Professional Documents

Culture Documents

Test Bank Financial Management

Uploaded by

Jakarta PunyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Bank Financial Management

Uploaded by

Jakarta PunyaCopyright:

Available Formats

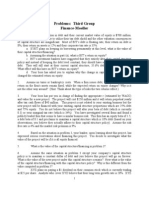

TEST BANK

182

Chapter 1 Introduction 1. Which of the following is the primary objective of a firm? A. employees' benefits B. satisfaction of customers . satisfaction of suppliers !. prompt payment to cre"itors $. ma%imi&e stoc'hol"er wealth (inancial ris' involves ))). A. fluctuation in e%change rates B. "ifferent interest an" inflation rates . balance of payments position !. A an" B $. A* B* an" ,hree sweeping changes inclu"e ))). A. the en" of ol" War B. in"ustriali&ation an" growth of the "eveloping worl" . the creation of the -orth American ,ra"e Agreement !. increase" globali&ation $. A* B* an" ! /anagers are generally "efine" as ))). A. stoc'hol"ers B. agents . cre"itors !. suppliers $. customers Which of the following is not one of seven principles of global finance? A. mar'et imperfection B. ris'1return tra"eoff . portfolio effect !. comparative a"vantage $. company a"vantage 3ncentives for multinational company managers inclu"e the following e%cept ))). A. stoc' options B. bonuses . per4uisites !. salary increases $. vacation 18+

# 2.

# +.

# .. #

0.

# 2.

5.

# 8. #

$nvironmental factors affecting international operations are as follows e%cept ))). A. foreign customs B. foreign economic factors . foreign political situations !. foreign legal aspect $. international "istance ,hree major ris's in international business are ))). A. political* financial an" weather B. economic* political an" people . political* financial an" regulatory !. accounting* management an" information $. mar'eting* ethics an" political onflicts of interest for multinational corporations "o not inclu"e ))). A. the interests of sovereign governments may be "ifferent B. the goals of multinationals are "ivergent from host countries . some conflicts may e%ist within multinational subsi"iaries !. multinational companies may conflict with local laws $. multinational managers live in "ifferent time &ones ,he conflict between owners* employees* suppliers* an" customers of a company is 'nown as ))). A. regulatory ris' B. problem of agency . conflict of multiple environments !. conflict of interests $. none of the above ,he main "ifferences between "omestic an" international companies from a financial manager's point of view are largely "ue to "ifferences in ))). A. ris's B. national laws . economic factors !. political factors $. all of the above A global company is an organi&ation that attempts to ))). A. have a worl"wi"e presence in its mar'et B. integrate its operations worl"wi"e . stan"ar"i&e operations in one or more of the company's functional areas !. A an" B $. A* B* an" 18.

6.

# 17.

# 11.

# 12.

1+. #

orporate governance is often narrowly "efine" as the pru"ent e%ercise of ownership rights towar" the goal of increase" ))). A. sharehol"er value B. profit . profit margin on sales !. asset turnover $. sales volume ,he most common form of sharehol"er activism inclu"es ))). A. a sharehol"er proposal for pro%y fight B. "irect negotiation with management . public targeting of a corporation ! A* B* an" $. A an" only ,he 8$ ! 9rinciples of orporate :overnance covers ))). A. the rights of sharehol"ers B. the e4uitable treatment of sharehol"ers . the responsibilities of the boar" !. "isclosure an" transparency $. all of the above ,he political* regulatory* technological* an" economic forces ra"ically changing the global competitive environment inclu"e ))). A. the collapse of communism B. the privati&ation of state1owne" enterprises aroun" the worl" . the revolution in information technologies !. a wave of mergers* leverage" buyouts* an" ta'eovers $. all of the above All of the following have playe" an important role in the globali&ation process of the worl" economy e%cept ))). A. a"vances in information technologies B. increase" tariffs . re"uctions in tra"e barriers !. re"uce" transportation an" communication costs $. re"uctions in technological barriers

1..

# 10.

# 12.

# 15. #

180

18.

# 16.

;e"uctions in transportation an" communication costs have ))). A. facilitate" international pro"uction activities B. enlarge" tra"ing areas . enable" companies to e%ploit international cost "ifferentials !. re"uce" technological barriers $. all of the above ;easons for management to focus on stoc'hol"er wealth ma%imi&ation inclu"e ))). A. stoc'hol"ers are the owners of the company B. stoc'hol"ers provi"e the ris' capital that protects the welfare of other constituents . a high stoc' price provi"es the best "efense against a hostile ta'eover !. enhance" sharehol"er value ma'es it easier for the company to attract a""itional e4uity capital $. all of the above Which of the following statements about financial planning an" control is not true? A. financial planning an" control must be consi"ere" simultaneously B. the preparation of bu"gets is a planning function* but their a"ministration is a controlling function . bu"gets are use" to compare actual performance with planne" performance !. the foreign e%change mar'et plays a 'ey role in /- financial planning an" control $. all of the above statements are true ,he role of the /- financial manager has e%pan"e" in recent years to inclu"e ))). A. corporate strategy B. financial planning an" control . subsi"iary performance !. multiple environments $. regulatory ris's

# 27.

# 21. #

182

Chapter 2 Motives for World Trade and Forei n Invest!ent 1. Accor"ing to the classical economic theory* international tra"e ta'es place between countries base" on the . A. absolute a"vantage of lan" B. absolute a"vantage of labor . absolute a"vantage of technology !. comparative a"vantage of s'ills $. comparative a"vantage of cost Accor"ing to the theory of factor en"owments* a country must speciali&e in the pro"uction an" e%port of any goo" that uses its large amount of pro"uction factors. A. scarce B. limite" . wasteful !. abun"ant $. small A pro"uct life cycle theory wor's only . A. in international tra"e B. in international investment . in both international tra"e an" foreign investment !. with an e%porter who has a monopolistic position $. with an importer who has a comparative a"vantage Which of the following is not a major form of tra"e restriction? A. forfaiting B. tariffs . non1tariff barriers !. import 4uotas $. countervailing "uties ,he main functions of the Worl" ,ra"e 8rgani&ation <W,8= "o not inclu"e A. a"ministrating its tra"e agreements B. forum for tra"e negotiations . technical assistance an" training for "eveloping countries !. monitoring national tra"e policies $. the establishment of tra"e centers aroun" the worl" .

# 2.

# +. #

.. #

0.

185

2. #

,he major forms of economic cooperation among countries "o not inclu"e A. a free tra"e area B. a consortium ban' . customs union !. economic union $. political union Which of the following is a vali" argument for protectionism? A. national security B. unfair competition . "omestic employment !. A an" B $. A* B* an"

5.

# 8. #

Which of the following is not a main objective of the free tra"e agreement between the >nite" ?tates an" ana"a? A. establish common e%ternal tariffs B. phase out tariffs between the two countries . liberali&e investment laws between the two countries !. grant @national treatment@ with each other $. liberali&e the tra"ing relationships between the two countries ,wo loose tra"ing blocs in Asia are ))). A. A?$A- an" -A(,A B. A?$A- an" $> . A?$A- an" A9$ !. -A(,A an" $> $. A9$ an" -A(,A ,he $clectic ,heory* "esigne" to e%plain a logical lin' between tra"e an" investment theories* was "evelope" by ))). A. Aevy B. ?nart . Aessar" !. -ehrt $. !unning Which of the following theories best "escribes a major motive for international tra"e? A. the theory of comparative a"vantage B. portfolio theory . eclectic theory !. oligopoly mo"el $. none of the above 188

6. #

17.

# 11. #

12.

# 1+. #

-ehrt an" Bogue suggeste" that companies invest abroa" because of ))). A. new mar'ets B. raw materials . pro"uct efficiency !. new 'nowle"ge $. all of the above Which of the following is not one of benefits of open tra"e? A. increase" government spen"ing B. comparative a"vantage . increase" competition !. increase" pro"uctivity $. e%pan"e" menu of goo"s Which of the following is not an e%ample of tra"ing bloc? A. African >nion B. -orth American (ree ,ra"e Agreement . /ercosur !. the entral American ommon /ar'et $. the Asian 9acific $conomic ooperation ,ariffs on importe" goo"s can be impose" for the following reason<s= A. revenue B. national pri"e . protection of "omestic companies !. retaliation $. A* * an" ! 3mport 4uotas specify the perio" of time. A. minimum B. ma%imum . unlimite" !. small $. given .

1.. #

10.

# 12. #

amounts of certain pro"ucts to be importe" "uring a given

15.

,he portfolio theory of foreign investment relies on the following variable<s= A. ris' B. technology . return !. mar'et share $. both A an"

186

18.

# 16. #

An oligopoly e%ists when A. many B. e%actly two . 10 !. a few $. about 20

firms "ominate the mar'et.

,he portfolio theory assumes that "omestic investment projects ten" to be with foreign investment projects than with other "omestic projects. A. less B. more . perfectly negatively !. perfectly positively $. in"epen"ently

correlate"

27.

# 21.

Which of the following a"vantages typically is <are= associate" with a multinational firm over a "omestic firm? A. access to technology B. "ifferentiate" pro"ucts . access to capital !. superior management $. all of the above orporate responses to tra"ing blocs inclu"e ))). A. "irect investment in major tra"ing blocs B. joint ventures with firms in major tra"ing blocs . strategic alliances with firms in major tra"ing blocs !. A an" B $. A* B* an" Cohn !unning argues that a company is willing to invest abroa" when it has ))). A. ownership1specific a"vantages B. benefit1specific a"vantages . internationali&ation a"vantages !. location1specific a"vantages $. A* * an" !

# 22. #

167

2+.

# 2.. #

Which of the flowing statements concerning economies of scale is false? A. it is a synergistic effect sai" to e%ist when the whole is worth more than the mere sum of its parts B. costs fall as outputs e%pan" . each country shoul" speciali&e in a limite" number of pro"ucts in which it has a comparative a"vantage !. mass pro"uction an" mass mar'eting "eplete s'ills an" technologies $. the functions of pro"uction* mar'eting an" purchasing can be consoli"ate" ,he synergistic effect sai" to e%ist when the whole is worth more than the mere sum of its parts is calle" ))). A. economies of scale B. "ifferences in taste . the theory of factor en"owments !. the pro"uct life1cycle theory $. the theory of comparative a"vantage Anti"umping "uties are ))). A. impose" for technical an" health regulations B. non1tariff barriers . a""itional import "uties impose" to offset an e%port subsi"y by another country !. customs "uties impose" on an importe" pro"uct whose price is lower than that of the same pro"uct in the home mar'et $. customs "uties impose" on an importe" pro"uct whose price is higher than that of the same pro"uct in the home mar'et

20.

161

Chapter " The Balance of #a$!ents 1. ,he balance of payments on current account "oes not inclu"e the following items A. merchan"ise e%ports B. invisible tra"e items <services= . current transfer items !. foreign stoc's an" bon"s $. merchan"ise imports ,he financial account in the balance of payments "oes not inclu"e the following )) . A. foreign "irect investment B. gol" . foreign ban' loans !. portfolio investment $. investment on foreign bon"s 8fficial reserve assets "o not inclu"e A. gol" B. convertible foreign e%change . special "rawing rights <?!;s= !. British poun" $. Algerian "inars . .

# 2. #

+.

# .. #

re"it transactions in the balance of payments "o not inclu"e ))). A. e%ports of goo"s an" services B. investments an" interest pai" to foreign resi"ents . investment an" interest earnings !. transfer receipts from foreign resi"ents $. investments an" loans from foreign resi"ents ,he general tren" of the >? service tra"e account has been A. a stable "eficit B. an increasing "eficit . a "ecreasing "eficit !. a falling "eficit $. a surplus .

0.

162

2.

# 5. #

Which of the following is not one of the major groups that ma'e up the balance of payments? A. current account B. capital account . financial account !. net errors an" omissions $. profit account ,he financial account in the balance of payments "oes not inclu"e )))). A. foreign "irect investments B. foreign portfolio investments . e%ports of goo"s an" services !. other investments $. A* B* an" ! ,he accounting statement that summari&es all the economic transactions between a country's resi"ents an" foreign resi"ents is calle" the balance of . A. merchan"ise tra"e B. current account . capital account !. official account $. payments 3n a freely floating e%change rate system* a current account "eficit shoul" pro"uce a financial account . A. surplus B. "eficit . balance !. both A an" B $. all of the above !uring the 1667s* the >nite" ?tates ha" a A. surplus B. "eficit . reasonable balance !. both A an" B $. none of the above in its current account.

8.

# 6. #

17. #

11. #

As the real value of the yen rises* the balance on Capan's current account is li'ely to A. stay the same B. improve . "eteriorate !. cannot tell $. none of the above 16+

12. #

3f a country imposes tariffs on importe" goo"s* then that country's balance of payments will very li'ely . A. improve B. "eteriorate . stay the same !. cannot tell $. all of the above Bol"ing other things constant* an increase in the current account "eficit of a country's balance of payments will most li'ely . A. wea'en the value of its currency B. increase the value of its currency . not affect the value of its currency !. all of the above $. none of the above 3nterest an" "ivi"en" incomes show up in the A. merchan"ise account B. reserves an" relate" items . capital account !. current account $. financial account ,he current account inclu"es . A. merchan"ise e%ports an" imports B. earnings from invisible tra"e . unilateral transfer items !. A an" B $. A* B* an" 8fficial reserve assets are compose" of A. gol" B. convertible foreign e%changes . special "rawing rights <?!;= !. all of the above $. A an" B . .

1+. #

1..

# 10.

# 12.

16.

15.

,he balance of payments i"entify states that the combine" balance of current account* capital account* financial account* net errors an" omissions* an" reserves an" relate" items must be . A. greater than one <1= B. less than one <1= . e4ual to &ero <7= !. between 11 an" D1 (. between 1 an" 7 Worl" output has grown ))))) than worl" tra"e "uring the 1667s. A. faster B. slower . ten times faster !. all of the above $. none of the above ,he C1curve effect hol"s that a country's currency "epreciation causes its tra"e balance to )))). A. "eteriorate for a short time B. flatten out after an initial "eterioration . significantly improve in the long run !. A* B* an" !. A an" B only ,o re"uce its tra"e "eficit* a country shoul" "o all of the following but )))). A. "eflate the economy B. "evalue the currency . a"opt foreign e%change controls !. institute tra"e controls $. increase money supply All of the following statements concerning a countryEs balance of payments are true e%cept ))). A. it is commonly "efine" as the recor" of transactions between the countryEs resi"ents an" foreign resi"ents over a specific perio" B. the recor"e" transactions inclu"e e%ports an" imports of goo"s an" services . it recor"s only the transactions of business firms !. it is use" to analy&e a countryEs competitive position $. it is use" to forecast the "irection of e%change rates

18. #

16.

# 27.

# 21.

160

22.

# 2+.

All of the following statements concerning a countryEs balance of payments are true e%cept ))). A. it is a sources1an"1uses of fun"s statement B. it recor"s transactions that earn or e%pen" foreign e%change . it reflects changes in assets* liabilities* an" net worth "uring a specifie" perio" !. statistics are gathere" on a "ouble1entry accounting basis $. it recor"s transactions between "omestic an" foreign resi"ents A country incurs a surplus in its balance of payments when ))). A. cre"it transactions e%cee" "ebit transactions B. it earns more abroa" than it spen"s . autonomous receipts e%cee" autonomous payments !. A an" B $. all of the above

162

Chapter % The International Monetar$ S$ste! 1. # Which of the following is not one of a"vantages for a fle%ible e%change rate system? A. countries can maintain in"epen"ent monetary policy B. e%change rates un"er a fle%ible system are unstable . countries can maintain in"epen"ent fiscal policy !. fle%ible e%change rates permit a smooth a"justment to e%ternal shoc's $. entral ban's "o not nee" to maintain large reserves >n"er the purely fluctuating e%change rate system* the balance of payments imbalances are automatically correcte" by the following mechanism . A. speculation B. government intervention . interest rate changes !. supply an" "eman" in e%change mar'ets $. none of the above Which of the following is not "irectly relate" to the Bretton Woo"s system? A. 16.. B. the fi%e" e%change rate system . the ban' of $nglan" !. the 3nternational /onetary (un" $. the Worl" Ban' Which of the following is not "irectly attributable to the collapse of the fi%e" e%change rate system? A. >.?. balance of payments "eficits B. the "ecrease in the >.?. "ollar value . the "ecline of international reserves !. Capan's tra"e surplus $. none of the above ,he :roup of ,en got together at the ?mithsonian 3nstitution to agree on a wi"er ban" system so that e%change rates can fluctuate . A. 0F above an" below the central rate B. 2.20F above an" below the central rate . 2F above an" below the central rate !. .F above an" below the central rate $. 17F above an" below the central rate

2.

# +. #

..

# 0. #

165

2.

,he Camaican Agreement was hel" to amen" the Bretton Woo"s Agreement of the fi%e" e%change rate system in . A. 165+ B. 1650 . 1652 !. 1658 $. 1656 (actors that cause "eman" an" supply sche"ules for foreign e%change to shift "o not inclu"e G A. relative inflation rates B. relative interest rates . "ifferent welfare systems !. relative income levels $. government intervention ,he Culy 166+ currency crisis in $urope cause" the $uropean /onetary ?ystem to wi"en the ban"s within which member currencies coul" fluctuate against other member currencies* to of a central value. A. 1.F B. 10F . 12F !. 15F $. 18F ,he objectives of the 3nternational /onetary (un" <3/(= are A. to promote international monetary cooperation B. to promote e%change stability . to create stan"by reserves !. all of the above $. none of the above .

5.

8.

6.

# 17.

,he reserve tranche of the 3nternational /onetary (un" <3/(= means that by e%changing their own currencies for convertible currencies* a member country may "raw F of its 4uota. A. 20 B. 07 . 50 !. 87 $. 177

168

11. #

Which of the following is not a ?!; component currency? A. >? "ollar B. euro . ?wiss franc !. Capanese yen $. British poun" ?pecial "rawing rights are use" to settle payments by the following organi&ations e%cept A. 3/( member countries B. prescribe" organi&ations . central ban's !. multinational corporations $. A* B* an" ,he euro began public circulation in )))). A. 1666 B. 2777 . 2771 !. 277+ $. 2772 ,he "irty floating e%change system was establishe" in A. 1626 B. 165+ . 1652 !. 1656 $. 1687 .

12.

# 1+.

# 1.. #

10. #

,he "ecline of the >? "ollar value in the late 1687s was mainly attributable to the following agreement . A. Aouvre Accor" B. 9la&a Accor" . ?mithsonian Agreement !. Camaica Agreement $. -one of the above ,he Asian currency crisis in 1665 starte" in A. Horea B. ,hailan" . 3n"onesia !. Bong Hong $. 9hilippines .

12. #

166

15. #

,he ?eptember 1662 currency crisis in $urope was mainly attributable to A. the British currency action B. the increase in :erman interest rate . the !anish election !. the (rench currency policy $. all of the above

18.

,he proposal un"er which a par value of a currency is a"juste" intermittently is referre" to as a . A. wi"e ban" B. narrow ban" . crawling peg !. crawling ban" $. gli"ing ban" ,he 4uota allotte" to a member country of the 3/(* which it can borrow at will* is 'nown as tranche. A. gol" B. basic . member !. cre"it $. reserve $conomists regar" the creation of the $uro as a new $uropean currency in the international monetary system as the most important "evelopment since . A. 160+ B. 162+ . 165+ !. 168+ $. 166+ A country may lin' its e%change rate to the value of a major currency* often the >? "ollar. ,his is calle" . A. a currency par B. a currency peg . a currency composite !. a currency bas'et $. none of the above

16.

# 27.

21. #

277

22.

# 2+.

3f an" when the value of the Capanese yen against the >? "ollar goes up 10F* it affects the following items . A. the price of importe" Capanese cars B. the price of Capanese cameras . the price of Capanese pearls sol" in ,roy* 8hio !. the price of a ?harp copier in !etroit $. all of the above Which of the following currencies is "irectly lin'e" to the value of gol"? A. >? "ollar B. Capanese yen . euro !. British poun" $. none of the above A foreign e%change rate ))). A. is the par value B. is an e%change rate which "oes not fluctuate . can involve a single currency !. is the price of one currency e%presse" in terms of another currency $. fluctuates accor"ing to mar'et forces A fi%e" e%change rate ))). A. is an e%change rate which "oes not fluctuate or which changes within a pre"etermine" ban" B. will have a par value . re4uires central ban's to absorb currency surpluses an" eliminate currency "eficiencies !. B an" $. all of the above A currency boar" ))). A. is a monetary institution that only issues currency to the e%tent it is fully bac'e" by foreign reserves B. is an e%treme form of the fi%e" e%change rate system . involves an e%change rate fi%e" by law !. B an" $. all of the above

# 2..

# 20.

# 22.

271

25.

A currency "evaluation is ))). A. an official increase in the value of a currency by the government of that currency B. a rise in the value of a currency against other currencies un"er a floating system . a "ecrease in the value of a currency against other currencies un"er a floating system !. an official re"uction in the par value of a currency un"er a fi%e" rate system $. a currency boar"

272

Chapter & The Forei n E'chan e Mar(et and #arit$ Conditions 1. ,he foreign e%change mar'et is referre" to as a mar'et where one country's currency is e%change" for another currency. ,he currency e%change is usually ma"e through the following metho"s . A. buyers an" sellers of foreign e%change meet at a physical location. B. buyers an" sellers of foreign e%change meet through a telephone networ' . buyers an" sellers of foreign e%change meet through computer communications !. A an" B $. B an" Which of the following is not a function of a commercial ban' in the foreign e%change mar'et? A. they operate the payment mechanism B. they "etermine e%change rates . they e%ten" cre"it !. they help re"uce foreign e%change ris' $. they buy an" sell foreign e%change Which of the following is not a characteristic of speculation A. profit motive B. e%change rate fluctuation . he"ging !. ris' ta'ing $. "eliberate uncovere" position A cross rate is an e%change rate between ))) an" ))). A. ,he >? "ollar an" the Capanese yen B. any two non1home currencies . the /e%ican peso an" the euro !. the "omestic currency an" a foreign currency $. the euro an" the Capanese yen A >? company is e%pecte" to receive I177*777 in 127 "ays. 3f the company wants to minimi&e the ris' of foreign e%change* then it woul" . A. buy British poun"s forwar" B. sell British poun"s forwar" . buy British poun"s 127 "ays from now !. sell British poun"s 127 "ays from now $. sell British poun"s in the current spot mar'et .

# 2. #

+. #

.. #

0. #

27+

2.

# 5. #

?peculation in foreign e%change mar'ets entails . A. covering in the forwar" mar'et B. covering in the money mar'et . he"ging in the option mar'et !. buying in the current spot mar'et an" selling in the future spot mar'et $. covering in the futures mar'et (oreign e%change mar'ets are efficient if . A. goo" information is available at no or little cost B. you have insi"e information . mar'ets are highly regulate" !. mar'et information is secretive $. most foreign e%change "ealers are speculators ,he theory of purchasing power parity says that . A. the inflation rates in two countries are unrelate" B. the e%change rate will a"just to reflect changes in the price levels of two countries . the inflation rate is greater than the interest rate !. the interest rate is greater than the inflation rate $. the interest rate an" the inflation rate are i"entical ,he (isher $ffect assumes that the . A. real interest rate is e4ual to the nominal interest rate B. nominal interest rate is e4ual to the real interest rate plus the inflation rate . inflation rate is e4ual to the real interest rate !. nominal interest rate is e4ual to the inflation rate $. nominal interest rate is lower than the inflation rate ,he 3nternational (isher $ffect says that the . A. e%change rate "ifference reflects the inflation rate "ifference between two countries B. future spot rate shoul" move in an amount e4ual to* but in the opposite "irection from* the "ifference in interest rates between two countries . future spot rate reflects the forwar" rate !. interest rate is greater than the inflation rate $. all of the above

8. #

6. #

17. #

27.

11. #

,he theory of interest rate parity means that the . A. interest rates are e4ual in two countries B. "ifference between a forwar" rate an" a spot rate e4uals the "ifference between a "omestic interest rate an" a foreign interest rate . "ifference between the spot rate an" the future spot rate reflects the interest rate "ifference between two countries !. future spot rate reflects the inflation "ifference between two countries $. all of the above A forwar" rate is e4ual to a future spot rate if foreign e%change mar'ets are A. controlle" by the government B. efficient . controlle" by speculators !. are partially controlle" by the 3nternational /onetary (un" $. none of the above Actual e%change mar'et participants inclu"e A. ban's B. companies . in"ivi"uals !. governments $. all of the above . .

12. #

1+.

# 1..

# 10. #

ommercial ban's play the flowing role in international transactions ))). A. they operate the payment mechanism B. they e%ten" cre"it . they help re"uce ris' !. A an" B $. all of the above ))) is use" a major means of re"ucing ris' in international transactions. A. e%change tra"ing B. the payment mechanism . letter of cre"it !. the >? (e"eral ;eserve $. ban' tra"ing rooms entral ban's ))). A. attempt to control the growth of the money supply within their juris"ictions B. serve as their governmentsE ban'er for "omestic an" international payments . strive to maintain the value of their own currency against any foreign currency !. A an" $. all of the above 270

12.

15.

3f the spot rate of the /alaysian ringgit is J.+7 an" the si% month forwar" rate of the ringgit is J.+2* what is the forwar" premium or "iscount on an annual basis? A. premiumK about 1..0F B. "iscountK about 1..0F . premiumK about 1+.+F !. "iscountK about 1+.+F $. premiumK about 12.5F Solution) use E*uation +&,%.+/"2 , /"0-1/"02 ' +"301140- 5 1"/"6

18.

3f the spot rate of the 3srael she'el is J.+2 an" the si% month forwar" rate is J.+7* what is the forwar" premium or "iscount on an annual basis? A. "iscountK 11.0F B. premiumK 11.0F . premiumK 12.0F !. "iscountK 12.0F $. premiumK 22.0F Solution) use E*uation +&,%.+/"0 , /"2-1/"22 ' +"301140- 5 ,12/&6 3f the ana"ian "ollar is e4ual to J.82 an" the Bra&ilian real is e4ual to J.28* what is the value of the Bra&ilian real in terms of ana"ian "ollars? A. about .+202 reals B. about .+028 reals . about 1.2 reals !. about 1.0 reals $. about .0277 reals Solution) cross rate /241/43 5 /"2&3

16. #

27. #

3f the Capanese yen was worth J.77+0 si% months ago an" is worth J.77.0 to"ay* how much has the yen appreciate" or "epreciate"? A. appreciate"K about 26F B. appreciate"K about 20F . "epreciate"K about 27F !. "epreciate"K about 18F $. appreciate"K about 10F Solution) use E*uation +&,1+/00%& , /00"&-1/00"& 5 276

272

21.

AssumeG <1= the >? annual interest rate L 17FK <2= the /alaysian annual interest rate L .FK an" <+= the 671"ay forwar" rate for the /alaysian ringgit L J.+82.. At what current spot rate will interest rate parity hol"? A. J.+622 B. J.+800 . J.+875 !. J.+502 $. J.2777 Solution) use E*uation +&,4.+/"43% , S-1S- ' +"30170-2 5 /10 , /0% S 5 /"408

22.

?uppose annual inflation rates in the >? an" ambo"ia are e%pecte" to be 0F an" 67F* respectively over the ne%t year. 3f the current spot rate for the ambo"ian riel <HB;= is ++.2.22 riels per "ollar* then the best estimate of the riel's future spot rate one year from now isG A. J270+.25 B. J2+07.66 . J++.2.22 !. J2280.2. $. J5877.77 Solution) use E*uation +&,3-/ 9e!e!:er that the reciprocal of ""%2/3" 5 0/0002771/ ne; e'chan e rate 5 <0/0002771.+1 = /0&-1+1 = /70-2 5 </00013&21K>9? or K>911</00013&" 5 K>930&"/281<

2+. #

3f the e%pecte" inflation rate is .F an" the real re4uire" return is 0F* what is the nominal interest rate? A. 1F B. 6F . 2F !. 0F $. 11F Solution) @se E*uation +&,8-) no!inal rate 5 real rate = inflation rate/ No!inal rate 5 &6 = %6 5 76

>se the following information to answer the ne%t three 4uestions. Assume the followingG you have J17*777 to investK the current spot rate of British poun"s is J1.877K the 671"ay forwar" rate of the poun" is J1.587K the annual interest rate in the >? is .FK the annual interest rate in the >H is 2F. 275

2.. #

Where woul" you invest your J17*777 to ma%imi&e your yiel" with no foreign e%change ris'? A. in the >nite" ?tates B. in the >nite" Hing"om . cannot tell !. "oes not ma'e any "ifference $. in :ermany Solution) invest in the @S) <10A000 ' 1/01 5 <10A100 Invest in the @K and cover in the for;ard !ar(et/ Bu$ pounds at the present spot rate) <10A00011/4 5 B&A&&& invest in the @K) B&A&&& ' 1/01& 5 B&A3"4 sell pounds for;ard) B&A3"4 ' 1/84 5 <10A0"3 The investor ;ould earn <3% !ore :$ investin in the @nited States instead of the @nited Kin do!/

20.

:iven the >? interest rate* the >H interest rate* an" the spot rate* what woul" be an e4uilibrium forwar" e%change 4uotation? A. 1.877 B. 1.587 . 1.876 !. 1.670 $. 2.777 Solution) use E*uation +&,4- and solve for the for;ard rate) .+F , 1/400-11/400 ' +"30170-2 5 0/0% , 0/03 F 5 B1/407

22.

:iven the spot rate* the forwar" rate* an" the >? interest rate* what is the e4uilibrium >H interest rate? A. 2.7F B. 8.6F . ..7F !. 2.7F $. 8..F Solution) use E*uation +&,4- and solve for the @K interest rate/ .+1/840 , 1/400-11/400 ' +"30170-2 5 0/0% , if if 5 0/04% 278

>se the following information to answer the ne%t two 4uestionsG Assume that the spot rate change" from J7.2. per ?wiss franc on Canuary 1 in one recent year to J7.28 per ?wiss franc on !ecember +1 of that year. 25. # What is the percentage change in the franc spot rate using "irect 4uotes for a >? company? A. 0.00F B. 2.20F . 5.00F !. 8.77F $. 6.66F Solution) @se E*uation +&,1-/ 6 Chan e 5 +0/34 , 0/3%-10/3% 5 0/032& or 3/2&6 28. # What is the percentage change in the franc spot rate using in"irect 4uotes for a >? company? A. B. . !. $. 2.20F 5.55F 8.88F 6..0F 0.00F

Solution) Convertin the a:ove e'a!ple into indirect *uotationsA the S;iss franc chan es fro! 1/&32& francs to 1/%803 francs/ @se E*uation +&,2- to solve this pro:le!/ 6 Chan e 5 +1/&32& , 1/%803-11/%803 5 3/2&6 26. ,he bi" price is J7.2. for the ana"ian "ollar an" the as' price is J7.28 for the ana"ian "ollar. What is the bi"1as' sprea" for the ana"ian "ollar? A. 2.55F B. 5.55F . 8.50F !. 2.20F $. 0.20F Solution) @se E*uation +&,"-/ Spread 5 +0/34 , 0/3%-10/3% 5 0/032& or 3/2&6

276

Chapter 3 Currenc$ Futures and Cptions 1. ,he 3nternational /onetary /ar'et in the hicago /ercantile $%change tra"es A. stoc's B. bon"s . >? ,reasury Bills !. currency futures $. all of the above !ifferences between the futures mar'et an" the forwar" mar'et inclu"e A. price range B. maturity . si&e of contract !. cre"it ris' $. all of the above ,he buyer an" the seller in currency future mar'ets agree on A. a future "elivery "ate B. the price to be pai" . the 4uantity of the currency !. all of the above $. none of the above ,he main objective of he"gers in currency futures mar'ets is to A. ma'e a profit B. protect against e%change ris' . ma'e sure that foreign bills are collecte" !. protect against political ris' $. none of the above urrency futures contracts are normally available . A. in a pre1"etermine" amount for a specifie" maturity "ate B. in fle%ible maturity "ates . tailore" to the "esire of the buyer !. tailore" to the "esire of the seller $. tailore" to the "esire of both the buyer an" the seller ,he forwar" mar'et of foreign e%change offers contracts . A. tailore" to meet the nee"s of the buyers an" sellers B. which are normally stan"ar"i&e" . which have a stan"ar"i&e" maturity "ate !. which are regulate" by the ommo"ity (utures ommission $. which are available in a pre1"etermine" amount 217 . . .

# 2.

# +.

# .. #

0. #

2. #

5. #

urrency futures contracts are . A. tra"e" on organi&e" e%changes B. actually settle" for "elivery . bac'e" by compensating balances !. han"le" by commercial ban's $. han"le" by mutual savings ban's ,he lifetime high an" low figures in the currency futures 4uotation table mean A. the highest an" lowest prices "uring the year B. the highest an" lowest prices "uring the "ay . the highest an" lowest prices for each contract month "uring its life time !. the highest an" lowest prices for each wee' $. none of the above .

8. #

6. #

,he @open interest@ in a currency futures 4uotation table refers to the . A. total number of contracts tra"e" B. total number of outstan"ing contracts which are not offset by opposing transactions . total number of intereste" parties !. total number of contracts tra"e" in a year $. none of the above /argin re4uirements in currency futures mar'ets are a form of A. transaction cost B. collateral "eposit . bro'erage fee !. compensation $. all of the above ?peculators in currency futures mar'ets are A. covere" by options contracts B. covere" by future contracts . usually ma'ing profits !. greatly e%pose" to e%change rate ris' $. always losing money . .

17. #

11.

# 12.

,he e%changes that tra"es currency options inclu"e ))). A. 9hila"elphia ?toc' $%change B. hicago /ercantile $%change . hicago Boar" 8ptions $%change !. ?ingapore ?toc' $%change $. all of the above 211

1+. #

A currency call option gives the . A. buyer the right to buy the un"erlying currency B. seller the right to sell the un"erlying currency . bro'er the right to buy the un"erlying currency !. seller the right to buy the currency futures contracts $. none of the above A currency put option gives the A. buyer the right to buy B. buyer the right to sell . bro'er the right to sell !. seller the right to sell $. none of the above the un"erlying currency.

1.. #

10. #

A stri'e price in currency options mar'ets is the specifie" e%change rate at which the A. option can be e%ercise" B. option can be bought . option can be sol" !. futures options can be sol" $. none of the above A call option has an intrinsic value if the stri'e price is . A. above the e%change rate of the un"erlying currency B. below the e%change rate of the un"erlying currency . above the forwar" rate !. below the forwar" rate $. above the spot rate of the >.?. "ollar A currency futures call option gives . A. the buyer the obligation to buy a particular currency futures contract B. the seller the right to sell a particular currency futures contract . the seller the obligation to sell a particular un"erlying currency !. the buyer the right to buy a particular currency futures contract $. none of the above A currency futures put option gives . A. the buyer the obligation to sell a particular currency futures contract B. the seller the right to sell a particular currency futures contract . the seller the right to sell an un"erlying currency !. both the seller an" the buyer to sell a particular currency futures contract $. the buyer the right to sell a particular currency futures contract

12. #

15.

# 18.

212

16. #

8ption premiums consist of . A. intrinsic value* time value* an" current value B. intrinsic value* time value* an" volatility . current value* time value* an" volatility !. time value* intrinsic value* an" historical value $. all of the above (utures contracts of the following currencies are tra"e" on the $%change e%cept )))). A. British poun" B. euro . Capanese yen !. ?wiss franc $. -ew Mealan" "ollar hicago /ercantile

27.

# 21. #

A long currency futures position means that an investor has the following situation A. a put option B. a call option . a forwar" he"ge !. a futures he"ge $. none of the above Which of the following instruments is a financial "erivative? A. currency futures B. currency forwar" . interest swap !. currency swap $. all of the above 8rgani&e" e%changes tra"e the following futures instrumentsG A. currency futures of any maturity B. stan"ar"i&e" currency futures . currency futures of any si&e !. currency futures sol" in any currency $. none of the above .

22.

# 2+. #

2..

urrency futures contracts are ac4uire" for the following purposes ))). A. he"ging B. speculation . arbitrage !. he"ging an" speculation $. all of the above

21+

20.

# 22.

,he major types of ris' in "erivatives tra"ing are A. cre"it B. li4ui"ity . settlement !. mar'et $. all of the above

A multinational company wants to use a currency put option to he"ge 17 million ?ingapore "ollars in accounts receivable. ,he premium of the currency option with a stri'e price of J.00 >? is J.70 >?. 3f the option is e%ercise"* what is the total amount of >? "ollars receive" after accounting for the premium payment? A. J0*777*777. B. J0*277*777. . J0*077*777. !. J2*777*777. $. J6*777*777. Solution) total receipts 5 Sin apore dollars 10A000A000 ' /&& 5 <&A&00A000 total pre!iu! 5 Sin apore dollars 10A000A000 ' /0& 5 &00A000 net receipts 5 <&A000A000

25. #

,he premium for a British put poun" with an e%ercise price of J1.57 is J.70. What is the brea'even spot rate for the buyer of the put? A. J1.57. B. J1.20. . J1.50. !. J1.27. $. J2.17. Solution) :rea(even point 5 <1/80 , <0/0& 5 <1/3&

28.

Nou purchase a call option on British poun"s for a premium of J.7. per unit with an e%ercise price of J1.20. ,he option will not be e%ercise" until the e%piration "ate* if at all. 3f the spot rate on the e%piration "ate is J1.25* your net profit or net loss per unit isG A. J.7.. B. J.72. . 1J.72. !. 1J.7.. $. J.07. Solution) @se E*uation +3,2- ) profit or loss 5 <1/38 , +<1/3& = </0%- 5 ,</02

21.

>se the following information to answer the ne%t three 4uestionsG 8n 8ctober 2+* the closing e%change rate of British poun"s was J1.87. alls which woul" mature the following Canuary with a stri'e price of J1.80 were tra"e" at J7.17. 26. # ,he call options were . A. in the money. B. at the money. . out of the money. !. below the money. $. above the money. Solution) +7. # <1/40 , <1/4& 5 ,<0/0&

What is the intrinsic value? A. 1J.70. B. J.70. . J.77. !. J.17. $. J.07. Solution) The !athe!atical value of the option is ne ative +,<0/0&-A :ut the intrinsic value is Dero :ecause it cannot :e ne ative/

+1.

3f the e%change rate of British poun"s rises to J2.77 prior to the Canuary option e%piration "ate* what is the percentage return on investment for an investor who purchase" a call on 8ctober 2+? A. .7F B. .0F . 07F !. 00F $. 57F Solution) 6 return 5 +<2/00 , <1/4& , <0/10-1<0/10 5 &06

210

Chapter 8 Financial S;aps 1. (inancial swap mar'ets have emerge" in recent years because of the following reasons ))). A. e%change rates fluctuate wi"ely B. interest rates fluctuate wi"ely . forwar" mar'ets may not function properly !. currency futures are available only for selecte" currencies $. all of the above (inancial swaps are use" by the following organi&ations ))). A. multinational companies B. commercial ban's . worl" organi&ations !. sovereign governments $. all of the above ,he origins of the swap mar'et are usually regar"e" as an outgrowth of the following financial instruments ))). A. parallel loans B. bac'1to1bac' loans . commercial paper !. treasury bills $. A an" B ,ypically* parallel loans involve the following parties A. two multinational firms B. three multinational firms . two subsi"iary firms !. five multinational firms $. A an" A bac'1to1bac' loan usually involves A. two* two B. four* four . three* three !. A an" B $. all of the above companies in .

# 2.

# +.

# ..

# 0. #

"ifferent countries.

212

2.

# 5. #

,he shortcomings of parallel an" bac'1to1bac' loans inclu"e A. "ifficulty of fin"ing counterparties B. a non1compliance by one of the parties . "ifficulty of fin"ing e%act matching nee"s !. A an" B $. A* B* an"

urrency swaps overcome the shortcomings of parallel an" bac'1to1bac' loans because of . A. speciali&e" swap "ealers an" bro'ers B. their simplicity . their cost effectiveness !. A an" B $. A* B* an" ,he first currency swap between the Worl" Ban' an" 3B/ was arrange" in 1681 by A. iticorp B. Ban'America . ?olomon Brothers !. /errill Aynch $. none of the above A currency swap ban' is usually A. an en" user B. a financial interme"iary . a currency speculator !. A an" B $. all of the above . .

8. #

6. #

17. #

A currency swap bro'er is a swap ban' who . A. uses his or her own account in completing transactions B. is strictly an agent to ta'e or"ers from her client . a currency speculator !. A an" B $. all of the above 3nterest rate swaps involve counterparties who want to . A. e%change a floating rate commitment for a fi%e" rate loan B. e%change "ebt for stoc' . e%change a short1term loan for a long1term loan !. A an" B $. none of the above

11. #

215

12. #

urrency swaps involve A. one currency B. two currencies . foreign stoc's !. B an" $. none of the above

1+. #

all swaptions are attractive when interests are e%pecte" to A. fall B. rise . stay the same !. A an" B $. none of the above An interest rate floor in currency swaps sets . A. a ma%imum rate on floating interest rate payments B. a ma%imum rate on fi%e" interest rate payments . a minimum rate on floating interest rate payments !. a minimum rate on fi%e" interest rate payments $. none of the above

1.. #

10.

# 12. #

,he basic motivations for swaps inclu"e))). A. to provi"e protection against future changes in e%change rates B. to eliminate interest rate ris's arising from normal commercial operations . to re"uce financing costs !. A an" B $. all of the above /ortgage companies may use interest rate swaps mainly because A. they have short1term liabilities an" long1term assets B. they have long1term "ebt . they have mortgage loans !. A an" B $. none of the above .

15.

3nterest rate swaps are usually possible because international financial mar'ets in "ifferent countries are . A. efficient B. perfect . imperfect !. A an" B $. none of the above

218

18.

# 16.

urrency swaps* as oppose" to parallel an" bac'1to1bac' loans* ))). A. are arrange" by speciali&e" swap "ealers B. inclu"e the right of offset . re4uire principal values to be reflecte" in the participantsE boo's !. A an" B $. all of the above 9lain vanilla swaps ))). A. are the most basic form of swap B. involve two counterparties agreeing to ma'e payments to each other on the basis of some 4uantity of un"erlying assets . re4uire two parties to e%change notional principals !. A an" B $. all of the above -otional principals ))). A. may or may not be e%change" in plain vanilla swaps B. are use" to calculate interest payments . e4ual the value of un"erlying assets involve" in swaps !. B an" $. all of the above >se the following information to answer the ne%t three 4uestionsG Assume that you are a swap "ealer an" have just acte" as a counterparty in an interest rate swap. ,he notional principal for the swap was J5.0 million an" you are now obligate" to ma'e five annual payments of 8 percent interest. ,he floating rate that you will receive is 8.2 percent* an" the floating payments to you are annual as well.

# 27.

21. #

3f interest rates "o not change over the ne%t five years* what will be your annual net inflow? A. J17*777 B. J10*777 . J20*777 !. J.7*777 $. J00*777 Solution) <8A&00A000 ' +0/042 , 0/04- 5 <1&A000/

22.

What is the net present value of your swap agreement at a "iscount rate of 8 percent? A. J17*777 B. J20*66+ . J00*88+ !. J06*860 $. J27*222 216

Solution) <1&A000 ' the annuit$ discount factor of <1 for & $ears at 4 percent 5 <1&A000 ' "/77" 5 <&7A47&/ 2+. 3f the floating rate stays the same for the first two years an" then falls by 1.0 percent* what will be your net payments for the five years? A. B. . !. $. J 50*777 J 67*777 J177*777 1J107*677 1J222*077

Solution) Eou ;ill receive a total of <"0A000 for the first t;o $ears .<8A&00A000 ' +0/042 , 0/040- ' 22/ The ne; floatin rate that $ou ;ill receive) 4/26 , 1/&6 5 3/86/ Eou ;ill pa$ a total of <272A&00 for the last three $ears .<8A&00A000 ' +0/038 , 0/04- ' " $ears2/ ThusA $our net pa$!ent over the five $ears ;ill :e ,<232A&00 +<"0A000 , <272A&00-/ >se the following information to answer the ne%t five 4uestionsG ,wo counterparties agree to enter a foreign currency swap between American "ollars an" ?wiss francs. 8ne "ollar is currently worth 1.. francs. ,he American "ollar payor will provi"e J077*777. ,he interest rate on the "ollar is 6 percent* an" the ?wiss franc rate is 8 percent. ,he swap calls for a life of three years with annual payments. 2.. # Bow much will the provi"er of the "ollar pay at the outset? A. ?(r577*777 B. ?(r077*777 . ?(r+05*1.+ !. ?(r277*777 $. ?(r120*777 Solution) <&00A000 ' SFr1/% 5 SFr800A000/ 20. 3f the interest rates "o not change* what is the annual "ollar interest payment for the foreign borrower of "ollars? A. J+.*777 B. J.7*777 . J.0*777 !. J07*777 $. J00*777 Solution) <&00A000 ' 0/07 5 <%&A000/ 227

22.

3f a net payment is recor"e" for interest in year one an" e%change rates "o not change* what will be the net payment? A. J1*777 B. J2*777 . J+*777 !. J0*777 $. J5*777 Solution) <&00A000 ' +0/07 , 0/04- 5 <&A000/

25. #

What will be the total payment in francs by the borrower of "ollars for year +? A. ?(r502*777 B. ?(r077*777 . ?(r.77*777 !. ?(r+07*777 $. ?(r 0+*077 Solution) SFr800A000 +1/04- 5 SFr8&3A000/

28.

What will be the total payment in "ollars by the borrower of francs for year +? A. J107*777 B. J2.0*777 . J0.7*777 !. J0.0*777 $. J277*777 Solution) <&00A000 +1/07- 5 <&%&A000/

221

Chapter 4 E'chan e 9ate Forecastin 1. (oreign e%change mar'ets are efficient if . A. there are many informe" investors B. e%change rates reflect all available information . there are no barriers of fun"s movement !. transaction costs are negligible $. all of the above 3n empirical stu"ies on foreign e%change rate forecasting* the general consensus on mar'et efficiency. A. strong1form B. semistrong1form . wea'1form !. semiwea'1form $. all of the above efficiency best "escribes

# 2.

+.

# ..

A fun"amental analysis in e%change rate forecasting involves the following e%cept A. inflation rates B. interest rates . national income growth !. money supply $. price tren"s A technical analysis in e%change rate forecasting involves the following e%cept A. past price B. volume movements . price charting !. political factors $. filter rule ,here are three 'in"s of efficient mar'ets. ,hese are A. wea' form efficient mar'et B. semi1strong form efficient mar'et . strong form efficient mar'et !. perfectly efficient form mar'et $. A* B* an" . .

# 0.

222

2.

# 5.

,hree are A. B. . !. $.

metho"s are wi"ely use" to forecast floating e%change rates. ,hese three metho"s . technical analysis* fun"amental analysis* an" forwar" rates technical analysis* mar'et1base" forecasts* an" spot rates fun"amental analysis* mar'et1base" forecasts* an" forwar" rates fun"amental analysis* technical analysis* an" mar'et1base" forecasts all of the above

# 8. #

!ufey an" :i""y suggeste" that currency forecasting can be consistently useful or profitable only if one of four con"itions is met. ,hese con"itions inclu"e the following ))). A. the forecaster has e%clusive use of a superior forecasting mo"el B. the forecaster has consistent access to information before other investors . the forecaster pre"icts the nature of government intervention in the foreign e%change mar'et !. A an" B $. A* B* an" 3f the forwar" rate is the best available pre"ictor <unbiase"= of future spot rates* the forwar" mar'et is . A. inefficient B. efficient . semi1efficient !. B an" $. none of the above (orecasting nee"s of the multinational company inclu"e all of the following but A. he"ging "ecision B. wor'ing capital management . long1term investment analysis !. long1term financing "ecision $. speculation ,wo primary metho"s of technical analysis consist of . A. charting an" mechanical rules B. charting an" forwar" rates . mechanical rules an" spot rates !. charting an" the theory of purchasing power parity $. multiple regression analysis an" spot rates .

6.

# 17. #

22+

11.

# 12.

,wo major 4ualities of mechanical rules as compare" with chartists are A. subjective ju"gement an" objective s'ill B. consistency an" superior ju"gement . superior accuracy an" subjective ju"gement !. consistency an" "iscipline $. objective ju"gement an" error1free results (ilter rule is a rule that belongs to the following forecasting metho". A. fun"amental analysis B. mar'et1base" forecast . econometrics mo"el !. forwar"1rate forecasting mo"el $. technical analysis /ar'et1base" forecasts consist of . A. spot rate* forwar" rate* an" inflation rate B. spot rate* forwar" rate* an" e%change rate . spot rate* forwar" rate* an" interest rate !. spot rate* forwar" rate* an" wage rate $. technical analysis an" fun"amental analysis

# 1+. #

1..

# 10.

,he four1step se4uence as a general forecasting proce"ure un"er a fi%e" rate system consists of . A. assessing the balance of payments outloo' B. measuring the magnitu"e of re4uire" a"justment . timing of a"justment !. nature of a"justment $. all of the above ,here are at least three ways to "etermine the si&e of the change in the e%change rate re4uire" to bring the balance of payments bac' into e4uilibrium. Which of the following is one of the three ways to restore the balance1of1payments e4uilibrium? A. the theory of purchasing power parity B. forwar" e%change rate . free mar'et or blac' mar'et rate !. all of the above $. none of the above

22.

12.

Whether a country will "evalue its currency un"er a fi%e" rate system is ultimately a )) "ecision. A. economic B. momentary . political !. fiscal $. international 3n the case of a structural balance of payments "eficit* policy ma'ers attempt to implement a number of corrective policies* e%clu"ing . A. tight monetary policy B. tight fiscal policy . e%change controls !. higher government spen"ing $. wage controls ,he flowing may be e%pose" to foreign e%change ris's ))). A. cre"it purchases whose prices are state" in foreign currencies B. borrowe" fun"s "enominate" in foreign currencies . uncovere" forwar" contracts !. A an" B $. all of the above Wor'ing capital management involves all of the following e%cept ))). A. short term financing "ecisions B. short1term investment "ecisions . fi%e" assets !. interest rates $. selection of loan currencies A mar'et1base" forecast is ))). A. a currency forecasting techni4ue that uses historical prices or tren"s B. a forecast base" on mar'et in"icators such as forwar" rates . a systematic effort at uncovering functional relationships between a set of in"epen"ent variables an" a "epen"ent variable !. A an" B $. none of the above >se the following information to answer the ne%t two 4uestions. Assume that the ana"ian "ollar appreciates from >?J7.20 at the beginning of the year to >?J7.57 at the en" of the year.

15.

# 18.

# 16. #

27. #

220

21.

What is the percentage appreciation of the ana"ian "ollar? A. ..26F B. 0.26F . 2.26F !. 5.26F $. 8.26F Solution) @se E*uation +4,1-) #ercenta e Chan e 5 +0/80 , 0/3&-10/3& 5 8/376

22. #

What is the percentage "epreciation of the >? "ollar? A. 15.1.F B. 12.77F . 10.1.F !. 18.88F $. 16.16# Solution) @se E*uation +4,2-) #ercenta e Chan e 5 +0/3& , 0/80-10/80 5 ,8/1%6 >se the following information to answer the ne%t three 4uestions. ?uppose that the ?wiss franc appreciates from >?J7..7 at the beginning of the year to >?J7... at the en" of the year. ,he >? inflation rate is 0 percent an" the ?wiss inflation rate is + percent "uring the year.

2+. #

What is the percentage appreciation of the ?wiss franc? A. 11.12F B. 11.77F . 17.77F !. 17.06F $. 12.77F Solution) @se E*uation +4,1-) #ercenta e Chan e 5 +0/%% , 0/%0-10/%0 5 106

222

2..

What will the "ollar price of the ?wiss franc be in one year? A. J7..7.. B. J7.07.. . J7.2710 !. J7.5700 $. J7..758 Solution) @se E*uation +4,"-) #redicted 9ate 5 <0/% ' .+1 = 0/0&-1+1 = 0/0"-2 5 <0/%084

20. #

What is the real "epreciation <1= or real appreciation of the ?wiss franc "uring the year? A. 2..F B. 5.1F . 5.6# !. 8.2F $. 6.6F Solution) +0/%%00 , 0/%084-10/%084 5 8/76

22.

,he spot rate is >?J7.07 per Australian "ollar. ,he annual interest rates are 12 percent for the >nite" ?tates an" 8 percent for Australia. 3f these interest rates remain constant* then what is the >? "ollar mar'et forecast of the spot rate for the Australian "ollar in five years? A. J..226 B. J..666 . J0.665 !. J2...5 $. J5.228 Solution) @se E*uation +4,&-) #redicted 9ate 5 <0/&0 ' .+1 = 0/12-&1+1 = 0/04-&2 5 <0/&778

25.

A 27 peso percent return in /e%ico is higher than a 5 percent "ollar return in the >nite" ?tates. A. true B. false . either true or false !. none of the above $. it "epen"s on whether these are nominal or real returns.

225

Chapter 7 Mana in Transaction E'posure and Econo!ic E'posure 1. # ,ransaction e%posure occurs if there is a change in an e%change rate an" . A. an outstan"ing obligation "enominate" in a foreign currency is settle" B. sales are ma"e in cash . purchases are ma"e in cash !. an outstan"ing obligation "enominate" in a home currency is settle" $. all of the above 3f a foreign currency "epreciates* e%change losses will occur when e%pose" A. receipts are greater than e%pose" payments B. payments are greater than e%pose" receipts . receipts are greater than e%pose" net worth !. receipts an" e%pose" payments are the same $. none of the above .

2. #

+.

# ..

$conomic e%posure measures the impact of actual e%change conversion involving the following cases e%cept . A. cash flows from a foreign investment B. a foreign subsi"iary borrows money in international financial mar'ets . a foreign subsi"iary imports raw materials !. local wages go up $. none of the above A forwar" mar'et he"ge involves the following e%cept A. a fi%e" amount of foreign currency B. forwar" rate . forwar" contract !. future spot rate $. commercial ban's A money1mar'et he"ge "oes not involve the following A. spot rate B. interest rate . forwar" rate !. mar'etable securities $. accounts receivable .

# 0. #

228

2. #

An option1mar'et he"ge in foreign e%change ris' management is a form of a<n= A. covere" he"ge B. open position . balance sheet he"ge !. swap $. speculation A currency swap involves the following A. spot mar'et only B. forwar" mar'et only . spot an" forwar" mar'ets !. options an" futures mar'ets $. the -ew Nor' ?toc' $%change .

5. #

8. #

3n the case of a cre"it swap* a parent company . A. buys a foreign currency in the spot mar'et an" sells it in the forwar" mar'et B. buys a foreign currency in a home mar'et an" sells it in a foreign mar'et . "eposits a home currency at a home ban' on behalf of a foreign ban' an" the foreign ban' len"s money in a foreign currency to the company's foreign subsi"iary !. all of the above $. none of the above 3nterest rate swaps involve the following transaction . A. e%change cash flows of a fi%e" interest rate for cash flows of a floating interest rate B. e%change cash flows of long1term "ebt with cash flows of short1term "ebt . e%change cash flows of foreign currency "ebt with cash flows of home currency "ebt !. all of the above $. none of the above Bac'1to1bac' loans involve the following transaction . A. e4ual loans are arrange" by two multinational parent companies in two "ifferent countries B. e4ual loans are arrange" by one ban' in two "ifferent time perio"s . e4ual loans are arrange" by one multinational corporation in two "ifferent rates !. all of the above $. none of the above

6. #

17. #

226

11.

# 12. #

$conomic e%posure management "oes not involve the following A. "iversifie" pro"uction B. "iversifie" mar'eting . "iversifie" financing !. balance sheet he"ge $. "iversifie" operations ,he three types of foreign e%change e%posures are A. precautionary* transaction* an" speculative B. translation* economic* an" transaction . translation* precautionary* an" political !. transaction* political* an" "evaluation $. transaction* political* an" economic When have A. B. . !. $. .

1+.

a firm has "ivi"en"s payable "enominate" in foreign currency* the firm is sai" to . economic e%posure translation e%posure transaction e%posure ta% e%posure political e%posure

1.. #

(oreign e%change ris' ))). A. becomes less complicate" when currencies are allowe" to float B. "oes not e%ist when all currencies are fi%e" . is the ris' of loss "ue to changes in the international e%change value of national currencies !. "ecreases with the effects of globali&ation $. none of the above A cross1he"ge ))). A. involves the use of forwar" contracts* a combination of spot an" mar'et an" money mar'et transactions* an" other techni4ues to protect from foreign e%change loss B. is a techni4ue "esigne" to he"ge e%posure in one currency by the use of futures or other contracts on another currency that is correlate" with the first currency . involves an e%change of cash flows in two "ifferent currencies between two companies !. involves a loan contract an" a source of fun"s to carry out that contract in or"er to he"ge transaction e%posure $. involves the e%change of one currency for another at a fi%e" rate on some future "ate to he"ge transaction e%posure

10.

2+7

12.

$conomic e%posure management ))). A. is "esigne" to neutrali&e the impact of une%pecte" e%change1rate changes on net cash flows B. can use the same techni4ues use" to eliminate translation an" transaction ris's . uses "iversifie" operations an" financing to re"uce economic e%posure !. A an" $ all of the above >se the following information to answer the ne%t two 4uestionsG ONM ompany has an account receivable of I17*777*777 from a British company to be pai" in three months. ,he a""itional information is as followsG British poun" spot rateG J2.7267 British poun" +1month forwar" rateG J2.77+2 +1month interest rate in the >?G 2F +1month interest rate in the >HG +F

15.

What will be the appro%imate value of the account receivable in >? "ollars if the company ma'es a forwar" mar'et he"ge? A. J27*777*777 B. J27*267*777 . J27*7+2*777 !. J21*777*777 $. J17*777*777 Solution) @S dollar value 5 <2/00"2 ' B10A000A000 5 <20A0"2A000

18. #

What will be the appro%imate value of the accounts receivable in >? "ollars if the company ma'es a money1mar'et he"ge? A. about J27*701*777 B. about J27*76+*777 . about J27*101*777 !. about J27*26+*777 $. about J+7*777*777 Solution) +1+2+"+%:orro; B7A804A8"4 +10A000A00011/0":u$ <17A377A0"0 in e'chan e for B7A804A8"7 invest <17A377A0"0 in the @S at 26 receive <20A07"A010 +<17A377A0"1 ' 1/02-

2+1

>se the following information to answer the ne%t five 4uestionsG A subsi"iary in 3srael re4uires the 3srael she'el e4uivalent of J1 million at the current e%change rate of . she'els per "ollar. ,o obtain . million she'els for the subsi"iary in 3srael* the parent must open a J1 million cre"it in favor of as 3sraeli ban'. ,he 3sraeli ban' charges the parent 17F per year on the . million she'els ma"e available to the subsi"iary an" pays no interest on the J1 million that the parent has "eposite" in favor of the ban'. ,he parent's opportunity cost on the J1 million "eposit is 27F. ,wo financing alternatives are "irect loan an" cre"it swap. 16. # 3f the current e%change rate stays the same* which alternative is less e%pensiveG "irect loan or cre"it swap? A. "irect loan B. cre"it swap . both alternatives are e4ually e%pensive !. cannot tell $. "epen"s on the government policy Solution) Annual interest of the direct loan 5 206 Annual interest of the credit s;ap 5 "06 27. Which alternative is more attractiveG "irect loan or cre"it swap? A. "irect loan B. cre"it swap . e4ually attractive !. cannot tell $. "epen"s on the government policy Solution) The direct loan is cheaper :ut su:Fect to e'chan e ris(? the credit s;ap is !ore e'pensive and has no e'chan e ris(/ ThusA one cannot tell for sure ;hich alternative is !ore attractive. 21. # What is the e%change rate that will ma'e the cost of the "irect loan e4ual to the cost of the cre"it swap? A. 3srael she'el ..7 per J B. 3srael she'el ... per J . 3srael she'el ..8 per J !. 3srael she'el 0.0 per J $. 3srael she'el 6.7 per J Solution) Girect Hoan Cost Credit S;ap Cost 200A000$ = +1A000A000$ , %A000A000- 5 200A000$ = %00A000 $ 5 %/%

2+2

22.

A multinational company believes that the e%change rate at the maturity "ate of the loan is 0 3srael she'els per "ollar. 3f the company's pre"iction proves correct* which alternative is cheaper? A. "irect loan B. cre"it swap . e4ually e%pensive !. cannot tell $. all of the above Solution) Girect loan cost 5 +200A000 ' &- =.+1A000A000 ' &- , %A000A0002 5 2A000A000 Israel she(els Credit s;ap cost 5 200A000 ' & = %00A000 5 1A%00A000 Israel she(els

2+. #

3f mar'et analysts pre"ict that the e%change rate will be 0 3srael she'els per "ollar at the maturity of the loan* which alternative woul" rational "ecision1ma'ers recommen"? A. "irect loan for sure B. cre"it swap for sure . cannot tell !. all of the above $. none of the above Solution) The credit s;ap is :etter :ecause it is cheaper and has no e'chan e ris(/

2++

Chapter 10 Translation E'posure Mana e!ent 1. ,ranslation e%posure means that . A. a firm incurs actual losses in foreign e%change mar'ets B. currency conversion ta'es place in foreign e%change mar'et . a firm ma'es actual profits in foreign e%change mar'ets !. a firm covers its foreign e%change ris' in the forwar" mar'ets $. a firm e%periences an accounting impact of e%change rate changes -et translation e%posure means . A. the "ifference between e%pose" operating e%penses an" fi%e" assets B. the "ifference between e%pose" assets an" accounts receivable . the "ifference between e%pose" assets an" e%pose" liabilities !. the "ifference between e%pose" revenues an" e%pose" e%penses $. none of the above ,he currentPnon1current metho" of currency translation will not affect A. cash B. accounts receivable . accounts payable !. notes payable $. long1term "ebt .

# 2. #

+.

# .. #

,he monetaryPnon1monetary metho" of currency translation will not affect A. cash B. accounts receivable . inventory !. mar'etable securities $. accounts payable

0.

,he temporal metho" of currency translation is almost similar to the monetaryPnon1 monetary metho" e%cept the following item . A. accounts receivables at historical cost B. accounts receivables at mar'et price . inventory at historical cost !. inventory at mar'et price $. fi%e" assets at mar'et price

2+.

2. #

(A?B -o. 8 is the same as the following translation metho" A. currentPnon1current metho" B. monetaryPnon1monetary metho" . temporal metho" !. current rate metho" $. e%change rate metho" (A?B -o. 02 shows e%change gains or losses in the following A. 4uarterly income statement B. annual income statement . stoc'hol"ers' e4uity account !. the sources an" uses of fun"s statement $. none of the above

5. #

8. #

,he functional currency is "efine" as the currency of the environment in which the entity primarily generates an" e%pen"s cash* an" usually refers to the currency. A. parent B. local . reporting !. recor"ing $. home ,he >? "ollar is the functional currency for ))). A. those foreign operations whose cash flows "irectly affect the parentEs >? "ollar cash flows B. foreign entities that are merely an e%tension of the parent company . foreign subsi"iaries in countries with runaway inflation !. foreign subsi"iaries in countries with inflation of 177F over three years $. all of the above When an /- has several subsi"iaries* a variety of fun"s a"justment techni4ues can be use" to re"uce its translation loss. ,hese techni4ues inclu"e the following basic strategies ))))). A. "ecrease soft1currency assets* increase soft1currency liabilities B. increase soft1currency assets* increase soft1currency liabilities . "ecrease har"1currency assets* "ecrease soft1currency liabilities !. "ecrease har"1currency assets* increase har"1currency liabilities $. none of the above

6.

# 17. #

2+0

11.

# 12.

,he following statement "oes not apply to transfer prices ))))). A. they are prices of goo"s an" services sol" between relate" parties B. they are prices of goo"s an" services sol" between parents an" subsi"iaries . they are usually the subject of government policing mechanisms !. they cannot be manipulate" by importers $. they are fre4uently "ifferent from armEs length prices ,ranslation e%posure ))). A. is sometimes calle" accounting e%posure B. measures the affect of an e%change rate change on publishe" financial statement of a firm . refers to the potential change in the value of outstan"ing obligations "ue to changes in the e%change rate between the inception of a contract an" the settlement of the contract !. A an" B $. A an" ,ranslation e%posure affects a companyEs ))). A. ability to raise capital B. earnings per share . stoc' price !. 'ey financial ratios $. all of the above ,ranslation e%posure ))). A. measures the affect of an e%change rate change on publishe" financial statement of a firm B. "oes not involve actual cash flows . "oes not present any financial ris' to a firm !. A an" B $. all of the above Which of the following items is not relate" to a balance sheet he"ge in translation e%posure management? A. re"uce the levels of local currency B. tighten cre"it . "elay the collection of har" currency receivables !. increase har"1currency assets $. options mar'et he"ge >se the following information to answer the ne%t three 4uestionsG AB ompany's ana"ian subsi"iary has the following balance sheet. 2+2

# 1+.

# 1..

# 10.

ash an" receivables J 877 3nventory 677 (i%e" assets 577 ,otal assets J2*.77

9ayables J 677 Aong1,erm !ebt 077 -et Worth 1*777 ,otal claims J2*.77

?uppose the ana"ian "ollar "epreciates from >?J1.77 to >?J.87 "uring the perio". 12. # >n"er the monetaryPnon1monetary metho"* what is AB 's translation gain or loss? A. D J127 B. 1 J127 . D J277 !. 1 J277 $. D J677 Solution) net e'posure 5 C<1A%00 , C<400 5 C<300 ain or loss 5 </20 ' C<300 5 <120 15. # >n"er the currentPnon1current metho"* what is AB 's translation gain or loss? A. D J127 B. 1 J127 . D J227 !. 1 J227 $. D J577 Solution) net e'posure 5 C<700 , C<1A800 5 ,C<400 ain or loss 5 </20 ' +,C<400- 5 ,<130 18. # >n"er the current rate metho"* what is AB 's translation gain or loss? A. D J277 B. 1 J277 . D J207 !. 1 J207 $. D J207 Solution) net e'posure 5 C<1A%00 , C<2A%00 5 ,C<1A000 ain or loss 5 </20 ' +,C<1A000- 5 ,<200

2+5

Chapter 11 International Financial Mar(ets 1. # ,he $urocurrency mar'et consists of ban's which accept "eposits an" ma'e loans in foreign currencies . A. outsi"e the country of issue B. insi"e the country of issue . in the home country !. in $urope only $. none of the above $uro"ollars are >? "ollars "eposite" in A. -ew Nor' B. hicago . Aon"on !. ?an (rancisco $. !etroit $uro"ollars can be create" in A. $urope B. Asia . Aatin America !. Africa $. all of the above . .

2. #

+.

# ..

# 0. #

$uro"ollar "eposits coul" e%pan" in"efinitely if . A. public an" private "epositors always 'eep their money in non1>.?. ban's B. ban's always 'eep their money in non1>.?. ban's . ban's are able to fin" public an" private borrowers in $uro"ollars !. all of the above $. none of the above ,he Ban' for 3nternational ?ettlement is a ban' in central ban's. A. the >nite" ?tates B. ?wit&erlan" . ana"a !. :ermany $. Capan that facilitates transactions among

2+8

2.

# 5. #

,he $uro"ollar mar'et is probably the most efficient because there are no A. reserve re4uirements B. interest ceilings on "eposits . (!3 <(e"eral !eposit 3nsurance orporation= fees !. all of the above $. none of the above

3f the >.?. government imposes a""itional ta%es on interest pai" on >? ban' "eposits* the li'ely effect of this regulation is to . A. e%pan" the $uro"ollar mar'et B. re"uce the $uro"ollar mar'et . have no impact on the si&e of the $uro"ollar mar'et !. increase >.?. ban' "eposits $. none of the above ;ecent movement towar" a highly integrate" global financial system has cause" ban'ers to "evelop three s of central ban'ing. ,hese three s are . A. consultation* cooperation* an" common sense B. coor"ination* cooperation* an" con"itions . consultation* cooperation* an" con"itions !. consultation* cooperation* an" coor"ination $. none of the above $uronote issue facilities consist of . A. $uronotes* $urocommecial paper* an" $uro1me"ium1term notes B $uronotes* commercial paper* an" $urobon"s . $urocommercial paper* $uronotes* an" $urostoc's !. $urocommercial paper* $uronotes* an" $urobon"s $. none of the above 3nterest rates on $uro"ollar "eposits are normally A. lower B. same . higher !. cannot tell $ none of the above 3nterest rates on $uro"ollar loans are normally A. lower B. same . higher !. cannot tell $. all of the above 2+6 than those on >? "eposits.

8.

# 6. #

17. #

11. #

than those on >? loans.

12.

# 1+.

$urobon"s are long1term obligations "enominate" in A. ?wiss franc B. >? "ollars . Capanese yen !. British poun"s $. all of the above ,he main characteristics of straight bon"s "o not inclu"e A. a fi%e" interest rate B. a fi%e" maturity . unsecure" "ebentures !. no interest payment until maturity $. none of the above

outsi"e the country of issue.

# 1.. #

,he interest rate on floating rate bon"s is usually a"juste" every A. three months B. si% months . nine months !. twelve months $. two years ,he main characteristics of &ero1coupon bon"s "o not inclu"e A. interest payment ma"e at maturity B. principal payment ma"e at maturity . sales at a "eep "iscount !. "iscounte" interest $. no perio"ic interest to pay. ,he A. B. . !. $. .

10.

# 12. #

has the largest mar'et share of the international bon" mar'et. >? "ollar Capanese yen :erman mar' British poun" (rench franc

15.

Which of the following "oes not contribute to the efficiency of the $uro"ollar mar'et? A. the >? government imposes no restrictions on non1resi"ent transactions B. foreign entities are free to transact with >? ban's . $uropean ban's offer competitive rates for $uro"ollar "eposits an" loans !. no reserve re4uirements for $uro"ollar time "eposits $. none of the above

2.7

18. #

Which of the following is relate" to the $uro"ollar mar'et? A. H3B8; B. A3B8; . ?3B8; !. /3B8; $. none of the above Which of the following "oes not contribute to the "evelopment of the Asian currency mar'et in ?ingapore? A. Asian "ollar "eposits B. an increase in ban'ing activities in Asia . political instability in Asia !. an increase in tra"e in Asia $. none of the above 3nterest rates on $uro"ollar "eposits may be higher than the rates on "eposits in the >? because . A. $uroban's are more efficient B. $uro"ollar "eposits are not re4uire" to pay (!3 fees . $uroban's are free of reserve re4uirements !. A an" B $. A* B* an" ,he Ban' for 3nternational ?ettlements recommen"s that globally active ban's maintain capital e4ual to at least ))) percent of their assets. A. 17 B. 6 . 8 !. 5 $. 2 ,he popularity $uronotes in comparison with $uro ommercial paper is A. larger B. smaller . e4ual !. A an" $. B an" ,he international capital mar'et consists of the following A. international bon" mar'et B. international stoc' mar'et . $urocurrency mar'et !. $uro commercial paper mar'et $. A an" B 2.1 . .

16.

27.

# 21.

22. #

2+.

2.. #

:lobal bon"s are bon"s sol" . A. insi"e the country in whose currency they are "enominate" B. outsi"e the country in whose currency they are "enominate" . insi"e as well as outsi"e the country in whose currency they are "enominate" !. A an" B $. A* B* an" ,he hol"er of currency option bon"s are allowe" to receive their interest payments in the currency of their option among . A. ten pre"etermine" currencies B. five pre"etermine" currencies . two or three pre"etermine" currencies !. A an" B $. A* B* an" urrency coc'tail bon"s are issue" to minimi&e A. interest rate ris' B. foreign e%change rate ris' . sovereign ris' !. "efault ris' $. all of the above :overnments privati&e state1owne" companies to A. assist the "evelopment of capital mar'ets B. raise money . wi"en share ownership !. replace public1sector "ecision1ma'ing $. all of the above .

20.

22. #

25.

# 28.

,ra"itionally* >? ban's have face" all of the following prohibitions on e4uity1relate" activities e%cept for ))))). A. ban's cannot own stoc' for their own account B. ban's cannot ma'e a mar'et in e4uity securities . ban's cannot participate in interstate ban'ing !. ban's cannot actively vote shares hel" in trust for their ban'ing clients $. ban's cannot engage in investment ban'ing activities

2.2

26. #

By crosslisting its shares on foreign e%changes* an /- hopes to accomplish all but the following )))))). A. avoi" security regulations of all countries where their shares are liste" B. allow foreign investors to buy their shares in their home mar'et . provi"e another mar'et to support a new issuance !. compensate local management an" employees in the foreign affiliates $. establish a presence in an a""itional country

2.+

Chapter 12 International Ban(in Issues and Countr$ 9is( Anal$sis 1. # ,he foreign ban' representative office A. accepts "eposits B. obtains local mar'et information . ma'es loans !. issues letters of cre"it $. tra"es $uro"ollars .

2. #

,he foreign correspon"ent ban' is a form of A. branch ban'ing B. subsi"iary ban' . informal ban'ing relationship !. consortium ban'ing $. none of the above

+.

# ..

Which of the following is not a major characteristic of the foreign ban'ing subsi"iary? A. its own charter B. its own boar" of "irectors . its own stoc'hol"ers !. all ban'ing officers from the parent ban' $. none of the above ,he learing Bouse 3nterban' 9ayments ?ystem < B39?= . A. accepts international "eposits B. ma'es international loans . clears foreign e%change transactions !. moves "ollars between -ew Nor' offices of financial institutions $. moves foreign currencies between -ew Nor' an" Bong Hong ,he learing Bouse 9ayments Assistance ?ystem < B9A?= . A. accepts international "eposits B. ma'es international loans . clears foreign e%change transactions !. moves fun"s between Aon"on offices of most financial institutions which han"le foreign e%change tra"es $. all of the above

# 0.

2..

2. #

An international syn"icate" loan is ma"e by a group of A. ban's from "ifferent countries B. corporations from "ifferent countries . countries !. >? ban's $. Capanese ban's A country ris' analysis "oes not inclu"e A. political ris' B. economic ris' . objective criteria !. company financial analysis $. none of the above .

5.

# 8.

# 6. #

,he Worl" Ban' classifies the "ebt bur"en of "eveloping countries accor"ing to a set of ))))) ratios. A. five B. four . three !. seven $. two ountry ris' ran'ings can be foun" in the following journal ))). A. 3/( ?taff 9apers B. $uromoney . the Cournal of 3nternational Business ?tu"ies !. /ultinational Business ;eview $. Cournal of (inance ,wo financial service firms an" assign letter ratings to in"icate the 4uality of sovereign1government bon"s. A. !ow Cones ompany an" /oo"y's 3nvestor ?ervice B. ?tan"ar" Q 9oor's an" !ow Cones ompany . itiban' an" /oo"y's 3nvestor ?ervice !. C.9. /organ an" itiban' $. /oo"y's 3nvestor ?ervice an" ?tan"ar" Q 9oor's ,he international "ebt crisis of the 1687s starte" when the following countries coul" not ma'e international "ebt payments . A. /e%ico* Bra&il* an" ,aiwan B. Bra&il* /e%ico* an" Argentina . Argentina* Bra&il* an" Horea !. ,aiwan* Horea* an" /e%ico $. all of the above 2.0

17.

# 11. #

12. #

,he Asian financial crisis of 1665 starte" in A. Horea B. ,hailan" . /alaysia !. 3n"onesia $. 9hilippines

1+.

# 1..