Professional Documents

Culture Documents

Strategic Bidding in Electricity Spot Markets Under Uncertainty: A Roadmap

Uploaded by

sunitharajababuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Bidding in Electricity Spot Markets Under Uncertainty: A Roadmap

Uploaded by

sunitharajababuCopyright:

Available Formats

1

Strategic bidding in electricity spot markets under uncertainty: a roadmap

lvaro Ballo, Member, IEEE, Santiago Cerisola, Jos M. Fernndez-Lpez, and Rafael Bellido

the following due to weather changes. Something similar happens with wind production, now a relevant source of electricity in some systems. The unforeseen unavailability of generation units is an exogenous uncertain short-term event too [11]. On the other hand, generation companies are a source of uncertainty for their rivals, as they can change the price at which they offer the production of their units. In addition to uncertainty, there are other elements of the generation business that complicate the process of deciding a bidding strategy. Thermal generation units have short-term operation constraints such as start-up and shut-down curves, ramp-rate limits or minimum-up and -down times. The transmission network poses both upper and lower bounds to the power injected in certain nodes at specific moments. Generation units can provide several products (energy, active power reserves, reactive support), though an increase in the supply of one of these may require a reduction of the others due to limited capacity. Other scarce resources such as hydro reserves or emission allowances have an opportunity cost that must be determined on a daily or weekly basis with a yearly time horizon. The expected evolution of fuel prices should also be taken into account. The aspects mentioned so far are rather general and can be assumed to be present when trying to determine the optimal bidding strategy for any electricity spot market. However, in practice, it is quite frequent to find in the literature approaches that are very different one from another. This can be due to two reasons. Firstly, this is a relatively new field of research and there is still not a generally accepted body of knowledge that provides a common starting point for new developments. And secondly, the variety of spot market designs complicates the identification of a general formulation for the problem. Although this diversity can be interpreted as a consequence of the practical orientation of the proposed methodologies, it leads to some natural questions. Are all the authors that claim to be developing optimal bidding strategies solving a different problem? Is previous work of any help when a researcher or practitioner addresses a new version of the problem? The purpose of this paper is to contribute to the definition of a general framework that can be used to compare or categorize different approaches to address the problem of building optimal bidding strategies, even if they are conceived for different spot market designs. Ideally, such a general framework should reduce the effort that authors usually have to make in order to develop and describe their methodology from scratch. Additionally, it should help to foster new

�

AbstractThe liberalization of the power industry and the creation of electricity spot markets throughout the world has triggered a significant research effort both by academic and practitioners. A part of this effort has been oriented to the development of methodologies and tools devoted to the optimization of bidding strategies for electricity spot markets. Uncertainty with respect to the behavior of the rest of participants is a major ingredient of this problem. After several years a vast literature has been produced on this particular topic. The purpose of this paper is to contribute to the definition of a general body of knowledge by characterizing the most relevant features of some of the lines of research that have been followed. Index TermsElectricity spot markets, optimal bidding strategies, stochastic programming.

N many parts of the world electricity is now traded in wholesale markets in a similar way as other commodities. In particular, numerous electricity spot markets operate on a daily basis, providing a price reference in different regions. Generation companies play a relevant role in these markets because they act as the selling counterparty in most of the transactions. In some cases they are forced by regulation to sell their production under an audited-cost scheme. However, in many cases they do have some freedom to decide the price at which they offer the output of their units. This allows them to internalize opportunity costs that reflect the value of scarce resources such as hydro production, emission allowances or even production capacity (e.g. if they have to decide between using their capacity to produce energy or to provide spinning reserve [40]). In recent years many generation companies have faced the challenge of adapting their organization and processes to the daily operation of an electricity spot market. Designing a framework to decide consistent bidding strategies is one of the central pillars of this new business paradigm. Uncertainty is a major ingredient in electricity spot markets. Electricity is a non-storable commodity and its spot price results from the interaction of a variety of uncertain factors. On the one hand, there are factors that do not depend on the decisions of generation companies. For example, the demand for power can vary notably from one working day to

. Ballo, S. Cerisola, and J.M. Fernndez-Lpez are with Instituto de Investigacin Tecnolgica (IIT), Escuela Tcnica Superior de Ingeniera (ICAI), Universidad Pontificia Comillas de Madrid, Spain (e-mail: alvaro.baillo@iit.upcomillas.es) R. Bellido is with Iberdrola, S.A, Spain.

I. INTRODUCTION

1-4244-0493-2/06/$20.00 2006 IEEE.

research in those aspects that are still insufficiently explored. This work can be seen as a continuation of [12]. We restrict our attention to the case of generation bidding strategies. Demand-side bidding is also allowed in some spot markets and has been studied from the perspective of load serving entities [14], [23] and pumped-storage units [24]. Many of the comments made here could easily be extended to those cases. The paper is organized as follows. Section II discusses the most relevant aspects that must be considered when representing the electricity spot market of interest. Section III focuses on the representation of the behavior of the agents that participate in the electricity spot market. Section IV deals with the representation of the power system, whereas section V analyzes the most frequent solution approaches. Finally, section VI comments the main conclusions of our work.

TABLE I DESCRIBING DIFFERENT SPOT MARKET MECHANISMS AND PRODUCTS Question Some possible answers How many products - Only energy. - Energy and some ancillary services. are traded in the - Energy, ancillary services, transmission capacity. spot market? What trading - Half-hour intervals. intervals are used? - One-hour intervals. - Yes. Are different - No. Each product is traded in an independent market products traded in mechanism. Some products (e.g. energy) may have the same market several mechanisms. mechanism? When does trading - Day-ahead market: 24 hrs prior to delivery. - Transmission: 15 hrs prior to delivery. in each market - Ancillary services: 10 hrs prior to delivery. mechanism take - Balancing: 2 hrs prior to delivery. place? What is the relative - Energy and ancillary services explain 99% of the importance of the spot prices. different products? - Transmission capacity is also relevant. How is trading - By means of an optimization algorithm. conducted? - Based on one or several auctions. - Through bilateral trading.

II. ELECTRICITY SPOT MARKET REPRESENTATION This section presents some of the relevant features of an electricity spot market that must be discussed when developing an optimal bidding methodology. The discussion of these aspects should include at least two elements: a description of how these features are implemented in the spot market of interest and an explanation of how these features are represented in the proposed methodology. A. Modeling different spot market mechanisms and products As with any other commodity, in electricity spot markets electricity is traded for immediate delivery. However, due to the particular characteristics of electricity, spot market trading has to begin several hours (or even days) prior to the moment of physical delivery. In addition to this, the supply of electricity requires the combination of several products, such as active power and ancillary services (active power reserves, and reactive power). Different spot market designs have been adopted to implement these requirements. A description of the market mechanisms and products comprised in the spot market of study is therefore of great interest. Some guidelines for such a description can be seen in table I. After defining these details (and others, if required) it is important to explain which of these elements are being represented and to justify why others are being neglected. It is also important to evaluate the implications of any simplifications that may be assumed. For example, [40] suggests a representation including a day-ahead energy market and a spinning reserve market in order to represent the extinct California electricity market, although only one trading interval is considered. In [5] and [31] a multistage approach is proposed in order to represent three subsequent auctions of the Spanish electricity spot market: the day-ahead market, the secondary reserve market and the balancing market. In contrast, in [35] a bilateral trading environment is considered. B. Modeling the information submitted by agents 1) The supply side The creation of electricity spot markets has changed the way in which generation companies express and implement their operation plans. Under the old obligation-to-serve scheme the decision was how to operate the plants to reliably satisfy demand at the minimum possible cost. In the context of a spot market generation companies have to express on a daily basis the amount of power or ancillary services they are willing to provide in each node of the network at each price. The format in which a generation company must define its bidding strategy depends on the spot market of study. Table II provides some useful questions to orient the description of such format (one illustrative example has been suggested for each possible answer).

TABLE II DESCRIBING THE FORMAT REQUIRED FOR SUPPLY-SIDE BIDDING STRATEGIES Question Some possible answers (and examples) Considers non-convex - Yes: can include start-up and no-load costs (old costs? UK Pool). - No: can only include incremental operating costs (German EEX Spot). Considers operation - Yes: can include ramp-rate limits, daily energy constraints? limits,etc. (Australian NEMMCO). - No (German EEX Spot). Bids can change - Yes (Spanish OMEL). between hours? - No (old UK Pool). Portfolio bidding - Yes: No link required between bids and units allowed? (French PowerNext). - No: Each bid must refer to a particular unit (Spanish OMEL). Zonal/nodal bidding? - Yes: Bids must refer to a zone/node (PJM). - No: Single node bidding (German EEX Spot). Limited number of - Yes: A limited number of blocks is allowed (10 bids? blocks per unit in Australian NEMMCO). - No: Any number of bids can be submitted. Type of aggregate bid - Stepwise or staircase (Spanish OMEL). curves (if used) - Piecewise linear (French PowerNext).

The format in which bidding strategies must be submitted to the spot market is important for two reasons. On the one hand, it is obvious that the proposed methodology must suggest optimal bidding strategies that mimic that format. On the other hand, the representation of the rest of generation companies should take into account the format in which they will be making their decisions. If the proposed methodology includes an accurate representation of the format in which the company of study will be deciding its bidding strategies, the solution obtained might be used in a straightforward manner, which is clearly an advantage. Table III shows some examples of how bidding strategies have been represented by different authors.

TABLE III SOME APPROACHES USED TO REPRESENT BIDDING STRATEGIES OF THE GENERATION COMPANY OF INTEREST Approach Examples Affine function [16], [27], [39], [40] Quadratic function [11], [42] Piecewise linear function [14], [17], [18] Stepwise function [8], [21], [22], [25], [28], [30], [33], [34], Any function [2], [4], [5], [31]

cleared and the products are priced typically differs from one electricity spot market to another. Clearing and pricing rules are a key input when developing bidding strategies, as shown in [32]. The firmness of the results of the spot market is also relevant, given that it determines the payments received by agents. Table IV suggests some questions that can help to describe such features of the spot market.

TABLE IV DESCRIBING CLEARING AND PRICING IN A PARTICULAR MARKET MECHANISM Question Some possible answers How is the market - By means of an optimization algorithm. mechanism cleared? - Based on one or several auctions. - Through bilateral trading. Is the link between trading - No. Trading intervals are independent. intervals considered? - Yes (e.g. ramp-rate limits are considered). How is the transmission - Imbedded in the clearing process. network considered? - By means of an ex-post analysis. How are the different - Based on the dual variables of the products priced? optimization. - Based on the intersection of the aggregate offer and demand curves. - Each transaction has its price. Are generation units paid - Yes (though subsequent payments may arise). according to the results of - No (e.g. they are paid according to the actual supply of energy and ancillary services). this market mechanism?

In contrast, less modeling effort may be required to represent the bidding strategies of the rest of generation companies, as long as it yields a reasonable approximation of the spot market results from the point of view of the company of study. In many cases, however, the bidding strategies of all generation companies are represented in the same manner. 2) The demand side The participation of the demand side can vary notably from one spot market to another, or even between two mechanisms of the same spot market. Describing the role played by the demand side is usually quite simple. Demand-side bidding is permitted only in some particular market mechanisms. In other case demand is administratively determined by some entity and is typically inelastic (i.e. insensitive to price changes). For example, in the Spanish day-ahead market demand-side bids are submitted by distribution companies, load serving entities, large consumers, external agents (for exporting) and generation companies owning pumped-storage units. In contrast, demand in the secondary reserve market is set by the System Operator. Hence, the description is typically reduced to indicating whether demand-side bidding is allowed. The format of the purchase bids will usually be parallel to that of sell offers. The representation of demand is immediate if it is inelastic: one quantity for each trading period. In contrast, if demandside bidding is allowed, it should be modeled in a similar fashion as the bidding strategies of generation companies. C. Modeling clearing, pricing and uncertainty in a particular spot market mechanism The manner in which the different market mechanisms are

An optimal bidding methodology will normally include simplifications in its representation of how the market mechanisms are cleared or how the products are priced. These simplifications should be explained. In general, authors typically adopt one of four alternative approaches to represent market clearing and pricing. Each approach permits the explicit representation of uncertainty with respect to the market outcome. 1) The first approach is based on considering a uniform pricing scheme and assuming that the decisions made by the company of interest do not affect the market clearing price (i.e. the company is a price taker). The market clearing process can then simply be represented with the market clearing price. Uncertainty can be introduced in terms of price scenarios [8]. Several trading intervals can be modeled by means of a price for each interval. A disadvantage of this approach is that only small generation companies can be considered price takers. An advantage is that, if a company can be assumed to be a price taker, the problem is usually separable into several independent subproblems, one for each generation unit. 2) The second approach consists of a two-level representation in which, at the first level, market participants try to maximize their expected profits and, at the second level, the system operator determines the optimal dispatch and the clearing price. Under this framework the generation company of study and its rivals are usually represented in the same terms. This has the advantage of permitting a detailed representation of the market clearing process. A disadvantage is that, in most cases, the problem cannot be solved in a straightforward manner. Uncertainty can be introduced in the form of

scenarios of competitors bidding strategies [30]. These models usually represent several trading intervals. 3) The third approach is based on the idea of residual demand function, which indicates the quantity that the company of interest can sell at each market clearing price (see Fig. 1). The residual demand can be interpreted as a condensed representation of both rivals and the demand side. The market clearing process is then represented by the intersection of the companys offer curve and the residual demand curve in each trading interval. Uncertainty can be modeled in terms of residual demand scenarios [5]. Several trading intervals can be represented by defining a residual demand curve for each interval.

Price Aggregate demand Rivals aggregate offer Aggregate offer Price

Companys residual demand

Total sales Fig. 1. The idea of residual demand.

Companys sales

4) A final representation that has received attention is known as market distribution function [2]. This function � � q, p � indicates the probability with which a certain quantity-price pair

� q, p �

will not be completely

accepted. In other words, it expresses the probability with which the agents last accepted offer will be located between the origin and � q, p � . Consequently,

� � q2 , p2 � �� � q1 , p1 � provides the probability with

which the agents last accepted offer will lie between � q1 , p1 � and � q2 , p2 � , as shown in Fig.2. The market distribution function concept can be generalized to represent several trading intervals. Table V provides some examples of these four alternative modeling approaches.

Price p

D. Modeling uncertainty in a sequence of spot market mechanisms As mentioned, some spot markets are organized as sequences of market mechanisms. Hence, it is natural to develop a methodology that simultaneously considers these market mechanisms in order to determine a bidding strategy that is consistent with all of them. For example, assume that a generation company is trying to decide its optimal bidding strategy for a spot market with four market mechanisms: a day-ahead market, an adjustment market, a spinning reserve market and a balancing mechanism (Fig. 3). The generation company decides its offers for the adjustment market after the clearing of the day-ahead market. Similarly, the company decides its offers for the reserve market after the clearing of the adjustment market. Subsequently, the company introduces last-minute changes to its generation schedule through the balancing mechanism. In each market mechanism, the generation company has the possibility of taking recourse actions to correct any undesired results obtained in previous market mechanisms. Fig. 3 illustrates the decision process, which obviously has the structure of a multistage stochastic program with recourse [6]. Given this structure, a multistage stochastic programming framework can be adopted in order to address the problem of deciding optimal strategies for an agent that participates in such an electricity spot market [5], [26], [31], [36]. Building a scenario tree such as the one depicted in Fig. 3 is not easy. In [31] the stochastic process of each market mechanism is modeled as an ARIMA process. A nested simulation process is performed that yields a huge multistage scenario tree. Finally, a scenario-tree reduction technique is applied to obtain a computationally tractable structure.

Offers for the dayahead market Day-ahead market discrete probability distribution Day-ahead market clearing Adjustment market discrete probability distribution Adjustment market clearing Reserve market discrete probability distribution Reserve market clearing Balancing mechanism discrete probability distribution Balancing mechanism clearing Generation schedule

Offers for the adjustment market

� q2 , p2 �

� � � q2 , p2 �

Offers for the reserve market

� q1 , p1 �

� � � q1 , p1 �

Companys sales q Fig. 2. The market distribution function.

Offers for the balancing mechanism

TABLE V SOME APPROACHES USED TO REPRESENT MARKET CLEARING AND PRICING Approach Examples Market clearing price [8], [25],[33] Two-level representation [16], [17], [21], [22], [30], [36], [38] Residual demand [5], [7], [13], [15], [28] Market distribution function [2], [3], [4]

Fig. 3. The decision process of a generation company for a sequence of spot market mechanisms.

E. Information disclosure The release of information relative to spot market results and to the bids submitted by the agents is a very relevant aspect for the development of an optimal bidding methodology. It is also an issue of great concern for regulatory authorities. The disclosure of bidding data receives a variety of treatments throughout the world. Revealing the particular bids submitted by each participant is usually considered inappropriate due to the risk of strategic coordination between agents. In contrast, publishing the bids submitted by all agents in an aggregate manner reduces the information asymmetries that otherwise would arise due to differences in agents sizes. In Ontario, for example, agents do not have access to historical information relative to the bids or dispatch results of their competitors [33]. This complicates the construction of spot market scenarios. In contrast, in Spain, aggregate bidding curves are made available after the clearing of each market mechanism. In this manner each company has access to its most recent residual demand curves. It is of great importance to explain the hypotheses assumed regarding information disclosure, given that they condition the input data that can be used for any optimal bidding methodology. These assumptions should be consistent with the rules of the spot market of interest.

TABLE VI RISK MANAGEMENT IN SHORT-TERM DECISION-MAKING Approach Examples Utility function [14], [16], [33] Bound on the margin variance [9], [26] Bound on VaR [11] Bound on CVaR [19]

III. MODELING THE STRATEGIC BEHAVIOR OF AGENTS A. Modeling risk-neutral rational behavior It is usual to assume that generation companies behave rationally, which means that they take the actions leading to their highest expected utility. If risk neutrality is also assumed then generation companies are expected to try to maximize their expected operational margin, i.e. the difference between their revenues and their operational costs. B. Modeling risk aversion The uncertainty faced by generation companies in electricity spot markets is a relevant source of risk because, under certain realizations of uncertainty, their operational margin can be significantly lower than expected [10]. It is therefore natural to incorporate risk aversion into the optimal bidding problem. There are basically two ways to represent risk aversion. The first one is to define a risk-averse utility function for the generation company of interest so that low-margin scenarios are penalized [16]. The second one is to impose a bound to some risk measure (e.g. the variance of the operational margin, the value at risk, VaR, or the conditional value at risk, CVaR). Table VI provides some examples of how different authors have introduced risk aversion into their models.

C. Modeling long-term decisions It is important to highlight that the decisions that generation companies take in each spot market session affect not only their revenues in that session but also their future revenues in subsequent spot market sessions and other decision frameworks (e.g. new forward contracts or investment in new capacity). Additionally, the revenues obtained by the company in the spot market depend on decisions that may have been taken well in advance, such as forward contracts. It is evident that these aspects have an influence on the development of bidding strategies for the spot market [1], although the precise manner in which this influence is exerted is still a matter of discussion [41]. For example, in the case of forward contracts, a selling position diminishes the exposure of a company to the spot price, thus reducing its interest in high spot prices. However, current spot prices are used as a reference for subsequent contracts, which puts upward pressure on spot prices. From a different point of view, when a company makes an investment decision it has an incentive to behave more competitively in order to deter entrance [37]. In spite of these open questions, a methodology to construct optimal bidding strategies should consider the influence of all or some of these long-term decisions on the operational margin of the company of interest. For example, in [30] financial contracts and investment decisions as well as the opportunity cost of hydro resources are incorporated into an optimal bidding model.

IV. POWER SYSTEM REPRESENTATION As mentioned, the transactions performed in an electricity spot market are oriented to immediate physical delivery. Hence, generation companies should take into account the different generation schedules that might arise from their bidding strategy. In order to do so, there are two relevant aspects of the spot market design that must be considered. The first one is whether portfolio bidding is allowed. In such case, after the clearing of the spot market, each generation company can decide the best generation schedule in order to comply with its production obligations. In other case, the generation company must decide ex-ante the generation unit that corresponds to each bid. In both cases, the generation company should identify the lowest-cost feasible generation schedule corresponding to each spot market outcome. The second aspect that must be considered is the influence of the transmission network on the spot market results. In

some spot markets this influence may be irrelevant whereas in others it may pose significant constraints on the transactions that can be performed through the spot market. In the latter case a representation of the transmission network should be included in the strategic bidding methodology. A. Generation system representation The manner in which different authors represent the generation system varies greatly. It ranges from simply considering the aggregate marginal cost function of the company of interest to modeling in detail the operation of individual generation units. A distinguishing feature is whether the model includes generation intertemporal costs (e.g. start-up costs) and constraints (e.g. ramp-rate limits). This forces the modeler to simultaneously consider several trading intervals. Table VI displays the different representation approaches adopted by some authors.

TABLE VI DIFFERENT REPRESENTATIONS OF THE GENERATION SYSTEM Approach Examples Aggregate cost function [2], [4], [27], [32], [36], Individual generation units [16], [19], [22], [25], [29], [39], [40] Intertemporal costs and [5], [7], [8], [9], [11], [13], [17], [18], [21], constraints [26], [28], [30], [31], [33], [42]

B. Transmission network representation In those cases in which the transmission network exerts a relevant influence on the results of the spot market, it must be taken into account in order to develop optimal bidding strategies. In general, when authors include the transmission network in their models they do so under the two-level framework described in section II.C.2) and considering only active power flows [16], [22], [29], [30].

V. SOLUTION APPROACHES The mathematical problems that arise when applying an optimal bidding methodology to numerical examples are typically extremely difficult to solve. As a result, a variety of solution approaches have been suggested in the literature, four of which are analyzed in this section. In general terms it can be said that mathematical programming techniques are used when only the generation company of interest is represented in detail (see [30] for an exception). Game theory, genetic algorithms and other ad-hoc approaches are typically used when several generation companies are represented. A. Mathematical programming techniques In some cases the mathematical problem resulting from the formulation of the optimal bidding problem is amenable to mathematical programming techniques. We have identified three typical situations in which the optimal bidding problem is addressed as a mathematical programming problem:

1) In some cases the problem can be solved with a commercial optimizer in a straightforward manner. For example, in [31] the multistage stochastic programming problem faced by a company when optimizing its bids for a sequence of three market mechanisms is formulated as an equivalent deterministic problem and efficiently solved using a commercial mixed linear-integer solver. In [30], the optimal bidding problem of a generation company is formulated as a mathematical program with equilibrium constraints. A binary representation scheme is adopted in order to deal with the complementarity constraints. A commercial mixed linear-integer solver is used to solve the resulting problem. Another example in which the problem is solved with a commercial algorithm is [33]. 2) In other cases the problem has a structure that can be exploited by using a decomposition technique. For example, in [28] the strategic bidding problem is formulated as a two-stage stochastic programming problem. In the first stage, the generation company decides its generation schedule for the first day and its bids for the next day. In the second stage the generation company takes recourse actions once the outcome of the spot market for the next day is known. Due to the presence of binary variables in the second stage the problem is solved with a Lagrangian relaxation algorithm by relaxing the non-anticipative constraints that link different scenarios. In [5] the second-stage part is formulated as a linear program and a standard Benders decomposition algorithm is used. In [42] a different Lagrangian relaxation scheme is used, leading to the iterative solution of a set of subproblems, one for each generating unit and an additional one to construct the companys offer curve. The presence of this subproblem, in which the companys revenues are evaluated at each iteration, is an interesting result and shows how traditional generation scheduling procedures based on LR can be adapted to the new competitive environment. 3) Some authors concentrate on the formulation of the necessary and sufficient optimality conditions that must be fulfilled by a bidding curve to be locally optimal. For example, in [2] a set of necessary optimality conditions is derived assuming a market distribution function such as the one described in section II.C.4). The authors base their analysis on the systematic application of optimal control theory to the trajectory followed by the bidding curve. They start by considering a curve and then perturb it to derive the conditions that must hold for it to be locally optimal. The same line of reasoning is followed in [4] to develop necessary and sufficient conditions for local optimality. A link can be established between this approach and that of [18], in which a nominal bidding curve is built by optimizing the companys generation schedule given a set of price scenarios. Then a population of alternative bidding curves is constructed by perturbing the nominal bidding curve. Finally one of these curves is selected based on an ordinal optimization procedure.

B. Game theory Several authors have applied game theory to the problem of deriving the optimal bidding strategies for a set of generators. For example, [35] develops an algorithm for calculating Nashequilibrium bidding strategies in a bilateral trading environment. In [27] the bidding strategies of a set of generators with forward contracts are analyzed using the supply function equilibrium approach, originally suggested in [20]. C. Genetic algorithms Genetic algorithms have received attention from several authors in order to iteratively look for locally optimal bidding strategies. For example, [39] proposes sampling rivals bidding strategies with the Monte Carlo method and then optimizing the companys strategy with a genetic algorithm. A probability distribution is thus obtained for the companys profits both in the day-ahead and the spinning reserve market. A similar procedure is suggested in [16]. D. Ad-hoc algorithms Certain optimal bidding methodologies lead to problem structures that cannot be efficiently solved or addressed using the abovementioned techniques. This forces authors to develop ad-hoc algorithms in order to obtain numerical results. For example, in [21] an iterative algorithm is used to derive optimal bidding strategies for a set of agents participating in a day-ahead market. A similar approach is used in [11] and [22].

optimal bidding methods. An interesting conclusion that can be drawn from this work is that, in spite of the diversity of proposals that can be found in the literature, it is possible to identify a few dominant approaches in each of the aspects that we have examined. What is more, certain combinations of approaches seem to be preferred by authors. This suggests that the research in this field is more structured than it seems. This work can serve as a roadmap to define new optimal bidding methodologies for electricity spot markets.

VII. REFERENCES

[1] B. Allaz and J.-L. Villa, "Cournot Competition, Forward Markets and Efficiency," Journal of Economic Theory, vol. 59, pp. 1-16, 1993. [2] E. J. Anderson and A. B. Philpott, "Optimal offer construction in electricity markets," Mathematics of Operations Research, vol. 27, pp. 82-100, 2002. [3] E. J. Anderson and A. B. Philpott, "Estimation of electricity market distribution functions," Annals of Operations Research, vol. 121, pp. 2132, 2003. [4] E. J. Anderson and H. Xu, "Necessary and sufficient conditions for optimal offers in electricity markets," SIAM Journal on Control and Optimization, vol. 41, pp. 1212-1228, 2002. [5] A. Baillo, M. Ventosa, M. Rivier, and A. Ramos, "Optimal Offering Strategies for Generation Companies Operating in Electricity Spot Markets," IEEE Trans. Power Syst., vol. 19, pp. 745-753, 2004. [6] J. R. Birge and F. Louveaux, Introduction to Stochastic Programming, 1st ed. New York: Springer, 1997. [7] A. J. Conejo, J. Contreras, J. M. Arroyo, and S. de la Torre, "Optimal Response of an Oligopolistic Generating Company to a Competitive PoolBased Electric Power Market," IEEE Transactions on Power Systems, vol. 17, pp. 424-430, 2002. [8] A. J. Conejo, F. J. Nogales, and J. M. Arroyo, "Price-Taker Bidding Strategy Under Price Uncertainty," IEEE Trans. Power Syst., vol. 17, pp. 1081-1088, 2002. [9] A. J. Conejo, F. J. Nogales, J. M. Arroyo, and R. Garca-Bertrand, "RiskConstrained Self-Scheduling of a Thermal Power Producer," IEEE Trans. Power Syst., vol. 19, pp. 1569-1574, 2004. [10] R. Dahlgren, C.-C. Liu, and J. Lawarre, "Risk Assessment in Energy Trading," IEEE Trans. Power Syst., vol. 18, pp. 503-511, 2003. [11] D. Das and B. F. Wollenberg, "Risk Assessment of Generators Bidding in Day-Ahead Market," IEEE Trans. Power Syst., vol. 20, pp. 416-424, 2005. [12] A. K. David and F. Wen, "Strategic Bidding in Competitive Electricity Markets: a Literature Survey," presented at IEEE PES Summer Meeting, Seattle, Washington, 2000. [13] S. De la Torre, J. M. Arroyo, A. J. Conejo, and J. Contreras, "Price Maker Self-Scheduling in a Pool-Based Electricity Market: A Mixed-Integer LP Approach," IEEE Trans. Power Syst., vol. 17, pp. 1037-1042, 2002. [14] S.-E. Fleten and E. Pettersen, "Constructing Bidding Curves for a PriceTaking Retailer in the Norwegian Electricity Market," IEEE Trans. Power Syst., vol. 20, pp. 701-708, 2005. [15] J. Garca-Gonzlez, J. Romn, J. Barqun, and A. Gonzlez, "Strategic Bidding in Deregulated Power Systems," presented at 13th Power Systems Computation Conference, Trondheim, Norway, 1999. [16] V. P. Gountis and A. G. Bakirtzis, "Bidding Strategies for Electricity Producers in a Competitive Electricity Marketplace," IEEE Trans. Power Syst., vol. 19, pp. 356-365, 2004. [17] G. Gross and D. Finlay, "Generation Supply Bidding in Perfectly Competitive Electricity Markets," Computational & Mathematical Organization Theory, vol. 6, pp. 83-98, 2000. [18] X. Guan, Y.-C. Ho, and F. Lai, "An Ordinal Optimization Based Bidding Strategy for Electric Power Suppliers in the Daily Energy Market," IEEE Trans. Power Syst., vol. 16, pp. 788-797, 2001. [19] R. A. Jabr, "Robust Self-Scheduling Under Price Uncertainty Using Conditional Value-at-Risk," IEEE Trans. Power Syst., vol. 20, pp. 18521858, 2005. [20] P. D. Klemperer and M. A. Meyer, "Supply Function Equilibria in

VI. CONCLUSIONS This paper has presented a comprehensive review of the problem of constructing optimal bidding strategies for generation companies in electricity spot markets under uncertainty. The objective of this work has been to contribute to the definition of a unifying framework, given the variety of approaches that have been suggested to address this problem in recent years. We have examined in detail many of the features of an electricity spot market that are relevant in this context, including different market mechanisms and products, the format of bidding strategies, the manner in which markets are cleared and products priced, the amount of information that is released, the behavior that can be expected from generation companies, the connection with the physics of the generation units and the influence of the transmission network. We have also suggested guidelines to describe some of these features and provided examples of how these features have been incorporated by different authors into their models. Moreover, we have categorized the different modeling approaches and have evaluated their advantages and disadvantages. We have paid particular attention to the solution techniques that authors have used in order to obtain numerical results with their

8 Oligopoly under Uncertainty," Econometrica, vol. 57, pp. 1243-1277, 1989. [21] C.-a. Li, A. J. Svoboda, X. Guan, and H. Singh, "Revenue Adequate Bidding Strategies in Competitive Electricity Markets," IEEE Trans. Power Syst., vol. 14, pp. 492-497, 1999. [22] T. Li and M. Shahidehpour, "Strategic Bidding of TransmissionConstrained GENCOs with Incomplete Information," IEEE Trans. Power Syst., vol. 20, pp. 437-447, 2005. [23] Y. a. Liu and X. Guan, "Purchase Allocation and Demand Bidding in Electric Power Markets," IEEE Trans. Power Syst., vol. 18, pp. 106-112, 2003. [24] N. Lu, J. H. Chow, and A. A. Desrochers, "Pumped-Storage HydroTurbine Bidding Strategies in a Competitive Electricity Market," IEEE Trans. Power Syst., vol. 19, pp. 834-841, 2004. [25] P. J. Neame, A. B. Philpott, and G. Pritchard, "Offer Stack Optimization in Electricity Pool Markets," Operations Research, vol. 51, pp. 397-408, 2003. [26] E. Ni, P. B. Luh, and S. Rourke, "Optimal Integrated Generation Bidding and Scheduling With Risk Management Under a Deregulated Power Market," IEEE Trans. Power Syst., vol. 19, pp. 600-609, 2004. [27] H. Niu, R. Baldick, and G. Zhu, "Supply Function Equilibrium Bidding Strategies With Fixed Forward Contracts," IEEE Trans. Power Syst., vol. 20, pp. 1859-1867, 2005. [28] M. P. Nowak, R. Schultz, and M. Westphalen, "A stochastic integer programming model for incorporating day-ahead trading of electricity into hydro-thermal unit commitment," Optimization and Engineering, vol. 6, pp. 163-176, 2005. [29] T. Peng and K. Tomsovic, "Congestion Influence on Bidding Strategies in an Electricity Market," IEEE Trans. Power Syst., vol. 18, pp. 1054-1061, 2003. [30] M. V. Pereira, S. Granville, M. H. C. Fampa, R. Dix, and L. A. Barroso, "Strategic Bidding Under Uncertainty: A Binary Expansion Approach," IEEE Trans. Power Syst., vol. 20, pp. 180-188, 2005. [31] M. . Plazas, A. J. Conejo, and F. J. Prieto, "Multimarket Optimal Bidding for a Power Producer," IEEE Trans. Power Syst., vol. 20, pp. 2041-2050, 2005. [32] Y. Ren and F. D. Galiana, "Pay-as-Bid versus Marginal PricingPart I: Strategic Generator Offers," IEEE Trans. Power Syst., vol. 19, pp. 17711776, 2004. [33] C. P. Rodriguez and G. J. Anders, "Bidding Strategy Design for Different Types of Electric Power Market Participants," IEEE Trans. Power Syst., vol. 19, pp. 964-971, 2004. [34] G. B. Shrestha, S. Kai, and L. Goel, "Strategic Bidding for Minimum Power Output in the Competitive Power Market," IEEE Trans. Power Syst., vol. 16, pp. 813-818, 2001. [35] H. Song, C.-C. Liu, and J. Lawarre, "Nash Equilibrium Bidding Strategies in a Bilateral Electricity Market," IEEE Trans. Power Syst., vol. 17, pp. 73-79, 2002. [36] H. Song, C.-C. Liu, J. Lawarre, and R. W. Dahlgren, "Optimal Electricity Supply Bidding by Markov Decision Process," IEEE Trans. Power Syst., vol. 15, pp. 618-624, 2000. [37] W. K. Viscusi, J. M. Vernon, and J. E. Harrington, Economics of Regulation and Antitrust, 2nd ed. Boston: The MIT Press, 1998. [38] J. D. Weber and T. J. Overbye, "A two-level optimization problem for analysis of market bidding strategies," presented at IEEE Power Engineering Society Summer Meeting, Edmonton, 1999. [39] F. Wen and A. K. David, "Optimal Bidding Strategies and Modeling of Imperfect Information Among Competitive Generators," IEEE Trans. Power Syst., vol. 16, pp. 15-21, 2001. [40] F. Wen and A. K. David, "Optimally co-ordinated bidding strategies in energy and ancillary service markets," IEE Proceedings in Generation, Transmission and Distribution, vol. 149, pp. 331-338, 2002. [41] J. Yao, S. S. Oren, and I. Adler, "Computing Cournot Equilibria in Two Settlement Electricity Markets with Transmission Constraints," presented at Hawaii International Conference On System Sciences, HICSS37, Big Island, Hawaii, 2003. [42] D. Zhang, Y. Wang, and P. B. Luh, "Optimization Based Bidding Strategies in the Deregulated Market," IEEE Trans. Power Syst., vol. 15, pp. 981-986, 2000.

VIII. BIOGRAPHIES

Alvaro Baillo (M2002) received the Electrical Engineering degree in 1998 and the doctoral degree in 2002 from Universidad Pontificia Comillas, Madrid, Spain. He is a Research Fellow at the Instituto de Investigacin Tecnolgica (IIT) and an Assistant Professor at the Department of Industrial Organization of Comillas Engineering School (ICAI). His main interest is the development of optimization models applied to the operation, planning, regulation and economy of the power industry. Santiago Cerisola received the Mathematics degree in 1997 from Universidad Complutense de Madrid and the doctoral degree in 2002 from Universidad Pontificia Comillas, Madrid, Spain. He is Research Fellow at the Instituto de Investigacin Tecnolgica (IIT). His main interest is the development of stochastic programming applications with particular emphasis in decomposition techniques. Jos M. Fernndez-Lpez received the Electrical Engineering degree in 2004 from Universidad Pontifica Comillas, Madrid, Spain. He is a Research Fellow at the Instituto de Investigacin Tecnolgica (IIT). His main interest is the development of optimization models applied to the planning and operation of electrical energy systems. Rafael Bellido received the Electrical Engineering degree in 1996 from Universidad Pontificia Comillas, Madrid, Spain. He is a trading manager in the Planning and Offers Unit (PYOFE) of the Energy Management Division of Iberdrola, S.A. His main interest is the operation, planning, regulation and economy of the power industry.

You might also like

- Evolving Bidding Formats and Pricing Schemes in US and Europe Day-Ahead Electricity MarketsDocument38 pagesEvolving Bidding Formats and Pricing Schemes in US and Europe Day-Ahead Electricity MarketsKamil M. AhmedNo ratings yet

- Electricity Market Modeling Trends: Mariano Ventosa, ! Alvaro Ba !ıllo, Andr!es Ramos, Michel RivierDocument17 pagesElectricity Market Modeling Trends: Mariano Ventosa, ! Alvaro Ba !ıllo, Andr!es Ramos, Michel RivierSuad SalijuNo ratings yet

- Market Architecture of Restructured Power SystemsDocument5 pagesMarket Architecture of Restructured Power SystemsAkshay Sharma100% (1)

- Energy Trading Article An Electricity Day-Ahead Market Simulation ModelDocument5 pagesEnergy Trading Article An Electricity Day-Ahead Market Simulation ModelJustyna LipskaNo ratings yet

- Electricity Markets and Renewable Generation RevisedDocument334 pagesElectricity Markets and Renewable Generation RevisedMuhammad Anwar Ul Haq100% (1)

- Restructuring of The Nigerian Electricity Industry: A Partial Equilibrium AnalysisDocument20 pagesRestructuring of The Nigerian Electricity Industry: A Partial Equilibrium Analysisadwa_anj89No ratings yet

- Computing Market EquilibriumDocument8 pagesComputing Market EquilibriumLTE002No ratings yet

- Electricity Market Modeling TrendsDocument18 pagesElectricity Market Modeling TrendsManohar LalNo ratings yet

- Textbook Electricity Markets Elearning 2008 With Cover Eng FINAL PDFDocument68 pagesTextbook Electricity Markets Elearning 2008 With Cover Eng FINAL PDFAnis.MNo ratings yet

- Energy Policy: Yanchao Liu, Jesse T. Holzer, Michael C. FerrisDocument11 pagesEnergy Policy: Yanchao Liu, Jesse T. Holzer, Michael C. FerrisSyamasree RahaNo ratings yet

- Simulating DSM Impact in The New Liberalized Electricity MarketDocument8 pagesSimulating DSM Impact in The New Liberalized Electricity MarketDoankhoa DoanNo ratings yet

- Spot Fuel Markets' Influence On The Spot Electricity Market Using Leontief ModelDocument7 pagesSpot Fuel Markets' Influence On The Spot Electricity Market Using Leontief ModelgbshebleNo ratings yet

- Energies 11 00822Document19 pagesEnergies 11 00822anu_2013No ratings yet

- Demand AgregatorsDocument13 pagesDemand Agregatorsmaria jurado lopezNo ratings yet

- Distributed Locational Marginal PricesDocument10 pagesDistributed Locational Marginal PricesChetan KotwalNo ratings yet

- Electricity Markets and Renewable GenerationDocument326 pagesElectricity Markets and Renewable GenerationElimar RojasNo ratings yet

- Energy Journal PaperDocument18 pagesEnergy Journal Paperelpepe potatzioNo ratings yet

- Automated Electricity Energy Market ModelDocument11 pagesAutomated Electricity Energy Market ModelGero PlatanosNo ratings yet

- Diseño Del Mercado Eléctrico - Peter CramtonDocument24 pagesDiseño Del Mercado Eléctrico - Peter Cramtonjuan manuelNo ratings yet

- Power Markets With Renewables: New Perspectives For The European Target ModelDocument16 pagesPower Markets With Renewables: New Perspectives For The European Target ModelNick SimanNo ratings yet

- Electrical Power and Energy Systems: Debin Fang, Jingfang Wu, Dawei TangDocument9 pagesElectrical Power and Energy Systems: Debin Fang, Jingfang Wu, Dawei TangprateekbaldwaNo ratings yet

- Incentivos para Una Oferta Adecuada en Los Mercados de Electricidad:una Aplicación Al Sector Eléctrico MexicanoDocument34 pagesIncentivos para Una Oferta Adecuada en Los Mercados de Electricidad:una Aplicación Al Sector Eléctrico MexicanoNoticide Ciencias SocialesNo ratings yet

- Market Architecture: Robert WilsonDocument22 pagesMarket Architecture: Robert WilsonSiddharth VenkatNo ratings yet

- Prosumer Bidding and Scheduling in Electricity MarketsDocument16 pagesProsumer Bidding and Scheduling in Electricity MarketsAtiquzzaman ShomaNo ratings yet

- Electricity Market DesignDocument24 pagesElectricity Market DesignrtorrescoralNo ratings yet

- Chapter Seven Electricity Pricing and ManagementDocument20 pagesChapter Seven Electricity Pricing and ManagementBassem MostafaNo ratings yet

- 1928 TextDocument25 pages1928 TextPaulo OyanedelNo ratings yet

- Dispatch Optimization and Economic Evaluation of Distributed Generation in A Virtual Power PlantDocument6 pagesDispatch Optimization and Economic Evaluation of Distributed Generation in A Virtual Power Plantselaroth168No ratings yet

- Strategic Bidding and Generation Scheduling in Electricity Spot-MarketDocument6 pagesStrategic Bidding and Generation Scheduling in Electricity Spot-MarketNorway ChadNo ratings yet

- Course Notes For EE394V Restructured Electricity Markets: Locational Marginal PricingDocument62 pagesCourse Notes For EE394V Restructured Electricity Markets: Locational Marginal PricingLTE002No ratings yet

- Electric Power Systems Research: SciencedirectDocument12 pagesElectric Power Systems Research: Sciencedirectoctober87No ratings yet

- Modelling Electricity Spot and Futures PriceDocument115 pagesModelling Electricity Spot and Futures PriceBoris CikoticNo ratings yet

- Forecasting Next-Day Electricity Prices by Time Series ModelsDocument7 pagesForecasting Next-Day Electricity Prices by Time Series Modelsmail_205402752No ratings yet

- Auctions As Competition Mechanisms and The Brazilian Energy Industries Recent ExperienceDocument8 pagesAuctions As Competition Mechanisms and The Brazilian Energy Industries Recent ExperienceHeloisa BorgesNo ratings yet

- Vote For Your Energy: A Market Mechanism For Local Energy Markets Based On The Consumers, PreferencesDocument6 pagesVote For Your Energy: A Market Mechanism For Local Energy Markets Based On The Consumers, PreferencesDanilo GilNo ratings yet

- Ijert Ijert: Bidding Strategy For Competitive Electricity Market by Using Optimization Technique (Pso & Apso)Document8 pagesIjert Ijert: Bidding Strategy For Competitive Electricity Market by Using Optimization Technique (Pso & Apso)Saurav NandaNo ratings yet

- Optimal Response of An Oligopolistic Generating Company To A Competitive Pool-Based Electric Power MarketDocument7 pagesOptimal Response of An Oligopolistic Generating Company To A Competitive Pool-Based Electric Power MarketwilliamnuevoNo ratings yet

- Energies 14 03521 v3Document24 pagesEnergies 14 03521 v3marskie checkNo ratings yet

- A Wholesale Power Trading Simulator With Learning CapabilitiesDocument11 pagesA Wholesale Power Trading Simulator With Learning Capabilitiesapi-3697505No ratings yet

- 0309 Energy Transition and The Electricity MarketDocument70 pages0309 Energy Transition and The Electricity MarketFenhia RivasNo ratings yet

- Unlocking The GridDocument6 pagesUnlocking The GridNorway ChadNo ratings yet

- The Effect of Bilateral Contracting and Demand Responsiveness On Market Power in The Mexican Electricity SystemDocument7 pagesThe Effect of Bilateral Contracting and Demand Responsiveness On Market Power in The Mexican Electricity SystemItalo ChiarellaNo ratings yet

- A Multiagent Model of The UK Market in Electricity GenerationDocument15 pagesA Multiagent Model of The UK Market in Electricity Generationapi-3697505No ratings yet

- Eeca Ans Ia2 QBDocument13 pagesEeca Ans Ia2 QBNitishNo ratings yet

- BE Strategic BiddingDocument9 pagesBE Strategic Biddingkaren dejoNo ratings yet

- Chapter 2 Literature Review: Markets, Intermediation and E-CommerceDocument38 pagesChapter 2 Literature Review: Markets, Intermediation and E-CommercesslimjjNo ratings yet

- L02-Power System Restructuring ModelsDocument15 pagesL02-Power System Restructuring ModelsRavi KiranNo ratings yet

- Basic Analysis of The Pricing Processes in Modeled Electricity Markets With Multi-Agent SimulationDocument5 pagesBasic Analysis of The Pricing Processes in Modeled Electricity Markets With Multi-Agent Simulationapi-3697505No ratings yet

- Global Reform Oview Epw 066A02 PDFDocument24 pagesGlobal Reform Oview Epw 066A02 PDFsuderNo ratings yet

- Congestion Management in Restructed Electricity MarketDocument23 pagesCongestion Management in Restructed Electricity MarketShaliniNo ratings yet

- Analysis of The Balancing Energy MarketDocument39 pagesAnalysis of The Balancing Energy MarketRobertMcCulloughNo ratings yet

- Thesis Electricity MarketDocument4 pagesThesis Electricity MarketJackie Taylor100% (2)

- EScholarship UC Item 4nz0t3k9Document53 pagesEScholarship UC Item 4nz0t3k9hagbardcelanNo ratings yet

- Electricity Spot Price Modeling and Forecasting in European MarketsDocument23 pagesElectricity Spot Price Modeling and Forecasting in European MarketsPollsNo ratings yet

- Two-Settlement Electricity Markets with Price Caps and Cournot Generation FirmsDocument21 pagesTwo-Settlement Electricity Markets with Price Caps and Cournot Generation FirmsislammuddinNo ratings yet

- Pozo 2017Document32 pagesPozo 2017mandanatrisaviNo ratings yet

- Modelling Power Generation Investment Incentives Under UncertaintyDocument28 pagesModelling Power Generation Investment Incentives Under UncertaintyLevan PavlenishviliNo ratings yet

- Combination Two Methods Congestion Management: of ForDocument6 pagesCombination Two Methods Congestion Management: of Forapi-3697505No ratings yet

- Electricity RegulationsDocument26 pagesElectricity RegulationsAnderson Arenas MolinaNo ratings yet

- Web - Itu.edu - TR Yumakk Downloads Lab Notes Distance Protection v1Document6 pagesWeb - Itu.edu - TR Yumakk Downloads Lab Notes Distance Protection v1sunitharajababuNo ratings yet

- Voltage Depending Load Models. Validation by Voltage Step TestsDocument6 pagesVoltage Depending Load Models. Validation by Voltage Step TestssunitharajababuNo ratings yet

- Simulation With Controlled Fourier Spectrum Shifting For Efficient Computation of Power System TransientsDocument5 pagesSimulation With Controlled Fourier Spectrum Shifting For Efficient Computation of Power System TransientssunitharajababuNo ratings yet

- A Concept For Dual Gaseous and Electric Energy Transmission: P. Favre-Perrod, Student Member, IEEE, and A. BitschiDocument7 pagesA Concept For Dual Gaseous and Electric Energy Transmission: P. Favre-Perrod, Student Member, IEEE, and A. BitschisunitharajababuNo ratings yet

- HDP Based Optimal Control of A Grid Independent PV SystemDocument6 pagesHDP Based Optimal Control of A Grid Independent PV SystemsunitharajababuNo ratings yet

- Lightning Characterization For Flashover Rate Calculation of Overhead Transmission LinesDocument6 pagesLightning Characterization For Flashover Rate Calculation of Overhead Transmission LinessunitharajababuNo ratings yet

- Estimation of Transformer Saturation Characteristics From Inrush Current WaveformsDocument1 pageEstimation of Transformer Saturation Characteristics From Inrush Current WaveformssunitharajababuNo ratings yet

- Design Objectives For Spring Mechanism Generator Circuit Breaker With High ReliabilityDocument6 pagesDesign Objectives For Spring Mechanism Generator Circuit Breaker With High ReliabilitysunitharajababuNo ratings yet

- Pesgm2006 000102Document6 pagesPesgm2006 000102sunitharajababuNo ratings yet

- A Double Logarithmic Approximation of Carson's Ground-Return ImpedanceDocument1 pageA Double Logarithmic Approximation of Carson's Ground-Return ImpedancesunitharajababuNo ratings yet

- Reality Check Initiative On The Equivalency of 8/20 Versus 10/350 Waveforms For Testing Surge-Protective DevicesDocument8 pagesReality Check Initiative On The Equivalency of 8/20 Versus 10/350 Waveforms For Testing Surge-Protective DevicessunitharajababuNo ratings yet

- Energy Cost Optimization Through The Implementation of Cogeneration and Grid InterconnectionDocument5 pagesEnergy Cost Optimization Through The Implementation of Cogeneration and Grid InterconnectionsunitharajababuNo ratings yet

- Design of A Fast Transient Stability Control Scheme in Power SystemDocument8 pagesDesign of A Fast Transient Stability Control Scheme in Power SystemsunitharajababuNo ratings yet

- Effects of Multi-Objective Genetic Rule Selection On Short-Term Load Forecasting For Anomalous DaysDocument7 pagesEffects of Multi-Objective Genetic Rule Selection On Short-Term Load Forecasting For Anomalous DayssunitharajababuNo ratings yet

- Analysis of Wide-Area Frequency Measurement of Bulk Power SystemsDocument8 pagesAnalysis of Wide-Area Frequency Measurement of Bulk Power SystemssunitharajababuNo ratings yet

- Unit Commitment With Primary Frequency Regulation ConstraintsDocument1 pageUnit Commitment With Primary Frequency Regulation ConstraintssunitharajababuNo ratings yet

- Pesgm2006 000091Document8 pagesPesgm2006 000091sunitharajababuNo ratings yet

- Wide-Area Robust H /H Control With Pole Placement For Damping Inter-Area OscillationsDocument7 pagesWide-Area Robust H /H Control With Pole Placement For Damping Inter-Area OscillationssunitharajababuNo ratings yet

- A Wavelet Power Based Algorithm For Synchronous Generator ProtectionDocument6 pagesA Wavelet Power Based Algorithm For Synchronous Generator ProtectionsunitharajababuNo ratings yet

- Pesgm2006 000082Document1 pagePesgm2006 000082sunitharajababuNo ratings yet

- Modeling of VSC-HVDC and Control Strategies For Supplying Both Active and Passive SystemsDocument6 pagesModeling of VSC-HVDC and Control Strategies For Supplying Both Active and Passive SystemssunitharajababuNo ratings yet

- Assessing The Competitiveness of Loss Allocation Methods in A Deregulated Electricity MarketDocument8 pagesAssessing The Competitiveness of Loss Allocation Methods in A Deregulated Electricity MarketsunitharajababuNo ratings yet

- Pesgm2006 000078Document6 pagesPesgm2006 000078sunitharajababuNo ratings yet

- Hybrid HVDC Converters and Their Impact On Power System Dynamic PerformanceDocument6 pagesHybrid HVDC Converters and Their Impact On Power System Dynamic PerformancesunitharajababuNo ratings yet

- Optimization of Storage Devices For Regenerative Braking Energy in Subway SystemsDocument6 pagesOptimization of Storage Devices For Regenerative Braking Energy in Subway SystemssunitharajababuNo ratings yet

- New Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketsDocument8 pagesNew Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketssunitharajababuNo ratings yet

- Pesgm2006 000073Document1 pagePesgm2006 000073sunitharajababuNo ratings yet

- Robust Non-Communication Line Protection Scheme Using Novel QuantitiesDocument8 pagesRobust Non-Communication Line Protection Scheme Using Novel QuantitiessunitharajababuNo ratings yet

- Optimization of MPPT Step Si in Stand-Alone Solar Pumping SystemsDocument6 pagesOptimization of MPPT Step Si in Stand-Alone Solar Pumping SystemssunitharajababuNo ratings yet

- 115 MscugDocument894 pages115 Mscugmadesuenda100% (1)

- Module 2. Pascal-Bunagan - Journal ReviewDocument7 pagesModule 2. Pascal-Bunagan - Journal ReviewDiana BunaganNo ratings yet

- Uspex ManualDocument113 pagesUspex ManualarnoldNo ratings yet

- Quantitative Decision Making (Lectures)Document25 pagesQuantitative Decision Making (Lectures)Lars SchoninghNo ratings yet

- Mixed and Hybrid MethodsDocument113 pagesMixed and Hybrid MethodsGabo FernándezNo ratings yet

- The Effect of Regrinding On The Design of Flotation CircuitsDocument7 pagesThe Effect of Regrinding On The Design of Flotation CircuitsEnoque MatheNo ratings yet

- Lesson 1 Operations Research Power PointDocument48 pagesLesson 1 Operations Research Power PointMaria Joy Resultay100% (1)

- Inventory ModelsDocument8 pagesInventory ModelsBisoyeNo ratings yet

- Optimal and Robust ControlDocument233 pagesOptimal and Robust Controlيزن ابراهيم يعقوب دباس يزن ابراهيم يعقوب دباسNo ratings yet

- ICCM2014Document28 pagesICCM2014chenlei07No ratings yet

- Algorithmic Market Making: The Case of Equity DerivativesDocument15 pagesAlgorithmic Market Making: The Case of Equity DerivativesGaston GBNo ratings yet

- Serfidan 2020Document12 pagesSerfidan 2020light crow songNo ratings yet

- Simplex Method Microsoft Office PowerPoint PresentationDocument5 pagesSimplex Method Microsoft Office PowerPoint PresentationChetanhar singhNo ratings yet

- Introduction To Optimization ForDocument345 pagesIntroduction To Optimization ForIbrahim0% (1)

- tmp5056 TMPDocument6 pagestmp5056 TMPFrontiersNo ratings yet

- Robust GsDocument264 pagesRobust GsLucas S. CarmoNo ratings yet

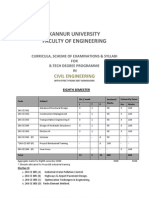

- KANNUR UNIVERSITY BTech S8 CE. SyllabusDocument12 pagesKANNUR UNIVERSITY BTech S8 CE. SyllabusManu K MNo ratings yet

- Evolutionary Many-Tasking Based On Biocoenosis Through Symbiosis: A Framework and Benchmark ProblemsDocument8 pagesEvolutionary Many-Tasking Based On Biocoenosis Through Symbiosis: A Framework and Benchmark ProblemsLê Tất ThànhNo ratings yet

- ANSYS Tutorial - Design Optimization in DX - EDRDocument10 pagesANSYS Tutorial - Design Optimization in DX - EDRNithyanandan NarayanasamyNo ratings yet

- Nonlinear Programming Concepts PDFDocument224 pagesNonlinear Programming Concepts PDFAshoka VanjareNo ratings yet

- MBBGM CMM10 PDFDocument24 pagesMBBGM CMM10 PDFangelNo ratings yet

- Using A Heuristic Approach To Design Personalized Urban Tourism Itineraries With Hotel SelectionDocument14 pagesUsing A Heuristic Approach To Design Personalized Urban Tourism Itineraries With Hotel SelectionBruno CanalesNo ratings yet

- Lecture 25: Dynamic Programming: Matlab Code: University of Southern CaliforniaDocument10 pagesLecture 25: Dynamic Programming: Matlab Code: University of Southern CaliforniaLaercioNo ratings yet

- MD R2 Nastran Release GuideDocument276 pagesMD R2 Nastran Release GuideMSC Nastran BeginnerNo ratings yet

- 3 - Decision MakingDocument33 pages3 - Decision Makingcecille corderoNo ratings yet

- Linear Programming: The Simplex Method in 40 CharactersDocument15 pagesLinear Programming: The Simplex Method in 40 CharactersheshambmNo ratings yet

- 6 Module 6 Unit 3 Linear Programming Simplex Method MinimizationDocument26 pages6 Module 6 Unit 3 Linear Programming Simplex Method MinimizationJlanie BalasNo ratings yet

- MED M.TechDocument39 pagesMED M.TechvinaykumaryadavNo ratings yet

- Linear ProgrammingDocument13 pagesLinear ProgrammingAira Cannille LalicNo ratings yet

- Lesson 7 - Power System Analysis and ControlDocument46 pagesLesson 7 - Power System Analysis and ControlBarun GhoraiNo ratings yet