Professional Documents

Culture Documents

Value Added Tax: 1. Definition

Uploaded by

Ella Mae Lopez YusonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Added Tax: 1. Definition

Uploaded by

Ella Mae Lopez YusonCopyright:

Available Formats

VALUE ADDED TAX

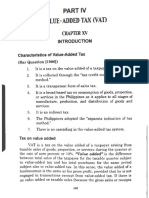

MONZA ULTIMATE REVIEWER 1. Definition a. It is a form of sales tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services. 2. Nature a. It is a Privilege Tax i. It is imposed not on the goods or services as such but on the privilege of selling or importing goods, or rendering services for a fee, remuneration or consideration. b. It is a Percentage Tax i. It is imposed on the sale, barter, exchange or importation of goods or the sale of services or lease/ sale of properties based upon the gross value in money or receipt derived by the manufacturer, producer, importer or seller who is liable for its timely payment. c. It is National Tax i. It is levied at all stages of the production channels. d. It is an Ad Valorem Tax i. It is imposed by law directly not on the thing or services but on the act (sale, importation or performance of service) of the seller, importer, or contractor who is exclusively made liable for its timely payment. It is imposed on the gross selling price or gross receipt derived from the sale, barter, exchange of goods or properties or services or the lease of goods or properties in the course of trade or business. e. It is an Indirect Tax i. The amount of tax may be shifted or passes on to the buyer, transferee, or lessee of the goods properties or services. 3. Characteristics a. It is Indirect b. Equitable i. The law is equipped with a threshold margin (P1, 919,500) c. Regressive i. The Constitution does not really prohibit the imposition of indirect taxes which is essentially regressive. What it simply provides is that Congress shall evolve a progressive system of taxation. d. It is consumption-based e. It is imposed on the value-added in each stage of distribution f. It is a credit-invoice method value-added tax g. It is not a cascading tax. i. Definition: An item is taxed more than once as it makes its way from production to final retail sale. ii. Ratio: VAT is merely added as part of the purchase price and not as a tax because the burden is merely shifted. Thus, there can be no tax on the tax itself. 4. The impact of tax a. The impact is on the seller 5. The incidence of Tax

a. It is on the final consumer, the place at which the tax comes to rest. The tax is shifted to the buyer of the goods, properties, or services.

6. Cross Boarder Doctrine or the Destination Principle a. Under this doctrine, goods and services are taxed only in the country where they are consumed. No VAT shall be imposed to form part of the cost of goods destined outside the territorial border of the taxing authority. Thus, exports are zero-rated, while imports are taxed. b. Actual shipment of the goods from the Philippines to a foreign country is a precondition of an export sale following the destination principle being adhered to by our VAT system. c. VAT is imposed in the country in which the products or services are actually consumed or used. Exports exempt, imports taxable. i. Is there an exception to the Cross Boarder Doctrine 1. Yes. The law clearly provides for an exception to the destination principle; that is, for a zero percent VAT rate for services that are performed in the Philippines, "paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the BSP." 2. Hence, actual or constructive export of goods and services from the Philippines to a foreign country must be zero-rated for VAT; while, those destined for use or consumption within the Philippines shall be imposed the twelve percent (12%) VAT. 7. Evolution of the present VAT System 8. How the VAT System Works? a. Cost deduction method i. This is a single-stage tax which is payable only by the original sellers. (Abakada Guro Party List (etc.) v. Ermita, etc., et al., G. R. No. 168056, September 1, 2005 and companion cases) This was subsequently modified and a mixture of cost deduction method and tax credit method was used to determine the value-added tax payable. b. Tax credit method (a.k.a invoice method) i. This method relies on invoices, an entity can credit against or subtract from the VAT charged on its sales or outputs the VAT paid on its purchases, inputs and imports. [Commissioner of Internal Revenue v. Seagate Technology (Philippines), G. R. No. 153866, February 11, 2005] 1. If at the end of a taxable period, the output taxes charged by a seller are equal to the input taxes passed on by the suppliers, no payment is required. It is when the output taxes exceed the input taxes that the excess has to be paid. 2. If however, the input taxes exceed the output taxes, the excess shall be carried over to the succeeding quarter or quarters. Should the input taxes result from zero-rated or effectively zero-rated transactions or from acquisition of capital goods, any excess over the output taxes shall instead be refunded to the taxpayer or credited against other internal revenue taxes. 9. VAT v. Percentage Tax 10. Basic Formula 11. Elements of VAT System a.

You might also like

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocument19 pages07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- VatDocument274 pagesVatzaneNo ratings yet

- SM MCQDocument30 pagesSM MCQWoroud Quraan100% (3)

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- Alternative Dispute ResolutionDocument28 pagesAlternative Dispute ResolutionElla Mae Lopez YusonNo ratings yet

- Tax 2 - VATDocument37 pagesTax 2 - VATShirley Marie Cada - CaraanNo ratings yet

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaNo ratings yet

- Tax 2Document14 pagesTax 2Nash Ortiz LuisNo ratings yet

- Overview - PrintingDocument10 pagesOverview - Printingemman carlNo ratings yet

- Value Added TaxDocument29 pagesValue Added TaxSNLTNo ratings yet

- VAT - GuidenotesDocument14 pagesVAT - GuidenotesNardz AndananNo ratings yet

- Cir Vs SeagateDocument3 pagesCir Vs Seagatemsu7070No ratings yet

- UST Golden Notes 2011 - Torts and Damages PDFDocument50 pagesUST Golden Notes 2011 - Torts and Damages PDFpot420_aivan50% (2)

- Partnership Accounting BreakdownDocument13 pagesPartnership Accounting BreakdownHoneylyne PlazaNo ratings yet

- Tax 2 ReviewerDocument21 pagesTax 2 ReviewerLouis MalaybalayNo ratings yet

- Executive SummaryDocument32 pagesExecutive SummaryMuhammad ZainNo ratings yet

- Lingating V COMELECDocument2 pagesLingating V COMELECElla Mae Lopez YusonNo ratings yet

- Vat Tax CasesDocument24 pagesVat Tax CasesEller-JedManalacMendozaNo ratings yet

- NIL Case Outline DigestDocument44 pagesNIL Case Outline DigestCid Benedict PabalanNo ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- Seagate DigestDocument3 pagesSeagate DigestSpencer Ong-Siong QuerubinNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- Forex Signals Success PDF - Forex Trading Lab (PDFDrive)Document30 pagesForex Signals Success PDF - Forex Trading Lab (PDFDrive)scorp nxNo ratings yet

- Jurisdiction of All Courts - PhilippinesDocument4 pagesJurisdiction of All Courts - PhilippinesJacinto Jr Jamero60% (5)

- GNotes2 VAT 2018 With TRAIN AmendmentsDocument31 pagesGNotes2 VAT 2018 With TRAIN AmendmentsKristine Bucu100% (4)

- The Travels of A T-Shirt in The Global Economy SCRDocument11 pagesThe Travels of A T-Shirt in The Global Economy SCRCarlos MendezNo ratings yet

- Understanding VAT TaxationDocument23 pagesUnderstanding VAT Taxationtherezzzz0% (1)

- Tax Vat Week4Document73 pagesTax Vat Week4Neil FrangilimanNo ratings yet

- Business Taxes ExplainedDocument51 pagesBusiness Taxes ExplainedLuna CakesNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- J.cornejo - Criminal LawDocument56 pagesJ.cornejo - Criminal Lawcmv mendozaNo ratings yet

- Mamalateo Part 1 VATDocument12 pagesMamalateo Part 1 VATPeterNo ratings yet

- Taxation VATDocument22 pagesTaxation VATB-an JavelosaNo ratings yet

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilNo ratings yet

- Unit 5 Management and Marketing: Section A: What Is Management ?Document33 pagesUnit 5 Management and Marketing: Section A: What Is Management ?Adelina MariaNo ratings yet

- VAT Refund CaseDocument1 pageVAT Refund Casekaira marie carlosNo ratings yet

- Case Study KarimRamziDocument10 pagesCase Study KarimRamziToufik Akhdari0% (1)

- Value Added TaxDocument9 pagesValue Added TaxĴõ ĔĺNo ratings yet

- UNDP Interview Questions - GlassdoorDocument6 pagesUNDP Interview Questions - GlassdoorKumar SaurabhNo ratings yet

- Vat TaxDocument6 pagesVat TaxJunivenReyUmadhayNo ratings yet

- Value Added TaxDocument38 pagesValue Added TaxAhmad AbduljalilNo ratings yet

- Gruba - Vat With TrainDocument31 pagesGruba - Vat With TrainPrincess Trisha Joy UyNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- HANDOUT FOR VAT-NewDocument25 pagesHANDOUT FOR VAT-NewCristian RenatusNo ratings yet

- CIR v. Seagate Technology PhilsDocument6 pagesCIR v. Seagate Technology PhilsL.A. ManlangitNo ratings yet

- Own Reviewer 1 PDFDocument34 pagesOwn Reviewer 1 PDFChristineNo ratings yet

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- Service TaxDocument10 pagesService TaxMonika GuptaNo ratings yet

- VAT BasicsDocument29 pagesVAT BasicsJaymee Andomang Os-agNo ratings yet

- Baf 306 Baf 3 - Introduction Vat Notes 1Document16 pagesBaf 306 Baf 3 - Introduction Vat Notes 1yudamwambafula30No ratings yet

- Northrise University student paper on Value Added Tax in ZambiaDocument6 pagesNorthrise University student paper on Value Added Tax in ZambiaSapcon ThePhoenixNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- VAT Taxpayer Guide - VAT Return FilingDocument16 pagesVAT Taxpayer Guide - VAT Return FilingNeeyum Njaanum0021No ratings yet

- Group Members:: Basit Ali (326) Faizan Khalid (348) Adnan SiddiqueDocument9 pagesGroup Members:: Basit Ali (326) Faizan Khalid (348) Adnan Siddiqueiza khanNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- CONTEX CORPORATION, Petitioner, Vs - HON. Commissioner of Internal Revenue, RespondentDocument13 pagesCONTEX CORPORATION, Petitioner, Vs - HON. Commissioner of Internal Revenue, RespondentJhudith De Julio BuhayNo ratings yet

- Taxn03b Vat IntroDocument20 pagesTaxn03b Vat IntroTrishamae legaspiNo ratings yet

- Information SheetDocument10 pagesInformation SheetmohammadNo ratings yet

- Taxrev VatDocument33 pagesTaxrev VatnikkiNo ratings yet

- Taxation 1 Mod 4Document48 pagesTaxation 1 Mod 4Harui Hani-31No ratings yet

- VAT Taxpayer Guide (Input Tax)Document54 pagesVAT Taxpayer Guide (Input Tax)NstrNo ratings yet

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- I. Introduction To Consumption TaxesDocument18 pagesI. Introduction To Consumption TaxescarlaNo ratings yet

- OtesvatDocument18 pagesOtesvatRichelle Joy Reyes BenitoNo ratings yet

- VAT, WHT and CIT SummaryDocument8 pagesVAT, WHT and CIT Summarymariko1234No ratings yet

- Characteristic of Vat-Business TaxationDocument8 pagesCharacteristic of Vat-Business TaxationAthena LouiseNo ratings yet

- VAT on importation and final withholding taxDocument2 pagesVAT on importation and final withholding taxHannah Alvarado BandolaNo ratings yet

- Value Added Tax NotesDocument15 pagesValue Added Tax NotesGODBARNo ratings yet

- Ownership of A Trademark Is Not Based on An Earlier Filing DateDocument13 pagesOwnership of A Trademark Is Not Based on An Earlier Filing DateElla Mae Lopez YusonNo ratings yet

- BM2872 PDFDocument2 pagesBM2872 PDFElla Mae Lopez YusonNo ratings yet

- Test Results of The October 16Document16 pagesTest Results of The October 16Ella Mae Lopez YusonNo ratings yet

- CourseDocument90 pagesCourseTrishia Fernandez GarciaNo ratings yet

- 2015 Last Minute ReviewerDocument49 pages2015 Last Minute ReviewerRichard BakerNo ratings yet

- Indigenous Rights Act of 1997Document14 pagesIndigenous Rights Act of 1997invictusincNo ratings yet

- Xavier Poison Reviewer For Tariff and Custom CodeDocument2 pagesXavier Poison Reviewer For Tariff and Custom CodeElla Mae Lopez YusonNo ratings yet

- Remedial Law PuhhleeasseDocument17 pagesRemedial Law PuhhleeasseElla Mae Lopez YusonNo ratings yet

- Economics With Taxation and Agrarian ReformDocument1 pageEconomics With Taxation and Agrarian ReformElla Mae Lopez YusonNo ratings yet

- Xavier Poison Reviewer For Tariff and Custom CodeDocument2 pagesXavier Poison Reviewer For Tariff and Custom CodeElla Mae Lopez YusonNo ratings yet

- Poe Case OpinionDocument8 pagesPoe Case OpinionElla Mae Lopez YusonNo ratings yet

- Hipster Fashion and Lifestyle GuideDocument35 pagesHipster Fashion and Lifestyle GuideElla Mae Lopez YusonNo ratings yet

- Phil. Baseline Law (RA 9522)Document20 pagesPhil. Baseline Law (RA 9522)Paul BalbinNo ratings yet

- JUSTICE VELASCO'S CASES PENNEDDocument5 pagesJUSTICE VELASCO'S CASES PENNEDAike Sadjail100% (1)

- De Castro-Criminal LawDocument32 pagesDe Castro-Criminal LawIvan LinNo ratings yet

- History and Evolution of Major Agrarian Reform LawsDocument11 pagesHistory and Evolution of Major Agrarian Reform LawsElla Mae Lopez Yuson88% (8)

- Happy Birthday SongDocument2 pagesHappy Birthday SongElla Mae Lopez YusonNo ratings yet

- 21 48Document6 pages21 48Ella Mae Lopez YusonNo ratings yet

- Different Modes of Acquiring OwnershipDocument2 pagesDifferent Modes of Acquiring OwnershipElla Mae Lopez YusonNo ratings yet

- Xavier's guide to civil procedure appealsDocument4 pagesXavier's guide to civil procedure appealsXavier Hawkins Lopez ZamoraNo ratings yet

- Disini VDocument47 pagesDisini VElla Mae Lopez YusonNo ratings yet

- Civil Procedure by Baviera (2011)Document4 pagesCivil Procedure by Baviera (2011)Ella Mae Lopez YusonNo ratings yet

- DoneDocument3 pagesDoneElla Mae Lopez YusonNo ratings yet

- Fns Intern ApplicationDocument7 pagesFns Intern ApplicationJoey Dela CruzNo ratings yet

- Monza Guradianship UltimatumDocument6 pagesMonza Guradianship UltimatumElla Mae Lopez YusonNo ratings yet

- PH.D BA - Class Schedule 1-2018Document1 pagePH.D BA - Class Schedule 1-2018Adnan KamalNo ratings yet

- Some Information About The Exam (Version 2023-2024 Groep T)Document17 pagesSome Information About The Exam (Version 2023-2024 Groep T)mawiya1535No ratings yet

- ACI LimitedDocument2 pagesACI LimitedAshique IqbalNo ratings yet

- Condition Classification For New GST ConditionsDocument3 pagesCondition Classification For New GST ConditionsVenugopal PNo ratings yet

- 01 - IntroductionDocument19 pages01 - IntroductionchamindaNo ratings yet

- Peoplesoft Enterprise Learning Management: Oracle Data SheetDocument11 pagesPeoplesoft Enterprise Learning Management: Oracle Data SheetnmkamatNo ratings yet

- Comparative Balance Sheets for Pin and San MergerDocument12 pagesComparative Balance Sheets for Pin and San MergerFuri Fatwa DiniNo ratings yet

- Ackoff Systems ThinkingDocument2 pagesAckoff Systems ThinkingLuiz S.No ratings yet

- DTC Agreement Between Cyprus and United StatesDocument30 pagesDTC Agreement Between Cyprus and United StatesOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- MCQDocument19 pagesMCQk_Dashy846580% (5)

- Kasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneDocument1 pageKasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneTimo PaulNo ratings yet

- Business Studies Glossary PDFDocument8 pagesBusiness Studies Glossary PDFAbdulaziz SaifuddinNo ratings yet

- Build Customer Relationships Through Relationship MarketingDocument15 pagesBuild Customer Relationships Through Relationship MarketingPranav LatkarNo ratings yet

- Women Entrepreneurs in IndiaDocument33 pagesWomen Entrepreneurs in Indiaritesh1991987No ratings yet

- Challan Form PDFDocument2 pagesChallan Form PDFaccountsmcc islamabadNo ratings yet

- Salim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director StatementDocument124 pagesSalim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director Statementilham pakpahanNo ratings yet

- Internship Report of State Bank of Pakistan KarachiDocument180 pagesInternship Report of State Bank of Pakistan KarachixavanahNo ratings yet

- Division (GR No. 82670, Sep 15, 1989) Dometila M. Andres V. Manufacturers HanoverDocument6 pagesDivision (GR No. 82670, Sep 15, 1989) Dometila M. Andres V. Manufacturers HanovervivivioletteNo ratings yet