Professional Documents

Culture Documents

Syndicate DD Circular

Uploaded by

paramsnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syndicate DD Circular

Uploaded by

paramsnCopyright:

Available Formats

ffitffi.En.

#yndtr,enfreBsruk

q{fir ?r'$qffiqE ilIrqFr* *}sst- uf {tdiatrf:r*r*tEic$rr.g ff$fir ffwdsw qeffpr WqM&?l*s{*fi**: $d*nip* * 5fS t6* S*,nn***t**J

/*\i

n\

ilrr

Tl|-fr{ q+ Tffi trtlFl / Qnr; *rnnrylcr& fiilnrmnxFXTI

No.3 16.-201 Circular I -BC-RBD-34

eCircular

Date: l8-l l-2011 PERMANENT UTTLITY DUE DILIGENCE REPORTOF MSME BORROWERS BY CRISIL oaOe) Attention of Branches/Offices is draivn ro HO.Cir.No.287/2011/BC dated 22.10.2011 regarding implementation of Scheme for Financing Micro andSmallEnterprises -"SyndMSE" with effect&om 0l.l 1.201 l. Rateof interest on MSEshasbeen drastically reduced andprocess at operational levelare simplified to provide the increased thrust on credit flow to Micro and Small Enterprises. Further,to increase our reachto MSME Sector by ensuring availabilityof adequate andtimely creditto the sector, it{srintended to avail the services of CRISIL to empowerthesanctioning authorities with additional inputsto enable themto taketimely creditdecisions. CRISIL is engagedin the businessof credit rating, investmentresearchand also collection and dissemination of corporate, financial,marketinformation to variousclients.CRISIL hasstarted rating services for SmallandMediumEnterprises in 2005andhasso far evaludted morethan30,000MSMEs across the country.Several corporate areutilizing the services to CRISIL to evaluate their existingand prospective dealers,vendors,associates, franchisees, etc. Our Bank has enteredMemorandum of (MOU) with CRISIL on 28.10.2011 Understanding to provideDue DiligenceReports for MSME customers to supplement our internal evaluations andfor better understanding of various risksinvolved whilelending to MSMEs. Duediligence is a process to verif andvalidate thecredentials of the prospective borrower. Thisis an intense andfocused exercise conducted by a neutral crediblethird party. Bankhasan exclusive tie up with CRISIL'for Due Diligenceand the process is intemalized as per bank's requirement. This exerciseis undertaken to supportthe opinion of credit appraisalin the bank and offer comfort for decisionmakersat all levels.The exercise encompasses site visit, reference checks,and a brief management discussion. The due diligence process is completed within a shorttumaround time of 7 daysfrom the dateof receiptof complete documents and conducting a management discussion. This quickerloanprocessing enables andenhances the competitive edgeofthe bank. Benefits of obtaining Due Diligence ) Validationof prospective MSMEscredentials by a credible, reputedandneutralthird parfy. F Offersconfidence andcomfortto sanctioning authorityfor taking a well informedcreditdecision. ) Rigorous process of site visits,management discussions, refereniechecks, etc. ) Helps hranches to expand business andquickdecision making ) Cultivates andenhances disciplinewith theunorganized Micro, SmallandMediumenterprises. Eligible Units: > All MSME unitsasper RBI/Gol guidelines wirhcredit facilitiesfrom {l crore to { 25 crore in respect of solebanking arrangement payable Fess to CRISIL : Professional fee of{ 18700+ service taxl per reportall inclusive is payable to CRISIL in advance on collectionof all requireddocuments.The fee charged by cRISIL is to be paid out of processing /upfrontfeeto be collectedfrom the borrower. } Non refundable 25%o of theapplicableprocessing /upfrontfee is to be collected from theborrower beforereferringthe proposal to CRISIL .

Fjjllil::l:::i_'

[,, ' ' i'. i,

i

1 l-BC-RBD-34/18.11'201 No.316 Circular -201

at No. 0032-0500-0032 account to CRISIL'sBankCurrent feeshallbe remitted F Theapplicable by 400 014 Mumbai Dadar, Road, Dr; Ambedkar ICICI BankLtd., - DadarBranch,Poonawadi, E 3l5l AAACT No: PAN ICIC0000032. Code: code: 400-229-0|0,IFSC NEFT/RTGS.(MICR 001) TaxNo: AAACT 3151EST :Service at CRISIL for clarifications: Contactpersons to get in touchwith Mr' Madhumangesh advised details brancheslare on remittance For any queries mbagul@crisil.com him at email or at 022-3342-1917 Bagul etc. CIBIL at the followingaddress the Manager, may contact branches Foranyotherqueries Mr. SerjilAlam , Manager Road, FI oor,43I 44,Montieth Mezzanine House, Thapar Chennai Egmore, -600008. 3I 6,Fax:9 144285475 63| 36, 0988480220 TeI: 9 I 44 66.5 Emai I : sala"m@crisil.com Report : to obtain Due diligence Procedure of MSME client as per the list for preparingthe Stepl. Branchwill collect all requireddocuments for creditfacilities. of application receipt (Annexure on Report Diligence Due -I) /upfront fee from the borrower in advance non of the applicableProcessing Step 2.Collect25o/o proposal CRISIL. to the referring before refundable II and process as per Annexure aboutCRISIL due diligence to inform the applicant Step 3.Branch Branch emails, to access id or have email do not wherecustomers *uik u copy to CRISIL. In cases with a emailcopyto CRISIL. courier/post through informcustomers should of CRISIL to a bankaccount feesthroughRTGSd{EFT to remit entiredue diligence Step4.Branch as of BankAccount Report of M/s ......,..." (Details with a narration "FOR CRISIL DueDiligence above) andfee of loanapplication details informing to sendan emailto svndicatebank@crisil. Step5 Branch in -lII per format Annexure as details remittance and informationfrom the branchand contactthe will collect documents Step 6. CRISIL associates to CRISIL (if any)andsendthe documents documents sitevisit and collectremaining clientto conduct HO, with the informationand conducta brief telephonicconversation to analyse Step 7. CRISIL analysts thecustomer. Step 8. CRISIL to sendthe due diligencereportwithin 7 working daysform site visit and telephonic with customer.The reportshallbe sentto branchalongwith the invoicecontainingall the conversion aspects. inspiteof repeated loan applicant for a particular If the branchis not ableto collectall the information alongwith 3 Years documents Related branch shouldin the minimumcollectthe Financial follow-ups,the of otherinformation, for non-availability thereason (personal andintimate & company) tax retums Income is branch However, information. andcollect balance the clientaccordingly so thatCRISILshallapproach tumaround the to CRISIL, is not submitted information to takenoteof the fact that if complete requested of client. based on theco-operation may getextended, of reports time for submission

l-201I l-BC-RBD-34/18-l No.3l6-201 Crcular

Due DiligenceReport would cover the fotlowing aspectsof the borrowers and their business activities: in the field andexperience description profile:Business ) Business customerprofile andsupplierprofile andsupplysideanalysis: >> Demand profile of owner/partners/promoters pa'ttem andmanagement ) Ownership andsystems structure, oontrols ) Organizational ) Key management Personnel andfirms of othergroupcompanies ) Brief details enjoyed thebankandfacilities name of with facilities F Current banking key turnover, sheet, balance performance - profit andlossaccount, ) Current andpastfinancial ratios, andfund'flowstatement financial by management) owned(asconfirmed of properties Details X,$ite visit details, feedback) Bankers Suppliers/ Customers'/ ) Thirdpartychecks: Other Guidelines to CRISIL for Credit facilities from {l for Due DiligenceReportis to be submitted ) The request processing and shall not delay the quicker loan to enable ior MSMEs t 25 crore crore upto process ofsanction. uponthe requirement to CRISIL for Due diligencereportdepending shall refer the cases ) branches to case basis. on case of the borrowerand their all the aspects that Due Diligencereportcontains F Branches shall ensure activities. business to the branchwithin 7 days from the date of ) The Due.DiligenceReport will be delivered of sitevisit' and completion documents of all requisite subrnission in time the reportif any shallbe takenup with CRISIL, If not resolved F The delay in furnishing office. theirRegional through Bangalore with CO:MSME, shalltakeup thematter Branches andseek in this areaextensively to makeuseof CRISIL'sexpertise areadvised All Branches/offices will not only This of t I croreto { 25 crores. reportfor MSMEswith exposure their "Due Diligence" in taking qualitative support provide but also for branches proposals savetime in aplraisal oi NASNAS decisions. timelycredit Clarificationsrequired,if any, on take note of the aboveguidelines. are requested Branches/Offices & Retail Banking Enterprises &Medium Small Micron from sought may be this circular Department at Corporate Office, Bangalore through respectiveRegional Office, as per extant guidelines.

MAOAX:YRSRE:YRUNO Check Word

GENERAL MANAGER

I l-201 Circular No.3l6-201l-BC-RBD-34i18-l

I Annexure

V d'

F

nnexurel

t

i

,. Dilieence and inforFatio4 requiredbv 9RISIL for ConducfiqeDue. List,of documentp

Financial related

./ Audited/Provisional entity 1 for evaluated fo, ZOtO-t financialstatefi:lents ./ Financialstatements entity and2007-08for evaluated (annualrepoh) for 2009-10, 2008-09 ./ Financial group entities I for / Provisional 2010-l (annual 200$'10 report) for statements ./ Net worth statements (statements shouldbe certified by CA) of all promoters related Bankinsfacilities r' of all longtermdebt Repaypgnt schedule

related Compliance Statutorv ,/ ,/ ./ ,/ ,/ / (personal & company) tax retums 3 YearsIncome tax retums 3 Yearssales 3 Yearsexciseduty returns retums ESICiEPF 3 Years 3 Yearswealthtax returns in respect of new units /Finalpowersanction Proofof Provisional

Others Provide documentssupporting for registration (memorandumand articles of associations, (if any). partnership documents). agreements, andregistration namechange andlegalstructure. Documents supporting (if any). changes in capital Documents supporting policy- Xeroxcopy. Insurance Details of Tax Exemptions. (copyof telephone bill proofof the entity and promoters andguarantor bill or electricity Address or copyofdrivinglicense) or copyofpassport

ogOu>

I 1-201 l-BC-RBD-34118-1 l6 -201 No.3 Circular

AnnexureII

Ref : 000/001/2011-12

Date:dd/mm/yy

Mr. ABC Pvt Ltd Company

trpm:

Biinch Head Bank Syndicate

Sub: CRISIL .; ,, i?. , DearSir,

Due Diligence RePort on

XYZ

Company Pvt

Ltd

time, to provideyou bestin classservicelevelsand improveour turnaround endeavor In our constant we are this Towards MSME customers. our of for evaluation new initiative an a on embarked we have risk andpolicy advisory and leadingrating,research, with CRISIL - India's mostrespected partnering of MSME customers' duediligence company,to undertake for for a meeting.They will alsobe requesting of CRISIL will contactyou requesting Representatives your you extend to the due diligenceReport.We request requiredfor preparing copiesof documents and informationcollection themin the documentation andassist to CRISIL rlpresentativei cobperation process. our public sector banks,is to reduce India'sleading Bank- amongst This initiativefrom Syndicate enhance process to credit delivery our strengthen & collection information improve time, tumaround with us. of dealing your overallexperience You Thanking YoursSincerely

ffi

BranchManager

<rsOe)

l-2011 No.316 1-BC-RBD-34/18-1 Circular -201

Annexure III SpeCimen letter to CRISfL authorizingto conductDue Dilieence. Ref : 000/001 /2011-12 CRISILLtd CRISILHouse, Hiranandani Business Park, - 400 076 Powai,N$f"4bai From: Branch Manager Bank Syndicate Date: (ddimmlyy)

(Complete address of branch) BICCode:XXXX Tel:+91XX XXXXXXXX Sub:CRISIL DueDiligence Reporton ...........Company Pvt Ltd. DearSir, As per the agreement executed with the Bank,we areauthorizing you to conductDue Diligencein the case of .........XYTCompany PvtLtd. Necessary intimationin this regardis already passed on to the customer alsoandwe havealsoremitted * service an amount your of { 18,700/tax to account no: 0032-0500-0032 with ICICI Bank,Dadar Branch on DD/MM/YYYY & thereference no for thesame is Givenbelowarethecontact details of thecustomer:

Name of entity Name of the customer Contact no. of the customer Email Address customer

Addressof entity

Loan amount aonliedfor

Please submityour reportwithin 7 days. Thanking You Yours Sincerely

BranchManager

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bhagavad Gita SanskritDocument108 pagesBhagavad Gita SanskritMaheshanand Mainali100% (1)

- December + Yearly ReviewDocument2 pagesDecember + Yearly ReviewNick FabrioNo ratings yet

- Particulars Opening Closing Balance Balance Rameswar Agro Industries Pvt. Ltd.-10-11Document1 pageParticulars Opening Closing Balance Balance Rameswar Agro Industries Pvt. Ltd.-10-11paramsnNo ratings yet

- Operational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedDocument1 pageOperational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedparamsnNo ratings yet

- SVP-Advances (Eastern Zone) : VP & Head (SME Centre-BBSR) : Rameswar Agro Industries PVT LTD Replies To Risk Department ObservationsDocument8 pagesSVP-Advances (Eastern Zone) : VP & Head (SME Centre-BBSR) : Rameswar Agro Industries PVT LTD Replies To Risk Department ObservationsparamsnNo ratings yet

- Clarification 16.01.09Document5 pagesClarification 16.01.09paramsnNo ratings yet

- Ffr-I 30.06.09Document1 pageFfr-I 30.06.09paramsnNo ratings yet

- Not Contactable Clients For Incentive Calculation - Sep'14Document1,000 pagesNot Contactable Clients For Incentive Calculation - Sep'14paramsnNo ratings yet

- CMA2009Document21 pagesCMA2009paramsn0% (1)

- Estimated Projected BS & PL09!10!11Document21 pagesEstimated Projected BS & PL09!10!11paramsnNo ratings yet

- Food and Procurement Policy KMS 2009 - 10Document16 pagesFood and Procurement Policy KMS 2009 - 10paramsn0% (1)

- FIGLDocument58 pagesFIGLparamsnNo ratings yet

- Rice Milling Industry: Diagnostic Study ReportDocument62 pagesRice Milling Industry: Diagnostic Study ReportVigneshwaran AiyappanNo ratings yet

- Milling Agreement FAQDocument1 pageMilling Agreement FAQparamsnNo ratings yet

- Sreeragam Exports Pvt. LTDDocument8 pagesSreeragam Exports Pvt. LTDparamsnNo ratings yet

- JAIIB LowDocument10 pagesJAIIB LowVimal RamakrishnanNo ratings yet

- SubhadraDocument1 pageSubhadraparamsnNo ratings yet

- Article of AssociationDocument12 pagesArticle of AssociationparamsnNo ratings yet

- Iiiiiii II: OJ CDDocument17 pagesIiiiiii II: OJ CDparamsnNo ratings yet

- Trading Account Closure Form/RequestDocument1 pageTrading Account Closure Form/RequestparamsnNo ratings yet

- Mienral Based IndustriesDocument11 pagesMienral Based IndustriesparamsnNo ratings yet

- Revised NMFP GuidelinesDocument98 pagesRevised NMFP GuidelinesparamsnNo ratings yet

- United India InsuranceDocument10 pagesUnited India Insurancegowtham19892003No ratings yet

- To The President, Biju Janata Dal, Odisha, BhubaneswarDocument1 pageTo The President, Biju Janata Dal, Odisha, BhubaneswarparamsnNo ratings yet

- North Orissa University: Vision of The UniversityDocument36 pagesNorth Orissa University: Vision of The UniversityparamsnNo ratings yet

- Expenditure Target of Rs 16,65,297 Crore in 2013-14. Plan Expenditure Is at Rs 5,55,320 Crore - Up 29 Per CentDocument8 pagesExpenditure Target of Rs 16,65,297 Crore in 2013-14. Plan Expenditure Is at Rs 5,55,320 Crore - Up 29 Per CentparamsnNo ratings yet

- Government Expenditure and BudgetDocument33 pagesGovernment Expenditure and Budgetparamsn100% (1)

- Help Line Numbers in OJEE Cell Ojee 2012 163Document1 pageHelp Line Numbers in OJEE Cell Ojee 2012 163Kanhu PadhiNo ratings yet

- Notification Chhattisgarh Gramin Bank Officers OfficeAsstDocument10 pagesNotification Chhattisgarh Gramin Bank Officers OfficeAsstCareerNotifications.comNo ratings yet

- GanjamDocument3 pagesGanjamparamsnNo ratings yet

- CV: LT Col MD Rakibul Hassan, Raqueeb HassanDocument14 pagesCV: LT Col MD Rakibul Hassan, Raqueeb HassanRakibul Hassan100% (26)

- 2008 Almocera vs. OngDocument11 pages2008 Almocera vs. OngErika C. DizonNo ratings yet

- Project JavascriptDocument58 pagesProject JavascriptashwinNo ratings yet

- Avamar Backup Clients User Guide 19.3Document86 pagesAvamar Backup Clients User Guide 19.3manish.puri.gcpNo ratings yet

- Java 9 Real - TimeDocument57 pagesJava 9 Real - TimeDiego AmayaNo ratings yet

- Cbi LNG Storage US Rev8 LoresDocument4 pagesCbi LNG Storage US Rev8 LoresVilas AndhaleNo ratings yet

- Text-Book P3Document147 pagesText-Book P3Nat SuphattrachaiphisitNo ratings yet

- 17 Farley Fulache Vs ABS-CBN G.R. No. 183810Document7 pages17 Farley Fulache Vs ABS-CBN G.R. No. 183810SDN HelplineNo ratings yet

- Is Your Money Safe With Builders Indulging in Criminal Disreputation Management - Story of Navin Raheja & Raheja Developers in GurgaonDocument44 pagesIs Your Money Safe With Builders Indulging in Criminal Disreputation Management - Story of Navin Raheja & Raheja Developers in Gurgaonqubrex1No ratings yet

- Service Laws ProjectDocument4 pagesService Laws ProjectRaman PatelNo ratings yet

- Railway CircularsDocument263 pagesRailway CircularsDrPvss Gangadhar80% (5)

- Introduction To SCILABDocument14 pagesIntroduction To SCILABMertwysef DevrajNo ratings yet

- Safety Manual For DumperDocument9 pagesSafety Manual For DumperHimanshu Bhushan100% (1)

- 201805graphene PDFDocument204 pages201805graphene PDFMohammad RezkyNo ratings yet

- Unit 5 PythonDocument10 pagesUnit 5 PythonVikas PareekNo ratings yet

- Introduction To MAX InternationalDocument48 pagesIntroduction To MAX InternationalDanieldoeNo ratings yet

- P443 OrderForm - v43 - 122020Document14 pagesP443 OrderForm - v43 - 122020Tuan Dang AnhNo ratings yet

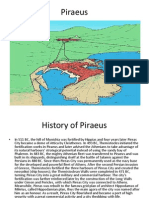

- PiraeusDocument9 pagesPiraeusBen JamesNo ratings yet

- Solar Smart Irrigation SystemDocument22 pagesSolar Smart Irrigation SystemSubhranshu Mohapatra100% (1)

- Slates Cembrit Berona 600x300 Datasheet SirDocument2 pagesSlates Cembrit Berona 600x300 Datasheet SirJNo ratings yet

- Bank Details and Payment MethodsDocument1 pageBank Details and Payment Methodsetrit0% (1)

- MyLabX8 160000166 V02 LowRes PDFDocument8 pagesMyLabX8 160000166 V02 LowRes PDFhery_targerNo ratings yet

- Type DG Mod 320 Part No. 952 013: Figure Without ObligationDocument1 pageType DG Mod 320 Part No. 952 013: Figure Without Obligationsherub wangdiNo ratings yet

- L8 Logistics ManagementDocument41 pagesL8 Logistics ManagementShahmien SevenNo ratings yet

- ION 900 Series Owners ManualDocument24 pagesION 900 Series Owners ManualParosanu IonelNo ratings yet

- ''Adhibeo'' in LatinDocument5 pages''Adhibeo'' in LatinThriw100% (1)

- Journal of Air Transport Management: Tim HazledineDocument3 pagesJournal of Air Transport Management: Tim HazledineRumaisa HamidNo ratings yet

- ABSTRACT (CG To Epichlorohydrin)Document5 pagesABSTRACT (CG To Epichlorohydrin)Amiel DionisioNo ratings yet

- ION Architecture & ION ModulesDocument512 pagesION Architecture & ION ModulesAhmed RabaaNo ratings yet