Professional Documents

Culture Documents

Selector March 2013 Quarterly Newsletter

Uploaded by

SelectorFundCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Selector March 2013 Quarterly Newsletter

Uploaded by

SelectorFundCopyright:

Available Formats

SelectorAustEquitiesEx50Fund QuarterlyNewsletterNo.

33

March2013

In this quarterly edition we review performance and attribution. We do a roundup of the recent reporting season. Our macro focus is on the new global war. At home we take a look at the Federal Government and our miners and finally we discuss some global developmentsinexecutivepay.Photo:CurrencyWars.

SelectorFundsManagementLimited ACN102756347AFSL225316 Level3,10BridgeStreet SydneyNSW2000Australia Tel61280903612 www.selectorfund.com.au

Abou utSelector Weare a aboutiqu uefundman nagerandwehaveacom mbinedexpe erienceof over60years.We W believeinlongtermwealth w creationandbuildinglasting relationshipswit thourinvest tors. Ourfocus f isstockselection.Ourfundsarehighconv viction,conc centratedan nd index xunaware.As A aresultwe w havelowturnoverandproducetaxeffective retur rns. Firstweidentifythebestbus sinessfranch hiseswithth hebestmanagementtea ams. Then nwefocusonvaluations s. Whenwearriveatworkeachdayweare eremindedthat; Theartofsucce essfulinvestm mentisthepatientinvestortakingmoney m fromthe impa atientinvesto or. Ourfund f isopen ntonewsub bscriptions.Pleaseforw wardtousco ontactdetail lsif youwould w likefu uturenewsl letterstobe eemailed to ofamily, friends orbusin ness

SelectorFun ndsManagementLimited ACN102756 6347AFSL225316 Level3,10Bridge B StreetSy ydneyNSW2000 0,Australia Telephone612 6 80903612Web W www.selec ctorfund.com.au u

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

DearInv vestor, Markets s turned the corner during January 2013 in a classic reminder th hat buying in gloom provi ides the best form of cap pital protectio on. It doesnt t entirely rem move the risk of capital loss but it certainly provide es a greater margin of sa afety. Having said that, the conviction n to step in and invest in i a busines ss requires a couple of things. Firstly, a good unde erstanding of what the bu usiness does and secondl ly,amentalpreparedness p toactdespit tetheoverwh helmingmajorityurgingca aution. Duringthe t pastquar rter,sharema arketshaved drivenhigher, ,ledinlargepartbytheUS, U withtheDow D Jones Industrial Ave erage Index up 11.2% to o a new hig gh of 14,573. Locally, ou ur All Ordinaries Accumu ulation Index x peaked in early e March at 40,968, a rise of 11.8%. All in al ll, optimism has returned and with th hat comes so ome challenge es. As valuations rise, the margin of safety sought with w anyinve estmentdiminishesandhe erein,investo orsarecautio onedtoproce eedwithcare. . In addit tion, the even nts surroundi ing the bailou ut of the Cypriot Governm ment during the latter days of March are a timely reminder th hat financial shocks remain a real and d ongoing threat to inves stor confidence. While Cyprus C has re eluctantly agr reed to term ms with the 17 1 nation eur ro zone and the Internat tional Monet tary Fund (IM MF) for a 10 b billion euro bailout facility y, it has come e at a signific cant cost to bank deposit tors. In a timely reminder r that deposit tors run the real r risk of ca apital losses, the terms of o the agreem ment has led to senior Cy ypriot bank bond holders taking losses s and uninsu ured depositors facing vir rtual wipeou ut. It is not an n ideal situation and the c consequences run far dee eper and wid der than just t the country y of Cyprus. However, the e option of bailing b out go overnments and a financia al institutions s whenever the situatio on dictates is becoming unpalatable and reflect ts a hardeni ingstanceindealingwiththeseissuesf followingthe e2008financialcrisis. Whilst mindful m of th he economic backdrop, go ood investme ent opportunities continue e to surface and a the late est reporting period provided greater transparency to some of these. In th his quarterly we explore anumberof fbusinessesand a shareour r thoughtson n theirimmed diateoutlook k.Wealsoref flect onourtwo t big mine ers, discuss th he new war fa acing governm ments and bu usinesses and d finally how one o country yislookingtotackletheth hornyissueof fexecutivepa ay. During the past qua arter and for r the financia al year to date the Fund has delivere ed gross posit tive returns of 8.51% an nd 37.17% re espectively, as compared to the All Or rdinaries Accu umulation Index whichreturned 8.04 4% and 24.84% % over the sa ame periods. These results are pleasing g and provide e us withconfidencethat tourinvestmentapproach hisdelivering gmeaningfulresults. Toallou urinvestorswe w trustthatyoufindthereportinform mative. Regards s TonySc cenna CoreyVincent V

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

TableofContents Page1:Lettertoinve estors eMarchQuar rter2013 Page4:Performance etablesinceinception i Page4:Performance Page4:PortfolioTop p10 Page5:SelectorRe eportingseasonroundup 2:Governmen ntandourminers Page12 Page13 3:Thenewglo obalwar Page15 5:Executivepay p Page16 6Companyvis sitdiaryMarc chQuarter20 013 Page18 8:PortfoliostatisticsMarch hQuarter201 13 Therise eofsuper Investm ment experts predict that by 2030 the local supera annuation fun nds industry will have gro own from the current $1. .5 trillion to a figure closer to $5.0 trillion. At that p point the indu ustry is expec cted neandahalftimeslargerthanthegros ssdomesticproduct p (GDP) )ofourlocaleconomy.While tobeon industry y funds will fo orm a large percentage p of f this figure, the t industry has also witn nessed a surge in self managed super funds (SMSF). These SMS SFs currently represent ab bout $450 million of the to otal $1.5 tril llion. In addit tion, applicati ions for your new SMSFs have been pouring in at the t rate of 1,000 perwee ek,withtotalSMSFslikely ytohit500,00 00inthevery ynearterm. It is little wonder th hat the Gover rnment has p primed the in ndustry for a tax grab. Ar rguments will l be made that the curre ent tax concessions offer red to those earning high h sums of inc come should be ed,withtheextraraisedea armarkedfortheGovernm mentsconsolidatedrevenuebucket. modifie And at stake is a higher contributions tax, su uggested to be 30% rather than the current c 15%, , on incomes above $30 00,000. Don t be surpris sed that this s threshold is lowered, judging by the Governments grow wing budget deficit d when it reports in May. Unfo ortunately Governments are expertsintinkeringwith w somethingworkingw wellinorderto t plugholesinthingswor rkingnotsowell. w SFM

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

Perform manceMarch2013 For the e quarter en nding March 2013, the F Fund delivere ed a gross p positive return of 8.51% as compar red with the 8.04% rise in n the All Ordinaries Accum mulation Inde ex. Performan nce statistics are detailed donpage18. Perform mancetablesince s inceptio on %Retu urns Gro ossFund AllOrdsInde ex All lOrdsAcc Re eturn% % I Index % 3months +8.51 +6.76 +8.04 1Year +33.26 +12.67 +17.80 3years +7.68 +0.59 +5.01 5years +6.27 1.64 +2.76 Sinceinceptioncom mpoundp.a. +9.56 +2.86 +7.25 Top10 0March2013 3* Top10De ecember201 12* ARBCo orporation ARBCorporation Carsale es Blackmores Flexigr roup Flexigroup FlightCentre C FlightCen ntre IOOFHoldings H IOOFHold dings ResMe edInc. IRESS SEEK ResMedInc. SIRTeX XMedical SEEK SuperRetailGroup SIRTeXMedical Techno ologyOne SuperRet tailGroup Top10 0=55.71% Top10=54.85% *Listedinalphabetic calorder Selector runs a high conviction in ndex unaware e stock select tion investme ent strategy with w typically 25 40 stocks chosen for r the Fund. As A shown abo ove, the Fund ds top 10 po ositions usual lly represent the great majority m of its s equity expo osure. Current t and past po ortfolio comp position has historically h been very unlike that of your y average runofthem mill index hugger fund manager. m Our stock select tion tothispoint p hasnotincludedeith herretailban nksorthelarg geresourcecompanies,RIOandBHP.Our O goal rem mains to focu us on truly differentiated broad cap sto ock selection rather than the closet index hugging gportfoliosof fferedbymos stlargefundmanagers.

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

Perform manceattribu utionforthequarter Top5stockcontrib butors % Top5sto ockdetractors % SEEK +2.17 Pharmaxis 1.61 FlightCentre C +1.41 SirtexMe edical 0.94 SuperRetail +1.31 Blackmor res 0.77 Carsale es +1.11 BrevilleGroup G 0.38 IOOF +1.08 AMAGro oup 0.21 As we will w discuss fu urther in this report, the la atest reportin ng period alw ways provided d some surprises for inve estors. A toug gh economic backdrop an nd a number r of external factors, inclu uding the strong Australi ian dollar impacted and in some case es unduly ma asked the results delivere ed. As the ta able above highlights, h the e main detrac ctors for the quarter were e largely restr ricted to thre ee businesses s, of which Pharmaxis P has been the most m disappoi inting. It is an n investment that we hav ve held for many years as s the compan ny sought to bring its cys stic fibrosis drug Bronchitol to market. As is often the way,the epathhasbe eenlonger,pr rovenmorecostly c anddel layedbyanumberofregu ulatoryissues.To date, th he company has succeed ded in gainin ng approval and a reimburs sement in both Europe and a hieved, with regulators n Australi ia, however, the very important US market m has yet y to be ach now seeking further dat ta. This has impacted in nvestor expe ectations and d required the company y to reconsid deritsUSstra ategyandfun ndingarrange ements. InthecaseofSirtex,thesharepricerespiteismoreafunct tionofthestr rongpricemo ovethecompany has enjoyed over th he past few months. m The companys in nterim result t was solid an nd managem ment continues to execute e on a long term t business s plan to elev vate its sirsp pheres liver cancer treatm ment from th he current sal lvage patient t use to a firs st line treatm ment therapy. . Blackmores suffered from m a tough retail r environ nment, which has seen th he business provide p greater store reba ates to maint tain sales an nd market share. Offsettin ng this has be een the groups strong As sian expansio on, with sales s up 10%to$28.5million nduringthehalf,althoughmutedbyastronger s curre ency. On the plus side, a number of lo ong held inve estments con ntinued to sh hine during th he quarter most m notably y SEEK, Flight t Centre, and ResMed. Pleasingly, th hese busines sses have so ought to rem main focused dandhaveallsuccessfullyexpandedof ffshoretopro ovidegreaterdepthandea arningsdivers sity. SEEK in particular co ontinues to make m sizable investments in new mark kets and while current sh hare price va aluations appear full, we suspect s these markets will provide amp ple room forgrowth g in fut ture years.We W covertheSuperRetailGroupinmor redetailfurth herinthisrep port. Finally, IOOF remains domestically based w within the financial servi ices space. During D the half, h manage ement confir rmed the go ood progress achieved following a number of recent bolt ton acquisit tions. With a rebounding share marke et, IOOF is well w placed to deliver solid growth in n an industry ythatisunde ergoingstruct turalregulato orychangevia alegislatedsu uperannuatio onrequirements. IOOF en njoys the be enefits that comes c with s scale, ranking g within the top six finan ncial institutions locally,behindthebigfourbanksandAMP.SF FM

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

Reporti ingseasonro oundup For the e most part, reporting se eason provides business leaders with h the opportunity to upd date shareho olders on how w things are e travelling. W We say for the most part as there is a tendency for manage ement to spin n things their way. No inve estor wants to really hear that things are a tough or that t profits are down. But B above all what inves stors dislike most are surprises, or more m specific cally negative e surprises. However, in business, go ood and bad go hand in hand. Dealin ng with busin ness adversit ty and prepar ring for grow wth are illustra ative of good managemen nt teams doin ng what needs to bedone e. In our September S 2012 2 quarterly newsletter r, of which past copies ar re accessible on our website under the heading newsletters, n we w outlined t the investment philosophy y that underp pins the way we do things at Selecto or. Under the e heading Looking up ra ather than do own, we dis scussed how we approac ch every inve estment decision and ev very business s review on the individua al merits of the opportu unity present ted at the tim me. With this s in mind, the next sectio on brings into o focus some e of those that t caught our eye dur ring the latest profit rou und up. Som me were goo od, while oth hers disappo ointed. As alw ways investor rs are quick to judge and share prices react sharply y to the news s of theday. Those businesses b an nd manageme ent teams delivering the not n so good n news, aim to soothe s invest tors andreaffirmabusinessplanthattheybelievewilldeliverthe t returnsex xpected.Itisnoteasyandfor our par rt we try not t to judge to oo harshly co ompanies tha at have a pr roven track record r offset t by occasional stumbles. As we discu ussed in our p previous new wsletters, this approach is underpinned d by thefour rbusinessqualitieswesee ekinanyinve estmentoppo ortunityconsidered; 1. 2. 3. 4. mentteam Stronglyalignedmanagem Businesswit thbestofbreedqualities Balanceshee et,conservativelyposition ned Shareholderreturnstreat tedwithpara amountimportance

Our sea arch for these best of breed busin ot restricted to the large e. Many sma aller nesses is no busines sses have bot th the drive and a products to succeed and a many do. . However, what w is becom ming increasi ingly clear to o us is the im mportance tha at incumbenc cy and scale bestows on an organisation. Not onl ly does it allo ow them to fight f a good f fight with a market m leadin ng position but b it also allo ows themto oinvestforth hefuture. It is often lost on in nvestors that investing for r tomorrow is i more critic cal than the profits of tod day, because e when you buy b into a bus siness, you ar re paying for its future earnings stream m. So with thi is in mind we w listened to, t reviewed and in som me cases visited the following comp panies and th heir manage ementteamsduringthepastquarter.Some S ofthese etheFundalreadyowns,whileothersare . underconsideration c

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

1.SAIGlobal G (SAI):share s price$3 3.37|market tcapitalisatio on$693millio on Busines ssbackground d

SAI Glob bals website outlines its b business as p providing org ganisations ar round the wo orld withinf formationser rvicesandsolutionsforma anagingrisk,achieving a com mplianceanddrivingbusin ness improve ement. Even n those unfa amiliar with SAI would recognise r the e groups 5 tick logo t that endorse es independe ent assessme ent of products and serv vices. This is the core bu usiness that was w floatedonto the stock market in 2003. There was much to o like back the en as the bus siness had all the hallmar rksofagreatinvestmentsimple,monopolyandanannuityinco omestreammodel. m A good business can be put at risk from po oor execution n. And the ea arly signs we erent good with w previous manageme ent embarking on a series s of acquisiti ions, increasi ing both the debt levels and a shares on o issue. The e new manag gement team m, led by CEO Tony Scotto on continued along this pa ath, with the very best of o intentions to build thr ree stand alo one formidable businesses s, encompass sing Standar rdsregulation n,productcer rtificationand dcompliance eriskmanagement. We are mindful of the t pitfalls th hat can befall a business seeking to gr row by acqui isitions and as a a resultwe w haveprefe erredtowatchfromthesidelines.Ourpatiencehas beenreward dedthusfarwith w thegrou upslatestresults failing tomeetinves storexpectati ions.In short, ,while the or riginal Standa ards busines ss provides a dependable e earnings ba ase, the new wer earnings streams of compliance and a propert ty servicing have added co osts and exec cution risk. Management M i is confident that t these iss sues can be sorted s out an nd that the expected stron ng growth that underpinn ned these inve estments will be evidentinfutureper riods. Ourview Our issu ue has alway ys been, can management t avoid the perils p of grow wing too fast whilst taking g on debt? As A things curr rently stand, SAI S has over $550 million worth of intangibles on its balance sh heet and net t debt of abo out $200 milli ion. Group re evenue is exp pected to hit $480 million n for 2013, while net pro ofits are forec cast to reach h $41 million. On this bas sis SAI is trav velling on a prospective PER multiple eof13andafullyfrankedyieldof4.4% %. To date e the group has struggle ed with bedd ding down ac cquisitions undertaken in n its compliance division and the road ahead will require considerable time e and will tes st manageme ents resolve. SAI unquest tionably operates three high h quality businesses, however it remains r to be seen whet ther current shareholders will continu ue to give ma anagement th he benefit of f the doubt. SAI S is certainly a stock worth w watchin ng and should d it stumble f further the as sset quality is s such that a takeover of the busines sscouldntbe eruledout.

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

2.Jumb boInteractive e(JIN):shareprice$2.50|marketcapit talisation$10 00million Busines ss backgroun nd: The nam me Jumbo In nteractive giv ves little aw way to the groups g busin ness activitie es, other than n to suggest something big. b In short, the company y has develop ped a successful online lottery busine ess that has been b in opera ation for over r a decade. Th he groups fo ounding CEO and largest shareholder Mike Veverk ka is successf fully exploitin ng the growin ng adoption of o online lott tery playing inmuchthesame waythat onlinehas semerged inmostwalkso of life. Thetot tal global lott tery busines ss is valued at t $250 billion n, while onlin ne is currently y in its infanc cy and repres sents about $ $2.5 billion of o this total. Importantly, lottery l playin ng is played so ocially and ac ccepted for what w it is, a sm mall wagerto t earnacons siderablepay yout,despitethe t longodds s. r avaluable v sour rceofrevenueandinkeep pingwiththechangingtrends Forgovernmentsitrepresents nology, the emergence e of f online playi ing has opened the door for Jumbo and other lott tery in techn provide ers to exploit this significant global opp portunity. Fro om its origins s stretching some 13 year rs in Australi ia, Jumbo has s built a $100 0 million local online lottery business. T The group enjoys a long te erm relation nship with lot ttery provider r Tatts Group p under existi ing reseller agreements, although a ther re is a risk that t future agreements may m not be r renewed. Ma anagement is s candid that t such an ev vent cannotberuledout,althoughthe egroupispre eparedshould dthisevereventuate. In the mean m time, th he business has h grown rapidly over th he past five years and with no debt an nd a current cash balance of $16 million, CEO Veverka has moved to secu ure new oppo ortunities in the global markets m of th he US, Mexico o and Germany. These are e early days but the onlin ne emergence e of lottery playing is gro owing in size and Jumbo s seems to have a well thou ught out strat tegy. The cap pital requirementsarerel lativelysmallandthebusinessisinstro ongshapetoundertaketh hetask. Ourview We acknowledge that the risks in Jumbo are higher but also a note that t management have stuck k to their co ore competen ncy, remained d debt free and a executed d on a strateg gy that appears realistic. We invested d in Jumbo so ome time bac ck and despit te the strong g move in the e companys market m value we remainonboard. 3.IRESS S(IRE): shar reprice$7.75 5|marketcapitalisation$992million Busines ssbackground d:WeprofiledtheIRESSb businessinou urMarch2010 0quarterlyne ewsletter.Those whooperateinfinan ncialmarketsorfinancialp planningbusi inesseswould d befamiliarwiththegrou ups core of ffering as a leading softw ware supplie er of services s and trading g platforms to the finan ncial markets s.Thebusinesshasevolve ed sinceitsfo oundingin199 93and impor rtantlynowenjoys e bothsc cale andmarketincumbe ency.Manage ementisnota ashamedofdoing d whatsr rightforthelong l termhea alth of the business b desp pite the short t term financ cial impacts that such dec cisions carry, as evidenced d by thelowerfullyearre eportedprofit tfor2012. A case in i point is the e groups pre eparedness to o target new overseas mar rkets by investing small su ums of money to execute the plan. This T is a strat tegy that has s served the company we ell and delive ered excellen ntfinancialou utcomeswith houttakingun nduerisk.Tod day,theIRESS Stradingplat tformdomina ates

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

the loca al market, allo owing stock brokers, b fund d managers, financial f planners and individual clients s to gain acc cess to live data d feeds wh hile also prov viding all the necessary co ompliance req quirements. The T key tothe t IRESSbusiness isthatit isa subscription based model m deliver ringtimecritical information. As such h IRESS is a must m have service that will l live or die based b on wha at the client requires r and the compan nydelivers. On this point, the co ompany has worked w hard to t develop lo ong lasting relationships an nd this has been reflecte ed in the mo ost recent announcements from its ne ewest market the United d Kingdom. Here H IRESS has beaten the incumbents to supply S Sesame Bankh hall and Towry, two of the largest wea alth ement groups s in the count try, with IRES SSs XPLAN fin nancial planning business software. This is manage amarke etopportunit tymultipletim meslargertha anAustraliaand a providesconsiderable econfidencet that themon neythusfarinvestedwilldeliver d excellentreturnsover o theensui ingyears. Ourview We app plaud the bus siness ethos that t underpin ns IRESS and its i management team. They think and act long ter rm and their financial rec cord stands as public reco ord of what c can be achiev ved when vision, focus and a conserv vative approa ach is applied d sensibly. Th he business su urvived the financial f crisis s of 2008 in very good sh hape, despite e the drop in client deman nd. More imp portantly, while managem ment have co ontinued to in nvest for tom morrow, a deb bt free balanc ce sheet and a high annui ity type earni ings stream has allowed the group to o reward exis sting shareho olders with an attractive dividend stre eam thatcur rrentlyrepres sentsa5.0%yield. y 4.Comp putershare(C CPU):shareprice p $10.10|marketcapitalisation$5,6 617million In many y areas Comp putershare ha as similarities s to IRESS. A business which had its ori igins in Austr ralia has now w become the largest glob bal share reg gistry player with w revenue es approachin ng $2 billion and netprof fitsexceeding g$300million.Thefounde er andnowchairman c Chri is Morrisisno o longerrunn ning the bus siness but his initial appr roach to bui ild and opera ate a proprie etary software platform has allowed d the group to o act as an ag ggregator of registry busin nesses both here h and abroad. Today, the group services s over 30,000 globa al clients, pre edominately around finan ncial markets s and specific cally registry ymanagemen nt. At its heart, h the Co omputershare e business in nvolves a sca alable inform mation gather ring service t that charges s on a per cus stomer basis. As such, the company be enefits enorm mously from economic e grow wth and wh hen financial markets are positive, as this invariab bly leads to more corpor rate activity and a increasi ing numbers of shareholders that requ uire the service. It would come c as no surprise s that the lastfew wyearshavebeen b toughoncompanieslikeIRESSandComputers share,whore elyheavilyonthe positive e health of the equity markets. Howe ever unlike other o cyclical l businesses, Computersh hare enjoys scale, s incumb bency and an n annuity type e income stre eam. This has s seen the co ompany weat ther theglob balfinancialcrisis c whilstal lsotakingadv vantageofacquisitionopp portunities. Ourview We hav ve held a positive view on n global share e markets and in particula ar the US for some time now n and a business b like Computersha are is not on nly a best of breed busine ess, it also enjoys wonde erful

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

earning gs leverage when w conditions allow. Management M has delivere ed excellent returns on the capital employed th hus far and our o view rem mains that Computershare e is a share to t own for most m seasons s. 5.Skille edEngineerin ng(SKE):shareprice$3.50 0|marketcapi italisation$84 47million Busines ss background d:TheSkilled d groupis Aus straliasand New N Zealand s leadingpro oviderof staff fing services s. A national l operator with w over 170 0 offices, Ski illed assists clients c with their workfo orce requirements and skilled labour needs. As such Skilled employs e over r 50,000 trad de and techn nical e of industries s including mining, m oil and d gas, transpo ort, defence and specialists covering a wide range as founded by Frank Ha argraves in 1964, 1 in Melbourne, bef fore infrastructure. The business wa y in subsequent years. Th he company listed in 199 94, with Harg graves remain ning expanding nationally tilretiringandpassingthe ebatonontos sonGregHargravesin200 03. CEOunt A series sof acquisitio onsduring the eperiod2005 5and2008sa awcompany net debtblow w outto$300 0m, resulting in a gearin ng ratio of ov ver 50%. The e financial cr risis and dow wnturn that hit h the econo omy during 2008 2 severely y tested the business b and management was forced to restructur re and raise new n equity at a $1.50 per share. CEO Greg G Hargrav ves resigned in i 2010 and the external appointment t of currentCEOMickMcMahonhasrestoredmuc chneededfin nancial disciplineand businessrigortothe group. With a background that include es food grou up Coles Group and priva ate equity firm TPG Capital, McMah hon appears to t have the necessary n skill sets to not only run a la arge people business b but also a financia ally prepare it for the more m difficult t times ahea ad. Our mee etings with McMahon have impress sedusbuthis sactionstoda atearewhatcountsandto othatendhe ehasnotdisappointed. A no no onsense appr roach exemp plified by a fo ocus on cutti ing waste, re emoving a blo oated corpor rate structur re and drivin ng greater use u of techn nology to lift t efficiency has been th he hallmarks s of McMah hons tenure to date. His success can be seen in th he numbers, with debt le evels now sitt ting below$70 $ million,netprofitsare esettohitanew n highofover$50millio on,alongwith hhighermarg gins andthe erecommence ementofdivi idendpayments. Ourview This is a tough business, where managing pe eople and me eeting custom mer needs re equires const tant attentio on. That said d, Skilled dom minates in many m segmen nts of the m market and holds h long te erm customer contracts extending e out two years f for 50% of clie ents, with another 18% stretching beyo ond fiveyea ars.Thebusin nessrequireslittleinthew wayofcapitalandgenerate essignificantamountsoffree f cash. McMahon M clea arly understa ands what ne eeds to be done and the importance of driving more m efficiency, lowering cost and keeping debt to a minimum. While W Skilled will always be b susceptible e to theeconomicswings s,wesuggest tthathaving placed thegr rouponafirm merfooting,the t best isyetto come.

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

6.SuperRetailGrou up(SUL):shar reprice$12.2 25|marketcapitalisation$2,389million Backgro ound busines ss: The story of Super Ret tail Group ex xemplifies wh hy manageme ent can often n be the difference betwe een a business that is goo od and one that is great. In 1972 Reg and Hazel Ro owe kicked off o a mail or rder automot tives business from Quee ensland. It be ecame the fo orerunner to the Super Cheap C Auto business that eventually ex xpanded interstate under the leadership of Bob Tho orn. The roll lout model, which w typifies s most retail concepts tod day, continue ed well into the t new decade and led d to the company listing onto the stock exchange in 2004. With a listing price p of $1.97 7, a market capitalisation of $210 million m and 20 00 Super Che eap Auto sto ores already up u and running, ationswerehighthatthebest b wasyett tocome. expecta rupt departure of respect ted CEO Thor rn in 2006 pu ut a tempora ary lid on things as invest tors The abr surveye ed the circum mstances beh hind the mov ve. However, any concern ns should have been allayed with the e appointmen nt of the grou ups CFO Pete er Birtles to the t top job. Having H worked with Thorn for over fiv ve years and with w strong retail r experience working in the UK, Bi irtles hit the ground running. The roll lout of Super r Cheap Auto o continued a at pace, while e the newer outdoor reta ail offering aptly named Boating, Cam mping and Fishing F (BCF), , that began n under Thor rns watch, was w given more m attentio on. The gro oup undertoo ok acquisition ns to provide e additional scale although not every ything has go one accordin ng to plan. It ts move into cycling in 20 008 has proven a tougher r ride while the t slowdown n in retailco onditionspostthe2008globalcrisishasrequiredagreater g focus soncosts.Andperhapsthisis where Birtles B and his team have really excelle ed. If the Super Retail Group has a key strength, it is i in the way y they appro oach their tas sk. No big ba ang sales pitc ch but a long g term consis stent strategy y to improve e on costs an nd lift margins s by adopting g better techn nology and delivering on customer c nee eds. Itmight tsoundsimplebutmanyretailers r failto ojumpthisim mportanthurdle. Over the ensuing years, the grou up continued to lift revenu ues and marg gins. In 2011 Birtles surpri ised the market with the e purchase of f Rebel Sport ts from priva ate equity for r a total cash h outlay of $610 million. Accompany ying the buy y, the group p also annou unced a larg ge rights issu ue to fund the transact tion. In short t, the compan ny was asking shareholde ers to trust m management on o the merits s of this pur rchase. Desp pite initial inv vestor concerns, Birtles and a his team m have justifia ably earned the markets sapplause.Birtlesisquick ktopointoutthatwhatth heyhavedone eatRebelissimply s sales1 101. Howeve er,thingsareneverthatsimple. Manage ementhasshownanabilit tytodealwiththeissuesof o todaywhils stinvestingandpreparing gfor tomorro ow.The inter rnets growing gpenetration n is botha threat and ano opportunityand a onceagai in it is too early e to deter rmine how well w the group p is placed to o deal with th hese issues. So S far, the Su uper Retail Group G has co ontinued to deliver d year on o year, driving like for li ike sales growth while more m established retail br rands including Harvey N Norman, Myer and David Jones have stumbled badly. Evenmo oreimpressiv ve,theyhaveachievedthe eseresultswithaminimum moffusswhilstmaintainin nga conserv vatively geare ed balance sh heet. On this score alone, the group d deserves the attention a it n now receives s.

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

10

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

7.Brevi illeGroup:sh hareprice$5.34|marketca apitalisation$694 $ million Busines ss Backgroun nd: If you are e a whiz in th he kitchen the name Brev ville may mea an something g to you.Thegroupswebsitedescribe esitselfasA AnAustralianpubliclylistedcompanywhich w isalead ding provide er of small ele ectrical applia ances in the consumer products industry. Even those less familiar with the brand wou uld have noticed the groups stellar financial f perf formance ove er recent tim mes. Howeve er, managem ments commentary at the interim sounded a warning of potentially toug gher times ahead. a Under r those circu umstances it didnt take long for the e market to impose its o own penalty,droppingthesharesfrom mahighof$7 7.34.Sowhatdowemakeofit? eville business s has history, , dating back to 1957 whe en it operated d as a small im mporter of basic The Bre home wares. w It list ted in 1999, , before it w was acquired d by anothe er listed grou up, Housewa ares Internat tional in 200 01. The busin ness focus sh hifted toward ds electrical appliances and in 2008, the BrevilleGroupname ewasrestored d. At its co ore, managem ment has set a strategy, to develop premium brand ded products s by avoiding the mass market. m Products that have e flowed from m the groups s research and developme ent area inclu ude, the Kitc chen Wizz Pr ro Food Proc cessor, the Yo ouBrew Drip Coffee Make er, and the Smart S Scoop Ice Cream Maker. In addition, the gr roups North America ope erations have e benefited enormously e fr rom itsroleasdistributor rofKeurigssingle s serveco offeebrewing gsystem. Unfortu unately succe ess can often bring its own n challenges. In the case of o Keurig, the e decision to cut Brevilles distribution margin effe ectively force ed Breville management t to hand back the business s as the eco onomics no lo onger justified an ongoing g investment. . During the half, this bus siness genera ated $12.5 million m in com mmission revenue and for the full yea ar close to $20 million is expected. After covering g overhead costs, c some $8 $ million is expected e to flows f to the bottom b line. To put that into i some co ontext, Brevil lle is forecast t to generate $73 million in i earnings be efore interest t and tax for the full year, so the loss of the contra act at the end d of 2013 will deliver a sig gnificant dent t in earnings and a requiremanagementtorestructu ureitsNorthAmerican A ope erations.Whilethishasco omeasablow w,it shouldn nt come as a complete surprise that distribution deals d can be axed, particularly successful ones. These events however rein nforce the im mportance of building and d promoting company c owned brands,apointnotlo ostonmanag gement. Ourview Manage ement has de elivered excel llent results f for sharehold ders over a nu umber of yea ars. The busin ness clearlyis i atacrossro oadsasitdealswiththelossoftheKeurigdistributio ondeal.Inthemeantime,the group continues c to invest and expand e the B Breville owned products. With a conse ervative balance sheet, carrying c net cash c of $50 million m and a focus on delivering long term sustain nable earning gs, a weaken ning share price provides the ideal op pportunity to reexamine the merits of o this consum mer busines ss.SFM

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

11

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

Governmentandou urbigminers It may be b a strange way to think about it but what do the Federal Gov vernment and d our big miners, BHP Bill liton and Rio Tinto have in n common? F For one thing g, leadership issues i have been b grabbing g all the atte ention of late e. In the case e of both BHP Billiton and d Rio Tinto we w already kn now that Marius Klopper rs and Tom Albanese A have e moved on, extraordinary y as that may y seem. One minute both are outlinin nglongtermcapital c expenditurebudge etstocoincide ewithongoin ngresourcesdemandandthe nextthe eyarehaveexited,replace edbynewma anagement,now n intenton nconservingcash c andlook king toprote ecttheintere estsofshareholders. As for the t Prime Minister, the omens o are no ot looking go ood although a September election if she makes it that far is s still a long way off. However, more e startling are the deterio orating finan ncial position ns of both the miners and d the Govern nments budg get position. Having prom mised a return n to surplus in 2013, the Treasurer ha as had to con ncede that it t wont get w within cooee of o that target. A combinationofoverspendingand dlowerreven nueshasforce edtheinevita ablebelttigh htening. So rathe er than banking surpluses s, we now need to conten nd with cuts, cuts and more cuts. Our t two big min ners are no different. Having H enjoy yed the fruit ts of a stron ng resources s boom, cap pital expenditure and acq quisitions hav ve dominated d the agenda at the expen nse of financial prudence and shareho older focus. So S why have e things chan nged so fast, surely the r resources bo oom isn't end ding tomorro ow.Wellnotquite,butthe erecentshar rpdropiniron norepriceswas w animportantwakeupcall that ou ur miners cou uldnt ignore e. As price ta akers, our miners have m minimal down nside protect tion should prices drop sharply, s making the task o of funding additional long term resourc ce projects even moredi ifficult. Table1:Financialsta andingofour rminers

RioTint to SalesRe evenueUS$M NetPro ofitAfterTaxUS$M EPSUS$ $ DPSUS$ $(ordinary) Payout% NetDeb btUS$M FullYearDec cember2007 25,400 7,800 5.50 1.04 19 2,800 FullYearJune2007 47,500 13,700 2.34 0.47 20 8,700 FullYearDecember2012 55,600 9,300 5.03 1.67 33 19,300 FullYearJune e2012 72,200 17,100 3.21 1.12 35 23,500

12

BHPBill liton SalesRe evenueUS$M NetPro ofitAfterTaxUS$M EPSUS$ $ DPSUS$ $(ordinary) Payout% NetDeb btUS$M

Here it helps to loo ok back on th he financial s standing of both b these b businesses wh hen things were w cruising g along. As th hings would have h it, both Albanese an nd Kloppers, took over th heir CEO reins in May and October 20 007 respectiv vely. As the accompanying g Table 1 high hlights, whils st revenues have

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

continuedtorise,so ohasnetdebt t.InthecaseofRio,netpr rofitsareupfrom f US$7.8billiontoUS$ $9.3 billion, while net de ebt has increased seven fold f from US$ $2.8 billion t to US$19.3 billion. BHP fa ares little be etter, with net earnings ov ver the period d rising from US$13.7 billio on to US$17.1 billion and net debtjum mpingfromUS$8.7 U billiontoUS$23.5b billion. In isolat tion even at these t elevate ed debt levels s coverage ap ppears adequate, however r, these earni ings wereac chievedduringtimeswhen nmineralpric ceswereatth heirpeak.Thi isisnolongerthecase,made worseby b ongoing largecapital ex xpenditurepr rojectsthatth heminers are e committedto fund. Inw ways not diss similar to the e Government t, during this point of the cycle, the pr referred posit tion should have seen bo oth Rio and BHP B running conservative c debt levels and a tight control on cost ts. Unfortunat tely inbothinstancesthisisnottheca aseandthetrueconseque encesofeach hareyettoplayoutinfull. . ncial markets this hasn't gone g unnoticed with ratin ng agency Sta andard & Poo or's placing BHP B In finan and Rio o Tinto on not tice. In the ca ase of BHP, the group's A rating was le eft intact but it did warn that t with a limited buffe er, action was s needed to maintain this s rating. For Rio Tinto the e result was less favoura able, with the groups A rating revised from stable to negat tive. What triggered such a turnaro ound can be sheeted s hom me to manage ement makin ng the cardinal mistake of f overpaying for assets in boom times. In the case e of Rio, share eholders have endured writeoffs totaling a stagger ring $US34 billion since 2008. It is lit ttle wonder that t new CEO O's are usher red in at this juncture wit th a renewed focus on financial f prud dence and sh hareholder re eturns. It's cl lear that action was need ded swiftly to t address th he changing economic e clim mate, but why y did it take management t and the boa ards of both h companies so long to see and do o what was so obvious. Time will te ell whether this GovernmentandPrimeMinisterwillalsohave etomakeway,havingdev viatedsofarfrom f wherethey expecte edtobe.SFM M Thenew wglobalwar Tension ns have been rising and behind closed doors gover rnments are in i deep discu ussions on a war w thatishard h tocontainandwhere etheconsequ uencesofinaction a canlea adtomanyou utcomes.Weare ofcours setalkingabo outtheglobalcurrencywa ars.WhetheritstheSwiss sfranc,theJa apaneseyen,the German n deutschmar rk, the Chines se yuan, the U US dollar or our o own Aust tralian dollar, there is gene eral agreementthatthegloves g arewe ellandtrulyo off. Enough has been said and writte en about the euro fallout and a the econ nomic pain th hat has follow wed. Hindsightisawonde erfulthingandonreflectio on,whethercountries c such hasGreece,Portugal,Italy yor many others o should d have aband doned their o own currencies for the e euro appears s on the surf face pretty clear c no. An nd without wanting w to ge et into any lengthy debate es as to the pros p and cons s of each,th heshortansw werfromourperspectiveisthatfloating gcurrenciesa allowcountriestoreadjus stto the eco onomic conditions of the day. They ac ct as a self correcting c me echanism des spite the pain nful process sinvolved. In many y ways curren ncies reflect the t underlyin ng strength of f a nation. Au ustralia has a strong curre ency and wh hile there are e significant economic iss sues that nee ed addressing, when com mpared to many othernationsitappe earsverywellplaced.That tsaid, ifandwhenconditi ionsdeteriora ateourcurre ency

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

13

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

will no doubt follow suit. Its not perfect but governm ments that tinker t with this t are directly interfer ring with an economys self correctin ng mechanism. What is often lost in n the discuss sion process sisthatchang geisinevitableandaiming gtoprotectin ndustriesorb businessesthatcannolon nger compet te effectively without protection, is in the long run n a flawed strategy. Those e who argue for currenc cy interventio on are quick k to denote why help is s needed. Lo ost jobs, mor re imports, less domest tic manufactu uring are all valid reasons for assistan nce but who measures th he benefits that t restruct turing brings, , the redirect tion of capita al to more productive area as and the industries that set upandlearntocompetemoreef ffectively. nsiblebutithasntstopped dcountriesta akingaction.Things T reallygot Ourpointof viewmaysoundsen goingon6Septembe er 2011when ntheSwissGovernmentsteppedintodevaluetheSwiss S francin nan attempt t to protect the t economy y. In pegging the t franc to the t euro the Swiss Nation nal Bank warn ned that it would w no longer allow one e Swiss franc c to be worth h more than 0.83 equiv valent to SFr1 1.20 to the euro. In order to achieve e this, the B Bank would have h to purchase unlimite ed quantities s of foreigncurrenciesto oforceitsvalu uedown.Hav vingbecomeasafehaven fromtherav vagesoftheeuro e zone cr risis, the Swiss felt the need n to act h however, not everyone is convinced. Louise Coop per, markets s analyst at BGC B Partners, , warned tha at central ban nks do not ha ave unlimited d power as the UKlearn nedduringBl lackWednesd dayinSeptem mber1992. Eighteen months on n and as Grap ph 1 illustrate es, the Swiss have kept th he franc pegg ged to the eu uro. But for how long? As A Cooper no oted "The Jap panese examp ple with yen intervention teaches us t that interven ntion can wo ork in the ver ry short term but changing longterm global curren ncy flows is n near impossiblealesson nthattheUKlearnedfrom mGeorgeSoro os". Graph1: 1 Swissfranc cveuro

14

The dan nger in all th his is the tit for f tat menta ality that inva ariably result ts when one country tries s to interfer re with norm mal market workings. w This s need to act t and to protect is largely driven by self

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

interest t, that govern nments are seen to be do oing somethin ng to protect t jobs and ind dustries. Already thingsare a escalating g. n under newly n installe ed Prime Min nister Shinzo Abe, appear rs determined d to stimulat te a Japan, now moribun nd economy by ordering the t countrys s central bank k to be more e expansionar ry. Governme ents that pri int money ar re invariably signing up fo or a weaker domestic cu urrency in ord der to stimulate exportdemand. d TheJapaneseintakingthisac ctionhavesen ntaveryclea armessageth hattheywilltake t action to t compete for business s. The weake ening yen is now placing g pressure on o neighbour ring countrie es including the t Chinese. Already A tensions are high and some form of retaliat tion is expect ted. The flow woneffectsfrom f currency ywars are ha ardtoquantif fyhoweverit t issafetosay ythatwesho ould expectmore m ofthesame s aseachcountrylook kstoprotecttheir t ownpat tchoftheworld.SFM Executiv vepay It's a go ood thing many of our lo ocal executiv ves don't rely y on the Swiss to set their pay packets. Followin ng on from th he European crisis, execut tive remunera ation has bec come a very hot h topic. Top p of the hit list are the bankers but what w the Swiss s are contem mplating has fa ar reaching ra amifications and a Australi ia may not be e that far aw way, judging b by the reactio on that greeted Marius Kloppers when n he recently y stepped down from BHP P Billiton with h cash, shares s and perform mance rights estimated to o be worth$75 $ million. BHPsha areholdersca anjudgewhet thertheygot tvalueformo oneyhowever,theissueof o whatsomeo one should be paid and over o what tim me frame has s no easy solu ution. We str ruggle to actu ually understa and many remuneration n packages and unfortuna ately the ann nual reports of today ha as more cont tent devoted dtowhatexe ecutivesarepaid p ratherthanthebusine essitself. We don n't begrudge paying top dollar for an ny management team tha at delivers fo or shareholders. Alignme ent of interes st is in our op pinion the key y and measur ring that is no ot a one size fits all policy y. At its core e, remunerat tion policies should enc courage man nagement to think as ow wners first and foremost, rewarding g performanc ce that achieves the twin aims of protecting the existing e busin ness beforeseeking s grow wth. The new w Swiss appr roach is still in draft form m but already y it has cause ed quite a sti ir. Following the financia al collapse of Swissair in 2001, 2 parliam mentarian Tho omas Minder has waged a personal ba attle culmina ating inanati ionalreferend dum tocorre ect what heca alls the"ripo off merchants s".During Ma arch Swiss vo oters appeare ed to back him and the ou utcome, shou uld the draft b bill get up, will result in Sw wiss compan nyboardmem mbermandat tesrestrictedtooneyearterms, t salarie esofexecutiv vesand direct tors set by shareholders s and not th he board and d certain compensation payments in ncluding sign on bonuses sandpaymen ntsreceivedfor f takeovers sbanned. It sound ds quite revolutionary, but for too long g investors ha ave been pay ying top dollar for boards and a manage ement teams, with little skin s in the ga ame and a propensity p to chase growt th. Whether the Swiss have the right t answer is up u for debate e but this is an a issue that t is unlikely to pass any time soon.SF FM

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

15

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

Compan nyvisitdiaryMarchQuart ter2013 January y AMA AMA AGroupmana agementconferencecall PXS Phar rmaxismanag gementconfe erencecall RMD ResM MedQ22013 3conferencec call ACR Acru uxmanageme entconferenc cecall CCP Cred ditCorpinteri imresultsbriefing Februar ry PGI PanT TerraGoldmanagementmeeting m NVT Navi itasinterimre esultsbriefing g COH Coch hlearinterimresultsbriefing PRY Prim maryHealthca areinterimresultsbriefing g REA REAGroupinterim mresultsbrie efing NWS New wsCorpQ2resultsbriefing g FXL Flexigroupinterim mresultsbrie efing JBH JBHiFiinterimre esultsbriefing g LGD Lege endsinterimresults r briefin ng CRZ Cars sales.cominte erimresultsb briefing WOR Wor rleyParsonsin nterimresults sbriefing CPU Com mputersharein nterimresultsbriefing SKE Skille edEngineerin nginterimres sultsbriefing SAI SAIGlobal G interim mresultsbriefing NHF NIBHoldingsinte erimresultsbriefing PXS Phar rmaxismanag gementmeet ting MND Mon nadelphousin nterimresults sbriefing FWD FleetwoodCorpo orationinterim mresultsbrie efing FBU Fletc cherBuildinginterimresul ltsbriefing IRE IRES SSfullyearres sultsbriefing SEK SEEK Kinterimresu ultsbriefing AMM Amc comTelecommunicationsinterimresult tsbriefing SUL Supe erRetailGrou upinterimres sultsbriefing EGP Echo oEntertainme entGroupint terimresultsbriefing TTS Tatts sGroupinter rimresultsbriefing JIN JumboInteractive einterimresu ultsbriefing BRG Brev villeGroupint terimresultsbriefing TRS TheRejectShopinterim i result tsbriefing IFL IOOF FHoldingsint terimresultsbriefing SYD Sydn neyAirportin nterimresults sbriefing MYX May ynePharmaGroup G interim mresultsbriefing PPT Perp petualinterim mresultsbrief fing

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

23/01/13 3 24/01/13 3 25/01/13 3 30/01/13 3 31/01/13 3

04/02/13 3 05/02/13 3 05/02/13 3 06/02/13 3 06/02/13 3 07/02/13 3 07/02/13 3 11/02/13 3 12/02/13 3 13/02/13 3 13/02/13 3 13/02/13 3 13/02/13 3 15/02/13 3 18/02/13 3 18/02/13 3 19/02/13 3 19/02/13 3 20/02/13 3 20/02/13 3 20/02/13 3 20/02/13 3 20/02/13 3 21/02/13 3 21/02/13 3 22/02/13 3 22/02/13 3 22/02/13 3 25/02/13 3 27/02/13 3 27/02/13 3 28/02/13 3

16

March20 013SelectorAus stralianEquitiesFundQuarterlyNewsletter#33

March WTF IRE APE SRX CPU MND FLT DTL JIN NHF SAI PBT SIP SIV NTC Wot tif.comHoldin ngsinterimre esultsbriefing g IRES SSmanageme entmeeting APEagers E interim mresultsbrief fing Sirte exinterimres sultsbriefing Com mputersharemanagement m conferencecall c Mon nadelphousmanagement m m meeting Fligh htCentreman nagementconferencecall Data a#3interimre esultsbriefing g JumboInteractive econferencecall NIBHoldingsman nagementme eeting G sitevis sit SAIGlobal Pran naBiotechnologymanagem mentmeeting g Sigm maPharmaceu uticalsinterim mresultsbriefing Silve erChefmanag gementmeet ting Netc commWirele esssitevisit 01/03/13 3 04/03/13 3 05/03/13 3 05/03/13 3 07/03/13 3 06/03/13 3 06/03/13 3 07/03/13 3 11/03/13 3 12/03/13 3 13/03/13 3 13/03/13 3 14/03/13 3 14/03/13 3 15/03/13 3

SelectorFundsManagementLim mitedDisclaim mer The info ormation con ntained in this document is general in nformation only. This do ocument has not been prepared p taki ing into acco ount any pa articular Inve estors or cla ass of Invest tors investm ment objectiv ves,financialsituationorneeds. n The Dir rectors and our o associates s take no res sponsibility fo or error or o omission; how wever all care is takenin npreparingth hisdocument t. The Directors and our associates s do hold units in the fund d and may hold investme ents in individ dual compan niesmentione edinthisdoc cument.SFM

SelectorFunds F Managem mentLimited ACN1027 756347AFSL225 5316 Level3,10 1 BridgeStreetSydneyNSW20 000,Australia Telephon ne6128090361 12Webwww.se electorfund.com m.au

17

You might also like

- Corsair Capital Q3 2010Document5 pagesCorsair Capital Q3 2010tigerjcNo ratings yet

- Quarterly Fund GuideDocument72 pagesQuarterly Fund GuideJohn SmithNo ratings yet

- Dear Investor,: June 20 011 Selector Qu Arterly Newslett Ter #32Document15 pagesDear Investor,: June 20 011 Selector Qu Arterly Newslett Ter #32SelectorFundNo ratings yet

- Selector September 2010 Quarterly NewsletterDocument27 pagesSelector September 2010 Quarterly Newsletterapi-237451731No ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- Q2 2020 Investor LetterDocument14 pagesQ2 2020 Investor LetterAndy HuffNo ratings yet

- Pakistan's Debt Maturity Expected to Remain Within LimitsDocument4 pagesPakistan's Debt Maturity Expected to Remain Within LimitsMuhammad Ali KhanNo ratings yet

- Selector June 2011 Quarterly NewsletterDocument17 pagesSelector June 2011 Quarterly Newsletterapi-237451731No ratings yet

- Chapter 10Document42 pagesChapter 10Sandy TanyarinNo ratings yet

- Selector June 2013 Quarterly NewsletterDocument24 pagesSelector June 2013 Quarterly NewsletterSelectorFundNo ratings yet

- Group 24Document23 pagesGroup 24dineomokoena327No ratings yet

- Nine Percent Solution 11-08-10 Epoch PartnersDocument4 pagesNine Percent Solution 11-08-10 Epoch Partnerssankap11No ratings yet

- Selector March 2010 Quarterly NewsletterDocument31 pagesSelector March 2010 Quarterly Newsletterapi-237451731No ratings yet

- Prasarn Trairatvorakul: The Strength of The Thai Economy and Future Development in Thailand's Financial SystemDocument3 pagesPrasarn Trairatvorakul: The Strength of The Thai Economy and Future Development in Thailand's Financial Systemivan anonuevoNo ratings yet

- Glenview Q4 14Document23 pagesGlenview Q4 14marketfolly.comNo ratings yet

- Selector June 2010 Quarterly NewsletterDocument22 pagesSelector June 2010 Quarterly Newsletterapi-237451731No ratings yet

- 209652CIMB Islamic DALI Equity Growth FundDocument2 pages209652CIMB Islamic DALI Equity Growth FundazmimdaliNo ratings yet

- Investment Term Paper TopicsDocument5 pagesInvestment Term Paper Topicsc5qp53ee100% (1)

- 02 FinancialMarketsADocument30 pages02 FinancialMarketsAtrillion5No ratings yet

- Inflation Monetary Policy: Fiscal Discipline Refers To A State of An Ideal Balance Between Revenues andDocument3 pagesInflation Monetary Policy: Fiscal Discipline Refers To A State of An Ideal Balance Between Revenues andJhonard GaliciaNo ratings yet

- 2011-07-31 Brait Multi StrategyDocument2 pages2011-07-31 Brait Multi StrategykcousinsNo ratings yet

- CI Signature Dividend FundDocument2 pagesCI Signature Dividend Fundkirby333No ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 ReDocument10 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 RepolandspringsNo ratings yet

- Jul20 ErDocument5 pagesJul20 Errwmortell3580No ratings yet

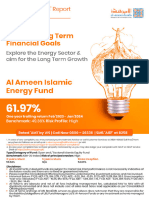

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharNo ratings yet

- Pitchford Thesis Current Account DeficitDocument8 pagesPitchford Thesis Current Account DeficitErin Taylor100% (2)

- Security Bank - UITF Investment ReportDocument2 pagesSecurity Bank - UITF Investment ReportgwapongkabayoNo ratings yet

- Microequities Deep Value Microcap Fund January 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund January 2012 UpdateMicroequities Pty LtdNo ratings yet

- AAIB Mutual Fund (Shield) : Fact SheetDocument2 pagesAAIB Mutual Fund (Shield) : Fact Sheetapi-237717884No ratings yet

- SPOT OPPORTUNITIES IN FMCG SECTORDocument55 pagesSPOT OPPORTUNITIES IN FMCG SECTORakcool91No ratings yet

- Microequities Deep Value Microcap Fund July 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund July 2011 UpdateMicroequities Pty LtdNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- Tutorial 1Document2 pagesTutorial 1One AshleyNo ratings yet

- GF Letter 09-30-16 FinalDocument4 pagesGF Letter 09-30-16 FinalAnonymous Feglbx5No ratings yet

- Data Gathering Sources for Industry and Economic AnalysisDocument31 pagesData Gathering Sources for Industry and Economic AnalysisAdio Foster80% (5)

- Budget Statement 2011Document57 pagesBudget Statement 2011Low Huai PinNo ratings yet

- Fpa Capital Fund Commentary 2017 q1Document12 pagesFpa Capital Fund Commentary 2017 q1superinvestorbulletiNo ratings yet

- Fixed Income Attribution WhitepaperDocument24 pagesFixed Income Attribution WhitepaperreviurNo ratings yet

- 9th, September 2015: Nifty Outlook Sectoral OutlookDocument5 pages9th, September 2015: Nifty Outlook Sectoral OutlookPrashantKumarNo ratings yet

- Portfolio ConstructionDocument21 pagesPortfolio ConstructionRobin SahaNo ratings yet

- Joe HockeyDocument7 pagesJoe HockeyPolitical AlertNo ratings yet

- ICMAniacs Report Final (In Need of Finishing Touches)Document19 pagesICMAniacs Report Final (In Need of Finishing Touches)George Stuart CottonNo ratings yet

- Knowledge Initiative - July 2014Document10 pagesKnowledge Initiative - July 2014Gursimran SinghNo ratings yet

- Setting Investment ObjectivesDocument49 pagesSetting Investment ObjectivesgeekwannabeNo ratings yet

- Contribution of Insurance Sector in Nepalese EconomyDocument10 pagesContribution of Insurance Sector in Nepalese EconomySharad Pyakurel100% (1)

- INDEPTH - September 2011Document17 pagesINDEPTH - September 2011Vivek BnNo ratings yet

- Capital Outflow & Exchange RateDocument7 pagesCapital Outflow & Exchange RateAkhmal AzmeyNo ratings yet

- PFL Media Release Platform Wrap 312Document2 pagesPFL Media Release Platform Wrap 312Tuan Pham Heyts-YuNo ratings yet

- Macro Economics AssignmentDocument10 pagesMacro Economics AssignmentSithari RanawakaNo ratings yet

- Point of View: Labour Force: Top 200: Movers and ShakersDocument4 pagesPoint of View: Labour Force: Top 200: Movers and ShakersLong LuongNo ratings yet

- Annual Report: March 31, 2011Document23 pagesAnnual Report: March 31, 2011VALUEWALK LLCNo ratings yet

- Empower February 2017Document104 pagesEmpower February 2017Arjun BhatnagarNo ratings yet

- Lectura Unidad 2 - Equity Artículos 3 y 4Document44 pagesLectura Unidad 2 - Equity Artículos 3 y 4Maria Del Mar LenisNo ratings yet

- Budget Insight 2010Document58 pagesBudget Insight 2010Muhammad Usman AshrafNo ratings yet

- Assignment May2011 ADocument6 pagesAssignment May2011 AZyn Wann HoNo ratings yet

- Selector September 2004 Quarterly NewsletterDocument5 pagesSelector September 2004 Quarterly Newsletterapi-237451731No ratings yet

- The effects of investment regulations on pension funds performance in BrazilFrom EverandThe effects of investment regulations on pension funds performance in BrazilNo ratings yet

- EIB Investment Survey 2023 - European Union overviewFrom EverandEIB Investment Survey 2023 - European Union overviewNo ratings yet

- EIB Group Survey on Investment and Investment Finance 2019: EU overviewFrom EverandEIB Group Survey on Investment and Investment Finance 2019: EU overviewNo ratings yet

- Selector September 2011 Quarterly NewsletterDocument19 pagesSelector September 2011 Quarterly NewsletterSelectorFundNo ratings yet

- Selector December 2011 Quarterly NewsletterDocument20 pagesSelector December 2011 Quarterly Newsletterapi-237451731No ratings yet

- Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612Document20 pagesSelector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612SelectorFundNo ratings yet

- Selector June 2012 Quarterly NewsletterDocument21 pagesSelector June 2012 Quarterly NewsletterSelectorFundNo ratings yet

- Selector September 2012 Quarterly NewsletterDocument20 pagesSelector September 2012 Quarterly NewsletterSelectorFundNo ratings yet

- Selector March 2012 Quarterly NewsletterDocument23 pagesSelector March 2012 Quarterly NewsletterSelectorFundNo ratings yet

- Selector June 2013 Quarterly NewsletterDocument24 pagesSelector June 2013 Quarterly NewsletterSelectorFundNo ratings yet

- Selector September 2013 Quarterly NewsletterDocument21 pagesSelector September 2013 Quarterly NewsletterSelectorFundNo ratings yet

- Past Tense Irregular Verbs Lesson Plan 02Document7 pagesPast Tense Irregular Verbs Lesson Plan 02drdineshbhmsNo ratings yet

- Types, Shapes and MarginsDocument10 pagesTypes, Shapes and MarginsAkhil KanukulaNo ratings yet

- Southern Railway, Tiruchchirappalli: RC Guards Batch No: 1819045 Paper PresentationDocument12 pagesSouthern Railway, Tiruchchirappalli: RC Guards Batch No: 1819045 Paper PresentationSathya VNo ratings yet

- Phonetics Exercises PDFDocument2 pagesPhonetics Exercises PDFShanti YuliastitiNo ratings yet

- SMS Romantis Bhs Inggris Buat Pacar TercintaDocument5 pagesSMS Romantis Bhs Inggris Buat Pacar TercintaAdnan MaruliNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Smoochie Monsterpants: I Have Added My Pattern To RavelryDocument3 pagesSmoochie Monsterpants: I Have Added My Pattern To RavelryadinaNo ratings yet

- Hold-Up?" As He Simultaneously Grabbed The Firearm of Verzosa. WhenDocument2 pagesHold-Up?" As He Simultaneously Grabbed The Firearm of Verzosa. WhenVener MargalloNo ratings yet

- Solar PV Power Plants Harmonics Impacts: Abstract - The Power Quality (PQ) Effects of AggregatedDocument5 pagesSolar PV Power Plants Harmonics Impacts: Abstract - The Power Quality (PQ) Effects of Aggregatederic saputraNo ratings yet

- CARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Document3 pagesCARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Joana Jean SuymanNo ratings yet

- History I.M.PeiDocument26 pagesHistory I.M.PeiVedasri RachaNo ratings yet

- Doctrine of Double EffectDocument69 pagesDoctrine of Double Effectcharu555No ratings yet

- Guna Fibres Case Study: Financial Forecasting and Debt ManagementDocument2 pagesGuna Fibres Case Study: Financial Forecasting and Debt ManagementvinitaNo ratings yet

- Talha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFDocument4 pagesTalha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFMohammad TalhaNo ratings yet

- Bible TabsDocument8 pagesBible TabsAstrid TabordaNo ratings yet

- Lawson v. Mabrie Lawsuit About Botched Funeral Service - October 2014Document9 pagesLawson v. Mabrie Lawsuit About Botched Funeral Service - October 2014cindy_georgeNo ratings yet

- Art 1207-1257 CCDocument5 pagesArt 1207-1257 CCRubz JeanNo ratings yet

- Literature Circles Secondary SolutionsDocument2 pagesLiterature Circles Secondary Solutionsapi-235368198No ratings yet

- Fernández Kelly - Death in Mexican Folk CultureDocument21 pagesFernández Kelly - Death in Mexican Folk CultureantoniadelateNo ratings yet

- Economy 1 PDFDocument163 pagesEconomy 1 PDFAnil Kumar SudarsiNo ratings yet

- Slope StabilityDocument11 pagesSlope StabilityAhmed MohebNo ratings yet

- A.A AntagonismDocument19 pagesA.A Antagonismjraj030_2k6No ratings yet

- Methods of GeographyDocument3 pagesMethods of Geographyramyatan SinghNo ratings yet

- FA Program BrochureDocument25 pagesFA Program BrochureThandolwenkosi NyoniNo ratings yet

- Cambridge IGCSE: Pakistan Studies 0448/01Document4 pagesCambridge IGCSE: Pakistan Studies 0448/01Mehmood AlimNo ratings yet

- Wa0004.Document85 pagesWa0004.sheetalsri1407No ratings yet

- Leanplum - Platform Data SheetDocument10 pagesLeanplum - Platform Data SheetKiran Manjunath BesthaNo ratings yet

- Yoga For The Primary Prevention of Cardiovascular Disease (Hartley 2014)Document52 pagesYoga For The Primary Prevention of Cardiovascular Disease (Hartley 2014)Marcelo NorisNo ratings yet

- Diagnostic Test in Mapeh 8: Department of EducationDocument4 pagesDiagnostic Test in Mapeh 8: Department of Educationcarl jayNo ratings yet

- Csd88584Q5Dc 40-V Half-Bridge Nexfet Power Block: 1 Features 3 DescriptionDocument26 pagesCsd88584Q5Dc 40-V Half-Bridge Nexfet Power Block: 1 Features 3 DescriptionJ. Carlos RGNo ratings yet