Professional Documents

Culture Documents

Lenovo IBM

Uploaded by

Mia CristianaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lenovo IBM

Uploaded by

Mia CristianaCopyright:

Available Formats

Lenovos Acquisition of IBMs PC Division

@2009, ESCP Europe Business School, London ecch the case for learning This case was written by Dr. Terence Tse and Jerome Couturier, ESCP Europe Business School. It is intended to be used as the basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation. The case was compiled from published sources.

Lenovos Acquisition of IBMs PC Division: A Short-cut to be a World Player or a Lemon that Leads Nowhere?

Terence Tse and Jerome Couturier INTRODUCTION

On April 20, 2004, a group of directors at Lenovo gathered in a windowless conference room on the 10 th floor of a high-rise building in Beijing, at the Lenovos headquarters. The meeting was of critical importance to the future of the company. The one and only item on the agenda was to evaluate the potential acquisition of IBMs personal computer (PC) division. Amongst many concerns debated, the central one remained whether Lenovos executives were capable of running a complex global business. Su ch an acquisition would open the way for Chinas largest computer manufacturer to purchase Big Blues PC division for US$ 1.75 billion. In turn, IBM had agreed to take an 18.9% stake in the new Lenovo. Based in Beijing, Lenovo began as a spin-off of the Chinese Academy of Sciences (the Academy) new technology unit in 1994. It started its life as a reseller/distributor for AST computers and later HP and IBM. The company began making its own brand PC in 1990. Six years later, it became the first Chinese brand to outsell any foreign brand (including non-PC products) in China. Lenovos stellar growth was attributable to the Academys strong technological support and close relationship with the Chinese government. Turnover figures for the company in 2003 and 2004 were HK$1 20 billion and HK$ 23 billion, respectively. Compared to Lenovo, IBM had a much longer history. Founded in 1896, the company started as the Tabulating Machine Company and focused on the development and production of punched card data processing equipment. Having later merged with two other companies, it changed its name to International Business Machine, or IBM, in 1926. In the fifties, IBM emerged at the forefront of business computing, reaching the peak of its dominance in the industry in t he 1980s. Sales of IBMs PC division were US$ 9.6 billion in 2003. IBM had been a major supplier of PCs to retail consumers, corporate and the US government. However, the PC division was far less profitable than the high-value products and services that it also offers. The rationale behind the divestment of the PC division was that IBM could then focus on high growth opportunities.

1

US$1:HK$7.75 (19982005)

Lenovos Acquisition of IBMs PC Division

THE WORLD PC MARKET

At the time of the meeting, Lenovos share of world PC market was only 2.2% and the company ranked number nine, behind Dell, HP, IBM, Fujitsu/Siemens, Acer, Toshiba, NEC and Apple. By acquiring IBMs PC division, the Chinese company would become the third largest PC maker in the world overnight. Competitive pressure has been increasing for all the players in the market as prices of PC continue to fall over the years. This is not least the result of Dells business model. While through this innovative model the company had re-invented the computer industry and driven prices down significantly, the very forces that it relied on for success have unintentionally cut costs for its rivals. As a result, PC makers around the world had benefitted from the commoditization of components and the rise of the Internet as a sales channel pioneered by Dell. As an industry expert opined, the supply chain becomes as standardized as the components the money has been wring out. Furthermore, it is increasingly difficult to cut production costs, given that many computer makers have already moved their PC production to low cost countries such as China. As an illustration, the labor costs for Lenovo were a rock-bottom $ 3 per desktop PC, which is among the lowest anywhere. Such low cost helped drive its operating expenses to less than 9% of revenues, which was half the average for the computer hardware businesses and about the same as Dells.

LENOVOS GLOBAL EXPANSION STRATEGY

Lenovo had a 27% market share in China. Having assumed market leadership in its country, Lenovo aspired to become a global player. It attempted to achieve this by diversifying into non-PC areas such as mobile handsets, the Internet, various IT services and even going beyond IT. However, as Liu Chuanzhi, founder of Lenovo, pointed out: Things did not go well with our plans. We were too anxious to achieve our goals, we did not think through our plan clearly, and we did not succeed. Trying for the second time, the company decided to follow a strategy that focused on expanding within the PC industry. This could be achieved by 1) building its foreign subsidiaries or 2) acquiring an existing global player. Given that the latter strategy would, in theory, allow the company to gain market share rapidly, establish distribution channels and solve problems such as lack of market and sales experience in foreign markets, acquisition represented the best strategic option for Lenovo. This reasoning underpinned Lenovos possible acquisition of IBMs PC division. Specifically, there were a number of potential benefits, including: An unique opportunity to fulfill its globalization strategy and to achieve its global leadership in PCs and related products; Instant presence and coverage outside China; The widely recognized brand of IBM and its Think marks including ThinkPad, ThinkCentre, ThinkVision and ThinkVantage. These brands would bring rapid global awareness that could assist Lenovo to establish a single world-wide brand; Enhancement of Lenovos product portfolio using IBMs technology, laptops and commercial product lines and capabilities; Cost savings through economies of scale in procurement and best practice sharing;

Lenovos Acquisition of IBMs PC Division

Access to a highly skilled and experienced product development team, advanced facilities and a portfolio of technology intellectual property and know-how; An experienced management team for the development and execution of international strategy and the management of large scale global operations.

Executives at Lenovo were confident that they would be able to save more than US$ 200 million a year in supply chain efficiencies. By combining with IBMs PC division, declared Yang Yuanqing, Lenovos current chairman, Lenovo would be the PC company with the best balance between innovation and efficiency.

CHINESE FIRMS AND OUTBOUND M&A

By the very beginning of the 21st century, it becomes increasingly common for Chinese firms to acquire Western companies. While big Chinese names such as TCL, Huawei and CNOOC had made offers to buy Western companies, Lenovos deal heralded the dawn of Chinese firms becoming global players. The purchase of IBMs PC division would be different from all previous transactions in one important way: it stirred up questions about US technological leadership. There was general skepticism over Chinese companies ability to make and manage mergers and acquisitions (M&A) overseas. China-based firms had a long way to go when it came to understanding foreign markets. For example, for many of these companies, pricing and marketing strategies were still at the nascent stage of development. Coming out of a protected environment, Chinese companies were exposed to unfamiliar business concepts such as customer services and customer relationships. In fact, Chinese acquirers typically did not have a clearly defined view of the role of M&A in their globalization strategy and had the tendency to respond opportunistically to deals as they became available. The companies also lacked experience in managing a portfolio of businesses across diverse markets as well as a deep understanding of customers, competitors, distribution structures and the regular environment in these markets. Compared to large global firms, Chinese companies tended to have less developed management information systems, governance structures, managerial skills and corporate processes. They were also less experienced at eliminating duplication and waste in newly combined operations, and at establishing best practices. Many of these problems were reflected in TCLs Chinas largest television maker disastrous acquisition of Thomson Electronic, a French counterpart. The Chinese firms had made at least four strategic errors: The highly commoditized CRT-based televisions ought to have been manufactured in low cost countries instead of remaining in Europe; European consumers were gradually turning away from CRT-based televisions to flat-panels. Not only did TCL fall to conduct proper market research on trends in television technology, but it also did not fully understand Thomsons operation in Europe and the needs of consumers; Thomson did not have a strong brand name outside France. Additionally, distribution channels for flat-panel and CRT-based televisions were different; TCL was inexperienced in managing global operations and lacked qualified managers.

Another major obstacle to success was the vast differences between how Western and Chinese companies operate. Cultural differences could cause problems. In 2002, Lenovo recruited in the US a group of IT elite hires to fill middle management. However, in just under a year, most of these recruits left the company. The main reason given was that they had found it difficult to fit into its corporate culture. For example, they

Lenovos Acquisition of IBMs PC Division

could tolerate neither the regular daily collective morning exercises nor the ritual of singing the companys official tune before any major meeting. Chinese companies acquiring in the West often faced further non-economic challenges such as political barriers. In 2005, CNOOC, a Chinese state-own oil company, failed to acquire Unocal, a US oil company, facing opposition from the US Congress who cited national security concerns.

THE IBM AND LENOVO BRAND

As part of the merger agreement, Lenovo could use the IBM brand on its products in the 18 months following the acquisition. After that, Lenovo had another 18 months to co-brand its products, allowing customers to be weaned away from the IBM logo. Beyond this point, the Lenovo brand alone would appear on its products. As a result of the transaction, the Chinese company would own the Think series brand. In spite of the progressive rebranding, some customers appeared to have already started to defect. According to a report, General Electric in late 2004 dropped IBM as one of its two PC suppliers to go exclusively with Dell for desktop and notebook computers, attributing their decision to Dells lower prices. The same report also pointed out that IBM PC sale had lost momentum and suffered from component failures, the consequence of which pushed warranty costs up. Additionally, in a survey of 100 Chief Information Officers half of the respondents reported that they would consider switching away from IBM to new vendors. Some analysts also predicted that Dell and HP would be the true winners in this merger as customers would think twice about buying ThinkPads or ThinkCentres. However, not everyone agreed with this. Some observers contended that this merger would create a stronger competitor to Dell and HP.

TO ACQUIRE OR NOT TO ACQUIRE?

Lenovo was confident that the acquisition would propel it to the ranks of world players. As Liu Chuanzhi said: I am excited by this breakthrough in Lenovos journey towards becoming an international company From the beginning, however, our unwavering goal has been to create a truly international enterprise. From 2003 when we changed our international brand name to 2004to todays [merger] with IBM, I have been delighted to watch Lenovo become a truly world-class company. However, potential rivals had a different opinion. Michael Dell opined: Were not a big fan of idea of taking companies and smashing them together. When was the last time you saw a successful acquisition or merger in the computer industry? It hasnt happened in a long, long time I dont see this one as being all that different. One thing was yet for sure: the board of directors had reached the deadline to make a decision and had promised IBM to return to them by the end of the day with a definitive answer. The decision to be made today would engage the company on a route for global success or massive failure.

You might also like

- Cagayan de Oro Revenue Code of 2015Document134 pagesCagayan de Oro Revenue Code of 2015Jazz Adaza67% (6)

- This Study Resource Was: Global Strategy at LenovoDocument3 pagesThis Study Resource Was: Global Strategy at LenovoAnukriti ShakyawarNo ratings yet

- MRI & Ultrasound Group Project Market AnalysisDocument2 pagesMRI & Ultrasound Group Project Market AnalysisRishabh KothariNo ratings yet

- Bank Recovery SuitDocument6 pagesBank Recovery SuitAAnmol Narang100% (1)

- Licensing ProposalDocument6 pagesLicensing ProposalKungfu SpartaNo ratings yet

- Lenovo: Building A Global BrandDocument11 pagesLenovo: Building A Global Brandafif12No ratings yet

- Group 6 IB KonkaDocument8 pagesGroup 6 IB KonkaAbhishek JhaNo ratings yet

- Li & FungDocument30 pagesLi & FungShiva RamNo ratings yet

- Case StudyDocument3 pagesCase StudyAman GuptaNo ratings yet

- Biocon's Phase 3 Testing and Launch Plan for Cancer Drug BIOMAbDocument4 pagesBiocon's Phase 3 Testing and Launch Plan for Cancer Drug BIOMAbMukesh SahuNo ratings yet

- Reinventing Best Buy Through Customer-Centric StrategyDocument4 pagesReinventing Best Buy Through Customer-Centric StrategyShubham ThakurNo ratings yet

- Group 3 - Optical DistortionDocument15 pagesGroup 3 - Optical DistortionsrivatsaNo ratings yet

- Case Sessi-3 IntelDocument4 pagesCase Sessi-3 IntelArun KumarNo ratings yet

- End-Term Examination Of: Cultural Distance Administrative Distance Geographic Distance Economic DistanceDocument4 pagesEnd-Term Examination Of: Cultural Distance Administrative Distance Geographic Distance Economic DistanceSwarna Sanjay SANGHAI100% (1)

- Quiz For ISO 9001Document4 pagesQuiz For ISO 9001lipueee100% (1)

- Randy Gage Haciendo Que El Primer Circulo Funciones RG1Document64 pagesRandy Gage Haciendo Que El Primer Circulo Funciones RG1Viviana RodriguesNo ratings yet

- H4 Swing SetupDocument19 pagesH4 Swing SetupEric Woon Kim ThakNo ratings yet

- LenovoDocument36 pagesLenovoRonish Patel100% (1)

- Case Study On Lenovo and Ibm Lenovo Mergers and AcquisitionsDocument28 pagesCase Study On Lenovo and Ibm Lenovo Mergers and AcquisitionsLê Trần CảnhNo ratings yet

- Business Strategy Case Study - DoCoMoDocument18 pagesBusiness Strategy Case Study - DoCoMoRobinHood TiwariNo ratings yet

- Nucleon's Future Direction: 3 Options for R&D FirmDocument2 pagesNucleon's Future Direction: 3 Options for R&D FirmAditya ShahNo ratings yet

- Motorola RAZR - Case PDFDocument8 pagesMotorola RAZR - Case PDFSergio AlejandroNo ratings yet

- Integrated Electronics CorporationDocument13 pagesIntegrated Electronics CorporationzamkovNo ratings yet

- Nucleon's manufacturing strategy optionsDocument12 pagesNucleon's manufacturing strategy optionsGulshan DhananiNo ratings yet

- The Future of LenovoDocument9 pagesThe Future of LenovoMihir ParsaniNo ratings yet

- Case Study: Nucleon Inc. Opts for Contract ManufacturingDocument4 pagesCase Study: Nucleon Inc. Opts for Contract ManufacturingMukul KhuranaNo ratings yet

- Changing the Global Steel Game: Mittal Steel in 2006Document9 pagesChanging the Global Steel Game: Mittal Steel in 2006aaidanrathiNo ratings yet

- Nucleon, IncDocument5 pagesNucleon, IncSwati AryaNo ratings yet

- British Columbia Box Limited: Stages of The Buying ProcessDocument2 pagesBritish Columbia Box Limited: Stages of The Buying ProcessAravind LiverpoolNo ratings yet

- Google's Android Industry ShakeupDocument5 pagesGoogle's Android Industry Shakeupsanmishra1990No ratings yet

- TDC Case FinalDocument3 pagesTDC Case Finalbjefferson21No ratings yet

- Apple Case StudyDocument17 pagesApple Case StudyLeopoldo PerezNo ratings yet

- Iphone Case Study Assignment - MARKET LED ManagementDocument8 pagesIphone Case Study Assignment - MARKET LED ManagementSebnem KavcinNo ratings yet

- Nokia's Lack of InnovationDocument11 pagesNokia's Lack of InnovationAdonis GaoiranNo ratings yet

- Flex CaseDocument4 pagesFlex Casekathait.manish3271No ratings yet

- Nucleon, Inc.: Submitted By: Aryan Singh Chouhan (PGP01013) Paresh Rajput (PGP01033) Priyanshu Nagar (PGP01038)Document8 pagesNucleon, Inc.: Submitted By: Aryan Singh Chouhan (PGP01013) Paresh Rajput (PGP01033) Priyanshu Nagar (PGP01038)Priyanshu NagarNo ratings yet

- Inside the Cutthroat Smartphone IndustryDocument33 pagesInside the Cutthroat Smartphone IndustrySuraj ChhedaNo ratings yet

- Nucleon IncDocument4 pagesNucleon IncSakshi GoyalNo ratings yet

- Samsung Electronics CompanyDocument4 pagesSamsung Electronics CompanyAlexis SolisNo ratings yet

- India Mobile Market Growth Blackberry ChallengeDocument33 pagesIndia Mobile Market Growth Blackberry ChallengegunpriyaNo ratings yet

- Apple Inc. Case2Document10 pagesApple Inc. Case2melody panaliganNo ratings yet

- Cola WarsDocument11 pagesCola WarsAshish MahapatraNo ratings yet

- AppleDocument17 pagesAppleyadavraj23No ratings yet

- Samsung & IBMDocument3 pagesSamsung & IBMFauzi FauziahNo ratings yet

- Casestudy Nego 1Document3 pagesCasestudy Nego 1Claire0% (1)

- Apple Inc.'s Strengths and WeaknessesDocument11 pagesApple Inc.'s Strengths and WeaknessesCATELEENNo ratings yet

- Strategic Management Report - Acquisitions and MergerDocument37 pagesStrategic Management Report - Acquisitions and MergerAnand RoyNo ratings yet

- NucleonDocument12 pagesNucleonPriya Singh100% (3)

- 2018-03-05 - C18 - SM - AS - Case Study - Apple Inc PDFDocument4 pages2018-03-05 - C18 - SM - AS - Case Study - Apple Inc PDFmilon1998No ratings yet

- 3 MOptical SystemsDocument15 pages3 MOptical SystemsCharlene GnNo ratings yet

- Etisalat Egypt 1st AssignmentDocument4 pagesEtisalat Egypt 1st AssignmentNehal AbdellatifNo ratings yet

- Analysing The Case of BPLDocument3 pagesAnalysing The Case of BPLLOKESH DUTTANo ratings yet

- Working Conditions at FoxconnDocument3 pagesWorking Conditions at FoxconnChanuka KotigalaNo ratings yet

- HP Final ProjectDocument18 pagesHP Final ProjectNISHANT SINGHNo ratings yet

- Simulation CaseDocument4 pagesSimulation CaseNikhil GoelNo ratings yet

- Marketing Case: Sonance at A Turning PointDocument5 pagesMarketing Case: Sonance at A Turning PointAlexa oliviaNo ratings yet

- African Expansion of Bharti Airtel:: Acquisition of Zain AfricaDocument8 pagesAfrican Expansion of Bharti Airtel:: Acquisition of Zain AfricaSwaady Martin-LekeNo ratings yet

- Swot Analysis of LenovoDocument2 pagesSwot Analysis of LenovoSuyash ShuklaNo ratings yet

- Apple in China Case Study AnalysisDocument8 pagesApple in China Case Study Analysisaeldra aeldraNo ratings yet

- ACC Vs DJC Case StudyDocument10 pagesACC Vs DJC Case StudyChalapathirao V DesirajuNo ratings yet

- Running Head: INTEL CASE STUDYDocument7 pagesRunning Head: INTEL CASE STUDYWhimsical BrunetteNo ratings yet

- Eli Lilly manufacturing strategy case studyDocument5 pagesEli Lilly manufacturing strategy case studyprakhar guptaNo ratings yet

- Compiled Case Study-LenovoDocument24 pagesCompiled Case Study-LenovoHowell Yap100% (2)

- From The IBM PC Division To Lenovo: Frédéric Raes Country General Manager Lenovo Belgium LuxembourgDocument37 pagesFrom The IBM PC Division To Lenovo: Frédéric Raes Country General Manager Lenovo Belgium LuxembourgakhilduggalNo ratings yet

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocument2 pagesGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNo ratings yet

- SLEMCoopDocument3 pagesSLEMCoopPaul Dexter GoNo ratings yet

- Βιογραφικά ΟμιλητώνDocument33 pagesΒιογραφικά ΟμιλητώνANDREASNo ratings yet

- I Ifma FMP PM ToDocument3 pagesI Ifma FMP PM TostranfirNo ratings yet

- Acca FeeDocument2 pagesAcca FeeKamlendran BaradidathanNo ratings yet

- Starting A Caf or Coffee Shop BusinessDocument11 pagesStarting A Caf or Coffee Shop Businessastral05No ratings yet

- Model LOC Model LOC: CeltronDocument3 pagesModel LOC Model LOC: CeltronmhemaraNo ratings yet

- Lecture 4Document27 pagesLecture 4aqukinnouoNo ratings yet

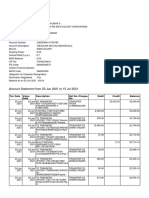

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- CH 07Document50 pagesCH 07Anonymous fb7C3tcNo ratings yet

- 5 Why AnalysisDocument2 pages5 Why Analysislnicolae100% (2)

- AWS Compete: Microsoft's Response to AWSDocument6 pagesAWS Compete: Microsoft's Response to AWSSalman AslamNo ratings yet

- Session 5Document2 pagesSession 5Angelia SimbolonNo ratings yet

- Living To Work: What Do You Really Like? What Do You Want?"Document1 pageLiving To Work: What Do You Really Like? What Do You Want?"John FoxNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

- Bangalore University SullabusDocument35 pagesBangalore University SullabusJayaJayashNo ratings yet

- Case Study: When in RomaniaDocument3 pagesCase Study: When in RomaniaAle IvanovNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsReymark MutiaNo ratings yet

- Module 2 - Extra Practice Questions With SolutionsDocument3 pagesModule 2 - Extra Practice Questions With SolutionsYatin WaliaNo ratings yet

- Sap V0.0Document20 pagesSap V0.0yg89No ratings yet

- 1 Deed of Absolute Sale Saldua - ComvalDocument3 pages1 Deed of Absolute Sale Saldua - ComvalAgsa ForceNo ratings yet

- Supply Chain Management Abbot Pharmaceutical PDFDocument23 pagesSupply Chain Management Abbot Pharmaceutical PDFasees_abidNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- VivithaDocument53 pagesVivithavajoansaNo ratings yet