Professional Documents

Culture Documents

Paints and NBFC

Uploaded by

sankalptiwariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paints and NBFC

Uploaded by

sankalptiwariCopyright:

Available Formats

Paints and NBFC

Berger Paints India rose 0.93% after consolidated net profit rose 7.1% to Rs 82.30 crore on 11.9% growth in net sales and other operating income to Rs 1029.80 crore in Q3 December 2013 over Q3 December 2012. The Q3 result was announced on Saturday, 1 February 2014. Berger Paints India's consolidated earnings before depreciation, interest and taxation (EBDIT) rose 12.6% to Rs 131.50 crore in Q3 December 2013 over Q3 December 2012. Berger Paints India's net profit rose 0.33% to Rs 65.66 crore on 7.4% growth in net sales and other operating income to Rs 882.78 crore in Q3 December 2013 over Q3 December 2012. IDFC fell 2.63%. The company's consolidated net profit rose 10.02% to Rs 500.68 crore on 3.67% growth in total income to Rs 2122.84 crore in Q3 December 2013 over Q3 December 2012. The Q3 result was announced after market hours on Friday, 31 January 2014. IDFC's balance sheet remained stable at Rs 70,073 crore as on 31 December 2013. Gross loan book increased 1% to Rs 54552 crore as on 31 December 2013, from Rs 54104 crore as on 31 December 2012. ING Vysya Bank lost 3.16% after net profit rose 3.08% to Rs 167.34 crore on 4.37% growth in total income to Rs 1487.85 crore in Q3 December 2013 over Q3 December 2012. The Q3 result was announced after market hours on Friday, 31 January 2014. The bank's provisions and contingencies declined 6.46% to Rs 23.01 crore in Q3 December 2013 over Q3 December 2012. ING Vysya Bank's ratio of gross non-performing assets (NPAs) to gross advances declined to 1.68% as on 31 December 2013, from 1.72% as on 30 September 2013 and 1.77% as on 31 December 2012. The ratio of net NPAs to net advances stood at 0.21% as on 31 December 2013 as against 0.19% as on 30 September 2012 and 0.05% as on 31 December 2012. The bank's Capital Adequacy Ratio (CAR) stood at 16.93% as on 31 December 2013 as against 16.75% as on 30 September 2013 and 12.47% as on 31 December 2012.

The Reserve Bank of India (RBI) has vide its circular dated 20 December 2013 advised all banks to create, as a matter of prudence, a Deferred Tax Liability (DTL) on Special Reserve created under Section 36(1)(viii) of Income Tax Act, 1961. Accordingly, the tax expense for the quarter and nine months ended 31 December 2013 includes proportionate nine month deferred tax charge of Rs 4.08 crore on Special Reserve at that date. Further, on the Special Reserve balance of Rs 74.70 crore at 31 March 2013, the bank created a DTL of Rs 25.39 crore by debiting opening Revenue Reserves, ING Vysya Bank said. IDBI Bank lost 1.98% after net profit declined 75.05% to Rs 103.96 crore on 1.12% growth in total income to Rs 7149.88 crore in Q3 December 2013 over Q3 December 2012. The Q3 result was announced on Saturday, 1 February 2014. IDBI Bank's provisions and contingencies rose 7.31% to Rs 1033.36 crore in Q3 December 2013 over Q3 December 2012.

You might also like

- Smart Lifetime Saver SPDocument2 pagesSmart Lifetime Saver SPsankalptiwariNo ratings yet

- Project Lead - PatnaDocument3 pagesProject Lead - PatnasankalptiwariNo ratings yet

- Annexure B 33 KV Oil Immersed Outdoor Current Transformer ValueDocument1 pageAnnexure B 33 KV Oil Immersed Outdoor Current Transformer ValuesankalptiwariNo ratings yet

- CRP NoteDocument1 pageCRP NotesankalptiwariNo ratings yet

- Description Opening1Document1 pageDescription Opening1sankalptiwariNo ratings yet

- 33kV Post Insulator Technical SpecificationDocument1 page33kV Post Insulator Technical SpecificationsankalptiwariNo ratings yet

- Optical SensorsDocument2 pagesOptical SensorssankalptiwariNo ratings yet

- Item Name Description PCC Panel MCC Panel APFC Panel Distribution Boards Rising MainDocument1 pageItem Name Description PCC Panel MCC Panel APFC Panel Distribution Boards Rising MainsankalptiwariNo ratings yet

- CT Grounding in SubstationDocument2 pagesCT Grounding in SubstationsankalptiwariNo ratings yet

- OutdoorDocument1 pageOutdoorsankalptiwariNo ratings yet

- VCB panels: reliable medium voltage circuit breaker technologyDocument2 pagesVCB panels: reliable medium voltage circuit breaker technologysankalptiwariNo ratings yet

- CRP NoteDocument1 pageCRP NotesankalptiwariNo ratings yet

- Commissioning RequirementDocument3 pagesCommissioning RequirementsankalptiwariNo ratings yet

- SiemensDocument2 pagesSiemenssankalptiwariNo ratings yet

- Description Opening1Document1 pageDescription Opening1sankalptiwariNo ratings yet

- ContractDocument1 pageContractsankalptiwariNo ratings yet

- Description OpeningDocument1 pageDescription OpeningsankalptiwariNo ratings yet

- NotesDocument1 pageNotessankalptiwariNo ratings yet

- Pioneer of HVDC SolutionDocument1 pagePioneer of HVDC SolutionsankalptiwariNo ratings yet

- Requirement AnalysisDocument1 pageRequirement AnalysissankalptiwariNo ratings yet

- Business Analysis BasicsDocument2 pagesBusiness Analysis BasicssankalptiwariNo ratings yet

- Training ClassnoteDocument1 pageTraining ClassnotesankalptiwariNo ratings yet

- Metering and RAPDRPDocument2 pagesMetering and RAPDRPsankalptiwariNo ratings yet

- Grégoire Poux-Guillaume, Alstom Grid President. "We Are Very Pleased To Have BeenDocument1 pageGrégoire Poux-Guillaume, Alstom Grid President. "We Are Very Pleased To Have BeensankalptiwariNo ratings yet

- 10 Power Words For Your CVDocument3 pages10 Power Words For Your CVparabolicepaNo ratings yet

- RelayDocument2 pagesRelayIván MartínezNo ratings yet

- Mausi N JayDocument1 pageMausi N JaysankalptiwariNo ratings yet

- Ece 472 - Power Systems Ii Transformer Protection Homework #4Document5 pagesEce 472 - Power Systems Ii Transformer Protection Homework #4sankalptiwariNo ratings yet

- HVDC LinksDocument5 pagesHVDC LinkssankalptiwariNo ratings yet

- Short Circuit For Power SystemDocument8 pagesShort Circuit For Power SystemsankalptiwariNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Landman Right of Way Agent in Oklahoma City OK Resume David ManningDocument2 pagesLandman Right of Way Agent in Oklahoma City OK Resume David ManningDavid ManningNo ratings yet

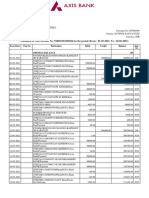

- Account STMTDocument3 pagesAccount STMTDhanush KumarNo ratings yet

- 2014 December Statement PDFDocument1 page2014 December Statement PDFMishaal ShaukatNo ratings yet

- E Receipt For State Bank Collect PaymentDocument1 pageE Receipt For State Bank Collect PaymentAyush MukhopadhyayNo ratings yet

- DEPOSITORY AND CUSTODIAL SERVICESDocument25 pagesDEPOSITORY AND CUSTODIAL SERVICESRiya Das RdNo ratings yet

- CHAPTER 1 Audit of Cash and Cash EquivalentDocument15 pagesCHAPTER 1 Audit of Cash and Cash EquivalentKycieh PadecioNo ratings yet

- ATM and POS - Functional User GuideDocument8 pagesATM and POS - Functional User GuideLavanyenNo ratings yet

- Experience of Internship in EXIM BankDocument7 pagesExperience of Internship in EXIM BankMd Shahidul IslamNo ratings yet

- United States District Court District of New Jersey: Criminal ComplaintDocument11 pagesUnited States District Court District of New Jersey: Criminal ComplaintSHIFrankel100% (2)

- Legal Opinion Qualified Theft 1Document6 pagesLegal Opinion Qualified Theft 1rjapsNo ratings yet

- E Bucks Gold BusinessDocument40 pagesE Bucks Gold BusinessDanielle Toni Dee NdlovuNo ratings yet

- An Empirical Study On The Performance Evaluation of Public Sector Banks in IndiaDocument16 pagesAn Empirical Study On The Performance Evaluation of Public Sector Banks in Indiapratik053No ratings yet

- GR No. L-61549Document3 pagesGR No. L-61549Fritz Jared P. AfableNo ratings yet

- BSP PresentationDocument27 pagesBSP PresentationMika AlimurongNo ratings yet

- Amla PDFDocument75 pagesAmla PDFKristine AbellaNo ratings yet

- Customer's Credit Card Settlement DetailsDocument3 pagesCustomer's Credit Card Settlement DetailsNoble InfoTechNo ratings yet

- Invitation For Tender - P3Document2 pagesInvitation For Tender - P3SuhailAhmedNo ratings yet

- Electricity Bill PDFDocument1 pageElectricity Bill PDFAMULYA RANJAN PAULNo ratings yet

- H S B C: Ongkong and Hanghai Anking OrporationDocument16 pagesH S B C: Ongkong and Hanghai Anking OrporationPreethi RaviNo ratings yet

- HRG-Complaint Resolution GLOBALDocument32 pagesHRG-Complaint Resolution GLOBALDannyShallowNo ratings yet

- Allied Car Finance Application FormDocument21 pagesAllied Car Finance Application FormSuhail AhmedNo ratings yet

- Teena FDHGDocument2 pagesTeena FDHGTeena VarmaNo ratings yet

- Project Report (Aniket18GSOB1010055, Sakshi18GSOB1010164, Rupali18GSOB1010192)Document25 pagesProject Report (Aniket18GSOB1010055, Sakshi18GSOB1010164, Rupali18GSOB1010192)vidhya vijayanNo ratings yet

- DLF's Capital Structure Over TimeDocument17 pagesDLF's Capital Structure Over TimepoojasahoooooNo ratings yet

- Checkbook Reconciliation: Total Withdrawals OutstandingDocument1 pageCheckbook Reconciliation: Total Withdrawals Outstandingsumit_b123No ratings yet

- Feed Industry of Bangladesh:: Sustaining Covid-19 and Potentials in Upcoming DaysDocument41 pagesFeed Industry of Bangladesh:: Sustaining Covid-19 and Potentials in Upcoming Daysnandt bangladeshNo ratings yet

- Brief History of International BankingDocument27 pagesBrief History of International BankingAsima Syed91% (11)

- Jyske AftalerDocument15 pagesJyske AftalerFa JM0% (1)

- Cera Sanitaryware Limited: Annual Report 2007-08Document40 pagesCera Sanitaryware Limited: Annual Report 2007-08Rakhi183No ratings yet

- Experience The Difference: Annual Report & Accounts 2003Document41 pagesExperience The Difference: Annual Report & Accounts 2003thestorydotieNo ratings yet