Professional Documents

Culture Documents

Bureau of Internal Revenue

Uploaded by

api-2477930550 ratings0% found this document useful (0 votes)

65 views14 pagesOriginal Title

24-2004

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

65 views14 pagesBureau of Internal Revenue

Uploaded by

api-247793055Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

1

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

April 12, 2004

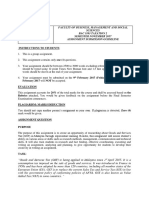

REVENUE MEMORANDUM CIRCULAR NO. 24-2004

SUBJECT: Primer on the CENTENNIAL TAXPAYERS RECOGNITION

PROGRAM (CTRP) as covered by Revenue Memorandum Order

(RMO) No. 7-2004, RMO No. 14-2004, RMO No. 18-2004 and RMO

No. 20-2004.

TO : All Taxpayers and Revenue Officials and Other Concerned

Q1: What is the Centennial Taxpayers Recognition Program or CTRP?

A1: The Centennial Taxpayers Recognition Program or the CTRP is a program instituted

by the Bureau of Internal Revenue (Bureau) to commemorate its centennial

anniversary aimed at giving recognition to taxpayers, corporate or individual, who

pay their taxes properly and who have shown remarkable growth rates/ratios in their

tax payments (income and business) for taxable year 2003 as compared to taxable

year 2002.

It is a recognition or award of nationalistic taxpayers who perform their patriotic and

civic duty of paying proper taxes. It was conceived to recognize taxpayers for

declaring the correct/right amount of taxes; for doing more than what is required of

them, i.e., paying more that what is required of them, all for the cause of nation

building. With the recognition come certain benefits and privileges designed to

encourage continually doing the right thing for the country.

Q2: Is the CTRP an amnesty program?

A2: No. CTRP is not an amnesty program. It covers future payments, i.e. payments to

be made on April 15, 2004 for income taxes due for taxable year 2003, and payments

to be made for income taxes due for the 1

st

quarter of taxable year 2004.

It does not condone any wrong/erroneous declaration made for returns already filed

and taxes paid for.

2

Q3: What are the primary benefits of the CTRP?

A3: All Centennial Taxpayers will be entitled to the following benefits:

1. Recognition during the Centennial Anniversary celebration of the Bureau on

August 1, 2004;

2. Listed in the Honor Roll to be published in a national newspaper; unless they

shall otherwise notify the Bureau (Attention: Assistant Commissioner,

Taxpayers Assistance Service) not to include their names in the list to be

published

3. Centennial Taxpayers Trophy;

4. Centennial Honor Taxpayers Card which will entitled the taxpayer special

attention in any official transaction with the Bureau or Department of Finance

(DOF) office;

5. Priority availment of various e-services of the Bureau such as Electronic

Filing and Payment Systems (EFPS), E-Submission, and E-Payee.

Q4: What are other benefits of the CTRP?

A4: In addition to the above mentioned benefits, TOP CENTENNIAL TAXPAYERS

will be accorded the protection of last priority in audit and investigation for taxable

year 2003 for all taxes. The grant of protection of last priority in audit will only be

undertaken upon careful evaluation and authorization by the Commissioner of the

Bureau.

Q5: Who are qualified to be a Top Centennial Taxpayer?

A5: Among all the Centennial Taxpayers, the top 1,000 with highest weighted score for

percentage increase and absolute peso amount increase in tax payment shall be

referred to as the TOP Centennial Taxpayers.

Q6: Who can vie for a Centennial Taxpayer Award / who can be eligible as

Centennial Taxpayer?

A6: The following taxpayers can vie for a Centennial Taxpayer Award:

1. Corporations following the calendar year of reporting [RMO No. 7-2004]

2. Corporations following the fiscal year of reporting whose fiscal year ends

from July 31, 2003 up to November 30, 2003 [RMO No. 14-2004]

3. Individual taxpayers engaged in business or are considered as mixed income

earners [RMO No. 7-2004]

4. Individual taxpayers engaged in business or are considered as mixed income

earners who reported a net loss for taxable year 2002 [RMO No. 18-2004,

RMO No. 20-2004]

Taxpayers mentioned above are eligible to be a Centennial Taxpayer provided they

meet all the qualities laid down in RMO No. 7-2004 as supplemented by RMO Nos.

14-2004, 18-2004 and 20-2004.

3

Q7: What are the qualities of an eligible taxpayer to be considered in the Centennial

Award Selection Process?

A7: In general, for a taxpayer to be considered in the centennial award selection process

as a Centennial Taxpayer, said taxpayer must fulfill, in the minimum, ALL the

following conditions:

1. Annual Growth Rate of Income Tax Payment

Growth rate of actual income tax payment for taxable year 2003 over tax

due for taxable year 2002 must be at least 20%

For example:

Tax due for 2002 P1,000,000

x 20%

Minimum growth requirement P 200,000

========

Therefore, the actual income tax payment for 2003 should at least amount to

P1,200,000 (P1,000,000 + P200,000).

2. Last Quarter 2003 Income Tax Growth Rate

Growth rate of actual income tax payment for 4

th

quarter 2003 over tax

due for 4

th

quarter 2002 must be at least 25%

For example:

Tax due for the 4

th

qtr 2002 P200,000

x 25%

Minimum growth requirement P 50,000

=======

Therefore, the actual income tax computed for the 4

th

quarter 2003 should

at least amount to P250,000 (P200,000 + P50,000).

3. First Quarter 2004 Income Tax Growth Rate

Growth rate of actual income tax payment for the 1

st

quarter 2004 is at least

25% more than the tax due for the 1

st

quarter 2003, provided, that tax due

for the 1

st

quarter 2003 shall not be less than 25% of the tax due of the

taxpayer for the whole taxable year 2003; and

For example:

A. Tax due for the 1

st

qtr 2003 P150,000

B. 25% of Tax due for the whole year of 2003

Tax due for the whole year of 2003 P500,000

x 25%

25% of tax due for the whole year P125,000

=======

Tax due for the 1

st

qtr 2003 (A or B whichever is higher) P150,000

x 25%

Minimum growth requirement P 37,500

=======

Therefore, the actual income tax payment for the 1

st

quarter 2004 should

at least amount to P187,500 (P150,000 + P37,500).

4

4. Ratio of Income Tax Payment to Gross Sales/Receipts

Ratio of income tax payment to gross sales/receipts in year 2003 must at least

equal to year 2002. In addition, the ratio of income tax payment to gross

sales/receipts for the 1

st

quarter of 2004 must at least be equal to the 1

st

quarter

of 2003; and

For example:

For year 2003

2003 2002 .

A. Income Tax Payment P 1,200,000 P 1,000,000

B. Gross Sales P125,000,000 P115,000,000

Ratio (A divided by B) 0.96% 0.87%

For 1

st

quarter 2004

1

st

qtr 2004 1

st

qtr 2003

A. Income Tax Payment P 187,500 P 150,000

B. Gross Sales P20,000,000 P16,000,000

Ratio (A divided by B) 0.94% 0.94%

Thus, in order to qualify for this condition the ratio for 2003 or 1

st

quarter 2004

Should at least be equal or greater than the ratio for 2002 or 1

st

quarter 2003.

5. Ratio of VAT/Percentage Payments

For those subject to value added tax (VAT), the VAT actually paid to the

Bureau for taxable year 2003 shall equal to or be greater than the higher of

(a) the equivalent of three percent (3%) of their gross sale/receipt for

2003, or

(b) effective VAT rate for the taxable year 2002.

For example:

2003 2002 .

A. VAT Payment P 4,375,000 P 3,680,000

B. Gross Sales P125,000,000 P115,000,000

Ratio (A divided by B) 3.50% 3.20%

Thus, in order to qualify for this condition the effective VAT rate for 2003 should

at least be 3%; or higher than or equal to the effective rate for 2002, if the

effective VAT rate for 2002 is higher than 3%.

For those subject to percentage tax, the ratio of percentage tax actually paid to

gross sales/receipt for taxable year 2003 should not be less than the ratio of

the percentage tax actually paid to gross sales/receipts for taxable year 2002.

For example:

2003 2002 .

A. Percentage Tax Payment P 3,750,000 P 3,450,000

B. Gross Sales P125,000,000 P115,000,000

Ratio (A divided by B) 3.00% 3.00%

Thus, in order to qualify for this condition the ratio for 2003 should not be less

than the ratio for 2002.

5

However, for individual taxpayers engaged in business or are considered as mixed

income earners who reported a net loss for tax year 2002 to be considered in the

centennial award selection process as a Centennial Taxpayer, said taxpayer must

fulfill, in the minimum, the fourth and the fifth conditions mentioned above and all

the following conditions:

1. Made an actual income tax payment for taxable year 2003 with growth rate

equal to or greater than twenty five percent (25%) of the amount equivalent to

Minimum Corporate Income Tax (MCIT) said taxpayer would have paid in

taxable year 2002 had he been a corporation, i.e., two percent (2%) of Gross

Income.

For example:

Tax due for 2002 (Reported Net Loss) none

Gross Income 2002 P15,000,000

MCIT rate x 2%

Equivalent MCIT P 300,000

x 25%

Minimum growth requirement P 75,000

=========

Therefore, the actual income tax payment for 2003 should at least amount to

P375,000 (P300,000 + P75,000).

2. Made an actual tax payment for the 1

st

quarter 2004 with growth rate equal to

or greater than twenty five percent (25%) of the tax due of the taxpayer for the

1

st

quarter 2003.

Provided, the tax due of the taxpayer for the 1

st

quarter 2003 shall not be less

than twenty five percent (25%) of the would have been tax payment for

taxable year 2003 determined under the preceding condition (using the MCIT

formula) plus any creditable withholding tax included in computing the actual

tax payment made by the taxpayer for taxable year 2003.

For example:

A. Actual tax due for the 1

st

quarter 2003 P 95,000

========

B. Tax due using the MCIT formula

Gross Income 2003 P18,000,000

x MCIT rate x 2%

Should be MCIT P 360,000

Add: Creditable withholding taxes 2003 40,000

Total for 2003 P 400,000

x 25%

One Quarter equivalent using MCIT formula P 100,000

=========

Tax Due for 1

st

quarter 2003 (A or B whichever is higher) P 100,000

x 25%

Minimum growth requirement P 25,000

=========

Therefore, the actual income tax payment for the 1

st

quarter 2004 should at

6

least amount to P125,000 (P100,000 + P25,000).

Q8: What are to be considered as actual income tax payments for taxable year

2003 or 1

st

quarter 2004?

A8: Actual income tax payments to be considered in qualifying for the CTRP

conditions shall mean tax payments actually paid for in cash and the creditable

withholding taxes actually withheld for the period. Other than the foregoing, no other

types of payments, such as prior years excess creditable tax carried over, excess

Minimum Corporate Income Tax (MCIT) and Tax Credit Certificates / Tax Debit

Memos (TCCs/TDMs) shall be allowed.

Q9: What are to be considered as income tax due for taxable year 2002 or 1

st

quarter 2003 for purposes of applying the conditions?

A9: In general, the tax due to be used for taxable year 2002 or 1

st

quarter 2003 shall be

the aggregate of:

1. Tax due reflected per the taxpayers annual or quarterly income tax return;

2. Tax due per taxpayers availment of the VAAP, if any;

3. Paid and settled basic deficiency income tax assessment, assessed either

through a Letter of Authority or a Letter Notice covering taxable year or any

period of 2002, if any.

For example:

Tax due 2002 per ITR P100,000

Add: Additional income tax for 2002 paid per VAAP 40,000

Basic income tax for 2002 paid for LA or LN settlement 10,000

Tax Due for 2002 P150,000

=======

However, for individual taxpayers engaged in business or are considered as mixed

income earners who reported a net loss for taxable year 2002, the tax due would be

as follows:

The tax due for taxable year 2002 shall be:

Minimum Corporate Income Tax (MCIT) said taxpayer would have paid in

taxable year 2002 had he been a corporation, i.e., two percent (2%) of Gross

Income for taxable year 2002.

In computing for the Gross Income for taxable year 2002, it shall include all

adjustments affecting gross income as declared by the taxpayer in the

availment of the VAAP, if any; as well as adjustments affecting gross income

resulting to any payment of deficiency income taxes assessed either through a

Letter of Authority or Letter Notice.

7

For example:

Gross Income 2002 P5,000,000

Add: Adjustments (VAAP or LA or LN) 500,000

Adjusted Gross Income P5,500,000

x 2%

Tax due for 2002 using the MCIT Formula P 110,000

========

The tax due for 1

st

quarter 2003 shall be:

The tax due of the taxpayer for the 1

st

quarter of 2003, which should not be

less than twenty five percent (25%) of the would have been tax payment for

taxable year 2003 determined under the preceding condition (using the MCIT

formula) plus any creditable withholding tax included in computing the actual

tax payment made by the taxpayer for taxable year 2003.

For example:

A. Tax due per ITR for the 1

st

quarter 2003 P 40,000

Add: Adjustments (VAAP, LA or LN) 8,000

Tax due adjusted P 48,000

========

B. Tax due using the MCIT formula

Gross Income 2003 P8,000,000

x MCIT rate x 2%

Should be MCIT P 160,000

Add: Creditable withholding taxes 2003 40,000

Total for 2003 P 200,000

x 25%

One Quarter equivalent using MCIT formula P 50,000

========

Tax Due for 1

st

quarter 2003 (A or B whichever is higher) P 50,000

========

Q10: What is a Centennial Voluntary Payment?

A10: A centennial award aspirant whose correct/accurate income tax payments will

result in the shortfall or gap in the growth rates and ratios required as a condition to

be eligible centennial taxpayer may opt to make up for the shortfall or gap by making

a voluntary additional payment. Said additional voluntary payment shall be referred

to as the Centennial Voluntary Payment.

For this purpose, the centennial award aspirant should accomplish a Centennial

Voluntary Payment Form (BIR Form 0605-100). The centennial voluntary payment

for income taxes when added to the correct income tax payment must provide the

growth rates and income tax payment to gross sales/receipts ratio required.

8

Q11: Until when is the Centennial Taxpayers Recognition Program open?

A11: All corporate and individual business income earner shall have until May 30, 2004

to vie for the Centennial Taxpayers Recognition Award.

Submission of duly accomplished and completed CTRP Participation Form and

payment of the CTRP voluntary payment using the CTRP Voluntary Payment Form

should be made on or before May 30, 2004.

Q12: Where should I file and pay the CTRP Voluntary Payment Form? / CTRP

Participation Form?

A12: The CTRP Voluntary Payment Form (BIR Form 0605-100) should be filed and

paid with any Authorized Agent Banks (AABs) or Authorized Collection Agent

having jurisdiction over the place where the taxpayer is duly registered or having

business.

The CTRP Participation Form should be filed with the Revenue District Office

(RDO) /Large Taxpayers District Office (LTDO) / Large Taxpayers Assistance

Divisions (LTAD I or II) where the taxpayer is duly registered.

Q13: Can TCCs/TDMs or excess creditable withholding taxes be used as payments

for the CTRP Voluntary Payment?

A13: No. To qualify under the CTRP, TCCs/TDMs or excess creditable withholding

taxes may not be used as CTRP voluntary payment.

Likewise, TCCs/TDMs may not be used as part of the tax payment to be made

covering taxable year 2003, nor for the tax payments to be made for income tax

payable covering 1

st

quarter of 2004.

Q14: Can prior years excess payments/ carry over withholding taxes be made part

of the tax payments?

A14: No, to qualify under the CTRP, prior years excess payment carryover may not be

considered as part of the tax payments to be made covering taxable year 2003, 1

st

quarter 2004 or as part of the CTRP voluntary payment.

Q15: What are the necessary attachments for filing the CTRP Participation Form?

A15: The CTRP Participation Form should be filed together with the following

documents:

1. Photocopy of duly filed CTRP Voluntary Payment

2. Photocopy of Audited Financial Statements for taxable year 2003 and taxable

year 2002

9

3. Interim Financial Statements covering 4

th

quarter of 2003 and 1

st

quarter of

2004

4. Photocopy of all duly filed Quarterly and the Final Income Tax Returns

covering taxable year 2003 and taxable year 2002

a. 1702Q and 1702 for Corporations

b. 1701Q and 1701 for Individuals engaged in business

5. Photocopy of duly filed VAT or Percentage Tax returns for taxable year 2002

and taxable year 2003

Q16: I did not meet the growth rate requirement for the CTRP but I want to

participate in the program by making a voluntary payment, should I reflect the

voluntary payment on my income tax return, if not, where should the voluntary

payment be reported?

A16: No, the voluntary payment should not be reflected on the income tax return to be

filed by the taxpayer. The taxpayer should accomplish their income tax return

reflecting therein the amount of the correct/accurate income tax due/payment

representing the actual result of the business operations of the taxpayer.

Voluntary payments to meet the CTRP conditions should be made using the CTRP

Voluntary Payment Form (BIR Form 0605-100). The details of the actual amounts

voluntarily paid and actual tax payments per ITR, together with the other relevant

CTRP information shall be reported in the taxpayers CTRP Participation Form.

Q17: Should I make the voluntary payment together with the filing of my income

tax return and payment of my income taxes for taxable year 2003?

A17: The taxpayer may chose to make the voluntary payment for CTRP and pay it

together with the filing and payment of the income taxes for taxable year 2003 which

is due on or before April 15, 2004. However, such procedure is not mandatory.

The taxpayer should file the income tax returns and pay income taxes due therein

(annual or quarterly) on designated statutory deadlines. But the filing and payment of

the Centennial Voluntary Payment may be done after the income tax return has been

filed but it should be made no later than May 30, 2004.

Q18: Can the Centennial Voluntary Payment be claimed as a deduction?

A18: No. The centennial voluntary payment may not be claimed as a deductible expense

for taxation purposes. It may not be classified as Taxes or as Donation to the

Government. It is not subject to Donors Tax.

10

Q19: Can the Centennial Voluntary Payment be used as tax credit for future tax

liabilities?

A19: No. The amount paid as centennial voluntary payment may not be used as tax

credit for future tax liabilities nor may a taxpayer file a claim for refund of such

payment. When a taxpayer makes a centennial voluntary payment, he is required to

expressly waive his right to make use of such payment as a credit against future tax

liabilities as well as waive his right to claim for a refund of such payment.

Q20: Can taxpayer amend previously filed tax returns?

A20: Yes. A taxpayer may amend any previously filed tax return, however, taxpayers

should amend tax returns for purposes of making a correct/accurate return reflective

of the actual business transactions/operations of the taxpayer not just for the purpose

of complying with the conditions of the CTRP. Provided further, that no notice of

audit and investigation have yet been issued against the taxpayer covering the tax

return which is the object of an amendment.

Q21: How do we compute for the effective VAT rate?

A21: Effective VAT rate = Total Output VAT less Total Input VAT

Total Vatable Transactions

where:

Total output VAT = 10% VAT on all gross sales/receipts of a taxpayer in a given

period

Total input VAT = VAT payments made by the taxpayer on purchases of goods

and/or services from VAT Registered Taxpayers that are

directly attributable or allocated to vatable sales transaction

Total Vatable transaction = Total sales/receipts of a taxpayer which are subject to VAT

For taxpayers who have mixed transactions, i.e., vat and non-vat transactions, they

should segregate their vatable and non-vatable sales/receipts before computing for the

effective VAT rate.

Q22: A companys VAT payments are mostly paid in Bureau of Customs (Customs)

for their importations, should VAT payments Customs be included in the term

VAT Payments to derive effective VAT rate since BOC and BIR are under the

same department?

A22: VAT Payments made to Customs for taxpayers importation are not included in the

term VAT Payments in deriving the effective VAT rate. VAT Payments will

refer only to payments made to the Bureau which is the difference between the

taxpayers Output VAT and Input VAT. Rather, VAT Payments to the Customs are

properly classified as Input VAT of the taxpayer.

11

Q23: What is the rationale of the 3% effective VAT/Percentage rate?

A23: Taxpayers whose gross sales/receipts do not exceed P550,000 a year pay a

percentage tax equivalent to three percent (3%) of their gross sales/receipts.

Therefore, if small taxpayers not subject to VAT effectively pays a business tax

equivalent to three percent (3%) of their gross sales/receipts, big taxpayers should be

paying more, if not at least equal to three percent (3%).

Q24: I did not meet the effective VAT requirement for condition #5, can I make a

voluntary payment to make up for the shortfall or gap?

A24: Yes, a voluntary payment can be made to make up for the shortfall or gap in the

effective VAT rate.

Q25: Is taxpayer disqualified to join the CTRP if taxpayers business taxes for 2002

and 2003 are of different kind (e.g. VAT for 2002, Percentage Tax for 2003 or no

business tax for 2002, with business tax for 2003)?

A25: The taxpayer may still join the CTRP, provided conditions #1 to #4 are met. In

addition, the taxpayer should present a written justification/explanation why condition

#5 is not applicable to their case. Said explanation should be filed together with the

CTRP Participation Form.

Q26: I am a VAT Registered Taxpayer, I would like to join the CTRP, in fact I am

able to meet conditions #1 to #4 already, however, for condition #5 my effective

VAT rate is less than 3% or less than the effective rate for 2002, will I be

disqualified to join the CTRP?

A26: Not necessarily. For VAT Taxpayers, condition #5 of the CTRP, requires an

effective VAT rate of at least 3% for taxable year 2003. However, the Bureau

recognizes that there are certain types of industry which might have an effective VAT

rate below three percent (3%).

Taxpayers whose effective VAT rate for taxable year 2003 is equal to or greater than

their effective VAT rate for taxable year 2002, but is less than three percent (3%),

may still qualify for CTRP, as may be determined by the CTRP Participation

Committee constituted by the Commissioner. The CTRP Participation Form of said

taxpayers shall be properly identified and forwarded by the Revenue District Officer

(RDO)/Regional Director (RD) to the National Office for proper evaluation.

Taxpayers whose effective VAT rate for taxable year 2003 is less than their effective

VAT rate for taxable year 2002, but is equal to or greater than three percent (3%),

may still qualify for CTRP upon recommendation of their respective RDOs and/or

RDs, having jurisdiction over said taxpayer where the deterioration was caused by (a)

acquisitions of large amount thus, high input VAT; or (b) shift in sales mix resulting

to more non-vatable transactions. The RDO/RDs recommendation and the

12

justification in reduction of effective VAT rate together with the taxpayers CTRP

Participation Form and its attachments should be forwarded to the Commissioner,

who shall make the final determination.

Q27: Is there an assurance that a Centennial Taxpayer will be given last priority in

audit and investigation?

A27: Only those classified as Top Centennial Taxpayer will be assured with last priority

in audit and investigation. Non-Top Centennial Taxpayer will only enjoy the primary

benefits of the CTRP as mentioned above.

Q28: I am qualified as a Centennial Taxpayer, however I am not sure if I would be

one of the Top Centennial Taxpayers, what would I do to ensure myself of the

benefit of last priority in audit and investigation?

A28: Centennial Taxpayers who may not be among the Top Centennial Taxpayers will

still be accorded protection of last priority in audit and investigation for taxable year

2003 provided they make an additional voluntary payment based on the reported tax

due for taxable year 2003, as follows:

Amount Tax Due for Taxable Year 2003

P100,000.00 Up to P10,000,000

P500,000.00 Over P10,000,000 to P50,000,000

P1,000,000.00 Over P50,000,000 to P100,000,000

P5,000,000.00 Over P100,000,000 to P500,000,000

P10,000,000.00 Over P500,000,000

There additional voluntary payment will be in addition to the voluntary payment

which may be necessary to qualify as a Centennial Taxpayer. Payment will likewise

be effected by accomplishing a CTRP Voluntary Payment Form (BIR Form 0605-

100).

Q29: For corporations reporting based on a fiscal year basis, what fiscal year

accounts will be covered by the CTRP?

A29: Taxpayers with the following fiscal year for 2003 may join the CTRP:

Beginning Ending

August 1, 2002 July 31, 2003

September 1, 2002 August 31, 2003

October 1, 2002 September 30, 2003

November 1, 2002 October 31, 2003

December 1, 2002 November 30, 2003

13

Q30: Corporation A, has the following tax information, how will they apply CTRP

conditions?

Tax Information:

Year 2004 Year 2003 Year 2002

Gross Sales

1

st

qtr 45,000,000 40,000,000 39,000,000

2

nd

qtr 30,000,000 29,000,000

3

rd

qtr 45,000,000 44,000,000

4

th

qtr 55,000,000 53,000,000

Total 170,000,000 165,000,000

Actual Income Tax Payment

For year 1,725,000 1,500,000

1

st

qtr 490,000 405,000

4

th

qtr 560,000 480,000

VAT Payments for the year 6,800,000 4,950,000

A30: Based on the above-mentioned tax information, Corporation As CTRP

Participation Form will be presented as follows:

Growth

Rate

Required

Taxable

Year 2004

Taxable

Year 2003

Taxable

Year 2002

Growth

Rate

Additional

Growth

Rate

Required

to Qualify

Additional

Tax /

Voluntary

Payment

Required

1 Income Tax Payments ! 20% 1,725,000 1,500,000 15% 5% 75,000

2 4

th

Qtr Income Tax Payment ! 25% 560,000 480,000 17% 8% 40,000

3 1

st

Qtr Income Tax Payment ! 25% 490,000 405,000 21% 4% 16,250

4 Tax Payment Ratio

A Gross Sales/Receipts 170,000,000 165,000,000

B Ratio of Income Tax Payment

over Gross Sales or Receipts

1.01% .909%

C 1

st

Qtr Gross Sales/Receipts 45,000,000 40,000,000

D Ratio of 1

st

Qtr Income Tax

Payment over 1

st

Qtr Gross Sales

or Receipts

1.088% 1.0125%

5 VAT/Percentage Tax Ratio

A VAT/Percentage Tax Payment 6,800,000 4,950,000

B Ratio of VAT/Percentage Tax

Payment over Gross

Sales/Receipts

3% or

same rate

as previous

year

whichever

is higher

4% 3%

CTRP Voluntary Payment 131,250

Add: Additional Voluntary Payment for last priority audit and investigation -

Total CTRP Voluntary Payment 131,250

The CTRP Voluntary Payment should be made by accomplishing BIR Form 0605-100 to be filed and

paid with any Authorized Agent Bank (AAB) or Authorized Collection Agent having jurisdiction

where Company A is registered as taxpayer.

The Participation Form together with all the necessary attachments including a copy of the CTRP

Voluntary Payment (0605-100) should be filed with the RDO where Company A is registered no later

than May 30, 2004.

14

Q31: Where can we ask more information regarding the CTRP?

A31: For questions and inquiries regarding the CTRP, you may call the BIR Call Center

at telephone no. 981-8888 or visit our website at www.bir.gov.ph.

Please be guided accordingly.

(Original Signed)

GUILLERMO L. PARAYNO, JR.

Commissioner of Internal Revenue

You might also like

- RR 12-2007 PDFDocument7 pagesRR 12-2007 PDFnaldsdomingoNo ratings yet

- Payroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverDocument2 pagesPayroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverJuline CisnerosNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Taxation Mid TermDocument6 pagesTaxation Mid TermMuhammad AlfarrabieNo ratings yet

- 5.0 Intro To Income TaxDocument31 pages5.0 Intro To Income TaxAllan BacudioNo ratings yet

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- Module 2 - Part 2Document6 pagesModule 2 - Part 2trixie maeNo ratings yet

- Accounting Standard - 22 PPT PresentationDocument25 pagesAccounting Standard - 22 PPT PresentationHimanshu Agrawal0% (1)

- Vat Advisor ExamDocument79 pagesVat Advisor ExamMoin UddinNo ratings yet

- Annual Income Information Form For General Professional PartnershipsDocument2 pagesAnnual Income Information Form For General Professional PartnershipsAlvin Dela CruzNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Value Added Taxes Part 2Document15 pagesValue Added Taxes Part 2Deo CoronaNo ratings yet

- Chapter 9 Percentage TaxDocument25 pagesChapter 9 Percentage TaxTrisha Mae BoholNo ratings yet

- Bangladesh Tax Handbook 2008-2009 PDFDocument53 pagesBangladesh Tax Handbook 2008-2009 PDFNur Md Al HossainNo ratings yet

- 3.2 Business Profit TaxDocument49 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- Filing Tax ReturnsDocument10 pagesFiling Tax ReturnsSamNo ratings yet

- Accounting Standards For Deferred TaxDocument17 pagesAccounting Standards For Deferred TaxRishi AgnihotriNo ratings yet

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- Tax Sample ComputationDocument10 pagesTax Sample ComputationEryka Jo MonatoNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument1 pageRepublic of The Philippines Department of Finance Bureau of Internal Revenueapi-247793055No ratings yet

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- Personal (Or Individual) Income Tax: 1) Domain of ApplicationDocument30 pagesPersonal (Or Individual) Income Tax: 1) Domain of ApplicationChe OmarNo ratings yet

- BIR Form NoDocument26 pagesBIR Form NomikeeNo ratings yet

- Proposal BaDocument17 pagesProposal BaDùķe HPNo ratings yet

- Eagle Localization MexicanRequirementsDocument36 pagesEagle Localization MexicanRequirementsAgnaldo GomesNo ratings yet

- Accounting For Taxes On IncomeDocument25 pagesAccounting For Taxes On IncomeSUMANSHU_PATELNo ratings yet

- Guide For Value Added Tax Via EFiling - External GuideDocument39 pagesGuide For Value Added Tax Via EFiling - External GuidemusvibaNo ratings yet

- 16thFeb2019EIA Skill DetailsDocument19 pages16thFeb2019EIA Skill Detailssubitha samyNo ratings yet

- RR 12-2007Document6 pagesRR 12-2007Irish BalabaNo ratings yet

- CHAPTER 14 Regular Income Tax IndividualDocument28 pagesCHAPTER 14 Regular Income Tax IndividualAvada Kedavra100% (1)

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- Briefing MADE EASY-LUCILLEDocument51 pagesBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNo ratings yet

- Optional Standard DeductionDocument3 pagesOptional Standard Deductionopep77No ratings yet

- Finance Bill, 2002 Provisions Relating To Direct TaxesDocument17 pagesFinance Bill, 2002 Provisions Relating To Direct Taxesgbiyer1234No ratings yet

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyDocument5 pagesTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Income Tax CircularDocument67 pagesIncome Tax CirculartaxscribdNo ratings yet

- Deferred TaxationDocument20 pagesDeferred TaxationayyazmNo ratings yet

- VAT ReturnsDocument39 pagesVAT ReturnsTaha AhmedNo ratings yet

- VAT Other Aspects - January 2024Document5 pagesVAT Other Aspects - January 2024Charisma CharlesNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- Tax Sample ComputationDocument9 pagesTax Sample ComputationErykaNo ratings yet

- How To Compute Quarterly Income Tax ReturnDocument44 pagesHow To Compute Quarterly Income Tax ReturnMia Torres100% (1)

- White Paper: Ministry of Finance, Trade and Economic PlanningDocument16 pagesWhite Paper: Ministry of Finance, Trade and Economic PlanningBonar StepanusNo ratings yet

- Value-Added Tax: DescriptionDocument26 pagesValue-Added Tax: DescriptionGIGI BODONo ratings yet

- 3.2 Business Profit TaxDocument53 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Scope of Progressive TaxDocument3 pagesScope of Progressive TaxGeriel FajardoNo ratings yet

- BIR 1702Q FormDocument3 pagesBIR 1702Q FormyellahfellahNo ratings yet

- Tax Reform For Acceleration and Inclusion LawDocument28 pagesTax Reform For Acceleration and Inclusion LawGloriosa SzeNo ratings yet

- Ryhuqphqwri, QGLD 0Lqlvwu/Ri) LQDQFH 'Hsduwphqwri5Hyhqxh &Hqwudo%Rdugri'Luhfw7D (HVDocument24 pagesRyhuqphqwri, QGLD 0Lqlvwu/Ri) LQDQFH 'Hsduwphqwri5Hyhqxh &Hqwudo%Rdugri'Luhfw7D (HVNiraj JainNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Circular Letter: Republic of The PhilippinesDocument2 pagesCircular Letter: Republic of The Philippinesapi-247793055No ratings yet

- 43 2004Document2 pages43 2004api-247793055No ratings yet

- 40-2004 BmbeDocument1 page40-2004 Bmbeapi-247793055No ratings yet

- Bureau of Internal Revenue: N-5 RBVDocument1 pageBureau of Internal Revenue: N-5 RBVapi-247793055No ratings yet

- 39-2004 Local Water DistrictsDocument2 pages39-2004 Local Water Districtsapi-247793055No ratings yet

- Revenue Memorandum Circular No. 17-2011Document3 pagesRevenue Memorandum Circular No. 17-2011Orlando O. CalundanNo ratings yet

- Revenue Memorandum Circular No.: Bureau of Internal RevenueDocument2 pagesRevenue Memorandum Circular No.: Bureau of Internal Revenueapi-247793055No ratings yet

- RikksDocument1 pageRikksapi-247793055No ratings yet

- 37-2004 Vat of PawnshopsDocument2 pages37-2004 Vat of Pawnshopsapi-247793055No ratings yet

- 33-2004 Jewelry Industry Development ActDocument18 pages33-2004 Jewelry Industry Development Actapi-247793055No ratings yet

- rikksDocument1 pagerikksapi-247793055No ratings yet

- Revenue Memorandum Circular No. 17-2011Document3 pagesRevenue Memorandum Circular No. 17-2011Orlando O. CalundanNo ratings yet

- Bureau of Internal Revenue: Revenue vs. Michel J. Lhuillier Pawnshop, Inc. (G.R. No. 150947), Declared RevenueDocument1 pageBureau of Internal Revenue: Revenue vs. Michel J. Lhuillier Pawnshop, Inc. (G.R. No. 150947), Declared Revenueapi-247793055No ratings yet

- Bureau of Internal RevenueDocument1 pageBureau of Internal Revenueapi-247793055No ratings yet

- 22 2004Document2 pages22 2004api-247793055No ratings yet

- Bureau of Internal RevenueDocument1 pageBureau of Internal Revenueapi-247793055No ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument1 pageBureau of Internal Revenue: Republic of The Philippines Department of Financeapi-247793055No ratings yet

- Bureau of Internal Revenue: EducationalDocument2 pagesBureau of Internal Revenue: Educationalapi-247793055No ratings yet

- 26 2004Document4 pages26 2004api-247793055No ratings yet

- Revenue Memorandum Circular No. 17-2011Document3 pagesRevenue Memorandum Circular No. 17-2011Orlando O. CalundanNo ratings yet

- Bureau of Internal RevenueDocument1 pageBureau of Internal Revenueapi-247793055No ratings yet

- Revenue Memorandum Circular No. 17-2011Document3 pagesRevenue Memorandum Circular No. 17-2011Orlando O. CalundanNo ratings yet

- 23 2004Document2 pages23 2004api-247793055No ratings yet

- Bureau of Internal Revenue: Shall No Longer Be Assessed Nor Be Collected"Document2 pagesBureau of Internal Revenue: Shall No Longer Be Assessed Nor Be Collected"api-247793055No ratings yet

- rikksDocument1 pagerikksapi-247793055No ratings yet

- Bureau of Internal RevenueDocument1 pageBureau of Internal Revenueapi-247793055No ratings yet

- SubjectDocument2 pagesSubjectapi-247793055No ratings yet

- 10-2004 Gross Receipts TaxDocument3 pages10-2004 Gross Receipts Taxapi-247793055No ratings yet

- 15 2004Document2 pages15 2004api-247793055No ratings yet

- Construction Contract Administration by Goldfayl, GregDocument289 pagesConstruction Contract Administration by Goldfayl, GregrezadNo ratings yet

- Quotation Form MTO171110-2 15006 R Square CSC 02-710-1607 Batangas 02-857-2728Document1 pageQuotation Form MTO171110-2 15006 R Square CSC 02-710-1607 Batangas 02-857-2728Bhegz EscalonaNo ratings yet

- Automotive Resource Guide PDFDocument233 pagesAutomotive Resource Guide PDFAndrei ItemNo ratings yet

- LMIDOCOrdrsp Orders 05Document25 pagesLMIDOCOrdrsp Orders 05Lydia DixonNo ratings yet

- Mushak-9.1 VAT Return On 14.JAN.2022Document8 pagesMushak-9.1 VAT Return On 14.JAN.2022Md. Abu NaserNo ratings yet

- 18ac4102-e780-4e9c-aa43-3ff28fd095a6Document4 pages18ac4102-e780-4e9c-aa43-3ff28fd095a6Kamal SadhukhanNo ratings yet

- BillDocument5 pagesBillPratap BilluNo ratings yet

- Coffee Shop Business PlanDocument30 pagesCoffee Shop Business Planashrav gurungNo ratings yet

- EMBA Corporate Partnership ProposalDocument9 pagesEMBA Corporate Partnership ProposalDarpan MehtaNo ratings yet

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, RespondentDocument8 pagesAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, RespondentJeorge VerbaNo ratings yet

- Secretary of Finance vs. Lazatin GR No. 210588Document14 pagesSecretary of Finance vs. Lazatin GR No. 210588Gwen Alistaer CanaleNo ratings yet

- CIR v. Dash Engineering Philippines, Inc. Full CaseDocument7 pagesCIR v. Dash Engineering Philippines, Inc. Full CaseLIERANo ratings yet

- Babylon Produce - 2013 3rd PlaceDocument43 pagesBabylon Produce - 2013 3rd PlacedewanibipinNo ratings yet

- The Cash Budget - A Short-Term Forecast Tool For The Financial Statements of Economic EntitiesDocument6 pagesThe Cash Budget - A Short-Term Forecast Tool For The Financial Statements of Economic EntitiesAndoNo ratings yet

- Basic Accountin (1) Q & ADocument77 pagesBasic Accountin (1) Q & AmayunadiNo ratings yet

- Delhi Metro Rail Corporation LTD: Special Conditions of ContractDocument6 pagesDelhi Metro Rail Corporation LTD: Special Conditions of ContractAnkit KumarNo ratings yet

- RMC No.100 - 2021Document1 pageRMC No.100 - 2021Jeorge VerbaNo ratings yet

- Tax Case 1 To 30Document21 pagesTax Case 1 To 30Ma RaNo ratings yet

- Confirmation of Your Hotel Reservation - Novotel Paris Gare de Lyon (France), 04 07 23 - 15 07 23 Process Number 163202190Document2 pagesConfirmation of Your Hotel Reservation - Novotel Paris Gare de Lyon (France), 04 07 23 - 15 07 23 Process Number 163202190Thangadurai SureshNo ratings yet

- Mushak-9.1 VAT Return On 19.NOV.2020 PDFDocument6 pagesMushak-9.1 VAT Return On 19.NOV.2020 PDFApexBD01No ratings yet

- de Leon Tax 2016Document79 pagesde Leon Tax 2016Ron AceNo ratings yet

- Mushak-6.3 Practise Sales InvoiceDocument6 pagesMushak-6.3 Practise Sales InvoiceArnold Roger CurryNo ratings yet

- Module 3Document13 pagesModule 3ellaNo ratings yet

- Assignment-BAC3103 Taxation 2Document2 pagesAssignment-BAC3103 Taxation 2Pui YanNo ratings yet

- SIA - Conditions of Appointment 3rd Ed 2002Document31 pagesSIA - Conditions of Appointment 3rd Ed 2002Viveka ZhengNo ratings yet

- Shriram Break Free BrochureDocument5 pagesShriram Break Free Brochurenaveen.bitsgoa8303No ratings yet

- Evaluating Tax Compliance Cost On SME Performance in VietnamDocument13 pagesEvaluating Tax Compliance Cost On SME Performance in VietnamTân Trịnh LêNo ratings yet

- Tax Amendment Boolet Final 2020-2021-CompressedDocument40 pagesTax Amendment Boolet Final 2020-2021-CompressedCaesarKamanziNo ratings yet

- Tender 2Document189 pagesTender 2pradeep3110850% (1)

- Trading Business Plan Draft PDFDocument27 pagesTrading Business Plan Draft PDFwillieNo ratings yet