Professional Documents

Culture Documents

Development Banks

Uploaded by

Joseph JenningsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Development Banks

Uploaded by

Joseph JenningsCopyright:

Available Formats

Definition of Development Banks

The definition of the term 'development banks' can be stated as follows, 1. In General sense, "Development banks are those financial institutions whose prime goal (motive is to finance the primar! (basic needs of the societ!. "uch funding results in the growth and development of social and economic sectors of the nation. #owever, needs of the societ! var! from region to region due to differences seen in its communal structure, econom! and other aspects." $. %s per Banking sub&ect (mainl! in Indian conte't , "Development banks are financial institutions established to lend (loan finance (mone! on subsidi(ed interest rate. "uch lending is sanctioned to promote and develop important sectors like agriculture, industr!, import)e'port, housing and allied activities."

Development Banks in India

Development banking was started after the *orld *ar II. It provided finance to reconstruct the buildings and industries which were destro!ed in the war. In India, development banking was started immediatel! after independence. The arrangement of development banks in India is depicted below. Development banks in India are classified into following four groups+ 1. Industrial Development Banks + It includes, for e'ample, Industrial ,inance -orporation of India (I,-I , Industrial Development .ank of India (ID.I , and "mall Industries Development .ank of India ("ID.I . $. Agricultural Development Banks + It includes, for e'ample, /ational .ank for %griculture 0 1ural Development (/%.%1D . 2. Export-Import Development Banks + It includes, for e'ample, 3'port)Import .ank of India (34I5 .ank . 6. Housing Development Banks + It includes, for e'ample, /ational #ousing .ank (/#. . Industrial ,inance -orporation of India (I,-I is the first development bank in India. It started in 1768 to provide finance to medium and large)scale industries in India.

Top 5 Major Objectives of Development Banks in India

The major o jectives of development anks in India are as follo!s" Development .anks are those financial institutions that provide funds and financial assistance to new and upcoming business enterprises. Development bank helps in %ccording to *illian Diamond, "development bank is a financial institution to promote and finance enterprises in private sector." Development banks like ID.I, "ID.I, and I,-I etc. were set up to meet long term and short term capital re9uirements of the industr!. Development banks coordinate the activities of those institutions, engaged in financing, promoting and developing industries. The! help in accelerating industrial and economic growth. The follo!ing are the o jectives of development anks"

1. Rapid Industrial growth:

Industrial sector is the d!namic sector of the Indian econom!. This sector contributes to the generation of emplo!ment and income in the countr!. ,unds are provided b! the development banks to start a new business venture, e'pansion and diversification of the business in new sector etc. These funds are utilised to achieve several ob&ectives that leads to accelerate industries and economic growth. Development banking supports the programmes of industrialisation of the countr!, b! promoting entrepreneurial activities.

2. Encouraging entrepreneurs:

Industrialisation helps in curbing economic and social problems thereb! making economies progress. 3merging entrepreneurs are encouraged to give shape to their ideas. Development bank helps those entrepreneurs b! providing funds for commencing new business. :overnment has recognised the importance of entrepreneurs in the industrial development and thus providing number of facilities and incentives to motivate them for undertaking industrial pro&ects.

3. Balanced regional development:

There has been alwa!s an issue related to regional disparities. Development bank helps in curbing these regional disparities b! providing funds to the entrepreneurs at low rate of interest if the organisation is planned in the backward areas. This would lead to the development of all areas thereb! making balanced regional development.

4. Filling gaps:

It is not possible for the commercial banks to fulfill all financial needs of all the customers. %bsence of organised capital market, absence of ade9uate facilities for financing industries arise the problem of slow development of industrialisation. "uch development banks can fulfill the credit gap. The! provide long) term funds for industries where gestation period ma! be longer.

5. elps government:

:overnment formulates financial policies with the help of development banks. The! also help in implementing these policies. ,or e'ample, /%.%1D bank is set up as an ape' development bank for e'tending support to the rural areas. It helps the government in matters relating to the rural development, offers training and research facilities for banks working in the field of rural development, and acts as a regulator for co)operative banks and 11.'s.

#unctions of Development Banks

The role or functions of development banks in India are depicted below. The nine important functions of development banks in India are as follows+ 1. $. 2. 6. <. =. >. 8. 7. To promote and develop small)scale industries (""I in India. To finance the development of the housing sector in India. To facilitate the development of large)scale industries (;"I in India. To help the development of agricultural sector and rural India. To enhance the foreign trade of India. To help to review (cure sick industrial units. To encourage the development of Indian entrepreneurs. To promote economic activities in backward regions of the countr!. To contribute in the growth of capital markets.

/ow let's discuss each important function of development banks one b! one.

$% &mall &cale Industries '&&I(

Development banks pla! an important role in the promotion and development of the small)scale sector. :overnment of India (:?I started "mall industries Development .ank of India ("ID.I to provide medium and long)term loans to "mall "cale Industries (""I units. "ID.I provides direct pro&ect finance, and e9uipment finance to ""I units. It also refinances banks and financial institutions that provide seed capital, e9uipment finance, etc., to ""I units.

)% Development of Housing &ector

Development banks provide finance for the development of the housing sector. :?I started the /ational #ousing .ank (/#. in 1788. /#. promotes the housing sector in the following wa!s+ 1. It promotes and develops housing and financial institutions. $. It refinances banks and financial institutions that provide credit to the housing sector.

*% +arge &cale Industries '+&I(

Development banks promote and develop large)scale industries (;"I . Development financial institutions like ID.I, I,-I, etc., provide medium and long)term finance to the corporate sector. The! provide merchant banking services, such as preparing pro&ect reports, doing feasibilit! studies, advising on location of a pro&ect, and so on.

,% Agriculture and -ural Development

Development banks like /ational .ank for %griculture 0 1ural Development (/%.%1D helps in the development of agriculture. /%.%1D started in 178$ to provide refinance to banks, which provide credit to the agriculture sector and also for rural development activities. It coordinates the working of all financial institutions that provide credit to agriculture and rural development. It also provides training to agricultural banks and helps to conduct agricultural research.

.% Enhance #oreign Trade

Development banks help to promote foreign trade. :overnment of India started 3'port)Import .ank of India (34I5 .ank in 178$ to provide medium and long)term loans to e'porters and importers from India. It provides ?verseas .u!ers -redit to bu! Indian capital goods. It also encourages abroad banks to provide finance to the bu!ers in their countr! to bu! capital goods from India.

/% -evie! of &ick 0nits

Development banks help to revive (cure sick)units. :overnment of India (:?I started Industrial investment .ank of India (II.I to help sick units. II.I is the main credit and reconstruction institution for revival of sick units. It facilitates moderni(ation, restructuring and diversification of sick)units b! providing credit and other services.

1% Entrepreneurship Development

5an! development banks facilitate entrepreneurship development. /%.%1D, "tate Industrial Development .anks and "tate ,inance -orporations provide training to entrepreneurs in developing leadership and business management skills. The! conduct seminars and workshops for the benefit of entrepreneurs.

2% -egional Development

Development banks facilitate rural and regional development. The! provide finance for starting companies in backward areas. The! also help the companies in pro&ect management in such less) developed areas.

3% 4ontri ution to 4apital 5arkets

Development banks contribute the growth of capital markets. The! invest in e9uit! shares and debentures of various companies listed in India. The! also invest in mutual funds and facilitate the growth of capital markets in India

You might also like

- Temenos T24 Limits: User GuideDocument91 pagesTemenos T24 Limits: User GuidePranay Sahu100% (6)

- UTI Scam: Robbery Through Other Means: What Is The UTI ?Document3 pagesUTI Scam: Robbery Through Other Means: What Is The UTI ?Joseph JenningsNo ratings yet

- Juan Ramón Rallo - Georg Friedrich Knapp Was Not A ''Chartalist''Document21 pagesJuan Ramón Rallo - Georg Friedrich Knapp Was Not A ''Chartalist''Cesar Jeanpierre Castillo Garcia100% (1)

- Financial Markets Assignment 2Document14 pagesFinancial Markets Assignment 2Robera HailuNo ratings yet

- Development Banking in IndiaDocument10 pagesDevelopment Banking in IndiaAkshay SharmaNo ratings yet

- Development Banking in IndiaDocument39 pagesDevelopment Banking in IndiaMonika RaniNo ratings yet

- Development Banks in IndiaDocument16 pagesDevelopment Banks in Indiacarolsaviapeters0% (1)

- Module 4 - ED - 14MBA26Document28 pagesModule 4 - ED - 14MBA26Uday GowdaNo ratings yet

- Development BanksDocument23 pagesDevelopment Bankskhatiwada2005No ratings yet

- Development BanksDocument24 pagesDevelopment Bankssumit_garg_93No ratings yet

- Small Industrial Development Bank of IndiaDocument32 pagesSmall Industrial Development Bank of IndiahariniariesNo ratings yet

- Banking: & Microfinace - IDocument8 pagesBanking: & Microfinace - IPayal hazraNo ratings yet

- Top 5 Major Objectives of Development Banks in IndiaDocument2 pagesTop 5 Major Objectives of Development Banks in Indiababa3673No ratings yet

- Eds 4Document69 pagesEds 4YUVRAJ SINGH TAKNo ratings yet

- Banking Law ProjectDocument10 pagesBanking Law Projectaatish babuNo ratings yet

- Indian Financial InstitutionsDocument26 pagesIndian Financial InstitutionsRimple Abhishek Delisha ViraajvirNo ratings yet

- Development BanksDocument2 pagesDevelopment BanksAnne VargheseNo ratings yet

- Commercial BankingDocument5 pagesCommercial BankingJasleen kaurNo ratings yet

- Developmental Banking Institutions Course Code: MBAD16F33B4 MBA III - Section E, ODD Semester Prof. Siju NairDocument48 pagesDevelopmental Banking Institutions Course Code: MBAD16F33B4 MBA III - Section E, ODD Semester Prof. Siju NairK C Keerthiraj gowdaNo ratings yet

- Module 3 - Development BanksDocument42 pagesModule 3 - Development BanksAnitha GirigoudruNo ratings yet

- Develop BankDocument17 pagesDevelop BankVarun SareenNo ratings yet

- Presented byDocument11 pagesPresented byVineet VermaNo ratings yet

- Role of BanksDocument14 pagesRole of BanksKaustubh ShilkarNo ratings yet

- Group PPT FinanceDocument17 pagesGroup PPT Financesarah IsharatNo ratings yet

- Development BanksDocument17 pagesDevelopment BanksVarsha RustagiNo ratings yet

- Hlearning - In: For Download Notes and Question PaperDocument7 pagesHlearning - In: For Download Notes and Question PaperPrince SinghNo ratings yet

- Chapter-6 The Role of Financial Institutions in Ssi Development-An OverviewDocument94 pagesChapter-6 The Role of Financial Institutions in Ssi Development-An OverviewVidya Hegde KavitasphurtiNo ratings yet

- Industrial Development Bank of IndiaDocument3 pagesIndustrial Development Bank of IndiaZulnun SayedNo ratings yet

- Development Financial InstitutionsDocument21 pagesDevelopment Financial Institutionsviveksharma51No ratings yet

- Praful Final9Document50 pagesPraful Final9TusharJoshiNo ratings yet

- Financial Institutions in India: Reserve Bank of IndiaDocument16 pagesFinancial Institutions in India: Reserve Bank of IndiaManganNo ratings yet

- Financial Institutions: By-Shalu MalikDocument11 pagesFinancial Institutions: By-Shalu MalikShailly GargNo ratings yet

- Development BanksDocument17 pagesDevelopment BanksAsim jawedNo ratings yet

- Institutional Finance To EntrepreneursDocument13 pagesInstitutional Finance To Entrepreneursnvijay83% (6)

- Economic Functions of BankPPTDocument23 pagesEconomic Functions of BankPPTKeith Brandon AlanaNo ratings yet

- Importance of Financial Instituitions in EntrepreneurshipDocument7 pagesImportance of Financial Instituitions in EntrepreneurshiphimanshuNo ratings yet

- Mfi 3 Unit AlreadyDocument6 pagesMfi 3 Unit AlreadySoniya Omir VijanNo ratings yet

- Economics - Sources of Institutional Finance in IndiaDocument22 pagesEconomics - Sources of Institutional Finance in IndiaLakshya DheerNo ratings yet

- Development Financial Institution of IndiaDocument11 pagesDevelopment Financial Institution of IndiaarunimaNo ratings yet

- IFS SolutionDocument7 pagesIFS SolutionGanesh OfficialNo ratings yet

- Sources of Finance: Baishalee ChakrabartiDocument31 pagesSources of Finance: Baishalee ChakrabartiMohit GargNo ratings yet

- Tertiary SectorDocument29 pagesTertiary SectorVanita SharmaNo ratings yet

- Indian Finnacial Developement Institutions. WORD FILEDocument35 pagesIndian Finnacial Developement Institutions. WORD FILEIffat ZehraNo ratings yet

- Developmental Banks in India ProjectDocument19 pagesDevelopmental Banks in India ProjectParvati BoraNo ratings yet

- Financial InstitutionsDocument3 pagesFinancial InstitutionsMuhammad Asif AyazNo ratings yet

- Capital Market InvestorsDocument12 pagesCapital Market InvestorsVidushi PuriNo ratings yet

- Banking UNIT IVDocument17 pagesBanking UNIT IVSivaNo ratings yet

- Project On Foreign BanksDocument57 pagesProject On Foreign BanksAditya SawantNo ratings yet

- Unit 2 EXIM BankDocument4 pagesUnit 2 EXIM BankDhruvi LimbadNo ratings yet

- Conclusion and RecommendationsDocument3 pagesConclusion and Recommendationsstore_2043370333% (3)

- Finance Banks Lending Investment: BelowDocument2 pagesFinance Banks Lending Investment: Belowseepi345No ratings yet

- 1 Fi D Il 1. Fixed CapitalDocument12 pages1 Fi D Il 1. Fixed CapitalNeha SumanNo ratings yet

- Icici: Broad Objectives of The ICICI AreDocument7 pagesIcici: Broad Objectives of The ICICI Aremanya jayasiNo ratings yet

- Performance of Non-Banking Financial Institutions in IndiaDocument12 pagesPerformance of Non-Banking Financial Institutions in Indianoor_fatima04No ratings yet

- Institutional AssistanceDocument37 pagesInstitutional AssistanceVarun Dabir100% (1)

- Small Industrial Development Bank of IndiaDocument21 pagesSmall Industrial Development Bank of IndiaRockyLagishettyNo ratings yet

- Development BankDocument5 pagesDevelopment BankAbhijit GogoiNo ratings yet

- Financial Market and ServicesDocument18 pagesFinancial Market and ServicesManvi SharmaNo ratings yet

- Institutional Support For New VenturesDocument6 pagesInstitutional Support For New VenturesMadhavi SadizaNo ratings yet

- Exim BankDocument79 pagesExim Banklaxmi sambre0% (1)

- Institutions Supporting EntrepreneursDocument31 pagesInstitutions Supporting EntrepreneursgirishvishNo ratings yet

- BankingDocument20 pagesBankingFinal ExaminationNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Panchayati Raj & MuncipalitiesDocument11 pagesPanchayati Raj & MuncipalitiesJoseph JenningsNo ratings yet

- Jokes and Riddles PDFDocument21 pagesJokes and Riddles PDFbigblue99No ratings yet

- Sales TerritoriesDocument19 pagesSales TerritoriesJoseph JenningsNo ratings yet

- Harshad M Mehta (Document2 pagesHarshad M Mehta (Joseph JenningsNo ratings yet

- Capital BudgetingDocument77 pagesCapital BudgetingJoseph Jennings50% (2)

- Outsourcing: Contracting United StatesDocument1 pageOutsourcing: Contracting United StatesJoseph JenningsNo ratings yet

- Differences Between Ethics, Morals and ValuesDocument2 pagesDifferences Between Ethics, Morals and ValuesJoseph JenningsNo ratings yet

- CGL Corrigendum 10102013Document1 pageCGL Corrigendum 10102013Joseph JenningsNo ratings yet

- Job EvaluationDocument7 pagesJob EvaluationJoseph JenningsNo ratings yet

- Internal Marketing Journal PDFDocument26 pagesInternal Marketing Journal PDFIndiani Putri Datik100% (1)

- 8514923A30Z0001Document1 page8514923A30Z0001shekarprabhas51No ratings yet

- Mobile Deposit TermsDocument6 pagesMobile Deposit TermsHussein El BeqaiNo ratings yet

- Case Study On Uti - GTBDocument4 pagesCase Study On Uti - GTBManmeet KaurNo ratings yet

- A Project On Garuda Fashions by Atul JainDocument51 pagesA Project On Garuda Fashions by Atul Jainatul_rockstarNo ratings yet

- Bcom Sem1 Modern BankingDocument21 pagesBcom Sem1 Modern BankingShruthi VijayanNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Sem V Tybcom Sample MCQS All Subjects PDFDocument51 pagesSem V Tybcom Sample MCQS All Subjects PDFHarshal Tamore100% (2)

- HDFC Bank Privacy PolicyDocument12 pagesHDFC Bank Privacy PolicyEshwar CenationNo ratings yet

- UAE GuideDocument130 pagesUAE Guidejacek_sawicz100% (1)

- CBM - Group 3 - Batch BDocument20 pagesCBM - Group 3 - Batch BANEESH KHANNANo ratings yet

- Interim - Statement - 03-Oct-2023 04 - 50 - 35Document22 pagesInterim - Statement - 03-Oct-2023 04 - 50 - 35wei09754No ratings yet

- The Bankruptcy of Lehman Brothers: Causes of Failure & Recommendations Going ForwardDocument20 pagesThe Bankruptcy of Lehman Brothers: Causes of Failure & Recommendations Going Forwardroohan AdeelNo ratings yet

- A Study On Problems Faced by The Customers at The Time of Mergers and Auqusition of BanksDocument32 pagesA Study On Problems Faced by The Customers at The Time of Mergers and Auqusition of Banksranjith reddy100% (1)

- Date Customer Application Form InstitutionsDocument5 pagesDate Customer Application Form InstitutionsAnaliza Kitongan LantayanNo ratings yet

- Chapter 12Document1 pageChapter 12Evelyn RiesNo ratings yet

- BNP - Development Credit Bank 08072010Document24 pagesBNP - Development Credit Bank 08072010Zeenat KerawalaNo ratings yet

- Wa0012.Document2 pagesWa0012.Anonymous FnM14a0No ratings yet

- Finance-Careers VVFDocument51 pagesFinance-Careers VVFRay FBNo ratings yet

- Problems and Prospects of Smes Loan Management: A Study On Mercantile Bank Limited, Khulna BranchDocument15 pagesProblems and Prospects of Smes Loan Management: A Study On Mercantile Bank Limited, Khulna BranchKuntal GhoshNo ratings yet

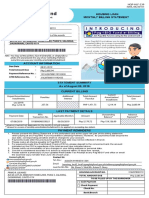

- Billingstatement - Primo R. JulianesDocument2 pagesBillingstatement - Primo R. JulianesMaria Judith Peña Julianes100% (1)

- Money and CreditDocument14 pagesMoney and CreditRajau RajputanaNo ratings yet

- Cash Requirements For A Small StartupDocument12 pagesCash Requirements For A Small StartupArturo VillaseñorNo ratings yet

- Zeal Black Book Project NewDocument86 pagesZeal Black Book Project NewAshwini PadwalNo ratings yet

- PeSukuk - PHS - 3 IN 1Document17 pagesPeSukuk - PHS - 3 IN 1hairyna37No ratings yet

- Sources of CapitalDocument3 pagesSources of CapitalALBERT AMONCIO ALONZONo ratings yet

- 2013-12-22Document2 pages2013-12-22Simbarashe MarisaNo ratings yet

- Deposit Notes Credit TransactionsDocument20 pagesDeposit Notes Credit TransactionsGino Alejandro SisonNo ratings yet