Professional Documents

Culture Documents

SOTU Reactions: View It As A Web Page

Uploaded by

American Enterprise InstituteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SOTU Reactions: View It As A Web Page

Uploaded by

American Enterprise InstituteCopyright:

Available Formats

Subject: Obamacare taxes, challenges for the Yellen Fed (AEI Economics Ledger) If you have trouble reading

this message, click here to view it as a web page.

SOTU reactions

It glossed over the jobs crisis. Michael Strain: The president called on Congress to extend unemployment benefits, and Congress should heed the presidents call. But other than that, and the aforementioned pledge, the president barely mentioned our unemployment crisis. Given that it is arguably our countrys most serious and immediate social and economic problem, the fact that the president continues to avoid it is deeply troubling. Retirees arent headed for the poor house. Andrew Biggs and Sylvester Schieber: There is a widespread perception that most Americans are inadequately prepared for retirement. The story pushed by pundits and policy makers is that the shift over the past 30 years from defined-benefit pensions to defined-contribution savings plans such as 401(k)s has dramatically reduced retirement income to supplement the benefits provided by Social Security. . . . Nevertheless, the story about the declining income prospects of retirees is not true. The minimum-wage hike for federal contractors is good news for the tea party. Stan Veuger: By voluntarily paying higher prices for some goods and services the federal government procures, without clamoring for new appropriations, Obama is effectively reducing the size of government. Paying prices that are 40 percent higher than before, without the corresponding massive budget expansion, brings down the amount of goods and services acquired by almost 30 percent. The evidence is weak for populism. Jim Pethokoukis: The superstar economists of the Equality of Opportunity Project find American upward mobility getting no better or worse for decades. As the EOP study puts it: Children entering the labor market today have the same chances of moving up in the income distribution (relative to their parents) as children born in the 1970s.

Tax season begins

Republicans lower-taxing alternative to Obamacare. James Capretta: [Republicans] plan would repeal the entirety of the Obamacare tax hikes. That, by itself, would represent one of the largest tax cuts in American history. When Obamacare was enacted, the Congressional Budget Office (CBO) estimated the net Obamacare tax hike at $525 billion over a decade. The estimate now is that the total tax hike will be around $1 trillion over the next ten years. Senators Burr, Coburn, and Hatch would wipe this entire tax increase off the books. Unpopular companies singled out for tax treatment. Kevin Hassett and Alan Viard: Almost two years ago, we warned against ongoing efforts to undermine the rule of law by singling out unpopular taxpayers for disadvantageous tax rules that dont apply to anyone else. Recent efforts have targeted five companies BP, Chevron, ConocoPhillips, ExxonMobil, and Shell for special tax increases that would apply to no other companies. Apparently, no bad idea ever dies. AUDIO The future of corporate tax reform

The Fed continues to taper

NEW RESEARCH Endogeneity: Why policy and antibiotics fail. John Makin: Quantitative easing (QE) and fiscal stimulus are becoming less effective. Why is that? The reason is the same as the reason that antibiotics, overused in an attempt to cure infections including common colds, are becoming less and less effective with more intensive use: endogeneity. The good and the bad for Yellen. Phillip Swagel: The good news for Janet Yellen is that she will take the reins at the Federal Reserve on Saturday with inflationary pressures subdued and the United States economy finally in an upswing . . . the difficult part for Ms. Yellen is that she faces a new set of challenges involving not just monetary policy but also broader questions regarding the role of the Fed. Twelve predictions about the future of the Fed. Alex Pollock: The Feds lender-of-last-resource function, or the ability to create elastic currency in a crisis, will continue to be necessary for at least another 100 years . . . in the intermediate term the Federal Reserve will be insolvent on a mark-to-market basis . . . there will be a Federal Reserve Reform Act of 2000-something and/or 2100-something, at least once or twice, in the Feds second century.

Spotlight on housing

NEW RESEARCH Homeownership rate remains unchanged despite loosening of credit standards. Edward Pinto: The homeownership rate, as reported by the US Census Bureau, stands today at 65.3 percent. When adjusted for the millions of homeowners who are seriously delinquent, the rate drops to 62.7 percent. This is virtually unchanged from the rate of 61.9 percent in 1960, notwithstanding a dramatic loosening of lending standards over the last 50-plus years. NEW RELEASE Mortgage Risk Index (January). Edward Pinto:: 2013 saw substantially increasing credit risk for Fannie Mae, Freddie Mac, FHA, and the Rural Housing Service (RHS) as reported by the National Mortgage Risk Index for home purchase loans (NMRI-P) published by the AEI International Center on Housing Risk.

In other news

Download the free AEI book of the week! Privatizing Fannie Mae, Freddie Mac, and the Federal Home Loan Banks by Peter Wallison, Bert Ely, and Thomas Stanton Crisis in Greece continues. Desmond Lachman: A growing chorus of senior European policymakers, including ECB President Mario Draghi and European Commission President Jose Barroso, keep reassuring us that the worst phase of the Euro crisis is over. They also keep telling us that there is now no risk of any country leaving the Euro. Evidently they are not paying much attention to the recent worsening in political and economic developments in Greece. For those developments are now very much heightening the risk that we will again be talking about Greece leaving the Euro before the year is out. NEW RESEARCH Tech policy lacks well-rounded experts. Richard Bennett: Technology policy is especially difficult because it combines four complex disciplines: law, economics, engineering, and policy analysis. Very few people have comprehensive backgrounds in all four fields, so they tend to rely on the judgments of people with stronger grounding. But policy advocates often misstate facts in their own areas of expertise, either intentionally or as a result of subconscious bias.

Mark your calendar

2.6 Jobless claims estimate 2.7 January employment situation data released 2.12 AEI event: Banks and governments: Whats the deal? 2.18 AEI event: The Detroit bankruptcy: Conflicts and implications

Keep up with AEIecon

Get up-to-the-minute updates on Twitter @AEIecon. Read more from the American Enterprise Institute economic policy team at www.aei.org/economics. Contact Abby at abby.mccloskey@aei.org if you have questions for the economics team. Sign up for a weekly copy of the LEDGER here. If you were forwarded this message, click here to subscribe to AEI newsletters. Click here to unsubscribe or manage your subscriptions. American Enterprise Institute for Public Policy Research | 1150 Seventeenth Street, NW, Washington, DC 20036 | 202.862.5800 | www.aei.org

You might also like

- Let's Understand Social Security and Stimulate Investment: Or Separating Economic Voodoo from the TruthFrom EverandLet's Understand Social Security and Stimulate Investment: Or Separating Economic Voodoo from the TruthNo ratings yet

- Before The Year Ends: Kevin HassettDocument3 pagesBefore The Year Ends: Kevin HassettAmerican Enterprise InstituteNo ratings yet

- The Ledger 01/09/14Document3 pagesThe Ledger 01/09/14American Enterprise InstituteNo ratings yet

- The Ledger 5/29/13Document3 pagesThe Ledger 5/29/13American Enterprise InstituteNo ratings yet

- Spotlight On Giving: View It As A Web PageDocument3 pagesSpotlight On Giving: View It As A Web PageAmerican Enterprise InstituteNo ratings yet

- The Ledger 03/28/14Document3 pagesThe Ledger 03/28/14American Enterprise InstituteNo ratings yet

- The Ledger 04/25/14Document3 pagesThe Ledger 04/25/14American Enterprise InstituteNo ratings yet

- The Ledger 09/13/13Document2 pagesThe Ledger 09/13/13American Enterprise InstituteNo ratings yet

- The President Turns To Wall Street Regulation: View It As A Web PageDocument3 pagesThe President Turns To Wall Street Regulation: View It As A Web PageAmerican Enterprise InstituteNo ratings yet

- The Ledger 10/25/13Document2 pagesThe Ledger 10/25/13American Enterprise InstituteNo ratings yet

- Tax Reform: View It As A Web PageDocument2 pagesTax Reform: View It As A Web PageAmerican Enterprise InstituteNo ratings yet

- The Way Forward: View It As A Web PageDocument2 pagesThe Way Forward: View It As A Web PageAmerican Enterprise InstituteNo ratings yet

- The Ledger 03/07/14Document2 pagesThe Ledger 03/07/14American Enterprise InstituteNo ratings yet

- The Ledger 07/11/14Document3 pagesThe Ledger 07/11/14American Enterprise InstituteNo ratings yet

- Econom My: Jo Ohn MakinDocument2 pagesEconom My: Jo Ohn MakinAmerican Enterprise InstituteNo ratings yet

- Shutdown, Debt Limit Merge:: "One Hundred Years After ItsDocument2 pagesShutdown, Debt Limit Merge:: "One Hundred Years After ItsAmerican Enterprise InstituteNo ratings yet

- The Ledger 06/14/2013Document3 pagesThe Ledger 06/14/2013American Enterprise InstituteNo ratings yet

- The Ledger 03/14/14Document2 pagesThe Ledger 03/14/14American Enterprise InstituteNo ratings yet

- Fall Budget Battles: Fiscal Collisions AheadDocument3 pagesFall Budget Battles: Fiscal Collisions AheadAmerican Enterprise InstituteNo ratings yet

- Immigration: Madeline ZavodnyDocument3 pagesImmigration: Madeline ZavodnyAmerican Enterprise InstituteNo ratings yet

- The Clock Keeps Ticking: We Can Delay Default, But We Shouldn'tDocument3 pagesThe Clock Keeps Ticking: We Can Delay Default, But We Shouldn'tAmerican Enterprise InstituteNo ratings yet

- Big Themes For The State of The UnionDocument2 pagesBig Themes For The State of The UnionAmerican Enterprise InstituteNo ratings yet

- The Ledger 08/28/13Document2 pagesThe Ledger 08/28/13American Enterprise InstituteNo ratings yet

- The Ledger 07/18/13Document2 pagesThe Ledger 07/18/13American Enterprise InstituteNo ratings yet

- Media Bias: View It As A Web PageDocument2 pagesMedia Bias: View It As A Web PageAmerican Enterprise InstituteNo ratings yet

- The Ledger 03/21/14Document3 pagesThe Ledger 03/21/14American Enterprise InstituteNo ratings yet

- Us Critical UnravelingDocument11 pagesUs Critical UnravelingshelleyNo ratings yet

- Obama Stimulus Third AnniversaryDocument6 pagesObama Stimulus Third AnniversarySenateRPCNo ratings yet

- Economic Growth: Key TakeawaysDocument2 pagesEconomic Growth: Key TakeawaysAmerican Enterprise InstituteNo ratings yet

- The Ledger 5/3/2013Document2 pagesThe Ledger 5/3/2013American Enterprise InstituteNo ratings yet

- Obama Destroys The Middle ClassDocument6 pagesObama Destroys The Middle ClassAbdul NaeemNo ratings yet

- A Shrinking Labor Force: If You Have Trouble Reading This Message, Click Here ToDocument3 pagesA Shrinking Labor Force: If You Have Trouble Reading This Message, Click Here ToAmerican Enterprise InstituteNo ratings yet

- The Ledger 6/7/2013Document3 pagesThe Ledger 6/7/2013American Enterprise InstituteNo ratings yet

- The Ledger 11/22/13Document2 pagesThe Ledger 11/22/13American Enterprise InstituteNo ratings yet

- 1NC Foster R2Document14 pages1NC Foster R2Saje BushNo ratings yet

- Space Aff GrapevineDocument25 pagesSpace Aff Grapevinegsd24337No ratings yet

- The Ledger 06/27/14Document3 pagesThe Ledger 06/27/14American Enterprise InstituteNo ratings yet

- The LEDGER 04/12/13Document2 pagesThe LEDGER 04/12/13American Enterprise InstituteNo ratings yet

- The Cloud of Uncertainty - Thomas OyeDocument2 pagesThe Cloud of Uncertainty - Thomas OyethommasoyeNo ratings yet

- BlueValleyNorth CoTo Neg Three Trails District Tournament Round 4Document35 pagesBlueValleyNorth CoTo Neg Three Trails District Tournament Round 4EmronNo ratings yet

- Funding GapDocument2 pagesFunding GapURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- The Ledger 06/20/14Document3 pagesThe Ledger 06/20/14American Enterprise InstituteNo ratings yet

- Morning News Notes: 2011-04-13Document1 pageMorning News Notes: 2011-04-13glerner133926No ratings yet

- WashPost, The Battle Over Biden's Child Tax Credit and Its Impact On Poverty and WorkersDocument6 pagesWashPost, The Battle Over Biden's Child Tax Credit and Its Impact On Poverty and WorkersPaulo Vitor Antonacci MouraNo ratings yet

- 5 MythsDocument6 pages5 MythsParvesh KhuranaNo ratings yet

- 2020.4 Coronavirus Crisis Underlines Weak Spots in U.S. Economic System - The New York TimesDocument3 pages2020.4 Coronavirus Crisis Underlines Weak Spots in U.S. Economic System - The New York TimesgioanelaNo ratings yet

- A Bailout For The PeopleDocument28 pagesA Bailout For The Peoplesirius57No ratings yet

- The Real World of Money and Taxation in AmericaDocument9 pagesThe Real World of Money and Taxation in AmericaPotomacOracleNo ratings yet

- Green Span UsaDocument2 pagesGreen Span Usahpedrero9532No ratings yet

- Death of The American Dream: Historical PrecedenceDocument8 pagesDeath of The American Dream: Historical PrecedenceJack DarmodyNo ratings yet

- Public FinancesDocument5 pagesPublic Financesteebone747100% (1)

- 01-12-09 AlterNet-Note To Obama - Thinking Small Will Lead To Disaster by Robert KuttnerDocument3 pages01-12-09 AlterNet-Note To Obama - Thinking Small Will Lead To Disaster by Robert KuttnerMark WelkieNo ratings yet

- Whither China?: The Problem With PensionsDocument10 pagesWhither China?: The Problem With Pensionsjallan1984No ratings yet

- 08-08-11 Noam Chomsky - America in DeclineDocument3 pages08-08-11 Noam Chomsky - America in DeclineWilliam J GreenbergNo ratings yet

- The Great Ambiguity of The US EconomyDocument4 pagesThe Great Ambiguity of The US EconomyJH_CarrNo ratings yet

- Bob Chapman Spending Debt Which Is Other People S Money Further Recession and Financial Turmoil in America and The EU 1 10 2011Document4 pagesBob Chapman Spending Debt Which Is Other People S Money Further Recession and Financial Turmoil in America and The EU 1 10 2011sankaratNo ratings yet

- Opinion - The Coronavirus Leaves The State of The States DireDocument2 pagesOpinion - The Coronavirus Leaves The State of The States DirejakeNo ratings yet

- Luisa Mcgarvey Period: 4 2-2-14 Economics EssayDocument7 pagesLuisa Mcgarvey Period: 4 2-2-14 Economics Essayluisamcap2016No ratings yet

- USA Inc. - Mary Meeker Letter To ShareholdersDocument7 pagesUSA Inc. - Mary Meeker Letter To Shareholdersrotterdam010No ratings yet

- Running Out of Other People's Money: It's The Entitlements, StupidDocument4 pagesRunning Out of Other People's Money: It's The Entitlements, StupidLatinos Ready To VoteNo ratings yet

- Revisiting Equity Market Structure: Principles To Promote Efficiency and FairnessDocument5 pagesRevisiting Equity Market Structure: Principles To Promote Efficiency and FairnessAmerican Enterprise InstituteNo ratings yet

- AEI Special Poll Report: Health Care and The ElectionDocument8 pagesAEI Special Poll Report: Health Care and The ElectionAmerican Enterprise InstituteNo ratings yet

- House Prices and Land Prices Under The Microscope: A Property-Level AnalysisDocument38 pagesHouse Prices and Land Prices Under The Microscope: A Property-Level AnalysisAmerican Enterprise InstituteNo ratings yet

- The International Union For Housing Finance 1914-2014: A 100-Year PerspectiveDocument12 pagesThe International Union For Housing Finance 1914-2014: A 100-Year PerspectiveAmerican Enterprise InstituteNo ratings yet

- Retirement Savings 2.0: Updating Savings Policy For The Modern EconomyDocument12 pagesRetirement Savings 2.0: Updating Savings Policy For The Modern EconomyAmerican Enterprise InstituteNo ratings yet

- AEI Special Poll Report: Health Care and The ElectionDocument8 pagesAEI Special Poll Report: Health Care and The ElectionAmerican Enterprise InstituteNo ratings yet

- The Ledger 08/15/14Document2 pagesThe Ledger 08/15/14American Enterprise InstituteNo ratings yet

- The State of The American Worker 2014: Attitudes About Work in AmericaDocument72 pagesThe State of The American Worker 2014: Attitudes About Work in AmericaAmerican Enterprise InstituteNo ratings yet

- The Fed: Watchful Waiting This Year, Tough Choices Next YearDocument4 pagesThe Fed: Watchful Waiting This Year, Tough Choices Next YearAmerican Enterprise InstituteNo ratings yet

- How To Improve Economic Opportunity For Women in The USDocument26 pagesHow To Improve Economic Opportunity For Women in The USAmerican Enterprise InstituteNo ratings yet

- Economic Insecurity: Americans' Concerns About Their Jobs, Personal Finances, Retirement, Health Costs, Housing, and MoreDocument114 pagesEconomic Insecurity: Americans' Concerns About Their Jobs, Personal Finances, Retirement, Health Costs, Housing, and MoreAmerican Enterprise InstituteNo ratings yet

- Iraq, Iran, Nixon's Resignation and More: A Public Opinion RundownDocument12 pagesIraq, Iran, Nixon's Resignation and More: A Public Opinion RundownAmerican Enterprise InstituteNo ratings yet

- Economic Insecurity: Americans' Concerns About Their Jobs, Personal Finances, Retirement, Health Costs, Housing, and MoreDocument115 pagesEconomic Insecurity: Americans' Concerns About Their Jobs, Personal Finances, Retirement, Health Costs, Housing, and MoreAmerican Enterprise InstituteNo ratings yet

- Education and OpportunityDocument17 pagesEducation and OpportunityAmerican Enterprise InstituteNo ratings yet

- Capital Taxation in The 21st CenturyDocument11 pagesCapital Taxation in The 21st CenturyAmerican Enterprise InstituteNo ratings yet

- AEI Enterprise ReportDocument8 pagesAEI Enterprise ReportAmerican Enterprise InstituteNo ratings yet

- The Ledger 08/08/14Document3 pagesThe Ledger 08/08/14American Enterprise InstituteNo ratings yet

- Even If You Like Your Plan, You May Well Lose Your Plan. and Even If You Like Your Doctor, You May Well Lose Your DoctorDocument5 pagesEven If You Like Your Plan, You May Well Lose Your Plan. and Even If You Like Your Doctor, You May Well Lose Your DoctorAmerican Enterprise InstituteNo ratings yet

- Increasing Economic Opportunity For African Americans: Local Initiatives That Are Making A DifferenceDocument21 pagesIncreasing Economic Opportunity For African Americans: Local Initiatives That Are Making A DifferenceAmerican Enterprise InstituteNo ratings yet

- The Ledger 08/01/14Document3 pagesThe Ledger 08/01/14American Enterprise InstituteNo ratings yet

- SSDI Program Growth Will Continue Unless Fundamental Reforms Are ImplementedDocument18 pagesSSDI Program Growth Will Continue Unless Fundamental Reforms Are ImplementedAmerican Enterprise InstituteNo ratings yet

- Does SNAP Support Work? Yes and NoDocument15 pagesDoes SNAP Support Work? Yes and NoAmerican Enterprise InstituteNo ratings yet

- Assessing The Impact of The Dodd-Frank Act Four Years LaterDocument36 pagesAssessing The Impact of The Dodd-Frank Act Four Years LaterAmerican Enterprise InstituteNo ratings yet

- Latin America and Europe Toward A Mutual UnderstandingDocument35 pagesLatin America and Europe Toward A Mutual UnderstandingAmerican Enterprise InstituteNo ratings yet

- Culture of How Washington Pays For Medical CareDocument3 pagesCulture of How Washington Pays For Medical CareAmerican Enterprise InstituteNo ratings yet

- The Ledger 07/18/14Document2 pagesThe Ledger 07/18/14American Enterprise InstituteNo ratings yet

- AEI Special Poll Report: Health Care and The Affordable Care ActDocument18 pagesAEI Special Poll Report: Health Care and The Affordable Care ActAmerican Enterprise Institute100% (1)

- Entrepreneurship For Human FlourishingDocument17 pagesEntrepreneurship For Human FlourishingAmerican Enterprise Institute67% (3)

- What Makes A Bank Systemically Important?Document26 pagesWhat Makes A Bank Systemically Important?American Enterprise InstituteNo ratings yet

- Accounting 1 Assignment 1Document13 pagesAccounting 1 Assignment 1Adinda TiaraNo ratings yet

- Labor Law Guide For NGOs in CambodiaDocument33 pagesLabor Law Guide For NGOs in CambodiaDane Keo100% (1)

- Direct Taxation PDFDocument604 pagesDirect Taxation PDFSasank PacchaNo ratings yet

- Ana Chua Versus Attorney MesinaDocument3 pagesAna Chua Versus Attorney MesinaDona M. ValbuenaNo ratings yet

- BS Adfree 02.01.2020 PDFDocument14 pagesBS Adfree 02.01.2020 PDFSourin SauNo ratings yet

- Thittayil Builders & Developers: Form GST Inv - 1Document2 pagesThittayil Builders & Developers: Form GST Inv - 1SujithNo ratings yet

- Taxation On Religious InstitutionsDocument2 pagesTaxation On Religious InstitutionsJeru SagaoinitNo ratings yet

- Fay Too Much Government Too Much TaxationDocument439 pagesFay Too Much Government Too Much TaxationWade SperryNo ratings yet

- Annual Report 2011Document415 pagesAnnual Report 2011Subramanya BhatNo ratings yet

- By Graham HoltDocument5 pagesBy Graham Holtwhosnext886No ratings yet

- RGP 2009-04Document159 pagesRGP 2009-04maanyag6685No ratings yet

- Full Download Fundamental Managerial Accounting Concepts 9th Edition Edmonds Test BankDocument36 pagesFull Download Fundamental Managerial Accounting Concepts 9th Edition Edmonds Test Bankmargrave.mackinaw.2121r100% (33)

- m20 ATX MYS QPDocument13 pagesm20 ATX MYS QPizzahderhamNo ratings yet

- Invoice OD116033246598925000Document1 pageInvoice OD116033246598925000Dipak MitraNo ratings yet

- Perquisites in Indian Tax SystemDocument5 pagesPerquisites in Indian Tax SystemShreyas DalviNo ratings yet

- The Revenues From Different Sources Received by The Government Are Called Public RevenuesDocument2 pagesThe Revenues From Different Sources Received by The Government Are Called Public Revenuessohan shresthaNo ratings yet

- Course Outline Tax II - Karim Final SY 2223 PG1-2v2Document4 pagesCourse Outline Tax II - Karim Final SY 2223 PG1-2v2Lucifer MorningstarNo ratings yet

- Irr Eo 156Document13 pagesIrr Eo 156Jennifer AndoNo ratings yet

- Bagatsing Vs Ramirez - DigestDocument1 pageBagatsing Vs Ramirez - DigestAnonymous 3cfBSXFNo ratings yet

- Case Digest Volume 7 V3Document74 pagesCase Digest Volume 7 V3Wobusobozi MicheleNo ratings yet

- G.R. No. L-2934Document3 pagesG.R. No. L-2934Randy LorenzanaNo ratings yet

- Marketing Plan - Assessment On INDIAN CUISINE IN NEW ZEALANDDocument7 pagesMarketing Plan - Assessment On INDIAN CUISINE IN NEW ZEALANDseemabulekha484No ratings yet

- GST Licence PDFDocument3 pagesGST Licence PDFkirandevi1981No ratings yet

- Fusion Assets - India Tax DepreciationDocument8 pagesFusion Assets - India Tax DepreciationshashankNo ratings yet

- International TaxationDocument42 pagesInternational TaxationYash MittalNo ratings yet

- What Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeDocument4 pagesWhat Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeBenazir HitoishiNo ratings yet

- Indian Payroll Help SAPDocument133 pagesIndian Payroll Help SAPPrem SinghNo ratings yet

- 2 (36) (C) (Application For Approval As Non-Profit Organization)Document2 pages2 (36) (C) (Application For Approval As Non-Profit Organization)Max ClerkNo ratings yet

- Shubham Devnani DM21A61 (Case Study)Document3 pagesShubham Devnani DM21A61 (Case Study)Shubham DevnaniNo ratings yet

- Market Environment - GodrejDocument13 pagesMarket Environment - GodrejShubhangi AgrawalNo ratings yet

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- Trumpocracy: The Corruption of the American RepublicFrom EverandTrumpocracy: The Corruption of the American RepublicRating: 4 out of 5 stars4/5 (68)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismFrom EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismRating: 4.5 out of 5 stars4.5/5 (42)

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNo ratings yet

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- Confidence Men: Wall Street, Washington, and the Education of a PresidentFrom EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentRating: 3.5 out of 5 stars3.5/5 (52)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)

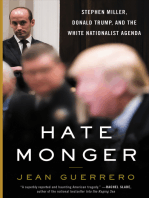

- Hatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaFrom EverandHatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaRating: 4 out of 5 stars4/5 (5)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryFrom EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryRating: 4 out of 5 stars4/5 (6)

- Commander In Chief: FDR's Battle with Churchill, 1943From EverandCommander In Chief: FDR's Battle with Churchill, 1943Rating: 4 out of 5 stars4/5 (16)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityNo ratings yet

- The Invisible Bridge: The Fall of Nixon and the Rise of ReaganFrom EverandThe Invisible Bridge: The Fall of Nixon and the Rise of ReaganRating: 4.5 out of 5 stars4.5/5 (32)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- The Science of Liberty: Democracy, Reason, and the Laws of NatureFrom EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNo ratings yet