Professional Documents

Culture Documents

Cost Reconcillation

Uploaded by

mahendrabpatelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Reconcillation

Uploaded by

mahendrabpatelCopyright:

Available Formats

1

Reconciliation:

Reconciliation: 1. Reconciliation of cost and financial accounts in the modern computer age is redundant. Comment. Ans: In the modern computer age the use of computer knowledge and accounting softwares has helped the field of Financial and Cost Accounting in a big way. In fact, computers work at a very high speed and can process voluminous data generating desired output in no time. utput produced is precise and accurate. Computers can work for hours without any fatigue. !hey can bring out different Financial Accounting and Cost Accounting statements and reports accurately in a presentable form. Financial accounts and Cost accounts show their results accurately and precisely, when maintained on a computer system, but the profit shown by one set of books may not agree with that of the other set. !he main reasons for the disagreement of the profit figures shown by the two set of books is the absence of certain items which appear in financial books only and are not recorded in cost accounting books. "imilarly, there may be some items which appear in cost accounts but do not find a place in the financial books. "ome e#amples which affects it are as below : i.. ii. iii. iv. v. vi. vii. viii. i#. * $oss % profit on sale of fi#ed assets. &#penses on stamp duty, discount and other e#penses relating to the issue and transfer of shares and debentures. Fee received on issue and transfer of shares etc. Interest on bank loan, mortgage etc. Interest received on bank deposits and other investments. Fines and penalties 'ividend received on investments in shares. (ental income etc. )nder or over recovered e#penses. 'ifference due to varying basis of valuation of stock or in the matter of charging depreciation.

)nder the situation of differential profit figure shown by financial and cost accounts, it is necessary to reconcile the results +profit%loss, shown. "uch a reconciliation proves arithmetical accuracy of data, e#plains reasons for the difference in the two sets of books and affords reliability to them. -ence, the reconciliation of cost and financial accounts is essential and not redundant even in the modern age of computer. 2. Need for reconciliation: .hen cost and financial accounts are maintained separately, the profit shown by one set of books may not agree with that of the other set. In such a situation, it becomes necessary to reconcile the results +profit%loss, shown by two sets of books. Causes for difference between/ profit shown by cost and financial accounts !here are certain items, which appear in financial books only and are not recorded in cost accounting books e.g. loss on sale of fi#ed assets/ e#penses on stamp duty/ interest on bank loan etc. "imilarly, there may be some items, which appear in cost accounts only and do not find a place in the financial books e.g. notional rent/ notional interest etc., In cost accounts, overheads are generally absorbed on the basis of a pre0determined overhead rate, whereas in financial accounts actual e#penditure on overheads is recorded, this will also cause a difference between the figures of profit shown under financial and cost accounts.

'ifferent methods of valuation of closing stock adopted in cost and financial a accounts will also cause a difference in the results shown by the two sets of books. In financial accounts the method generally followed is cost or market price, whichever is less whereas in cost accounts different methods of pricing of material issues such as $IF , FIF , average etc are used. )se of different methods of depreciation is also responsible for the variation of profit shown by two sets of books. In financial accounts, depreciation may be charged according to writt1en down value method whereas in cost accounts it may be charged on the basis of the life of the machine. Abnormal items not included in cost accounts also causes a difference in profit. If such items of e#penses are included, cost ascertained will not be correct. 3. What are the reasons for disagreement of Profits as per Financial accounts and Cost accounts ? Ans: (easons for disagreement of 23rofits as per Financial accounts and Cost accounts are as below. !here are certain items which are included in Financial accounts but not in Cost accounts. $ikewise there are certain items which are in Cost accounts but not Financial accounts. &#amples of financial charges which appear only in financial books are : i. ii. iii. iv. $oss on the sale of fi#ed assets and investments. Interest on bank loans, mortgage etc. &#penses relating to the issue and transfer of shares and debentures like stamps duty e#penses/ discount on shares and debentures etc. 3enalties and fines.

&#amples of income which are recorded in the financial books only are : i. ii. iii. iv. v. 3rofit on the sale of investments and fi#ed assets. Interest received on investments and bank deposits. 'ividend received on investment in shares. Fees received on issue and transfer of shares etc. (ental income.

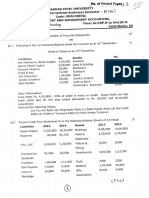

!here are abnormal or special items of e#penditure and income which are not included in the cost of production. !heir inclusion in cost of production, would result into incorrect cost ascertainment. 'ifferent bases of charging depreciation also accounts for the disagreement of profits as per financial and cost accounts. 'ifferent methods of valuation of closing stock adopted in cost and financial accounts will also account for the difference in profits under financial and cost accounts. 1. !he following figures have been e#tracted from the Cost (ecords of a manufacturing unit: "tores : pening 4alance 3urchases !ransfers from work0in03rogress Issues to work0in03rogress Issues to (epairs and 9aintenance 'eficiencies found in stock taking .ork0in03rogress : pening 4alance (s. 15,555 6,75,555 85,555 6,75,555 :5,555 7,555 75,555

'irect .ages applied verheads applied Closing balance . thers : wages incurred (s. =5,555 / verhead incurred (s. :,>5,555.

75,555 :,;5,555 ;5,555

Finished products : &ntire output is sold at a profit of 65< on actual cost from work0in0progress

Items not included in Cost (ecords : Income from investments (s. 65,555 . 3rofit and $oss Account, 3rofit ? $oss Account and (econciliation statement. 2. !he following information is available from the financial books of a company having a normal production capacity of 75,555 units for the year ended 16st 9arch, :55;. : +i, +ii, . +iii, +iv, +v, +vi, +vii, 'irect material and direct wages cost were (s,>,55,555 and (s.:,>5,555 respectively. Actual factory e#penses were (s.6,>5,555 of which 75< are fi#ed. Actual administrative e#penses were (s.;>,555 which are complete fi#ed. Actual selling and distribution e#penses were (s.15,555 of which ;5< are fi#ed. Interest and dividends received (s.6>,555. "ales (s.65,55,555 +>5,555 units,. !here was no opening and closing stock of finished units

@ou are reAuired to : +a, +b, +c , 3. Find out profit as per financial books for the year ended 16st 9arch, :55; / 3repare the cost sheet and ascertain the profit as per cost accounts for the ended 16 st 9arch, :55;. assuming that the indirect e#penses are absorbed on the basis of normal production capacity/ and 3repare a statement reconciling profits shown by financial and cost books.

!he financial records of 9odern $td. reveal the following for the year ended 15.7.:551 : "ales +:5,555 units,. 9aterials .ages Factory verheads ffice and Administrative verheads "elling and 'istribution verheads Finished Boods +6,:15 units,. .ork in 3rogress : 9aterials $abour verhead +Factory, Boodwill written off. Interest of Capital (s. In thousands. ;,555 6,755 855 =:5 ;67 :88 :;5 ;8 1: 66: 1:5 1:

In the Costing (ecords, factory overheads is charged at 655< wages, administration overhead 65< of conversion cost and selling and distribution overhead at the rate of (s. 67 per unit sold.

3repare a statement reconciling the 3rofit as per cost records with the 3rofit as per financial records of the Company. . !he financial 3rofit and $oss Account for the year ended last of a company shows a net profit of (s. 1>,;>,555. 'uring the course of Cost Audit it was noticed that : +I, +ii, +iii, +iv, +v, +vi, the Company was engaged in trading activity by purchasing goods at (s. ;,55,555 and selling it for (s. >,55,555 after incurring an e#penditure of (s. :>,555. "ome old assets were sold off at the year end fetching a profit of (s. 75,555. A maCor overhaul of machinery is carried out at a cost of (s. 6:,55,555 and the ne#t such overhaul will be done only after three years. Interest was received amounting to (s. :,55,555 from outside investments. 'epreciation to the e#tent of (s. :,>5,555 was provided on the revaluation value of assets. .ork0in0progress valuation for financial accounts does not as a practice take into account factory overheads. !his amount was (s. :,;>,555 in opening ..I.3. and (s. 1,=>,555 in closing ..I.3.

.ork out the profit as per Cost Accounts and briefly e#plain the adCustment if any carried out. !. A firm of "ports &Auipment commenced business on 6%;%51 for manufacturing : varieties of bat. 2"eniorD and 2sub0CuniorD. !he following information has been e#tracted from the accounts records for the half0year period ended 15%E%51. : (s. +.i, Average material cost per piece of 2"eniorD bat 85 +ii, Average material cost per piece of 2"ub0CuniorD bat 75 +iii, Average cost of labour per piece of 2"eniorD bat 6;5 +iv, Average cost of labour per piece of 2"ub0CuniorD bat 665 +v, Finished goods sold : "enior 155 pieces "ub0Cunior =55 pieces "ale price : 00 per piece of 2"eniorD bat 00 per piece of 2sub0CuniorD bat >55 1E5

+vi,

+vii, +viii,

.ork overhead %e#penses incurred during the period 6,:5,555 ffice e#penses 78,555

@ou are reAuired to prepare a statement showing : the profit per each brand0piece of bat / charge labour and material at actual average cost, works cost at 655< on labour cost and office cost at :>< of works cost. Financial profit for the half0year ending 15%E%51. (econciliation between profit as shown by cost accounts and financial accounts. !he profit and loss account as shown in the financial books of a company for the year ended 15.E.:551 together with a statement of reconciliation between the profit as per financial and cost accounts is given below

".

3rofit and $oss Account for the year ended 15.E.:551 (s. (s. pening "tock (aw 9aterials .ork in progress Finished goods E5,555 >5,555 =5,555 :,65,555 (aw 9aterial purchases 'irect wages Factory overheads Administration e#penses "elling ? 'istribution &#penses 3reliminary e#penses .ritten off 'ebenture Interest Fet 3rofit >,55,555 :,55,555 :,55,555 6,=5,555 :,:5,555 =>,555 15,555 6,71,555 6=,78,555 "ales Closing "tock :0 (aw 9aterials .ork in progress Finished goods 9iscellaneous receipts

(s.

(s. 6>,55,555

E8,555 >1,555 =:,555 0000000000

:,:1,555 ;>,555

6=,78,555

"tatement of reconciliation of profit as per financial and cost accounts (s. 3rofit as per financial accounts 6,71,555 'ifference in valuation of stock : Add : (aw 9aterials 0 closing stock .ork in progress0 pening stock Finished goods 0 opening stock 0 Closing stock !otal +A, $ess : (aw 9aterials 0 pening stock .ork in progress 0 closing stock !otal +4, +A04, +b, ther items : Add : 3reliminary e#penses written off 'ebenture interest $ess : 9iscellaneous receipts 3rofit as per Cost Accounts #. 6,:55 6,155 :,555 6,555 >,>55 6,7>5 =>5 :,;55 1,655 =>,555 15,555 6,5>,555 ;>,555 75,555 :,:7,655

@ou are reAuired to calculate the profit as per ledger accounts Bemini Industries maintains separate books for financial accounting and cost accounting. !he Financial 3rofit and $oss Account of the company for the year ended 16%1%:551 is given below :

Profit and $oss %&c. for the 'ear ended 31&3&2((3 (s. !o pening bal. f inventory : (s. 4y "ales 17,58,555 4y Closing bal. of inventory : (aw materials 6,85,555 .ork0in0progress ;5,555 Finished goods 6,75,555 1,85,555 4y 9isc. income ::,555 (s. (s.

(aw materials :,55,555 .ork0in0progress >5,555 Finished goods 6,>5,555 !o 3urchase of raw materials !o wages !o Factory overheads !o Admn. verheads !o 'istrn. and selling verheads !o 'ebenture interest !o 3reliminary e#penses written off !o Fet profit

;,55,555 6>,;5,555 ;,85,555 :,75,555 :,;5,555 6,85,555 ;5,555 >5,555 8,:5,555 ;5,65,555

;5,65,555

A statement reconciling profit as per financial accounts with that as per cost accounting records prepared by firm is also given below. : (econciliation "tatement 3rofit as per profit and loss account +a, 'ifference in valuation of inventory : :5,555 6:,555 ;,555 15,555 77,555 15,555 6>,555 ;>,555 :6,555 8,:5,555

'educt. (aw materials G opening balance .ork0in0progress G opening balance .ork0in0progress G closing balance Finished goods G opening balance Add. (aw materials G closing balance Finished goods G closing balance

ther items : Add. 'ebenture interest 3reliminary e#penses written off ;5,555 >5,555 E5,555 ::,555

'educt 9isc. income 3rofit as per costing profit and loss account

7=,555 8,7=,555

3repare the following accounts as they would appear in the cost records : +i, (aw materials control account +ii, .ork0in0progress account +iii, Finished goods stock account +iv, Cost of sales account +v, Costing profit and loss account.

You might also like

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Final AccountsDocument65 pagesFinal AccountsAmit Mishra100% (1)

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- PE Ratio Factors Book vs Market ValueDocument28 pagesPE Ratio Factors Book vs Market Valuebeyonce0% (1)

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- NCERT Class 11 Accountancy Part 2Document296 pagesNCERT Class 11 Accountancy Part 2AnoojxNo ratings yet

- Reconciliation of Cost and Financial Accounts PDFDocument14 pagesReconciliation of Cost and Financial Accounts PDFvihangimadu100% (2)

- Barclays Capital - The - W - Ides of MarchDocument59 pagesBarclays Capital - The - W - Ides of MarchjonnathannNo ratings yet

- Thyrocare Technologies Ltd. - IPODocument4 pagesThyrocare Technologies Ltd. - IPOKalpeshNo ratings yet

- Solution Manual For Survey of Accounting 8th Edition Carl S WarrenDocument33 pagesSolution Manual For Survey of Accounting 8th Edition Carl S WarrenDanielHernandezqmgx100% (32)

- Infra Projects Total 148Document564 pagesInfra Projects Total 148chintuuuNo ratings yet

- Chapter04 (1) Advanced Accounting Larson Reference AnswersDocument31 pagesChapter04 (1) Advanced Accounting Larson Reference AnswersRamez AhmedNo ratings yet

- KarachiDocument2 pagesKarachiBaran ShafqatNo ratings yet

- Kieso IFRS TestBank Ch03Document44 pagesKieso IFRS TestBank Ch03Zhim Handjoko100% (1)

- Companies List 2014 PDFDocument36 pagesCompanies List 2014 PDFArnold JohnnyNo ratings yet

- NBCC Heights - Brochure PDFDocument12 pagesNBCC Heights - Brochure PDFAr. Yudhveer SinghNo ratings yet

- Hong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Document19 pagesHong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Anonymous BJNqtknNo ratings yet

- Consolidated Statement of Financial Position with Intra-Group AdjustmentsDocument17 pagesConsolidated Statement of Financial Position with Intra-Group Adjustmentssamuel_dwumfourNo ratings yet

- 1587226653unit 4, Cost Accounting, Sem4Document5 pages1587226653unit 4, Cost Accounting, Sem4Sanjukta Das100% (1)

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial AccountsHari RamNo ratings yet

- SCDL PGDBA Finance Sem 1 Management AccountingDocument19 pagesSCDL PGDBA Finance Sem 1 Management Accountingamitm17No ratings yet

- Distinguish Between Capital Expenditure and Revenue ExpenditureDocument11 pagesDistinguish Between Capital Expenditure and Revenue ExpenditureGopika GopalakrishnanNo ratings yet

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial AccountsHari RamNo ratings yet

- Original 1436552353 VICTORIA ProjectDocument12 pagesOriginal 1436552353 VICTORIA ProjectShashank SharanNo ratings yet

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial Accountsdoselo7432No ratings yet

- ON Ntegrated Ccounts: Basic Concepts and FormulaeDocument0 pagesON Ntegrated Ccounts: Basic Concepts and FormulaeRajan PvNo ratings yet

- Income Statement & Cash Flows Chapter 5Document101 pagesIncome Statement & Cash Flows Chapter 5Joey LessardNo ratings yet

- BBA-4 Cost Acc.Unit 1Document5 pagesBBA-4 Cost Acc.Unit 1TilluNo ratings yet

- Capital-Budgeting Principles and TechniquesDocument14 pagesCapital-Budgeting Principles and TechniquesPradeep HemachandranNo ratings yet

- Financial Ratios For Chico ElectronicsDocument8 pagesFinancial Ratios For Chico ElectronicsThiago Dias DefendiNo ratings yet

- Unit 11 Reconciliation of Cost Financial: AccountsDocument18 pagesUnit 11 Reconciliation of Cost Financial: AccountsDrJay DaveNo ratings yet

- Single EntryDocument38 pagesSingle EntryAbhishek MlshraNo ratings yet

- Bcom Cost Accounting Long Question Important Theory Notes 2Document22 pagesBcom Cost Accounting Long Question Important Theory Notes 2getnadaNo ratings yet

- Capital and RevenueDocument9 pagesCapital and Revenuenazusmani2No ratings yet

- BA 211 Midterm 2Document6 pagesBA 211 Midterm 2Gene'sNo ratings yet

- AccountingDocument13 pagesAccountingArjun SrinivasNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Acc. 101-True or False and IdentificationDocument9 pagesAcc. 101-True or False and IdentificationAuroraNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- Reconciling Cost & Financial Records"TITLE"Notes on Differences Between Cost & Financial Accounts" TITLE"Cost Accounting: Reconciling Profits in Cost & Financial StatementsDocument7 pagesReconciling Cost & Financial Records"TITLE"Notes on Differences Between Cost & Financial Accounts" TITLE"Cost Accounting: Reconciling Profits in Cost & Financial StatementsDevender SinghNo ratings yet

- FASB and GAAP standards for small dental practiceDocument6 pagesFASB and GAAP standards for small dental practiceNatasha DeclanNo ratings yet

- Soutions To Practice Problems For Modules 1 & 2Document17 pagesSoutions To Practice Problems For Modules 1 & 2b1234naNo ratings yet

- Keac 211Document38 pagesKeac 211vichmegaNo ratings yet

- Applied Cost AccountingDocument6 pagesApplied Cost AccountingNandhini MNo ratings yet

- Accounting 04Document91 pagesAccounting 04Tamara WilsonNo ratings yet

- Account TheoryDocument24 pagesAccount TheoryDristi SaudNo ratings yet

- SwrfeDocument204 pagesSwrfekmillatNo ratings yet

- A. Detailed Organizational Structure of Finance DepartmentDocument22 pagesA. Detailed Organizational Structure of Finance Departmentk_harlalkaNo ratings yet

- Departmental AccountDocument3 pagesDepartmental AccountAnupam BaliNo ratings yet

- Accounting 4Document8 pagesAccounting 4syopiNo ratings yet

- Accounting Final ExamDocument6 pagesAccounting Final ExamKarim Abdel Salam Elzahby100% (1)

- Single Transaction and Revenue Should Be RecognizedDocument5 pagesSingle Transaction and Revenue Should Be RecognizedShesharam ChouhanNo ratings yet

- Chapter 5 Non Integrated AccountsDocument52 pagesChapter 5 Non Integrated AccountsmahendrabpatelNo ratings yet

- Accounts Project 1Document27 pagesAccounts Project 1Yashasvi SharmaNo ratings yet

- Profit Loss Account GraphsDocument10 pagesProfit Loss Account GraphsAnka Sorina PredutNo ratings yet

- Chap 2Document5 pagesChap 2Cẩm ChiNo ratings yet

- Introduction To Balance Sheet: Assets Liabilities Owner's (Stockholders') EquityDocument7 pagesIntroduction To Balance Sheet: Assets Liabilities Owner's (Stockholders') EquityChanti KumarNo ratings yet

- Meaning of Cost Sheet:: SampleDocument16 pagesMeaning of Cost Sheet:: SampleSunil Shekhar NayakNo ratings yet

- Homework PDFDocument8 pagesHomework PDFTracey NguyenNo ratings yet

- Module 2: Recording TransactionsDocument22 pagesModule 2: Recording TransactionsAntonio QuirozMaganNo ratings yet

- Cost Accounting 1-7 Lessons PDFDocument130 pagesCost Accounting 1-7 Lessons PDFRupak ChandnaNo ratings yet

- Dong Tien Ias 36Document8 pagesDong Tien Ias 36Quoc Viet TrinhNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- Keac 210Document65 pagesKeac 210vichmegaNo ratings yet

- Accounting A1 Assignment No. 1 11 Nov'10 Thursday: Q1 (A) What Are Capital Expenditures? Give ExamplesDocument4 pagesAccounting A1 Assignment No. 1 11 Nov'10 Thursday: Q1 (A) What Are Capital Expenditures? Give ExamplesIqra'a NadeemNo ratings yet

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelNo ratings yet

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelNo ratings yet

- Assignenment 1 DT Unit 1Document9 pagesAssignenment 1 DT Unit 1mahendrabpatelNo ratings yet

- 1 CostsheetDocument8 pages1 CostsheetNash ShahNo ratings yet

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelNo ratings yet

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelNo ratings yet

- Historia Del Mondonguito A La ItalianaDocument7 pagesHistoria Del Mondonguito A La ItalianaJuan OrocoNo ratings yet

- Material Variance: Unit 2 Standard Costing (MA-06101355)Document12 pagesMaterial Variance: Unit 2 Standard Costing (MA-06101355)mahendrabpatelNo ratings yet

- Get Started Right AwayDocument2 pagesGet Started Right AwaymahendrabpatelNo ratings yet

- Unit V Cost of CapitalDocument24 pagesUnit V Cost of CapitalmahendrabpatelNo ratings yet

- MotivationDocument6 pagesMotivationmahendrabpatelNo ratings yet

- Financial Accounting IntroductionDocument15 pagesFinancial Accounting IntroductionmahendrabpatelNo ratings yet

- Amit ResumeDocument3 pagesAmit ResumemahendrabpatelNo ratings yet

- Ch1 6Document109 pagesCh1 6Tia MejiaNo ratings yet

- SP Uni CA 2015Document3 pagesSP Uni CA 2015mahendrabpatelNo ratings yet

- SP Uni CA 2016Document2 pagesSP Uni CA 2016mahendrabpatelNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- SP Uni CA 2016 MayDocument4 pagesSP Uni CA 2016 MaymahendrabpatelNo ratings yet

- Cost and Management Accounting exam questions and ratiosDocument3 pagesCost and Management Accounting exam questions and ratiosmahendrabpatelNo ratings yet

- SP Uni CA 1Document4 pagesSP Uni CA 1mahendrabpatelNo ratings yet

- TestDocument2 pagesTestmahendrabpatelNo ratings yet

- API Format 2017Document4 pagesAPI Format 2017mahendrabpatelNo ratings yet

- Capital StructureDocument37 pagesCapital StructuremahendrabpatelNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingmahendrabpatelNo ratings yet

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelNo ratings yet

- Instructor Effectiveness Form (IEF) Cronbach ReliabilitiesDocument3 pagesInstructor Effectiveness Form (IEF) Cronbach ReliabilitiesmahendrabpatelNo ratings yet

- TestDocument2 pagesTestmahendrabpatelNo ratings yet

- What Is Cost Reconciliation Statement?Document2 pagesWhat Is Cost Reconciliation Statement?mahendrabpatelNo ratings yet

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelNo ratings yet

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelNo ratings yet

- BlackBuck Looks To Disrupt B2B Logistics Market Apart From The Regular GPS-Enabled Freight Management, It Offers Features Such As Track and Trace, Truck Mapping - The Financial ExpressDocument2 pagesBlackBuck Looks To Disrupt B2B Logistics Market Apart From The Regular GPS-Enabled Freight Management, It Offers Features Such As Track and Trace, Truck Mapping - The Financial ExpressPrashant100% (1)

- CI Principles of MacroeconomicsDocument454 pagesCI Principles of MacroeconomicsHoury GostanianNo ratings yet

- 12-11-2022 To 18-11-2022Document74 pages12-11-2022 To 18-11-2022umerNo ratings yet

- Exchange RatesDocument11 pagesExchange RatesElizavetaNo ratings yet

- Cargo MarDocument6 pagesCargo MarJayadev S RNo ratings yet

- ReidtaylorDocument326 pagesReidtayloralankriti12345No ratings yet

- SBI Statement 1.11 - 09.12Document2 pagesSBI Statement 1.11 - 09.12Manju GNo ratings yet

- Chapter 2 Consumer's BehaviourDocument14 pagesChapter 2 Consumer's BehaviourAdnan KanwalNo ratings yet

- How High Would My Net-Worth Have To Be. - QuoraDocument1 pageHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerNo ratings yet

- Social Science Class Viii WORKSHEET-1-Map WorkDocument2 pagesSocial Science Class Viii WORKSHEET-1-Map WorkChahal JainNo ratings yet

- Managing DifferencesDocument15 pagesManaging DifferencesAnonymous mAB7MfNo ratings yet

- MB m.2 Amd 9series-GamingDocument1 pageMB m.2 Amd 9series-GamingHannaNo ratings yet

- Proforma LocDocument3 pagesProforma LocPooja MohiteNo ratings yet

- Informative FinalDocument7 pagesInformative FinalJefry GhazalehNo ratings yet

- Nicl Exam GK Capsule: 25 March, 2015Document69 pagesNicl Exam GK Capsule: 25 March, 2015Jatin YadavNo ratings yet

- Oxylane Supplier Information FormDocument4 pagesOxylane Supplier Information Formkiss_naaNo ratings yet

- Company accounts underwriting shares debenturesDocument7 pagesCompany accounts underwriting shares debenturesSakshi chauhanNo ratings yet

- G4-Strataxman-Bir Form and DeadlinesDocument4 pagesG4-Strataxman-Bir Form and DeadlinesKristen StewartNo ratings yet

- High Potential Near MissDocument12 pagesHigh Potential Near Missja23gonzNo ratings yet

- Indonesian Railways Law and StudyDocument108 pagesIndonesian Railways Law and StudyGonald PerezNo ratings yet

- Packaged Tea Leaves Market ShareDocument22 pagesPackaged Tea Leaves Market ShareKadambariNo ratings yet

- October Month Progress ReportDocument12 pagesOctober Month Progress ReportShashi PrakashNo ratings yet

- Frame6 UserNetworks p2-30Document29 pagesFrame6 UserNetworks p2-30jasonNo ratings yet