Professional Documents

Culture Documents

Nelson Siegel Yield Curve Model

Uploaded by

Nicolas PierreCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nelson Siegel Yield Curve Model

Uploaded by

Nicolas PierreCopyright:

Available Formats

IMPORTANT INSTALLATION INFORMATION

Programmed by and copyright Kurt Hess March 2004, kurthess@waikato.ac.nz

Illustration of Extended Nelson & Siegel Spot Rate Model

Fitting Extended Nelson & Siegel Spot Rate with Solver

The SOLVER macros in this workbook will only run if your Excel is set up

as follows.

You must have SOLVER installed with your Excel.

Go to Tools Menu and see whether item Solver appears there.

If it does not, go to Tools - Add-ins and tick "Solver Add-in".

This 1st step will allow you to use SOLVER from Excel but because SOLVER is

also called by a VBA macro, you will also need to establish a reference to the

Solver add-in in the VBA editor:

With a Visual Basic module active, click References on the Tools menu, and

then select the Solver.xla check box under Available References. If Solver.xla

doesn't appear under Available References, click Browse and open Solver.xla in

the \Office\Library subfolder.

Kurt Hess, kurthess@waikato.ac.nz 199512653.xls.ms_office Introduction 1/2/2014

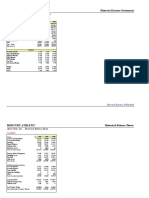

Illustration of Extended Nelson & Siegel Spot Rate Model

programmed by Kurt Hess May 2004, kurthess@waikato.ac.nz

Time to maturity m 3.0 30.00

Long-run levels of interest rates

|

0 5.0% 50

Short-run component

|

1 2.0% 120

Medium-term component

|

2 8.0% 80 determines magnitude and the direction of the hump

Decay parameter 1

t

1 1.000 100

determines decay of short-term component, must be > 0

Decay parameter 2

t

2 1.200 120

determines decay of medium-term component, must be > 0

Spot rate at time t

r

t,i 7.9141%

7.9141% with VBA Function

Components of N&S spot rate

Comp 1 5.000% |

0

Comp 2 0.633% |

1

*((1-EXP(-m/tau1))/(m/tau1))

Comp 3 2.281% |

2

*((1-EXP(-m/tau2))/(m/tau2)-EXP(-m/tau2))

7.91%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

0 2 4 6 8 10 12

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

0 2 4 6 8 10

( )

( )

( )

2 1 2 1 0

2

,

,

2

2

1

1 0 ,

, , , ,

, 0 ~

1 1

,

2

2 1

t t | | |

o c

c

t

|

t

| |

t

t t

= O

+

|

|

|

.

|

\

|

+

|

|

|

.

|

\

|

+ = O

|

.

|

\

|

|

.

|

\

|

|

.

|

\

|

N with

e

m

e

m

e

m r

j t

j t

m m

j t

m

Kurt Hess, Waikato Management School Page 2 199512653.xls.ms_office Extended Nelson Siegel 1/2/2014

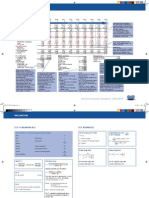

Fitting Extended Nelson & Siegel Spot Rate with Solver programmed by Kurt Hess May 2004, kurthess@waikato.ac.nz

Time to maturity m 3.0 30

Long-run levels of interest rates |

0 7.30% 73.02474

Short-run component |

1 -2.80% 71.97526

Medium-term component |

2 -1.40% -14.0174 determines magnitude and the direction of the hump

Decay parameter 1 t

1 0.412 41.19045

determines decay of short-term component, must be > 0

Decay parameter 2 t

2 2.905 290.466

determines decay of medium-term component, must be > 0

Spot rate at time t r

t,i 6.5429%

Objective Functions see formulas

Non-weighted objective function x10

3

0.200134

Inverse duration weighted function x 10

5

0.028763

Initial Guess Values:

Bond Data

Short-term rate 4.50%

Settlement date 14-Feb-99

Issuer Coupon Maturity Bid Ask Mid Clean Mid Dirty

Model

Price

Duration Weights (w

i

) (cheap) / rich

NZ Government 6.50% 15-Feb-00 100.563 100.583 100.57% 103.80% 103.573% 0.956271 0.361346082 0.23%

NZ Government 8.00% 15-Feb-01 102.786 102.854 102.82% 106.80% 106.742% 1.821322 0.189721979 0.06%

NZ Government 10.00% 15-Mar-02 108.406 108.526 108.47% 112.60% 113.399% 2.647526 0.130516077 (0.79%)

NZ Government 5.50% 15-Apr-03 96.673 96.827 96.75% 98.57% 97.483% 3.706899 0.093216656 1.08%

NZ Government 8.00% 15-Apr-04 105.034 105.234 105.13% 107.78% 108.039% 4.253648 0.081234908 (0.26%)

NZ Government 8.00% 15-Nov-06 106.518 106.809 106.66% 108.64% 108.878% 5.884208 0.058724089 (0.24%)

NZ Government 7.00% 15-Jul-09 100.549 100.903 100.73% 101.29% 101.176% 7.537708 0.045842151 0.11%

NZ Government 6.00% 15-Nov-11 91.666 92.049 91.86% 93.34% 93.343% 8.770603 0.039398058 (0.00%)

Total 1

6.54%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

0 2 4 6 8 10

N&S Zero Rate

0.82178

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

0 2 4 6

N&S Discount Factors

Minimize

Minimize

Default Values Set Random Values

Step through

optimization

Kurt Hess, Waikato Management School Page 3 199512653.xls.ms_office Fitting Bond Universe 1/2/2014

Formula Objective Function back to top Extended Nelson Siegel Model (parameters explained on top)

D: Duration

Pi: Price of bond i

^P

i

: Model price of bond i

N: number of bonds in universe

Subject to:

Rate r at time 0 must remain positive (m

min

is a value just slightly larger than 0)

Rate at the end of the estimation horizon must remain positive

Discount functions must be non-increasing

References:

Nelson, C. R. & Siegel, A. F. (1987). Parsimonious modeling of yield curves, Journal of Business 60(4): 473489.

as discussed in

Bliss, R. R. (1997). Testing Term Structure Estimation Methods. Advances in Futures and Options Research(9), 197-

231.

( )

i i i

N

j

j

i

i

N

i

i i

P P

D

D

w

w

=

=

|

.

|

\

|

=

=

1

1

min

1

1

2

c

c

( )

( )

( ) ( ) ( ) ( )

max 1 1

min

exp exp

0

0

m m m m r m m r

m r

m r

k k k k k

< >

= s

s

+ +

( )

( )

( )

2 1 2 1 0

2

,

2

2

1

1 0

, , , ,

, 0 ~

1 1

,

2

2 1

t t | | |

o c

t

|

t

| |

t

t t

= O

|

|

|

.

|

\

|

+

|

|

|

.

|

\

|

+ = O

|

.

|

\

|

|

.

|

\

|

|

.

|

\

|

N with

e

m

e

m

e

m r

j t

m m

j

m

Kurt Hess, Waikato Management School Page 4 199512653.xls.ms_office Fitting Bond Universe 1/2/2014

You might also like

- Solutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelFrom EverandSolutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelNo ratings yet

- Δr=α b−r Δt+σε Δt: Simulation of short-term interest ratesDocument19 pagesΔr=α b−r Δt+σε Δt: Simulation of short-term interest ratesapi-3763138No ratings yet

- Term Structure JP Morgan Model (Feb04)Document7 pagesTerm Structure JP Morgan Model (Feb04)api-3763138No ratings yet

- Relative Value Models (Feb04)Document18 pagesRelative Value Models (Feb04)api-3763138No ratings yet

- RV YTM Model PDFDocument47 pagesRV YTM Model PDFAllen LiNo ratings yet

- Application - Valuation and Capital StructureDocument4 pagesApplication - Valuation and Capital StructureLU TangNo ratings yet

- Qatar National Bank April 2011Document6 pagesQatar National Bank April 2011Michael KiddNo ratings yet

- Degree Polynomial:: Generic Yield Interpolation ChartDocument9 pagesDegree Polynomial:: Generic Yield Interpolation Chartapi-3763138No ratings yet

- Case 1 SwanDavisDocument4 pagesCase 1 SwanDavissilly_rabbit0% (1)

- Indonesia Loss Reserving (Example)Document6 pagesIndonesia Loss Reserving (Example)Setyo Tyas JarwantoNo ratings yet

- Technical Finance Prep AnswersDocument28 pagesTechnical Finance Prep Answersajaw267No ratings yet

- ChristophJanz SaaSCohortAnalysis21Document13 pagesChristophJanz SaaSCohortAnalysis21Diego SinayNo ratings yet

- Valuation of A FirmDocument13 pagesValuation of A FirmAshish RanjanNo ratings yet

- PDD Holdings (PDD) - Addressing Key Investor Debates Post Upgrade Domestic Ad Growth Outlook & Temu Risks The Key Focuses BuyDocument20 pagesPDD Holdings (PDD) - Addressing Key Investor Debates Post Upgrade Domestic Ad Growth Outlook & Temu Risks The Key Focuses BuyYuqingNo ratings yet

- Helius Medical Technologies Mackie Initiation June 2016Document49 pagesHelius Medical Technologies Mackie Initiation June 2016Martin TsankovNo ratings yet

- Duff and Phelps Equity Risk PremiumDocument20 pagesDuff and Phelps Equity Risk PremiumAparajita SharmaNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Vcel PDFDocument30 pagesVcel PDFAnonymous XGz2JENo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Equity+ +Non+Premium+Display+Ads+050409Document142 pagesEquity+ +Non+Premium+Display+Ads+050409WanyssaKariNo ratings yet

- Oil Price Benchmarks: Legal DisclaimerDocument53 pagesOil Price Benchmarks: Legal Disclaimersushilk28No ratings yet

- Myriad Genetics Coverage ReportDocument8 pagesMyriad Genetics Coverage ReportChazz262No ratings yet

- Mphasis: Performance HighlightsDocument13 pagesMphasis: Performance HighlightsAngel BrokingNo ratings yet

- Binomial PSCDocument12 pagesBinomial PSCBurhanNo ratings yet

- q2 Valuation Insights Second 2020 PDFDocument20 pagesq2 Valuation Insights Second 2020 PDFKojiro FuumaNo ratings yet

- Cfroi HoltDocument7 pagesCfroi Holtamro_baryNo ratings yet

- Financial Modeling-A Valuation Model of Boeing Co.Document49 pagesFinancial Modeling-A Valuation Model of Boeing Co.Shahid AliNo ratings yet

- Financial Model - Version 3 (03!10!2020)Document41 pagesFinancial Model - Version 3 (03!10!2020)Fazal ImranNo ratings yet

- Credit Suisse's Guide To Global Tradable and Benchmark Index ProductsDocument115 pagesCredit Suisse's Guide To Global Tradable and Benchmark Index ProductsHeathcliff NyambiyaNo ratings yet

- Model 1 Historical Financial StatementsDocument21 pagesModel 1 Historical Financial StatementsZeusNo ratings yet

- Drout Advertising Case: Course: Fin534 GROUP: BA2423DDocument12 pagesDrout Advertising Case: Course: Fin534 GROUP: BA2423DHasha ShahNo ratings yet

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBADocument7 pagesIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Revenue RecognitionDocument35 pagesRevenue RecognitionCaterina De LucaNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Estimating The Cost of Risky Debt by Ian CooperDocument8 pagesEstimating The Cost of Risky Debt by Ian CooperAntonio EmmeNo ratings yet

- Tudor Pickering Holt&CoDocument65 pagesTudor Pickering Holt&CotalentedtraderNo ratings yet

- 72 11 NAV Part 4 Share Prices AfterDocument75 pages72 11 NAV Part 4 Share Prices Aftercfang_2005No ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- EV Equity Value ModelDocument6 pagesEV Equity Value Modelkirihara95No ratings yet

- 72Ho-Singer Model V3Document28 pages72Ho-Singer Model V3aqwaNo ratings yet

- Deferred RevenueDocument273 pagesDeferred RevenuechetanNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- KKR - Consolidated Research ReportsDocument60 pagesKKR - Consolidated Research Reportscs.ankur7010No ratings yet

- Asset Schedule Corality ModelOff Worked Solution Asset ScheduleDocument23 pagesAsset Schedule Corality ModelOff Worked Solution Asset ScheduleFelicia Shan SugataNo ratings yet

- SEEP FRAME Tool, Version 2.02Document159 pagesSEEP FRAME Tool, Version 2.02anish-kc-8151No ratings yet

- M&A Resource Collection For StartupsDocument3 pagesM&A Resource Collection For StartupsmamaNo ratings yet

- Jet Fuel - DataDocument40 pagesJet Fuel - Datasanjana jainNo ratings yet

- Natural Gas - US Gas Likely The First Commodity Market To RebalanceDocument14 pagesNatural Gas - US Gas Likely The First Commodity Market To RebalanceMarcelo MeiraNo ratings yet

- JPM研报 ELDocument34 pagesJPM研报 ELMENGWEI ZHOUNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsGolamMostafaNo ratings yet

- Treynor Black Model: Index (M) 0.08 0.0036 1.3333 Securities 1 0.02 0.2 0.0004 2 0.02 0.3 0.0016 3 0.01 0.6 0.0025Document4 pagesTreynor Black Model: Index (M) 0.08 0.0036 1.3333 Securities 1 0.02 0.2 0.0004 2 0.02 0.3 0.0016 3 0.01 0.6 0.0025MS NagNo ratings yet

- GS Inflation Implementation 10-20Document20 pagesGS Inflation Implementation 10-20bobmezzNo ratings yet

- Wyeth ValuationDocument54 pagesWyeth ValuationSaurav GoyalNo ratings yet

- Bocq Advisory - Financial Modeling TrainingDocument7 pagesBocq Advisory - Financial Modeling TrainingThomas DldesNo ratings yet

- Decision Science June 2022 Unique Set4 WiDocument14 pagesDecision Science June 2022 Unique Set4 WiManoj KumarNo ratings yet

- Exercises For Chapter 6 of Vinod's " Hands-On Intermediate Econometrics Using R"Document25 pagesExercises For Chapter 6 of Vinod's " Hands-On Intermediate Econometrics Using R"damian camargoNo ratings yet

- Decision ScienceDocument8 pagesDecision ScienceHimanshi YadavNo ratings yet

- The Monte Carlo Method in Excel - André FarberDocument5 pagesThe Monte Carlo Method in Excel - André FarbersneikderNo ratings yet

- Best of The Photo DetectiveDocument55 pagesBest of The Photo DetectiveSazeed Hossain100% (3)

- Sinamics g120 BrochureDocument16 pagesSinamics g120 BrochuremihacraciunNo ratings yet

- Wire Rope TesterDocument4 pagesWire Rope TesterclzagaNo ratings yet

- ResearchDocument10 pagesResearchhridoy tripuraNo ratings yet

- Datalogic tl46 A Manual - 230104 - 140343Document2 pagesDatalogic tl46 A Manual - 230104 - 140343Emmanuel Baldenegro PadillaNo ratings yet

- Fish Culture in Ponds: Extension Bulletin No. 103Document32 pagesFish Culture in Ponds: Extension Bulletin No. 103Bagas IndiantoNo ratings yet

- Singer 900 Series Service ManualDocument188 pagesSinger 900 Series Service ManualGinny RossNo ratings yet

- Vignyapan 18-04-2024Document16 pagesVignyapan 18-04-2024adil1787No ratings yet

- POLYTHEOREMSDocument32 pagesPOLYTHEOREMSYen LeeNo ratings yet

- AYUSH Warli Art 100628Document10 pagesAYUSH Warli Art 100628adivasi yuva shakti0% (1)

- Conjunctions in SentencesDocument8 pagesConjunctions in SentencesPunitha PoppyNo ratings yet

- 2018 H2 JC1 MSM Differential Equations (Solutions)Document31 pages2018 H2 JC1 MSM Differential Equations (Solutions)VincentNo ratings yet

- Straw Bale ConstructionDocument37 pagesStraw Bale ConstructionelissiumNo ratings yet

- Mtech Vlsi Lab ManualDocument38 pagesMtech Vlsi Lab ManualRajesh Aaitha100% (2)

- Accounting System (Compatibility Mode) PDFDocument10 pagesAccounting System (Compatibility Mode) PDFAftab AlamNo ratings yet

- The Global Entrepreneurship and Development Index 2014 For Web1 PDFDocument249 pagesThe Global Entrepreneurship and Development Index 2014 For Web1 PDFAlex Yuri Rodriguez100% (1)

- Altura Architect & Interior Design BriefDocument56 pagesAltura Architect & Interior Design BriefDave WongNo ratings yet

- Mang-May-Tinh - 03a.-Dns1 - (Cuuduongthancong - Com)Document52 pagesMang-May-Tinh - 03a.-Dns1 - (Cuuduongthancong - Com)Anh Quân TrầnNo ratings yet

- Elementary Electronics 1968-09-10Document108 pagesElementary Electronics 1968-09-10Jim ToewsNo ratings yet

- Gummy Bear Story RubricDocument1 pageGummy Bear Story Rubricapi-365008921No ratings yet

- Regulated and Non Regulated BodiesDocument28 pagesRegulated and Non Regulated Bodiesnivea rajNo ratings yet

- Human Capital PlanningDocument27 pagesHuman Capital Planningalokshri25No ratings yet

- GT I9100g Service SchematicsDocument8 pagesGT I9100g Service SchematicsMassolo RoyNo ratings yet

- Differential Calculus ExamDocument6 pagesDifferential Calculus ExamCaro Kan LopezNo ratings yet

- Johari WindowDocument7 pagesJohari WindowSarthak Priyank VermaNo ratings yet

- Catalogo HydronixDocument68 pagesCatalogo HydronixNANCHO77No ratings yet

- Intertext: HypertextDocument8 pagesIntertext: HypertextRaihana MacabandingNo ratings yet

- 1ST Term J1 Fine Art-1Document22 pages1ST Term J1 Fine Art-1Peter Omovigho Dugbo100% (1)

- 3 A Sanitary Standards Quick Reference GuideDocument98 pages3 A Sanitary Standards Quick Reference GuideLorettaMayNo ratings yet

- Alem Ketema Proposal NewDocument25 pagesAlem Ketema Proposal NewLeulNo ratings yet