Professional Documents

Culture Documents

Relevant Dates: 15-Apr Quarterly

Uploaded by

sanyu1208Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relevant Dates: 15-Apr Quarterly

Uploaded by

sanyu1208Copyright:

Available Formats

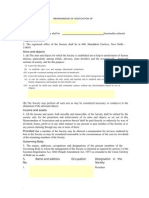

RELEVANT DATES

S.No. Act 1 Income Tax Act 1961 2 Income Tax Act 1961 (TDS Prov) 3 4 5 6 7 8 Income Tax Act 1961 Central Excise Act 1944 Apprentice Act,1961 EPF Scheme,1952 Central Excise Act 1944 Central Excise Act 1944 Relevant Dates 1-Apr 7-Apr 7-Apr 10-Apr 15-Apr 15-Apr 15-Apr 20-Apr 21-Apr 21-Apr 21-Apr 21-Apr 25-Apr 25-Apr 30-Apr 30-Apr 30-Apr 30-Apr 30-Apr 30-Apr 30-Apr Annual Monthly Monthly Monthly Half Yearly Monthly Quarterly Quarterly Monthly Quarterly Monthly Monthly Monthly Monthly Half Yearly Half Yearly Monthly Quarterly Annual Monthly Annual Monthly Quarterly Monthly Monthly Monthly Monthly Monthly Monthly Quarterly Monthly Monthly Monthly Monthly Monthly Quarterly Annual Activities Required Beginning of New Financial Year. TCS ( Not TDS ) collected to be Deposited for march 15G and 15H for March to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for March 2011 to be submitted Return to be submitted APP-2 upto March. EPF contribution amt to be deposited for march Qtrly return for excise for First Stage Dealer and Second stage Dealers for jan to march. Qtrly Excise Return ER-3 to Manufactureres availing SSI Exemption for March 2011 to be submitted Monthly MVAT Return to be submitted for March. Quarterly MVAT Return to be submitted for March qtr. If tax is bet. 1 lac to 10 lac.. WCT TDS Deposit for March ESI Contribution to be deposited for March. Service Tax Return for March EPF Monthly Return in Form 5,10 12A for March and Annual Return for last year in Form 3A/6A. Half Yearly WCT Return for Oct. to March MVAT Return for oct to march for Retailers who opted for Composition scheme. Monthly return for march. Quarterly return for jan to march Annual return for last year Monthly return for profeesion tax for march. For 31st march end , ESI Contribution Cards with Monthly deposit Challans to be submitted . TDS for march to be deposited . Jan to March qtrly return in Form ER-1 Service tax for April to be deposited Exicse Duty for April to be deposited TDS deducted /TCS collected to be Deposited for April. 15G and 15H for April to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for April to be submitted Form No.5 (Form 6) in triplicate with challans to be submitted. Qtly Return 15th May for qter ended 31st march Form 24Q, 26Q , 27EQ. EPF contribution amt to be deposited for April Monthly MVAT Return to be submitted for April. WCT TDS Deposit for April. ESI Contribution to be deposited for April. EPF Monthly Return in Form 5,10 12A for April Form 16A for TDS / Form 27D for TCS Certificate to other than salary (15 days from qtrly return filing ) Form 16 , TDS/TCS Certificate for employees to be issued by 31stMay of the FY immediately following the FY in which the income was paid and tax deducted. Monthly return for april Monthly return for profeesion tax for april Form No. 2A,6A and 7 to be submitted. Service tax for May to be deposited Exicse Duty for May to be deposited TDS deducted /TCS collected to be Deposited for May. 15G and 15H for May to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank

9 MVAT Act 2002 10 MVAT Act 2002 11 12 13 14 Works Contract (WCT) ESI Act 1948 Service Tax (Under Finance Act 1994) EPF Scheme,1952

15 Works Contract (WCT) 16 MVAT Act 2002 17 18 19 20 21 22 23 24 25 26 Luxury Tax Act 1987 Luxury Tax Act 1987 Luxury Tax Act 1987 Profession Tax , 1975 ESI Act 1948

Income Tax Act 1961 (TDS Prov) 30-Apr Employment Exchange(CNV) Act 1959 Rule 6 30-Apr Service Tax (Under Finance Act 1994) 5-May Central Excise Act 1944 5-May Income Tax Act 1961 (TDS Prov) 7-May 7-May 10-May 12-May 15-May 15-May 21-May 21-May 21-May 25-May 30-May 31-May

27 Income Tax Act 1961 28 Central Excise Act 1944 29 ESI Act 1948 30 Income Tax Act 1961 (TDS Prov) 31 32 33 34 35 36 EPF Scheme,1952 MVAT Act 2002 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Income Tax Act 1961 (TDS Prov)

37 Income Tax Act 1961 (TDS Prov)

38 39 40 41 42 43

Luxury Tax Act 1987 Profession Tax , 1975 EPF Scheme,1952 Service Tax (Under Finance Act 1994) Central Excise Act 1944 Income Tax Act 1961 (TDS Prov)

31-May 31-May 31-May 5-Jun 5-Jun 7-Jun 7-Jun

Monthly Monthly Annual Monthly Monthly Monthly Monthly

44 Income Tax Act 1961

45 Central Excise Act 1944 46 Income Tax Act 1961 47 48 49 50 51 52 53 54 55 56 57 EPF Scheme,1952 MVAT Act 2002 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Works Contract (WCT) Luxury Tax Act 1987 Profession Tax , 1975 Profession Tax , 1975 Service Tax (Under Finance Act 1994) Service Tax (Under Finance Act 1994)

10-Jun 15-Jun 15-Jun 21-Jun 21-Jun 21-Jun 25-Jun 30-Jun 30-Jun 30-Jun 30-Jun 5-Jul 5-Jul 5-Jul 7-Jul 7-Jul 10-Jul 15-Jul 15-Jul 15-Jul 15-Jul 15-Jul 20-Jul 21-Jul 21-Jul 21-Jul 21-Jul 25-Jul 30-Jul

Monthly Quarterly Monthly Monthly Monthly Monthly Monthly Annual Monthly Monthly Annual Monthly Quarterly Monthly Monthly Monthly Monthly Quarterly Monthly Half Yearly Quarterly Quarterly Quarterly Monthly Quarterly Monthly Monthly Monthly Annual

58 Central Excise Act 1944 59 Income Tax Act 1961 (TDS Prov) 60 Income Tax Act 1961 61 Central Excise Act 1944 62 Income Tax Act 1961 (TDS Prov) 63 EPF Scheme,1952 64 The Bombay Labour Welfare Fund Act 1953 65 Central Excise Act 1944 66 Central Excise Act 1944 67 Central Excise Act 1944 68 MVAT Act 2002 69 MVAT Act 2002 70 71 72 73 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 EPF Scheme,1952

Monthly Excise Return ER-1 / ER-2 for May. to be submitted Advance tax 1st instalment for Company assessee (15% of Estimated taxable Income) EPF contribution amt to be deposited for May Monthly MVAT Return to be submitted for May WCT TDS Deposit for May ESI Contribution to be deposited for May EPF Monthly Return in Form 5,10 12A for May Form 405 for last year WCT TDS Return Monthly return for May Monthly return for profeesion tax for May For current year new Enrollment in Profession tax. Service tax for June to be deposited Service tax for april to June qtr.to be deposited (Only for Individuals / Partnership Firms) Exicse Duty for June to be deposited TDS deducted /TCS collected to be Deposited for June 15G and 15H for June to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for June. to be submitted Qtly TDS / TCS Return 15th july for qter ended 30th june Form 24Q, 26Q , 27EQ. EPF contribution amt to be deposited for June BLWF contribution for Jan to June to be deposited. SSI Units required to deposit the excise duty for April to June quarter FSD/SSD required to file Excise return SSI Units required to file the excise return in form no. ER-3 for April to June quarter Monthly MVAT Return to be submitted for June. Quarterly MVAT Return to be submitted for June qtr. If tax is bet. 1 lac to 10 lac.. WCT TDS Deposit for June ESI Contribution to be deposited for June EPF Monthly Return in Form 5,10 12A for June EPF Contribution Cards with Monthly deposit Challans and Return to be submitted ,for 31st march end. Form 24 required to be submitted Form 16A for TDS / Form 27D for TCS Certificate to other than salary (15 days from qtrly return filing ) April to june qtrly return in Form ER-1 Filing of Income Tax and wealth tax return for assesses who are not required to get their accounts audited. Monthly return for June Quarterly return for April to june Monthly return for profeesion tax for June BLWF Act , amount not to be paid to workers should be deposited before this date. Service tax for July to be deposited Exicse Duty for July to be deposited TDS deducted /TCS collected to be Deposited for July 15G and 15H for July to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for July. to be submitted EPF contribution amt to be deposited for July Monthly MVAT Return to be submitted for July WCT TDS Deposit for July ESI Contribution to be deposited for July EPF Monthly Return in Form 5,10 12A for July Annual information Return to be submitted by specified assessees to IT Dept .

74 Contract Labour Act 1970 75 Income Tax Act 1961 (TDS Prov)

30-Jul 30-Jul

Annual Quarterly Quarterly Annual

76 Employment Exchange(CNV) Act 1959 Rule 6 30-Jul 77 Income Tax Act 1961 31-Jul

78 79 80 81

Luxury Tax Act 1987 Luxury Tax Act 1987 Profession Tax , 1975 The Bombay Labour Welfare Fund Act 1953

31-Jul 31-Jul 31-Jul 31-Jul 5-Aug 5-Aug 7-Aug 7-Aug 10-Aug 15-Aug 21-Aug 21-Aug 21-Aug 25-Aug 31-Aug

Monthly Quarterly Monthly Half Yearly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Annual

82 Service Tax (Under Finance Act 1994) 83 Central Excise Act 1944 84 Income Tax Act 1961 (TDS Prov) 85 Income Tax Act 1961 86 Central Excise Act 1944 87 88 89 90 91 92 EPF Scheme,1952 MVAT Act 2002 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Income Tax Act 1961

93 94 95 96 97

Luxury Tax Act 1987 Profession Tax , 1975 Service Tax (Under Finance Act 1994) Central Excise Act 1944 Income Tax Act 1961 (TDS Prov)

31-Aug 31-Aug 5-Sep 5-Sep 7-Sep 7-Sep 10-Sep 15-Sep 15-Sep 15-Sep 25-Sep 30-Sep

Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Quarterly Quarterly Monthly Annual

98 Income Tax Act 1961 99 Central Excise Act 1944 100 EPF Scheme,1952 101 Income Tax Act 1961 102 Income Tax Act 1961 103 EPF Scheme,1952 104 Income Tax Act 1961

105 106 107 108

Luxury Tax Act 1987 Profession Tax , 1975 Service Tax (Under Finance Act 1994) Service Tax (Under Finance Act 1994)

30-Sep 30-Sep 5-Oct 5-Oct 5-Oct 7-Oct 7-Oct

Monthly Monthly Monthly Quarterly Monthly Monthly Monthly

109 Central Excise Act 1944 110 Income Tax Act 1961 (TDS Prov) 111 Income Tax Act 1961

112 Central Excise Act 1944 113 Central Excise Act 1944 114 Income Tax Act 1961 (TDS Prov) 115 EPF Scheme,1952 116 Central Excise Act 1944 117 Apprentice Act,1961 118 Central Excise Act 1944 119 MVAT Act 2002 120 MVAT Act 2002 121 122 123 124 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Central Excise Act 1944

10-Oct 14-Oct 15-Oct 15-Oct 15-Oct 15-Oct 20-Oct 21-Oct 21-Oct 21-Oct 21-Oct 25-Oct 25-Oct 30-Oct

Monthly Quarterly Quarterly Monthly Quarterly Half Yearly Quarterly Monthly Quarterly Monthly Monthly Monthly Half Yearly Annual

Monthly return for July Monthly return for profeesion tax for July Service tax for August to be deposited Exicse Duty for August to be deposited TDS deducted /TCS collected to be Deposited for August 15G and 15H for August to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for August to be submitted EPF contribution amt to be deposited for August Advance tax 2nd instalment for Company assessee (45% of Estimated taxable Income) Advance tax 1st instalment for non - Company assessee (30% of Estimated taxable Income) EPF Monthly Return in Form 5,10 12A for August Company Assessees which are required to be audited and the The partners of a firm which are required to be audited u/s 44AB. Monthly return for August Monthly return for profeesion tax for August Service tax for September to be deposited Service tax for July to September qtr.to be deposited (Only for Individuals / Partnership Firms) Exicse Duty for September to be deposited TDS deducted /TCS collected to be Deposited for September 15G and 15H for September to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for September. to be submitted SSI Units required to deposit the excise duty for July to September quarter Qtly Return 15th oct for qter ended 30th sept.Form 24Q, 26Q , 27EQ. EPF contribution amt to be deposited for September FSD/SSD required to file Excise return for July to September quarter Return to be submitted APP-2 upto September SSI Units required to file the excise return in form no. ER-3 for July to September quarter Monthly MVAT Return to be submitted for September. Quarterly MVAT Return to be submitted for September qtr. If tax is bet. 1 lac to 10 lac.. WCT TDS Deposit for September ESI Contribution to be deposited for September EPF Monthly Return in Form 5,10 12A for August Half yearly service tax return of Taxable service provided for April to September. For 31st march end , ESI Return with contribution Cards with Monthly deposit Challans to be submitted . MVAT Half Yearly return for those assessees whose tax liability is < 1 lac. Form 16A for TDS / Form 27D for TCS Certificate to other than salary (15 days from qtrly return filing ) July to Sept. qtrly return in Form ER-1 MVAT Return for jan to september for Retailers who opted for Composition scheme. Monthly return for profeesion tax for September Monthly return for September Quarterly return for July to September. Factory Licence Renewal Form No.3 Registered Certificate to be Renewed by Principle Employer, under Contract Labour Act. Service tax for October to be deposited

125 ESI Act 1948

126 MVAT Act 2002 127 Income Tax Act 1961 (TDS Prov)

30-Oct 30-Oct

Half Yearly Quarterly Quarterly Half Yearly Monthly Monthly Quarterly Annual Annual Monthly

128 Employment Exchange(CNV) Act 1959 Rule 6 30-Oct 129 MVAT Act 2002 31-Oct 130 131 132 133 134 Profession Tax , 1975 Luxury Tax Act 1987 Luxury Tax Act 1987 Factory Act 1948 Contract Labour Act 1970 31-Oct 31-Oct 31-Oct 31-Oct 31-Oct 5-Nov

135 Service Tax (Under Finance Act 1994)

136 Central Excise Act 1944 137 Income Tax Act 1961 (TDS Prov) 138 Income Tax Act 1961

5-Nov 7-Nov 7-Nov

Monthly Monthly Monthly

Exicse Duty for October to be deposited TDS deducted /TCS collected to be Deposited for October 15G and 15H for October to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for October to be submitted Form No.6 in triplicate , Return of contribution is required to be submitted. EPF contribution amt to be deposited for October SSI Units required to deposit the excise duty for October Form B to be submitted for Renewal of Registration. (15Nov. to15Dec.) Monthly MVAT Return to be submitted for October WCT TDS Deposit for October ESI Contribution to be deposited for October EPF Monthly Return in Form 5,10 12A for October Monthly return for profeesion tax for October Monthly return for October Annual Financial Information Statement for last year in ER -4 for those assesses who are paying duty above 1 crore (PLA or CENVAT or both) Application Form I amnd IV to be submitted for getting approval of Holidays. Form APP-3 to be submitted Company assessees whom Sec 92E Transfer Pricing Reports in Form 3CEB required to be submitted, the last date for filing Return u/s 139 Date for Bonus amount distribution. Service tax for November to be deposited Exicse Duty for November to be deposited TDS deducted /TCS collected to be Deposited for November 15G and 15H for November to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for November to be submitted Advance tax 3rd instalment for Company assessee (75% of Estimated taxable Income) Advance tax 1st instalment for non - Company assessee (60% of Estimated taxable Income) EPF contribution amt to be deposited for November Form B to be submitted for Renewal of Registration. (15Nov. to15Dec.) Monthly MVAT Return to be submitted for November WCT TDS Deposit for Novemberr ESI Contribution to be deposited for November EPF Monthly Return in Form 5,10 12A for November Annual return for last year in Form D required to be submitted. Monthly return for November Monthly return for profeesion tax for November List of holidays in the coming year requirede to be submitted at Factory Office. Service tax for December to be deposited Service tax for October to December qtr.to be deposited (Only for Individuals / Partnership Firms) Exicse Duty for December to be deposited TDS deducted /TCS collected to be Deposited for December 15G and 15H for December to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for December to be submitted

139 Central Excise Act 1944 140 ESI Act 1948 141 EPF Scheme,1952 142 Central Excise Act 1944

10-Nov 10-Nov 15-Nov 15-Nov

Monthly Annual Monthly Monthly Annual Monthly Monthly Monthly Monthly Monthly Monthly Annual

143 The Bombay Shop & Establishment Act, 194815-Nov 144 145 146 147 148 149 150 MVAT Act 2002 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Profession Tax , 1975 Luxury Tax Act 1987 Central Excise Act 1944 21-Nov 21-Nov 21-Nov 25-Nov 30-Nov 30-Nov 30-Nov

151 The National and Festival Holiday Act 152 Apprentice Act,1961 153 Income Tax Act 1961

30-Nov 30-Nov 30-Nov

Annual Annual Annual

154 155 156 157

Bonus Act Service Tax (Under Finance Act 1994) Central Excise Act 1944 Income Tax Act 1961 (TDS Prov)

30-Nov 5-Dec 5-Dec 7-Dec 7-Dec

Annual Monthly Monthly Monthly Monthly

158 Income Tax Act 1961

159 Central Excise Act 1944 160 Income Tax Act 1961 161 Income Tax Act 1961

10-Dec 15-Dec 15-Dec

Monthly Quarterly Quarterly Monthly Monthly Monthly Monthly Monthly Monthly Annual Monthly Monthly Annual Monthly Quarterly Monthly Monthly Monthly

162 EPF Scheme,1952 15-Dec 163 The Bombay Shop & Establishment Act, 194815-Dec 164 165 166 167 168 MVAT Act 2002 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Bonus Act 21-Dec 21-Dec 21-Dec 25-Dec 30-Dec 31-Dec 31-Dec 31-Dec 5-Jan 5-Jan 5-Jan 7-Jan 7-Jan

169 Luxury Tax Act 1987 170 Profession Tax , 1975 171 Factory Act 1948 172 Service Tax (Under Finance Act 1994) 173 Service Tax (Under Finance Act 1994) 174 Central Excise Act 1944 175 Income Tax Act 1961 (TDS Prov) 176 Income Tax Act 1961

177 Central Excise Act 1944

10-Jan

Monthly

178 Income Tax Act 1961 (TDS Prov) 179 EPF Scheme,1952 180 Central Excise Act 1944 181 Central Excise Act 1944 182 Meternity Benefit Act 1961 183 Central Excise Act 1944 184 MVAT Act 2002 185 MVAT Act 2002 186 187 188 189 190 Works Contract (WCT) ESI Act 1948 Industrial Disputes Act 1947 EPF Scheme,1952 Income Tax Act 1961 (TDS Prov)

15-Jan 15-Jan 15-Jan 15-Jan 15-Jan 20-Jan 21-Jan 21-Jan 21-Jan 21-Jan 21-Jan 25-Jan 30-Jan

Quarterly Monthly Quarterly Quarterly Annual Quarterly Monthly Quarterly Monthly Monthly Annual Monthly Quarterly Quarterly Annual Monthly Monthly Quarterly Annual Annual Annual Annual Half Yearly Monthly Monthly Monthly Monthly

191 Employment Exchange(CNV) Act 1959 Rule 6 30-Jan 192 MVAT Act 2002 31-Jan 193 194 195 196 197 198 199 200 201 202 203 Profession Tax , 1975 Luxury Tax Act 1987 Luxury Tax Act 1987 Factory Act 1948 Workmen Compensation Act 1923 The National and Festival Holiday Act The Bombay Labour Welfare Fund Act 1953 The Bombay Labour Welfare Fund Act 1953 Service Tax (Under Finance Act 1994) Central Excise Act 1944 Income Tax Act 1961 (TDS Prov) 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan 31-Jan 5-Feb 5-Feb 7-Feb 7-Feb

204 Income Tax Act 1961

Qtly Return 15th jan for qter ended 31st dec Form 24Q, 26Q , 27EQ. EPF contribution amt to be deposited for December SSI Units required to deposit the excise duty for October to December quarter FSD/SSD required to file Excise return for October to December quarter Return in Form 11 required to be submitted. SSI Units required to file the excise return in form no. ER-3 for October to December quarter Monthly MVAT Return to be submitted for December. Quarterly MVAT Return to be submitted for December qtr. If tax is bet. 1 lac to 10 lac.. WCT TDS Deposit for December ESI Contribution to be deposited for December Annual Return in Form XV EPF Monthly Return in Form 5,10 12A for December Form 16A for TDS / Form 27D for TCS Certificate to other than salary (15 days from qtrly return filing ) October to December qtrly return in Form ER-1 Audit Report in Form E-704 required to be submitted. Monthly return for profeesion tax for December Monthly return for December Quarterly return for October to December quarter . Annual return in Form No.27 require to be submitted. Annual Return Annual Return in Form V Transfer Unpaid accumulations to Welfare Commissioner Deposit the contributions for July to December Service tax for January to be deposited Exicse Duty for January to be deposited TDS deducted /TCS collected to be Deposited for January 15G and 15H for January to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for January to be submitted EPF contribution amt to be deposited for January Form No.30 ( Accident register) required to be submitted at Factory Office. Annual Return in Form XXI in duplicate required to submitted by Principal Employer Monthly MVAT Return to be submitted for January WCT TDS Deposit for January ESI Contribution to be deposited for January EPF Monthly Return in Form 5,10 12A for January Monthly return for January Monthly return for profeesion tax for January Service tax for February to be deposited Exicse Duty for February to be deposited TDS deducted /TCS collected to be Deposited for February 15G and 15H for February to be submmitted to Income Tax Dept online, CA Certificate and to SBI Bank Monthly Excise Return ER-1 / ER-2 for February to be submitted Advance tax 4th instalment for Company assessee (100% of Estimated taxable Income) Advance tax 3rd instalment for non - Company assessee (100% of Estimated taxable Income) EPF contribution amt to be deposited for February Monthly MVAT Return to be submitted for February WCT TDS Deposit for February ESI Contribution to be deposited for February

205 Central Excise Act 1944 206 EPF Scheme,1952 207 Factory Act 1948 208 Contract Labour Act 1970 209 210 211 212 213 214 215 216 217 MVAT Act 2002 Works Contract (WCT) ESI Act 1948 EPF Scheme,1952 Luxury Tax Act 1987 Profession Tax , 1975 Service Tax (Under Finance Act 1994) Central Excise Act 1944 Income Tax Act 1961 (TDS Prov)

10-Feb 15-Feb 15-Feb 15-Feb 21-Feb 21-Feb 21-Feb 25-Feb 28-Feb 28-Feb 5-Mar 5-Mar 7-Mar 7-Mar

Monthly Monthly Annual Annual Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly Monthly

218 Income Tax Act 1961

219 Central Excise Act 1944 220 Income Tax Act 1961 221 Income Tax Act 1961 222 223 224 225 EPF Scheme,1952 MVAT Act 2002 Works Contract (WCT) ESI Act 1948

10-Mar 15-Mar 15-Mar 15-Mar 21-Mar 21-Mar 21-Mar

Monthly Quarterly Quarterly Monthly Monthly Monthly Monthly

226 EPF Scheme,1952 227 Income Tax Act 1961 228 Profession Tax , 1975 229 Profession Tax , 1975 230 Luxury Tax Act 1987 231 Service Tax (Under Finance Act 1994) 232 Service Tax (Under Finance Act 1994) 233 Central Excise Act 1944 234 Central Excise Act 1944

25-Mar 31-Mar 31-Mar 31-Mar 31-Mar 31-Mar 31-Mar 31-Mar 31-Mar

Monthly Annual Monthly Annual Monthly Monthly Quarterly Monthly Quarterly

EPF Monthly Return in Form 5,10 12A for February Last date for filing of Income Tax return with interest without penalty (after that u/s 271F pay Rs. 5000/-) Monthly return for profeesion tax for Februray Annual Return for 1st march to 28th Feb for those assessess whose liability is below Rs.5000/Monthly return for Februray Service tax for March to be deposited Service tax for Jan to March qtr.to be deposited (Only for Individuals / Partnership Firms) Exicse Duty for March to be deposited SSI Units required to deposit the excise duty for Jan to March quarter

You might also like

- ESI & PF Brief InformationDocument8 pagesESI & PF Brief InformationPrashant Dhangar0% (1)

- Monthwise Checklist For Submission of Various ReturnsDocument3 pagesMonthwise Checklist For Submission of Various ReturnsBapusaheb GuthaleNo ratings yet

- Statutory Labour Law MaintenanceDocument6 pagesStatutory Labour Law MaintenanceGURMUKH SINGHNo ratings yet

- Statutory Compliances - GeneralDocument25 pagesStatutory Compliances - GeneralajaydhageNo ratings yet

- PF & ESI Compliance GuideDocument15 pagesPF & ESI Compliance GuideAbdul KhadhirNo ratings yet

- Check List of All Labour LawsDocument16 pagesCheck List of All Labour LawsGoutham ShettyNo ratings yet

- Employee Provident Fund ComplianceDocument3 pagesEmployee Provident Fund ComplianceAswanth GokaNo ratings yet

- Provident Fund Full DetailsDocument5 pagesProvident Fund Full DetailsGaurav VijayNo ratings yet

- Statutory Check List 927Document62 pagesStatutory Check List 927Saravana KumarNo ratings yet

- Month Wise Checklist For Submission of Various ReturnsDocument3 pagesMonth Wise Checklist For Submission of Various ReturnsKS Jagadish100% (1)

- Month Wise Checklist For Submission of Various ReturnsDocument3 pagesMonth Wise Checklist For Submission of Various Returnsadith24No ratings yet

- Statutory ComplianceDocument2 pagesStatutory Compliancemax997No ratings yet

- Cheklist For Employers: Statutory Deposits & ReturnsDocument4 pagesCheklist For Employers: Statutory Deposits & ReturnsVas VasakulaNo ratings yet

- Acts RegisterDocument3 pagesActs Registersheru006No ratings yet

- EPF CalenderDocument1 pageEPF CalenderAmitav TalukdarNo ratings yet

- RegistrationDocument15 pagesRegistrationpratikdhond100% (3)

- Kar Shops Commercial Forms FormatDocument16 pagesKar Shops Commercial Forms FormatbelvaisudheerNo ratings yet

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocument52 pagesCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGNo ratings yet

- Calculate income tax liability under old and new tax regimesDocument6 pagesCalculate income tax liability under old and new tax regimesJigeesha BhargaviNo ratings yet

- Esic ChallanDocument7 pagesEsic Challanrgsr2008No ratings yet

- Contract Labour RegisterDocument34 pagesContract Labour Registerravinder.singh19853857No ratings yet

- PF Pension Settlement Form-TCSDocument4 pagesPF Pension Settlement Form-TCSSridhara Krishna BodavulaNo ratings yet

- EPF Book PDFDocument47 pagesEPF Book PDFKrishnarao MadhurakaviNo ratings yet

- Overtime Allowance Eligibility and RatesDocument3 pagesOvertime Allowance Eligibility and RatesKumudha Devi100% (1)

- Karnataka Shops and Commercial Establishments Act, 1961Document44 pagesKarnataka Shops and Commercial Establishments Act, 1961Latest Laws TeamNo ratings yet

- INCOME UNDER SALARIESDocument44 pagesINCOME UNDER SALARIEShny0910No ratings yet

- All Forms Under Factories Act 1948Document2 pagesAll Forms Under Factories Act 1948jagshishNo ratings yet

- Compliance PDFDocument20 pagesCompliance PDFSUBHANKAR PALNo ratings yet

- Salary AdministrationDocument17 pagesSalary AdministrationMae Ann GonzalesNo ratings yet

- Form No. 9: (See Rule 107)Document1 pageForm No. 9: (See Rule 107)13sandipNo ratings yet

- Benefits & Contributory Conditions: (I) (A) Sickness BenefitDocument4 pagesBenefits & Contributory Conditions: (I) (A) Sickness BenefitKunwar Sa Amit SinghNo ratings yet

- ECR PreparationDocument6 pagesECR Preparationkunalaggarwal123100% (10)

- Labour Law Compliance Due DatesDocument4 pagesLabour Law Compliance Due DatesAchuthan RamanNo ratings yet

- Gratuity ActDocument34 pagesGratuity Actapi-369848680% (5)

- Family Pension SchemeDocument15 pagesFamily Pension SchemeJitu Choudhary100% (1)

- International J. Seed Spices Growth RatesDocument4 pagesInternational J. Seed Spices Growth Ratesmohan rathoreNo ratings yet

- Attendance Register FormatDocument1 pageAttendance Register Formatvishal_mtoNo ratings yet

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACADocument25 pagesSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalNo ratings yet

- USSP User Manual v1.0Document18 pagesUSSP User Manual v1.0Siva ChNo ratings yet

- Anirudh Kumar JainDocument4 pagesAnirudh Kumar JainAnirudh JainNo ratings yet

- Income Tax DepartmentDocument19 pagesIncome Tax DepartmentSharathNo ratings yet

- Labour Laws - SimpleDocument17 pagesLabour Laws - SimpleSaranya Vijayakumar100% (1)

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- Online Registration of Establishment With DSC: User ManualDocument39 pagesOnline Registration of Establishment With DSC: User ManualroseNo ratings yet

- ESIC e-Pehchan Card BenefitsDocument3 pagesESIC e-Pehchan Card BenefitsGoutam HotaNo ratings yet

- Employee Pension SchemeDocument6 pagesEmployee Pension SchemeAarthi PadmanabhanNo ratings yet

- Form of Pension Proposals FormDocument14 pagesForm of Pension Proposals Formlakshmi naryanaNo ratings yet

- EPF Provident Fund CalculatorDocument6 pagesEPF Provident Fund CalculatorUtkal SolankiNo ratings yet

- PF & Esi ChallanDocument19 pagesPF & Esi ChallanSatyam mishra0% (1)

- Registers and reports required under Factories ActDocument2 pagesRegisters and reports required under Factories ActSanjay SinghNo ratings yet

- Aparajitha - HR Compliance ServicesDocument6 pagesAparajitha - HR Compliance ServicessunilboyalaNo ratings yet

- CCENT Notes Part-3Document63 pagesCCENT Notes Part-3Anil JunagalNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet

- Statutory Compliance ChecklistDocument5 pagesStatutory Compliance ChecklistMuthu ManikandanNo ratings yet

- Due Date Wise Tax AlertDocument1 pageDue Date Wise Tax AlertCA Arpit YadavNo ratings yet

- Checklist: Statutory Compliances by Employers For Statutory Deposits, Returns & InformationDocument25 pagesChecklist: Statutory Compliances by Employers For Statutory Deposits, Returns & Informationप्रदीप मिश्रNo ratings yet

- 12 Compliance ChartDocument19 pages12 Compliance CharttabrezullakhanNo ratings yet

- TAX AND REGULATORY COMPLIANCE CALENDARDocument6 pagesTAX AND REGULATORY COMPLIANCE CALENDARRohit KariwalaNo ratings yet

- Statutory Due Date For F y 15 16Document1 pageStatutory Due Date For F y 15 16rajdeeppawarNo ratings yet

- Financial Due Date ReminderDocument16 pagesFinancial Due Date ReminderSureshArigelaNo ratings yet

- MCADocument100 pagesMCAsanyu1208No ratings yet

- Due Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSDocument1 pageDue Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSsanyu1208No ratings yet

- Aaghat2 4Document138 pagesAaghat2 4parashuram maliNo ratings yet

- Non-Vegetarian Meal Plan by Age - 12 MonthsDocument4 pagesNon-Vegetarian Meal Plan by Age - 12 Monthssanyu1208No ratings yet

- E Book Listjan 2014 Cute2Document38 pagesE Book Listjan 2014 Cute2Baburao BadweNo ratings yet

- Uidai Om On e Aadhaar Validity PDFDocument2 pagesUidai Om On e Aadhaar Validity PDFsanyu1208No ratings yet

- Read MeDocument1 pageRead Mesanyu1208No ratings yet

- Multi Level Numbering Kamaraj ManiDocument6 pagesMulti Level Numbering Kamaraj Manisanyu1208No ratings yet

- Partition DeedDocument2 pagesPartition Deedsanyu1208No ratings yet

- A S Shenoy Paper Child AdoptionDocument6 pagesA S Shenoy Paper Child AdoptionTaannyya TiwariNo ratings yet

- Sap Screenshots FileDocument30 pagesSap Screenshots Filesanyu1208No ratings yet

- WillDocument2 pagesWillsanyu1208No ratings yet

- 40 51320 G Flash September Issue 1Document20 pages40 51320 G Flash September Issue 1sanyu1208No ratings yet

- 8 MAR Z013: Node - , LLDocument1 page8 MAR Z013: Node - , LLsanyu1208No ratings yet

- Vegetarian Meal Plan by Age - 12 MonthsDocument4 pagesVegetarian Meal Plan by Age - 12 Monthssanyu1208No ratings yet

- Results of Global Online Referendum: GenderDocument5 pagesResults of Global Online Referendum: Gendersanyu1208No ratings yet

- Partition DeedDocument2 pagesPartition Deedsanyu1208No ratings yet

- 7 Moa SocietyDocument3 pages7 Moa SocietySAJITHNo ratings yet

- Declaration Regarding Permanent Account Number1Document1 pageDeclaration Regarding Permanent Account Number1sanyu1208No ratings yet

- 18 Reg SocietyDocument5 pages18 Reg Societysanyu1208No ratings yet

- Govt Lokpal Bill Vs Jan Lokpal BillDocument6 pagesGovt Lokpal Bill Vs Jan Lokpal BillOutlookMagazine100% (1)

- Income Tax Form 12BDocument3 pagesIncome Tax Form 12BlktyagiNo ratings yet

- Covering Sheet For Investment Proof 2011-12Document1 pageCovering Sheet For Investment Proof 2011-12sanyu1208No ratings yet

- Govt Lokpal Bill 2011 - सरकारी लोकपाल बिल 2011Document41 pagesGovt Lokpal Bill 2011 - सरकारी लोकपाल बिल 2011Shivendra Singh ChauhanNo ratings yet

- Ramraksha StotraDocument4 pagesRamraksha StotraDeoxinNo ratings yet

- Aarti LaxmiDocument1 pageAarti LaxmidaqttdNo ratings yet

- Leave Application FormatDocument1 pageLeave Application Formatsanyu1208No ratings yet

- Driver Salary Claim FormatDocument1 pageDriver Salary Claim Formatsanyu1208No ratings yet

- Statement For Other IncomeDocument2 pagesStatement For Other Incomesanyu1208No ratings yet

- Investment ProofDocument6 pagesInvestment Proofsanyu1208No ratings yet