Professional Documents

Culture Documents

Canada - House Price Index

Uploaded by

Eduardo PetazzeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Canada - House Price Index

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

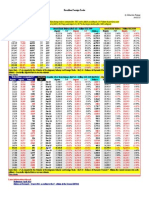

Canada House Price Index

by Eduardo Petazze

In April 2014, according to official statistics, prices are growing at an annual rate equivalent to 1.55% Y/Y

In May 2014, the TeranetNational Bank National Composite House Price Index was up 0.76% M/M (+4.58% Y/Y)

The purpose of this is to review available information on the Canadian real estate market.

StatsCan released the following information on a monthly basis:

Building permits, April 2014

New Housing Price Index (NHPI)

April 2014 pdf, 4 pages

March 2014 pdf, 4 pages

February 2014 pdf, 4 pages

Annual weights

Investment in new housing construction (table 026-0017)

Teranet and National Bank of Canada release its House Price Index

May 2014

Since in May 2013 the monthly rise of the composite index was 1.1%, this Mays 0.8% rise meant

that 12 month home price inflation decelerated 0.3 percentage points to 4.6%

In April the TeranetNational Bank National Composite House Price Index was up 0.5% M/M

March 2014

Canada Mortgage and Housing Corporation (CMHC) release

Canadas Rental Vacancy Rate Remains Unchanged

May 2014 Housing Starts in Canada

April 2014 Housing Starts in Canada

Comprehensive Report on Housing in Canada

The Canadian Real Estate Association (CREA) release its:

Canadian home sales +5.9% M/M (+4.8% Y/Y) in May 2014 pdf, 9 pages

Canadian home sales pick up in April

Canadian home sales edge slightly higher in March

CREA Updates and Extends Resale Housing Forecast

The following table summarizes the price indicators, expressed as index numbers with base 2007 = 100) compiled by

StatsCan and Teranet (Composite House Price Index for 11 cities)

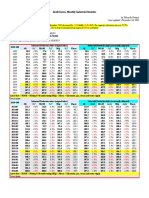

2007=100

2008

2009

2010

2011

2012

2013

2014

Own estimate

Sep-12

Oct-12

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Own estimate

Last data

StatCan

New housing price

103.4

101.0

103.2

105.5

108.0

109.9

112.3

108.5

108.7

108.8

109.0

109.1

109.3

109.4

109.6

109.7

109.9

110.1

110.2

110.2

110.3

110.3

110.4

110.7

110.9

111.1

111.3

111.6

112.2

112.6

113.1

113.3

Y/Y

3.41%

-2.32%

2.20%

2.20%

2.35%

1.76%

2.21%

Composite 11

105.5

102.5

111.6

117.2

122.8

126.0

131.1

2.36%

2.35%

2.16%

2.25%

2.25%

2.15%

1.96%

1.95%

1.76%

1.76%

1.85%

1.75%

1.57%

1.47%

1.38%

1.28%

1.47%

1.46%

1.55%

1.55%

1.76%

2.08%

2.30%

2.59%

2.82%

124.7

124.4

123.9

123.4

123.1

122.9

123.3

123.6

125.0

126.3

127.2

128.0

128.0

128.2

128.1

128.1

128.7

129.0

129.1

129.7

130.7

131.0

131.6

132.2

132.5

IMF - Global Housing Watch

Link to the new website

From IMF web page

Launch Press Release

New Global Housing Watch Throws Spotlight on Booms and Busts

Housing Markets, Financial Stability and the Economy

Era of Benign Neglect of House Price Booms is Over

Teranet

M/M

Y/Y

5.46%

-2.79%

8.90%

4.97%

4.81%

2.57%

4.05%

-0.35%

-0.25%

-0.37%

-0.37%

-0.29%

-0.18%

0.39%

0.24%

1.11%

1.04%

0.74%

0.61%

0.00%

0.14%

-0.08%

0.05%

0.40%

0.30%

0.01%

0.54%

0.76%

0.18%

0.45%

0.48%

0.25%

3.64%

3.43%

3.29%

3.08%

2.67%

2.66%

2.60%

2.04%

2.00%

1.81%

1.85%

2.31%

2.68%

3.07%

3.37%

3.81%

4.53%

5.04%

4.64%

4.95%

4.58%

3.69%

3.39%

3.26%

3.52%

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Technical AnalysisDocument69 pagesTechnical AnalysisMRINMOY KARMAKAR100% (1)

- ZSCOREDocument9 pagesZSCORENitin Govind BhujbalNo ratings yet

- Solution To Problem Set #4Document4 pagesSolution To Problem Set #4testingNo ratings yet

- Introduction To Macroeconomics: © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray FairDocument32 pagesIntroduction To Macroeconomics: © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fairusmcdoc113597No ratings yet

- Analysis of Bonds With Embedded Options: Chapter SummaryDocument29 pagesAnalysis of Bonds With Embedded Options: Chapter SummaryasdasdNo ratings yet

- VaR I PDFDocument84 pagesVaR I PDFSunil ShettyNo ratings yet

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 1: Introduction Multiple Choice Test BankDocument4 pagesHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 1: Introduction Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- How To Refine Order Blocks: Created TagsDocument20 pagesHow To Refine Order Blocks: Created TagsSamuel LarryNo ratings yet

- Analysis and Estimation of The US Oil ProductionDocument1 pageAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNo ratings yet

- India - Index of Industrial ProductionDocument1 pageIndia - Index of Industrial ProductionEduardo PetazzeNo ratings yet

- Germany - Renewable Energies ActDocument1 pageGermany - Renewable Energies ActEduardo PetazzeNo ratings yet

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- Highlights, Wednesday June 8, 2016Document1 pageHighlights, Wednesday June 8, 2016Eduardo PetazzeNo ratings yet

- Turkey - Gross Domestic Product, Outlook 2016-2017Document1 pageTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNo ratings yet

- U.S. New Home Sales and House Price IndexDocument1 pageU.S. New Home Sales and House Price IndexEduardo PetazzeNo ratings yet

- Reflections On The Greek Crisis and The Level of EmploymentDocument1 pageReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- U.S. Employment Situation - 2015 / 2017 OutlookDocument1 pageU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNo ratings yet

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Document1 pageCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNo ratings yet

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocument1 pageChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNo ratings yet

- India 2015 GDPDocument1 pageIndia 2015 GDPEduardo PetazzeNo ratings yet

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocument1 pageUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNo ratings yet

- Singapore - 2015 GDP OutlookDocument1 pageSingapore - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- South Africa - 2015 GDP OutlookDocument1 pageSouth Africa - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- China - Power GenerationDocument1 pageChina - Power GenerationEduardo PetazzeNo ratings yet

- US Mining Production IndexDocument1 pageUS Mining Production IndexEduardo PetazzeNo ratings yet

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocument1 pageEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNo ratings yet

- Chile, Monthly Index of Economic Activity, IMACECDocument2 pagesChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNo ratings yet

- Highlights in Scribd, Updated in April 2015Document1 pageHighlights in Scribd, Updated in April 2015Eduardo PetazzeNo ratings yet

- U.S. Federal Open Market Committee: Federal Funds RateDocument1 pageU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNo ratings yet

- Mainland China - Interest Rates and InflationDocument1 pageMainland China - Interest Rates and InflationEduardo PetazzeNo ratings yet

- US - Personal Income and Outlays - 2015-2016 OutlookDocument1 pageUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNo ratings yet

- Japan, Population and Labour Force - 2015-2017 OutlookDocument1 pageJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNo ratings yet

- United States - Gross Domestic Product by IndustryDocument1 pageUnited States - Gross Domestic Product by IndustryEduardo PetazzeNo ratings yet

- South Korea, Monthly Industrial StatisticsDocument1 pageSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNo ratings yet

- Japan, Indices of Industrial ProductionDocument1 pageJapan, Indices of Industrial ProductionEduardo PetazzeNo ratings yet

- Case Ch06 Discussion QuestionsDocument3 pagesCase Ch06 Discussion QuestionsSilvia TjangNo ratings yet

- SecuritisationDocument11 pagesSecuritisationamu231286No ratings yet

- Indian Money MarketDocument11 pagesIndian Money MarketPradeepKumarNo ratings yet

- Debt Trap of Jain Irrigation Systems by LebinDocument2 pagesDebt Trap of Jain Irrigation Systems by LebinlebinNo ratings yet

- ASSIGNMENT3Document2 pagesASSIGNMENT3SandeepNo ratings yet

- Flexible House WithdrawalDocument4 pagesFlexible House WithdrawalFoong Seong LoongNo ratings yet

- Mutual Funds Classification: by Structure by Nature by Investment Objective Other SchemesDocument7 pagesMutual Funds Classification: by Structure by Nature by Investment Objective Other SchemesOsham JumaniNo ratings yet

- Ruminations by Other PeopleDocument31 pagesRuminations by Other PeopledhultstromNo ratings yet

- HW 2Document4 pagesHW 2milay2002No ratings yet

- The Introduction To The Effectiveness of VWAPP in TradingDocument4 pagesThe Introduction To The Effectiveness of VWAPP in Tradingnaldspirit69No ratings yet

- BUS330: International Finance: Post-Topic11 (Chapter 17) International Equity MarketsDocument2 pagesBUS330: International Finance: Post-Topic11 (Chapter 17) International Equity MarketsDelishaNo ratings yet

- Introduction To Financial ServicesDocument19 pagesIntroduction To Financial ServicesshailjaNo ratings yet

- Ppp/Pfi Terminology Unravelled: Richard Dyton (Simmons & Simmons) and Nick Hopkins (KPMG) 16 January 2007Document25 pagesPpp/Pfi Terminology Unravelled: Richard Dyton (Simmons & Simmons) and Nick Hopkins (KPMG) 16 January 2007Kasun ChathurangaNo ratings yet

- Pershing Sqaure CP ActivismDocument31 pagesPershing Sqaure CP ActivismMichael BenzingerNo ratings yet

- ING Market Shield: New Product Training Sales TrainingDocument23 pagesING Market Shield: New Product Training Sales TrainingAnumesh KariappaNo ratings yet

- J022 Portfolio Analyst - Triple Jump BVDocument1 pageJ022 Portfolio Analyst - Triple Jump BVTikz KrubNo ratings yet

- Liquidit mgt2Document10 pagesLiquidit mgt2kashifshaikh76No ratings yet

- Studi Perbandingan Metode Capm Dan Apt Pada Perusahaan Sektor Manufaktur Yang Terdaftar Di Bursa Efek Indonesia PERIODE 2008 - 2013Document9 pagesStudi Perbandingan Metode Capm Dan Apt Pada Perusahaan Sektor Manufaktur Yang Terdaftar Di Bursa Efek Indonesia PERIODE 2008 - 2013Ayu WidiaNo ratings yet

- PK Tax News Jun 2008Document2 pagesPK Tax News Jun 2008PKTaxServicesNo ratings yet

- BlogDocument4 pagesBlogShabih FatimaNo ratings yet

- CAT Maurizio Bonacchi Caterpillar GeneveModule 5 WIP 2012Document10 pagesCAT Maurizio Bonacchi Caterpillar GeneveModule 5 WIP 2012enjoythedocsNo ratings yet

- The Ratio Analysis Technique Applied To PersonalDocument15 pagesThe Ratio Analysis Technique Applied To PersonalladycocoNo ratings yet