Professional Documents

Culture Documents

Analysis: 1. Leverage

Uploaded by

Zubair ZahoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis: 1. Leverage

Uploaded by

Zubair ZahoorCopyright:

Available Formats

Analysis

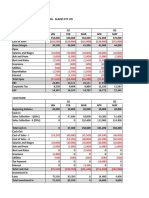

1. Leverage:

The leverage of the firms in the industry can be defined under two parameters: Financial leverage- it measures the surplus or deficit that will increase or decrease the ROE. In the case of steel industry, tata steel has an EPS of 68.95, in SAIL it is 8.58, and in JINDAL it is 22.78. here also the number of shares issued by SAIL is far greater than the rest of the industry, keeping that in mind if we calculate the best returns that a investor is getting is in the case of SAIL followed by TATA and then followed by JINDAL. We can also see that the DFL of SAIL is the best in the industry which is closely followed by tata. Operating leverage- the operating leverage affects the firms EBIT, in the case of steel industry it can be seen that the most EBIT is earned by TATA steel followed by SAIL which is closely followed by JINDAL. The DOL in this case is highest of TATA steel which is followed by SAIL as their competitors.

2. Capital structureIn the case of steel industry a major part of financing is done by the equity shares, in TATA steel the capital earned is 959 crores, in SAIL it is 4130 crores and in JINDAL it is comparatively low at 93 corores. It shows that most of the finance done in SAIL is through the equity, TATA depends upon both the equity and borrowings and in case of JINDAL it is done mostly by borrowings. Here we can see that the firms in the industry works upon different parameters to raise the money from the market to finance their activities.

3. Dividend policyIn the steel industry scenario we can see that the dividends paid by the firms are, SAIL provides dividends worth 826 crores with an EBIT of more than 5000 crores which shows that their retention ratio is quite high. And JINDAL provides dividends worth 150 crores out of their EBIT of more than 4000 crores which shows that their retention ratio is higher than that of SAIL. As a whole industry it can be seen that the retention ratio is quite high and only a significant amount of dividends are issued by the firms.

4. Working capitalWorking capital is essential in the day to day working of the firm and it is important for the firms to maintain a significant working capital so that they can maintain their operations and upcoming demands. In the case of steel industry, in case of TATA we can see that the working capital is significantly high in the year 2011 but it has dropped down in 2012 upto a negative level, this shows that the loans have significantly dropped and the current liabilities have risen to a high level. In case of SAIL we can see that the working capital is positive and high, so they are able to meet their day to day working operations smoothly and are in a strong position to meet their upcoming demands. Also in case of JINDAL we can see that the working capital is positive and they are able to meet their day to day operations. But if we analyse the industry as a whole it can be noticed that SAIL holds the strongest position and it truly the market leader in the steel industry.

5. Industry interpretations(as per ratios)a. Debt equity ratio- the standard industry ratio is 0.88, taking this into mind while comparing the soundness of the firms regarding their capital structure, only JINDAL has a higher ratio whereas TATA and SAIL both have around 0.4 percent, which shows that both the firms have more quity in their finance whereas JINDAL depends mostly on debt.

b. Current ratio- the standard industry ratio is 1.31, taking this into mind while comparing the assets and liabilities of the firms, SAIL is the most closest to the standard industry ratio followed by TATA and then by JINDAL. It shows that SAIL is most able to pay its short term obligations then the rest of its competitors. c. Inventory turnover ratio- the standard industry ratio is 4.94, taking this into mind while calculating the number of times an inventory is sold or replaced over a period, the most number of times an inventory is sold or replaced is by TATA steel with a ratio of above 9, this proves their significance in the working of the inventory and the flow in the firm. It is backed by SAIL with a ratio of around 5 and then is JINDAL.

By carrying out an overall analysis it can be seen that SAIL is undoubtedly the market leader being a government firm, which is competed by TATA is a close competition and the steel industry being a fast moving goods industry with a requirement of high amount of long term financing for their production. The capital structure of the top firms in the industry can be improved by financing it with debts of long term as well as short term so that the interest is less and can be met by the firms producing a significant level of inventories. For the overall development of the industry the debt and equity needs to be balanced by the top two firms to reach for new and fast developments and avoiding any competition in the future.

You might also like

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- Project On Ratio and Cash Flow Analysis For Titan Industries Pvt. Ltd.Document15 pagesProject On Ratio and Cash Flow Analysis For Titan Industries Pvt. Ltd.hemu1163% (16)

- Corporate Finance ProjectDocument18 pagesCorporate Finance ProjectRohan SaxenaNo ratings yet

- Free Accounting Firm Business PlanDocument1 pageFree Accounting Firm Business PlansolomonNo ratings yet

- India's Largest Private Sector Steel Company Tata Steel LtdDocument16 pagesIndia's Largest Private Sector Steel Company Tata Steel LtdVaibhav Pathare0% (2)

- The Impact of Inflation On Working CapitalDocument16 pagesThe Impact of Inflation On Working CapitalVishal Mohanka0% (1)

- Odel PLC Company ReportDocument13 pagesOdel PLC Company ReportTharushikaNo ratings yet

- Financial Statement Analysis ProjectDocument15 pagesFinancial Statement Analysis ProjectAnonymous wcE2ABquENo ratings yet

- C A N S L I MDocument7 pagesC A N S L I MIndi KinantiNo ratings yet

- Financial Ratio Analysis of M/s Tata SteelDocument33 pagesFinancial Ratio Analysis of M/s Tata Steel23pba104No ratings yet

- Cost Leadership Strategy of TATA Steel in the Global Steel IndustryDocument8 pagesCost Leadership Strategy of TATA Steel in the Global Steel IndustryTabrej KhanNo ratings yet

- Capstone FinalDocument66 pagesCapstone FinalNisha RaniNo ratings yet

- Group 10 - Deliverable 3Document5 pagesGroup 10 - Deliverable 3Hamza AsifNo ratings yet

- Nomura Capital GoodsDocument86 pagesNomura Capital GoodsAnish MathewNo ratings yet

- Business Restructuring - NSPCLDocument12 pagesBusiness Restructuring - NSPCLmayraNo ratings yet

- HBL Power Systems Ltd.Document3 pagesHBL Power Systems Ltd.BHAGYANo ratings yet

- A Case Study On Financial Performance of Tata Steel LimitedDocument7 pagesA Case Study On Financial Performance of Tata Steel LimitedhuyhnNo ratings yet

- JSW Steel Financial AnalysisDocument12 pagesJSW Steel Financial AnalysisAadya SuriNo ratings yet

- P.E.S Institute of Technology Department of MBADocument14 pagesP.E.S Institute of Technology Department of MBASandeep KulkarniNo ratings yet

- THE FOUNDER: LATE O.P JINDAL-Babuji (The Man of Destiny)Document9 pagesTHE FOUNDER: LATE O.P JINDAL-Babuji (The Man of Destiny)jassi7nishadNo ratings yet

- Leverage Analysis: (Jindal Steel & Power LTD) (SAIL)Document15 pagesLeverage Analysis: (Jindal Steel & Power LTD) (SAIL)Shaurya SingruNo ratings yet

- LGB Q4FY12Update 05may2012Document4 pagesLGB Q4FY12Update 05may2012equityanalystinvestorNo ratings yet

- HindalcoDocument26 pagesHindalcoAbhinav PrakashNo ratings yet

- Mid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Document21 pagesMid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Chetan MaheshwariNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceDhinakaran PillaiNo ratings yet

- Working Capital ManagementDocument49 pagesWorking Capital ManagementAshok Kumar KNo ratings yet

- Financial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosDocument15 pagesFinancial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosdjmondieNo ratings yet

- Tata Executive SummaryDocument2 pagesTata Executive SummaryShaojun YaoNo ratings yet

- Indian Steel Companies: Financial Restructuring Key To Turnaround"Document6 pagesIndian Steel Companies: Financial Restructuring Key To Turnaround"Khushboo GuptaNo ratings yet

- List of Stocks For Delivery Based Buying: Banking Axis Bank CMP Rs.853.00 Target - Rs.980Document5 pagesList of Stocks For Delivery Based Buying: Banking Axis Bank CMP Rs.853.00 Target - Rs.980Jijoy PillaiNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT Analysissidlbsim100% (1)

- Findings, Suggestions and Conclusi: Chapter-5Document10 pagesFindings, Suggestions and Conclusi: Chapter-5kavilankuttyNo ratings yet

- Analysis - Why Investing in PSUs Is A Good Idea - MoneycontrolDocument2 pagesAnalysis - Why Investing in PSUs Is A Good Idea - Moneycontrollaloo01No ratings yet

- Havells India LTD: Market Data Buy Target Price: Rs 500 Investment RationaleDocument6 pagesHavells India LTD: Market Data Buy Target Price: Rs 500 Investment Rationalenalinschwarz123No ratings yet

- Working Capital Management: TATA SteelDocument17 pagesWorking Capital Management: TATA SteelSaurabh KhandelwalNo ratings yet

- Essar Energy Annual Reports and AccountsDocument125 pagesEssar Energy Annual Reports and AccountsAakash GuptaNo ratings yet

- Summary, Findings and ConclusionDocument10 pagesSummary, Findings and ConclusionmgajenNo ratings yet

- Uu U U !"#$%# &! !u$%$%'%$#Document12 pagesUu U U !"#$%# &! !u$%$%'%$#ankitkhetan_meNo ratings yet

- Executive Summary Industry OverviewDocument5 pagesExecutive Summary Industry OverviewVarun SinghNo ratings yet

- Financial Performance Analysis of Exide IndustriesDocument11 pagesFinancial Performance Analysis of Exide IndustriesAnupriya SenNo ratings yet

- Accounting and Performance ReviewDocument20 pagesAccounting and Performance Reviewhellome11291No ratings yet

- Accounts Presentation PointDocument3 pagesAccounts Presentation PointSAURAV KUMAR GUPTANo ratings yet

- SECTOR ANALYSIS Animesh Ranjan PGDM 1537 AK BatchDocument10 pagesSECTOR ANALYSIS Animesh Ranjan PGDM 1537 AK BatchAvinash TaterNo ratings yet

- CFRA Project PDFDocument14 pagesCFRA Project PDFSYKAM KRISHNA PRASADNo ratings yet

- Fundamental Analysis IDFC, Tata SteelDocument43 pagesFundamental Analysis IDFC, Tata SteelharshleeNo ratings yet

- A Study On Financial Performance Analysis: 1. Short-Term SolvencyDocument4 pagesA Study On Financial Performance Analysis: 1. Short-Term SolvencysujithvijiNo ratings yet

- F S A JSW - Ispat: Prof. Padmini SrinivasanDocument18 pagesF S A JSW - Ispat: Prof. Padmini Srinivasantanmay1984No ratings yet

- Working Capital FinancingDocument80 pagesWorking Capital FinancingArjun John100% (1)

- Saad Ratio AnalysisDocument33 pagesSaad Ratio AnalysisManiruzzaman TanvirNo ratings yet

- Financial Analysis of Reliance Steel and Aluminium Co. LTDDocument4 pagesFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHINo ratings yet

- Accounts AssignmentDocument5 pagesAccounts AssignmentVatsal MagajwalaNo ratings yet

- Financial Analysis of Tata Steel and Jindal Steel and Power Ltd.Document34 pagesFinancial Analysis of Tata Steel and Jindal Steel and Power Ltd.O.p. SharmaNo ratings yet

- MC 200203 LucasDocument4 pagesMC 200203 LucasArvindkumar ShanmugamNo ratings yet

- Factors that Create Wealth: A Study of Top Indian CompaniesDocument16 pagesFactors that Create Wealth: A Study of Top Indian CompaniesavlakhiaNo ratings yet

- The Impact of LBO On FirmsDocument16 pagesThe Impact of LBO On Firmssoujanya_nagarajaNo ratings yet

- DividendAnalysis UDocument5 pagesDividendAnalysis USaprem KulkarniNo ratings yet

- Research Speak - 10-7-2010Document7 pagesResearch Speak - 10-7-2010A_KinshukNo ratings yet

- Top Stock PicksDocument22 pagesTop Stock Picksjitesh.dhawanNo ratings yet

- Reliance Infrastructure 091113 01Document4 pagesReliance Infrastructure 091113 01Vishakha KhannaNo ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Nishi Taint Eco 090811Document36 pagesNishi Taint Eco 090811NagabhushanaNo ratings yet

- Pepsi Product Management ProjectDocument11 pagesPepsi Product Management ProjectZubair ZahoorNo ratings yet

- Farhad DarvishDocument2 pagesFarhad DarvishZubair ZahoorNo ratings yet

- Telecom Regulatory Authority of India: Financial Analysis DivisionDocument14 pagesTelecom Regulatory Authority of India: Financial Analysis Divisionvishvasa11No ratings yet

- Guide To International Financial Reporting Standards: September 2009Document7 pagesGuide To International Financial Reporting Standards: September 2009Mark StonehamNo ratings yet

- Zubair Reliance CommunicationDocument1 pageZubair Reliance CommunicationZubair ZahoorNo ratings yet

- Why Do Countries Adopt International Financial Reporting Standards?Document48 pagesWhy Do Countries Adopt International Financial Reporting Standards?Khwahish ArmanNo ratings yet

- Cfakepathfinalprojectonreliancecommunication2003 100813023442 Phpapp02Document64 pagesCfakepathfinalprojectonreliancecommunication2003 100813023442 Phpapp02Anil GautamNo ratings yet

- Telecom Sector Vision 2020Document32 pagesTelecom Sector Vision 2020jayantsuri85No ratings yet

- Company PrintDocument2 pagesCompany PrintZubair ZahoorNo ratings yet

- Chotukool: The $69 Fridge For Rural India: Suresh MunuswamyDocument3 pagesChotukool: The $69 Fridge For Rural India: Suresh MunuswamySwapnil KharadeNo ratings yet

- Engineering CodeDocument217 pagesEngineering CodeSudeepSMenasinakaiNo ratings yet

- Cashback Redemption FormDocument1 pageCashback Redemption FormPapuKaliyaNo ratings yet

- Ch.3 Size of BusinessDocument5 pagesCh.3 Size of BusinessRosina KaneNo ratings yet

- BMWDocument52 pagesBMWDuje Čipčić100% (3)

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- What Are Equity Securities?Document2 pagesWhat Are Equity Securities?Tin PangilinanNo ratings yet

- QUIZDocument15 pagesQUIZCarlo ConsuegraNo ratings yet

- No. 13 EMHDocument33 pagesNo. 13 EMHayazNo ratings yet

- Mechanics of Futures MarketsDocument42 pagesMechanics of Futures MarketsSidharth ChoudharyNo ratings yet

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet

- Vol. 49, No. 2, March 2017 PDFDocument19 pagesVol. 49, No. 2, March 2017 PDFStrathmore Bel PreNo ratings yet

- Analysis On The Proposed Property Tax AssessmentDocument32 pagesAnalysis On The Proposed Property Tax AssessmentAB AgostoNo ratings yet

- Strategic Plan of Indian Tobacco Company (ItcDocument27 pagesStrategic Plan of Indian Tobacco Company (ItcJennifer Smith100% (1)

- Identification of Potential Insurance AdvisorsDocument96 pagesIdentification of Potential Insurance AdvisorsAnimesh TiwariNo ratings yet

- 41 and 42 Tolentino Vs Secretary of FinanceDocument2 pages41 and 42 Tolentino Vs Secretary of FinanceYvon Baguio100% (1)

- What is Operations ResearchDocument10 pagesWhat is Operations ResearchSHILPA GOPINATHANNo ratings yet

- Solutions To Exercises and Problems - Budgeting: GivenDocument8 pagesSolutions To Exercises and Problems - Budgeting: GivenTiến AnhNo ratings yet

- Hersey K Delynn PayStubDocument1 pageHersey K Delynn PayStubSharon JonesNo ratings yet

- LTD Report Innocent Purchaser For ValueDocument3 pagesLTD Report Innocent Purchaser For ValuebcarNo ratings yet

- Extinguishment of Obligations by Confusion and CompensationDocument38 pagesExtinguishment of Obligations by Confusion and CompensationMaicah Marie AlegadoNo ratings yet

- Delhi Rent Control Act, 1958Document6 pagesDelhi Rent Control Act, 1958a-468951No ratings yet

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Document15 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 1Kyrie IrvingNo ratings yet

- SAP Global Implementation Conceptual-Design-Of-Finance and ControllingDocument172 pagesSAP Global Implementation Conceptual-Design-Of-Finance and Controllingprakhar31No ratings yet

- CVPA ANALYSIS AND BEP CALCULATIONSDocument38 pagesCVPA ANALYSIS AND BEP CALCULATIONSLouie De La TorreNo ratings yet

- Atria Convergence Technologies Limited, Due Date: 15/11/2021Document2 pagesAtria Convergence Technologies Limited, Due Date: 15/11/2021NaveenKumar S NNo ratings yet

- Risk and Rates of Return: Multiple Choice: ConceptualDocument79 pagesRisk and Rates of Return: Multiple Choice: ConceptualKatherine Cabading InocandoNo ratings yet

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerNo ratings yet