements in farmers income & agricultural growth and assist in lowering consumer prices inflation.10 Apart from this, by allowing FDI in retail trade, India will significantly flourish in terms of quality standards and consumer expectations, since the inflow of FDI in retail sector is bound to pull up the quality standards and cost-competitiveness of Indian producers in all the segments. It is therefore obvious that we should not only permit but encourage FDI in retail trade. Lastly, it is to be noted that the Indian Council of Research in International Economic Relations (ICRIER), a premier economic think tank of the country, which was appointed to look into the impact of BIG capital in the retail sector, has projected the worth of Indian retail sector to reach $496 billion by 2011-12 and ICRIER has also come to the conclusion that investment of big money (large corporates and FDI) in the retail sector would in the long run not harm interests of small traditional retailers.11 Further, to take care of the concerns of the Government before allowing 100% FDI in Single Brand Retail and MultiBrand Retail, the following recommendations are being proposed10 Preparation of a legal and regulatory framework and enforcement mechanism to ensure that large retailers are not able to dislocate small retailers by unfair means. Extension of institutional credit, at lower rates, by public sector banks, to help improve efficiencies of small retailers; undertaking of proactive programme for assisting small retailers to upgrade themselves. Enactment of a National Shopping Mall Regulation Act to regulate the fiscal and social aspects of the entire retail sector. Formulation of a Model Central Law regarding FDI of Retail Sector. 282

Conclusions

In light of the above, it can be safely concluded that allowing healthy FDI in the retail sector would not only lead to a substantial surge in the countrys GDP and overall economic development, but would inter alia also help in integrating the Indian retail market with that of the global retail market in addition to providing not just employment but a better paying employment, which the unorganized sector (kirana and other small time retailing shops) have undoubtedly failed to provide to the masses employed in them. Thus, as a matter of fact FDI in the buzzing Indian retail sector should not just be freely allowed but per contra should be significantly encouraged. Allowing FDI in multi brand retail can bring about Supply Chain Improvement, Investment in Technology, Manpower and Skill Development, Tourism Development, Greater Sourcing from India, Up-gradation in Agriculture, Efficient Small and Medium Scale Industries, Growth in market size and Benefits to Government through greater GDP, tax income and employment generation.

References

1. http://business.mapsofindia.com 2. http://www.financialexpress.com/news/fdi-sparking-arevival-in-the-retailsector/899862/) 3. M. Guruswamy, K. Sharma, J.P. Mohanty, and T.J. Korah, FDI in Indias Retail Sector More Bad than Good? , Centre for Policy Alternatives, New Delhi, India (www.cpasind.com) 4. The Times of India. January 16,2012 5. Dipankar Dey, Aspects of Indias Economy - FDI in Indias Retail Trade: Some Additional Issues No. 43 (July 2007), Research Unit for Political Economy (R U P E) Publications, Colaba, Mumbai, India 6.http://www.businessstandard.com., Article by Zubin Kabraji, Regional Director, Indo-German Chamber of Commerce 7. Hemant Batra, FDI in Retailing Sector in India Pros & Cons, posted on 3 Nov 2010 by Reader Blogs on Legally India: Uncut (http://www.legallyindia.com/1468-fdiinretailing-sector-in-india-pros-cons-by-hemant-batra) 8. Nabael Mancheri, Indias FDI policies: Parad igm shift (http cies-paradigm-shift/-) 9. Discussion Paper on FDI in Multi Brand Retail Trading ( randRetailTrading_06July2010.pdf) 10. Pulkit Agarwal, Esha Tyagi Foreign Direct Investment in Indian Retail Sector An Analysis (http://www.legalindia.in/ foreign- direct-investment-inindian-retail-sector-an-analysis) 11. Sarthak Sarin, Foreign Direct Investment in Retail Sector (Nov 23, 2010) (http://www.legalindia.in/foreign-direct-investment-inretail-sector- others-surmountingindia-napping)

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tata Nano - Perceptual Study PDFDocument10 pagesTata Nano - Perceptual Study PDFWilliam McconnellNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Sap mm01Document1 pageSap mm01Jayashree ChatterjeeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chisquare in Spss 1209705384088874 8Document10 pagesChisquare in Spss 1209705384088874 8Jayashree ChatterjeeNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- EconomicsDocument8 pagesEconomicsJayashree ChatterjeeNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- EconomicsDocument8 pagesEconomicsJayashree ChatterjeeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- D.K. Yadav Vs J.M.A. Industries LTD On 7 May, 1993 PDFDocument9 pagesD.K. Yadav Vs J.M.A. Industries LTD On 7 May, 1993 PDFJayashree ChatterjeeNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Factor AnalysisDocument36 pagesFactor AnalysisJayashree Chatterjee100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Celebrating Cerebration 2013 - QuizTalkDocument9 pagesCelebrating Cerebration 2013 - QuizTalkJayashree ChatterjeeNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ohrabrujuce Liderstvo I Kreativnost Zaposlenih8Document23 pagesOhrabrujuce Liderstvo I Kreativnost Zaposlenih8Ana StevanovicNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- AISHE201011Document140 pagesAISHE201011Jayashree ChatterjeeNo ratings yet

- Automobile Industry in IndiaDocument37 pagesAutomobile Industry in IndiaKiran DuggarajuNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- PV Industry 201103Document15 pagesPV Industry 201103Aditya SharmaNo ratings yet

- ZUST Marketing Lecture 3 - Segmenting and Targeting MarketsDocument34 pagesZUST Marketing Lecture 3 - Segmenting and Targeting MarketsJayashree ChatterjeeNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- HM Annual Report 2010 11 (With Subsidiaries)Document138 pagesHM Annual Report 2010 11 (With Subsidiaries)mrgauravaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Apprentice Trainee Management Development Plan April 2012Document6 pagesApprentice Trainee Management Development Plan April 2012Jayashree ChatterjeeNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- ZUST Marketing Lecture 3 - Segmenting and Targeting MarketsDocument34 pagesZUST Marketing Lecture 3 - Segmenting and Targeting MarketsJayashree ChatterjeeNo ratings yet

- Annual Report and Accounts 2011 2012Document146 pagesAnnual Report and Accounts 2011 2012Surbhi JainNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Educational Statistics at A GlanceDocument45 pagesEducational Statistics at A GlanceJayashree ChatterjeeNo ratings yet

- Intro ERP Using GBI GBI Slides en v2.20Document15 pagesIntro ERP Using GBI GBI Slides en v2.20Jayashree ChatterjeeNo ratings yet

- AISHE201011Document140 pagesAISHE201011Jayashree ChatterjeeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AISHE201011Document140 pagesAISHE201011Jayashree ChatterjeeNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Boosting Indias Manufacturing Exports 140512Document25 pagesBoosting Indias Manufacturing Exports 140512Jayashree ChatterjeeNo ratings yet

- Intro ERP Using GBI SAP Slides en v2.20Document14 pagesIntro ERP Using GBI SAP Slides en v2.20Jayashree ChatterjeeNo ratings yet

- CIL Sample Questions MT2012 05072012Document8 pagesCIL Sample Questions MT2012 05072012Jayashree ChatterjeeNo ratings yet

- SAP IntroductionDocument27 pagesSAP Introductiongundala_thejokarthikNo ratings yet

- Methods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Document21 pagesMethods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Precious MamigoNo ratings yet

- Indian Economic Social History Review-1979-Henningham-53-75Document24 pagesIndian Economic Social History Review-1979-Henningham-53-75Dipankar MishraNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Test Bank For Entrepreneurship The Art Science and Process For Success 3rd Edition Charles Bamford Garry BrutonDocument15 pagesTest Bank For Entrepreneurship The Art Science and Process For Success 3rd Edition Charles Bamford Garry Brutonsaleburrock1srNo ratings yet

- Shantilal Shah Engineering College, Bhavnagar: Submission of Proposal For Project/ModelDocument7 pagesShantilal Shah Engineering College, Bhavnagar: Submission of Proposal For Project/Modelparth patelNo ratings yet

- Economic Engineering - Inflation - Lectures 1&2Document66 pagesEconomic Engineering - Inflation - Lectures 1&21k subs with no videos challengeNo ratings yet

- IET Educational (Xiao-Ping Zhang)Document17 pagesIET Educational (Xiao-Ping Zhang)Mayita ContrerasNo ratings yet

- Grammar Vocabulary 1star Unit7 PDFDocument1 pageGrammar Vocabulary 1star Unit7 PDFLorenaAbreuNo ratings yet

- L12022 Laser Cutter Flyer SinglesDocument4 pagesL12022 Laser Cutter Flyer SinglesPablo Marcelo Garnica TejerinaNo ratings yet

- Acctg 1 PS 1Document3 pagesAcctg 1 PS 1Aj GuanzonNo ratings yet

- KFC Offer T&C: SL - No Outlet Name CityDocument16 pagesKFC Offer T&C: SL - No Outlet Name Cityanita rajenNo ratings yet

- MNCDocument25 pagesMNCPiyush SoniNo ratings yet

- Borjas 2013 Power Point Chapter 8Document36 pagesBorjas 2013 Power Point Chapter 8Shahirah Hafit0% (1)

- Dummy VariableDocument21 pagesDummy VariableMuhammad MudassirNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ForEx Hidden SystemsDocument123 pagesForEx Hidden SystemsWar Prince100% (2)

- Social Integration Approaches and Issues, UNRISD Publication (1994)Document16 pagesSocial Integration Approaches and Issues, UNRISD Publication (1994)United Nations Research Institute for Social DevelopmentNo ratings yet

- Certificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Document3 pagesCertificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Habibie MikhailNo ratings yet

- Chap 3 MCDocument29 pagesChap 3 MCIlyas SadvokassovNo ratings yet

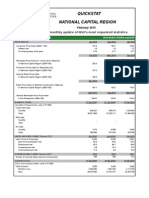

- Quickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDocument3 pagesQuickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDaniel John Cañares LegaspiNo ratings yet

- 0413 Germany Yapp PDFDocument9 pages0413 Germany Yapp PDFBharatNo ratings yet

- Real Estate Player in BangaloreDocument20 pagesReal Estate Player in BangaloreAnkit GoelNo ratings yet

- Abu Dhabi EstidamaDocument63 pagesAbu Dhabi Estidamagolashdi100% (3)

- Carbon Footprint CalculatorDocument1 pageCarbon Footprint CalculatorLadylee AcuñaNo ratings yet

- IGCSE Economics U1 AnsDocument4 pagesIGCSE Economics U1 AnsChristy SitNo ratings yet

- 18 043Document3 pages18 043cah7rf9099No ratings yet

- Daniela Del Bene e Kesang ThakurDocument23 pagesDaniela Del Bene e Kesang ThakurYara CerpaNo ratings yet

- © 2019 TOKOIN. All Rights ReservedDocument47 pages© 2019 TOKOIN. All Rights ReservedPutra KongkeksNo ratings yet

- Globalization and The Sociology of Immanuel Wallerstein: A Critical AppraisalDocument23 pagesGlobalization and The Sociology of Immanuel Wallerstein: A Critical AppraisalMario__7No ratings yet

- Woodward Life Cycle CostingDocument10 pagesWoodward Life Cycle CostingmelatorNo ratings yet

- AIRTITEDocument2 pagesAIRTITEMuhammad AtifNo ratings yet

- Model Sale AgreementDocument4 pagesModel Sale AgreementNagaraj KumbleNo ratings yet

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (709)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (383)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1635)