Professional Documents

Culture Documents

52 Remuneration of Managerial Personnel

Uploaded by

kumar_anil666Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

52 Remuneration of Managerial Personnel

Uploaded by

kumar_anil666Copyright:

Available Formats

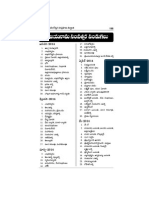

HANDOUT_REMUNERA TION OF MANAGERIAL PERSONNEL

For CA/CS Final Students

This handout deal with certain provisions related to Managerial Remunertion like Meaning of Managerial personnel and their remuneration along with total ceiling of managerial remuneration and various other connected details. Ankur Garg 9/25/2009

Remunera !"n " Manager!a# Per$"nne#

This handout deal with certain provisions related to Managerial Remuneration like Meaning of Managerial personnel and their remuneration along with total ceiling of managerial remuneration and various other connected details.

O %er &ea ure$ "& %!$ %an'"u are(

1. Remuneration for professional services rendered ! a director ". Mode of pa!ment of remuneration #. $rovisions of Sitting Fees %. &eneral permission granted ! the R'( to pa! sitting fees to non) resident non)whole)time directors *. Remuneration pa!a le to managerial personnel ! compan! having no profits or inade+uate profits ,. Meaning of -no profit- or -inade+uate profit.. Meaning of the /effective capital/ 0. Amount of ma1imum remuneration pa!a le to a managerial person 2. Remuneration Committee 13. Ma1imum remuneration pa!a le to managerial person in case he is a managerial personnel in two companies 11. $a!ment of remuneration to managerial person with the approval of the Central &overnment 1". $a!ment of guarantee commission to the managing or whole) time director is remuneration which re+uires approval of the Central &overnment

1#. Amendment of provisions relating to the managing4 whole) time director or non)rotational directors re+uire approval of the Central &overnment 1%. $rovisions related to 5on)e1ecutive directors

Manager!a# )er$"nne# The term /Managerial $erson/ under the Act means a managing director4 whole)time director or manager. A compan! ma! either have a managing director or manager and in an! of the case ma! also have whole)time director. $art ( of Schedule 6((( to the Companies Act4 12*, also states that the managerial person means a managing director or whole)time director or a manager. Mean!ng "& remunera !"n The remuneration includes pa!4 compensation4 or reward for work4 etc. The word remuneration is defined in the e1planation appended to section 120 of the Companies Act. Accordingl!4 for the purposes of sections 1204 #324 #13 and #114 remuneration shall include the following78 9a: an! e1penditure incurred ! the compan! in providing an! rent free accommodation4 or an! other enefit or amenit! in respect of accommodation4 free of charge4 to an! of the compan!-s directors and manager; 9b: an! e1penditure incurred ! the compan! in providing an! other enefit or amenit! free of charge or at a concessional rate to an! of the compan!-s directors and manager; 9c: an! e1penditure incurred ! the compan! in respect of an! o ligation or service4 which4 ut for such e1penditure ! the compan!4 would have een incurred ! an! of the compan!-s directors and manager; and 9d: an! e1penditure incurred ! the compan! to effect an! insurance on the life of4 or to provide an! pension4 annuit! or gratuit! for4 an! of the compan!-s directors and manager or his spouse or child. <1penditure incurred on maintenance of vehicles would fall within the meaning of the e1pression -remuneration- and once remuneration is fi1ed as provided under section #32 it is not possi le to state that the e1penditure incurred ! the compan! on personal use of car ! directors would not e allowa le deduction. (n so far as the compan! is concerned the e1penditure is usiness e1penditure4 which could not e 3

disallowed as such. =Sayaji Iron & Engineering Co. v CIT 9"33":

Comp Cas ,.* 9&u>:?. T" a# *e!#!ng "& manager!a# remunera !"n

Section 12091: relates to overall ma1imum managerial remuneration and managerial remuneration in case of a sence or inade+uac! of profits. The total managerial remuneration pa!a le ! a pu lic compan! or a private compan! which is a su sidiar! of a pu lic compan!4 to its directors and its manager in respect of an! financial !ear shall not e1ceed 11@ of the net profits of the compan! for that financial !ear. Such net profits shall e computed in a manner laid down under sections #%2 and #*34 e1cept that the remuneration of the directors shall not e deducted from the gross profits. Remuneration is pa!a le to all the directors including managing and whole)time directors and in an! capacit!. Therefore4 it includes the remuneration for services rendered ! him in an! other capacit! other than that of a director.

Remunera !"n &"r )r"&e$$!"na# $er+!*e$ ren'ere' ,- a '!re* "r

$roviso of section #3291: e1cludes an! remuneration for professional services rendered ! a director4 provided that the director possesses re+uisite professional +ualification for practicing the profession in respect of which the! render special services. (t is immaterial4 whether the professional fees4 which are paid to him is on a monthl! asis or on a case to case asis. =Stup Consultants Ltd. v Union of India?. .%e %er remunera !"n " 'e)u - manag!ng '!re* "r//"rk$ manager/$a#e$ manager "u $!'e %e )r"+!$!"n$ "& $e* !"n 0912034 The Act does not recognise a /Aeput! Managing Airector/. The designation would e misleading if the incum ent is not a director. Bowever4 if the person concerned is in fact not a director and is not occup!ing the position of a managing director4 manager or holding other managerial office4 his remuneration would e outside the scope of section 120. Appointment of a director as a whole)time sales manager or works manager would attract the provisions of section ",2 as from the date of his appointment since4 as a director4 he will e in the position of a whole)time director. The provisions of sections #32 and 120 would also e attracted.

.%e %er remunera !"n " Te*%n!*a# '!re* "r$ "r '!re* "r$ 'e$!gna e' a$ e*%n!*a# "u $!'e %e )ur+!e/ "& $e* !"n 0912034 Though the directors are designated as /technical advisors- or as -technical directors- the functions entrusted to them are not of a purel! advisor! or technical nature and in fact considera le administrative and e1ecutive powers4 involving the e1ercise of managerial decision have een entrusted to them4 and conse+uentl! the remuneration paid to them is held to fall within the scope of section 12091: of the Act. (t is hardl! necessar! to stress the point that the formal designation given to a director is in no wa! significant4 so far as the +uestion of applica ilit! of the provisions of the Act is concerned. The important point is whether the nature of the duties and powers delegated to a director would4 in fact4 place him in the position of a managing director or a director in the whole)time emplo!ment of a compan!. .%e %er remunera !"n " '!re* "r /"rk!ng a$ e*%n!*a# a'+!$er ,e !n*#u'e' !n 005 manager!a# remunera !"n4 (f a director of the compan! is working as a technical adviser to the compan! and is paid remuneration ! wa! of monthl! salar!4 his salar! will e included in the 11@ limit of managerial remuneration. M"'e "& )a-men "& remunera !"n Cithin the limits of the ma1imum remuneration specified in section 12091:4 a compan! ma! pa! a monthl! remuneration to its managing or whole)time director in accordance with the provisions of section #32 or to its manager in accordance with the provisions of section #0.. $a!ment of monthl! remuneration to an ordinar! or a sitting director is governed ! the provisions of section #32.

SITTING FEES

A director who is not a managing or whole)time director ma! e paid sitting fees for attending meetings of the 'oard or of the committee of directors. S! !ng &ee$ )a!' &"r a en'!ng mee !ng are e6*#u'e' &r"m "+era## manager!a# remunera !"n *e!#!ng The limit of 11@ of the net profits on overall ma1imum managerial remuneration $%a## ,e e6*#u$!+e "& an- $! !ng &ee$ pa!a le to directors for attending each meeting of the 'oard or committee. A))r"+a# "& %e 7en ra# G"+ernmen !$ n" !n*rea$e !n $! !ng &ee /! %!n %e )re$*r!,e' #!m! 5 re8u!re' &"r

5o approval of the Central &overnment under section 120 will e necessar! for an increase in the amount of sitting fee so long as such increase is within the limits prescri ed ! the &overnment. '! N" !&!*a !"n N"9 GSR 5102E3: 'a e' 2;<=<200>: the government has increased the fees pa!a le to directors of pu lic companies and private companies which are su sidiaries of pu lic companies for attending the 'oard meetings and Committee thereof w.e.f. "%).)"33# as under7 9a: Companies with a paid)up share capital and free reserves of Rs. 13 crore and a ove or turnover of Rs. *3 crore and a ove shall e paid sitting fees not e1ceeding the sum of twent! thousand rupees; and 9b: Dther companies shall pa! sitting fees not e1ceeding the sum of ten thousand rupees. Pr"+!$!"n$ !n %e Ar !*#e$ "& A$$"*!a !"n The Articles shall contain a provision authorising pa!ment of sitting fees to directors. Chere the articles provide that sitting fees to directors ma! e paid in conformit! with the provisions of the Companies Act4 12*, as ma! e applica le from time to time4 then the 'oard of the said compan! could increase the sitting fees on the asis of the provision in the said Rules from time to time. S! !ng &ee: ra+e#!ng e6)en$e$: e *9 )a-a,#e &"r a en'!ng mee !ng e+en: !& n" ,u$!ne$$ !$ ran$a* e' a %e mee !ng &"r /an "& 8u"rum (t has een clarified vide Circular 5o. 1 of 12."4 dated ")")12." 9ACA: that sitting fees4 traveling allowances4 etc.4 are pa!a le to a director who was present at the meeting of the 'oard or committees thereof with a view to participating in its proceedings though no usiness could e transacted at that meeting for want of +uorum. Genera# )erm!$$!"n gran e' ,- %e R?I " )a- $! !ng &ee$ " n"n<re$!'en n"n</%"#e< !me '!re* "r$ The Reserve 'ank has granted general permission vide its 5otification 5o. F<RA 1"0/2")R'4 dated 12th March4 122# to companies in (ndia to make pa!ments in (ndian rupees to their non whole)time directors who are resident outside (ndia and are on a visit to (ndia for the compan!-s work such as attending 'oard meetings4 etc.4 and are entitled to pa!ment of sitting fees or commission or remuneration in accordance with the provisions contained in the concerned compan!-s entered into ! it or in an! 'oard resolution or general od! resolution passed ! the compan!. $rovided that the Central &overnment-s approval has

een o tained ! the compan! under section #329%: or section #13 of the Companies Act4 12*,4 wherever it applies. Bowever4 &overnment of (ndia-s approval should have een o tained ! the compan! under the Companies Act4 12*,4 for the appointment of the director4 wherever applica le. REMUNERATION PA@A?LE TO MANAGERIAL PERSONNEL ?@ 7OMPAN@ HAAING PROFITS As per provisions of Section ( of $art (( of Schedule 6((( to the Companies Act4 12*,4 su >ect to the provisions of sections 120 and #324 a compan! ma! pa! an! remuneration4 ! wa! of salar!4 dearness allowance4 per+uisites4 commission and other allowances4 which shall not e1ceed *@ of its net profits for one such managerial person4 and if there is more than one such managerial person4 13@ for all of them together. Section #329#: provides that managerial personnel ma! e paid remuneration either ! wa! of a monthl! pa!ment or at specified percentage of the net profits of the compan! or partl! ! one wa! and partl! ! the other. (n case if remuneration e1ceeds *@ or 13@ as the case ma! e4 it cannot e paid without the approval of the Central &overnment. Re8u!remen &"r a))r"+a# "& mem,er$ !n %e genera# mee !ng an' &!#!ng "& e<F"rm 257 The appointment ma! e made ! the 'oard su >ect to the approval of mem ers in the ne1t general meeting ! wa! of ordinar! resolution. The compan! shall also e re+uired to file e)Form "*C electronicall! with the Registrar of Companies4 within 23 da!s from the date of appointment. REMUNERATION PA@A?LE TO MANAGERIAL PERSONNEL ?@ 7OMPAN@ HAAING NO PROFITS OR INADEBUATE PROFITS Section (( of $art (( of Schedule 6((( to the Companies Act4 12*, relates to remuneration pa!a le to managerial person i.e.4 a managing or whole)time director or a manager ! companies having no profits or inade+uate profits. Following are the worth noting points in regard to pa!ment of remuneration ! companies having no profits or inade+uate profits for appointment of a managerial person under the provisions of Schedule 6((( to the Companies Act4 12*,. Mean!ng "& Cn" )r"&! C "r C!na'e8ua e )r"&! C (f in an! financial !ear4 a compan! has suffered losses or the profit of the compan! computed in the manner laid down in sections #%2 and #*34 e1cept that the remuneration of directors shall not e deducted 7

from the gross profit4 is less than the overall managerial remuneration pa!a le under the provisions of section 120 read with the provisions of section #32 of the Act4 shall e considered as -no profit- or -inade+uate profit-. (t means that the remuneration pa!a le to the managerial person is more than *@ of the net profit in case of one managerial person or more than 13@ of the net profit in case of more than one managerial person. 7"m)u a !"n "& )r"&! un'er $e* !"n >;9 Computation of net profits under section #%2 has to e ased on the net profits shown in the profit and loss account of a compan! prepared in accordance with the normal accounting principles and applica le accounting standards. Certain additions and deletions contained in section #%2 are to e made. S a emen $ "& *"m)u a !"n "& )r"&! &"r %e )ur)"$e "& manager!a# remunera !"n *"+er!ng +ar!"u$ ! em$ "& a''! !"n$ an' 'e#e !"n$ ,a$e' "n %e ana#-$!$ "& $e* !"n >;9 !$ )#a*e' ,e#"/( Managerial Remuneration 8 Salaries 8 Allowances 8 Compan!-s contri ution to $F E other funds 8 'enefits 8 $ersonal accident insurance premium 8 Feave <ncashment 8 Medical Reim ursement $rofit 'efore Ta1 as per profit and loss account Add the follo ing if debited to the profit & loss account before arriving at the profit before ta! 8 Sitting fee $rovision for dou tful de ts $rovision for dou tful advances Foss on sale/disposal/discarding of assets Foss on sale of investments Crite off of investments $rovision for diminution in the value of investments Gnservicea le fi1ed assets written off Fall in the value of foreign currenc! monetar! assets Foss on cancellation of foreign e1change contracts $rovision for contingencies and unascertained lia ilities 8

$rovision for loss of su sidiar! companies Fease $remiums written off $rovision for warrant! spares/supplies (nfructious pro>ect e1penses written off $rovisions for redundanc! in stores4 spares and finished goods $rovision for anticipated loss in case of contracts Foss on sale of undertaking $rovision for wealth ta1 Holuntar! compensation paid under HRS Less the follo ing if credited to the profit & loss account for arriving at profit before ta! Capital profit on sale/disposal of fi1ed assets Capital profit on sale of immova le assets 9if the compan! is engaged in usiness of wholl! or partl! u!ing and selling of an! such immova le propert!4 it shall not e deducted: $rofit on sale of undertaking/an! part thereof $rofit on u!) ack of shares $rofit/discount on redemption of shares or de entures $rofit on sale of investments Compensation received on /5on compete/ Agreements Crite ack of provision for dou tful de ts Crite ack of provision for dou tful advances Appreciation in the value of investments Compensation received on surrender of tenanc! rights $rofit on sale of undertaking Consideration received on assignment of operating licences Crite ack of provision for contingencies Crite off ad de ts against the provision created earlier Crite ack of provision for diminution in the value of investments <1cess of e1penditure over income4 i.e. loss of earlier !ears computed in accordance with section #%2. $rofit on sale of forfeited shares Aepreciation as provided in the ooks of account 9a: certain e1traordinar! items as re+uired under accounting standard) * are shown after arriving at profits efore ta14 such items also need to e considered for arriving at the profit under section #%2 of the Companies Act; 9b: ounties and su sidies received from an! &overnment or an! $u lic Authorit! constituted or authorised ! an! &overnment shall also e added notwithstanding the fact that the! ma! have een directl! credited to capital reserves.

MEANING OF THE DEFFE7TIAE 7APITALD

For the purpose of deciding remuneration pa!a le to managerial persons in a compan!4 the effective capital4 which is the ase for 9

determining eligi ilit! of remuneration4 shall e calculated as on the last date of the financial !ear preceding the financial !ear in which the appointment is made. For ascertaining the effective capital of a compan! for arriving at the ma1imum permissi le remuneration4 the following shall e considered and added78 1. $aid)up share capital 9e1cluding share application mone! and advances against shares:; ". Share premium account; #. Reserves and surplus 9e1cluding revaluation reserve:; and %. Fong)term loans and deposits repa!a le after one !ear ut e1cluding working capital loans4 overdrafts4 interest due on loans unless funded4 ank guarantee and short)term arrangements. The following amount shall e deducted78 1. (nvestments 9e1cept in the case of investment compan!:; ". Accumulated losses; #. $reliminar! e1penses not written off. The net figure will e considered as the effective capital of a compan!. Chere the appointment of the managerial person is made in the !ear in which the compan! has een incorporated4 the effective capital shall e calculated on the date of such appointment on the a ovesaid asis. REMUNERATION 7OMMITTEE Re8u!remen &"r a))"!n men "& a Remunera !"n 7"mm! ee "& %e ?"ar' Schedule 6((( of the Companies Act4 12*, as amended ! N" !&!*a !"n N"9 GSR >E2E3: 'a e' 0E % Fanuar-: 2002 provides that pa!ment of remuneration of a managerial person shall e approved ! a resolution passed ! the Remuneration Committee. Therefore4 it shall e compulsor! for a pu lic compan! or a private compan!4 which is a su sidiar! of a pu lic compan! to constitute and appoint a remuneration committee of the directors. E!planation I" of Schedule 6(((4 inserted ! 5otification 5o. &SR #,9<:4 dated 1,th Ianuar!4 "33" provides that for the purposes of this section4 -Remuneration Committee- means that a committee which consists of at least three non)e1ecutive independent directors including nominee director or nominee directors4 if an!. Therefore4 if a compan! is not capa le to appoint a remuneration committee consisting of three non)e1ecutive independent directors it shall not e eligi le to appoint or re)appoint a managerial person under the provisions of Schedule 6((( of the Companies Act and it shall e 10

re+uired to o tain approval of the Central &overnment for that purpose in terms of the provisions of section ",2 of the Act. 7"m)an$%"u#' %a+e a #ea$ %ree n"n<e6e*u !+e !n'e)en'en '!re* "r$ To fulfill the re+uirements for approval of remuneration pa!a le to a managerial person ! a remuneration committee4 it shall e compulsor! for a compan! to have at least three non)e1ecutive independent directors in the 'oard of directors at the time of appointment of a managerial person. Bowever4 a nominee director of a financial institution shall e considered as an independent director and ma! e appointed as a mem er of the remuneration committee. 7"m)an- $%"u#' n" %a+e *"mm! e' an- 'e&au# !n re)a-men "& an- "& ! $ 'e, $ The $art A and $art ' of $art (( of Schedule 6((( of the Act provides that the compan! should not have made an! default in repa!ment of an! of its de ts 9including pu lic deposits: or de entures or interest pa!a le thereon for a continuous period of thirt! da!s in the preceding financial !ear efore the date of appointment of such managerial person. Therefore4 if a compan! has committed an! of the a ove said default it shall not e eligi le to appoint or re)appoint a managerial person under the provisions of Schedule 6((( of the Companies Act and it shall e re+uired to o tain approval of the Central &overnment for that purpose in terms of the provisions of section ",2 of the Act. Re8u!remen "& a))r"+a# ,- /a- "& a $)e*!a# re$"#u !"n )a$$e' !n genera# mee !ng "& mem,er$ (n the following cases the appointment of managerial person shall e made ! the mem ers at the general meeting ! wa! of a special resolution78 9a: if the appointee has not completed the age of "* !ears4 ut has attained the age of ma>orit! or he has attained the age of .3 !ears; 9b: where in an! financial !ear during the currenc! of tenure of the managerial person a compan! has no profits or its profits are inade+uate4 and the proposed remuneration to managerial person ! wa! of salar!4 dearness allowance4 per+uisites and other allowances not e1ceeding the limit of Rs. %04334333 per annum or Rs. %4334333 per month calculated on the scale as given in 5otification 5o. &SR #,9<:4 dated 1,th Ianuar!4 "33". Tenure "& a))"!n men 11

(n terms of the amendments made ! in Schedule 6((( of the Companies Act4 12*, vide 5otification 5o. &SR #,9<:4 dated 1,th Ianuar!4 "33" a compan! ma! appoint managerial person for a period of five !ears at a time. Bowever4 if a compan! proposes to pa! remuneration in e1cess of Rs. "%4334333 p.a. or Rs. "4334333 p.m. and the compan! has no profits or its profits are inade+uate4 the remuneration will e approved for a period not e1ceeding three !ears at a time. Ma6!mum remunera !"n )a-a,#e " manager!a# )er$"n !n *a$e %e !$ a manager!a# )er$"nne# !n /" *"m)an!e$ Section ((( of $art (( of Schedule 6((( to the Companies Act4 12*, inter alia provides that the total remuneration which can e paid ! two companies in which an individual is a managerial person shall not e1ceed the higher ma1imum limit admissi le from an! one of the companies of which he is a managerial person. (t is to e noted that Section ((( is also su >ect to the provisions of Sections ( and ((. As per $ress 5ote 5o. "/2,4 dated 1,)2)122, issued ! the Aepartment of Compan! Affairs vide F. 5o. 1/10/2,)CF H inter alia provides that a person who is a managerial person in more than one compan! shall e a le to draw remuneration from one or oth the companies. For making pa!ment to a managerial person from two companies4 the following steps are to e taken78 9i: ascertain that which of the following two sections is applica le to oth the companies of which one common individual is a managerial person; Se* !"n I 8 Remuneration pa!a le ! companies having profits. Se* !"n II 8 Remuneration pa!a le ! companies having no profits or inade+uate profits. 9ii: working out of ma1imum remuneration which can e paid to the managerial person ! each compan! separatel!4 the higher of a ove two ma1imum limits will e the ceiling on total ma1imum remuneration which can e paid to such managerial person ! oth companies taken together. PA@MENT OF REMUNERATION TO MANAGERIAL PERSON .ITH THE APPROAAL OF THE 7ENTRAL GOAERNMENT Re8u!remen "& a))r"+a# "& %e 7en ra# G"+ernmen &"r )a-men "& remunera !"n " manager!a# )er$"n A compan! which has no profits or has inade+uate profits shall not pa! to its directors4 including an! managing or whole)time director or 12

manager4 ! wa! of remuneration an! sum e1clusive of an! fees pa!a le to directors under section #329":4 e1cept with the previous approval of the Central &overnment. =Section 1209%:? Bowever4 approval of the Central &overnment shall not e re+uired for pa!ment of remuneration to its managerial person if the appointment has een made in accordance with the provisions of section ",2 read with Schedule 6((( to the Act. =Section 1209%:? 7"m)u#$"rre8u!remen "& a))r"+a# "& %e 7en ra# G"+ernmen &"r a))"!n men "& manager!a# )er$"nne# (f the appointment and remuneration of a managerial person has not een made in accordance with the provisions of Schedule 6(((4 it shall e got approved ! the Central &overnment. (n order to o tain approval of the Central &overnment4 application shall e made in the prescri ed Form "*A within a period of ninet! da!s from the date of appointment. Approval of the Central &overnment for pa!ment of remuneration shall e necessar! onl! if remuneration e1ceeds *@ of the net profits for one such director4 and if there is more than one such director4 13@ for all of them put together. This aforesaid limit is applica le in the case of a compan! having profits. 7"m)u#$"r- re8u!remen &"r )r!"r a))r"+a# &"r )a-men "& remunera !"n e6*ee'!ng %e *e!#!ng #!m! "& R$9 ;1:00:000 )9a9 "r R$9 ;:00:000 )9m9 (n the case of a compan! having negative or Jero effective capital and proposes to pa! managerial remuneration to a person in e1cess of Rs. %04334333 p.a. or Rs. %4334333 p.m. calculated on the scale in terms of the amendments made in Schedule 6((( of the Companies Act4 12*, vide 5otification 5o. &SR #,9<:4 dated 1,th Ianuar!4 "33" the appointment of such managerial person shall e made su >ect to the prior approval of the Central &overnment. In*rea$e !n remunera !"n an' re8u!remen &"r a))r"+a# "& %e 7en ra# G"+ernmen Section #13 stipulates that in case of a pu lic compan!4 or a private compan! which is a su sidiar! of a pu lic compan!4 an! provision relating to increase in the remuneration of an! director including a managing or whole)time director4 or an! amendment thereof4 which purports to increase or has the effect of increasing4 whether directl! or indirectl! the amount thereof shall not have an! effect8 9a: in cases where Schedule 6((( is applica le4 unless such increase is in accordance with the conditions specified in that Schedule; and 13

9b: in an! other case4 unless it is approved ! the Central &overnment; and the amendment shall ecome void if4 and in so far as4 it is disapproved ! that &overnment. The provision relating to the remuneration ma! e contained in the compan!-s Memorandum or Articles4 or in an! agreement entered into ! it4 or in an! resolution passed ! the compan! in general meeting or ! its 'oard of directors. Following are the other important provisions in this regard78 91: Approval of the Central &overnment shall e o tained where the provision for increase in remuneration is not in accordance with the provisions of Schedule 6((( to the Act. (n order to o tain approval of the Central &overnment4 application shall e made in the prescri ed e)Form "*A. 9$reviousl! it was re+uired to su mit in the Form ",4 which has een merged with an e)Form "*A vide 5otification 5o. &SR *,9<: dated 13th Fe .4 "33,: 9": Section #13 does not appl! to an independent private compan!. (t also does not appl! to a &overnment Compan! 8 ACA 5otification 5o. &SR "#*4 dated #1)1)12.0. Amen'men "& )r"+!$!"n$ re#a !ng " %e manag!ng: /%"#e< !me '!re* "r "r n"n<r" a !"na# '!re* "r$ re8u!re a))r"+a# "& %e 7en ra# G"+ernmen 2Se* !"n<2E13 (n the case of a pu lic compan!4 or a private compan! which is a su sidiar! of a pu lic compan!4 an amendment of an! provisions relating to the appointment or re)appointment of a managing4 whole) time director or of the directors not lia le to retire ! rotation4 whether that provision e contained in the compan!-s Memorandum or Articles4 or in an! agreement entered into ! it4 or in an! resolution passed ! the compan! in general meeting or ! its 'oard of directors shall not have an! effect unless approved ! the Central &overnment and the amendment shall ecome void if4 and in so far as4 it is disapproved ! that &overnment. An application in the prescri ed e)Form "*' electronicall! has to e made to the Central &overnment. The application need not e made where a new provision regarding appointment or re)appointment of a managing director4 whole)time director or director not lia le to retire ! rotation is to e inserted. The approval would e re+uired onl! when an e1isting provision in the Articles of Association is amended.

CNON<EGE7UTIAE DIRE7TORC

Mean!ng "& COr'!nar-C "r CN"n<E6e*u !+e D!re* "rC 14

5on)e1ecutive directors are those on the 'oard of a compan! who are other than a managing or whole)time director. These non)e1ecutive directors normall! receive onl! sitting fees for ever! meeting of the 'oard and Committee attended ! them. Therefore4 a director who is neither in the whole)time emplo!ment of the compan! nor a managing director is called an ordinar! director or non)e1ecutive director. 7e!#!ng "n remunera !"n "& "r'!nar- "r n"n<e6e*u !+e '!re* "r$ Sections #329%: and #329.: deals with remuneration pa!a le to the part time directors4 that is to sa! the directors who are neither in the whole)time emplo!ment of the compan! nor a managing director4 within the overall limit stipulated in section 12091: and further in section #329%: itself. Section #329%: authorises pa!ment of remuneration to part time directors in two alternative wa!s78 9i: ! wa! of monthl!4 +uarterl! or annual pa!ment with the approval of the Central &overnment; and/or 9ii: ! wa! of commission without the approval of the Central &overnment4 su >ect to the approval of the mem ers ! wa! of special resolution. Therefore4 if the commission pa!a le e1ceeds the limit4 pa!ment can e made onl! with the approval of the Central &overnment. Buan um "& *"mm!$$!"n %a ma- ,e )a!' " n"n<e6e*u !+e '!re* "r$ Section #329%: provides that a director or directors who is/are not managing or whole)time directors ma! e paid remuneration periodicall! with the approval of the Central &overnment or ma! e paid commission4 provided the said remuneration shall not e1ceed 1@ of the net profits if the compan! has a managing or whole)time director and #@ in other cases. The net profits shall e computed in terms of sections 1204 #%2 and #*3 of the Act. 7"mm!$$!"n ma- ,e )a!' " a## n"n<e6e*u !+e '!re* "r$ At the time of initiating the pa!ment of commission to non)e1ecutive directors4 su >ect to necessar! approvals4 the 'oard ma! decide that the same shall e shared e+uall! ! and amongst all such directors or in an! other wa! as ma! e approved ! the 'oard or as prescri ed in the Articles. Pr!"r a))r"+a# "& %e mem,er$

15

'esides the approval of the Central &overnment4 no pa!ment to non) e1ecutive directors without the prior approval of the compan! in general meeting accorded ! a special resolution in terms of section #329%: can e made. S)e*!a# re$"#u !"n $%a## ,e +a#!' &"r a )er!"' "& &!+e -ear$ The approval of mem ers ! wa! of special resolution will e valid at a time for a period of five !ears. The said approval shall e prior to the pa!ment of the commission.

Rene/a# "& $)e*!a# re$"#u !"n The special resolution passed under section #139%:9 b: is valid for a period of * !ears at a time4 it ma! e renewed for a further period of five !ears at a time and an! renewal must e done not earlier than one !ear from the date on which it is to come into force. Ar !*#e$ mu$ )r"+!'e &"r remunera !"n " n"n<e6e*u !+e '!re* "r$ (f there is no provision in the articles for pa!ment of remuneration to non)e1ecutive directors4 action shall first e taken to amend the provisions of articles to include a suita le provision ! wa! of a special resolution at a general meeting. 7en ra# G"+ernmen C$ a))r"+a# Although the section prescri es that the approval of the Central &overnment is necessar! onl! for pa!ment of fi1ed remuneration to non)e1ecutive directors4 it is found that the Aepartment is of the view that a compan! cannot pa! commission to non)e1ecutive directors ased on 1@ or #@ of net profits4 as the case ma! e4 without the prior approval of that government on the ground that an! such pa!ment would mean increase in the remuneration to a director which would attract the provisions of section #13 and thus need the approval of the Central &overnment. The &overnment-s view is that where directors receive fees for 'oard meetings attended ! them4 proposal for pa!ment of commission or other remuneration to them would mean increase in remuneration under section #13. Bowever4 where the directors do not receive 'oard meeting fees or other remuneration4 Central &overnment-s approval is re+uired as an! remuneration proposed to e paid will e deemed to e an increase in remuneration and will re+uire approval of the 16

&overnment under section #13 and also approval of mem ers special resolution.

A))#!*a !"n " %e 7en ra# G"+ernmen The application for pa!ment of remuneration to non)e1ecutive directors shall e made in e)Form "*A. 9$reviousl! in the Form ",4 which has een merged in the e)Form "*A ! the 5otification 5o. &SR *,9<: dated 13th Fe .4 "33,: 'efore making the application4 the compan! shall pu lish a notice to the mem ers of the compan! indicating the nature of the application proposed to e made4 one in a newspaper in the principal language of the district in which the registered office is situated and also in an <nglish newspaper circulating in that district. Copies of the notices dul! certified as to date of pu lication shall e sent with the application. Fees as prescri ed in the Companies 9Fees on Applications: Rules4 1222 shall accompan! the application. (t ma! e noted that no form is prescri ed for making application to the Central &overnment under section #329%: for pa!ment of remuneration in e1cess of 1@ or #@. 'ut where application is made under section #13 even for pa!ment within 1@ or #@4 the application shall e in the prescri ed Form ", esides issue of general notice under section ,%3'. Cop! of the a ove application shall e forwarded to the Registrar of Companiesalso.

17

E6*e$$ remunera !"n: !& an-: )a!' " '!re* "r$ (f an! director draws remuneration in e1cess of the limits provided in section #32 or without the approval of the Central &overnment4 where re+uired4 he shall refund such e1cess to the compan! unless on an application made ! the compan!4 the &overnment waives the recover! for good and sufficient reasons. The application ma! e made in the form of a letter after it is approved ! the 'oard. Such waiver of e1cess remuneration also re+uires the approval of mem ers. Pa-men "& ra+e#!ng: ,"ar'!ng an' #"'g!ng e6)en$e$ The Articles shall contain a provision for pa!ment of traveling4 oarding and lodging e1penses to directors in connection with the usiness of a compan!. (n this conte1t the clarification vide Circular 5o. */.*4 dated 1)")12.* given ! the ACA have een reproduced as under7 /Chether the condition restricting traveling and dail! allowances4 which ma! e paid to the directors of the compan! for performing >ourne!s on the usiness of the compan! to the limits laid down in rule ,A of the (ncome)ta1 Rules4 12," should e imposed4 has een considered in consultation with the Compan! Faw Advisor! Committee. Baving regard to the various practical difficulties faced ! the companies in compl!ing with the aforesaid condition4 the Central &overnment have decided that no such condition could e imposed. The companies ma!4 however4 e advised to ensure that the pa!ment will e on the asis of actual e1penditure and e1penditure kept to the minimum./ Pa-men "& guaran ee *"mm!$$!"n " '!re* "r$ !$ n" remunera !"n The Aepartment had issued earlier Circular 5o. 1%/*3)CF.H4 dated 1,) 1")12,2 according to which guarantee commission pa!a le to the directors for personal guarantee on loans to the compan! was to e treated as remuneration under section #3291: of the Companies Act4 12*,. (n Sussen Te!tile #earings Ltd. v Union of India reported in 9120%: ** Comp Cas %2"4 it was held ! Aelhi Bigh Court that guarantee Commission paid ! a compan! to its director for standing suret! for loans and credit facilities taken ! the compan! was not a remuneration within the meaning of section #32 of the Companies Act4 12*, and approval of the Central &overnment was not necessar!. =Circular 5o. #/2% 9F. 5o. 1%/#/0.)CF.H:4 dated 1,)")122%?

))))))))))))))))))))))))))) ))))))))))))))))))))))))))))))))))))

You might also like

- FileDocument8 pagesFilekumar_anil666No ratings yet

- On Career As A Company Secretary - 12.02.2024Document16 pagesOn Career As A Company Secretary - 12.02.2024kumar_anil666No ratings yet

- Adhoc Case LawDocument1 pageAdhoc Case Lawkumar_anil666No ratings yet

- CV AnilDocument3 pagesCV Anilkumar_anil666No ratings yet

- 1 2 Name of The Company CINDocument16 pages1 2 Name of The Company CINkumar_anil666No ratings yet

- Lockdown Instructisons On Maid ServantsDocument1 pageLockdown Instructisons On Maid Servantskumar_anil666No ratings yet

- Tax Updates For June 2015 Examination - 20!03!15Document37 pagesTax Updates For June 2015 Examination - 20!03!15kumar_anil666No ratings yet

- Plethora of Exemptions To Government Companies!! - Corporate LawDocument11 pagesPlethora of Exemptions To Government Companies!! - Corporate Lawkumar_anil666No ratings yet

- Lawcet2014 5yearDocument28 pagesLawcet2014 5yearsarmasarmateja100% (1)

- Annual Report - 2012-13Document12 pagesAnnual Report - 2012-13kumar_anil666No ratings yet

- Appointment To The Post of Company SecretaryDocument1 pageAppointment To The Post of Company Secretarykumar_anil666No ratings yet

- CS Test One - ExecutiveDocument1 pageCS Test One - Executivekumar_anil666No ratings yet

- Linkedin DataDocument1 pageLinkedin Datakumar_anil666No ratings yet

- List of Labour Laws: Compiled by P.velu CA (Final)Document20 pagesList of Labour Laws: Compiled by P.velu CA (Final)santoshiyerNo ratings yet

- Mahalaya PakshaDocument4 pagesMahalaya Pakshakumar_anil666No ratings yet

- Holiday List 2014Document1 pageHoliday List 2014kumar_anil666No ratings yet

- ACLPDocument734 pagesACLPkumar_anil666No ratings yet

- Guidelines To Prepare A Workbook: Question Should Force Him/her To Learn Rather Than Depend On Past MemoryDocument6 pagesGuidelines To Prepare A Workbook: Question Should Force Him/her To Learn Rather Than Depend On Past Memorykumar_anil666No ratings yet

- Pandagalu MuhurthaluDocument61 pagesPandagalu MuhurthaluMallikaarjjuna MunagapatiNo ratings yet

- Lawcet&pglcet 2014Document1 pageLawcet&pglcet 2014kumar_anil666No ratings yet

- Ayurvedam March-2008Document36 pagesAyurvedam March-2008kumar_anil666No ratings yet

- Ayurvedam February 2008Document36 pagesAyurvedam February 2008kumar_anil666100% (1)

- ICSI MagazineDocument19 pagesICSI Magazinekumar_anil666No ratings yet

- Business Communication & Soft Skills: Sample QuestionsDocument2 pagesBusiness Communication & Soft Skills: Sample Questionskumar_anil666No ratings yet

- Kamakya Temple PhampletDocument1 pageKamakya Temple Phampletkumar_anil666No ratings yet

- Compounding of OffencesDocument49 pagesCompounding of Offenceskumar_anil6660% (1)

- 0901 Om-Ii (Mb2e4)Document32 pages0901 Om-Ii (Mb2e4)api-19916064No ratings yet

- Stamps BillDocument1 pageStamps Billkumar_anil666No ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word Documentkumar_anil666No ratings yet

- Panchangam2013 2014Document37 pagesPanchangam2013 2014atreya757No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MACS - Assignment 3 - Question PaperDocument8 pagesMACS - Assignment 3 - Question PaperAudrey KhwinanaNo ratings yet

- Constant Mix Portfolios and Risk Aversion: Samuel Kyle Jones and J. Bert StineDocument8 pagesConstant Mix Portfolios and Risk Aversion: Samuel Kyle Jones and J. Bert StineEyres ValkrieNo ratings yet

- Home Loan Form NewDocument6 pagesHome Loan Form NewrahulNo ratings yet

- BV2018 - MFRS 4Document41 pagesBV2018 - MFRS 4Tok DalangNo ratings yet

- Tax BillDocument1 pageTax BillBrenda SorensonNo ratings yet

- Meinhardt (Malaysia) SDN BHD: Leave Application FormDocument1 pageMeinhardt (Malaysia) SDN BHD: Leave Application FormrasydanNo ratings yet

- Microfinance As A Poverty Reduction PolicyDocument12 pagesMicrofinance As A Poverty Reduction PolicyCarlos105No ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 7Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 7LaVida Loca100% (1)

- Innocents Abroad Currencies and International Stock ReturnsDocument39 pagesInnocents Abroad Currencies and International Stock ReturnsShivaniNo ratings yet

- MQF Syllabus 22 390 587Document2 pagesMQF Syllabus 22 390 587Economiks PanviewsNo ratings yet

- Adm657 TutoDocument11 pagesAdm657 TutoLily NarisaNo ratings yet

- Blue Point CapitalDocument9 pagesBlue Point CapitalgalindoalfonsoNo ratings yet

- Interest and Depreciation QuestionsDocument5 pagesInterest and Depreciation QuestionsP100% (1)

- Cost Audit ProjectDocument49 pagesCost Audit Projectashuti75% (4)

- Revenue Memo Ruling 02-2002Document20 pagesRevenue Memo Ruling 02-2002Annie SibayanNo ratings yet

- Bayou Steel Bankruptcy FilingDocument19 pagesBayou Steel Bankruptcy FilingWWLTVWebteamNo ratings yet

- The Future Is Not What It Used To Be Thoughts On The Shape of The Next NormalDocument7 pagesThe Future Is Not What It Used To Be Thoughts On The Shape of The Next NormalAnna Maria HernandezNo ratings yet

- Case 16 Group 56 FinalDocument54 pagesCase 16 Group 56 FinalSayeedMdAzaharulIslamNo ratings yet

- Foreign Exchange Market: Presented By:-Parth Shingala Rohan Dhone Sandeep Singh Saikat Datta Ila JoshiDocument13 pagesForeign Exchange Market: Presented By:-Parth Shingala Rohan Dhone Sandeep Singh Saikat Datta Ila JoshiParth ShingalaNo ratings yet

- Form CSRF Subscriber Registration FormDocument7 pagesForm CSRF Subscriber Registration FormPranab Kumar DasNo ratings yet

- Bos 50519Document48 pagesBos 50519VARSHA BHOJWANINo ratings yet

- Printable Conference Programme, Paris July 2012Document15 pagesPrintable Conference Programme, Paris July 2012tprugNo ratings yet

- Brunei Darussalam TINDocument6 pagesBrunei Darussalam TINAyman MehassebNo ratings yet

- Kesar Terminals & Infrastructure LTDDocument118 pagesKesar Terminals & Infrastructure LTDSanjeev AggarwalNo ratings yet

- The Firm-Specific Determinants of Capital Structure - An Empirical Analysis of Firms Before and During The Euro CrisisDocument3 pagesThe Firm-Specific Determinants of Capital Structure - An Empirical Analysis of Firms Before and During The Euro CrisisHermela tedlaNo ratings yet

- Document No 76 - Debt Fund Update Jan' 23Document3 pagesDocument No 76 - Debt Fund Update Jan' 23AmrutaNo ratings yet

- VCF Stock AnalysisDocument36 pagesVCF Stock Analysisruh cinNo ratings yet

- IC 1928-2020union MudraDocument11 pagesIC 1928-2020union Mudraamit_200619No ratings yet

- Victoria's Secret Annual ReportDocument13 pagesVictoria's Secret Annual Reportapi-373843164% (28)

- TOC of Pre Feasibility Report On Five Star HotelDocument6 pagesTOC of Pre Feasibility Report On Five Star Hotelbrainkrusherz0% (1)