Professional Documents

Culture Documents

In Setting 2 Product

Uploaded by

Anamika Rai PandeyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Setting 2 Product

Uploaded by

Anamika Rai PandeyCopyright:

Available Formats

In setting products price, many factors must be considered.

A firm must set prices for the first time when it develops 2 new product, introduces its regular product into new distribution channel or geographical area, or enters 2 bid on new contract work. Moreover, it must decide where to position its product on price and uality! some may have three to live price points or tiers. "he following is 2 si#$step procedure for setting pricing policy% &l' selecting the pricing ob(ective! &2' determining demand! &)' estimating costs! &*' analy+ing competitors costs, prices, and offers! &,' selecting 2 pricing method! and &-' selecting the final price &see .igure /2./'.

A'

,tep /% ,electing the 0ricing 1b(ective%

A company can pursue any of five ma(or ob(ectives through pricing% survival, ma#imum current profit, ma#imum market share, ma#imum market skimming, or product$ uality leadership. /' ,urvival %

,urvival is a short$term ob(ective that is appropriate for companies plagued with overcapacity, intense competition, or changing consumer wants. As long as prices cover variable costs and some fi#ed costs, the company can stay in business. 2' "o 2ain "he Ma#imum 3urrent 0rofit%

"o gain the ma#imum current profit, companies estimate the demand and costs associated with alternative prices and then choose the price that produces ma#imum current profit, cash flow, or return on investment. 4owever, by emphasising current profits, the company may sacrifice long$ run performance by ignoring the effects of other marketing$mi# variables, competitors reactions, and legal restraints on price. )' 1b(ective 1f Ma#imum Market ,hare %

.irms choosing the ob(ective of ma#imum market share believe that higher sales volume will lead to lower unit costs and higher long$run profit. 5ith market$penetration pricing, the 6arn sets the lowest price, assuming the market is price sensitive. "his is appropriate when the market is highly price sensitive and a low price stimulates market growth! when production and distribution costs fall with accumulated production e#perience! and when a low price discourages competition.

*'

Market7 ,kimming 0ricing %

Many companies favor setting high prices to 8skim9 the market. Market7 skimming pricing makes sense when enough buyers have high current demand! when the unit costs of producing a small volume are not so high that they cancel the advantage of charging what the traffic will bear! when the high initial price does not attract more competitors! and when the high price communicates the image of a superior product. :' 0roduct ;uality <eaders %

3ompanies that aim to be 0roduct uality leaders can either offer affordable lu#uries at prices (ust high enough not to be out of reach &such as ,tarbucks coffee' or products combining uality, lu#ury, and premium prices &such as Absolute super premium vodka'. =' ,tep 2% >etermining >emand

6ach price will lead to a different level of demand and therefore will have a different impact on a companys marketing ob(ectives. A demand curve shows the relationship between alternative prices and the resulting current demand. ?ormally, demand and price are inversely related% "he higher the price, the lower the demand. .or prestige goods, the demand curve sometimes slopes upward because some consumers take the higher price to signify a better product. ,till, if the price is too high, the level of demand may fall. /' 0rice ,ensitivity% uantity at alternative prices,

"he demand curve shows the markets probable purchase

summing the reactions of many individuals who have different price sensitivities. "he first step in estimating demand is to understand what affects price sensitivity. 2enerally speaking, customers are most prices sensitive to products that cost a lot or are bought fre uently. "hey are less price sensitive when price is only a small part of the total cost of obtaining, operating, and servicing the product over its over its lifetime. .inns, of course, prefer customers who are fewer prices sensitive. "he following is a list of factors leading to less price sensitivity, as identified by ?agle and 4olden. 7 "he product is more distinctive 7 =uyers are less aware of substitutes 7 =uyers cannot easily compare the uality of substitutes

7 "he e#penditure is a smaller part of the buyer@s total income 7 "he e#penditure is small compared to the total cost of the end product 7 0art of the cost is borne by another party 7 "he product is used in con(unction with assets previously bought 7 "he product is assumed to have more uality, prestige or 6#clusiveness 7 =uyers cannot store the product 2' Analysing >emand 3urves %

Most firms make some attempt to measure their demand curves using methods like statistical analysis, price e#periments and surveys. In measuring the price demand relationship, the marketer must control for various factors that will influence demand. "he competitors response will make a difference. Also, if the company changes other marketing mi# factors besides price, the effect of the price change itself will be hard to estimate and measure. Most companies attempt to measure their demand curves using several different methods. a' b' ,urveys can e#plore how many units consumers would buy at different proposed prices. 0rice e#periments can vary the prices of different products to see how the change

affects sales. c' ,tatistical analysis of past prices, uantities sold, and other factors can reveal their

relationships. "hese can be% /' <ongitudinal or 2' 3ross sectional.

)'

0rice 6lasticity of >emand %

0rice elasticity depends on the magnitude and direction of the contemplated price change. It may be negligible with a small price change and substantial with a large price change! it may differ for a price cut versus a price increase. .inally, long$run price elasticity may differ from short$run elasticity. =uyers may continue to buy from their current supplier after a price increase but they may eventually switch suppliers. "he distinction between short$run and long$run elasticity means that sellers will not know the total effect of a price change limit as time passes. Marketers need to know how responsive or elastic, demand would be to a change in price.

a' b' c' i' ii' iii' iv' d'

If demand hardly changes with a small change in price, we say the demand is inelastic. If demand changes considerably, demand is elastic. >emand is likely to be less elastic under the following conditions% "here are few or no substitutes or competitors. =uyers do not readily notice a higher price. =uyers are slow to change their buying habits. =uyers think the higher prices are (ustified. If demand is elastic, sellers will consider lowering the price. A lower price will produce

more total revenue as long as the costs of producing and selling more units do not increase disproportionately

3'

,tep )% 6stimating 3osts

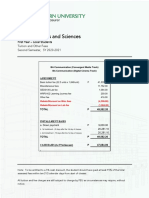

5hereas demand sets a ceiling on the price the company can charge for its product, costs set the floor. "he company wants to charge a price that covers its cost of producing, distributing, and selling the product, including a fair return for its effort and risk. /' "ypes of 3osts and <evels of 0roduction

3ompanys costs take two formsAfi#ed and variable. .i#ed costs &also known as overhead' are costs that do not vary with production or sales revenue, such as payments for rent, heat, interest, salaries, and other bills that must be paid regardless of output. Bariable costs vary directly with the level of production. .or e#ample, each calculator produced by "e#as Instruments &"I' involves a cost of plastic, micro$processing chips, and the like. "hese costs tend to be constant per unit produced, but they are called variable because their total varies with the number of units produced. "otal costs are the sum of the fi#ed and variable costs for any given level of production. Average cost is the cost per unit at that level of production! it is e ual

total costs divided by production. Management wants to charge a price that will at least cover the total production costs at a given level of production. "o price intelligently management needs to know how its cost vary with different levels of production. A firms cost per unit is high if only a few units are produced every day, but as production increases, fi#ed costs are spread over a higher level of production results in each unit, bringing the average cost down. At some point, however, higher production will lead to higher average cost because the plant becomes inefficient &due to problems such as machines breaking down more often'. =y calculating costs for different plants, a company can identify the optimal plant si+e and production level to achieve economies of scale and cost. 2' Accumulated 0roduction down the average

6#perience$curve pricing is risky because aggressive pricing may give the product a cheap image. "his strategy also assumes that competitors are weak followers and may lead the firm into building more plants to meet demand. Meanwhile, a competitor innovate a lower$cost technology, leaving the leader stuck with old technology. )' Activity$=ased 3ost Accounting

"odays companies try to adapt their offers and terms to different buyers. "hus, a manufacturer will negotiate different terms with different retail chains, meaning the costs and profits will differ with each chain. "o estimate the real profitability of dealing with different retailers, the manufacturer needs to use activity$based cost &A=3' accounting instead of standard cost accountingC A=3 accounting tries to identify die real costs &both variable and overhead' associated with serving each customer. 3ompanies that fail to measure their costs correctly are not measuring their problem correctly, and they are likely to misallocate their marketing effort. *' "arget 3osting

3osts change with production scale and e#perience. "hey can also change as a result of a concentrated effort by the companys designers, engineers, and purchasing agents to reduce them through target costing. Market research is used to establish a new products desired functions and the price at which it will sell, given its appeal and competitors prices. >educting the desired profit margin from this price leaves the target cost that be must achieved. 6ach cost elementAdesign, engineering, manufacturing, salesAmust be e#amined and different ways

considered bringing the final cost pro(ections into the target cost range. If this is not possible, the 2nu may decide against developing the product because it could not sell for the target price and make the target profit. >' ,tep *% Analy+ing 3ompetitors 3osts, 0rices, and 1ffers

5ithin the range of possible prices determined by market demand and company costs, the firm must take into account its competitors@ costs, prices, and possible price reactions. If the firms offer contains features not offered by the nearest competitor! their 5orth to the customer should be evaluated and added to the competitors price. If the competitors offer contains some features not offered by the firm, their worth to the customer should be evaluated and subtracted from the firms price. ?ow the firm can decide whether it can charge more, the same, or less than the competitor, remembering that competitors can change their prices at any time. 6' ,tep ,% ,electing a 0ricing Method

"he three 3s$the customers@ demand schedule, the cost function, and competitors pricesAare ma(or considerations in setting price. .irst, costs set a floor to the price. ,econd, competitors prices and the price of substitutes provide an orienting point. "hird, customers@ assessment of uni ue product features establishes the ceiling price. 3ompanies therefore must select a pricing method that includes one or more of these considerations. 5e will e#amine si# price$setting methods% markup pricing, target$return pricing, perceived$value pricing, value pricing, goingA rate pricing, and auction$type pricing. "ypes of 0ricing Method % "here are three pricing methods that can be employed by a firm% /' 3ost 1riented 0ricing %

3ompanies often use cost oriented pricing methods when setting prices. "wo methods are normally used a' .ull 3ost 0ricing %

5hat does a firm do hereD 4ere the firm determines the direct and fi#ed costs for each unit of product. "he first problem with .ull$cost pricing is that it leads to an increase in price as sales fall. "he process is illogical also because to arrive at a cost per unit the firm must anticipate how many products they are going to sell. "his is an almost impossible prediction. "his method

focuses upon the internal costs of the firm as opposed to the prospective customers willingness to pay. b' >irect &1r Marginal' 3ost 0ricing%

"his involves the calculation of only those costs, which are likely to increase as output increases. Indirect or fi#ed costs &plant, machinery etc' will remain unaffected whether one unit or one thousand units are produced. <ike full cost pricing, this method will include a profit margin in the final price. >irect cost approach is useful when pricing services for e#ample. 3onsider aircraft seats! if they are unused on a flight then the revenue is lost. "hese remaining seats may be offered at a discount so that some contribution is made to the flight e#penses. "he risk here is that other customers who paid the full price may find out about the discounted offer and complain. >irect costs then, indicate the lowest price at which it is sensible to take business if the alternative is to let machinery, aircraft seats or hotel rooms lie idle. 2' a' 3ompetition$=ased Approach % 2oing$Eate 0ricing %

In going$rate pricing, the firm bases its price largely on competitors prices, with less attention paid to its own costs or to demand. "he firm might charge the same, more, or less than its ma(or competitors. 5here the products offered by firms in a certain industry are very similar the public often finds difficulty in perceiving which firm meets their needs best. In cases like this &for e#ample in financial services and delivery services' the firm may attempt to differentiate on delivery or service uality in an attempt to (ustify a higher selling price. b' 3ompetitive =idding %

Many contracts are won or lost on the basis of competitive bidding. "he most usual process is the drawing up of detailed specifications for a product and putting the contract out for tender. 0otential suppliers uote a price, which is confidential to themselves and the buyer. In sealed$ bid pricing &i.e. only known to client and not to the other parties tendering for the service', firms bid for (obs, with the firms basing the price on what it thinks other firms will be bidding rather than on its own costs or demand. All other things being e ual the buyer will select the supplier that offers the lowest price. )' Marketing 1riented 0ricing %

"he price of a product should be set in line with the marketing strategy. "he danger is that if price is viewed in isolation &as would be the case with full cost pricing' with no reference to other marketing decisions such as positioning, strategic ob(ectives, promotion, distribution and product benefits. "he way around this problem is to recogni+e that the pricing decision is dependent on other earlier decisions in the marketing planning process. .or new products, price will depend upon positioning, strategy, and for e#isting products price will be affected by strategic ob(ectives. .' ,tep -% ,electing the .inal 0rice %

0ricing methods narrow the range from which the company selects its final price. In selecting that price, the company must consider additional factors, including the impact of other marketing activities, company pricing policies, gain$and$risk$sharing pricing, and the impact of price on other parties. "he /' Influence of 1ther Marketing Activities %

"he final price must take into account the brand@s uality and advertising relative to competition. It is e#amined that the relationships among relative price, relative uality, and relative advertising for consumer businesses, they found that brands with average relative uality but high relative advertising budgets were able to charge premium prices. 3onsumers seemed willing to pay higher prices for known products than for unknown products. Also, brands with high relative uality and high relative advertising obtained the highest prices, while brands with low uality and advertising had the lowest prices. .inally, the positive relationship between high prices and high advertising held most strongly late in the product life cycle for market leaders. 2' 3ompany 0ricing 0olicies%

"he price must be consistent with company pricing policies. "o accomplish this, many firms set up a pricing department to develop policies and establish or approve decisions. "he aim is to ensure that the salespeople uote prices that are reasonable to customers and profitable to the company. )' 2ain$and Eisk$,haring %

0ricing =uyers may resist a sellers proposal because of a high perceived level of risk. "he seller has the option of offering to absorb part or all of the risk if it fails to deliver the promised value.

*'

Impact of 0rice on other 0arties %

Management must also consider the reactions of other parties to the contemplated price, including distributors, dealers, and the sales force. 4ow will competitors reactD 5ill suppliers raise their prices when they see the companys priceD 5ill the government intervene and prevent this price from being charged forever, marketers need to know the laws regulating pricing. ,ellers are not allowed to talk to competitors about pricing and not allowed to use deceptive pricing practices. .or e#ample, it is illegal to set artificially high Fregular9 prices, then announce a 8sale9 at prices close to previous everyday prices.

"he only time when price setting is not a problem is when firms are a 8price$taker9 and has to set prices at the going rate, or else sell nothing at all. "his normally only occurs under near$ perfect market conditions, where products are almost identical. More usually, pricing decisions are among the most difficult that a business has to make. In considering these decisions it is important to distinguish between pricing strategy and tactics. ,trategy is concerned with setting prices for the first time, either for a new product or for an e#isting product in a new market! tactics are about changing prices. 3hanges can be either self$initiated &to improve profitability or as a means of promotion' or in response to outside change &i.e. in costs or the prices of a competitor'.

0ricing strategy

0ricing strategy should be an integral part of the market$ positioning decision, which in turn depends, to a great e#tent, on your overall business development strategy and marketing plans. 3ompanies usually do not set a single price, but rather a pricing structure that reflects variations in geographical demand and costs, market$segment re uirements, purchase timing, order levels, delivery fre uency, guarantees, service contracts, and other factors As a result of discounts, allowances, and promotional support, a company rarely real$i+es the same profit from each unit of a product that it sells. 4ere we will e#amine sev$eral price$adaptation strategies% geographical pricing, price discounts and allowances, promotional pricing, discriminatory pricing, and product$mi# pricing.

2./

Meaning

0rice adaptation is the ability of a business to change its pricing models to suit different geographic areas, consumer demands and prevailing incomes. Marketing plays a significant role in price adaptation because pricing strategy is one of the four main components in determining product positioning, which is is how a company chooses to present products to consumers and generate interest. "he more adaptability a business has, the better chance it has of appealing to more consumers.

0roduct >iscounts Adapting pricing models to include price discounts is a marketing strategy used to attract bargain hunting consumers and to fend off new competitors attempting to enter target market areas. price discounts allow marketing management to create short advertising campaigns to stimulate e#citement over a company@s brands and individual product offerings. =usiness marketers can also use discounts to create consumer interest in market areas with traditionally lower median incomes. "his allows those consumers to try products they might not otherwise be able to afford on a regular basis.

A'

2eographic 0ricing and Marketing

2eographic pricing relates to how a business chooses to price its products within different regions. "his can mean different parts of a particular state, country or even around the globe. In selecting its product prices for different regions, a business also adapts its marketing strategies to fit those pricing models. .or e#ample, a company may increase its product prices in areas where median income among consumers is high, and reduce its prices in areas where median income is low. A business may also keep prices low as a means of generating product interest in areas of the country outside its normal target market areas. "his allows a company to spread interest for its products across wider geographic areas and ultimately increase sales. It is takes several forms% barter, compensation deals, buyback agreements, and offset. /' =arter %

"he direct e#change of goods, with no money and no third party involved 2' 3ompensation >eal %

"he seller receives some percentage of the payment in cash and the rest in products. A =ritish aircraft manufacturer sold planes to =ra+il for GH percent cash and the rest in coffee. )' =uyback Arrangement %

"he seller sells a plant, e uipment, or technology to another country and agrees to accept as partial payment products manufactured with the supplied e uipment. A I,. 3hemical company built a plant for an Indian company and accepted partial payment in cash and the remainder in chemicals manufactured at the plant. *' 1ffset %

"he seller receives full payment in cash but agrees to spend a substantial amount of the money in that country within a stated time period. .or e#ample, 0epsi3o sells its cola syrup to Eussia for rubles and agrees to buy Eussian vodka at a certain rate for sale in the Inited ,tates.

='

0rice >iscounts and Allowances %

"he role of discount can be a useful tactic in response to aggressive competition by a competitor. 4owever, discounting can be dangerous unless carefully controlled and conceived as part of your overall marketing strategy. >iscounting is common in many industries J in some

it is so endemic as to render normal price lists practically meaningless. "his is not to say that there is anything particularly wrong with price discounting provided that you are getting something specific that you want in return. "he trouble is that, all too often, companies get themselves embroiled in a comple# structure of cash, types of discounts common today /' 3ash And ,ettlement >iscounts % uantity and other discounts, whilst getting absolutely nothing in return e#cept a lower profit margin. <et us look briefly at the main

"hese are intended to bring payments in faster. 4owever, since such discounts need to be at least 2,:K per month to have any real effect, this means paying the customer an annual rate of interest of )HK (ust to get in money which is due to the trader anyway. 5hat is more, customers fre uently take all the discounts on offer and still do not pay promptly, so that they lose both ways. Much better, we believe, are either to eliminate these discounts altogether and introduce an efficient credit control system, or change the terms of business so that one can impose a surcharge on overdue accounts instead. 5hilst trader may lose some business by doing this, these will probably is the worst payers anyway. If some customers will not pay him for months trader probably better off trying to win others who will. 2' ;uantity >iscounts %

"he trouble with these is that, when formali+ed on a published price list, they become an established part of your pricing structure and as a result their impact can be lost. If you are not very careful, although they may have helped you win the business to start with, in the long run the only effect they have is to spoil your profit margin. As a general rule, only publish the very minimum of uantity discounts J your very largest customers will probably try to negotiate uantity discounts small, so that you hold something in something e#tra anyway. Also keep or as part of a special promotion. )' 0romotional >iscounts%

reserve for when your customers do something e#tra for you, such as offering you sole supply,

"hese are the best kind of discounts because they enable you to retain the power to be fle#ible. "here may be times when you want to give an e#tra boost to sales J to shift an old product before launching an updated one for e#ample. At times like these special offers or promotional discounts can be useful. =ut try to think of unusual offers J a larger pack si+e for the same price or a9 five for the price of four9 can often stimulate more interest than a straight percentage

discount. "hey also make sure that the end user gets at least some of the benefit, which doesnt always happen with other types of discounts. 3learly the role of discounts will vary from one type of business to another and not all of the comments above will apply to you. In part your ability to minimi+e discounts, or eliminate them altogether, will depend on the non$price benefits of your product. =ut, whatever business you are in, you should always ask yourself what your discounts are supposed to achieve, whether they are effective, and how long they are e#pected to last. In general, keep standard discounts low to retain ma#imum fle#ibility and ensure that they are consistent with your overall marketing and pricing strategy. 3' 0romotional 0ricing %

3ompanies can use several pricing techni ues to stimulate early purchase% /' <oss$<eader 0ricing %

,upermarkets and department stores often drop the price on well Lnown brands to stimulate additional store traffic. "his pays if the revenue on the additional sales compensates for the lower margins on the' boss$leader items. Manufacturers of loss$leader brands typically ob(ect because this practice can dilute the brand image and bring complaints from retailers who charge the list price. Manufacturers have tried to restrain intermediaries from loss leader pricing through lobbying for retail$price $maintenance laws, but these laws have been revoked. 2' ,pecial$6vent 0ricing %

,ellers will establish special prices in certain seasons to draw in more customers )' 3ash Eebates %

Auto companies and other consumer$goods companies offer cash rebates to 6ncourage purchase of the manufacturers products within a specified time period. Eebates can help clear inventories without cutting the stated list price. *' <ow$Interest .inancing %

Instead of cutting its price, the company can offer customers low$ interest financing. Automakers have even announced no$interest financing to attract 3ustomers. :' <onger 0ayment "erms %

,ellers, especially mortgage banks and auto companies, stretch loans over longer periods and thus lower the monthly payments. 3onsumers often worry less about the cost &i.e., the interest rate' of a loan and more about whether they can afford the monthly payment. -' 5arranties and ,ervice 3ontracts%

3ompanies can promote sales by adding a free or low$ cost warranty or service contract. G' 0sychological >iscounting %

"his strategy involves setting an artificially high price and then offering the product at substantial savings 0romotional$pricing strategies are often a +ero$sum game. If they work, competitors 3opy them and they lose their effectiveness. If they do not work, they waste money that could have been put into other marketing tools, such as building up product uality and service or strengthening product image through advertising.

>'

>ifferentialM>iscriminatory 0ricing %

3ompanies often ad(ust their basic price to accommodate differences in customers, products, locations, and so on. 0rice discrimination occurs when a company sells a product or service at two or more prices that do not reflect a proportional difference in costs. In first$degree price discrimination, the seller charges a separate price to each customer depending on the intensity of his or her demand. In second$degree price discrimination, the seller charges less to buyers who buy a larger volume. In third$degree price discrimination, the seller charges different amounts to different classes of buyers, as in the following cases% /' 3ustomer$,egment 0ricing %

>ifferent customer groups are charged different prices for the same product or service. .or e#ample, museums often charge a lower admission fee to students and senior citi+ens. 2' 0roduct$.orm 0ricing %

>ifferent versions of the product Nare priced differently but not proportionately to their respective costs

)'

Image 0ricing %

,ome companies price the same product two different levels based on image differences at. A perfume manufacturer can put the perfume in one bottle, give it a name and image, and price it at Eest. :H. It can put the same perfume in another bottle with a different name and image and price it at Es. 2HH. *' 3hannel 0ricing %

3oca$3ola carries a different price depending on whether it is purchased ill a fine restaurant, a fast$food restaurant, or a vending machine. :' <ocation 0ricing %

"he same product is priced differently at different locations even though the cost of offering at each location is the same. A theater varies its seat prices according to audience preferences for different locations. -' "ime 0ricing %

0rices are varied by season, day, or hour. 0ublic utilities vary energy rates to commercial users by time of day and weekend versus weekday. Eestaurants charge less to 8early bird9 customers. 4otels charge less on weekends. 4otels and airlines use yield pricing, by which they offer lower rates on unsold inventory (ust before it e#pires. 3oca$3ola considered raising its vending machine soda prices on hot days using wireless technology, and lowering the price on cold days. 4owever, customers so dis$liked the idea that 3oke abandoned it. 6' 0roduct$Mi# 0ricing %

0rice$setting logic must be modified when! the product is part of a product mi#. In this case, the firm searches for a set of prices that ma#imi+es profits on the total mi#. 0ricing is difficult because the various products have demand and cost interrelationships and are sub(ect to different degrees of competition. 5e can distinguish si# situations involving product$mi# pricing% product$line pricing, optional$feature pricing, captive$product pricing, two$part pricing, by$product pricing, and product$bundling pricing. /' 0roduct <ine 0ricing !

3ompanies normally develop product lines rather than single products and introduce price steps. In many lines of trade, sellers use well$established price points for the products in their line. A mens clothing store might carry mens suits at three price levels% Es OHH, Es. /:HH, and Es. *:HH. 3ustomers will associate low$, average$, and high$ uality suits with the three price points. "he sellers task is to establish perceived$ uality differences that (ustify the price differences. 2' 1ptional$.eature 0ricing %

Many companies offer optional products, features, and services along with their main product. "he automobile buyer can order electric window controls, defoggers, light dimmers, and an e#tended warranty. 0ricing is a sticky problem! automobiles companies must decide which items to include in the price and which to offer as options. Eestaurants face a similar pricing problem. 3ustomers can often order li uor in addition to the meal. Many restaurants price their li uor high and their food low. "he food revenue covers costs, and the li uor produces the profit. "his e#plains why servers often press hard to get customers to order drinks. 1ther restaurants price their li uor low and food high to draw in a drinking crowd. )' 3aptive$0roduct 0ricing %

,ome products re uires the use of ancillary, or captive, products. Manufacturers of ra+ors and cameras often price them low and set high markups on ra+or blades and film, respectively. A cellular service operator may give a cellular phone free if the person commits to buying two years of phone service. *' "wo$0art 0ricing %

,ervice firms often engage in two$part pricing, consisting of a fi#ed fee plus a variable usage fee. "elephone users pay a minimum monthly fee plus charges for calls beyond the minimum number. Amusement parks charge an admission fee plus fees for rides over a certain minimum. "he service firm faces a problem similar to captive $product pricing$namely, how much to charge for the basic service and how much for the variable usage. "he fi#ed fee should be low enough to induce purchase of the ser$vice! the profit can then be made on the usage fees. :' =y$0roduct 0ricing %

"he production of certain goods$ meats, petroleum products, and other chemicals$often results in by$products. If the by$products have value to a customer group, they should be priced on their

value. Any income earned on the by$products will make it easier for the company to charge a lower price on its main product if competition forces it to do so. -' 0roduct$=undling 0ricing%

,ellers often bundle products and features. 0ure bundling occurs when a firm only offers its products as a bundle. In mi#ed bundling, the seller offers goods both individually and in bundles. 5hen offering a mi#ed bundle, the seller normally charges less for the bundle than if the items were purchased separately. An auto manufacturer might offer an option package at less than the cost of buying all the options separately. A theater company will price a season subscription at less than the cost of buying all the performances separately. =ecause customers may not have planned to buy all the components, the savings on the price bundle must be substantial enough to induce them to buy the bundle.

1) Initiating Price Cuts : ,everal situations may lead a firm to consider cutting its price.

a) Excess Capacity : 1ne such circumstance is e#cess capacity. In this case, the firm needs more business and cannot get it through increased sales effort, product improvement, or other measures. It may drop its Ffollow$the$leader pricingFAcharging about the same price as its leading competitor Aand aggressively cut prices to boost sales. =ut as the airline, construction e uipment, fast$food, and other industries have learned in recent years, cutting prices in an industry loaded with e#cess capacity may lead to price wars as competitors try to hold on to market share.

b) Falling Market Share : Another situation leading to price changes is falling market share in the face of strong price competition. ,everal American industriesAautomobiles, consumer electronics, cameras, watches, and steel, for e#ampleAlost market share to Papanese competitors whose high$ uality products carried lower prices than did their American counterparts. In response, American companies resorted to more$aggressive pricing action. c) Price cut to Dominate Market% A company may also cut prices in a drive to dominate the market through lower costs. 6ither the company starts with lower costs than its competitors, or it cuts prices in the hope of gaining market share that will further cut costs through larger volume. =ausch Q <omb used an aggressive low$cost, low$price strategy to become an early leader in the competitive soft contact lens market.

) Initiating Price Increases : a) !ea"s to Pro#it Increase: A successful price increase can greatly increase profits. .or e#ample, if the company@s profit margin is ) percent of sales, a / percent price increase will increase profits by )) percent if sales volume is unaffected. A ma(or factor in price increases is cost inflation. Eising costs s uee+e profit margins and lead companies to pass cost increases along to customers.

b) $%er Deman" : Another factor leading to price increases is over demand% 5hen a company cannot supply all its customers@ needs, it can raise its prices, ration products to customers, or both. c) Shi#ting in Customer Perception: 3ompanies can increase their prices in a number of ways to keep up with rising costs. 0rices can be raised almost invisibly by dropping discounts and adding higher$priced units to the line. 1r prices can be pushed up openly. In passing price increases on to customers, the company must avoid being perceived as a price gouger. 3ompanies also need to think of who will bear the brunt of increased prices. 3ustomer memories are long, and they will eventually turn away from companies or even whole industries that they perceive as charging e#cessive prices. "his happened to the cereal industry in the /RRHs. Industry leader Lellogg covered rising costs and preserved profits by steadily raising prices without also increasing customer value. 6ventually, frustrated consumers retaliated with a uiet fury by shifting away from branded cereals toward cheaper private$label brands. 5orse, many consumers switched to less e#pensive, more portable handheld breakfast foods, such as bagels, muffins, and breakfast bars. As a result, total American cereal sales began falling off by ) to * percent a year. "hus, customers paid the price in the short run but Lellogg paid the price in the long run. &echni'ues to (%oi" Pricing Situations: "here are some techni ues for avoiding problem. a) Maintain a Sense o# Fairness : 1ne is to maintain a sense of fairness surrounding any price increase. 0rice increases should be supported with a company communication program telling customers why prices are being increased. 5hen possible, customers should be given advance notice so they can do forward buying or shop around. b) Making !o)*+isibility Price Mo%es First: Making low$visibility price moves first is also a good techni ue% 6liminating discounts, increasing minimum order si+es, and curtailing production of low$margin products are some e#amples. 3ontracts or bids for long$term pro(ects should contain escalator clauses based

on such factors as increases in recogni+ed national price inde#es. "he company sales force should help business customers find ways to economise. a) ,ays to Meet Deman" )ithout -aising Prices : 5herever possible, the company should consider ways to meet higher costs or demand without raising prices. .or e#ample, it can consider more cost$effective ways to produce or distribute its products. It can shrink the product instead of raising the price, as candy bar manufacturers often do. It can substitute less e#pensive ingredients or remove certain product features, packaging, or services. 1r it can FunbundleF its products and services, removing and separately pricing elements that were formerly part of the offer. I=M, for e#ample, now offers training and consulting as separately priced services.

.uyer -eactions to Price Changes : 5hether the price is raised or lowered, the action will affect buyers, competitors, distributors, and suppliers and may interest government as well. 3ustomers do not always interpret prices in a straightforward way. "hey may view a price cut in several ways. .or e#ample, what would you think if Poy perfume, Fthe costliest fragrance in the world,F were to cut its price in halfD 1r what if I=M suddenly to cut its personal computer prices drasticallyD Sou might think that the computers are about to be replaced by newer models or that they have some fault and are not selling well. Sou might think that I=M is abandoning the computer business and may not stay in this business long enough to supply future parts. Sou might believe that and see. ,imilarly, a price increase, which would normally lower sales, may have some positive meanings for buyers. 5hat would you think if I=M raised the price of its latest personal computer modelD 1n the one hand, you might think that the item is very FhotF and may be unobtainable unless you buy it soon. 1r you might think that the computer is an unusually good value. 1n the other hand, you might think that I=M is greedy and charging what the traffic will bear. uality has been reduced. 1r you might think that the price will come down even further and that it will pay to wait

Competitor -eactions to Price Changes

1) A firm considering a price change has to worry about the reactions of its competitors as well as those of its customers. 3ompetitors are most likely to react when the number of firms involved is small, when the product is uniform, and when the buyers are well informed.

) 4ow can the firm anticipate the likely reactions of its competitorsD If the firm faces one large competitor, and if the competitor tends to react in a set way to price changes, that reaction can easily be anticipated. =ut if the competitor treats each price change as a fresh challenge and reacts according to its self$interest, the company will have to figure out (ust what makes up the competitor@s self$interest at the time.

/) "he problem is comple# because, like the customer, the competitor can interpret a company price cut in many ways. It might think the company is trying to grab a larger market share, that the company is doing poorly and trying to boost its sales, or that the company wants the whole industry to cut prices to increase total demand.

0) 5hen there are several competitors, the company must guess each competitor@s likely reaction. If all competitors behave alike, this amounts to analy+ing only a typical competitor. In contrast, if the competitors do not behave alikeAperhaps because of differences in si+e, market shares, or policiesAthen separate analyses are necessary. 4owever, if some competitors will match the price change, there is good reason to e#pect that the rest will also match it.

E6,01?>I?2 "1 0EI36 34A?26, Many uestions arises when price is changing! how a firm should respond to a price change by a competitor. "he firm needs to consider several issues% 5hy did the competitor change the priceD 5as it to take more market share, to use e#cess capacity, to meet changing cost conditions, or to lead an industry wide price changeD Is the price change temporary or permanentD 5hat will happen to the company@s market share and profits if it does not respondD Are other companies going to respondD And what are the competitor@s and other firms@

responses to each possible reaction likely to beD =esides these issues, the company must make a broader analysis. It has to consider its own product@s stage in the life cycle, the product@s importance in the company@s product mi#, the intentions and resources of the competitor, and the possible consumer reactions to price changes. "he company cannot always make an e#tended analysis of its alternatives at the time of a price change, however. "he competitor may have spent much time preparing this decision, but the company may have to react within hours or days. About the only way to cut down reaction time is to plan ahead for both possible competitor@s price changes and possible responses.

E##ecti%e (ction to cope*up )ith Competitor1s Price Changes: .igure shows the ways a company might assess and respond to a competitor@s price cut. 1nce the company has determined that the competitor has cut its price and that this price reduction is likely to harm company sales and profits, it might simply decide to hold its current price and profit margin. "he company might believe that it will not lose too much market share, or that it would lose too much profit if it reduced its own price. It might decide that it should wait and respond when it has more information on the effects of the competitor@s price change. .or now, it might be willing to hold on to good customers, while giving up the poorer ones to the competitor. "he argument against this holding strategy, however, is that the competitor may get stronger and more confident as its sales increase and that the company might wait too long to act. If the company decides that effective action can and should be taken, it might make any of four responses%

Figure: (ssessing an" -espon"ing to Competitor1s Price Changes

1) -e"uce its Price to Match Competitor1s Price : .irst, it could reduce its price to match the competitor@s price. It may decide that the market is price sensitive and that it would lose too much market share to the lower$priced competitor. 1r it might worry that recapturing lost market share later would be too hard. 3utting the price will reduce the company@s profits in the short run. ,ome companies might also reduce their product uality, services, and marketing communications to retain profit margins, but this will ultimately hurt long$run market share. "he company should try to maintain its uality as it cuts prices. ) -aise 2uality o# its $##er % Alternatively, the company might maintain its price but raise the perceived uality of its offer. It could improve its communications, stressing the relative uality of its product over that of the lower$price competitor. "he firm may find it cheaper to maintain price and spend money to improve its perceived value than to cut price and operate at a lower margin. /) May Impro%e 2uality an" Increase Price 1r, the company might improve uality and increase price, moving its brand into a higher$ price position. "he higher uality (ustifies the higher price, which in turn preserves the company@s higher margins. 1r the company can hold price on the current product and introduce a new brand at a higher$price position. 0) !aunch ( !o)*Price 3Fighting .ran"4 : .inally, the company might launch a low$price Ffighting brandFAadding a lower$price item to the line or creating a separate lower$price brand. "his is necessary if the particular market segment being lost is price sensitive and will not respond to arguments of higher uality. "hus, when challenged on price by store brands and other low$price entrants, 0rocter Q 2amble turned a number of its brands into fighting brands, including <uvs disposable diapers, Poy dishwashing detergent, and 3amay beauty soap. In turn, 0Q2 competitor Limberly$3lark offers its value$priced ,cott "owels brand as Fthe =ounty killer.F It scores well on customer satisfaction measures but sells for a lower price than 0Q2@s =ounty brand./:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Case Studies 1Document3 pagesCase Studies 1Anamika Rai Pandey100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CCM Configuration Guide EN 1909.1.0Document104 pagesCCM Configuration Guide EN 1909.1.0sonu50% (2)

- Semco Rebate FormDocument4 pagesSemco Rebate FormDante Pirouz0% (1)

- SAP S4HANA Sales Rebates and Commission ProcessDocument17 pagesSAP S4HANA Sales Rebates and Commission ProcessSugata BiswasNo ratings yet

- Cs Manual2013Document270 pagesCs Manual2013zydusNo ratings yet

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyNo ratings yet

- Q2. What Are Backing Assets?Document1 pageQ2. What Are Backing Assets?Anamika Rai PandeyNo ratings yet

- Although Marathas Observe Major Hindu FestivalsDocument1 pageAlthough Marathas Observe Major Hindu FestivalsAnamika Rai PandeyNo ratings yet

- EatggDocument8 pagesEatggAnamika Rai PandeyNo ratings yet

- Chemistry HydrocarbonDocument3 pagesChemistry HydrocarbonAnamika Rai PandeyNo ratings yet

- EatggDocument8 pagesEatggAnamika Rai PandeyNo ratings yet

- Financial Sector in IndiaDocument15 pagesFinancial Sector in IndiaAnamika Rai PandeyNo ratings yet

- Classification of CustomsDocument2 pagesClassification of CustomsAnamika Rai PandeyNo ratings yet

- 1Document23 pages1Anamika Rai PandeyNo ratings yet

- Explain The Major Societal Force Behind New MarketingDocument11 pagesExplain The Major Societal Force Behind New MarketingAnamika Rai Pandey100% (1)

- Ameworks IndiaDocument31 pagesAmeworks IndiaAnamika Rai PandeyNo ratings yet

- K C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesDocument9 pagesK C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesAnamika Rai PandeyNo ratings yet

- Classification of CustomsDocument2 pagesClassification of CustomsAnamika Rai PandeyNo ratings yet

- International Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioDocument19 pagesInternational Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioAnamika Rai PandeyNo ratings yet

- Basic Phases of AccountingDocument6 pagesBasic Phases of AccountingAnamika Rai PandeyNo ratings yet

- Unit VIIIDocument16 pagesUnit VIIIAnamika Rai PandeyNo ratings yet

- MIS Info. SystemDocument15 pagesMIS Info. SystemAkash KumarNo ratings yet

- Q. 1) Explain in Detail The Various Levels of Organization Culture. Ans: IntroductionDocument7 pagesQ. 1) Explain in Detail The Various Levels of Organization Culture. Ans: IntroductionAnamika Rai Pandey0% (1)

- LiteratureDocument2 pagesLiteratureAnamika Rai PandeyNo ratings yet

- Introduction To Poet Alfred Tennyson (1809-1892), English Poet Often Regarded As The Chief Representative of TheDocument9 pagesIntroduction To Poet Alfred Tennyson (1809-1892), English Poet Often Regarded As The Chief Representative of TheAnamika Rai PandeyNo ratings yet

- Archaeologists Often Utilize A Number of Dating TechniquesDocument6 pagesArchaeologists Often Utilize A Number of Dating TechniquesAnamika Rai PandeyNo ratings yet

- Advance Search:: Home Acts Implemented Details of The Acts Implemented The Industrial Employment Act, 1946Document3 pagesAdvance Search:: Home Acts Implemented Details of The Acts Implemented The Industrial Employment Act, 1946Anamika Rai PandeyNo ratings yet

- LimitationsDocument4 pagesLimitationsAnamika Rai PandeyNo ratings yet

- Managerial EffectivenessDocument3 pagesManagerial EffectivenessAnamika Rai Pandey100% (1)

- Services Is The Fastest Growing Sector in IndiaDocument3 pagesServices Is The Fastest Growing Sector in IndiaAnamika Rai PandeyNo ratings yet

- Action OrientedDocument10 pagesAction OrientedAnamika Rai PandeyNo ratings yet

- Extra DbmsDocument10 pagesExtra DbmsAnamika Rai PandeyNo ratings yet

- Factors Affecting Production Planning and ControlDocument7 pagesFactors Affecting Production Planning and ControlAnamika Rai PandeyNo ratings yet

- Walsh v. TRA Company Limited - Jan. 19, 2022Document116 pagesWalsh v. TRA Company Limited - Jan. 19, 2022Webbie Herald100% (1)

- Maharashtra State Electricity Distribution Co. LTD: Commercial Circular No. 80Document11 pagesMaharashtra State Electricity Distribution Co. LTD: Commercial Circular No. 80rahul desaiNo ratings yet

- Grade 6 Maths Practice Sheet Decimals (Ekam and Ena) (01!09!2017)Document5 pagesGrade 6 Maths Practice Sheet Decimals (Ekam and Ena) (01!09!2017)praschNo ratings yet

- Whirlpool RebateDocument3 pagesWhirlpool RebatePrasad ReddyNo ratings yet

- Copa Fi ReconDocument2 pagesCopa Fi ReconGupta VNo ratings yet

- Sales PromotionDocument34 pagesSales Promotionshanmugamhr0% (1)

- Veritas Partner Force Program Guide: Reseller PartnersDocument36 pagesVeritas Partner Force Program Guide: Reseller PartnersYan Naing Thwin100% (1)

- LAWS20060 Taxation Law of AustraliaDocument6 pagesLAWS20060 Taxation Law of AustraliaPrashansa AryalNo ratings yet

- RebatesDocument18 pagesRebatesmaheshNo ratings yet

- Statement of Account: Penyata AkaunDocument14 pagesStatement of Account: Penyata AkaunJohn MortonNo ratings yet

- PTR Form of North Delhi Municipal Corporation For 2014-15Document5 pagesPTR Form of North Delhi Municipal Corporation For 2014-15rasiya49No ratings yet

- Distributor Agreement-Lahore JafferDocument2 pagesDistributor Agreement-Lahore JafferTJbossNo ratings yet

- Rebate Agreement Homecrew Best Services Phils. CorpDocument1 pageRebate Agreement Homecrew Best Services Phils. CorpVic CumpasNo ratings yet

- Chapter 12 - Revenue Recognition: Revenue From Contracts With CustomerDocument21 pagesChapter 12 - Revenue Recognition: Revenue From Contracts With CustomerCruxzelle BajoNo ratings yet

- Passive Income - 40 Ideas To Successfully Launch Your Online BusinessDocument60 pagesPassive Income - 40 Ideas To Successfully Launch Your Online BusinessJon Lec100% (1)

- 17Document14 pages17rishav098No ratings yet

- 50 Legitimage Ways 2 Make Money From HomeDocument15 pages50 Legitimage Ways 2 Make Money From HomeW Kay100% (1)

- Rms 132x DealsDocument70 pagesRms 132x DealsSHOBAKINo ratings yet

- RW Vendor Compliance ManualDocument16 pagesRW Vendor Compliance ManualRyan CabralNo ratings yet

- 2T20202021 Tuition Fee Rates IAS FEUDocument96 pages2T20202021 Tuition Fee Rates IAS FEUanjNo ratings yet

- A Summer Training Project Report ON: "Customer Loyality Survey" AT Reliance SecuritiesDocument7 pagesA Summer Training Project Report ON: "Customer Loyality Survey" AT Reliance SecuritiesbuddysmbdNo ratings yet

- Ch-20 (Types and Techniques of Sales Promotion)Document25 pagesCh-20 (Types and Techniques of Sales Promotion)kshariq1990No ratings yet

- Module #4 Understanding Marketing PlanDocument33 pagesModule #4 Understanding Marketing PlanbigjebatNo ratings yet

- Request Repo FormDocument30 pagesRequest Repo Formana bagolorNo ratings yet

- The Economics of Best ExecutionDocument16 pagesThe Economics of Best ExecutionRichard DennisNo ratings yet

- RD Sharma Class 8 Maths Chapter 13 Profit LossDocument40 pagesRD Sharma Class 8 Maths Chapter 13 Profit Lossatharv jainNo ratings yet

- 1B6 S4hana2022 BPD en EsDocument70 pages1B6 S4hana2022 BPD en EsJulio CalacheNo ratings yet