Professional Documents

Culture Documents

Adam

Uploaded by

roc_jyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adam

Uploaded by

roc_jyCopyright:

Available Formats

GLOBAL MARKETS WEEKLY 16 DECEMBER 2013

Economics | Eurozone recovery to continue The European Central Bank (ECB) reduced its inflation forecast for next year at its December meeting, though apparently in no rush to provide more stimulus. But we think it will overcome this apparent complacency towards very low levels of inflation and deliver more easing in 2014. The ECB also upgraded its growth forecast by a tick to 1.1%, and said it expects inflation to start rising again in 2015 (to 1.3%) under current policies. We expect the slow eurozone recovery to continue, as reduced political and financial stress boosts consumption and investing, the need for austerity lessens, and the ECB provides more stimulus. We expect the improving economic environment to remain supportive for European equities, while peripheral government and corporate bonds are also underpinned by an improving economy and easing of debt burdens. Equities | Still positive, but lower conviction We maintain a preference for equities over bonds as we head into 2014. We remain firmly in the rates lower for longer camp and look for continued modest recovery in the global economy, which should support risk assets. But the level of conviction on our positive equity view has diminished compared to this time a year ago given the strong returns in developed markets so far this year. Earnings growth has been hard to come by with many markets seeing only single-digit growth this year. Easy money has provided some companies with an opportunity to borrow cheaply and buy back shares, thus boosting earnings per share. The big concern for global markets is the eventual withdrawal of US quantitative easing. We think the pace of withdrawal will be more modest than expected, which would be supportive for equities. We wouldnt be surprised if markets took a pause for breath. But we believe equities will continue to provide better returns than cash or bonds over the coming year, enhanced by growing dividends.

Tuesday

Key data and events this week

Wednesday

Friday

UK, eurozone & US consumer price inflation German ZEW economic sentiment German IFO business climate Bank of England meeting minutes UK unemployment Federal Reserve policy statement Bank of Japan policy statement

Bonds | UK growth good for corporate bonds Speaking in New York last week, Bank of England (BoE) Governor Mark Carney recognised that UK growth has accelerated, but suggested that monetary policy should stay loose for a long time. Carney noted that the equilibrium real interest rate the rate (less inflation) that would allow the economy to grow at its full potential without stoking long-term inflation was probably negative. This means that even if the economy grows at its potential and unemployment falls to the equilibrium level, the BoE intends to keep rates below inflation. We will be watching closely for any signs of inflationary pressures, such as tightness in the labour market, but we believe the strong growth environment in the UK still benefits corporate bonds over gilts. Currency | Australian dollar is vulnerable We see the Australian dollar as the most vulnerable major currency Australias current account deficit (exports of goods and services minus imports) was 3.3% of gross domestic product in the third quarter, while Reserve Bank of Australia Governor Glenn Stevens wants to see the currency materially lower (and the IMF agrees). The Australian currency has dropped over 8% in tradeweighted terms but remains in a long-term strengthening trend. As a result, it is vulnerable to what is expected to be a slower pace of growth in China in the years ahead, while US monetary policy is expected to tighten next year. Still, we see Australian rates also climbing back towards 3% in 2014-15, which should limit the Australian dollars losses.

ADAM INVESTMENT OFFICE

James Butterfill

Head of Equity Strategy

Pierre Bose

Head of Fixed Income

Mark McFarland

Chief Economist

Cameron Glasgow

Investment Director cameron.glasgow@adambank.com 0131 225 8484

Georgios Tsapouris

Investment Strategist

Charts of the week

Corporate sentiment has been improving across the eurozone, which should continue to support European equities

56 54 52 50 48 46 44 42 40 Jan 12

We expect only modest Fed tightening and see a continued modest global recovery next year, which should also be supportive for equities

2.30 2.10 1.90 1.70 1.50 1.30 1.10 0.90 0.70

E uro zo ne c o m po s it e P M Is

Fed gets better at interest rate management

Jul 12

Jan 13

Jul 13

Source: Dat ast ream

0.50 Jan- 12 Jul-12 Jan- 13 Jul- 13

Germany France Average of Spain, Italy and Ireland

Eurodollar (Dec 2015) minus Fed Funds rat e

Source: Bloomberg

Outlook for UK rates remains low although labour market tightness could lead to higher inflation

70 65 60 55 50 45 40 35 Permanent st aff salariy survey (Lhs, lagged 6 months) Total pay growt h 3-mont h average (Rhs) Source: Datast ream

The Australian dollar (AUD) looks vulnerable against the US dollar (USD) as US yields start to price in monetary policy tightening

2.5

La bo r de m a nd o v e rs upply & wa ge gro wt h

%yoy

6 5 4 3 2

Australian dollar vulnerable

1.15

2.2

1.10 1.05

1.9 1.00 1.6

1 0 -1

1.3

0.95 0.90

1 Jan-11 Jul-11 Jan- 12 Jul- 12 Jan-13 Jul- 13

0.85

10yr USD spread (Lhs)

USD per AUD (Rhs)

Source: Bloomberg

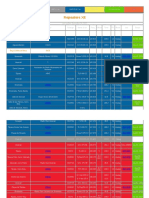

Market Performance

Developed & Emerging Equity Markets

115 110 105 100 95 90 85 13 Jun 13 13 Jul 13 13 Aug 13 13 Sep 13 13 Oct 13 13 Nov 13 13 Dec 13

Equity Markets As of: 13-Dec-13 Current -1W

Performance (%, local) -1M -3M YTD 12

Developed Equity (M SCI)

Emerging Equity (M SCI)

Developed Equity (MSCI) FTSE All Share FTSE 100 S&P 500 Nasdaq Composite DJ EuroStoxx Nikkei 225 Hang Seng Emerging Equity (MSCI) BRIC (MSCI)

Source: Datastream

1,133.0 3,447 6,440 1,775 4,001 296.5 15,403 23,246 46,341 507.8

-1.5 -1.5 -1.7 -1.7 -1.5 -1.8 0.7 -2.1 -1.2 -1.8

-1.0 -2.3 -2.9 -0.4 0.9 -3.0 5.7 3.5 0.7 1.2

3.2 -1.7 -2.2 5.2 7.5 1.9 6.9 1.4 0.4 1.0

20.8 11.5 9.2 24.5 32.5 13.7 48.2 2.6 -0.8 -1.2

13.1 8.2 5.8 13.4 15.9 15.5 22.9 22.9 13.9 13.8

Source: Datastream / MSCI, rebased to 100 10-Year Bond Yields As of: 13-Dec-13 Current -1W Change (basis points) -1M -3M YTD 12 Commodity Markets As of: 13-Dec-13 Current -1W Performance (%) -1M -3M YTD 12

US Treasuries UK Gilts German Bunds Japanese Govt. Bonds

Source: Datastream

2.87 2.90 1.83 0.67

-1 0 -1 1

14 9 9 6

-3 -3 -11 -4

99 92 0 -31

-12 -17 -53 -20

Commodities (TR) Brent Oil Price (Spot) Gold Bullion (Spot) Industrial Metals (TR)

Source: Datastream

253.9 108.2 1236 263.9

0.6 -3.1 0.0 2.1

2.7 1.3 -3.1 2.9

-2.5 -4.5 -6.1 1.6

-9.3 -1.7 -25.7 -14.9

-1.1 3.2 5.6 0.7

Inflation & Interest Rates

Inflation & Interest Rates Current Inflation (%) Current RBS Interest Rates Forecast (%) Dec'13 (F) Mar'14 (F) Rate Announcement Next Date

United States United Kingdom Eurozone

Japan

(Fed Funds) (Base Rate) (Repo Rate)

(Call Rate)

1.0 2.2 0.7

1.1

0.25 0.50 0.25

0.10

0.25 0.50 0.25

0.10

0.25 0.50 0.25

0.10

18-Dec 09-Jan 09-Jan

20-Dec

GLOBAL MARKETS WEEKLY 16 DECEMBER 2013

Issued by Adam & Company Investment Management Limited, which is authorised and regulated by the Financial Services Authority. Adam & Company Investment Management Limited is registered in Scotland Number 102144. Registered Office: 25 St Andrew Square, Edinburgh EH2 1AF. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance should not be taken as a guide to future performance. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The information in this document is not intended as an offer or solicitation to buy or sell securities or any other investment or banking product, nor does it constitute a personal recommendation. The information is believed to be correct but cannot be guaranteed. Any opinion or forecast constitutes our judgement as at the date of issue and is subject to change without notice. Any Adam company, or a connected company, its clients and officers may have a position or engage in transactions in any of the securities mentioned. The analysis contained in this document has been procured, and may have been acted upon, by Adam & Company Investment Management Limited and connected companies for their own purposes, and the results are being made available to you on this understanding. To the extent permitted by law and without being inconsistent with any applicable regulation, neither Adam & Company Investment Management Limited nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such analysis.

You might also like

- Adam WeeklyDocument3 pagesAdam Weeklyroc_jyNo ratings yet

- Point of View: Labour Force: Top 200: Movers and ShakersDocument4 pagesPoint of View: Labour Force: Top 200: Movers and ShakersLong LuongNo ratings yet

- Australian Dollar Outlook11/30/2011Document1 pageAustralian Dollar Outlook11/30/2011International Business Times AUNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- MRE121015Document3 pagesMRE121015naudaslietas_lvNo ratings yet

- Ier Nov 11Document2 pagesIer Nov 11derek_2010No ratings yet

- Economist Insights 201312233Document2 pagesEconomist Insights 201312233buyanalystlondonNo ratings yet

- September 2012 NewsletterDocument2 pagesSeptember 2012 NewslettermcphailandpartnersNo ratings yet

- Er 20120815 Bull Consumer SentimentDocument2 pagesEr 20120815 Bull Consumer SentimentChrisBeckerNo ratings yet

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocument25 pagesFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburNo ratings yet

- 3Q2011 Markets Outlook USDocument12 pages3Q2011 Markets Outlook USsahil-madhani-3137No ratings yet

- Thailand Economic and Strategy Outlook 2015: Clouds Lifting, Sunny Skies AheadDocument21 pagesThailand Economic and Strategy Outlook 2015: Clouds Lifting, Sunny Skies AheadbodaiNo ratings yet

- Barclays FX Weekly Brief 20100902Document18 pagesBarclays FX Weekly Brief 20100902aaronandmosesllcNo ratings yet

- EdisonInsight February2013Document157 pagesEdisonInsight February2013KB7551No ratings yet

- Weekly Trends Jan 30Document4 pagesWeekly Trends Jan 30dpbasicNo ratings yet

- Slow Growth Lingers Despite StimulusDocument4 pagesSlow Growth Lingers Despite Stimuluspathanfor786No ratings yet

- Ficc Times HTML HTML: The Key Events of Last WeekDocument6 pagesFicc Times HTML HTML: The Key Events of Last WeekMelissa MillerNo ratings yet

- US Fixed Income Markets WeeklyDocument96 pagesUS Fixed Income Markets Weeklyckman10014100% (1)

- March 2013 NewsletterDocument2 pagesMarch 2013 NewslettermcphailandpartnersNo ratings yet

- IMF Cautiously Optimistic For The US: Morning ReportDocument4 pagesIMF Cautiously Optimistic For The US: Morning Reportnaudaslietas_lvNo ratings yet

- Nordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Document7 pagesNordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Glenn ViklundNo ratings yet

- Daily Currency Briefing: Waiting For Godot?Document4 pagesDaily Currency Briefing: Waiting For Godot?timurrsNo ratings yet

- Financial Markets, Institutions & Instruments: CourseworkDocument9 pagesFinancial Markets, Institutions & Instruments: CourseworkIago SelemeNo ratings yet

- Australian Dollar Outlook 06 July 2011Document1 pageAustralian Dollar Outlook 06 July 2011International Business Times AUNo ratings yet

- Content But Not Complacent.: Policy PerspectiveDocument5 pagesContent But Not Complacent.: Policy Perspectiveapi-162199694No ratings yet

- Global Markets Research Daily AlertDocument7 pagesGlobal Markets Research Daily Alertpathanfor786No ratings yet

- North America Stocks Log 3-Day Rally but End Off HighsDocument5 pagesNorth America Stocks Log 3-Day Rally but End Off Highsjemliang_85No ratings yet

- The Pensford Letter - 8.13.12Document5 pagesThe Pensford Letter - 8.13.12Pensford FinancialNo ratings yet

- Bond Market Perspectives 06092015Document4 pagesBond Market Perspectives 06092015dpbasicNo ratings yet

- Weekly Trends Nov 5Document4 pagesWeekly Trends Nov 5dpbasicNo ratings yet

- U.S. Equity Strategy (What's Driving The Equity Market) - September 14, 2012Document4 pagesU.S. Equity Strategy (What's Driving The Equity Market) - September 14, 2012dpbasicNo ratings yet

- Market BulletinDocument1 pageMarket BulletinMoneyspriteNo ratings yet

- Craig James, Chief Economist, Savanth Sebastian, Economist,: Commsec CommsecDocument33 pagesCraig James, Chief Economist, Savanth Sebastian, Economist,: Commsec CommsecAaron Christie-DavidNo ratings yet

- 17 Aug 11 - The Ministry of CNY - 16 - 08 - 11 - 22 - 02Document8 pages17 Aug 11 - The Ministry of CNY - 16 - 08 - 11 - 22 - 02tallanzhouwenqiNo ratings yet

- March Market Outlook: Equities & Commodities Under PressureDocument8 pagesMarch Market Outlook: Equities & Commodities Under PressureMoed D'lhoxNo ratings yet

- The Monarch Report 04-23-12Document3 pagesThe Monarch Report 04-23-12monarchadvisorygroupNo ratings yet

- Weekly Trends January 10 2013Document4 pagesWeekly Trends January 10 2013John ClarkeNo ratings yet

- Citigold Citigold: Financial Market AnalysisDocument5 pagesCitigold Citigold: Financial Market AnalysisRam BehinNo ratings yet

- NZ External Imbalances RevealedDocument3 pagesNZ External Imbalances RevealedleithvanonselenNo ratings yet

- Goldman - July 25Document27 pagesGoldman - July 25Xavier Strauss100% (2)

- Daily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?Document2 pagesDaily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?GlobalStrategyNo ratings yet

- OCTIS Asset Management: Octis Asia Pacific FundDocument3 pagesOCTIS Asset Management: Octis Asia Pacific FundoctisadminNo ratings yet

- The Pensford Letter - 10.31.11Document5 pagesThe Pensford Letter - 10.31.11Pensford FinancialNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Daily Currency Briefing: How Would The ECB Treat A Greek Default Rating?Document4 pagesDaily Currency Briefing: How Would The ECB Treat A Greek Default Rating?timurrsNo ratings yet

- ASEAN Economics: What Does A Cross-Current of DM Recovery, Rising Real Rates & China Slowdown Mean For ASEAN?Document20 pagesASEAN Economics: What Does A Cross-Current of DM Recovery, Rising Real Rates & China Slowdown Mean For ASEAN?bodai100% (1)

- Global Market Outlook - August 2013 - GWMDocument14 pagesGlobal Market Outlook - August 2013 - GWMFauzi DjauhariNo ratings yet

- Degussa Marktreport Engl 22-07-2016Document11 pagesDegussa Marktreport Engl 22-07-2016richardck61No ratings yet

- The Pensford Letter - 10.1.12Document4 pagesThe Pensford Letter - 10.1.12Pensford FinancialNo ratings yet

- Er 20111012 Bull Consumer SentimentDocument1 pageEr 20111012 Bull Consumer Sentimentdavid_llewellyn5758No ratings yet

- SYZ & CO - SYZ Asset Management - 1 Month in 10 Snapshots March 2013Document4 pagesSYZ & CO - SYZ Asset Management - 1 Month in 10 Snapshots March 2013SYZBankNo ratings yet

- An Smu Economics Intelligence Club ProductionDocument10 pagesAn Smu Economics Intelligence Club ProductionSMU Political-Economics Exchange (SPEX)No ratings yet

- September 2013 NewsletterDocument2 pagesSeptember 2013 NewslettermcphailandpartnersNo ratings yet

- 0927 UsfiwDocument42 pages0927 Usfiwbbj1039No ratings yet

- Weekly Market Commentary 3-512-2012Document4 pagesWeekly Market Commentary 3-512-2012monarchadvisorygroupNo ratings yet

- ICMAniacs Report Final (In Need of Finishing Touches)Document19 pagesICMAniacs Report Final (In Need of Finishing Touches)George Stuart CottonNo ratings yet

- Australian Dollar Outlook 08/29/2011Document1 pageAustralian Dollar Outlook 08/29/2011International Business Times AUNo ratings yet

- Mre121213 PDFDocument3 pagesMre121213 PDFnaudaslietas_lvNo ratings yet

- Regulatory Capital Relief May Offer SolutionDocument16 pagesRegulatory Capital Relief May Offer Solutionroc_jyNo ratings yet

- JPMorgan On Currency Risk MGMTDocument40 pagesJPMorgan On Currency Risk MGMTroc_jyNo ratings yet

- JPMorgan On Currency Risk MGMTDocument40 pagesJPMorgan On Currency Risk MGMTroc_jyNo ratings yet

- 6349Document8 pages6349jahshaka666No ratings yet

- Duties of Trustees ExplainedDocument39 pagesDuties of Trustees ExplainedZia IzaziNo ratings yet

- Trends in Email Design and MarketingDocument18 pagesTrends in Email Design and MarketingDaria KomarovaNo ratings yet

- Leanplum - Platform Data SheetDocument10 pagesLeanplum - Platform Data SheetKiran Manjunath BesthaNo ratings yet

- Symbiosis Law School ICE QuestionsDocument2 pagesSymbiosis Law School ICE QuestionsRidhima PurwarNo ratings yet

- Quantitative Techniques For Business DecisionsDocument8 pagesQuantitative Techniques For Business DecisionsArumairaja0% (1)

- PPT ch01Document45 pagesPPT ch01Junel VeriNo ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- Quiz 1Document6 pagesQuiz 1Eliza Mae Aquino100% (1)

- Find Bridges in a Graph Using DFSDocument15 pagesFind Bridges in a Graph Using DFSVamshi YadavNo ratings yet

- FINAL Conflicts 2019 Official Guidelines PDFDocument48 pagesFINAL Conflicts 2019 Official Guidelines PDFxsar_xNo ratings yet

- Jeff Roth CVDocument3 pagesJeff Roth CVJoseph MooreNo ratings yet

- Senior SAP Engineer ResumeDocument1 pageSenior SAP Engineer ResumeSatish Acharya NamballaNo ratings yet

- STSDSD QuestionDocument12 pagesSTSDSD QuestionAakash DasNo ratings yet

- Ict Lesson 2 Lesson PlanDocument3 pagesIct Lesson 2 Lesson Planapi-279616721No ratings yet

- Contoh Format Soal PTSDocument3 pagesContoh Format Soal PTSSmp nasional plus widiatmikaNo ratings yet

- Geometry First 9 Weeks Test Review 1 2011Document6 pagesGeometry First 9 Weeks Test Review 1 2011esvraka1No ratings yet

- PDFDocument72 pagesPDFGCMediaNo ratings yet

- ICE Professional Review GuidanceDocument23 pagesICE Professional Review Guidancerahulgehlot2008No ratings yet

- MATHS UNDERSTANDINGDocument15 pagesMATHS UNDERSTANDINGNurul IzzaNo ratings yet

- Art 1207-1257 CCDocument5 pagesArt 1207-1257 CCRubz JeanNo ratings yet

- Christian Ministry Books: 00-OrientationGuideDocument36 pagesChristian Ministry Books: 00-OrientationGuideNessieNo ratings yet

- Repeaters XE PDFDocument12 pagesRepeaters XE PDFenzzo molinariNo ratings yet

- Handouts - Entity Relationship DiagramDocument8 pagesHandouts - Entity Relationship Diagramsecret studetNo ratings yet

- 268 General Knowledge Set ADocument48 pages268 General Knowledge Set Aguru prasadNo ratings yet

- Smart Irrigation System With Lora & Recording of Lora Broadcast Using RTL-SDR Dongle For Spectrum AnalyzationDocument4 pagesSmart Irrigation System With Lora & Recording of Lora Broadcast Using RTL-SDR Dongle For Spectrum AnalyzationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mock-B1 Writing ReadingDocument6 pagesMock-B1 Writing ReadingAnonymous 0uBSrduoNo ratings yet

- Ballet Folklórico de MéxicoDocument3 pagesBallet Folklórico de MéxicoDasikaPushkarNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Integrating Force - Com With MicrosoftDocument11 pagesIntegrating Force - Com With MicrosoftSurajAluruNo ratings yet

- 2017 Climate Survey ReportDocument11 pages2017 Climate Survey ReportRob PortNo ratings yet