Professional Documents

Culture Documents

Rural Bank of Lipa City Vs CA Case Digest

Uploaded by

Berch MelendezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rural Bank of Lipa City Vs CA Case Digest

Uploaded by

Berch MelendezCopyright:

Available Formats

Rural Bank of Lipa City vs CA Case Digest The Rural Bank of Lipa City Inc., etc. vs.

Court of Appeals [GR 124535, 28 September 2001]

Facts: Reynaldo Villanueva, Sr., a stockholder of the Rural Bank of Lipa City, executed a Deed of Assignment, wherein he assigned his shares, as well as those of 8 other shareholders under his control with a total of 10,467 shares, in favor of the stockholders of the Bank represented by its directors Bernardo Bautista, Jaime Custodio and Octavio Katigbak. Sometime thereafter, Reynaldo Villanueva, Sr. and his wife, Avelina, executed an Agreement wherein they acknowledged their indebtedness to the Bank in the amount of P4,000,000.00, and stipulated that said debt will be paid out of the proceeds of the sale of their real property described in the Agreement. At a meeting of the Board of Directors of the Bank on 15 November 1993, the Villanueva spouses assured the Board that their debt would be paid on or before December 31 of that same year; otherwise, the Bank would be entitled to liquidate their shareholdings, including those under their control. In such an event, should the proceeds of the sale of said shares fail to satisfy in full the obligation, the unpaid balance shall be secured by other collateral sufficient therefor. When the Villanueva spouses failed to settle their obligation to the Bank on the due date, the Board sent them a letter demanding: (1) the surrender of all the stock certificates issued to them; and (2) the delivery of sufficient collateral to secure the balance of their debt amounting to P3,346,898.54.

The Villanuevas ignored the bank's demands, whereupon their shares of stock were converted into Treasury Stocks. Later, the Villanuevas, through their counsel, questioned the legality of the conversion of their shares. On 15 January 1994, the stockholders of the Bank met to elect the new directors and set of officers for the year 1994. The Villanuevas were not notified of said meeting. In a letter dated 19 January 1994, Atty. Amado Ignacio, counsel for the Villanueva spouses, questioned the legality of the said stockholders' meeting and the validity of all the proceedings therein. In reply, the new set of officers of the Bank informed Atty. Ignacio that the Villanuevas were no longer entitled to notice of the said meeting since they had relinquished their rights as stockholders in favor of the Bank. Consequently, the Villanueva spouses filed with the Securities and Exchange Commission (SEC), a petition for annulment of the stockholders' meeting and election of directors and officers on 15 January 1994, with damages and prayer for preliminary injunction (SEC Case 02-94-4683_. Joining them as co-petitioners were Catalino Villanueva, Andres Gonzales, Aurora Lacerna, Celso Laygo, Edgardo Reyes, Alejandro Tonogan, and Elena Usi. Named respondents were the newly-elected officers and directors of the Rural Bank, namely: Bernardo Bautista, Jaime Custodio, Octavio Katigbak, Francisco Custodio and Juanita Bautista. On 6 April 1994, the Villanuevas' application for the issuance of a writ of preliminary injunction was denied by the SEC Hearing Officer on the ground of lack of sufficient basis for the issuance thereof.

However, a motion for reconsideration was granted on 16 December 1994, upon finding that since the Villanuevas' have not disposed of their shares, whether voluntarily or involuntarily, they were still stockholders entitled to notice of the annual stockholders' meeting was sustained by the SEC. Accordingly, a writ of preliminary injunction was issued enjoining Bautista, et. al. from acting as directors and officers of the bank. Thereafter, Bautista, et al. filed an urgent motion to quash the writ of preliminary injunction, challenging the propriety of the said writ considering that they had not yet received a copy of the order granting the application for the writ of preliminary injunction. With the impending 1995 annual stockholders' meeting only 9 days away, the Villanuevas filed an Omnibus Motion praying that the said meeting and election of officers scheduled on 14 January 1995 be suspended or held in abeyance, and that the 1993 Board of Directors be allowed, in the meantime, to act as such. 1 day before the scheduled stockholders meeting, the SEC Hearing Officer granted the Omnibus Motion by issuing a temporary restraining order preventing Bautista, et al. from holding the stockholders meeting and electing the board of directors and officers of the Bank. A petition for Certiorari and Annulment with Damages was filed by the Rural Bank, its directors and officers before the SEC en banc. On 7 June 1995, the SEC en banc denied the petition for certiorari. A subsequent motion for reconsideration was likewise denied by the SEC en banc in a Resolution dated 29 September 1995. A petition for review was filed before the Court of Appeals (CA-GR SP 38861), assailing the Order dated 7 June 1995 and the Resolution dated 29 September 1995 of the SEC en banc in SEC EB 440. The appellate court upheld the ruling of the SEC. Bautista, et al.'s motion for reconsideration was likewise denied by the Court of Appeals in an Order dated 29 March 1996. The bank, Bautista, et al. filed the instant petition for review.

Issue: Whether there was valid transfer of the shares to the Bank.

Held: For a valid transfer of stocks, there must be strict compliance with the mode of transfer prescribed by law. The requirements are: (a) There must be delivery of the stock certificate: (b) The certificate must be endorsed by the owner or his attorney-in-fact or other persons legally authorized to make the transfer; and (c) To be valid against third parties, the transfer must be recorded in the books of the corporation. As it is, compliance with any of these requisites has not been clearly and sufficiently shown. Still, while the assignment may be valid and binding on the bank, et al. and the Villanuevas, it does not necessarily make the transfer effective. Consequently, the bank et al., as mere assignees, cannot enjoy the status of a stockholder, cannot vote nor be voted for, and will not be entitled to dividends, insofar as the assigned shares are concerned. Parenthetically, the Villanuevas cannot, as yet, be deprived of their rights as stockholders, until and unless the issue of ownership and transfer of the shares in question is resolved with finality.

MR Holdings Ltd. vs. Sheriff Bajar Case Digest

MR Holdings Ltd. vs. Sheriff Bajar [GR 138104, April 11, 2002] Facts: Under a "Principal Loan Agreement" and "Complementary Loan Agreement," both dated 4 November 1992, Asian Development Bank (ADB), a multilateral development finance institution, agreed to extend to Marcopper Mining Corporation (Marcopper) a loan in the aggregate amount of US$40,000,000.00 to finance the latter's mining project at Sta. Cruz, Marinduque. The principal loan of US$15,000,000.00 was sourced from ADB's ordinary capital resources, while the complementary loan of US$25,000,000.00 was funded by the Bank of Nova Scotia, a participating finance institution. On even date, ADB and Placer Dome, Inc., (Placer Dome), a foreign corporation which owns 40% of Marcopper, executed a "Support and Standby Credit Agreement" whereby the latter. agreed to provide Marcopper with cash flow support for the payment of its obligations to ADB. To secure the loan, Marcopper executed in favor of ADB a "Deed of Real Estate and Chattel Mortgage" dated 11 November 1992, covering substantially all of its (Marcopper's) properties and assets in Marinduque. It was registered with the Register of Deeds on 12 November 1992. When Marcopper defaulted in the payment of its loan obligation, Placer Dome, in fulfillment of its undertaking under the "Support and Standby Credit Agreement," and presumably to preserve its international credit standing, agreed to have its subsidiary corporation, MR Holding, Ltd., assumed Marcopper's obligation to ADB in the amount of US$18,453,450.02. Consequently, in an "Assignment Agreement" dated 20 March 1997 ADB assigned to MR Holdings all its rights, interests and obligations under the principal and complementary loan agreements, ("Deed of Real Estate and Chattel Mortgage," and "Support and Standby Credit Agreement"). On 8 December 1997, Marcopper likewise executed a "Deed of Assignment" in favor of MR Holdings. Under its provisions, Marcopper assigns, transfers, cedes and conveys to MR Holdings, its assigns and/or successors-in-interest all of its (Marcopper's) properties, mining equipment and facilities. Meanwhile, it appeared that on 7 May 1997, Solidbank Corporation (Solidbank) obtained a Partial Judgment against Marcopper from the RTC, Branch 26, Manila, in Civil Case 96-80083, ordering Marcopper to pay Solidbank he amount if PHP 52,970,756.89, plus interest and charges until fully paid; to pay an amount equivalent to 10% of above-stated amount as attorney's fees; and to pay the costs of suit. Upon Solidbank's motion, the RTC of Manila issued a writ of execution pending appeal directing Carlos P. Bajar, sheriff, to require Marcopper "to pay the sums of money to satisfy the Partial Judgment." Thereafter, Bajar issued two notices of levy on Marcopper's personal and real properties, and over all its stocks of scrap iron and unserviceable mining equipment. Together with sheriff Ferdinand M. Jandusay of the RTC, Branch 94, Boac, Marinduque, Bajar issued two notices setting the public auction sale of the levied properties on 27 August 1998 at the Marcopper mine site. Having learned of the scheduled auction sale, MR Holdings served an "Affidavit of Third-Party Claim" upon the sheriffs on 26 August 1998, asserting its ownership over all Marcopper's mining properties, equipment and facilities by virtue of the "Deed of Assignment." Upon the denial of its "Affidavit of Third-Party Claim" by the RTC of Manila, MR Holdings commenced with the RTC of Boac, Marinduque, presided by Judge Leonardo P. Ansaldo, a complaint for reivindication of properties, etc., with prayer for preliminary injunction and temporary restraining order against Solidbank, Marcopper, and sheriffs Bajar and Jandusay (Civil Case 98-13). In an Order dated 6 October 1998, Judge Ansaldo denied MR Holdings' application for a writ of preliminary injunction on the ground that (a) MR Holdings has no legal capacity to sue, it being a foreign corporation doing business in the Philippines without license; (b) an injunction will amount "to staying the execution of a final judgment by a court of co-equal and concurrent jurisdiction;" and (c) the validity of the "Assignment Agreement" and the "Deed of Assignment" has been "put into serious question by the timing of their execution and registration." Unsatisfied, MR Holdings elevated the matter to the Court of Appeals on a Petition for Certiorari, Prohibition and Mandamus (CA-GR SP 49226). On 8 January 1999, the Court of Appeals rendered a Decision affirming the trial court's decision. MR Holdings filed the Petition for Review on Certiorari.

Issue: Whether MR Holdings' participation under the "Assignment Agreement" and the "Deed of Assignment" constitutes doing business. Held: Batas Pambansa 68, otherwise known as "The Corporation Code of the Philippines," is silent as to what constitutes doing" or "transacting" business in the Philippines. Fortunately, jurisprudence has supplied the deficiency and has held that the term "implies a continuity of commercial dealings and arrangements, and contemplates, to that extent, the performance of acts or works or the exercise of some of the functions normally incident to, and in progressive prosecution of, the purpose and object for which the corporation was organized." The traditional case law definition has metamorphosed into a statutory definition, having been adopted with some qualifications in various pieces of legislation in Philippine jurisdiction, such as Republic Act 7042 (Foreign Investment Act of 1991), and Republic Act 5455. There are other statutes defining the term "doing business," and as may be observed, one common denominator among them all is the concept of "continuity." The expression "doing business" should not be given such a strict and literal construction as to make it apply to any corporate dealing whatever. At this early stage and with MR Holdings' acts or transactions limited to the assignment contracts, it cannot be said that it had performed acts intended to continue the business for which it was organized. Herein, at this early stage and with MR Holdings' acts or transactions limited to the assignment contracts, it cannot be said that it had performed acts intended to continue the business for which it was organized. It may not be amiss to point out that the purpose or business for which MR Holdings was organized is not discernible in the records. No effort was exerted by the Court of Appeals to establish the nexus between MR Holdings' business and the acts supposed to constitute "doing business." Thus, whether the assignment contracts were incidental to MR Holdings' business or were continuation thereof is beyond determination. The Court of Appeals' holding that MR Holdings was determined to be "doing business" in the Philippines is based mainly on conjectures and speculation. In concluding that the "unmistakable intention" of MR Holdings is to continue Marcopper's business, the Court of Appeals hangs on the wobbly premise that "there is no other way for petitioner to recover its huge financial investments which it poured into Marcopper's rehabilitation without it (petitioner) continuing Marcopper's business in the country." Absent overt acts of MR Holdings from which we may directly infer its intention to continue Marcopper's business, the Supreme Court cannot give its concurrence. Significantly, a view subscribed upon by many authorities is that the mere ownership by a foreign corporation of a property in a certain state, unaccompanied by its active use in furtherance of the business for which it was formed, is insufficient in itself to constitute doing business. Further, long before MR Holdings assumed Marcopper's debt to ADB and became their assignee under the two assignment contracts, there already existed a "Support and Standby Credit Agreement" between ADB and Placer Dome whereby the latter bound itself to provide cash flow support for Marcopper's payment of its obligations to ADB. Plainly, MR Holdings' payment of US$18,453,450.12 to ADB was more of a fulfillment of an obligation under the "Support and Standby Credit Agreement" rather than an investment. That MR Holdings had to step into the shoes of ADB as Marcopper's creditor was just a necessary legal consequence of the transactions that transpired. Also, the "Support and Standby Credit Agreement" was executed 4 years prior to Marcopper's insolvency, hence, the alleged "intention of MR Holdings to continue Marcopper's business" could have no basis for at that time, Marcopper's fate cannot yet be determined. In the final analysis, MR Holdings was engaged only in isolated acts or transactions. Single or isolated acts, contracts, or transactions of foreign corporations are not regarded as a doing or carrying on of business. Typical examples of these are the making of a single contract, sale, sale with the taking of a note and mortgage in the state to secure payment therefor, purchase, or note, or the mere commission of a tort. In these instances, there is no purpose to do any other business within the country.

You might also like

- Associated Bank v. CA and SarmientoDocument2 pagesAssociated Bank v. CA and SarmientoChedeng KumaNo ratings yet

- Villamor JR V UmaleDocument2 pagesVillamor JR V UmaleSocNo ratings yet

- AVON DALE GARMENTS, INC., vs. NLRC DigestDocument1 pageAVON DALE GARMENTS, INC., vs. NLRC DigestChezka Celis100% (1)

- Vesagas v. CA DigestDocument1 pageVesagas v. CA Digestviva_33No ratings yet

- Dela Rama v. Ma-Ao Sugar CentralDocument2 pagesDela Rama v. Ma-Ao Sugar CentralLoi VillarinNo ratings yet

- Vicente Ponce v. Alsons Cement Corporation and GironDocument1 pageVicente Ponce v. Alsons Cement Corporation and GironCheCheNo ratings yet

- Domicile and Residence of Foreign CorpsDocument1 pageDomicile and Residence of Foreign CorpsShane Nuss RedNo ratings yet

- 213 de Los Santos v. McGrathDocument2 pages213 de Los Santos v. McGrathPatricia Kaye O. SevillaNo ratings yet

- Reburiano vs. CA G.R. No. 102965Document1 pageReburiano vs. CA G.R. No. 102965Marianne AndresNo ratings yet

- Reburiano V CA and Other Digests Under DissolutionDocument5 pagesReburiano V CA and Other Digests Under DissolutionNathalie LimNo ratings yet

- De Silva v. Aboitiz DIGESTDocument3 pagesDe Silva v. Aboitiz DIGESTkathrynmaydeveza100% (1)

- Rebollido vs. CA: Summons Properly Served on Dissolved CorporationDocument1 pageRebollido vs. CA: Summons Properly Served on Dissolved CorporationDean BenNo ratings yet

- Boyer Roxas V CA DigestDocument2 pagesBoyer Roxas V CA Digestmacmac12345No ratings yet

- DBP V OngDocument1 pageDBP V OngAices SalvadorNo ratings yet

- G.R. No. 187262, January 10, 2019 - Engineering Geoscience, Inc., Petitioner vs. Philippine Savings Bank, Respondent.Document2 pagesG.R. No. 187262, January 10, 2019 - Engineering Geoscience, Inc., Petitioner vs. Philippine Savings Bank, Respondent.Francis Coronel Jr.No ratings yet

- Gonzales vs. PNB (G.R. No. L-33320) CASE DIGESTDocument2 pagesGonzales vs. PNB (G.R. No. L-33320) CASE DIGESTEricha Joy GonadanNo ratings yet

- Iglesia Evangelica v. Bishop LazaroDocument3 pagesIglesia Evangelica v. Bishop LazaroAnonymous XvwKtnSrMR100% (1)

- Gokongwei Vs Sec DigestDocument2 pagesGokongwei Vs Sec DigestHaziell Pascua94% (18)

- Monserrat v. Ceron Stock Usufruct CaseDocument2 pagesMonserrat v. Ceron Stock Usufruct CaseFrances Stephanie Marie100% (2)

- 43 Calatagan Golf Club, Inc. vs. Sixto Clemente, JR.Document2 pages43 Calatagan Golf Club, Inc. vs. Sixto Clemente, JR.Arthur Archie Tiu100% (2)

- Premium Marble Resources Vs CADocument2 pagesPremium Marble Resources Vs CAKen AliudinNo ratings yet

- CASE DIGEST - Alabang Development Corporation VS Alabang Hills Village AssociationDocument2 pagesCASE DIGEST - Alabang Development Corporation VS Alabang Hills Village AssociationGladys Cañete100% (2)

- De La Rama Et Al Vs Ma-Ao Sugar CentralDocument17 pagesDe La Rama Et Al Vs Ma-Ao Sugar CentralSTEPHEN M. LAYSONNo ratings yet

- 08 TCL Sales Corp v. CADocument1 page08 TCL Sales Corp v. CAYvon BaguioNo ratings yet

- De Silva vs. Aboitiz & Co. (44 Phil 755)Document3 pagesDe Silva vs. Aboitiz & Co. (44 Phil 755)Rivera Meriem Grace MendezNo ratings yet

- Valley Golf and Country Club vs. VDA. de CaramDocument3 pagesValley Golf and Country Club vs. VDA. de CaramRia Evita RevitaNo ratings yet

- Western Institute of Technology v. SalasDocument1 pageWestern Institute of Technology v. SalasJudy RiveraNo ratings yet

- Rosita Peña Vs Court of AppealsDocument2 pagesRosita Peña Vs Court of AppealsKarlo Marco Cleto0% (1)

- Dishonored Check Case Dismissal UpheldDocument1 pageDishonored Check Case Dismissal UpheldEj TuringanNo ratings yet

- ANG-Abaya Vs ANGDocument3 pagesANG-Abaya Vs ANGRv TenorioNo ratings yet

- Lipat V Pacific Banking DigestDocument3 pagesLipat V Pacific Banking DigestSimeon SuanNo ratings yet

- G.R. No. 81123 DigestDocument2 pagesG.R. No. 81123 DigestJec Luceriaga BiraquitNo ratings yet

- Manuel Dulay Enterprises Vs CA 225 SCRA 678Document3 pagesManuel Dulay Enterprises Vs CA 225 SCRA 678Chino CabreraNo ratings yet

- Cebu Mactan V TsukaharaDocument3 pagesCebu Mactan V Tsukaharacha chaNo ratings yet

- Rural Bank Stock Transfer RequirementsDocument3 pagesRural Bank Stock Transfer RequirementsNikki Malferrari100% (1)

- BPI v. LeeDocument3 pagesBPI v. LeeHanna QuiambaoNo ratings yet

- Mindanao v. WillkomDocument2 pagesMindanao v. Willkomjanatot100% (2)

- Valley Golf & Country Club, Inc. v. Rosa Vda. de CaramDocument1 pageValley Golf & Country Club, Inc. v. Rosa Vda. de CaramCheCheNo ratings yet

- Transfer of shares case digest under 40 charactersDocument4 pagesTransfer of shares case digest under 40 charactersMaria Karen RamosNo ratings yet

- 03 Ching Vs QC Sports ClubDocument3 pages03 Ching Vs QC Sports ClubBeata CarolinoNo ratings yet

- Razon vs. IAC DigestDocument2 pagesRazon vs. IAC DigestMae Navarra100% (1)

- Republic Bank Vs CuadernoDocument1 pageRepublic Bank Vs CuadernoKristine Dy100% (1)

- Ponce Vs Alsons CementDocument3 pagesPonce Vs Alsons CementDiane UyNo ratings yet

- Iglesia vs. LazaroDocument3 pagesIglesia vs. LazaroRhev Xandra Acuña100% (1)

- Emilio Cano Enterprises Vs Cir PDFDocument1 pageEmilio Cano Enterprises Vs Cir PDFUE LawNo ratings yet

- San Miguel Corporation v. Khan (85339, August 11, 1989Document1 pageSan Miguel Corporation v. Khan (85339, August 11, 1989Joshua RiveraNo ratings yet

- 48 Eriks Pte V CADocument2 pages48 Eriks Pte V CAKenzo RodisNo ratings yet

- Calatagan Golf Club V ClementeDocument1 pageCalatagan Golf Club V ClementeRichel Dean100% (1)

- Wise Holdings Vs GarciaDocument2 pagesWise Holdings Vs GarciaMir Solaiman100% (2)

- SEC Vs Performance Foreign Exchange CorpDocument2 pagesSEC Vs Performance Foreign Exchange Corpnieville100% (1)

- Corpolaw Outline 2 DigestDocument24 pagesCorpolaw Outline 2 DigestAlexPamintuanAbitanNo ratings yet

- Engineering Geoscience Inc. Vs PSB DigestDocument2 pagesEngineering Geoscience Inc. Vs PSB Digestsally dee100% (2)

- Rural Bank of Salinas Vs CADocument1 pageRural Bank of Salinas Vs CAXing Keet LuNo ratings yet

- Philippine Smelting Corporation Cannot Preemptively Restrain Shareholders' Right to Inspect RecordsDocument2 pagesPhilippine Smelting Corporation Cannot Preemptively Restrain Shareholders' Right to Inspect RecordsGennard Michael Angelo Angeles100% (2)

- Jardine Not Liable for Subsidiary's ContractDocument1 pageJardine Not Liable for Subsidiary's ContractjjjzosaNo ratings yet

- TAN v. SYCIPDocument2 pagesTAN v. SYCIPnieville100% (4)

- 16 Lumanlan vs. CuraDocument2 pages16 Lumanlan vs. CuraJpSocratesNo ratings yet

- Rural Bank of Lipa vs. CA (G.r. No. 124535) Case DigestDocument2 pagesRural Bank of Lipa vs. CA (G.r. No. 124535) Case DigestEricha Joy GonadanNo ratings yet

- Rural Bank of Lipa Vs CADocument8 pagesRural Bank of Lipa Vs CAShane Fernandez JardinicoNo ratings yet

- Petitioners Vs VS: First DivisionDocument9 pagesPetitioners Vs VS: First DivisionBianca DawisNo ratings yet

- May 22,2019Document117 pagesMay 22,2019Berch MelendezNo ratings yet

- Media and Information Literacy Activity:: Adviser/Principal Subject Date/SignatureDocument1 pageMedia and Information Literacy Activity:: Adviser/Principal Subject Date/SignatureBerch MelendezNo ratings yet

- Cash Book: Cash Book City Economic Ent, Dev.& MNGMTN Office (Ceedmo)Document1 pageCash Book: Cash Book City Economic Ent, Dev.& MNGMTN Office (Ceedmo)Berch MelendezNo ratings yet

- DRRRDocument2 pagesDRRRBerch MelendezNo ratings yet

- Chapter 2 Summary DRRDocument4 pagesChapter 2 Summary DRRBerch MelendezNo ratings yet

- BirDocument1 pageBirBerch MelendezNo ratings yet

- Lemongrab (Research)Document1 pageLemongrab (Research)Berch MelendezNo ratings yet

- Prokaryotic CellsDocument2 pagesProkaryotic CellsBerch MelendezNo ratings yet

- Entrepre Nuer ShipDocument3 pagesEntrepre Nuer ShipBerch MelendezNo ratings yet

- Melendez Boarding HouseDocument1 pageMelendez Boarding HouseBerch MelendezNo ratings yet

- Richard Sing SingDocument2 pagesRichard Sing SingBerch MelendezNo ratings yet

- Seminar Outputmarch12Document1 pageSeminar Outputmarch12Berch MelendezNo ratings yet

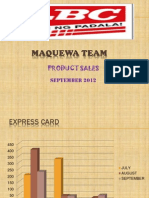

- Maque October 2012 Product Unit Sales ReportDocument2 pagesMaque October 2012 Product Unit Sales ReportBerch MelendezNo ratings yet

- PP Vs Nacua Drug CasesDocument4 pagesPP Vs Nacua Drug CasesBerch MelendezNo ratings yet

- ScrapDocument5 pagesScrapBerch MelendezNo ratings yet

- Product Unit Sales and Issuance - Maramag: Express Card RCBC Loading RTA SNSDocument16 pagesProduct Unit Sales and Issuance - Maramag: Express Card RCBC Loading RTA SNSBerch MelendezNo ratings yet

- Corporation Law Finals AnswerDocument2 pagesCorporation Law Finals AnswerBerch MelendezNo ratings yet

- Monthly Monitoring 2012Document5 pagesMonthly Monitoring 2012Berch MelendezNo ratings yet

- Maquewa Team July 2013 Sales and Issuance PerformanceDocument2 pagesMaquewa Team July 2013 Sales and Issuance PerformanceBerch MelendezNo ratings yet

- Nov. PresentationDocument9 pagesNov. PresentationBerch MelendezNo ratings yet

- Maque October 2012 Product Unit Sales ReportDocument2 pagesMaque October 2012 Product Unit Sales ReportBerch MelendezNo ratings yet

- PSPCA Authority Over Animal Cruelty CasesDocument11 pagesPSPCA Authority Over Animal Cruelty CasesBerch MelendezNo ratings yet

- Tel #. (088) 221-2231, Telefax # (088) 221-4281Document1 pageTel #. (088) 221-2231, Telefax # (088) 221-4281Berch MelendezNo ratings yet

- Tel #. (088) 221-2231, Telefax # (088) 221-4281Document1 pageTel #. (088) 221-2231, Telefax # (088) 221-4281Berch MelendezNo ratings yet

- Maquewa Team: ProductDocument9 pagesMaquewa Team: ProductBerch MelendezNo ratings yet

- Indigenous Cultural Communities Development Consultation MalaybalayDocument1 pageIndigenous Cultural Communities Development Consultation MalaybalayBerch MelendezNo ratings yet

- CorpoDocument2 pagesCorpoBerch MelendezNo ratings yet

- Motivation AprilDocument9 pagesMotivation AprilBerch MelendezNo ratings yet

- Activity Design Brgy 1Document1 pageActivity Design Brgy 1Berch Melendez100% (7)

- Rights & Obligations of Employers and Employees in the WorkplaceDocument3 pagesRights & Obligations of Employers and Employees in the WorkplaceBerch MelendezNo ratings yet

- FAS 140 Setoff Isolation Letter 51004Document15 pagesFAS 140 Setoff Isolation Letter 51004Madu El Musa Bey90% (10)

- Heirs of Salas vs. Laperal Realty CorpDocument2 pagesHeirs of Salas vs. Laperal Realty CorpAl DrinNo ratings yet

- AAO - SNITCH-ParCor Reviewer QuestionsDocument39 pagesAAO - SNITCH-ParCor Reviewer QuestionsKawaii SevennNo ratings yet

- 168 Reyes v. BancomDocument4 pages168 Reyes v. BancomAJ_123789No ratings yet

- ConsiderationDocument2 pagesConsiderationAkash MohantyNo ratings yet

- Revised Distillery Tender PDFDocument218 pagesRevised Distillery Tender PDFAmol DeshmukhNo ratings yet

- Document 1 - Staff Plus Applicant Filled Registration FormsDocument11 pagesDocument 1 - Staff Plus Applicant Filled Registration FormsEkam RaiNo ratings yet

- Form OC-10 Appl 4 FRNDocument51 pagesForm OC-10 Appl 4 FRNBenne James100% (4)

- Part 3 BibleDocument198 pagesPart 3 BibleTatiana Telles Ferreira100% (3)

- Connected Quizzing QuestionsDocument37 pagesConnected Quizzing QuestionsAnusha RamjattanNo ratings yet

- House Auction in Saujana PuchongDocument5 pagesHouse Auction in Saujana Puchongchek86351No ratings yet

- Lo v. KJS Eco-Formwork SystemDocument7 pagesLo v. KJS Eco-Formwork SystemNiel DabuetNo ratings yet

- Documentary Evidence of AuthorityDocument6 pagesDocumentary Evidence of AuthorityMichael Kovach100% (6)

- MPSADocument13 pagesMPSACris SosaNo ratings yet

- 3173 - Multiple Choice QuestionsDocument50 pages3173 - Multiple Choice Questionshyunsuk fhebieNo ratings yet

- Commercial Law Review TEXT, NOTES and CASESDocument168 pagesCommercial Law Review TEXT, NOTES and CASESRaikha D. BarraNo ratings yet

- Essentials of Contract Law 2nd Edition Frey Test Bank DownloadDocument4 pagesEssentials of Contract Law 2nd Edition Frey Test Bank DownloadWilliam Martin100% (23)

- Philippine Case Digests Databank QuotesDocument38 pagesPhilippine Case Digests Databank QuotesAnn DyNo ratings yet

- Conveyancing Cliffnotes ExplainedDocument32 pagesConveyancing Cliffnotes ExplainedhohoexeNo ratings yet

- Assignment No 27 Copyright Assignment DeedDocument5 pagesAssignment No 27 Copyright Assignment DeedAhmad AmmarNo ratings yet

- Montenegro Business Law GuideDocument72 pagesMontenegro Business Law GuideDhelio Heredia Ocampo100% (3)

- Legal Forms - GNDocument85 pagesLegal Forms - GNPau Teh100% (2)

- United States Court of Appeals First CircuitDocument8 pagesUnited States Court of Appeals First CircuitScribd Government DocsNo ratings yet

- Bonnevie vs. Hernandez DigestDocument2 pagesBonnevie vs. Hernandez DigestPaolo AdalemNo ratings yet

- Jose Dizon v. Alfredo Gaborro Land Sale DisputeDocument4 pagesJose Dizon v. Alfredo Gaborro Land Sale DisputeMac SorianoNo ratings yet

- Unit 1Document14 pagesUnit 1Mohammed HussainNo ratings yet

- Moon Land HimanshuDocument8 pagesMoon Land HimanshuHIMANSHU SHANDILYANo ratings yet

- Project Builders Inc Vs CADocument1 pageProject Builders Inc Vs CAsilosgrNo ratings yet

- Lease Extinguishment and Rights of PartiesDocument6 pagesLease Extinguishment and Rights of PartiesAngelica Nikki OlivarNo ratings yet

- PNR Not Liable to Agent; Real Party is PrincipalDocument2 pagesPNR Not Liable to Agent; Real Party is PrincipalSSNo ratings yet