Professional Documents

Culture Documents

Eeca BC

Uploaded by

basanth_712982Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eeca BC

Uploaded by

basanth_712982Copyright:

Available Formats

Benet / Cost Analysis

Public Sector Projects

Projects in private sector are owned by corporations, partnerships, and individuals and used by customers. Projects in public sector are owned, used and nanced by citizens. Public sector projects have a primary purpose to provide services to the citizens for the public good at no prot. Some public sector examples are:

Hospitals and clinics Highways, bridges and waterways Convention Centers Schools, Colleges, Universities Sports Arenas

There are signicant differences in the characteristics of private and public sector alternatives.

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

1 / 16

Benet / Cost Analysis

Public Sector Projects

Characteristic Size of Investment Life Estimates Cash Flow Estimates Funding Interest Rate Alternative Selection Criteria Environment of Evaluation

Public Sector Larger Longer (30-50+ yrs) No Prot; cost, benet, disbenet Taxes, bonds Lower Multiple Politically inclined

Private Sector Medium to Low Shorter (2-25 yrs) Revenues Costs Loans, stocks Higher ROR Economic

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

2 / 16

Benet / Cost Analysis

Public Sector Projects

Cash Flow Estimates To perform an economic analysis of public alternatives, the costs (initial and annual), the benets, and the disbenets must be estimated as accurately as possible in monetary units. Costs: Estimated expenditures to the government entity for construction, operation, and maintenance of the project, less any expected salvage value. Benets: Advantages to be experienced by the owners, the public Disbenets: Expected undesirable or negative consequences to the owners, the public Interest Rate for Public Sector Projects The interest rate for the public sector is also identied as i ; to distinguish it from the private sector rate called discount rate.

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

3 / 16

Benet / Cost Analysis

of a Single Project

All cost, benet and disbenet estimates must be converted to a common equivalent monetary unit (PW , AW , or FW ) B/C ratio is then calculated as: PW of benets B /C = PW of costs AW of benets = AW of costs FW of benets = FW of costs PW and AW are used more frequently Sign convention is + in B/C analysis

Costs are positive, salvage values are negative and subtracted from costs Benets are positive, disbenets are negative and subtracted from benets

The decision guideline is:

If B /C 1.0, accept the project If B /C < 1.0, reject the project

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 4 / 16

Benet / Cost Analysis

of a Single Project

This ratio is called conventional B/C ratio (all terms in PW or AW ): B /C = Benets Disbenets BD = Cost Salvage C S

The way how disbenets handled changes the magnitude of the B/C ratio

Disbenets are subtracted from benets (correct) Disbenets are added to costs (incorrect)

Handling the disbenets incorrectly and adding them to costs does not alter the decision (B/C < or > 1) B /C = BD < 1 BD < C S CS B = B <C S+D <1 CS+D

IE 347 Week 9 Industrial Engineering Dept. 5 / 16

Dr.Serhan Duran (METU)

Benet / Cost Analysis

of a Single Project

The modied B/C ratio includes maintenance and operation (M&O) costs in the numerator and treats them similar to disbenets Once all terms are expressed in PW , AW , or FW terms: Modied B /C = Benets - Disbenets-M&O costs Initial Investment-Salvage

The modied B/C ratio yields a different cost then conventional B/C ratio But the decision to accept or reject is same with both ratios There is also the benet and cost difference measure of worth Based on the difference of PW or AW of benets and costs

(B-C)=Net Benets - (Costs-Salvage)

The decision guideline is:

If (B C ) 0, accept the project If (B C ) < 0, reject the project

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 6 / 16

Benet / Cost Analysis

of a Single Project

In Class Work 12 The Ford Foundation expects to award $15 million today in grants to public high schools to develop new ways to teach the fundamentals of engineering that prepare students for university-level material. The grants will extend over a 10-year period and will create an estimated savings of $1.5 million per year in faculty salaries. The foundation uses a 6% discount rate for all grant awards. This grant program will share the Foundation funding with ongoing activities, so an estimated $200,000 per year will be removed from other program funding. Also $500,000 per year will be incurred as annual operation costs. Use the B/C method to determine if the grants program is economically justied using:

1 2 3

Conventional B/C analysis Modied B/C ratio benet and cost difference measure of worth

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 7 / 16

Benet / Cost Analysis

of a Single Project

Use AW as the common monetary equivalent: AW of investment cost = 15, 000, 000(A/P , 6%, 10) = $2, 038, 050 AW of benet = $1,500,000 AW of disbenet = $200,000 AW of M&O cost = $500,000

1

Conventional B/C B /C = $1, 500, 000 $200, 000 = 0.51 < 1 $2, 038, 050 + $500, 000

Modied B/C Modied B /C = $1, 500, 000 $200, 000 $500, 000 = 0.39 < 1 $2, 038, 050

(B C ) = (1, 500, 000 200, 000) (2, 038, 050 + 500, 000) 0

Program is not justied.

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 8 / 16

Benet / Cost Analysis

for Mutually Exclusive Alternatives

The technique to compare two mutually exclusive alternatives using B/C ratio is the incremental B/C analysis. The procedure for incremental B/C is given as (equivalent values can be in PW or AW ):

1 2

Determine the total equivalent costs for both alternatives Order the alternatives by the total equivalent cost, smaller rst. Calculate the incremental cost (C ) for the larger-cost alternative over the smaller-cost alternative. Calculate the total equivalent benets and disbenets for both alternatives. Calculate incremental net benets ((B D )) for the larger-cost alternative over the smaller-cost alternative. Calculate the incremental B/C ratio B /C = (B D ) C

Select the higher-cost alternative if B /C 1

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 9 / 16

Benet / Cost Analysis

for Mutually Exclusive Alternatives

Cautions in using Incremental B/C Analysis

1

Each alternative included in the incremental B/C analysis must have a B/C ratio 1. Ordering of alternatives is done on the basis of total cost not initial cost Like all methods considered so far, incremental B/C analysis requires equal-service comparison of alternatives.

Usually the alternatives have very long lives, so alternatives have equal lives When alternatives do have unequal lives, LCM of lives must be used Use AW equivalency of costs and benets whenever alternatives have unequal lives

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

10 / 16

Benet / Cost Analysis

for Mutually Exclusive Alternatives

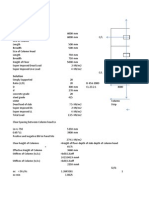

In Class Work 13 The city of Garden Ridge, Florida, has received designs for a new patient room wing to the municipal hospital from two architectural consultants. The three nancial estimates are given as: Construction Cost, $ Building maintenance cost, $ per year Savings in operation, $ per year Design A $1,000,000 35,000 200,000 Design B $1,500,000 55,000 450,000

The discount rate is 5%, and the life of the building is estimated as 30 years. Use conventional B/C ratio analysis to select design A or B.

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

11 / 16

Benet / Cost Analysis

for Mutually Exclusive Alternatives

Use AW equivalency: 1 AW of costs is the sum of construction and building maintenance costs AWA = 1, 000, 000(A/P , 5%, 30) + 35, 000 = $100, 050 AWB = 1, 500, 000(A/P , 5%, 30) + 55, 000 = $152, 575

2

Design B is the alternative with the larger total cost, so it is the alternative to be incrementally justied. C = 152, 575 100, 050 = $52, 525

Savings in operation are the benets: B = 450, 000 200, 000 = $250, 000

The incremental B/C ratio is calculated as: $250, 000 B /C = $52, 525 The incremental B/C is larger than 1, Therefore design B is selected.

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 12 / 16

Benet / Cost Analysis 1

for Multiple Mutually Exclusive Alternatives

2 3

Determine the the total equivalent costs for all alternatives (Use PW or AW ) Order the alternatives by the total equivalent cost, smaller rst Calculate the total equivalent benets and disbenets for each alternative Direct benet estimation only: Determine the B/C for all alternatives and retain the ones with B /C 1 Calculate the incremental costs (C ) and benets ((B D )):

C = challenger cost - defender cost (B D ) = challenger benets - defender benets if relative usage costs are estimated for each alternative, rather than direct benets:

(B D ) = defender usage cost - challenger usage cost

Calculate the incremental B/C for the rst challenger compared to the defender

if B /C 1, eliminate the defender, challenger becomes new defender if B /C < 1, eliminate the challenger

Repeat steps 5 and 6 until only one alternative remains

Dr.Serhan Duran (METU) IE 347 Week 9 Industrial Engineering Dept. 13 / 16

Benet / Cost Analysis

for Multiple Mutually Exclusive Alternatives

Example A municipal is seeking a developer that will place a major water park in the city area. Financial incentives will be awarded to the developers depending on their investment size. The developers will get reductions in property tax for 8 years. Each proposal includes a provision that residents of the county will benet from reduced entrance fees when using the park. This reduction will be effective for 8 years. The annual total entrance fees with the reduction are estimated. The discount rate is 7 %. Which proposal should be selected? Proposal 1 $250,000 25,000 500,000 310,00 8

IE 347 Week 9

Initial Incentive, $ Tax Incentive cost, $ per year Entrance fees, $ per year Extra sales tax, $ per year Study period, years

Dr.Serhan Duran (METU)

Proposal 2 $350,000 35,000 450,000 320,000 8

Proposal 3 500,000 50,000 425,000 320,000 8

14 / 16

Industrial Engineering Dept.

Benet / Cost Analysis

for Multiple Mutually Exclusive Alternatives

AW of costs is the sum of incentive cost and the annual cost of initial incentive. AWC 1 = 250, 000(A/P , 7%, 8) + 25, 000 = $66, 867 AWC 2 = 350, 000(A/P , 7%, 8) + 35, 000 = $93, 614 AWC 3 = 500, 000(A/P , 7%, 8) + 50, 000 = $133, 735 Alternatives are ordered as 1,2,3. The annual benets are the incremental benet from the decrease in entrance fees and increase in sales taxes. B21 = 50, 000 + 10, 000 = $60, 000 B32 = 25, 000 + 0 = $25, 000

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

15 / 16

Benet / Cost Analysis

for Multiple Mutually Exclusive Alternatives

The rst defender is alternative 1. For 2-1 comparison: B /C = B $60, 000 = >1 C 93, 614 66, 867

Alternative 2 is incrementally justied. Alternative 1 is eliminated, 2 is the new defender. For 3-2 comparison: B /C = B $25, 000 = <1 C 133, 735 93, 614

Alternative 3 is incrementally not justied. Alternative 3 is eliminated, Alternative 2 is the selection.

Dr.Serhan Duran (METU)

IE 347 Week 9

Industrial Engineering Dept.

16 / 16

You might also like

- Concrete BasicsDocument56 pagesConcrete Basicsengcecbepc100% (6)

- Concrete Lab ManualDocument14 pagesConcrete Lab Manualyeswanthr100% (3)

- CE49 Lab ManualDocument39 pagesCE49 Lab Manualbasanth_712982No ratings yet

- Plate Girder BridgesDocument116 pagesPlate Girder Bridgesbasanth_712982100% (4)

- Primavera TutorialDocument82 pagesPrimavera Tutorialgalante gorky95% (20)

- Unit 19Document34 pagesUnit 19basanth_712982No ratings yet

- Green PaintsDocument4 pagesGreen Paintssenthili4uNo ratings yet

- Buildings Green Building Movement in India - Catalysts and CourseDocument11 pagesBuildings Green Building Movement in India - Catalysts and CourseSarfaraz AnsariNo ratings yet

- Demolition Techniques - Case StudyDocument18 pagesDemolition Techniques - Case Studybasanth_71298296% (23)

- Ansys ManualDocument21 pagesAnsys Manualbasanth_712982No ratings yet

- GrihaDocument10 pagesGrihaFaraazMohamedNo ratings yet

- Durability of Concrete StructuresDocument20 pagesDurability of Concrete Structuresbasanth_712982No ratings yet

- Demolition Techniques - Case StudyDocument18 pagesDemolition Techniques - Case Studybasanth_71298296% (23)

- FillingDocument2 pagesFillingAr Aayush GoelNo ratings yet

- Demolition Techniques - Case StudyDocument18 pagesDemolition Techniques - Case Studybasanth_71298296% (23)

- GATE Civil - 2007Document18 pagesGATE Civil - 2007basanth_712982No ratings yet

- Front Page.Document2 pagesFront Page.basanth_712982No ratings yet

- 1Document6 pages1basanth_712982No ratings yet

- Durability of Concrete StructuresDocument20 pagesDurability of Concrete Structuresbasanth_712982No ratings yet

- Flat Slab Design ParametersDocument14 pagesFlat Slab Design Parametersbasanth_712982100% (1)

- PSG Lect1Document73 pagesPSG Lect1basanth_712982No ratings yet

- Demolition Techniques - Case StudyDocument18 pagesDemolition Techniques - Case Studybasanth_71298296% (23)

- Demolition Techniques - Case StudyDocument18 pagesDemolition Techniques - Case Studybasanth_71298296% (23)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- JTA Administration-CorporateDocument1 pageJTA Administration-CorporateActionNewsJaxNo ratings yet

- Value MethodologyDocument21 pagesValue Methodology1SABNo ratings yet

- Financial Analysis - Planning NotesDocument49 pagesFinancial Analysis - Planning NotesMadhan Kumar BobbalaNo ratings yet

- ITL Unit 1Document111 pagesITL Unit 1rakshitha9reddy-1No ratings yet

- College Course Enrollment SystemDocument7 pagesCollege Course Enrollment SystemMoazzam ShahNo ratings yet

- Process Order Use Case DocumentDocument5 pagesProcess Order Use Case DocumentalsuhimatNo ratings yet

- VIRTUAL BUSINESS PORTFOLIO: THE ACCOUNTING CYCLEDocument45 pagesVIRTUAL BUSINESS PORTFOLIO: THE ACCOUNTING CYCLEAdrian TastarNo ratings yet

- Database Administrator ResponsibilitiesDocument4 pagesDatabase Administrator ResponsibilitiesAfro MusicNo ratings yet

- Just in Time Inventory System-2Document29 pagesJust in Time Inventory System-2Priyal GoyalNo ratings yet

- PB01L - Accreditation Process For LabsDocument8 pagesPB01L - Accreditation Process For LabsAhmed AwwadNo ratings yet

- Tally Assignment 2Document2 pagesTally Assignment 2kishor0000kunalNo ratings yet

- Concept of Cost in Long Run and EnvelopeDocument21 pagesConcept of Cost in Long Run and Envelopeneha pu100% (1)

- Social Entrepreneurship: Driving Social ChangeDocument3 pagesSocial Entrepreneurship: Driving Social ChangerupalNo ratings yet

- CIR Vs Interpublic Group of Companies IncDocument2 pagesCIR Vs Interpublic Group of Companies IncDarlene Ganub75% (4)

- Request For Leave of Absence FormDocument1 pageRequest For Leave of Absence FormJoiche Itallo LunaNo ratings yet

- College of Business and Economics: Econ. 2082: International Economics II, AssignmentDocument11 pagesCollege of Business and Economics: Econ. 2082: International Economics II, AssignmentAbdulhafiz HajkedirNo ratings yet

- UK Company Law Share Bankruptcy Void: FactsDocument4 pagesUK Company Law Share Bankruptcy Void: FactsPhúc NgọcNo ratings yet

- IDRBT Launches Chief Analytics Officers ForumDocument28 pagesIDRBT Launches Chief Analytics Officers Forumvaraprasad_ganjiNo ratings yet

- Layt Vs Messier NYDocument24 pagesLayt Vs Messier NYBFMbusinesscomNo ratings yet

- Philippine Hoteliers Inc Vs National Union Workers - Dusit HotelDocument2 pagesPhilippine Hoteliers Inc Vs National Union Workers - Dusit HotelMaricris GalingganaNo ratings yet

- SUMARYDocument12 pagesSUMARYArishaNo ratings yet

- An Overview of Indian Banking SectorDocument24 pagesAn Overview of Indian Banking Sectorrahulsaha1986100% (3)

- CPVDocument5 pagesCPVPrasetyo AdityaNo ratings yet

- Ghillyer6e PPT Ch10Document14 pagesGhillyer6e PPT Ch10Cuong VUongNo ratings yet

- 2019 Business Agility Institute Report PDFDocument24 pages2019 Business Agility Institute Report PDFUsman SiddiquiNo ratings yet

- Prince2 in 60 Minutes Flat v7.2Document59 pagesPrince2 in 60 Minutes Flat v7.2Reni Dimitrova100% (1)

- Q2 - Entrep Module 4, Week 4 Revised2Final With Answer KeysDocument20 pagesQ2 - Entrep Module 4, Week 4 Revised2Final With Answer KeysFelipe Balinas33% (3)

- Objectives For Revenue Assurance Systems DesignDocument1 pageObjectives For Revenue Assurance Systems DesignMorad M SwidNo ratings yet

- Purchasing Manager Director Supply Chain in Portland OR Resume Randy UlmanDocument1 pagePurchasing Manager Director Supply Chain in Portland OR Resume Randy UlmanRandyUlmanNo ratings yet

- Capstone ProjectDocument63 pagesCapstone ProjectMike WorleyNo ratings yet