Professional Documents

Culture Documents

A Monetary Policy Rule For Emerging Market Economies

Uploaded by

Shay WaxenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Monetary Policy Rule For Emerging Market Economies

Uploaded by

Shay WaxenCopyright:

Available Formats

PERSPECTIVES

A Monetary Policy Rule for Emerging Market Economies

The Impossible Trinity and the Taylor Rule

Alok Sheel

The recent global debate on monetary policy has centred on whether policy should target nancial stability in addition to the domestic business cycle. With relatively tightly regulated nancial markets, where concerns presently are more developmental than regulatory, the counterpart debate in emerging market economies centres on reconciling two widely held economic policy formulations, namely, the Mundell-Fleming Impossible Trinity and the Taylor Rule. This article argues that EMEs can get around the trilemma by adopting a separate instrument as part of a consistent policy framework to target the external nancial cycle. This would free up their interest rate policies to target the domestic business cycle, without the need to deviate from the Taylor Rule from time to time to target external nancial stability.

These are the authors personal views. Alok Sheel (aloksheel@aloksheel.com) is secretary, Economic Advisory Council to the prime minister of India.

Economic & Political Weekly EPW

he currency crisis sweeping emerging market economies (EMEs), which has compelled Brazil, Turkey and Indonesia to tighten policy rates amidst collapsing growth, merits revisiting the application of two widely held economic policy formulations, namely the MundellFleming Impossible Trinity and the Taylor Rule of monetary policy. According to the impossible trinity, a country can have only two of the following three: a xed exchange rate, monetary independence and free capital ows. A free monetary policy means that it is free to respond to the domestic business cycle. The Taylor Rule is a rule-bound as opposed to discretionary monetary policy by which the central bank adjusts its short-term policy interest rate based on a mathematical formula using differentials between a countrys potential GDP and actual GDP, and between the ination target and actual ination. The Taylor Rule and its variants are now used by almost all advanced country central banks. The author of the rule, John B Taylor of Stanford University, is of the view that it is relevant for developing country central banks also. Many developing countries have indeed started using the Taylor Rule. In advanced economies the Taylor Rule responds to the domestic business cycle. Monetary policy in developing countries, on the other hand, is in addition constrained to respond to the external nancial cycle, which distorts the application of the Taylor Rule. Thus, if domestic growth concerns warrant low interest rates, a sudden stop in capital inows may induce them to keep interest rates unduly high to attract foreign capital, thereby magnifying the downturn in the business cycle. In other words, they end

vol xliX no 4

up trying to negotiate the impossible trinity. Raising interest rates at such times rarely works because the stops are frequently not country specic, and in any case foreign investors are more concerned about capital losses than higher interest income. The impossible trinity is no longer very relevant for advanced economies whose currencies the dollar, pound sterling, euro and the yen are now fully convertible against each other. There is therefore very little difference between their internal and external imbalances as these can both be backstopped by their central banks by printing currencies that are both freely convertible and tradable in liquid international nancial markets. Monetary policy is therefore free to respond to the domestic business cycle. However, following the recent global nancial crisis, there is now an animated debate in advanced economies as to whether their central banks need to explicitly target the nancial cycle as well to ensure nancial stability, and as to what policy instrument is best suited to meet this objective. In EMEs, where currencies are not freely convertible, and where nancial systems are much more tightly regulated, the counterpart of this debate has for long centred on the impossible trinity. Only domestic decits can be backstopped by their central banks. Their external decits are denominated in international reserve currencies, for which they are dependent on market support. They are therefore always susceptible to external payments crises in the event of market revolt if their decits are perceived to be excessive and unsustainable. This happened on a large scale in Latin America in the early 1980s, in east Asia in the late 1990s, and across a broad swathe of EMEs currently. In the past such external payments crises pushed EMEs to seek conditional bailouts from the International Monetary Fund (IMF), the international lender of last resort. It is this threat of an external payments crisis that compels developing countries to frequently use monetary policy for managing external imbalances, in addition

39

JANUARY 25, 2014

PERSPECTIVES

to managing the domestic business cycle. This can result in the loss of monetary independence. They therefore need a separate instrument, as part of a consistent policy framework, to target the external nancial cycle if the central bank is to retain monetary independence. Many EMEs, including India but with the notable exception of China, have, like advanced economies, also chosen to have independent monetary policy and free capital ows. Their exchange rates oat mostly freely on the current account, and to a great extent also on the capital account, with most of the capital restrictions imposed on residents rather than non-residents. This is because of the need to attract and conserve foreign capital: putting restrictions on external investors makes the latter less willing to bring in capital if it is not be allowed to be repatriated at will. Amongst the major EMEs, China has famously chosen a combination of a xed exchange rate, monetary independence and closed capital account. While there are few formal restrictions on capital inows, since China runs a current account surplus this effectively means that the central bank mops up as much dollars from the market as required to maintain more or less a xed nominal exchange rate against the dollar. Since China runs large current account surpluses against the US, it has accumulated a huge cache of dollar reserves in its attempt to keep its exchange rate pegged to the dollar in nominal terms. Its real effective exchange rate (REER) against the dollar has been depreciating continuously on account of relative productivity shifts. Under persistent criticism and pressure from the US, China has, of course, depreciated its nominal exchange rate against the dollar slightly from time to time, even as its REER continues to remain signicantly undervalued. Effective Exchange Rates One of the main reasons why several EMEs oated their currencies was to prevent the build-up of external imbalances, as a currency oat is expected to automatically adjust external imbalances: a current account imbalance should

40

depreciate the currency, thereby boosting exports by making them more competitive, and compressing imports by making them more expensive. This tends to move the current account back towards balance. Ceteris paribus, if a country runs a current account decit (CAD), its currency should depreciate in nominal terms against those of its trading partners. The nominal exchange rate, which is observable, is however, different from the REER, which is non-observable. The REER is the adjustment made for changes in both the nominal exchange rate and relative prices and productivity between trading partners, as the REER = (Exchange Rate* $ price)/domestic currency price. From this simple equation it would be evident that, ceteris paribus, if the domestic currency depreciates in nominal terms, the REER would depreciate by an equivalent margin. However, since the domestic currency price of goods also increases relative to the dollar price of the same goods, the real depreciation is countervailed to that extent. Indeed, when there is a spike in ination it is entirely possible for the nominal exchange rate to depreciate even as the REER appreciates. On the other hand, a relative improvement in productivity puts a downward pressure on domestic currency prices, thereby depreciating the REER. Ceteris paribus, higher ination tends to erode international competitiveness, while improved productivity enhances it. When EMEs oated their currencies the expectation was that capital account ows would simply be the counterpart of the current account, and that the exchange rate would respond primarily to the current account balance. Ination tended to be higher in EMEs, which appreciated the REER. However, productivity improvements were on the whole higher in EMEs on account of the structural shift in employment from the less productive agricultural sector to the more productive manufacturing and modern service sectors, and this tends to depreciate the REER. Therefore, with effective macroeconomic management that keeps ination within reasonable

limits, it should theoretically be possible for EMEs to keep their nominal and REER closely aligned. There are, however two major circumstances, one emanating from the current account (the Dutch Disease syndrome), and the other from the capital account (Southern Cone syndrome) under which this reasoning does not hold. The Dutch Disease arises when there is a sudden spurt in a countrys current account surplus, usually on account of a new resource discovery, such as oil. The consequential sharp appreciation of both the nominal and REER makes the country lose export competitiveness in all except the windfall sector. As a result huge external imbalances can arise once the windfall is depleted. More germane to the present argument, however, is the second set of circumstances, emanating from the capital account, and increasingly a far more frequent phenomenon, namely, large and volatile capital inows into EMEs. Cross-border ows to EMEs increased manifold since the 1970s following the oil price hikes and export-led high growth strategies adopted by several east Asian economies. The rst manifestation of this syndrome in developing economies was the wave of nancial liberalisation which led to a debt fuelled recycling of petrodollars by US banks in the Southern Cone in Latin America. Misalignments, Imbalances and Stops While large capital inows can sustain large CADs for sometime, over the medium to long-run they tend to magnify external imbalances and lay the ground for external payments crises. If there is a surge in capital ows that exceeds the CAD, assuming that there is no central bank intervention to increase foreign currency reserves, the (nominal) currency depreciation may not be adequate to push the CAD towards balance. Indeed, it is possible for the nominal exchange rate to even appreciate despite the CAD if the capital surge is excessive, thereby magnifying the external imbalance. If simultaneously the REER were also to appreciate because of ination differentials, the CAD could worsen even further.

vol xliX no 4

EPW Economic & Political Weekly

JANUARY 25, 2014

PERSPECTIVES

Once the capital surge abates, or in the event of a sudden stop, there is a likelihood of a sudden, rapid and accelerated correction in exchange rates, with the nominal exchange rate depreciating sharply, and the REER overshooting its neutral (longterm fundamental) rate. This can cause short-term macroeconomic instability, such as higher ination, a loss in international condence and a credit downgrade that could compound the reversal in capital ows and could precipitate an external payments crisis. Over the medium to longterm, however, the correction increases the likelihood of the current account moving back closer to balance. What pushes capital into EMEs, and what triggers sudden stops? While fundamentals and the prospects of higher returns are certainly contributory factors, over the years it has become increasingly clear that the major factor driving ows in and out of EMEs has little to do with the fundamentals of recipient countries but yields in the source countries, in particular the US which has the biggest and deepest nancial market in the world. The ows and outows, seem to come in waves, and across a wide swathe of countries. It is not entirely coincidental that the capital stop in the Southern Cone in the early 1980s, in east Asia in the late 1990s, and across a broad sweep of EMEs since May 2013, followed a tightening of monetary policy by the United States Federal Reserve. With the integration of nancial markets and globalisation the spillovers of US Fed monetary policies are only increasing because of the overarching dominance of the dollar in the international monetary system. Its policies therefore hugely determine the direction and velocity of cross-border capital ows. No other central bank comes even close to exercising this inuence across its own borders. Over the years the dollar has effectively become the global reserve currency. As a result, US monetary policy has a determining inuence on the direction of global capital ows. This in effect gives the issuer of the global reserve currency the exibility to soak up capital when it needs it most, and to export it out when it suffers from excessive domestic liquidity. Through this mechanism the US

Economic & Political Weekly EPW

can fund literally unlimited amounts of external and internal decits without being penalised by markets as happens in the case of other countries. Open capital accounts, espoused by the IMF, only facilitate this funding and magnify the exorbitant privilege of the dollar. It has long been argued, from the days of John Maynard Keynes, that the extant international monetary system has a structural aw in that it lacks a mechanism, market-based or otherwise, to induce surplus countries to adjust. This can lead to the persistence of large imbalances. Recent history however indicates that this is not entirely correct, as there is also little pressure on countries with reserve currencies, and especially the global reserve currency, to adjust even when they run current account decits, on account of the large external demand for their currencies. The latter is also consistent with the Trifn Paradox, by which the reserve currency issuer is expected to run larger and larger current account decits to meet the growing needs of global liquidity. This is manifestly not true in the cases of currencies like the Japanese yen and the Swiss franc. Both countries have run current account surpluses over the last decade and a half. Similarly, even while its currency was becoming important in the composition of the global portfolio of reserve currencies, the euro was running a roughly balanced current account position with the rest of the world. This is because it is really the dollar that is accepted as the de facto global reserve currency by markets, even though the IMF may have classied other currencies also as reserves. In effect, the US Federal Reserve acts as the global central bank. In the not too distant past, easy monetary policy by the US Federal Reserve, both prior to and following the global nancial crisis, led to a surge in capital inows into emerging markets, appreciating their currencies. There were intervening periods of sudden stops, as US monetary policy changed course, resulting in sharp currency depreciation, sudden stops and external payments crises. This again happened in the 1980s in Latin America, in the 1990s in east Asia, and is now affecting EME s globally. International nancial markets

vol xliX no 4

in EMEs appear to respond more to US Fed actions than to economic fundamentals in these economies. External Payment Crises The Southern Cone and east Asian economies were constrained to turn to the international lender of the last resort to bail them out of their external payment crises. This time around, however, EMEs have not turned to the IMF. Apart from providing immediate relief, these bail-outs rarely had a happy ending, with some notable exceptions such as the Indian programme of the early 1990s. Stiff conditionalities led to a protracted period of low growth, and protracted loss of access to international markets because of the stigma attached to approaching the IMF. Over the long run the IMF solution has not made EMEs less susceptible to external payment crises. Following the east Asian crisis, for whatever reason, conscious or fortuitous, EMEs self-insured themselves against sudden stops by accumulating large foreign exchange reserves. This has not prevented sudden stops, and sharp depreciation, but has nevertheless so far prevented external payments crises that in the past pushed them to turn to the IMF. During a sudden stop markets tend to overshoot far out of proportion to economic fundamentals. Following sharp and rapid depreciation a number of EMEs felt constrained to put in place precautionary liquidity facilities to reassure markets. It is pertinent that the bigger EMEs turned to the US Fed, rather than to the IMF, for currency swaps. It was the former, rather than the latter, that was regarded as the lender of last resort, or the ultimate bazooka. Even central banks that issued reserve currencies, such as Bank of England and the European Commercial Bank turned to the US Fed for dollar denominated facilities. This underscores the increasing systemic irrelevance of the IMF: despite the large replenishment of its resources it is now seen as the lender of last resort only for small developing countries. If, at the end of the day, there is only one global reserve currency, the dollar, the US Federal Reserve has a bottomless supply, whereas the IMFs resources are nite. This arguably makes the US Fed some

41

JANUARY 25, 2014

PERSPECTIVES

kind of a global central bank, setting monetary policy and providing liquidity. The US Fed swaps notwithstanding, it is quite clear that EMEs that had good self-insurance mechanisms in place weathered the sudden stops of the global nancial crisis better. There is also no good reason why EMEs would nd dependence on the US more palatable than on the IMF in the event of sudden stops. They therefore need an effective policy instrument to manage sudden stops. Two Instruments for Two Targets On the one hand, EME monetary policies have got caught up in the impossible trinity, with the central bank being constrained to set short-term policy rates that are inconsistent with the domestic business cycle, leading to loss of monetary independence. On the other hand, they have conceded policy independence by committing themselves in the G-20 to market determined exchange rates even though volatile capital ows distort market exchange rates, aggravating external imbalances and macroeconomic instability. Instead, they have negotiated policy space to impose temporary capital controls in the face of a surge in capital inows. Their experience with imposing capital controls has not been very happy: capital controls are notoriously leaky, at best they throw some sand into the wheels while leading to long-term damage by discouraging capital inows when they are most needed. They are particularly counterproductive in the event of capital outows as they aggravate the problem they seek to address, as foreign investors are likely to see discretionary controls as capricious, making them even more risk averse. Therefore some countries like India have relied more on interventions in the foreign exchange market to manage volatile capital ows. This has two advantages. First, by keeping the nominal exchange rate aligned to fundamentals, it keeps external imbalances in check which in turn could minimise the overshooting during episodes of capital stops. Second, by sequestering excessive inows during episodes of excessive inows, it enhances the war chest for combating disorderly adjustment which can boost market condence relative to EME peers.

42

According to the well accepted Tinbergen Rule a policy instrument can be effective only if it has a single objective. Despite this, EME central banks have been using a single policy instrument, namely, the interest rate, to sometimes target domestic imbalances (the ination-growth matrix) and sometimes external imbalances (the exchange rate-current account balance matrix), supplemented occasionally by market intervention, depending on which balance appears more pressing at the moment. This risks making the instrument ineffective, the policy inconsistent and magnifying rather than attenuating both domestic and external imbalances. Since there are two targets, a second policy instrument is required to achieve both objectives. The interest rate is clearly better suited to target domestic imbalances. Targeting a neutral REER through market intervention, on the other hand, is clearly better suited to targeting external imbalances. This would ensure that the exchange rate remains close to fundamentals, i e, that it responds primarily to the current account and is not distorted by volatile capital ows that can be destabilising from time to time, even though they might at times make it easier to nance current account decits over the short term. Such a policy/instrument is also entirely consistent with Article i(iii) of the IMFs Articles of Agreement that purports to promote exchange rate stability. Although a number of EME central banks monitor movements in the REER, they neither target it consistently, nor are they consistent in the use of instruments to achieve their target. A consistent, well-articulated and effectively communicated exchange rate and/or reserve management policy which protects monetary independence has still to be worked out by EME central banks. The use of separate instruments to target domestic and external balances by the central bank must be done within an overall framework of policy consistency that attenuates conicting outcomes. There would, for instance, be no conicting outcomes when there is a need to tighten monetary policy and sell foreign exchange reserves, or inversely when there is a need to loosen monetary policy and buy foreign exchange reserves. There could,

however, be some conict when there is a need to loosen monetary policy and sell reserves, and inversely when there is a need to tighten monetary policy and buy reserves. In the case of such conict the central bank would need to conduct sterilisation/liquidity provision operations alongside market intervention so that the monetary policy stance is not compromised. Whether or not the exchange rate target is clearly communicated to markets, it would be only a matter of time before markets gure out that the central bank is targeting a neutral REER. There is therefore a danger that they could try and game the system by placing one way bets. This could be avoided by being less predictable in intervention such as adopting a random walk approach and being tolerant of uctuations within a band rather than targeting a specic rate as such. During a capital stop episode it is important that the central banks response is a measured one, fully appreciating that markets have a tendency to overshoot at such times, otherwise it risks rapidly running out of reserves and damaging market condence. Conclusions The recent global debate on monetary policy has centred on whether it should target nancial stability in addition to the domestic business cycle. With relatively tightly regulated nancial markets, where concerns presently are more developmental than regulatory, the counterpart debate in EMEs centres on reconciling the impossible trinity with the Taylor Rule. The problem has become all the more compelling in a rapidly globalising world where large, volatile capital ows lead to misaligned and volatile exchange rates that threaten macroeconomic stability. The argument is that EMEs can get around the trilemma by adopting a separate instrument as part of a consistent policy framework to target the external nancial cycle, instead of using a single instrument, namely, the interest rate, to target both cycles. This would free up their interest rate policies to target the domestic business cycle, without the need to deviate from the Taylor Rule from time to time to target external nancial stability.

vol xliX no 4

EPW Economic & Political Weekly

JANUARY 25, 2014

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Armed Struggle in Africa (1969)Document167 pagesArmed Struggle in Africa (1969)Dr.VolandNo ratings yet

- Poka Yoke BDocument31 pagesPoka Yoke BjaymuscatNo ratings yet

- Tally QuestionsDocument73 pagesTally QuestionsVishal Shah100% (1)

- The Judicial Affidavit RuleDocument20 pagesThe Judicial Affidavit RuleMhay ReyesNo ratings yet

- Unit 8 Risk in The WorkplaceDocument11 pagesUnit 8 Risk in The WorkplaceAnonymous WalvB8No ratings yet

- EIA GuidelineDocument224 pagesEIA GuidelineAjlaa RahimNo ratings yet

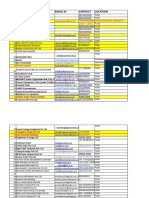

- Company Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDocument65 pagesCompany Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDhruv Parekh100% (1)

- Design Guide For Slug Force Calculation ProcedureDocument6 pagesDesign Guide For Slug Force Calculation ProcedurePratik PatreNo ratings yet

- A Sovereign Debt StoryDocument2 pagesA Sovereign Debt StoryShay WaxenNo ratings yet

- Power, and Wi-Fi, From Thin Air - The HinduDocument1 pagePower, and Wi-Fi, From Thin Air - The HinduShay WaxenNo ratings yet

- Why The Underdogs Came Out AheadDocument7 pagesWhy The Underdogs Came Out Aheadterminator1000bcNo ratings yet

- Cut Off Marks 15 May 16Document1 pageCut Off Marks 15 May 16Shay WaxenNo ratings yet

- The Self and The PoliticalDocument3 pagesThe Self and The PoliticalShay WaxenNo ratings yet

- Publicly Talking About CasteDocument3 pagesPublicly Talking About CasteShay WaxenNo ratings yet

- Silence of Subalterns in HimachalDocument2 pagesSilence of Subalterns in HimachalShay WaxenNo ratings yet

- The Future of Tribals in Telangana StateDocument2 pagesThe Future of Tribals in Telangana Stateranjan703No ratings yet

- PS XLIX 4 250114 Postscript Sudarshan RamaniDocument2 pagesPS XLIX 4 250114 Postscript Sudarshan RamaniShay WaxenNo ratings yet

- We Have OvercomeDocument1 pageWe Have OvercomeShay WaxenNo ratings yet

- Rescue Package For Power DiscomsDocument3 pagesRescue Package For Power DiscomsShay WaxenNo ratings yet

- Rightward Drift in NepalDocument4 pagesRightward Drift in NepalShay WaxenNo ratings yet

- PS XLIX 4 250114 Postscript Sharmistha MukherjeeDocument2 pagesPS XLIX 4 250114 Postscript Sharmistha MukherjeeShay WaxenNo ratings yet

- Natural Resources and Energy SecurityDocument9 pagesNatural Resources and Energy SecurityShay WaxenNo ratings yet

- The Indian Middle-Class Obsession with Food and Body ImageDocument2 pagesThe Indian Middle-Class Obsession with Food and Body ImageShay WaxenNo ratings yet

- Maoist Defeat in NepalDocument4 pagesMaoist Defeat in NepalShay WaxenNo ratings yet

- Can AAP Slay The DragonDocument2 pagesCan AAP Slay The DragonShay WaxenNo ratings yet

- PS XLIX 4 250114 Postscript Nabina DasDocument2 pagesPS XLIX 4 250114 Postscript Nabina DasShay WaxenNo ratings yet

- Great Turmoil Considerable PossibilitiesDocument4 pagesGreat Turmoil Considerable PossibilitiesShay WaxenNo ratings yet

- How Indian Voters Respond To Candidates With Criminal ChargesDocument9 pagesHow Indian Voters Respond To Candidates With Criminal ChargesShay WaxenNo ratings yet

- Jammu and KashmirDocument6 pagesJammu and Kashmirranjan703No ratings yet

- Climate Change in HimachalDocument4 pagesClimate Change in Himachalranjan703No ratings yet

- Violation of Bodily IntegrityDocument4 pagesViolation of Bodily IntegrityShay Waxen0% (1)

- Historical Validity of Mullaperiyar ProjectDocument5 pagesHistorical Validity of Mullaperiyar ProjectShay WaxenNo ratings yet

- From 50 Years AgoDocument1 pageFrom 50 Years AgoShay WaxenNo ratings yet

- Confronting CasteismDocument2 pagesConfronting CasteismShay WaxenNo ratings yet

- ED XLIX 4 250114 A Hare-Brained ProposalDocument2 pagesED XLIX 4 250114 A Hare-Brained ProposalShay WaxenNo ratings yet

- Ugcnet June 2012Document2 pagesUgcnet June 2012Shay WaxenNo ratings yet

- The Right To SellDocument1 pageThe Right To SellShay WaxenNo ratings yet

- Introduction Electrical MotorDocument36 pagesIntroduction Electrical MotorYajidNo ratings yet

- Less Than a Decade to Avoid Catastrophic Climate ChangeDocument1 pageLess Than a Decade to Avoid Catastrophic Climate ChangeXie YuJiaNo ratings yet

- VVIP Circuit House achieves 5-star GRIHA ratingDocument1 pageVVIP Circuit House achieves 5-star GRIHA ratingmallikaNo ratings yet

- IEEE Registration StuffDocument11 pagesIEEE Registration StuffsegeluluNo ratings yet

- Autocad 2016Document59 pagesAutocad 2016Kaye OleaNo ratings yet

- Circulation in Vacuum Pans: January 2004Document18 pagesCirculation in Vacuum Pans: January 2004REMINGTON SALAYANo ratings yet

- Mr. Arshad Nazer: Bawshar, Sultanate of OmanDocument2 pagesMr. Arshad Nazer: Bawshar, Sultanate of OmanTop GNo ratings yet

- Service Manual: DCR-DVD150E/DVD450E/DVD650/ DVD650E/DVD850/DVD850EDocument71 pagesService Manual: DCR-DVD150E/DVD450E/DVD650/ DVD650E/DVD850/DVD850EJonathan Da SilvaNo ratings yet

- Creating A Simple PHP Forum TutorialDocument14 pagesCreating A Simple PHP Forum TutorialLaz CaliphsNo ratings yet

- Recognition & Derecognition 5Document27 pagesRecognition & Derecognition 5sajedulNo ratings yet

- Ap22 FRQ World History ModernDocument13 pagesAp22 FRQ World History ModernDylan DanovNo ratings yet

- Shrey's PHP - PracticalDocument46 pagesShrey's PHP - PracticalNahi PataNo ratings yet

- TT1 2lecture SpinningDocument29 pagesTT1 2lecture SpinninghaiNo ratings yet

- Javacore 20100918 202221 6164 0003Document44 pagesJavacore 20100918 202221 6164 0003actmon123No ratings yet

- Siemens ProjectDocument17 pagesSiemens ProjectMayisha Alamgir100% (1)

- Modelo de NDA (English)Document2 pagesModelo de NDA (English)Jorge Partidas100% (3)

- The Mpeg Dash StandardDocument6 pagesThe Mpeg Dash Standard9716755397No ratings yet

- CS547Document11 pagesCS547Usman Suleman AhmadNo ratings yet

- An - APX18 206516L CT0Document2 pagesAn - APX18 206516L CT0Maria MartinsNo ratings yet

- OTA710C User ManualDocument32 pagesOTA710C User ManualEver Daniel Barreto Rojas100% (2)

- NYU Stern Evaluation NewsletterDocument25 pagesNYU Stern Evaluation NewsletterCanadianValueNo ratings yet

- Risk Assessments-These Are The Risk Assessments Which Are Applicable To Works Onsite. Risk Definition and MatrixDocument8 pagesRisk Assessments-These Are The Risk Assessments Which Are Applicable To Works Onsite. Risk Definition and MatrixTimothy AziegbemiNo ratings yet