Professional Documents

Culture Documents

Wto

Uploaded by

jehana_bethCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wto

Uploaded by

jehana_bethCopyright:

Available Formats

1

WTO Agreement on Subsidies and Countervailing Measures

(Subsidy Rules and WTO Jurisprudence)

Shailja Singh Assistant Professor Centre for WTO Studies IIFT

SCM Agreement: context

Dumping

Liberalization Subsidies Flooding of products

2

Subsides

Very sensitive matter in international trade relations On one hand, subsidies evidently used by governments to pursue legitimate objective of economic and social policy. On the other hand, subsidies may have adverse effects on the interests of trading partners, whose industries may suffer from unfair competition Subsidies: can distort trade flows if they give an artificial competitive advantage to exporters or import competing industries. Example of subsidies: aid to the poor, aid for technological development, special aids for education, aid to disadvantaged groups and regions etc.

COVERAGE OF THE SCM AGREEMENT

The SCM Agreement regulates:

Subsidisation by WTO Members Use of countervailing measures

Structure of the SCM Agreement: Two Tracks

Subsidies

SCM

Countervailing measures Different rules!

5

SCM Agreement: Subsidies

Traffic light approach Subsidies are put into various baskets/categories:

i. Red (prohibited) ii. Yellow or amber (actionable) iii. Green (non-actionable)

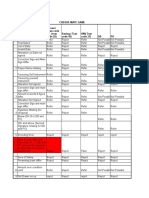

Broad Scheme of SCM Agreement

Uruguay Round Subsidies Text is extensive and detailed

Part I General Provisions (definition and specificity) Part II Prohibited subsidies (red light) Part III Actionable subsidies (yellow or amber light) Part IV Non-Actionable subsidies (green light) Part V Countervailing duty measures

Subsidy Defined

Three key elements when examining whether a programme, scheme, etc. constitutes a subsidy are:

i. Financial contribution / income or price support ii. By a Government or any public body iii. Which confers benefit

If any of the three elements is missing, then the programme, scheme, etc. is NOT a subsidy under SCM Agreement.

Coverage of the SCM Agreement

Applies to a measure that is a subsidy (article 1) - Financial contribution - Government - Benefit

9

and Specific (article 2)

10

Elements of a Subsidy

SCHEME, MEASURE, PROGRAMME, ETC. DOES IT INVOLVE A FINANCIAL CONTRIBUTION BY THE GOV'T? YES DOES IT CONFER A BENEFIT? YES IT IS A SUBSIDY NO IT IS NOT A SUBSIDY NO IT IS NOT A SUBSIDY

11

Financial Contribution

Direct transfer of funds (grants, loans, equity infusions) Potential direct transfer of funds or liabilities (loan guarantee) Government revenue, that is otherwise due if foregone or not collected (tax credits, import duty exemption) Provision of goods or services other than general infrastructure Purchase of goods

12

By a Government or any Public Body

Financial contribution granted by a Govt. (e.g. Federal, Regional or Municipal Govt.) OR by a public body (e.g. National Bank, National Power Company, etc.) Within the territory of a Member Or Government entrusts or directs a private body to make the financial contribution

13

Concept of Benefit

Benefit = advantage (to recipient), not cost to Govt:

Whether the financial contribution places the recipient in a more advantageous position than would have been the case, but for the financial contribution

Basis for comparison = Market place:

Is the financial contribution provided on terms which are more advantageous than those that would have been available to the recipient on the market

14

Concept of Benefit (Contd.)

Govt. equity infusions do not confer a benefit unless: the investment decision can be regarded as inconsistent with the usual investment practice (including risk capital) of private investors in the territory of that Member Govt. loans do not confer a benefit unless: there is a difference between the amount that the firm receiving the loan pays on the Govt. loan and the amount the firm would pay on a comparable commercial loan which the firm could actually obtain on the market.

15

Concept of Benefit (Contd.)

Govt. loan guarantees do not confer a benefit unless: there is a difference between the amount the firm receiving the guarantee pays on a loan guaranteed by the Govt. and the amount the firm would pay on comparable commercial loan absent the Govt. guarantee. Govt. provision of goods or services does not confer a benefit unless for less than adequate remuneration based on prevailing market conditions

16

Concept of Benefit (Contd.)

Govt. purchase of goods does not confer a benefit unless: for more than adequate remuneration based on prevailing market conditions.

17

Footnote 1 Important Exemption

Exemption of an exported product From duties or taxes borne by a like product destined for domestic consumption Not deemed a subsidy

18

Types of Specificity

Enterprise specific Industry specific Group of enterprises or industries Region specific Prohibited subsidies are deemed to be specific Setting or change of generally applicable tax rates by all levels of govts. entitled to do so are not specific subsidy

19

Types of Specificity (Contd.)

Specificity will not exist where granting authority or legislation concerned establishes objective criteria or conditions for extending the subsidy- these criteria should be neutral, economic in nature and horizontal in application

i. ii.

Two broad categories:

De-jure specific subsidies De-facto specific subsidies

20

Specific Subsidies de-jure

A subsidy is de-jure specific if

Access to the subsidy explicitly limited to certain enterprises. If access is limited based on objective criteria then it would not be a specific subsidy

To be determined with reference jurisdiction of the granting authority

to

the

21

De-facto Specificity (Art. 2.1(c))

Notwithstanding any appearance of nonspecificity, the subsidy may in fact be specific. Following factors may be considered:

Use by a limited number of enterprises Predominant use by certain enterprises Granting of disproportionately large amounts to certain enterprises Manner in which discretion has been exercised

22

Specificity : Implications

For Members as providers of subsidies: Specific subsidies are subject to the rules/disciplines under Article 4 and 7 of the SCM Agreement, in case of prohibited and actionable subsidies, respectively (under the MULTILATERAL TRACK); and can be countervailed (Part V) (under the NATIONAL TRACK) Must notify specific subsidies to the SCM Committee For Members affected by others subsidies: Can challenge (MULTILATERAL TRACK) or countervail (NATIONAL TRACK) other Members specific subsidies

23

Subsidies Categorization: Recap

i. Prohibited Subsidy ii. Actionable Subsidy iii. Non-actionable Subsidy

24

Subsidy Types: Prohibited Subsidy

Certain subsidies are regarded as outright trade distortive hence prohibited These are:

i. Export subsidies subsidies that are contingent on export performance , except as provided in the Agreement on Agriculture ii. Import substitution subsidies contingent on use of domestic over imported goods

25

Export Subsidy

Subsidies contingent, in law or in fact, whether wholly or as one of several other conditions, upon export performance are called export subsidies Examples (set out in Annex-I):

provision of goods or services for use in the production of exported goods in terms more favorable than those for the production of goods for domestic consumption; export related exemption, remission or deferral of direct taxes; excess exemption, remission, or deferral of indirect taxes or import duties; provision of export credit guarantee or insurance programmes at premium rates which are inadequate to cover the operating costs and losses of the programmes

26

Exemption or remission of indirect taxes on export productsFootnote 1

Export Subsidy: Permissible Duty Exemptions

Remission, Exemption & Deferral (RED) of prior stage cumulative indirect taxes on inputs used in production of the exported product provided this does not exceed corresponding RED on inputs used in the production of domestically sold like products item (h), Annex I RED on prior stage cumulative indirect taxes on inputs consumed in production of the exported product. To be interpreted in accordance with guidelines in Annex II item (h), Annex I Remission or drawback of import charges on imported inputs consumed in the production of the exported product. Substitution drawback schemes are permitted in accordance with guidelines in Annex III item (h), Annex I

27

Conditions for RED of Cumulative Indirect Taxes

Inputs must have been consumed in the production process

Physically incorporated inputs Energy, fuel, oil and catalysts

There must be a reasonable and effective verification system in place to confirm which inputs are consumed and in what amounts.

28

Remedy against Prohibited Subsidy

Remedy through DSU It can be challenged in WTO on the basis of special accelerated procedures Complaining Member not obliged to show trade effects as these are regarded as trade distorting subsidies Defaulting member required to withdraw the subsidy without delay or face counter measures

29

Special and Differential Provisions

No derogation for import substitution subsidies except for fixed transition periods which is already over For Annex VII countries i.e. LDCs and 21 listed developing countries whose GNP per capita is below $1000 per annum, prohibition on export subsidies not applicable - India one of them (others include Bolivia, Egypt, Indonesia, Kenya, Nigeria, Pakistan, Philippines, Sri Lanka etc.) Other developing countries to phase out export subsidy in a 8 year period

30

Export Competitiveness

Articles 27.5 and 27.6 If an Annex VII developing countrys export of a specific product has reached export competitiveness i.e. - A share of at least 3.25% in world trade (of that product) - For two consecutive years That Annex VII developing country must phase out its export subsidies for such products over a period of 8 years

31

Subsidy Types: Actionable Subsidy

Subsidy is actionable if:

It is specific Causes adverse effects (injury, serious prejudice, nullification and impairment)

32

Adverse Effects - examples

Serious prejudice effect of subsidy is:

Imports displaces or impeded in the market of the subsidizing member Exports displaces or impeded in third country market Significant price undertaking, price suppression, price depression or lost sales of another member Increase in world market share of the subsidizing country

Serious prejudice claim cannot be invoked against developing country Members

33

Serious Prejudice

Serious Prejudice deemed to exist (Art 6.1) where: i. Total ad valorem subsidization of a product exceeds 5%; ii. Subsidies cover operating losses sustained by an industry; iii. Subsidies to cover operating losses sustained by an enterprise exception: one-time measures which are non-recurrent and given to develop long term solutions and to avoid acute social problem; iv. Direct forgivenenss of debt These provisions lapsed in 1999

34

Nullification or Impairment

This arises where the improved access to a market that is presumed to flow from a bound tariff reduction is undercut by subsidization in that market This can serve as a basis for a complaint related to harm to a Members exporting interests in an importing country market

35

Types of Injury

There are three types of injury: i. Current material injury; ii. Threat of material injury; iii. Material retardation of the establishment of a domestic industry

36

Current Material Injury

Its determination is to be based on positive evidence There should be objective examination of both the volume of subsidized imports and the effect of these imports on prices in the domestic market for like product Consequent impact of such imports on the domestic producers of such products

37

Threat of Material Injury

It must be based on facts and not merely on possibility Factors to be considered are :

Nature of subsidy and trade effects likely to arise therefrom; Significant increase of subsidized imports; Sufficient freely disposable capacity or An imminent substantial increase in capacity of the exporter, indicating likelihood of substantially increased subsidized exports

38

Material Retardation of the Establishment of a Domestic Industry

The agreement is silent regarding criteria for evaluation of material retardation of the establishment of a domestic industry

39

Actionable Subsidy - Remedy

Action and DSU panel process in all cases and through countervailing duty investigation for imports:

Serious prejudice and nullification or impairment can be challenged at the multilateral level only

Remedy:

Removal of adverse effects of the subsidy or Withdrawal of subsidy or Imposition of countervailing duty on imports

40

Subsidy Type: Non-actionable Subsidy

No action can be taken against subsidies that are nonspecific determined on the basis of:

Criteria are neutral, economic in nature and horizontal in application No predominant use by certain enterprises Eligibility based on objective criteria or conditions Eligibility automatic, criteria strictly adhered to

Up to 1999 a specific subsidy given for R&D assistance, to disadvantaged regions and for environmental purposes were non-actionable. Now lapsed

41

Remedies

Subsidy that causes injury can be challenged at two levels:

i. Unilateral level through countervailing action; ii. Multilateral level through the WTOs Dispute Settlement Mechanism

Countervailing action can be taken only where there is injury Serious prejudice and nullification or impairment can be challenged at the multilateral level only

42

Countervailing Measures

SCM Agreement contains detailed rules regarding initiation and conduct of investigations, imposition of preliminary and final measures and the duration of measures These rules are meant to ensure that investigations are conducted in a transparent manner, all parties have full opportunity to defend their interests, and investigating authorities explain the basis of their determination Most of procedural rules are similar to those applied for Anti-Dumping Agreement

43

Special & Differential Treatment

De minimis - if overall subsidy level by a DC does not exceed 2% of the value of the product, countervailing investigation to be terminated immediately De minimis of 3% for Annex VII Members and DCs which have eliminated their export subsidies before the end of the 8-year transition period For other Members, De mimimis level is 1%

44

Special & Differential Treatment (contd.)

If volume of subsidized imports from a DC is less than 4% of the total imports of the like product in the importing Member, countervailing investigation has to be terminated The cut-off percentage is 9% where collective imports from more than one DC is under investigation and share of each DC is less than 4%

45

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Org ChartDocument1 pageOrg Chartjehana_bethNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 97 Language PolicyDocument23 pages97 Language Policyrah98No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Child Nutrition and WIC Reauthorization Act of 2004: Section 204 of Public Law 108-265-June 30, 2004Document2 pagesChild Nutrition and WIC Reauthorization Act of 2004: Section 204 of Public Law 108-265-June 30, 2004jehana_bethNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Child Nutrition Fact Sheet 12-10-10Document2 pagesChild Nutrition Fact Sheet 12-10-10Patricia DillonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Regression Diagnostics in MinitabDocument2 pagesRegression Diagnostics in Minitabjehana_bethNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Recruiting PoliciesDocument5 pagesRecruiting Policiesjehana_bethNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- What Is The Child Nutrition and WIC Reauthorization Act?Document2 pagesWhat Is The Child Nutrition and WIC Reauthorization Act?jehana_bethNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Minitab Instructions ANOVADocument3 pagesMinitab Instructions ANOVADavid MartinezNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- INSEAD MBA ElectiveCoursesDocument19 pagesINSEAD MBA ElectiveCoursesVictor IkeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Insead Faq 001Document19 pagesInsead Faq 001jehana_bethNo ratings yet

- Economist Case Writeup - InseadDocument14 pagesEconomist Case Writeup - Inseadjehana_bethNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Etheryl Working With INSEADDocument2 pagesEtheryl Working With INSEADjehana_bethNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Omb@insead EduDocument9 pagesOmb@insead Edujehana_bethNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Global Mba Ranking 2014Document1 pageGlobal Mba Ranking 2014Chakradhar DNo ratings yet

- Regression 14ChDocument10 pagesRegression 14ChFahad MushtaqNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Minitab Chi-Squared PDFDocument4 pagesMinitab Chi-Squared PDFParatchana JanNo ratings yet

- Onculer ManagingrisksDocument5 pagesOnculer Managingrisksjehana_bethNo ratings yet

- Singapore:, World Class MBA in TheDocument1 pageSingapore:, World Class MBA in Thejehana_bethNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Women and The INSEAD MBADocument1 pageWomen and The INSEAD MBAjehana_bethNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Computing Binomial Probabilities With MinitabDocument6 pagesComputing Binomial Probabilities With Minitabjehana_bethNo ratings yet

- Minitab Instructions ANOVADocument3 pagesMinitab Instructions ANOVADavid MartinezNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Math 113 - Minitab ProjectsDocument15 pagesMath 113 - Minitab Projectsjehana_bethNo ratings yet

- MT DescriptiveStatisticsDocument8 pagesMT DescriptiveStatisticsjehana_bethNo ratings yet

- Regression Diagnostics in MinitabDocument2 pagesRegression Diagnostics in Minitabjehana_bethNo ratings yet

- Teaching/UNVA/Econ 510 F09/Ch09Document23 pagesTeaching/UNVA/Econ 510 F09/Ch09jehana_bethNo ratings yet

- Ma SimpleDocument10 pagesMa Simplejehana_bethNo ratings yet

- Istanbul Bilgi University: Introduction To MicroeconomicsDocument22 pagesIstanbul Bilgi University: Introduction To Microeconomicsjehana_bethNo ratings yet

- Zero To Three - 30 To 36 MonthsDocument2 pagesZero To Three - 30 To 36 MonthsvmeederNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Elasticity and Its ApplicationDocument14 pagesElasticity and Its Applicationjehana_bethNo ratings yet

- Elasticity and Its Application: Chapter OutlineDocument6 pagesElasticity and Its Application: Chapter Outlinejehana_bethNo ratings yet

- Time Value of MoneyDocument24 pagesTime Value of MoneyNitin R GondNo ratings yet

- Service Quality Analysis in Banking SectorDocument48 pagesService Quality Analysis in Banking SectorVarun GangaNo ratings yet

- Nevada Sagebrush Archives 02/19/08Document20 pagesNevada Sagebrush Archives 02/19/08The Nevada SagebrushNo ratings yet

- Fair Debt Collection ICLEDocument24 pagesFair Debt Collection ICLEPWOODSLAWNo ratings yet

- Merchant Banking in IndiaDocument14 pagesMerchant Banking in IndiaMohitraheja007No ratings yet

- Project Profile-Gerbera Cultivation: Prepared byDocument15 pagesProject Profile-Gerbera Cultivation: Prepared byqazi bilal rasheedNo ratings yet

- Types of Negotiable InstrumentDocument3 pagesTypes of Negotiable Instrumentanon_919197283No ratings yet

- Cheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Document1 pageCheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Nandini JaganNo ratings yet

- Travel Per Diem Claim Form YPADocument2 pagesTravel Per Diem Claim Form YPAAadilIftikharNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hargeisa Somaliland Guleid Hassan 063-6035652Document4 pagesHargeisa Somaliland Guleid Hassan 063-6035652Eng-Mukhtaar CatooshNo ratings yet

- Huaneng Power International Case FinalDocument23 pagesHuaneng Power International Case FinalEduardo Munoz100% (1)

- Businessfinance12 q3 Mod1.2 Introduction To Financial ManagementDocument23 pagesBusinessfinance12 q3 Mod1.2 Introduction To Financial ManagementAsset Dy100% (2)

- Modelo de Docs Internacionais - LC-SBLC-BGDocument19 pagesModelo de Docs Internacionais - LC-SBLC-BGMario AndradeNo ratings yet

- FF7A Cash PositionDocument9 pagesFF7A Cash PositionloanltkNo ratings yet

- Cross Currency RiskDocument21 pagesCross Currency RiskManish AnandNo ratings yet

- Cases Credit TransDocument19 pagesCases Credit TransLex AmarieNo ratings yet

- Kase StatWare V 9.8.1 ManualDocument62 pagesKase StatWare V 9.8.1 ManualsekawareNo ratings yet

- Ch14 - 2015Document86 pagesCh14 - 2015lawrence hNo ratings yet

- Fiestan Vs Court of AppealsDocument2 pagesFiestan Vs Court of Appeals'mhariie-mhAriie TOotNo ratings yet

- Dudh Sagar Dairy of Financial ReportDocument83 pagesDudh Sagar Dairy of Financial ReportPatel Kashyap100% (2)

- Prelims 2018 Paper 1 SolDocument94 pagesPrelims 2018 Paper 1 Solmakkala shireeshaNo ratings yet

- HB o BR Wire-App0914Document2 pagesHB o BR Wire-App0914Anonymous HH3c17osNo ratings yet

- Barakaeli S. MassangwaDocument58 pagesBarakaeli S. MassangwaMohamed MlawaNo ratings yet

- Pakistan Money MarketDocument2 pagesPakistan Money MarketOvais AdenwallaNo ratings yet

- 163 CIR v. MarubeniDocument4 pages163 CIR v. MarubeniJustin ParasNo ratings yet

- Project ReportDocument2 pagesProject ReportTeja PalankiNo ratings yet

- Rapid Response To Internet Leads Drives ConversionDocument3 pagesRapid Response To Internet Leads Drives Conversionapi-26000027No ratings yet

- JCI World CongressDocument1 pageJCI World CongressJCINo ratings yet

- Mahr (Dower) Under Muslim LawDocument8 pagesMahr (Dower) Under Muslim LawJoseph NielsenNo ratings yet

- Petroleum Development Oman LLC Contract Number C311333 Amal Heat Recovery Steam Generator (HRSG) - 1 Project T2, Instructions To TenderersDocument9 pagesPetroleum Development Oman LLC Contract Number C311333 Amal Heat Recovery Steam Generator (HRSG) - 1 Project T2, Instructions To TenderersNadim JilaniNo ratings yet