Professional Documents

Culture Documents

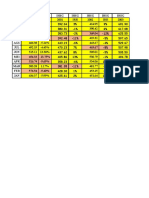

BSE Sensex S&P Nifty BSE 200 CNX500 CNX Midcap BSE500

Uploaded by

dsankalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSE Sensex S&P Nifty BSE 200 CNX500 CNX Midcap BSE500

Uploaded by

dsankalaCopyright:

Available Formats

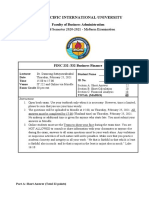

As on Aug 30, 2011

Equity Funds

Funds Recommended based on Long Term Trends

Name of

Inception

Scheme

Date

BSE Sensex

S&P Nifty

BSE 200

CNX500

CNX Midcap

BSE500

NAV

Rs

3m

-8.54%

-8.63%

-9.03%

-8.67%

-8.19%

-8.89%

6m

-6.44%

-6.23%

-5.71%

-4.92%

-1.02%

-5.30%

Returns for

1 yr

-7.52%

-7.65%

-10.86%

-11.39%

-16.51%

-11.39%

3 Yrs

4.61%

4.67%

4.96%

4.99%

8.57%

4.82%

5 Yrs

7.30%

7.83%

7.95%

7.40%

10.91%

7.84%

Incep

-------

14.14%

15.63%

10.16%

12.71%

14.89%

13.58%

15.30%

21.25%

23.08%

18.05%

29.28%

23.10%

25.87%

17.20%

Aggressive Funds

1) Large and Flexi Cap Funds

HDFC Equity Fund

DSP BlackRock Equity Fund - Dividend

Franklin India Flexi Cap Fund

ICICI Prudential Dynamic Plan

Canara Robeco Equity Diversified

Birla Sun Life Frontline Equity Fund - Plan A

Reliance RSF - Equity

2) Mid Cap oriented Funds

HDFC Mid-Cap Opportunities Fund

ICICI Prudential Discovery Fund

DSP BlackRock Small and Midcap Fund

IDFC Premier Equity Fund - Plan A

UTI Master Value Fund

Conservative Funds

Reliance Equity Opportunities Fund

HDFC Top 200

UTI Opportunities Fund

Fidelity Equity Fund

Franklin India Bluechip Fund

Templeton India Equity Income Fund

TATA Equity P-E Fund

1-Jan-95

29-Apr-97

2-Mar-05

31-Oct-02

16-Sep-03

30-Aug-02

9-Jun-05

248.3610

45.0160

29.4003

96.7056

52.2700

79.4300

26.9268

-9.55%

-5.24%

-8.67%

-9.27%

-3.44%

-7.55%

-9.08%

-4.95%

0.18%

-2.58%

-5.63%

1.65%

-4.21%

-3.94%

-9.50%

-8.39%

-7.98%

-5.06%

-4.96%

-7.93%

-14.01%

16.03%

12.72%

12.54%

10.61%

15.82%

11.69%

9.98%

25-Jun-07

14-Aug-04

14-Nov-06

28-Sep-05

1-Jun-98

15.4110

43.9100

16.7200

32.2592

49.4300

-1.61% 10.85%

-9.71% -2.94%

-2.46% 6.17%

1.36% 9.64%

-4.67% 2.32%

1.22%

-8.64%

-8.61%

-3.13%

-6.24%

19.51%

-10.89%

19.73% 11.59% 23.36%

18.33%

-11.32%

19.36% 24.41% 21.86%

15.64% 13.27% 21.32%

31-Mar-05

11-Sep-96

20-Jul-05

16-May-05

1-Dec-93

18-May-06

29-Jun-04

33.5575

188.8590

26.3100

32.7970

199.0014

18.3397

42.8296

-5.15%

-8.24%

-1.83%

-5.92%

-5.85%

-10.39%

-8.01%

2.68%

-4.42%

4.07%

-2.64%

-2.18%

-7.58%

-3.08%

-6.29%

-8.14%

0.19%

-5.87%

-3.66%

-6.22%

-8.64%

18.81%

13.47%

17.92%

13.17%

12.76%

8.52%

10.86%

13.35%

14.46%

14.59%

13.91%

12.29%

12.69%

14.75%

20.76%

23.37%

17.14%

20.77%

25.83%

12.15%

22.48%

3m

-4.80%

6m

-2.69%

3 Yrs

6.77%

5 Yrs

8.21%

Incep

--

Balanced Funds

Funds Recommended based on Long Term Trends

Name of

Inception

Scheme

Date

Crisil Balanced Fund Index

Aggressive Funds

Reliance RSF - Balanced

Canara Robeco Balance

Tata Balanced Fund

SBI Magnum Balanced Fund

Conservative Funds

HDFC Prudence Fund

DSP BlackRock Balanced Fund

Birla Sun Life 95

Index Funds

Name of

Scheme

BSE Sensex

S&P Nifty

SBI Magnum Index Fund

NAV

Rs

Returns for

1 yr

-2.76%

8-Jun-05

1-Feb-93

8-Oct-95

9-Oct-95

20.4441

59.9800

79.6057

45.3500

-5.63%

-0.45%

-2.89%

-7.26%

-1.54%

4.11%

2.61%

-5.74%

-10.03%

-1.45%

-1.82%

-10.82%

15.48% 13.17% 12.16%

14.26% 11.14% 10.34%

13.14% 13.14% 16.17%

6.51% 8.00% 15.86%

1-Feb-94

27-May-99

10-Feb-95

204.6840

62.9270

297.1400

-3.01%

-3.39%

-3.18%

1.90%

1.24%

0.68%

-1.78%

-4.82%

-3.37%

19.02% 15.80% 20.51%

11.27% 13.18% 16.18%

15.56% 14.33% 22.73%

Inception

Date

NAV

Rs

17-Jan-02

42.7193

3m

-8.54%

-8.63%

-7.99%

6m

-6.44%

-6.23%

-5.91%

Returns for

1 yr

-7.52%

-7.65%

-7.65%

3 yr

4.61%

4.67%

4.60%

5 Yrs

7.30%

7.83%

6.01%

Incep

--16.29%

Franklin India Index Fund - NSE Nifty Plan

UTI Nifty Fund

Franklin India Index Fund - BSE Sensex Plan

Equity Linked Saving Schems

Name of

Scheme

S&P Nifty

BSE 200

CNX500

ICICI Prudential Taxplan

HDFC Taxsaver

Fidelity Tax Advantage Fund

Franklin India Taxshield

DSP BlackRock Tax Saver Fund

26-Mar-04

14-Feb-00

26-Mar-04

39.5030

31.1812

47.2114

Inception

Date

NAV

Rs

19-Aug-99

13-Jun-96

27-Feb-06

10-Apr-99

18-Jan-07

127.9800

213.1400

20.3480

199.5202

15.1

-8.00%

-8.24%

-7.98%

-5.66%

-5.93%

-5.90%

-7.39%

-7.84%

-7.09%

3m

-8.63%

-9.03%

-8.67%

-7.84%

-6.47%

-5.68%

-4.04%

-8.48%

6m

-6.23%

-5.71%

-4.92%

-3.46%

-2.35%

-2.11%

2.17%

-4.30%

Returns for

1 yr

-7.65%

-10.86%

-11.39%

-6.41%

-8.17%

-6.09%

-0.13%

-12.82%

4.65%

4.28%

4.75%

* The fund is available only for STPs and SIP investments.

Equity Oriented Scheme recommendations have been made based on the methodology, which assigns weightages to parameters

like FAMA, Sharpe Ratio, Sortino Ratio, Corpus, Past Performance, Beta and Volatility.

All the NAVs and return calculation are for the Growth Oriented Plans.

15.82%

10.35%

15.67%

3 yr

5 Yrs

Incep

4.67% 7.83%

-4.96% 7.95%

-4.99% 7.40%

-12.59% 8.21% 23.59%

14.39% 11.11% 29.45%

13.89% 14.10% 13.77%

13.17% 12.27% 27.31%

8.47%

-9.34%

Note: Return figures for all the Equity oriented schemes are not annualised for less than one year period. Moreover, past returns cannot be taken as

an indicator of future performance.

7.70%

7.35%

7.58%

You might also like

- Equity FundsDocument2 pagesEquity FundsPraveen PenigandlaNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- Equity FundsDocument2 pagesEquity FundsMahesh SainiNo ratings yet

- Probabilitas IHSG TurunDocument45 pagesProbabilitas IHSG TurunRosa LinaNo ratings yet

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- DataDocument2 pagesDataFabrizio LopezNo ratings yet

- HDFC Equity FundsDocument2 pagesHDFC Equity FundsAmit MalikNo ratings yet

- FIN 615 Fall 2022 Quiz 2 Solution 20221008Document17 pagesFIN 615 Fall 2022 Quiz 2 Solution 20221008sigit luhur pambudiNo ratings yet

- Currency (Yearly) TrendDocument3 pagesCurrency (Yearly) Trendismun nadhifahNo ratings yet

- Debt FuAndsDocument1 pageDebt FuAndsyogeshNo ratings yet

- Final DataDocument66 pagesFinal DataDilshadNo ratings yet

- MSSP - Guaranteed Surrender Value Factors - tcm47-71735Document9 pagesMSSP - Guaranteed Surrender Value Factors - tcm47-71735Sheetal KumariNo ratings yet

- Year Jan Feb Mar Apr May Jun Jul AugDocument6 pagesYear Jan Feb Mar Apr May Jun Jul AugcristianoNo ratings yet

- Six Yrs Per OGDCLDocument2 pagesSix Yrs Per OGDCLMAk KhanNo ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- HC Investimentos - Como Calcular A Correlação Entre InvestimentosDocument7 pagesHC Investimentos - Como Calcular A Correlação Entre InvestimentosMario Sergio GouveaNo ratings yet

- Rendimientos Mensuales - Portafolios 2023-1Document2 pagesRendimientos Mensuales - Portafolios 2023-1Lucero ÁlvarezNo ratings yet

- AUROBINDO (Akshat Jain)Document90 pagesAUROBINDO (Akshat Jain)Akshat JainNo ratings yet

- PortfolioModelDocument4 pagesPortfolioModelSem's IndustryNo ratings yet

- Financial Statements For BYCO Income StatementDocument3 pagesFinancial Statements For BYCO Income Statementmohammad bilalNo ratings yet

- Rendimiento de AccionesDocument6 pagesRendimiento de AccionesFrancis Ariana Cervantes BermejoNo ratings yet

- Tabela de Correlatos Academia Do Trader PDFDocument4 pagesTabela de Correlatos Academia Do Trader PDFCLELIO GOMES DE SOUZANo ratings yet

- Módulo 5 - Estatística para o Mercado Financeiro - Correlação EstatísticaDocument12 pagesMódulo 5 - Estatística para o Mercado Financeiro - Correlação EstatísticaVitor dhNo ratings yet

- Stability Ratios Chart (2019 Update)Document1 pageStability Ratios Chart (2019 Update)Amaya SydorNo ratings yet

- Care Home - Management AccountsDocument9 pagesCare Home - Management AccountscoolmanzNo ratings yet

- Nuevo Hoja de Cálculo de Microsoft ExcelDocument14 pagesNuevo Hoja de Cálculo de Microsoft ExcelMarcelo SalasNo ratings yet

- C&W U.S. Lodging Overview 2017Document18 pagesC&W U.S. Lodging Overview 2017crticoticoNo ratings yet

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNo ratings yet

- Portofolio Correlation - Kaunang, MarioDocument3 pagesPortofolio Correlation - Kaunang, Mariomario kaunangNo ratings yet

- Portofolio Correlation - Kaunang, MarioDocument3 pagesPortofolio Correlation - Kaunang, Mariomario kaunangNo ratings yet

- MCLR - Central Bank of IndiaDocument8 pagesMCLR - Central Bank of IndiaSravya NamburiNo ratings yet

- National Stock ExchangeDocument8 pagesNational Stock ExchangeCA Manoj GuptaNo ratings yet

- Administración Financiera Ii: Flavio Bueno Juan Pablo Carrión Sara Collaguazo Creistina GarciaDocument7 pagesAdministración Financiera Ii: Flavio Bueno Juan Pablo Carrión Sara Collaguazo Creistina Garciaflavio buenoNo ratings yet

- Ifi 5Document334 pagesIfi 5MARCO DAVID COPATITI ULURINo ratings yet

- Fin RatiosDocument7 pagesFin Ratiosakankshag_13No ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- Efficient FrontiersDocument10 pagesEfficient FrontiersMuhammad Ahsan MukhtarNo ratings yet

- Calculating Adjusted BetasDocument11 pagesCalculating Adjusted BetasMuhammad Ahsan MukhtarNo ratings yet

- Beta Management CorpDocument11 pagesBeta Management CorpKaneez FatimaNo ratings yet

- Historical Profit Rates - (Sep21 - Aug23)Document5 pagesHistorical Profit Rates - (Sep21 - Aug23)Amir NaseemNo ratings yet

- Constância Fundamento FIA Informativo - Julho 2020 C: Características Do FundoDocument2 pagesConstância Fundamento FIA Informativo - Julho 2020 C: Características Do FundoCarlos Henrique limaNo ratings yet

- P02 18Document248 pagesP02 18priyankaNo ratings yet

- Par de DivisasDocument38 pagesPar de DivisasRonny FarinangoNo ratings yet

- Currency (Weekly) TrendDocument3 pagesCurrency (Weekly) Trendismun nadhifahNo ratings yet

- Stock Portfolio Formation: BRK-B, CSCO & BADocument18 pagesStock Portfolio Formation: BRK-B, CSCO & BAsandeep shresthaNo ratings yet

- ICICIdirect Pledgedshares November2011Document4 pagesICICIdirect Pledgedshares November2011Atul TandonNo ratings yet

- Premarket MarketPreview NirmalBang 02.11.16Document8 pagesPremarket MarketPreview NirmalBang 02.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Date S&P500 Aapl MSFT BAC XOM PFE Month TDocument17 pagesDate S&P500 Aapl MSFT BAC XOM PFE Month TZeynep DerinözNo ratings yet

- Chapter 3 CovarianceDocument4 pagesChapter 3 CovarianceGovind SinghNo ratings yet

- NAV Mutual FundsDocument18 pagesNAV Mutual FundsBriana DizonNo ratings yet

- BreakdownDocument103 pagesBreakdownhandiNo ratings yet

- HC Investimentos - HedgeDocument11 pagesHC Investimentos - HedgeFabiano MorattiNo ratings yet

- Date Close Price Daily RTDocument8 pagesDate Close Price Daily RTNitin GarjeNo ratings yet

- Apollo Bse Sensex Date Adj Close RETURNS Date Close ReturnsDocument23 pagesApollo Bse Sensex Date Adj Close RETURNS Date Close ReturnsShubham MehrotraNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Applied Predictive Analytics: Principles and Techniques for the Professional Data AnalystFrom EverandApplied Predictive Analytics: Principles and Techniques for the Professional Data AnalystNo ratings yet

- Tanjavuri Andhrarajula CharitraDocument86 pagesTanjavuri Andhrarajula Charitradsankala100% (1)

- ManchuPoolaVarsham by YandamuriDocument46 pagesManchuPoolaVarsham by Yandamuridsankala25% (4)

- GalaGalaGodari by Lalladevi PDFDocument130 pagesGalaGalaGodari by Lalladevi PDFdsankala75% (4)

- Mayarambha by BhayankarDocument45 pagesMayarambha by Bhayankardsankala83% (6)

- AmsumathiDocument122 pagesAmsumathidsankalaNo ratings yet

- Athadu Adavini JayinchaduDocument55 pagesAthadu Adavini Jayinchadudsankala100% (13)

- Allullu by MunimanikyamDocument140 pagesAllullu by MunimanikyamdsankalaNo ratings yet

- Andariki Ayurvedam Nov13Document32 pagesAndariki Ayurvedam Nov13dsankala50% (2)

- Vedic Wisdom 1Document219 pagesVedic Wisdom 1m.s.subramania sharmaNo ratings yet

- ArabianNights PDFDocument56 pagesArabianNights PDFKrishKoNo ratings yet

- Ayurveda Itihaasa Part - I TeluguDocument343 pagesAyurveda Itihaasa Part - I Telugurejuven88% (17)

- Teepiguruthulu Chedugnapakalu by Gummadi PDFDocument99 pagesTeepiguruthulu Chedugnapakalu by Gummadi PDFShaik Firdosi75% (4)

- Sakti PeetaluDocument51 pagesSakti PeetaluVamshi KrishnaNo ratings yet

- TreasuryDocument53 pagesTreasuryLuis RosendoNo ratings yet

- Oracle® Supplier Management: Implementation and Administration Guide Release 12.1Document194 pagesOracle® Supplier Management: Implementation and Administration Guide Release 12.1younomeNo ratings yet

- Revolution 2020 by Chetan BhagatDocument302 pagesRevolution 2020 by Chetan Bhagatdsankala100% (1)

- Art of Living Part 1Document4 pagesArt of Living Part 1poonam.pbsNo ratings yet

- Objectives of The StudyDocument51 pagesObjectives of The StudyMmp AbacusNo ratings yet

- Acct Statement - XX0575 - 21052022Document4 pagesAcct Statement - XX0575 - 21052022shivji007No ratings yet

- Swot Analysis of HDFC BankDocument1 pageSwot Analysis of HDFC BankRishabh KumarNo ratings yet

- Lic Ado ResultDocument217 pagesLic Ado ResultNixie BlackNo ratings yet

- 021CLSM012 Innovations in Indian Banking Sector.Document4 pages021CLSM012 Innovations in Indian Banking Sector.SasidharNo ratings yet

- Reserve Bank of IndiaDocument84 pagesReserve Bank of IndiaSunil ColacoNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument5 pagesMobile Services: Your Account Summary This Month'S ChargesParvatiNo ratings yet

- Sit Land Holdings LTDDocument2 pagesSit Land Holdings LTDnooneNo ratings yet

- 2018 Portfolio Risk and Return: Part II: Test Code: R42 PRR2 Q-BankDocument14 pages2018 Portfolio Risk and Return: Part II: Test Code: R42 PRR2 Q-BankAhmed RiajNo ratings yet

- WWW Simandhareducation Com Blogs Mba Vs Cpa What Is Wiser To ChooseDocument5 pagesWWW Simandhareducation Com Blogs Mba Vs Cpa What Is Wiser To Choosesrinu patroNo ratings yet

- ECGCDocument22 pagesECGCchandran0567No ratings yet

- Akowonjo TC BillDocument2 pagesAkowonjo TC BillJadesola AdeoyeNo ratings yet

- Robo-Signers: National AssociationDocument59 pagesRobo-Signers: National AssociationJohn Nehmatallah100% (4)

- Statement DEC PDFDocument14 pagesStatement DEC PDFUmay Delisha0% (1)

- CCC C CCCCCC CCCCC CCCCCCCC C CCCC CCCCCCC CC CCCCDocument9 pagesCCC C CCCCCC CCCCC CCCCCCCC C CCCC CCCCCCC CC CCCCJagpreet MalhotraNo ratings yet

- Final Report KasbDocument70 pagesFinal Report KasbtrueliarerNo ratings yet

- Last Assignment December 2022Document77 pagesLast Assignment December 2022DavidNo ratings yet

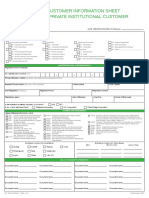

- Landbank Customer Information Sheet CorporationDocument6 pagesLandbank Customer Information Sheet CorporationMayNo ratings yet

- Assignment - Funds and Other InvestmentsDocument2 pagesAssignment - Funds and Other InvestmentsJane DizonNo ratings yet

- Pengantar Akuntansi Pertemuan Ke 3Document85 pagesPengantar Akuntansi Pertemuan Ke 3Denny ramadhanNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- HDFC Life Super Savings Plan (SPL) IllustrationDocument2 pagesHDFC Life Super Savings Plan (SPL) IllustrationBrandon WarrenNo ratings yet

- Seller Closing Statement - When Buyer Gets FinancingDocument2 pagesSeller Closing Statement - When Buyer Gets FinancingJo Jemison EnglandNo ratings yet

- Amarakosha Knowledge StructureDocument5 pagesAmarakosha Knowledge Structureaarpee78No ratings yet

- 300+ TOP Islamic Banking MCQs and Answers Quiz Exam 2024Document19 pages300+ TOP Islamic Banking MCQs and Answers Quiz Exam 2024faisal17950No ratings yet

- Banking Maths ProjectDocument16 pagesBanking Maths ProjectAakash Sarkar60% (5)

- Match Each Definition With Its Related Term or Abbreviation byDocument2 pagesMatch Each Definition With Its Related Term or Abbreviation byHassan JanNo ratings yet

- Conversion Method or Final Accounts Method 21-04-2020Document14 pagesConversion Method or Final Accounts Method 21-04-2020BOHEMIAN GAMINGNo ratings yet

- Pantaleon Vs American Express InternationalDocument1 pagePantaleon Vs American Express InternationalNicole Marie Abella CortesNo ratings yet

- Partnership Additional ProbsDocument9 pagesPartnership Additional ProbsJoy LagtoNo ratings yet