Professional Documents

Culture Documents

Anlima Yarn Dyeing 2008

Uploaded by

Sanai ProdhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anlima Yarn Dyeing 2008

Uploaded by

Sanai ProdhanCopyright:

Available Formats

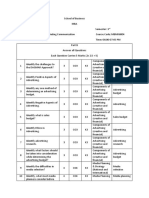

FIVE YEARS STATISTICS

2006-2007

2005-2006

2004-2005

2003-2004

2002-2003

Financial Position:

Authorized Capital

Paid up Share Capital

Reserves and Surplus

Shareholders' Equity

Total Assets

Fixed Assets - Cost

Fixed Assets - Carrying Value

Net Working Capital

Net Profit for the year

000'Tk

000'Tk

000'Tk

000'Tk

000'Tk

000'Tk

000'Tk

000'Tk

000'Tk

200,000

178,678

(3,317)

175,361

315,368

322,343

161,902

8,334

(7,842)

200,000

178,678

4,525

183,203

326,168

309,367

165,924

(9,511)

(8,693)

200,000

178,678

22,151

200,829

366,821

309,367

183,029

571

(9,332)

200,000

178,678

40,417

219,095

383,059

309,367

200,758

5,703

39

200,000

178,678

50,205

228,883

392,701

309,738

219,174

47,099

8,746

Results of Operation;

Revenue from Sales

Gross Profit Margin

Operating Profit

Net Profit /(Loss)

Earning per Share

Dividend per Share

000'Tk.

%

%

%

Tk.

Tk.

151,581

13.77

4.75

(5.17)

(4.39)

-

149,197

15.60

5.73

(5.83)

(4.87)

5.00

152,690

18.82

9.29

(6.11)

(5.22)

5.00

205,771

16.38

8.85

0.02

0.02

5.00

201,178

24.28

14.58

4.35

4.89

5.00

Key Financial Ratios:

Current Ratio

Inventory Turnover

Debtors Turnover

Debt Equity Ratio

Return on Investment

Net Assets Value per Share

Market Value of Share

Dividend Yield

Price Book Value Ratio

Times

Times

Days

Tk.

%

Tk.

Tk.

%

Times

1.08:1

2.37

127.17

44:56

-2.49%

98.14

51.00

0.00%

1.92

0.93:1

1.96

153.90

44:56

-2.67%

102.53

55.00

9.09%

1.86

1:1

0.83

155.44

45:55

-2.54%

112.40

59.00

8.47%

1.91

Other Information:

Total Shares

Total Shareholders

Number of Employees

No.

No.

No.

1,786,780

4,539

229

1,786,780

4,645

230

1,786,780

5,144

201

1.04:1

1.67

114.86

43:57

0.01%

122.62

86.00

5.81%

1.43

1,786,780

5,171

210

1.38:1

2.04

108.88

42:58

2.23%

128.10

84.00

5.95%

1.53

1,786,780

5,277

219

ANLIMA YARN DYEING LIMITED

BALANCE SHEET

As on June 30, 2007

Notes

(Amount in Taka)

30.06.2006

30.06.2007

ASSETS

Non-Current Assets

Property, Plant and Equipment - Net Book Value

Long Term Advances & Deposits

9

10

202,746,855

161,902,041

40,844,814

206,768,998

165,924,184

40,844,814

Current Assets

Inventories

Trade Debtors

Advances, Deposits & Prepayments

Cash and Cash Equivalents

11

12

13

14

112,620,656

56,017,686

53,547,108

1,302,146

1,753,716

119,398,543

54,298,399

63,779,993

691,996

628,155

Tk.

315,367,511

15

16

17

175,360,870

178,678,000

8,162,461

14,302,178

(25,781,769)

183,202,903

178,678,000

8,162,461

14,302,178

(17,939,736)

TOTAL ASSETS

EQUITY AND LIABILITIES

Shareholders' Equity

Issued Share Capital

Tax Holiday Reserve

Dividend Equalization Reserve

Accumulated Profit/(Loss) - as per the Statement of Changes in Equity

Tk.

326,167,541

Non-Current Liabilities

Term Loans

18

35,720,032

35,720,032

14,054,910

14,054,910

Current Liabilities and Provisions

Short Term Loans

Term Loan - Current Portion

Liabilities for Expenses

Liabilities for Other Finance

Dividend

19

20

21

22

23

104,286,609

94,282,138

6,900,000

2,106,189

998,282

-

128,909,728

101,615,497

6,900,000

7,538,417

3,921,914

8,933,900

TOTAL EQUITY AND LIABILITIES

Tk.

315,367,511

Tk.

326,167,541

Accounting Policies (Note - 5).

Contingent Liabilities and Commitments (Note - 36 & 37).

The notes are integral part of the Financial Statements.

Approved by the Board on October 31, 2007 and signed on its behalf by:

Mahmudul Hoque

Managing Director

Hubbun Nahar Hoque

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October 31, 2007

Rahman Kashem & Co.

Chartered Accountants

ANLIMA YARN DYEING LIMITED

PROFIT AND LOSS ACCOUNT

For the year ended June 30, 2007

Notes

NET REVENUE (TURNOVER) FROM SALES

Cost of Sales

GROSS PROFIT

24

25

151,581,408

(130,703,778)

20,877,630

OPERATING EXPENSES

Administrative Expenses

Marketing Expenses

29

30

(10,644,914)

(3,038,204)

(13,683,118)

PROFIT FROM OPERATIONS

Financing Cost

31

Other Income / (Loss)

Contribution to Workers' Profit Participation and Welfare Fund

(Amount in Taka)

2005-2006

2006-2007

7,194,512

(15,036,545)

(7,842,033)

(7,842,033)

-

NET PROFIT BEFORE TAX

Provision for Income Tax

NET PROFIT AFTER TAX FOR THE YEAR

32

(7,842,033)

(7,842,033)

Basic Earnings Per Share (Par value Tk. 100/-)

33

(4.39)

-86.2%

13.8%

-7.0%

-2.0%

-9.9%

-5.2%

149,196,707

(125,929,475)

23,267,232

(11,734,692)

(2,980,491)

(14,715,183)

8,552,049

(17,244,736)

(8,692,687)

(8,692,687)

0.0%

0.0%

(8,692,687)

(8,692,687)

(4.87)

0%

Number of shares used to compute EPS

1,786,780

1,786,780

Accounting Policies (Note - 5).

The notes are integral part of the Financial Statements.

Approved by the Board on October 31, 2007 and signed on its behalf by:

Mahmudul Hoque

Managing Director

Hubbun Nahar Hoque

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October 31, 2007

Rahman Kashem & Co.

Chartered Accountants

ANLIMA YARN DYEING LIMITED

CASH FLOW STATEMENT

For the year ended June 30, 2007

Notes

Cash Flow from Operating Activities:

Cash Collection from Customers

Cash Payment for Cost and Expenses

Cash Generated from Operations

Interest paid

Net Cash Generated from Operations

Tk.

34

(Amount in Taka)

30.06.2006

30.06.2007

161,814,293

(137,073,786)

24,740,507

(15,036,545)

9,703,962

Tk.

151,343,175

(104,788,247)

46,554,928

(14,833,141)

31,721,787

Cash Flow from Investing Activities:

Construction of Factory Building

Purchase of Plant & Machinery

Purchase of Electrical & Office Equipment

Net Cash Used in Investing Activities

(3,318,188)

(9,475,385)

(183,229)

(12,976,802)

Cash Flow from Financing Activities:

Short Term Loan - Cash Credit

Long Term Loan Repayment

Payment of Dividend

Net Cash Used in Financing Activities

Net Increase/(Decrease) in Cash & Cash Equivalent

Cash & Cash Equivalent at the beginning of year

Cash & Cash Equivalent at the closing of year

(7,333,359)

21,665,122

(9,933,362)

4,398,401

Tk.

1,125,561

628,155

1,753,716

(12,374,323)

(9,559,732)

(9,499,752)

(31,433,807)

Tk.

287,980

340,175

628,155

Figures in braket indicate deductions.

The notes are integral part of the Financial Statements.

Approved by the Board on October 31, 2007 and signed on its behalf by:

Mahmudul Hoque

Managing Director

Hubbun Nahar Hoque

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October 31, 2007

Rahman Kashem & Co.

Chartered Accountants

ANLIMA YARN DYEING LIMITED

Statement of Changes in Equity

For the year ended June 30, 2007

(Amount in Taka)

Notes

Balance as on June 30, 2006

Net Loss for the year transferred

from Profit and Loss Account

Balance as on June 30, 2007

Tk.

Share

Capital

178,678,000

Tax Holiday

Reserve

8,162,461

Dividend Equalization

Reserve

14,302,178

Retained

Earnings

(17,939,736)

Total

Equity

183,202,903

Tk.

178,678,000

8,162,461

14,302,178

(7,842,033)

(25,781,769)

(7,842,033)

175,360,870

Statement of Changes in Equity

For the year ended June 30, 2006

(Amount in Taka)

Notes

Balance as on June 30, 2005

Net Loss for the year transferred

from Profit and Loss Account

Dividend Equalization Reserve

transferred to Retained Earnings

Proposed Dividend for 2005-2006

Balance as on June 30, 2006

Tk.

Share

Capital

178,678,000

-

Tk.

178,678,000

Tax Holiday

Reserve

8,162,461

8,162,461

Dividend Equalization

Reserve

23,236,178

(8,934,000)

14,302,178

Retained

Earnings

(9,247,149)

Total

Equity

200,829,490

(8,692,687)

(8,692,687)

8,934,000

(8,933,900)

(17,939,736)

(8,933,900)

183,202,903

Figures in brakets indicate deductions.

The notes are integral part of the Financial Statements.

Approved by the Board on October 31, 2007 and signed on its behalf by:

Mahmudul Hoque

Managing Director

Hubbun Nahar Hoque

Director

M. Abul Kalam Mazumdar

Director

As per our report of even date.

Dhaka

October 31, 2007

Rahman Kashem & Co.

Chartered Accountants

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Economies of Large Scale ProductionDocument14 pagesEconomies of Large Scale ProductionPrabhkeert Malhotra100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Achieving Excellence in After-Sales Services - BCG PDFDocument16 pagesAchieving Excellence in After-Sales Services - BCG PDFAndrey Doran GambaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- ISBPlacements Report 2023Document24 pagesISBPlacements Report 2023Gaurav RawatNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- CreditSuisse Tenaris 26-05-2011Document10 pagesCreditSuisse Tenaris 26-05-2011stirner_07No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Managerial Accounting 3rd Edition Whitecotton Solutions ManualDocument42 pagesManagerial Accounting 3rd Edition Whitecotton Solutions Manualsestetto.vitoe.d4rcv4100% (19)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Ch.02 The Recording Process PDFDocument47 pagesCh.02 The Recording Process PDFSothcheyNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Promotion & DistributionDocument18 pagesPromotion & DistributionKertik SinghNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- RECEIVABLESDocument12 pagesRECEIVABLESNath BongalonNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Soap Production Concept Note - KOEEDODocument5 pagesSoap Production Concept Note - KOEEDORobinson Stanley ObadhaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- FX INSTRUMENTS: Spot, Forward & SwapsDocument152 pagesFX INSTRUMENTS: Spot, Forward & Swapshimanshugupta6No ratings yet

- Tarang LaunchDocument10 pagesTarang LaunchBatool Yousuf0% (1)

- Network Externalities and Their EffectsDocument14 pagesNetwork Externalities and Their EffectsTan Huey YinNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Understanding The Time Value of MoneyDocument13 pagesUnderstanding The Time Value of MoneyDaniel HunksNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- COMPARISON OF BUSINESS TRANSACTION CYCLESDocument2 pagesCOMPARISON OF BUSINESS TRANSACTION CYCLESJN Villacruel AbayariNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Questions For The Spotify Case StudyDocument2 pagesQuestions For The Spotify Case StudyAnirudh GuptaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CMA Exam Content Specification OutlinesDocument16 pagesCMA Exam Content Specification OutlinesMolly SchneidNo ratings yet

- Final Question Paper For CAT-2 Part B & CDocument4 pagesFinal Question Paper For CAT-2 Part B & CShailendra SrivastavaNo ratings yet

- Ent300 Assignment 3 Business Plan General Guidelines 2021Document18 pagesEnt300 Assignment 3 Business Plan General Guidelines 2021anisNo ratings yet

- Grain Distribution Risk MitigationDocument27 pagesGrain Distribution Risk MitigationWendy SugandaNo ratings yet

- StaplesDocument18 pagesStaplesMohit NaithaniNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- VIXFuturesBasisTrading 2 Rev1Document16 pagesVIXFuturesBasisTrading 2 Rev1samuelcwlsonNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Objectives / Importance / Benefits of Personal SellingDocument6 pagesObjectives / Importance / Benefits of Personal Sellingzakirno19248No ratings yet

- Muhammad Adeel Aziz - ResumeDocument3 pagesMuhammad Adeel Aziz - ResumeAdeel AzizNo ratings yet

- Indian Pharma Industry OverviewDocument78 pagesIndian Pharma Industry OverviewHardik PatelNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Common Size Income Statements 2Document7 pagesCommon Size Income Statements 2Aniket KedareNo ratings yet

- The Battle For Value FedEx UPSDocument23 pagesThe Battle For Value FedEx UPSCoolminded CoolmindedNo ratings yet

- Chapter 14Document46 pagesChapter 14Nguyen Hai Anh100% (1)

- Assessment of The Impact of CSR Implementation Social Investment Using Social Return On Investment (SROI) MethodsDocument15 pagesAssessment of The Impact of CSR Implementation Social Investment Using Social Return On Investment (SROI) MethodsCho bitzNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Unit 5. Accounting For Joint Products & Byproducts: 5.1 OverviewDocument9 pagesUnit 5. Accounting For Joint Products & Byproducts: 5.1 OverviewAmanuel TesfayeNo ratings yet

- Examination: Subject CT1 Financial Mathematics Core TechnicalDocument211 pagesExamination: Subject CT1 Financial Mathematics Core TechnicalMfundo MshenguNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)