Professional Documents

Culture Documents

58 Download Annual Result 12

Uploaded by

karandeep19854645Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

58 Download Annual Result 12

Uploaded by

karandeep19854645Copyright:

Available Formats

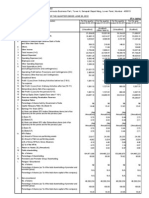

SEGMENT WISE REVENUE, RESULTS AND CAPITAL EMPLOYED

( ` in Lakhs)

PARTICULARS

A Total Solutions Consultancy and EPC Company

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31st MARCH, 2013

AUDITED RESULTS

AUDITED CONSOLIDATED RESULTS

FOR THREE MONTHS ENDED

31-Mar-13 31-Dec-12 31-Mar-12

0

0

0

30265.08 28955.00

32110.06

90420.83

21082.20 31521.91

51347.28 60476.91 122530.89

FOR THE YEAR ENDED

31-Mar-13 31-Mar-12

0

0

123423.53 120731.11

127173.17 249151.32

250596.70 369882.43

FOR THE YEAR ENDED

31-Mar-13 31-Mar-12

0

0

125730.73 123192.24

127173.17 249151.32

252903.90 372343.56

13358.23

1517.28

14875.51

427.75

(12.28)

1237.11

1652.58

10525.14

23748.07

223754.64

12017.32

2409.40

14426.72

0.00

0.00

1557.63

1557.63

6692.85

19561.94

229191.51

13023.38

6821.51

19844.89

(7.23)

116.02

3086.63

3195.42

9201.07

25850.54

188404.51

52704.81

11047.67

63752.48

427.75

0.18

5873.02

6300.95

31642.17

89093.70

223754.64

51090.88

24521.08

75611.96

191.57

116.02

7045.58

7353.17

23217.74

91476.53

184404.51

53543.88

11047.67

64591.55

447.37

0.28

5976.36

6424.01

31679.07

89846.61

229523.61

52495.68

24521.08

77016.76

191.83

116.02

7221.31

7529.16

23224.06

92711.66

189877.73

*Fixed assets used in the company's business or liabilities contracted have not been identified to any of the reportable segments, as the fixed assets and support services

are used interchangeably between segments. Accordingly, no disclosure relating to total segment assets and liabilities has been made.

( ` in Lakhs)

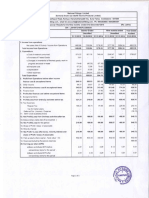

AUDITED RESULTS

SL.

NO.

PARTICULARS

UNAUDITED RESULTS

(1)

(2)

FOR THREE MONTHS ENDED

31-Mar-13 31-Dec-12 31-Mar-12

(3)

(4)

(5)

Income from operations

a) Net Sales/ Income From Operations

b) Other Operating Income

Total income from operations (net)

2. Expenses

a) Cost of materials consumed

b) Purchases of stock-in-trade

c) Changes in inventories of finished goods, work-in-progress

and stock-in-trade

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Other expenses

I) Sub-Contract payment

II) Construction material

III) Other expenses

Total expenses

3. Profit from Operations before Other Income, finance

costs & Exceptional items (1-2)

4. Other Income

Profit

from ordinary activities before finance cost &

5.

Exceptional Items (3+4)

6. Finance costs

7. Profit from ordinary activities after finance cost but

before Exceptional Items (5-6)

8. Exceptional items

9. Profit from Ordinary Activities before tax (7-8)

10.a Provision for Taxation

10.b Short/ (Excess) Provision for earlier years

10.c Provision for Deferred Tax Liability/(Asset) including

earlier years adjustment

11. Net Profit from Ordinary Activities after tax (9-10)

12. Extraordinary Items (net of tax expense)

13. Net Profit for the period (11-12)

14. Share of Profit/ (loss) of associates

15. Minority Interest

16. Net Profit after taxes, minority interest & share of profit/(loss)

of associates (13+14+15)

17. Paid-up equity share capital ( Face Value of ` 5/-)

18. Reserves excluding Revaluation Reserves

19. Earning Per Share (EPS)

i) Basic & diluted EPS before Extraordinary items in `

ii) Basic & diluted EPS after Extraordinary items in `

PART II

PARTICULARS OF SHAREHOLDING

A

1. Public Shareholding

--Number of Shares

--Percentage of Share holding

2. Promoters and Promoter group Shareholding

a) Pledged/ Encumbered

-- Number of Shares

-- Percentage of Shares (as a % of the total shareholding

of promoter and promoter group)

-- Percentage of Shares (as a % of the total share

capital of the company)

b) Non- encumbered

-- Number of Shares

-- Percentage of Shares (as a % of the total shareholding

of promoter and promoter group)

-- Percentage of Shares (as a % of the total share

capital of the company)

Particulars

INVESTOR COMPLAINTS

B

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

FOR THE YEAR ENDED

31-Mar-13

31-Mar-12

(8)

(9)

0

51347.28

51347.28

0

60476.91

60476.91

0

122530.89

122530.89

0

250596.70

250596.70

0

369882.43

369882.43

0

252903.90

252903.90

0

372343.56

372343.56

13877.31

251.02

14438.77

241.65

13237.88

1078.54

57655.90

1087.00

54168.93

1944.90

58417.43

1111.77

54783.95

1969.23

10116.69

8306.79

5584.82

38136.63

8717.84

19243.92

4965.64

47607.82

23314.94

58594.50

9539.54

105765.40

50261.88

61371.96

22768.25

193144.99

67196.93

151652.92

26543.94

301507.62

50512.37

61372.71

23321.80

194736.08

67268.32

151653.45

27064.99

302739.94

13210.65

10525.14

12869.09

6692.85

16765.49

9201.07

57451.71

31642.17

68374.81

23217.74

58167.82

31679.07

69603.62

23224.06

23735.79

(12.28)

19561.94

0.00

25966.56

116.02

89093.88

0.18

91592.55

116.02

89846.89

0.28

92827.68

116.02

23748.07

23748.07

6397.89

0.64

19561.94

19561.94

6552.49

-

25850.54

25850.54

8688.92

(302.61)

89093.70

89093.70

28445.61

1.36

91476.53

91476.53

32025.99

(318.66)

89846.61

89846.61

28856.55

1.36

92711.66

92711.66

32527.09

(318.07)

(721.01)

18070.55

18070.55

-

(223.59)

13233.04

13233.04

-

(1569.41)

19033.64

19033.64

-

(2210.82)

62857.55

62857.55

-

(3862.33)

63631.53

63631.53

-

(2231.04)

63219.74

63219.74

-

(3884.00)

64386.64

64386.64

-

18070.55

16846.84

-

13233.04

16846.84

-

19033.64

16846.84

-

62857.55

16846.84

206907.80

63631.53

16846.84

167557.67

63219.74

16846.84

212676.77

64386.64

16846.84

173030.89

5.37

5.37

3.93

3.93

5.65

5.65

18.66

18.66

18.89

18.89

18.76

18.76

19.11

19.11

66036060

19.599%

66036060

19.599%

66036060

19.599%

66036060

19.599%

66036060

19.599%

66036060

19.599%

66036060

19.599%

270900540 270900540

270900540

270900540

270900540

270900540

270900540

100%

100%

STATEMENT OF ASSETS AND LIABILITIES

AUDITED CONSOLIDATED RESULTS

FOR THE YEAR ENDED

31-Mar-13

31-Mar-12

(6)

(7)

100%

100%

100%

100%

100%

80.401%

80.401%

80.401%

Three months ended 31-Mar-13

IN NUMBERS

0

69

69

0

80.401%

80.401%

80.401%

80.401%

( ` in Lakhs)

STANDALONE

AS AT

PARTICULARS

31-Mar-13

Audited

A

1

B

1

EQUITY AND LIABILITIES

Shareholders' funds

(a) Share Capital

(b) Reserves and Surplus

CONSOLIDATED

AS AT

31-Mar-12

Audited

31-Mar-13

Audited

31-Mar-12

Audited

Sub-total- Shareholders' funds

16846.84

206907.80

223754.64

16846.84

167557.67

184404.51

16846.84

212676.77

229523.61

16846.84

173030.89

189877.73

Sub-total- Non-current liabilities

380.82

2099.13

2479.95

513.09

2002.12

2515.21

383.75

2306.84

2690.59

519.48

2153.40

2672.88

Sub-total- Current liabilities

TOTAL- EQUITY AND LIABILITIES

34638.96

76179.98

47413.34

158232.28

384466.87

58723.32

75427.12

53336.02

187486.46

374406.18

34705.37

76334.45

47476.39

158516.21

390730.41

58810.97

75598.48

53400.96

187810.41

380361.02

Sub-total- Non-current assets

18597.45

10813.85

23636.73

4682.16

37.47

57767.66

10469.07

7647.05

21425.91

5625.92

25.86

45193.81

18909.91

10211.98

23726.91

4912.97

197.79

57959.56

10808.60

6901.30

21495.87

5773.21

234.90

45213.88

Sub-total- Current assets

TOTAL - ASSETS

54500.00

82.10

33217.03

184801.99

6335.15

47762.94

326699.21

384466.87

55850.40

81.73

30737.25

164314.20

18509.37

59719.42

329212.37

374406.18

54530.74

84.33

34386.80

189083.79

6501.47

48183.72

332770.85

390730.41

55949.24

82.60

31578.55

168702.11

18597.38

60237.26

335147.14

380361.02

Non-Current Liabilities

(a) Other Long Term Liabilities

(b) Long Term Provisions

Current Liabilities

(a) Trade Payables

(b) Other Current Liabilities

(c) Short Term Provisions

ASSETS

Non-current assets

(a) Fixed Assets

(b) Non-Current Investments

(c) Deferred Tax Assets (Net)

(d) Long Term Loans and Advances

(e) Other Non Current Assets

Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash and Bank Balances

(e) Short Term Loans and Advances

(f) Other Current Assets

Notes:

1) The above results have been reviewed by the Audit Committee and approved by the Board of Directors at their meeting held on 28.05.2013

2) The Audited Accounts are subject to review by the Comptroller and Auditor General of India under section 619(4) of the Companies Act, 1956.

3) The Board of Directors have recommended a final dividend of ` 3/- per share (Face value ` 5/- per share) in addition to interim dividend of `3/- per share (Face value

` 5/- per share) paid during the year.

4) The figures of last quarter ended 31st March, 2013 are the balancing figures between audited figures in respect of the full financial year ended 31st March, 2013 and

the published year to date figures upto the third quarter of the current financial year.

5) Previous year's figures have been recasted and / regrouped wherever necessary to make them comparable with current year's figures.

By Order of the Board

For Engineers India Limited

Sd/(Ram Singh)

Director(Finance)

Place: New Delhi

Dated: 28th May, 2013

Delivering Excellence through People

Regd Office: E I Bhawan, 1, Bhikaiji Cama Place, New Delhi - 110066 Website: www.engineersindia.com

= Petroleum Refining =Petrochemicals =Pipelines =Offshore Oil & Gas = Onshore Oil & Gas = Terminals & Storages = Mining & Metallurgy = Fertilizers = Power = Infrastructure

CA/2013-14/26

PART I

1.

Segment Revenue

Consultancy & Engineering Projects

Turnkey Projects

Total

Segment Profit from operations

Consultancy & Engineering Projects

Turnkey Projects

Total (a)

Prior period adjustments

Interest

Other un- allocable expenditure

Total (b)

Other Income (c)

Profit Before Tax (a-b+c)

Capital Employed *

UNAUDITED RESULTS

You might also like

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For March 31, 2016 (Result)Document1 pageStandalone & Consolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- ITC LimitedDocument7 pagesITC LimitedlovemethewayiamNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Nucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003Document1 pageNucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003nit111No ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Aplab Limited: Unaudited Standalone Financial Results For The Quarter & Nine Months Ended 31St December 2012Document1 pageAplab Limited: Unaudited Standalone Financial Results For The Quarter & Nine Months Ended 31St December 2012Tanmoy AcharyaNo ratings yet

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Result Q-1-11 For PrintDocument1 pageResult Q-1-11 For PrintSagar KadamNo ratings yet

- BHL Fin Res 2011 12 q1 MillionDocument2 pagesBHL Fin Res 2011 12 q1 Millionacrule07No ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Ref: Code No. 530427: Encl: As AboveDocument3 pagesRef: Code No. 530427: Encl: As AboveShyam SunderNo ratings yet

- IFCI Dec09Document3 pagesIFCI Dec09nitin2khNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Document6 pagesStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhaleNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDocument5 pagesParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Sadbhav Infrastructure ProjectDocument16 pagesSadbhav Infrastructure ProjectbardhanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Sebi Million Q3 1213 PDFDocument2 pagesSebi Million Q3 1213 PDFGino SunnyNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 1Q2013 AnnouncementDocument17 pages1Q2013 AnnouncementphuawlNo ratings yet

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Signed LGE FY16 Q1 English Report Separate PDFDocument62 pagesSigned LGE FY16 Q1 English Report Separate PDFvinodNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Farm AnimalsDocument10 pagesFarm AnimalsRakesh BalboaNo ratings yet

- Design-II Samples Tutorial PDFDocument385 pagesDesign-II Samples Tutorial PDFHani Kirmani100% (1)

- Everything About A To Z Savings For All The Persons in The WorldDocument42 pagesEverything About A To Z Savings For All The Persons in The WorldRakesh BalboaNo ratings yet

- Everything About A To Z Savings For All The Persons in The WorldDocument42 pagesEverything About A To Z Savings For All The Persons in The WorldRakesh BalboaNo ratings yet

- Pro II Input ManualDocument69 pagesPro II Input ManualNareshNo ratings yet

- Pro II Input ManualDocument69 pagesPro II Input ManualNareshNo ratings yet

- Panch TatvaDocument24 pagesPanch TatvaRakesh BalboaNo ratings yet

- 170Document6 pages170AmimaniaNo ratings yet

- Leisure Park BrouchureDocument20 pagesLeisure Park BrouchureRakesh BalboaNo ratings yet