Professional Documents

Culture Documents

FINAL EXAM Winter 2014

Uploaded by

denisemriceOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINAL EXAM Winter 2014

Uploaded by

denisemriceCopyright:

Available Formats

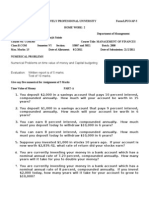

FIN 6212 Winter 2014 Final Exam Name:________________________________________ The Exam is a total of 130 points.

You must complete at least 100 points of problems and you may exceed that for EXTRA CREDIT. MAKE SURE TO SHOW ALL YOUR WORK!!!!

Problem 1: 5 points Blockbuster Inc. Balance Sheet for year-ended Dec 31 ($000's) ASSETS Cash Accounts Receivables Inventory Other Current Assets Total Current Assets Fixed Assets Long Term Investments PP&E Goodwill Total Fixed Assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Accounts Payable Short-term Debt 1,090,400 32,800 1,087,400 181,400 214,100 1,079,400 6,455,900 7,749,400 8,548,900 159,500 909,000 5,967,500 7,036,000 7,752,400 Year 1 194,200 185,800 242,200 177,300 799,500 Year 2 200,200 150,000 202,900 163,300 716,400

Total Current Liabilities Long-term Debt Total Liabilities Shareholders' Equity Common Stock Retained Earnings Total Stockholder Equity Total Liabilities and Shareholders' Equity

1,123,200 1,417,300 2,540,500

1,268,800 734,900 2,003,700

6,095,200 -86,800 6,008,400

6,075,800 -327,100 5,748,700

8,548,900

7,752,400

Blockbuster Inc. Income Statement for year-ended Dec 31 ($000's) Year 1 Sales COGS SG&A Depreciation 4,969,100 2,036,000 2,390,600 279,000 Year 2 5,157,600 2,420,700 2,532,400 246,600 176,100 -218,200 78,200 -296,400 -56,100 -240,300

Amortization of Intangibles 180,100 Operating Income (Loss) Interest Expense Income Before Tax Income Tax Expense Net Income 83,400 116,500 -33,100 45,400 -78,500

Referring to the Blockbuster financial statements, what is the change in ROE from Year 1 to Year 2? (ROE = )

Problem 2: 5 points Blockbuster Inc. Income Statement for year-ended Dec 31 ($000's) Year 1 Sales COGS SG&A Depreciation 4,969,100 2,036,000 2,390,600 279,000 Year 2 5,157,600 2,420,700 2,532,400 246,600 176,100 -218,200 78,200 -296,400 -56,100 -240,300

Amortization of Intangibles 180,100 Operating Income (Loss) Interest Expense Income Before Tax Income Tax Expense Net Income 83,400 116,500 -33,100 45,400 -78,500

Referring to the Blockbuster financial statements, what is the change in ROA from Year 1 to Year 2?

Problem 3: 5 points Blockbuster Inc. Income Statement for year-ended Dec 31 ($000's) Year 1 Sales COGS SG&A Depreciation 4,969,100 2,036,000 2,390,600 279,000 Year 2 5,157,600 2,420,700 2,532,400 246,600 176,100 -218,200 78,200 -296,400 -56,100 -240,300

Amortization of Intangibles 180,100 Operating Income (Loss) Interest Expense Income Before Tax Income Tax Expense Net Income 83,400 116,500 -33,100 45,400 -78,500

Referring to the Blockbuster financial statements, which of the following ratios decreased from Year 1 to Year 2: I. II. III. Equity Multiplier Net Profit Margin Total Asset Turnover 5 points

Problem 4:

Blockbuster Inc. Income Statement for year-ended Dec 31 ($000's) Year 1 Sales COGS SG&A 4,969,100 2,036,000 2,390,600 Year 2 5,157,600 2,420,700 2,532,400

4

Depreciation

279,000

246,600 176,100 -218,200 78,200 -296,400 -56,100 -240,300

Amortization of Intangibles 180,100 Operating Income (Loss) Interest Expense Income Before Tax Income Tax Expense Net Income 83,400 116,500 -33,100 45,400 -78,500

Referring to the Blockbuster financial statements, what is the change in Gross Margin from Year 1 to Year 2? (GM = )

Problem 5:

5 points

Blockbuster Inc. Income Statement for year-ended Dec 31 ($000's) Year 1 Sales COGS SG&A Depreciation 4,969,100 2,036,000 2,390,600 279,000 Year 2 5,157,600 2,420,700 2,532,400 246,600 176,100 -218,200 78,200 -296,400 -56,100 -240,300

Amortization of Intangibles 180,100 Operating Income (Loss) Interest Expense Income Before Tax Income Tax Expense Net Income 83,400 116,500 -33,100 45,400 -78,500

Referring to the Blockbuster financial statements, what is the most important underlying reason for the change in ROE?

Problem 6: 5 points Income Statement Molson Coors Inc. Years 1 & 2 ($000s) Year 1 Revenues 2,429,462 COGS 1,537,623 Depreciation 121,091 SG&A 619,143 EBIT 151,605 Interest Expense -14,403 Other income 32,005 Pre-Tax Income 198,013 Income Tax 75,049 Net Income 122,964 Shares outstanding 36,902 Earnings per share $3.33 Dividends per common share $0.80

Year 2 3,776,322 2,414,530 230,299 833,208 298,285 49,732 8,047 256,600 94,947 161,653 36,140 $4.47 $0.82

Referring to the Molson Coors financial statements, what is the most important determinant of the change in ROE?

Problem 7: 10points You have the opportunity to purchase an insurance policy for your newborn son. You must make the payments shown in the table. After his fifth birthday no more payments are required. If your son reaches the age of 60, then the insurance company will pay him $90,000. Alternatively, you could invest the money in a savings account. Your banker promises to pay you interest at the rate of 8% for the first 5 years (from now until your son's fifth birthday), but only promises 4% every year after that. Should you buy the policy or invest in the savings account? First birthday Second birthday Third birthday Fourth birthday Fifth birthday $600 $650 $700 $750 $800

Problem 8: 10

points

Suzanne has identified a project with the following cash flows. What is the present value of the cash flows at time 0 if the interest rate is 9%? Year 1 2 3 4 Cash Flow $2,000 $650 $375 $1,200

Problem 9 10points: Jacquie plans to deposit $3,500 into her savings account for each of the next 5 years, and then $2,000 per year for 5 years after that (all at year end). She anticipates interest rates to be 6% for the next 3 years and then 9% thereafter. How much will she have in the account after the 10 years? Problem 10 10points: You can invest $3,000 at the end of each of the next 20 years into a retirement account paying 10% annual interest. Alternatively, you can enter into a retirement plan with your employer where, for every yearly (end-of-year) payment of $3,000 you make, the firm will contribute $1,500. Your employer's plan will also last for the next 20 years. The firm guarantees a return of 7% on its retirement plan. Which option is better?

Problem 11 15 points: Utility Muffin Research Kitchen Inc. is financed with debt, preferred stock and common equity. Selected information for each of the securities is provided in the table below. Calculate the capital structure weights which would be used to calculate the weighted average cost of capital. Long-term Debt: $5M Face Value, Coupon Rate = 3.5%, Annual Coupons, Time to Maturity = 10 Years, YTM = 5%. Preferred Shares: 0.5M Shares outstanding, Par Value = $10 per share, Dividend Rate (Annual) = 4%, Equivalent preferred shares yield 7%.

Problem 12: 15 points Consider two firms that are identical in every way except that one has $1,200 of debt and 350 shares of stock outstanding, while the other is all-equity and has 400 shares of stock outstanding. Assume that the debt is a perpetuity with annual coupons at the rate of 7%. What is each firm's earnings per share if EBIT is $5,000? Assume a tax rate of 40%. All-Equity Firm $5,000 ?

EBIT EPS

Leveraged Firm $5,000 ?

Problem 13 15 points: The Seattle Corporation has been presented with an investment opportunity which will yield end of year cash flows of $30,000 per year in Years 1 through 4, $35,000 per year in Years 5 through 9, and $40,000 in Year 10. This investment will cost the firm $150,000 today, and the firm's cost of capital is 10%. What is the NPV for this investment? Problem 14 15points: Orange Inc., the Cupertino-based computer manufacturer, has developed a new all-in-one device: phone, music-player, camera, GPS, and computer. The device is called the iPip. The following data have been collected regarding the iPip project. The company has identified a prime piece of real estate and must purchase it immediately for $100,000. In addition, R&D expenditures of $175,000 must be made immediately. During the first year the manufacturing plant will be constructed. The plant will be ready for operation at the end of Year 1. The construction costs are $500,000 and will be paid upon completion. At the end of the Year 1, an inventory of raw materials will be purchased costing $50,000. Production and sales will occur during years 2 and 3. (Assume that all revenues and operating expenses are received (paid) at the end of each year.) Annual revenues are expected to be $850,000. Fixed operating expenses are $100,000 per year and variable operating expenses are 25% of sales. The construction facilities are classified as 10-year property for tax-depreciation purposes. When the plant is closed it will be sold for $200,000. (Note: Assume the investment in plant is depreciated during years 2 and 3.) The land will be sold for $225,000 at the end of year 3. The tax rate on all types of income is 34%. The cost of capital is 12%. What are the operating cash flows at the end of Year 2? MACRS Depreciation Rates Year 10-Year 1 10.00% 2 18.00% 3 14.40%

15-Year 5.00% 9.50% 8.55%

You might also like

- Tax Notes For Construction Industry in AlbaniaDocument117 pagesTax Notes For Construction Industry in AlbaniaEduart GjokutajNo ratings yet

- New Associate Checklist: Complete at OrientationDocument20 pagesNew Associate Checklist: Complete at OrientationJeremyNo ratings yet

- Assignment Workplace ScenarioDocument2 pagesAssignment Workplace ScenarioMahmoud AzzamNo ratings yet

- Construction Bonds and Contracts - Part 2Document18 pagesConstruction Bonds and Contracts - Part 2Erza LeeNo ratings yet

- Final Prep 6Document833 pagesFinal Prep 6rohitthalalNo ratings yet

- Employment ApplicationDocument2 pagesEmployment Applicationapi-315169234No ratings yet

- Ultimate Business Plan Template 3Document40 pagesUltimate Business Plan Template 3Stephanie GaylesNo ratings yet

- Intermediate Accounting BookDocument441 pagesIntermediate Accounting BookMD. Monzurul Karim Shanchay100% (1)

- Sample Questions Chapter 22 PDFDocument4 pagesSample Questions Chapter 22 PDFAli Mohsin100% (1)

- F4 MysDocument4 pagesF4 MysRicky Hooi67% (3)

- 2009 Compensation & Benefits Survey QuestionnaireDocument18 pages2009 Compensation & Benefits Survey QuestionnaireearendilvorondoNo ratings yet

- Claim MethodsDocument20 pagesClaim MethodsYasir AhmadNo ratings yet

- Chapter Review Problem 19.1 - Assignment # 2: Fundamentals of Income Tax Workbook 2019 - Volume 2 243Document6 pagesChapter Review Problem 19.1 - Assignment # 2: Fundamentals of Income Tax Workbook 2019 - Volume 2 243Nam Tran0% (3)

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Acct1511 Final VersionDocument33 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- Corporate Finance AssignmentDocument5 pagesCorporate Finance AssignmentKashif KhurshidNo ratings yet

- 6 201506Q3Document19 pages6 201506Q3Hannah GohNo ratings yet

- Mid Term Exam Odd Semester 2012/2013 Financial ManagementDocument4 pagesMid Term Exam Odd Semester 2012/2013 Financial ManagementNovita Sari ElysiaNo ratings yet

- Paper T6 (Int) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Document155 pagesPaper T6 (Int) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009haroldpsb50% (4)

- Homework PDFDocument3 pagesHomework PDFSyed AliNo ratings yet

- CasesDocument18 pagesCasesparmendra_singh25No ratings yet

- Exam Pattern Questions Marks Total SyllabusDocument55 pagesExam Pattern Questions Marks Total Syllabusrahulnationalite83% (6)

- IBF FINAL Exam SP 2020 ONLINE BDocument4 pagesIBF FINAL Exam SP 2020 ONLINE BSYED MANSOOR ALI SHAHNo ratings yet

- BU340 Managerial FinanceDocument58 pagesBU340 Managerial FinanceG JhaNo ratings yet

- Final Review Session SPR12RปDocument10 pagesFinal Review Session SPR12RปFight FionaNo ratings yet

- Trade Me analysis reveals stock valuationDocument20 pagesTrade Me analysis reveals stock valuationCindy YinNo ratings yet

- Finance Practice ProblemsDocument54 pagesFinance Practice ProblemsMariaNo ratings yet

- Mid Test SolutionDocument5 pagesMid Test SolutionHương Phạm MaiNo ratings yet

- Lady MDocument2 pagesLady MMəhəmməd Əli HəzizadəNo ratings yet

- Financial Forecasting: SIFE Lakehead 2009Document7 pagesFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermzm05280No ratings yet

- Sources of FundsDocument6 pagesSources of FundsAl ShahriarNo ratings yet

- Presentacion CapitalDocument11 pagesPresentacion CapitalLiliana Martínez LiraNo ratings yet

- Financial Management 1Document36 pagesFinancial Management 1nirmljnNo ratings yet

- Ma2 Examiner's Report S21-A22Document7 pagesMa2 Examiner's Report S21-A22tashiNo ratings yet

- Paper LBO Model Solutions BIWSDocument10 pagesPaper LBO Model Solutions BIWSDorian de GrubenNo ratings yet

- Financial PlanDocument18 pagesFinancial Planashura08No ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Case 3 and 4Document4 pagesCase 3 and 4Syed Osama0% (1)

- MBA436 Exam - 2020Document8 pagesMBA436 Exam - 2020Nivi KumarNo ratings yet

- Justa Corporation US market analysisDocument11 pagesJusta Corporation US market analysisMohsin Rehman0% (1)

- Korteweg FBE 432: Corporate Financial Strategy Spring 2019Document6 pagesKorteweg FBE 432: Corporate Financial Strategy Spring 2019PeterNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Answers to Warm-Up Exercises E14Document10 pagesAnswers to Warm-Up Exercises E14Amanda Ng100% (1)

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Ch16 Tool KitDocument18 pagesCh16 Tool Kitjst4funNo ratings yet

- FINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Document3 pagesFINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Sijo VMNo ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- FINAN204-23A - Tutorial 3Document19 pagesFINAN204-23A - Tutorial 3Xiaohan LuNo ratings yet

- Managerial FinanceDocument7 pagesManagerial FinanceHafsa Siddiq0% (1)

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- f9 2006 Dec PPQDocument17 pagesf9 2006 Dec PPQMuhammad Kamran KhanNo ratings yet

- Section A QUESTION 1 (Compulsory Question - 40 Marks)Document5 pagesSection A QUESTION 1 (Compulsory Question - 40 Marks)Jay Napstar NkomoNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Financial Accounting ProblemsDocument20 pagesFinancial Accounting Problemsmobinil1No ratings yet

- T.1042 Maliyy T Hlili Aynur F NdiyevaDocument15 pagesT.1042 Maliyy T Hlili Aynur F NdiyevaelvitaNo ratings yet

- FIN TestDocument7 pagesFIN Testisidro3791No ratings yet

- Assignment May2011 ADocument6 pagesAssignment May2011 AZyn Wann HoNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- Mr. Radhakrishnan's business transactionsDocument11 pagesMr. Radhakrishnan's business transactionsPriyasNo ratings yet

- Best Respondent Memorial PDFDocument38 pagesBest Respondent Memorial PDFPriyanka PriyadarshiniNo ratings yet

- CPA Licensure Exam Syllabus for Management Advisory ServicesDocument16 pagesCPA Licensure Exam Syllabus for Management Advisory ServiceskaderderkaNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- WIFS PTC - Sponsorship BrochureDocument2 pagesWIFS PTC - Sponsorship BrochureFinn GarrNo ratings yet

- Mckinsey-Model For Valuation of CompaniesDocument56 pagesMckinsey-Model For Valuation of CompaniesarjunrampalNo ratings yet

- Housing Loan ApplicationformDocument0 pagesHousing Loan Applicationformangel gryeNo ratings yet

- Financial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualDocument46 pagesFinancial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualJordanChristianqryox100% (14)

- Module - 4 Money Market & Capital Market in IndiaDocument11 pagesModule - 4 Money Market & Capital Market in IndiaIshan GoyalNo ratings yet

- COMM 308 Course Outline - Summer 2 2021 - Section CADocument14 pagesCOMM 308 Course Outline - Summer 2 2021 - Section CAOlivia ZakemNo ratings yet

- List of OCNs and key indicators of their activity as of Dec 31, 2021Document20 pagesList of OCNs and key indicators of their activity as of Dec 31, 2021Dragomir MariusNo ratings yet

- Manual Return Ty 2017Document56 pagesManual Return Ty 2017Muhammad RizwanNo ratings yet

- 2016 April ResumeDocument2 pages2016 April Resumeapi-308709576No ratings yet

- Case Study - Track SoftwareDocument6 pagesCase Study - Track SoftwareRey-Anne Paynter100% (14)

- Jaiib Previous Year Question PapersDocument3 pagesJaiib Previous Year Question PapersAbhijeet RawatNo ratings yet

- History of Cooperation in IndonesiaDocument8 pagesHistory of Cooperation in IndonesiakudaNo ratings yet

- Financial model assumptions and key statements for opening a tea cafe in IndiaDocument3 pagesFinancial model assumptions and key statements for opening a tea cafe in IndiaYASHASVI SHARMANo ratings yet

- A-IDEA Business Incubation TemplateDocument6 pagesA-IDEA Business Incubation TemplatevasantsunerkarNo ratings yet

- EFU Life Insurance Group ReportDocument20 pagesEFU Life Insurance Group ReportZawar Afzal Khan0% (1)

- RFBT 04 03 Law On Obligation For Discussion Part TwoDocument15 pagesRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieNo ratings yet

- DD Rules V 4 19 Rulebook Nov 2011 FinalDocument68 pagesDD Rules V 4 19 Rulebook Nov 2011 Finalimesimaging100% (1)

- Project Financial AnalysisDocument79 pagesProject Financial AnalysisAngel CastilloNo ratings yet

- Allied Banking Corp vs Lim Sio WanDocument12 pagesAllied Banking Corp vs Lim Sio WanKathleen MartinNo ratings yet

- Bank of Khyber Internship Report For The Year Ended 2010Document108 pagesBank of Khyber Internship Report For The Year Ended 2010Mohammad Arif67% (3)

- Transaction Details PayPalDocument1 pageTransaction Details PayPalChristine Eunice RaymondeNo ratings yet

- FADocument46 pagesFANishant JainNo ratings yet

- 1 - GDP Per CapitaDocument28 pages1 - GDP Per CapitaTrung TạNo ratings yet

- Difference Between NPV and IRR (With Comparison Chart) - Key DifferencesDocument9 pagesDifference Between NPV and IRR (With Comparison Chart) - Key DifferencessunilsinghmNo ratings yet

- Solved Refer To The Facts in The Preceding Problem Three YearsDocument1 pageSolved Refer To The Facts in The Preceding Problem Three YearsAnbu jaromiaNo ratings yet

- Ch30 Money Growth and InflationDocument16 pagesCh30 Money Growth and InflationMộc TràNo ratings yet