Professional Documents

Culture Documents

Financial Management - Smu

Uploaded by

sirajr0 ratings0% found this document useful (0 votes)

57 views0 pagesSMU paper

Original Title

Financial Management - smu

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSMU paper

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views0 pagesFinancial Management - Smu

Uploaded by

sirajrSMU paper

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

2007 SIKKIM MANIPAL UNIVERSITY OF HEALTH MEDICAL & TECHNOLOGICAL SCIENCE

II M.B.A MODEL QUESTION PAPER

FINANCIAL MANAGEMENT

JULY:07

TIME-3 HOUR

MAX MARKS-140

SECTION A 1 MARK EACH

1) Capital budgeting decision involves_________.

a) Current assets management b) financing of alternative sources at reasonable cost

c) allocation of capital to long term fund d) none

2) Cut off rate is also known as___________.

1) Hurdle rate 2) required rate 3) minimum rate of return 4) discounting rate

a) 1 & 2 only b) 1,2 & 3 only c) all of above d) 4 only

3) Financing decision should be evaluated in term of ______&______.

a) rate & value b) risk & return c) profitability & risk d) none

4) Pay out is related to_________.

a) Liquidity b) profitability c) return d) dividend decision

5) The mix of debt & capital is known as the firms _________

a) Capital structure b) capital budgeting c) allocation of fund d) investment decision.

6) _________&___________are two important aspect of financial goal.

a) Value maximization & network maximization .

b) wealth maximization& value maximization.

c) wealth maximization & profit maximization.

d) none

7) Arrange the following financial planning steps in correct sequence:-

a) determination of funds needed.

b) develop procedure.

c) projection of financial statement

d) forcast the availability of funds.

e) establish & maintain control systems.

a) a-b-c-d-e b) c-a-b-d-e c) a-c-b-e-d d) c-a-d-e-b

8) If the management want to have control over the firm it may raise fund from________

a) equity share b) debenture c) both a & b d) none

9) The components of capitalization are_________.

a) par value of share capital + reserve & surplus + long term borrowed fund

b) equity share capital + preference share capital +long term borrowed fund

c) equity share capital + preference share capital +long term borrowed fund + reserve & surplus

d) retained earning

10) The capacity of firms to raise.Fund in capital market depends upon_________.

a) turnover b) profit c)credibility d) growth prospect

11) Match different risk with their nature.

1) project specific risk (i) change in currency value

2) competition risk (ii)wrong estimation

3) industry specific risk (iii) reduction in price by competition

4) international risk (iv) change in technology

5) market risk (v) change in general economic condition.

a) 1-IV,2-III,3-II,4-I,5-V b) 1-II,2-III,3-IV,4-V,5-I

c) 1-IV,2-III,3-V,4-II,5-I d) 1-II,2-III,3-IV,4-I,5-V

12) TRUE & FALSE:-

1) risk adjusted discount rate is conventional technique

2)payback period considers the time period within which the initial investment is recovered

3)RADR is always less than risk free rate

4) risk premium is also known as surplus rate

a) 1,2&3 true b) 2,3& 4 true c) 1,2 &4 true d) all true

13) Certainty equivalents coefficient approach define the relationship between______&________.

a) initial investment & net cash inflow

b) net cash inflow & net cash outflow

c)certain net cash flow & risky net cash inflow

d) none

14) _________ includes the chances of occurrence of any event.

a) Sensitivity b) probability c) certainty equivalent d) none

15) When the projects are broken up into different activity & each activity is assessed for acceptance of

proposal.

a) Sensitivity b) probability c) decision tree d) none

16) When the equity of fund is not sufficient to pay dividends to the investor is known as_________

a)BEP b) under capitalization c) other capitalization d) optimum firm

17) Actual capitalization of the company exceeds the capitalization ,warranted by the activity level

is___________.

a) over capitalization b) under capitalization c) equal capitalization d) none

18) Calculate EPS with the help of following information:-

ebit-11,80,000

interest 2,20,000

no. of share outstanding -40,000

tax rate 40%

a) 24.00 b) 9.60 c) 14.40 d) none

19) The leverage of three firms are given below. Define which firm combined leverage is beneficial.

A B C

Operating leverage 1.14 1.23 1.33

Financial leverage 1.27 1.3 1.33

a) firm A b) firm B c) firm C d) firm D

20) If debenture of RS.1,00,000 discount on issue 5% expenses on issue.RS. 1,000 redamable.after 10 years

interest 12% calculate kd

a) 12% b)13% c) 14% d) 11%

21) TRUE & FALSE:-

Which of the following causes are true for under capitalization?

1) high initial lost by way of preliminary expenses

2) under estimation or wrong estimation of company earning capacity.

3) acquiring assets during boom phase

4) aggressive dividend policy

a) 1& 2 true b) 2&3 true c) 1 & 4 true d) only 2 true

22) Effects of over capitalization are?

1) fall in profit 2) encourage management to manipulate share price

3) encourage competition 4) loss of investor confidence.

(a) 1& 4 (b) 2& 3 (c) 1,2 & 4 (d) all

23) Calculate the effective rate of interest if the nominal rate of interest is 12% & interest is compounded

annually.

a) 12% p.a. b) 12.50% p.a. c) 12.60% p.a. d) none

24) __________ refers to the periodic flows of equal amount

a) installment b) present value c) annuity d) accumulation

25) The factor which is useful in determining the annual amount to be put a fund to be pay bond or

debenture are:-

a) compound b) annuity c) sinking d) none

26) Find out the present of an annuity of rs.10,000 over 3 years when discounted at 5%

a) 8640 b) 27730 c) 11580 d) none

27) The reciprocal of the present value annuity factor is called__________

a) Perpetuity b) capital recovery factor

c) discounting factor d) compound factor

28) A loan of rs. 2, 00,000 is to be paid repaid in 5 equal annual installments. if the loan carries a rate of 14%

p.a. what is the amt. of each installment.

a) 29,129 b) 58258 c) 32,127 d) none

29) Securities are _________ assets where as physical assets are_______ assets

a) liquid & fixed b) current & fixed c) cash & fixed d) financial & real

30) If earning per share on equity is 1.5 and market value of share is rs. 15 calculate cost of capital

a) 9% b) 10% c) 11% d) 12%

31) Sales rs. 2,00,000 variable cost rs. 1,40,000 fixed cost 40,000 ,10% interest on debt of rs. 1,00,000

calculate combined leverage.

a) 4 b) 3 c) 6 d) 2

32) Compounding technique is

a) Same as discounting technique

b) Slightly different from discounting technique

c) Exactly opposite to discounting technique.

d) None

33) ADF stand for

a) Annual discounting factor b) annuity discount factor

c) Annually debited fund d) none

34) If KD > coupon rate then value of bond is

a) = face value b) < face value c) > face values d) none

35) TRUE & FALSE:-

1) Interest rate & coupon rate are synonymous terms.

2) Equity share have a maturity period

3) Yield on preference share can be calculated on the same pattern as for debenture

a. 1 &3 true b. 2 &3 true c. all true d all false

36) In single period valuation model an investor hold on equity share for___________.

a) More than one year b) less than one year

c) one year d) none

37) Leverage means:-

a) Gear box of car b) capital structure c) profit & loss d) effectiveness

38) State whether each of the following statement is false

1) cash flows of two years in absolute terms are comparable

2)compound technique &discounting technique refer to one and the same thing

3) annuity table can be used for all kind of cash flows

4) perpetuity & annuity are two different concepts

5) Incase of compounding the basic amount on where interest is received remain constant

6) If the easier to calculate the present value of on even cash inflow than calculating present value for annuity

over an year.

a) 1, 2 & 5 b) 2, 3 & 4 c) 1, 2 ,3, 5 & 6 d) all of the above

39) Compounded value of a sum P for n year at interest rate I can calculated by the following formula

a) a = p(1+i/1)n b) a= p(1+i)n c)a= p(1/i+1) n d) none

40) Time preference for money prevails because

a) goods will become dearer after a time period.

b) the worth of money in hand is more that the same amount when received after a particular time period.

c) money facilitates purchase of necessary amenities in time

d) none

SECTION B 2 MARKS EACH

41) Multiple compounding period means:-

a) there are number of year for which money is compounded.

b) interest is paid many times at same rate.

c) interest is compounded more that once in a year.

d) none

42) The function of financial leverage is

a) financial arrangement

b) debt redemption

c) analysis of effect of fixed charges becausing sources of capital on profit

d) effect of equity share capital on profit.

43) Formula for operating leverage is

a) EBIT/EBT B) E/EBIT C) BEP/EBIT D) NONE

44) Operative leverage is effected by

a) EAIT/EBT B) EBIT/EAT C) EBIT/EBT D) NONE

45) FFL stand for:-

a) fixed financial leverage b) favourable financial leverage

c) final financial leverage d) none

46) Financial leverage is not exist when

a) capital structure contain 100% equity b) when ROI

c) capital structure contain 100% debenture d) none

47) Trading on equity means

a) less equity share & more long term loan in capital structure

b) more equity & less long term loan.

c) both are equal

d) none

48) If operating leverage of firm is 2,it shows :-

a) profit increase equal proportion to sales.

b) profit decrease equal proportion to sales.

c)increase/ decrease in profit double to sales.

d) none

49) Arrange those security from minimum rise to highest risky

1) government bonds 2) debenture 3) preference share 4) equity share

a) 1-2-3-4 b) 2-1-3-4 c) 1-3-2-4 d) 1-2-4-3

50) Which of the following assumption is not consider under CAPM model.

a) investor are risk averse.

b) investor make their investment decision on a multiple period basis.

c) transaction cost are low

d) only b & c

51) In CAPM model cost of capital is calculated

a) ke = rm + b (rf-rm) b) ke = rf + b (rm-rf) c) ke = rf + b (rf-rm) d) none

52) Cost of capital comprises both business & __________ risk

a) financial b) market c) technology d) all

53) Cost of capital serves as __________ rate. For capital investment decision.

a) minimum rate b) cut off c) discounting rate d) none

54) State whether each of the following statement are true & false.

1) the cost of capital is the minimum rate of return that will maintain the value of a firm equity share.

2) for financial decision making relevant cost are the historical cost.

3) Composite cost is inclusive of all cost of capital from all sources.

4) retained earning have no cost to the firm.

a) 1 & 3 true b) 1 & 4 true c) 1 & 2 true d) all true

55) The capital structure decision include debt equity mix & __________ decision.

a) investment b) dividend c) financing d) none

56) Optimum debt equity ratio for manufacturing concern is:-

a) 2:1 b) 3:1 c) 1:2 d) 1.5:1

57) State whether each of the following statement are true & false.

1) the term capital structure includes also the financial structure

2) the optimum capital structure is obtained when the market value per equity share is maximum

3) net income approach & net operating income approach are synonymous terms.

4) according to MM approach the value of a firm is affected by the debt equity mix.

5) the traditional approach is a midway approach between net income approach is a midway approach

between net income approach & net operating income approach.

a) all true b) all false c) 2& 5 true d) 1,2,5 are true

58) MM approach is similar to __________ approach.

a) net income approach b) net operating income approach

c) both a& b d) none

59) Match different project approval with their aspect.

SET I SET II

i. market appraisalii. Technical appraisaliii. Financial appraisaliv. Economic appraisal 1.2.3.4. appropriate

plant design & layoutprojected income & expensessubstitute analysiscontribution towards reducing the

unemployment problem.

a) 1-iii,2-I,3-ii,4-iv b) 1-i,2-ii,3-iii,4-iv c) 1-iii,2-iv,3-ii,4-i

60) While evaluating capital investment proposal, the time value of money is consider incase of:-

a) Payback period b) IPR c) APR d) present value index method

61) Depreciation is included in cost incase of:-

a) Payback period b) APR c) IPR d) present value index method.

62) Project acceptance criterion though PI is

a) PI > 1 b) PI < 1 c) P = 1 d) PI = 8

63) Plant are___________ assets. where as patene are__________

a) cash assets & capital assets.

b) capital assets & physical assets.

c) intangible assets & physical assets.

d) tangible & intangible assets.

64) Short term loan & advances is__________

a) current assets b) current liability c) fixed assets d) fixed liability

65) The firm ability to meet its short term obligation is depend on ________

a) current assets b) fixed assets c) liquid assets d) all

66) Net operating cycle is known as:-

a) cash management cycle b) cash conversation cycle c) operating cycle.

67) Sum of raw material storage period to average collection period cycle is__________

a) net operating cycle b) gross operating cycle

c) operating cycle d) combined cycle.

68) The minimum investment in the form of operating cycle is___________.

a) variable working capital b) temporary working capital

c) permanent working capital d) none

69) The upward swing in the economy__________

a) increase the W.C.R. b)decrease working capital requirement

c) constant W.C.R. d) none

70) Following statement are true/ false

a) Policy of the firm effect the working capital requirement

b) Manufacturing concern working capital requirement is greater than trading concern

c) Operational efficiency of a firm is also effect to working capital requirement.

d) Electricity generation W.C.R. is less than hotels sector

a) All true b) all false c) a,b,& c true d) b&c true

71) Cash management is concerned with

a) management of cash inflow & outflow both

b) management of cash balance held by the firm

c) only a

b) both a & b

72) Match the following:-

A B

1.2.3.4. transaction motiveprecautionary motivespeculative motive compensating motive 1.2.3.4. To meet

routine expenses Unforeseen Fluctuation Unexpected changes in business scenario Maintain minimum

balance to attain services.

a) 1-iv,2-I,3-iii,4-ii b) 1-i,2-iii,3-ii,4-iv c) 1-i,2-ii,3-iv,4-iii d) 1-i, 2-ii,3-iii,4-iv

73) When cheques are deposited into bank but not cleared is ___________.

a) collection float b) free float c) payment float d) none

74) When the balance in the firm book is less than the bank book is known as_________

a) net float is positive b) net float is negative c) constant float d) none

75) Forecasting are based on the ___________&__________

a) past & present event b) past & past event

c) past & future event d) future & future event

76) The first element of a cash budget is __________

a) time horizon b) planning horizon c) scheduling d)all

77) When raw material are purchased on credit & used to produced finished goods the lag is known as:-

a) storage lag b) creation lag c) sale lag d) time lag

78) Successful inventory management make a trade off between ________& __________ level of inventory.

a) high & low b) good & bad c) quantity & quality d) all

79) Abc analysis related with ________

a) Cash management b) time management

c) production management d) inventory management.

80) In ABC analysis a group requires ______ control

a) Intensive b) simple c) reasonable d) cant say

81) ABC is also known as ___________

a) Value analysis b) proportional value analysis c) variance analysis d) none

82) The formula for EOQ mode is__________

a) 2AS/C b) 2AQ/C c)2as/c d) 2aq/c

83) Maintenance of minimum additional inventory to meet unanticipated need or demand is known

as___________

a) Minimum stock b) recorder level c) safety stock d) none

84) In_________ method last received consignment is issued first

a) FIFO b) LIFO c)weighted average d) standard price

85) ___________ is a marketing tool that tries to bridge the gap between production & distribution of company

product.

a) Cash credit b) trade credit c) bank credit d) all

86) Additional cost in credit sales in form of reminder legal charge etc. are__________.

a) Capital cost b) collection cost c) delinquency cost d) default cost

87) The quantitative basis for setting credit standard are_________

a) Average payment period b) ratio analysis c) credit rating d) all

88) In traditional dividend approach, D.L. Dodd & B.Graham define the clear relationship between__________&

__________.

a) Dividend & profit b) growth & retained earning

c) dividend retained earning d) dividend & stock market.

89) In Walter model, if r < k the firm should have

a) 100% payout ratio b) zero payout ratio c) zero to 100% payout d) none

90) In Walter model formula used to determine the market price of share is ___________

a) P= [m(D+E/3)] b) P= D/ke + [u( E-D)/ke]/ ke

c) P = E(1-b) /ke-br d) P= D(1-b)/ke-br

91) A bond with a face value of rs. 100 provide an annual return of 8% and pays rs. 125 at the maturity

which is 10 yr. from now. If the investors required return is 12% what should be the price of the bond

a)43.38 b) 80.45 c) 40.25 d) 85.45

92) The bond of silicon enterprises with a par value of rs.500 is currently traded at rs. 435. The coupon rate is

12% be the yield to maturity.

a) 15% approx b) 16% approx c) 17% approx d) 14% approx

93) Sales 2, 00,000, variable cost rs.1, 40,000

Fixed cost 40,000 calculate operating leverage

A) 5 b) 3 c) 2 d) 2.5

94) A company has issued 6% debenture of rs. 100 each at a discount of 10% repayable after 10 years

calculate cost of debenture capital:-

a) 6% b) 6.33% c) 7.37% d) 7%

95) Given:- 10% preference share of rs. 100,issued at par value, issue expenses rs. 2, calculate cost of

preference share capital after tax will be:-

a)10.2% b) 10% c) 20% d) 20.4%

96) Calculate EOQ:- Annual consumption raw material 40,000 unit cost per unit rs.16,carrying cost is 15%

p.a. cost of placing an order rs.480

a)2000 units b) 3000 units c) 4000 units d) 4500 units

97) If cost of preference share capital is 7.5% & tax rate are not applicable then ROI is

a) Double to preference capital rate b) equal to preference capital rate

c) half of the preference capital rate d) all are correct.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Exam II Version BDocument12 pagesExam II Version B조서현No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Rich Dad, Poor DadDocument10 pagesRich Dad, Poor DadEngrZaptrescunoPauNo ratings yet

- MCQ On Financial ManagementDocument28 pagesMCQ On Financial ManagementibrahimNo ratings yet

- Finance MCQDocument46 pagesFinance MCQPallavi GNo ratings yet

- Buad 804 Sourced MCQ LQADocument21 pagesBuad 804 Sourced MCQ LQAAbdulrahman Adamu AhmedNo ratings yet

- Strategies of A Fashion Organisation - The RealRealDocument44 pagesStrategies of A Fashion Organisation - The RealRealMaggie Tan100% (1)

- MCQ of Corporate Finance PDFDocument11 pagesMCQ of Corporate Finance PDFsinghsanjNo ratings yet

- Corporate FinanceDocument418 pagesCorporate FinanceLusayo Mhango100% (2)

- MCQ of Corporate Valuation Mergers AcquisitionsDocument19 pagesMCQ of Corporate Valuation Mergers AcquisitionsNuman AliNo ratings yet

- NEFT MandateDocument1 pageNEFT MandateAyan ParuiNo ratings yet

- Mca - 204 - FM & CFDocument28 pagesMca - 204 - FM & CFjaitripathi26No ratings yet

- Corporate Finance MCQDocument35 pagesCorporate Finance MCQRohan RoyNo ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementMilind DesaiNo ratings yet

- MCQ On FM PDFDocument28 pagesMCQ On FM PDFharsh snehNo ratings yet

- Multiple Choice at The End of LectureDocument6 pagesMultiple Choice at The End of LectureOriana LiNo ratings yet

- MCQ 501Document90 pagesMCQ 501haqmalNo ratings yet

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Document27 pagesQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNo ratings yet

- Product Costing: Quizzer (Do-It-Yourself Drill)Document7 pagesProduct Costing: Quizzer (Do-It-Yourself Drill)loraine payuyoNo ratings yet

- Final Exam (6th Set) 54 QuestionsDocument9 pagesFinal Exam (6th Set) 54 QuestionsShoniqua JohnsonNo ratings yet

- FM MCQsDocument58 pagesFM MCQsPervaiz ShahidNo ratings yet

- MCQ-Financial AccountingDocument13 pagesMCQ-Financial AccountingArchana100% (1)

- Investment Planning (Finally Done)Document146 pagesInvestment Planning (Finally Done)api-3814557100% (2)

- Corporate Finance QBDocument27 pagesCorporate Finance QBVelu SamyNo ratings yet

- CHALLENEGE STATUS-Sample Paper Stage 1Document26 pagesCHALLENEGE STATUS-Sample Paper Stage 1Neelam Jain100% (1)

- MCQ On FMDocument28 pagesMCQ On FMSachin Tikale100% (1)

- Investment+Planning+Module (1)Document137 pagesInvestment+Planning+Module (1)jayaram_polaris100% (1)

- Home Office and Branch Accounting 1Document10 pagesHome Office and Branch Accounting 1Ma. Kristine Garcia100% (5)

- Tamilnadu Genera Tion and Distribution Corpora Tion: I. Security Deposit DetailsDocument1 pageTamilnadu Genera Tion and Distribution Corpora Tion: I. Security Deposit DetailssamaadhuNo ratings yet

- FM McqsDocument43 pagesFM Mcqssuryakanta garnaik100% (4)

- Philex Mining Vs CirDocument2 pagesPhilex Mining Vs CirKim Lorenzo CalatravaNo ratings yet

- FM Recollected QuestionsDocument8 pagesFM Recollected Questionsmevrick_guyNo ratings yet

- Questions Based On F Inancial Managem EntDocument21 pagesQuestions Based On F Inancial Managem EntHemant kumarNo ratings yet

- CAIIB Bank Financial Management - Questions and AnswersDocument15 pagesCAIIB Bank Financial Management - Questions and Answerssuperman1293No ratings yet

- CF MCQ ShareDocument17 pagesCF MCQ ShareMadhav RajbanshiNo ratings yet

- DocxDocument26 pagesDocxMary DenizeNo ratings yet

- Corporate Finance MCQ m-1Document6 pagesCorporate Finance MCQ m-1MD RehanNo ratings yet

- Corporate Finance - Question Bank 2Document10 pagesCorporate Finance - Question Bank 2Ganesh GaneshNo ratings yet

- FINC521Document10 pagesFINC521All rounder NitinNo ratings yet

- Mba Ii Sem - FM - QBDocument29 pagesMba Ii Sem - FM - QBMona GhunageNo ratings yet

- FM SolvedDocument16 pagesFM SolvedHridesh BadaniNo ratings yet

- ACF End Term 2015Document8 pagesACF End Term 2015SharmaNo ratings yet

- Quizlet - Corporate Finance Final ExamDocument15 pagesQuizlet - Corporate Finance Final ExamGriselda de BruynNo ratings yet

- CPD-I (Paper-I) MCQ - Analysis and Interpretation of Financial StatementsDocument9 pagesCPD-I (Paper-I) MCQ - Analysis and Interpretation of Financial Statementsravi yadavaNo ratings yet

- Sample of The Fin320 Department Final Exam With SolutionDocument10 pagesSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- Compilation of FMSM Telegram McqsDocument17 pagesCompilation of FMSM Telegram McqsAddvit ShrivastavaNo ratings yet

- MCQ PDFDocument23 pagesMCQ PDFAnandita Sharma0% (1)

- Finance 16UCF519-FINANCIAL-MANAGEMENTDocument23 pagesFinance 16UCF519-FINANCIAL-MANAGEMENTHuzaifa Aman AzizNo ratings yet

- Busi - Finance - MCQ - EnglishDocument17 pagesBusi - Finance - MCQ - EnglishHome SonawaneNo ratings yet

- Gat Subject Management Sciences Finance Mcqs1 50Document5 pagesGat Subject Management Sciences Finance Mcqs1 50Muhammad NajeebNo ratings yet

- HT TP: //qpa Pe R.W But .Ac .In: 2010-11 Financial ManagementDocument8 pagesHT TP: //qpa Pe R.W But .Ac .In: 2010-11 Financial ManagementpranabroyNo ratings yet

- Tybfm Sem Vi QBDocument27 pagesTybfm Sem Vi QBHitesh BaneNo ratings yet

- CF2 1Document11 pagesCF2 1COPY PAPAGAJKANo ratings yet

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDocument5 pagesGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385No ratings yet

- MCQ-on-FM WITH SOLDocument28 pagesMCQ-on-FM WITH SOLarmansafi761100% (1)

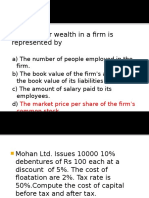

- D) The Market Price Per Share of The Firm's Common StockDocument6 pagesD) The Market Price Per Share of The Firm's Common StockMahesh UgalmugaleNo ratings yet

- BC0044 Accounting and Financial ManagementDocument12 pagesBC0044 Accounting and Financial ManagementSeekEducationNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers TheDocument6 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers TheKwaku Frimpong GyauNo ratings yet

- FXTM - Model AnswersDocument17 pagesFXTM - Model AnswersRajiv WarrierNo ratings yet

- Sub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceDocument12 pagesSub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceNetflix ChillNo ratings yet

- MCQ On FMDocument32 pagesMCQ On FMShubhada AmaneNo ratings yet

- FMSM - Practice Tests - With AnswersDocument39 pagesFMSM - Practice Tests - With AnswersRani LohiaNo ratings yet

- PAPER-6A Financial Management MCQSDocument64 pagesPAPER-6A Financial Management MCQSgurukhanolkar2004No ratings yet

- Financial Management Mcqs 2Document17 pagesFinancial Management Mcqs 2TestfNo ratings yet

- Finance MCQDocument27 pagesFinance MCQravi kangneNo ratings yet

- Ch11 ShowDocument63 pagesCh11 ShowMahmoud AbdullahNo ratings yet

- CLV - CalculationDocument10 pagesCLV - CalculationUtkarsh PandeyNo ratings yet

- Operating CostingDocument33 pagesOperating Costingenpreet kaur aroraNo ratings yet

- Khalaf Taani PDFDocument9 pagesKhalaf Taani PDFDuana ZulqaNo ratings yet

- Book Bank Form (SOT)Document2 pagesBook Bank Form (SOT)kaushalshah28598No ratings yet

- Block 5 MEC 006 Unit 15Document21 pagesBlock 5 MEC 006 Unit 15Abhishek Nath TiwariNo ratings yet

- Honey Processing Plant & Honey HouseDocument2 pagesHoney Processing Plant & Honey HouseJerish SolomonNo ratings yet

- What Is The Basic Difference Between Corporate and Commercial BankingDocument13 pagesWhat Is The Basic Difference Between Corporate and Commercial BankingDon Quichotte Al ArabNo ratings yet

- TR 17.02.2017 Productivity and Efficiency Measurement in AgricultureDocument77 pagesTR 17.02.2017 Productivity and Efficiency Measurement in AgricultureAngel TomNo ratings yet

- Illovo Malawi - Annual Report 2010Document54 pagesIllovo Malawi - Annual Report 2010Kristi DuranNo ratings yet

- Yeast Production IndustryDocument71 pagesYeast Production IndustryShabir TrambooNo ratings yet

- % Growth: FY14A FY15A FY16A FY17E FY18E FY19E FY20E FY21EDocument2 pages% Growth: FY14A FY15A FY16A FY17E FY18E FY19E FY20E FY21EAtul KolteNo ratings yet

- Vanguard High Dividend Yield Index ETF (VYM)Document4 pagesVanguard High Dividend Yield Index ETF (VYM)Francisco Aguilar PuyolNo ratings yet

- Bidding GuidelineDocument5 pagesBidding GuidelineBianca CezarNo ratings yet

- Tower Bersama Infrastructure TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesTower Bersama Infrastructure TBK.: Company Report: January 2019 As of 31 January 2019Felik KristantoNo ratings yet

- Report-Picic & NibDocument18 pagesReport-Picic & NibPrincely TravelNo ratings yet

- Chapter-I Introduction 1.1 BackgroundDocument14 pagesChapter-I Introduction 1.1 BackgroundSanjay KhadkaNo ratings yet

- 22087-047 Hoermann Geschaeftsbericht 2019 EN Web Sec 2 PDFDocument53 pages22087-047 Hoermann Geschaeftsbericht 2019 EN Web Sec 2 PDFPARAS JATANANo ratings yet

- NPC Vs Presiding JudgeDocument5 pagesNPC Vs Presiding JudgekhristineNo ratings yet

- Chapter 7 SummaryDocument3 pagesChapter 7 SummaryAce Hulsey TevesNo ratings yet

- Cambridge O Level: Accounting 7707/11Document12 pagesCambridge O Level: Accounting 7707/11For GamingNo ratings yet

- Sage 300 People Release Notes 19.4.2.0Document86 pagesSage 300 People Release Notes 19.4.2.0Gachuru AloisNo ratings yet