Professional Documents

Culture Documents

Form 15 H

Uploaded by

Vishwanath RaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 15 H

Uploaded by

Vishwanath RaoCopyright:

Available Formats

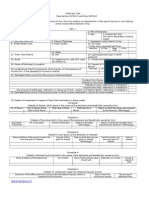

FORM NO.

15H

[See section 197A(1C), 197A(1A) and rule 29C(1A)] Declaration under section 197A(1C) of the Incometax Act, 19 1 to !e made !" an indi#idual $ho is of the a%e of sixt" "ears or more claimin% certain recei&ts $ithout deduction of tax' PART - I 1] (ame of Assessee (Declareant) ) 2] *A( ) +] A%e ) ,] Assessment -ear 7] Assessed in $hich 3ard 0 Circle 17] A8 Code ($hom assessed last time) ) Area 5an%e A8 9"&e Code Code 1,] 6ast Assessment -ear in $hich assessed ) 17] *resent 3ard 0 Circle 19] *resent A8 Code (if not same as a!o#e)) Area Code A8 9"&e 5an%e Code A8 (o'

.] /lat 0 Door 0 1loc2 (o' ) 4] 5oad 0 Street 0 6ane )

] (ame of *remises ) 9] Area 0 6ocalit" )

A8 (o'

11] 9o$n 0 Cit" 0 District )

12] State ) 1+] *I( 1 ] 9ele&hone 0 ;o!ile (o )

1.] :mail ) 14] (ame of 1usiness 0 8ccu&ation )

27] <urisdictional Chief Comm' of Income 9ax or Comm' of Income 9ax (if not assessed to income tax earlier)) 21] :stimated total income from the sources mentioned !elo$)

(*lease tic2 the rele#ant !ox)

Di#idend from shares referred to in Schedule = I Interest on securities referred to in Schedule = II Interest on sums referred to in Schedule = III Income form units referred to in Schedule = I> 9he amt of $ithdra$al referred in clause(a) of su!sec=2 of sec=47CCA referred in Schedule = > 22] :stimated total income of the &re#ious "ear in income mentioned in Col = 21 to !e included ) 2+] Details of in#estments in res&ect of $hich the declaration is !ein% made ) SCHEDULEI (Details of shares, $hich stand in the name of the declarant and !eneficiall" o$ned !" him) Class of shares ? face 9otal #alue Distincti#e num!ers Date on $hich the shares $ere ac@uired #alue of each share of shares of the shares !" the declarant (dd0mm0"""")

(o' of shares

Descri&tion of securities

SCHEDULEII (Details of the securities held in the name of declarant and !eneficiall" o$ned !" him) Date(s) of (um!er of Amount of Date(s) on $hich the securitues $ere securities securities securities ac@uired !" declarant (dd0mm0"""") (dd0mm0"""")

SCHEDULEIII (Details of the sums %i#en !" the declarant on interest) (ame and address of the &erson to $hom the sums are %i#en on interest Amount of sums %i#en on interest Date on $hich sums %i#en on Interest (dd0mm0"""") *eriod for $hich sums $ere %i#en on interest 5ate of interest

SCHEDULE IV (Details of the mutual fund units held in the name of declarant and !eneficiall" o$ned !" him) (ame and address of the Class of units ? face Distincti#e Income (um!er of units mutual fund #alue of each unit num!er of units in res&ect of units

SCHEDULEV (Details of the $ithdra$al made from (ational Sa#in%s Scheme)

*articulars of the *ost 8ffice $here the account under the (ational Sa#in%s Scheme is maintained and the account num!er

Date on $hich the account $as o&ened (dd0mm0"""")

9he amount of $ithdra$al from the account

Signature ! t"e De#$arant

De#$arati n % Veri!i#ati n

AI0 3e do here!" declare that I am resident in India $ithin the meanin% of section of the Incometax Act, 19 1' I also, here!" declare that to the !est of m" 2no$led%e and !elief $hat is stated a!o#e is correct, com&lete and is trul" stated and that the incomes referred to in this form are not includi!le in the total income of an" other &erson u0s 7 to , of the Incometax Act, 19 1' I further, declare that the tax m" estimated total income, includin% Aincome 0 incomes referred to in column 21com&uted in accordance $ith the &ro#isions of the Incometax Act, 19 1, for the &re#ious "ear endin% on &1.'&.('))) rele#ant to the rele#ant to the assessment "ear ('))) - ))) $ill !e nil'

*lace ) Date )

x

Signature ! t"e De#$arant

PART - II [/or use !" the &erson to $hom the declaration is furnished] 1] (ame of the &erson res&onsi!le for &a"in% the income referred to in Column 2] *A( of the &erson indicated in Column 1 of *art II 21 of *art I ) +] Com&lete Address ) ,] 9A( of the &erson indicated in Column 1 of *art II )

.] :mail )

] 9ele&hone 0 ;o!ile (o ) 9] *eriod in res&ect of $hich the di#idend has !een declared or the income has !een &aid 0 credited )

7] Status )

11] Date on $hich the income has !een &aid 0 credited (dd0mm0"""") )

4] Date on $hich Declaration is /urnished (dd0mm0"""") )

17] Amount of income &aid)

12] Date of declaration, distri!ution or &a"ment of di#idend0 $ithdra$al under the (ational Sa#in%s Scheme(dd0mm0"""") )

1+] Account (um!er of (ational Sa#in% Scheme from $hich $ithdra$al has !een made )

/or$arded to the Chief Commissioner or Commissioner of Incometax BBBBBBBBBBBBBBB

*lace ) Date )

Si%nature of the &erson res&onsi!le for &a"in% the income referred to in Column 21 of *art I

(otes) 1' 9he declaration should !e furnished in du&licate' 2' A Delete $hiche#er is not a&&lica!le' +' 1efore si%nin% the #erification, the declarant should satisf" himself that the information furnished in the declaration is true, correct and com&lete in all res&ects' An" &erson ma2in% a false statement in the declaration shall !e lia!le to &rosecution under section 277 of the Income 9ax Act, 19 1 and on con#iction !e &unisha!le C (i) In a case $here tax sou%ht to !e e#aded exceeds t$ent" fi#e la2h ru&ees, $ith ri%orous im&risonment $ich shall not !e less than six months !ut $hich ma" extend to se#en "ears and $ith fine D (ii) In an" other case, $ith ri%orous im&risonment $hich shall not !e less than three months !ut $hich ma" extend to t$o "ears and $ith fine' 9he &erson res&onsi!le for &a"in% the income referred to in column 21 of *art I shall not acce&t the declaration $here the amount of income of the nature referred to in section 197A(1C) or the a%%re%ate of the amounts of such income credited or &aid or li2el" to !e credited or &aid durin% the &re#ious "ear in $hich such income is to !e included exceeds the maximum amount $hich is not char%ea!le to tax and deduction(s) under Cha&ter >I A, if an" , for $hich the declarant is eli%i!le'

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Form 15g NewDocument4 pagesForm 15g NewnazirsayyedNo ratings yet

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Senior Citizen Tax FormDocument3 pagesSenior Citizen Tax FormRajanNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONgrover.jatinNo ratings yet

- FORM 15G DECLARATIONDocument3 pagesFORM 15G DECLARATIONulhas_nakasheNo ratings yet

- PDF Editor: Form No. 15GDocument2 pagesPDF Editor: Form No. 15GImissYouNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocument2 pages"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNo ratings yet

- Letter from the Secretary-General (A/51/796-S/1997/114)From EverandLetter from the Secretary-General (A/51/796-S/1997/114)No ratings yet

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- FORM-15G DECLARATIONDocument4 pagesFORM-15G DECLARATIONKayam BalajiNo ratings yet

- Form 15G/15H ReceiptsDocument6 pagesForm 15G/15H ReceiptspriyaradhiNo ratings yet

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssNo ratings yet

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocument2 pages"Form No. 15H: Area Code Range Code AO No. AO Typepkw007No ratings yet

- Form 15G TDS waiverDocument2 pagesForm 15G TDS waiverPalaniappan Meyyappan83% (6)

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- 15G FormDocument2 pages15G Formsurendar147No ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- "Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pages"Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2teniyaNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- FORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONDocument6 pagesFORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONRajasekar SivaguruvelNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Form 15G/15H detailsDocument7 pagesForm 15G/15H detailsKartikey RanaNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONRahul SahaniNo ratings yet

- PAN No.Document5 pagesPAN No.haldharkNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- Form 15H Declaration for Senior CitizensDocument4 pagesForm 15H Declaration for Senior CitizensraviNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- Form 15GDocument2 pagesForm 15GSrinivasa RaghavanNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- INCOME-TAXDocument3 pagesINCOME-TAXarjunv_14100% (1)

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- ShabanaDocument56 pagesShabanaFathimath SayyidaNo ratings yet

- 13 Testpaperint IDocument49 pages13 Testpaperint Itoton33No ratings yet

- BCOM PROJECT GUIDELINESDocument7 pagesBCOM PROJECT GUIDELINESKrishnendu BanerjeeNo ratings yet

- Experiences From State Health System Development ProjectDocument42 pagesExperiences From State Health System Development Projecttoton33No ratings yet

- The Seven Attributes of An Effective Records Management ProgramDocument15 pagesThe Seven Attributes of An Effective Records Management Programtoton33No ratings yet

- E-Tutorial - Download Form 16Document17 pagesE-Tutorial - Download Form 16maahi7No ratings yet

- Form-1 Bank Linking FormDocument1 pageForm-1 Bank Linking FormSayantan172No ratings yet

- NIRF-AdvtDocument1 pageNIRF-Advttoton33No ratings yet

- Form2 LPG Linking FormDocument1 pageForm2 LPG Linking FormSayantan172No ratings yet

- AdjectivesDocument1 pageAdjectivestoton33No ratings yet

- Part B Form16 MasterDocument6 pagesPart B Form16 Mastertoton33No ratings yet

- SHURBSDocument1 pageSHURBStoton33No ratings yet

- Form-1 Bank Linking FormDocument1 pageForm-1 Bank Linking FormSayantan172No ratings yet

- Cigarette SmokingDocument1 pageCigarette Smokingtoton33No ratings yet

- Financial AccountingDocument945 pagesFinancial Accountingtoton33100% (6)

- 13 Testpaperint IDocument49 pages13 Testpaperint Itoton33No ratings yet

- CERSAIDocument12 pagesCERSAItoton330% (1)

- FormsDocument31 pagesFormsSuvam Sinha100% (1)

- Joint Home LoanDocument6 pagesJoint Home Loantoton33No ratings yet

- 13 Testpaperint IDocument49 pages13 Testpaperint Itoton33No ratings yet

- 13 Testpaperint IDocument49 pages13 Testpaperint Itoton33No ratings yet

- FormsDocument31 pagesFormsSuvam Sinha100% (1)

- Cas Guidelines and Proforma Teachers Non Govt CollegeDocument35 pagesCas Guidelines and Proforma Teachers Non Govt Collegetoton33No ratings yet

- Capital and RevenueDocument23 pagesCapital and RevenueDhwani PanditNo ratings yet

- The Research ProblemDocument23 pagesThe Research ProblemMandar BorkarNo ratings yet

- Different Colleges Affiliated Under Different Universities of The State and in Non-Govt. OrganisationsDocument1 pageDifferent Colleges Affiliated Under Different Universities of The State and in Non-Govt. Organisationstoton33No ratings yet

- Return of IncomeDocument6 pagesReturn of Incometoton33No ratings yet

- CAS Order For State CollegeDocument11 pagesCAS Order For State CollegedvdmegaNo ratings yet

- Interest CalculationDocument2 pagesInterest Calculationtoton33No ratings yet