Professional Documents

Culture Documents

Chapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)

Uploaded by

Falah Ud Din SheryarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)

Uploaded by

Falah Ud Din SheryarCopyright:

Available Formats

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.1

In order for financial statements to be reliable, they should: not include material error or bias; be a faithful representation; show the substance rather than the legal form of the transaction; be neutral; be prudent (but not to the extent that reserves become hidden); and be complete (within the confines of materiality and cost).

Kolitz and Sowden-Service, 2009

Chapter 2: Page 1

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.2

The framework is not an International Financial Reporting Standard [paragraph 2 of framework]. Faithful representation forms part of the discussion of reliable information (qualitative characteristic) of useful information as addressed in the framework. IAS 1 p13 states that fair presentation requires faithful representation of transactions and elements as defined in the framework. As a result, IAS 1, p13, therefore requires a user to incorporate the principles set out in the framework (although it is not an IFRS) as well as the definitions of the elements, so as to achieve fair presentation.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 2

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.3

The qualitative characteristics are: Understandability; Comparability. Reliability; and Relevance; Understandability Since entities are allowed to use a variety of measurement models to report their financial information, understandability is impaired. For example, IAS 16 (Property, plant and equipment) allows the cost model or the revaluation model to be used for different classes of assets: users may not understand how different classes of property, plant and equipment can be measured using different measurement models. Conversely, IAS 39 (Financial instruments) allows the fair value model to be used for both financial assets at fair value through profit and loss and financial assets available for sale: users may not necessarily understand how financial assets that are classified differently are measured in the same way. Comparability Comparability amongst similar entities is impaired by permitting choice between measurement models and further detracts from their understandability. For example, two similar entities may choose different models (i.e. one may choose to measure their noncurrent assets at cost less accumulated depreciation (cost model) and another entity may choose to measure them at fair value less accumulated depreciation (revaluation model)). Reliability With regard to IAS 16 (Property, plant and equipment), for example, the cost model may be argued to be more reliable than the revaluation model. On the other hand, it is unlikely to provide relevant values for the statement of financial position as the depreciated cost is unlikely to have any relevance to its true value. Relevance The fair value and revaluation models are more likely to produce relevant values, but may be criticized as being unreliable in the absence of active markets. The fair value and revaluation models aid comparability as similar assets with differing historical costs could be reported as the same value in the statement of financial position. It may, however, be noted that fair value accounting can also detract from comparability in extremely volatile markets. Conclusion: It can be seen that it is difficult to successfully meet all four qualitative characteristics.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 3

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.4

a) Users and their information needs Investors. The providers of risk capital and their advisers are concerned with the risk inherent in, and return provided by, their investments. They need information to help them determine whether they should buy, hold or sell. Shareholders are also interested in information which enables them to assess the ability of the entity to pay dividends. Employees. Employees and their representative groups are interested in information about the stability and profitability of their employers. They are also interested in information which enables them to assess the ability of the entity to provide remuneration, retirement benefits and employment opportunities. Lenders. Lenders are interested in information that enables them to determine whether their loans, and the interest attaching to them, will be paid when due. Suppliers and other trade creditors. Suppliers and other creditors are interested in information that enables them to determine whether amounts owing to them will be paid when due. Trade creditors are likely to be interested in an entity over a shorter period than lenders unless they are dependent upon the continuation of the entity as a major customer. Customers. Customers have an interest in information about the continuance of an entity, especially when they have a long-term involvement with, or are dependent on, the entity. Governments and their agencies. Governments and their agencies are interested in the allocation of resources and, therefore, the activities of entities. They also require information in order to regulate the activities of entities, determine taxation policies and as the basis for national income and similar statistics. Public. Entities affect members of the public in a variety of ways. For example, entities may make a substantial contribution to the local economy in many ways including the number of people they employ and their patronage of local suppliers. Financial statements may assist the public by providing information about the trends and recent developments in the prosperity of the entity and the range of its activities.

b) Relationship between users and other investors While all of the information needs of these users cannot be met by financial statements, there are needs which are common to all users. As investors are providers of risk capital to the entity, the provision of financial statements that meet their needs will also meet most of the needs of other users that financial statements can satisfy.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 4

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.5

Statement of fact The credit entry represents equity. Explanation Introduction: An account with a credit balance is normally a liability, income or equity. The definitions of each of these elements will now be discussed. Definition of a liability and discussion thereof a present obligation of the entity, as a result of past events, the settlement of which is expected to result in an outflow of economic benefits. There is an essential difference between an equity participant and a financier. An equity participant (shareholder) invests money in a company for an indefinite period of time. He is considered to be a part owner, who never expects to be refunded the capital contributed. Instead, the shareholder hopes for dividend distributions and growth in the value of his share certificates through the success of the company. The financier (e.g. bank), on the other hand, lends money to the company for a defined period of time, meaning that as soon as the finance is received there is an obligation to repay this amount. (This discussion was not required). Although there is a past event the issue of shares this event, in itself, does not create an associated present obligation. The transaction in question involves equity participants and accordingly, there exists no obligation to repay the amount of C120 000. By default, there will be no related settlements resulting in the outflow of future economic benefits. Both the share capital and the share premium are obviously not liabilities. Definition of income and discussion thereof an increase in future economic benefits during the accounting period, in the form of inflows or enhancements of assets or decreases in liabilities, resulting in an increase in equity other than through contributions from equity participants. There has been an inflow of assets during the period: an amount of C 120 000 in cash upon the issue of shares. But, the definition specifically excludes contributions from equity participants: therefore both the share capital and share premium cannot be considered to be income since it represents a contribution from equity participants. Definition of equity and discussion thereof the residual interests in assets, after deducting all liabilities. Since the transaction creates an asset of C120 000 (cash in bank) and does not create a liability at all (as explained in the discussion above), the residual interest resulting from the transaction is a net asset of C120 000 with the result that both the share capital and the share premium should therefore be treated as equity.

Please note: The required specifically referred to a discussion of the relevant definitions whereas no reference was made to the discussion of the recognition criteria this is the reason why the recognition criteria were not discussed here. Had the required not specified definitions but rather required a discussion in terms of the Framework in general, then a discussion of both definitions and recognition criteria would have been required.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 5

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.6

Definitions and recognition criteria: Income definition: There must be an increase in economic benefits during the accounting period in the form of inflows or the enhancement of an asset/s; or decrease in liabilities resulting in an increase in equity other than contributions from equity participants.

Liability definition: There must be a present obligation of the entity as a result of a past event the settlement of which is expected to result in an outflow of future economic benefits.

Recognition criteria for a liability: A liability may only be recognised in the financial statements if: it is probable that future economic benefits will flow to/from the entity; and the element has a cost or value that can be reliably measured. Recognition criteria for income: Income may only be recognised in the financial statements if: there is a probable increase in future economic benefits through either an increase in assets or decrease in liabilities; and this increase can be measured reliably. Discussion: The bookkeeper is incorrect in the accounting treatment of the receipt since it does not meet the definition of income: although the cash received from the tenant is an increase in economic benefits during the accounting period (December 20X3); and the receipt has increased Hazyview Mall Ltds assets (bank); there has been a simultaneous increase in liabilities since Hazyview Mall Ltd has an obligation to provide the tenant with occupation for January 20X4 or refund the C65 000; with the result that there has been no increase in equity (assets: 65 000 liabilities: 65 000)

The receipt of C65 000 meets the definition of a liability: Hazyview Mall Ltd has a present obligation to provide the tenant occupation in January 20X4 or refund the C65 000; as a result of a past event, being the receipt of the C65 000; the settlement of which is expected to result in future economic benefits flowing from Hazyview Mall Ltd in the form of occupation rights or a refund of the cash receievd.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 6

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.6 continued

Both the recognition criteria for the recognition of a liability have been met in that: the outflow of future economic benefits is probable (the tenant is a long-standing tenant and, as such, it is not expected that Hazyview Mall Ltd would fail to provide occupation to the tenant in January 20X4 or would cancel the lease agreement and not refund the cash) the value can be reliably measured (C65 000). Conclusion: The bookkeeper must treat the receipt as a current liability in the financial statements of Hazyview Mall Ltd as at 31 December 20X3. The correcting journal entry is as follows:

31 December 20X3: Rental income Rental income received in advance (L) Rent income received in advance Debit 65 000 Credit 65 000

Kolitz and Sowden-Service, 2009

Chapter 2: Page 7

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.7

The accountant has debited an expense and credited a liability. Both of these elements will now be discussed in terms of the arguments presented by the accountant. Definition of a liability a present obligation of the entity, arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. Recognition criteria for a liability it must be probable that the future economic benefits will flow from the entity, the item must have a cost that can be reliably measured. Definition of an expense Decreases in economic benefits, during the accounting period, in the form of outflows or depletions of assets or incurrence of liabilities, that result in decreases in equity, other than those relating to distribution to equity participants. Recognition criteria for an expense An expense may only be recognised in the financial statements if: there is a probable decrease in future economic benefits through either an decrease in assets or an increase in liabilities; and this decrease can be measured reliably. Discussion of the definition of a liability Although a possible outflow of economic benefits would result in the event of a theft or other calamity, this outflow is not expected since: no past event has occurred: neither an insurance contract has been signed (requiring the payment of insurance premiums) nor has a calamity occurred (requiring a repair or replacement); and thus there is no present obligation (for an obligation to be a present obligation, there has to be a past event). Furthermore, there is no obligation as the company is not obliged, (legally or otherwise), to repair or replace any items damaged. An obligation derives from either a legal obligation or a constructive obligation (e.g. public expectations created through a public announcement). Neither a legal nor a constructive obligation exists here since there is simply an internal management decision that can obviously be rescinded. Discussion of the recognition criteria for a liability It can be argued that the cost of C480 000 is reliably measured, as it represents the best estimate of the insurance expense based on past experience. Although the liability has been estimated based on past insurance contributions, the actual claims have historically been significantly less than the insurance premiums. This means that the C480 000 may be slightly overestimated but still acceptable on the grounds that this is a prudent approach. The outflow of economic benefits is, however, not probable since no past event has occurred; the outflow is only possible at this stage.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 8

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.7 continued

Discussion of the definition of an expense Although the possible loss represents a decrease in future economic benefits (e.g. through the destruction of a machine), this has not yet occurred and is therefore not during the accounting period; and there is no outflow during the period (e.g. payment of insurance premiums), no depletion of assets (e.g. destruction of a machine) and no liability incurred (e.g. signing of an insurance contract or contract for repairs); and therefore there is no decrease in equity and therefore there is no expense. Discussion of the recognition criteria for an expense Although there is an amount that may have been reliably measured (C480 000), there is no change to either assets or liabilities, and therefore there is no decrease in equity (future economic benefits) and therefore the recognition criteria are not met. Conclusion Since there is no liability (meeting neither the definition nor the recognition criteria), there can also be no expense and therefore the journal entry should be reversed.

Please note: The required specifically referred to a discussion in terms of the Framework: for this reason, the discussion involves both definitions and recognition criteria.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 9

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.8

Treatment of brands as an asset Definition of an asset: resource controlled by the entity, as a result of past events, from which future economic benefits are expected to flow. Discusssion of the definition Control - the brand is a resource that is controlled by the entity since it has been purchased by the entity and control will therefore be supported by legal documents. Past event - the past event is the signing of the purchase documents. Future economic benefits - future economic benefits are expected through increased sales resulting from the ownership of the brand. The purchased brands therefore meet the definition of an asset. Recognition criteria and discussion thereof: Cost / value must be reliably measured: since the brand is purchased, the cost is reliably measurable (C1 500 000) in terms of purchase documentation. Future economic benefits must be probable: Although the sales have doubled, which may be indicative of future trends, (probable future economic benefits), what portion of these future economic benefits stem from the C1 500 000 brand and what portion from other expenditure, such as an effective sales team, is difficult to measure reliably. Conclusion: Assuming that the increase in sales can be attributed to the new brand, and to a sufficient extent, it would suggest that there are probable future economic benefits that are expected from the brand. In such a case, the C1 500 000 should be capitalised and amortised against the future income

Please note: Depending on time allocation in a test or examination, it may be prudent to also discuss the definition and recognition criteria of an expense as well (this was not discussed here since the required was not clear that both the asset and expense definitions and recognition criteria needed to be discussed and obviously a mark allocation was unavailable to guide the extent of the answer).

Kolitz and Sowden-Service, 2009

Chapter 2: Page 10

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.9

Introduction: The incentive payments represent a debit, therefore the treatment as an asset or an expense should be discussed. Definition of an asset: resource controlled by the entity, as a result past events, from which future economic benefits are expected to flow. Recognition criteria for an asset: it must be probable that the future economic benefits will flow to the entity, the item must have a cost that can be reliably measured. Discussion of the asset: The contract acquired through the payment of the incentive: is a resource (right to receive cash from the members), which is controlled by the entity (through a signed contract) from a past event (the signing of the contract) from which future economic benefits are expected to flow over the next 2 years (through membership fees). There is a probable inflow of future economic benefits since the customer is bound by a legal contract to pay monthly fees. The amount of the fees are stipulated in the contract and are therefore reliably measurable.

The definition and recognition criteria of an asset are therefore met. Definition of an expense: It represents a decrease in economic benefits, during the accounting period, in the form of outflows (through a decrease in assets or an increase in liabilities), that result in decrease in equity (other than through distributions to equity participants). Recognition criteria for an expense: there must be a probable decrease in future economic benefits related to a decrease in an asset or an increase of a liability has arisen that can be measured reliably. Discussion of the expense: The amount of the incentive payment is reliably measured since it would be stipulated in terms of the contract; The payment of the incentive payment is made in the accounting period, on which date There is a decrease in assets (bank); There is therefore a decrease in equity and therefore the payment could be expensed.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 11

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.9 continued

Conclusion: The incentive payment meets both the definition of an asset and the definition of an expense (and related recognition criteria). Since, however, the contract is a 2-year contract, thus meaning that income is expected over 2 years, the cost of the incentive payment should be recognised when the revenue is recognised. This requires the treatment of the payment as an asset that is amortised over the 2-year period. The amortisation should not be over a 10-year period since this is based on research into European trends and not South African trends in which the loyalty of South Africans might prove vastly different: the research in Europe covers only a five year period, so the asset should be amortised over a period not longer than 5 years, otherwise the concept of prudence is not met (assuming that the results of the European research are equally applicable in South Africa); the club has only recently entered into the South African market and may not survive so to keep an asset in the statement of financial position for 10 years is not prudent (since the probability of future economic benefits becomes questionable); it is more prudent to amortise the asset faster (over 2-years) based on the uncertainties mentioned above; since the asset will be decreased over two years, the definition of an expense will be met in each of these two years the expense will be reliably measured based on the amount by which the asset has decreased. Note: if the customer is able to cancel the contract relatively easily, then the future economic benefits from signing up a customer are no longer probable (recognition criteria not met) and it would therefore be more prudent to treat the full incentive payment as an expense in the first year.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 12

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.10

Definition of a liability A present obligation of the entity Arising from past events The settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

Discussion of a liability There is no past event at 31 March 20X4 since the event that would lead to an obligation is the declaration, which happened afterwards (13 April 20X4). There can be no present obligation at 31 March 20X4 since there is no past event. The settlement of the dividend will result in an outflow of economic benefits when the dividend payment is made.

Since the definition is not met in its entirety, a liability may not be recognized at the end of the financial year (31 March 20X4). Definition of an expense A decrease in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than distributions to equity participants.

Discussion of an expense At 31 March 20X4, there has been no increase in liabilities (see discussion above) or decrease in assets (no dividend payment was made on or before 31 March 20X4) and therefore there has been no decrease in economic benefits during the period. A dividend declaration should, in any event, never be included as an expense in the statement of comprehensive income as it represents a distribution to equity participants, which is expressly excluded from the definition of an expense.

Conclusion: The journal entry made in the books of the 31 March 20X4 must be reversed as follows:

31 March 20X4 Dividend payable (liability) Dividend (expense) Reversal of previous dividend journal entry: no obligation at 31 March X4 and incorrect allocation to an expense account Debit xxx Credit xxx

The following dividend journal entry should then be processed on 13 April 20X4 instead.

13 April 20X4 Dividend (equity distribution) Dividend payable (liability) Dividend declared on 13 April 20X4: 0.15 x number of issued shares Debit xxx Credit xxx

Kolitz and Sowden-Service, 2009

Chapter 2: Page 13

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.11

Definition of an asset resource controlled by the entity, as a result of past events, from which future economic benefits are expected to flow.

The river is a resource acquired by the entity from past events (the purchase of the farm) from which future economic benefits are expected to flow (the river promotes growth of the crops which in turn yield profits - cost savings on the water bill is also a future economic benefit to consider). There may be doubt as to whether the farm controls the river, since the river may run dry due to drought (which cannot be controlled by the farm) or due to a farm damming or polluting it upstream, etcetera. All these factors are effectively out of the control of the farmer. Recognition criteria for an asset the cost should be reliably measurable, the future economic benefits should be probable

It may be argued that the future economic benefits that will flow from the use of the river are probable (e.g. cost savings in not having to pay the local council for water; and profits from the sale of crops) but the cost or value of the river cannot be reliably measured since it was purchased as part of the farm (as opposed to purchasing it as a separate item). Conclusion Although the river may meet the definition of an asset, (assuming there is sufficient control over the river) it may not be included as an asset in the statement of financial position since it does not meet the recognition criteria. An alternative would be to revalue the entire land and buildings and in so doing include the value of the river in the land and buildings amount (i.e. the river will then be included in the valuation of the farm but would not be disclosed as a separate item due to the difficulty in measuring it as a separate item).

Kolitz and Sowden-Service, 2009

Chapter 2: Page 14

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.12

The Framework requires financial statements to reflect substance and economic reality of transactions over legal form. The issue in question is whether the inventory should be included as an asset in Minutemins financial statements or in the manufacturers financial statements. The Frameworks definition of an asset and the recognition criteria need to be applied to the situation. Definition of an asset: An asset is a resource, controlled by the entity, as a result of a past event, from which future economic benefits are expected to flow to the entity. Discussion of the asset definition: Minutemin pays insurance in respect of the photocopy machines which indicates the risks and rewards of ownership have passed. There has never been an instance where the machines were returned to the manufacturer. All indications are that the photocopiers are controlled by the company. The past event is Minutemin taking possession of the machines. Future economic benefits are expected to flow from the sale of the machines and sale of photocopies. All the elements of the definition of an asset are therefore met. Recognition criteria for an asset: The recognition criteria require an asset to be recognized when: it is probable that future economic benefits will flow to the entity and the asset has a cost or value that can be measured reliably. Discussion of the assets recognition criteria: It is probable that Minutemin will receive economic benefits from the sale of the inventory as inventory has never been returned to the manufacturer. The cost of the photocopiers can be reliably measured as it is determined when the photocopier is received by Minutemin. The recognition criteria are both met. Since both the asset definition and related recognition criteria are met, Minutemin must recognize the inventory as an asset in its books.

The journal entries would be as follows: (not required)

Debit

Inventory Bank Accounts payable Purchase of inventory and payment of deposit Accounts payable Bank Payment of balance owing upon sale of inventory Cost of sales Inventory Inventory is expensed as it is sold 30 000

Credit

3000 27 000

27 000 27 000 30 000 30 000

Kolitz and Sowden-Service, 2009

Chapter 2: Page 15

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.13

Introduction The main concern is whether the item should be treated as an asset or an expense depending on whether it meets the specific definitions and recognition criteria.

Treatment as an asset Definition of an asset Resource under control of the company Resulting from a past event From which future economic benefits are expected to flow to the company

Applying the asset definition to the plantation It is under the control of the company. The plantation is on company land and is being developed and maintained by the company. The past event is the development of the plantation. Future economic benefits: If the trees are harvested and the wood is sold, economic benefits will flow to the company. It can therefore be assumed that the plantation has been developed (and the costs incurred) with expected future economic benefits in mind.

Recognition criteria for an asset: The inflow of future economic benefits must be probable. The item must have a cost/value that can be measured with reliability.

Application of the recognition criteria to the plantation: As the period prior to expectation of the benefits is quite long, there is some uncertainty involved in the probability of the inflow of future economic benefits (e.g. drought, fire, market after 10 years, etc). The cost of developing the plantation can in this case be determined with accuracy since all costs have been provided for including both the original purchase cost of the land and the plantation costs to date.

Definition of an expense Expenses are decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 16

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.13 continued

Applying the expense definition to the plantation In this case the cost to develop and maintain the plantation must be paid and can be seen as the outflow of an economic benefit through the depletion of an asset, being the bank account or an increase in liabilities if the amounts have not yet been paid. These outflows of economic benefits have all occurred before 31 December 20X2 and the outflows are therefore said to have occurred during the accounting period. Since there has either been a decrease in assets or an increase in liabilities (or a decrease in assets and an increase in liabilities, assuming some amounts have not yet been paid), there will be a decrease in equity.

Since none of these outflows represent distributions to equity participants the outflows meet the definition of an expense. Recognition criteria for an expense: There must be a probable decrease in future economic benefits related to a decrease in an asset or an increase of a liability has arisen that can be measured reliably.

Applying the recognition criteria to the plantation: The decrease in future economic benefits is probable since the asset has been reduced already (e.g. cash in bank was reduced to make related payments); The C1,3 million is supported by documentation of payments and invoices and is therefore reliably measurable.

Since the recognition criteria relating to the expense are both met, the expense should be recognised. Conclusion: Assuming that the uncertainty regarding the probable inflow of future economic benefits is material, the definition of an asset is met but its recognition criteria are not. Conversely both the definition and related recognition criteria of an expense are met and therefore the journal entry showing the C1.3 million as an expense is correct. No adjustment is required.

Alternative conclusion: Assuming that the uncertainty regarding the probable inflow of future economic benefits is not material, the costs can be said to comply with the definition and recognition criteria of an asset. The development and maintenance costs are integral to the sustainability of the asset. The capitalisation is justified based on the fact that these costs will generate future income. Without spending on development and maintenance the company may not realise the expected incomes (20% on costs), and although a long time will pass before the trees will result in any income, it is fair to assume that they were planted with the intention of earning a return over and above the costs incurred and thus the future economic benefits will be earned. Therefore there are sufficient reasons for treating the costs as an asset.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 17

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.14

a) Definitions: i) Liability: Present obligation of the entity As a result of a past event The settlement of which will result in an outflow of future economic benefits. ii) Equity: The net increase in assets after deducting liabilities iii) Expense: A decrease in economic benefits During the accounting period Through an increase in liabilities or decrease in assets Resulting in a decrease in equity, other than a distribution to equity participants. b) Discussion: Recognition i) Recognition of the initial issue of preference shares: Liability: Since Keeptrying Ltds preference shares are compulsorily redeemable, they represent a present obligation of the entity. The past event is the issue of these shares on 1 January 20X3. The settlement of this obligation will result in an outflow of cash of C420 000 (in respect of the par value of the shares: C300 000, the premium: C30 000 and the annual dividends: C30 000 x 3 years = C90 000). The preference shares therefore meet the definition of a liability. Equity: Since bank (an asset) increased and preference shares (a liability) increased, there is no impact on equity. The preference shares therefore have no impact on equity.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 18

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.14 continued

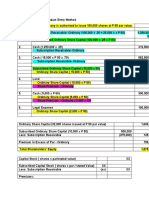

b) Discussion: Recognition continued ii) Recognition of the redemption of preference shares: Expense: A decrease in economic benefits: cash outflow During the accounting periods: 20X5 Through an increase in liabilities or decrease in assets: decrease in bank Resulting in a decrease in equity, other than a distribution to equity participants: Since the issue of the preference shares represents a liability, none of the payments to the preference shareholders represent distributions to equity participants. Since the par value of the shares and premium on redemption are both committed to on the date that the preference shares are issued and are thus recognised as liabilities, the repayment of each represents a decrease in assets (decrease in the bank account) and a decrease in this preference share liability balance, with the result that there is no impact on the equity. These repayments are therefore not expenses. The C300 000 paid is a settlement of the original liability The C30 000 paid is a settlement of the premium that accrued over the 3 years. Both the above payments thus decrease liabilities and, at the same time, decrease the assets (bank) with the result that the payments do not represent expenses. The preference shares therefore have no impact on expenses. c) Calculation: Measurement Liabilities should be recognised at the present value of the future obligation (future obligation is C420 000): C318 762 at 31 December 20X4. The liability balance may be calculated as follows:

Interest at 12,937% 38,811 39,951 Premium accrued 8,811 8,811 9,951 18,762 11,238 30,000 -30,000 0 Preference share liability 300,000 308,811 318,762

Effective interest rate table 31/12/20X3 31/12/20X4

Bank -30,000 -30,000

The rest of this table was not required: 31/12/20X5 31/12/20X5

41,238

-30,000 -330,000

330,000 0

120,000

-420,000

Kolitz and Sowden-Service, 2009

Chapter 2: Page 19

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.14 continued

d) Journals:

Debit 1 January 20X4 Retained earnings Premium accrued Correction: preference dividend & premium recognised as interest expense 1 January 20X4 Preference share (equity) Preference share (liability) Correction: recognition of preference shares as a liability 31 December 20X4 Finance charges Preference dividend Premium accrued Correction: preference dividend & premium recognised as interest expense 31 December 20X4 Preference share (liability) Current portion of preference share (liability) Correction: recognition of preference shares as a liability 8 811 8 811 Credit

300 000 300 000

39 951 30 000 9 951

318 762 318 762

Assuming that it was possible for the company to process correcting journals in the 20X3 records, the following correcting journal would be processed in 20X3 (below) instead of the correcting journal processed on 1 January 20X4 (above):

Debit 31 December 20X3 Finance charges Preference dividend Premium accrued Correction: preference dividend & premium recognised as interest expense 38 811 30 000 8 811 Credit

Kolitz and Sowden-Service, 2009

Chapter 2: Page 20

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.15

Introduction: The issue surrounds whether an increase in the value of an asset should be recognised as income or recognised directly as an increase in equity. Definitions: Equity is defined as: The residual interest in the assets of the entity After deducting its liabilities. Income is defined as: An increase in economic benefits During the accounting period That increases equity through either An increase in assets or a decrease in liabilities Other than through a contribution from equity participants. Discussion: Discussion of income definition: The value of the plant was re-measured to fair value and resulted in an increase in assets in the trial balance. Since the value of assets increased but liabilities remained the same, this resulted in an increase in equity. Although the revaluation occurred during the accounting period, this increase in economic benefits was not actually realised during the accounting period since it has not been sold. Although this item meets the framework definition of income, it is excluded from profit measurement. (IAS 1, paragraph 80) Discussion of equity definition: Since the plant (an asset) has increased in value and since there is no concomitant increase in liabilities, equity will have increased. Conclusion: Equity has increased and the income definition has been met. However, the increase in the assets value (since it is obviously not a liability in any way) is recognised directly in equity because it is excluded from the measurement of profit (IAS 1, paragraph 80). IAS 1, paragraph 96 requires that the statement of changes in equity to disclose: profit or loss; income and expenses recognised directly in equity; and the total of the above two items. This disclosure is necessary since it is important to consider all items of income and expense in assessing changes in an entitys financial position between two reporting dates.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 21

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.16

Asset definition: a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity. Recognition criteria for an asset: the future economic benefits expected to flow to the entity must be probable; and the asset must have a cost or value that can be measured reliably. Discussion: The increased customer awareness created through the advertising promotion could be argued to be a resource. The decision to undertake advertising promotions is within the control of the entity. There is a past event since the promotion took place before 31 December 20X8. The future economic benefits are expected to flow in through increased future sales. The cost can be reliably measured as the C2 000 000 has already been spent. The issue relates to the uncertainty of the probability of the future benefits. The company cannot control how the public will react to the advertising i.e. whether they will react positively, which will result in an increase in sales, or whether they will react negatively, which will result in a decrease in sales, or whether they are indifferent , which will result in no change to sales. This lack of control over the flow of future economic benefits and the difficulty in linking any future increase in the inflow of economic benefits directly to the advertising means that the probability criteria needed for recognition is not met.

So although the definition of an asset is met, the accountant may not capitalize the amount.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 22

Solutions to Gripping IFRS: Graded Questions

The framework

Solution 2.16 continued

Expense definition: decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrence of liabilities that result in decreases in equity, other than those relating to distributions to equity participants. Recognition criteria for an expense: Recognised in the statement of comprehensive income when a decrease in future economic benefits related to a decrease in an asset or an increase of a liability has arisen that can be measured reliably. Discussion: The advertising expense has been paid and can be seen as the outflow of an economic benefit through the depletion of an asset (bank account). The expenditure was approved by the board and paid prior to the year end; hence it occurs during the accounting period The payment does not represent a distribution to equity participants and should be recognised as an expense. The cost therefore meets the definition of an expense. The cost of the item can be reliably measured as there is an amount of C2 000 000 that has been paid. There is a decrease in future economic benefits as there has been a decrease in the asset bank.

The recognition criteria have also been met and therefore the expense should be recognised. Conclusion: The entire amount must be expensed in the financial statements for the year ended 31 December 20X8.

Kolitz and Sowden-Service, 2009

Chapter 2: Page 23

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Topic 1 Practice QuestionsDocument12 pagesTopic 1 Practice QuestionsLena ZhengNo ratings yet

- SBR 2020 NotesDocument39 pagesSBR 2020 NotesGlebNo ratings yet

- The Objective of General Purpose Financial ReportingDocument86 pagesThe Objective of General Purpose Financial ReportingAlex liaoNo ratings yet

- Group Statements of Cashflows PDFDocument19 pagesGroup Statements of Cashflows PDFObey SitholeNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsnaboumilikaNo ratings yet

- Contemporary Ch2 NotesDocument3 pagesContemporary Ch2 NotesdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- Investor Perspective Financial Instruments July 2014Document6 pagesInvestor Perspective Financial Instruments July 2014Bheki TshimedziNo ratings yet

- Don't Fall Foul of The New IFRS 9 and IFRS 15 Standards - ACCA GlobalDocument7 pagesDon't Fall Foul of The New IFRS 9 and IFRS 15 Standards - ACCA GlobalArun ThomasNo ratings yet

- PFRS For SMEsDocument16 pagesPFRS For SMEsTimothy Del Valle100% (2)

- CAC 1101: Financial Accounting Part 1Document100 pagesCAC 1101: Financial Accounting Part 1LOVERAGE MUNEMONo ratings yet

- Asset Liability ApproachDocument16 pagesAsset Liability ApproachJanitscharenNo ratings yet

- Relevant To ACCA Qualification Papers F7 and P2: Iasb'S Conceptual Framework For Financial ReportingDocument4 pagesRelevant To ACCA Qualification Papers F7 and P2: Iasb'S Conceptual Framework For Financial ReportingHoJoJoNo ratings yet

- CVS 465_Chapter 6_Project AccountingDocument10 pagesCVS 465_Chapter 6_Project AccountingOndari HesbonNo ratings yet

- WEEK 1 Discussion ProblemsDocument9 pagesWEEK 1 Discussion ProblemsJemNo ratings yet

- ACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsDocument5 pagesACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsNatalie Laurent SiaNo ratings yet

- Accounting 507 - Conceptual FrameworkDocument6 pagesAccounting 507 - Conceptual FrameworkPragyani ShresthaNo ratings yet

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- IFRS Standards OverviewDocument12 pagesIFRS Standards OverviewJeneef JoshuaNo ratings yet

- Revised AccountingDocument46 pagesRevised AccountingAli NasarNo ratings yet

- Acc702 Ap 2Document24 pagesAcc702 Ap 2Ushra KhanNo ratings yet

- IAS 7: Statement of Cash Flow: Single CompanyDocument27 pagesIAS 7: Statement of Cash Flow: Single CompanyAfsanaNo ratings yet

- Chapter 2 - The Conceptual FrameworkDocument5 pagesChapter 2 - The Conceptual FrameworkdiditayumeganNo ratings yet

- Accounting Notes Essential Features of Accounting PrinciplesDocument13 pagesAccounting Notes Essential Features of Accounting PrinciplesGM BalochNo ratings yet

- Kit AnswersDocument33 pagesKit AnswersHarshNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument14 pagesFramework For The Preparation and Presentation of Financial StatementsHasnain MahmoodNo ratings yet

- Chap 2 - SFARDocument6 pagesChap 2 - SFARApril Joy ObedozaNo ratings yet

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- Chapter 10: Regulation and The Conceptual Framework: Discussion QuestionsDocument8 pagesChapter 10: Regulation and The Conceptual Framework: Discussion QuestionswainikitiraculeNo ratings yet

- f1.3 Financial Acoounting CpaDocument173 pagesf1.3 Financial Acoounting CpaCyiza Ben RubenNo ratings yet

- CPWM Regulation Best InterestDocument129 pagesCPWM Regulation Best Interesttrade fastNo ratings yet

- Renew (Corporate ReportingDocument11 pagesRenew (Corporate ReportingBeng PutraNo ratings yet

- Fa4e SM Ch02Document53 pagesFa4e SM Ch02michaelkwok1No ratings yet

- Conceptual Framework Lecture NotesDocument5 pagesConceptual Framework Lecture NotesAnna Micaella Dela CruzNo ratings yet

- CSCF T11 - P14Document14 pagesCSCF T11 - P14sk2p7tsf5cNo ratings yet

- 1.1: Identify The Principles of Accounting AnsDocument5 pages1.1: Identify The Principles of Accounting AnsSheetal ShahNo ratings yet

- Master of Valuation Real Estate-II Unit-12 Page 255 To 271Document17 pagesMaster of Valuation Real Estate-II Unit-12 Page 255 To 271Udit TiwariNo ratings yet

- Aaa Standards by BeingaccaDocument9 pagesAaa Standards by Beingaccakshama3102100% (1)

- Financial Statement Anlysis 10e Subramanyam Wild Chapter 4 PDFDocument43 pagesFinancial Statement Anlysis 10e Subramanyam Wild Chapter 4 PDFRyan75% (4)

- Conceptual Framework For Financial ReportingDocument14 pagesConceptual Framework For Financial ReportingannaallagaNo ratings yet

- ACC 203 module explores conceptual framework and financial reportingDocument127 pagesACC 203 module explores conceptual framework and financial reportingAsi Cas Jav67% (3)

- ACCT 10001 Accounting Reports & Analysis Review Questions - Topic 1 Chapter 1: Introduction To Accounting and Business Decision MakingDocument5 pagesACCT 10001 Accounting Reports & Analysis Review Questions - Topic 1 Chapter 1: Introduction To Accounting and Business Decision MakingHui Ying LimNo ratings yet

- Acca NotesDocument100 pagesAcca Notesasifkazmi100% (2)

- Intermediate Financial Accounting I 1 1Document192 pagesIntermediate Financial Accounting I 1 1natinaelbahiru74No ratings yet

- CH 03Document67 pagesCH 03Khoirunnisa Dwiastuti100% (2)

- Guidelines in Fs PreparationDocument4 pagesGuidelines in Fs PreparationanacldnNo ratings yet

- Chapter 26 - Financial Liabilities and Debt RestructuringDocument59 pagesChapter 26 - Financial Liabilities and Debt RestructuringDeeNo ratings yet

- Ifrs For SMEsDocument104 pagesIfrs For SMEsApril AcboNo ratings yet

- LM05 Working Capital & LiquidityDocument16 pagesLM05 Working Capital & LiquiditySYED HAIDER ABBAS KAZMINo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- Mergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketFrom EverandMergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketRating: 1 out of 5 stars1/5 (1)

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Corporate Law Made Easy - Volume 2Document95 pagesCorporate Law Made Easy - Volume 2Asif IqbalNo ratings yet

- Corporate Laws Made Easy Volume 1Document52 pagesCorporate Laws Made Easy Volume 1Falah Ud Din SheryarNo ratings yet

- Fixed Assets I As 16Document25 pagesFixed Assets I As 16Falah Ud Din SheryarNo ratings yet

- Chapter 15 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 15 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Introduction To Financial Statements and AuditDocument26 pagesIntroduction To Financial Statements and AuditFalah Ud Din SheryarNo ratings yet

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Ias 23 - Borrowing CostDocument11 pagesIas 23 - Borrowing CostATIFREHMANWARRIACHNo ratings yet

- InventoriesDocument48 pagesInventoriesFalah Ud Din SheryarNo ratings yet

- Ias 40 Investment Property by A Deel SaleemDocument12 pagesIas 40 Investment Property by A Deel SaleemFalah Ud Din Sheryar100% (1)

- Ias 16 Property, Plant & Equipment: Adeel SaleemDocument20 pagesIas 16 Property, Plant & Equipment: Adeel SaleemAtif RehmanNo ratings yet

- Chapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 17 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document32 pagesChapter 17 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document16 pagesChapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- Chapter 10Document89 pagesChapter 10kazimkoroglu100% (1)

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 11 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document20 pagesChapter 11 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 29 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document10 pagesChapter 29 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar0% (1)

- Chapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document40 pagesChapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document25 pagesChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 28 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document6 pagesChapter 28 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 27 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document13 pagesChapter 27 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Z. Kolundzic - Street Smart Forex PDFDocument131 pagesZ. Kolundzic - Street Smart Forex PDFj2daaa50% (2)

- SIM Audit 421 Problem Week 4-5Document33 pagesSIM Audit 421 Problem Week 4-5Kristelle MarieNo ratings yet

- Chapter-1: Introduction of Merchant BankingDocument47 pagesChapter-1: Introduction of Merchant BankingKritika IyerNo ratings yet

- As1 LeadershipDocument19 pagesAs1 LeadershipSandeep BholahNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 2 Asia Global Edition PDF ScribdDocument42 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 2 Asia Global Edition PDF Scribdlauryn.corbett387100% (39)

- Chapter 9 - Home WorkDocument8 pagesChapter 9 - Home WorkFaisel MohamedNo ratings yet

- Syllabus Ba114.12012syllabusDocument9 pagesSyllabus Ba114.12012syllabusRyan SanitaNo ratings yet

- Report G1 IS202Document25 pagesReport G1 IS202Nonelon SalvadoraNo ratings yet

- The Company.: Particulars ParticularsDocument5 pagesThe Company.: Particulars ParticularsAnamul HaqueNo ratings yet

- Multiple Choice Questions: Answer: B. Wealth MaximisationDocument20 pagesMultiple Choice Questions: Answer: B. Wealth MaximisationArchana Neppolian100% (1)

- Balance Sheet: Annual DataDocument4 pagesBalance Sheet: Annual DataJulie RayanNo ratings yet

- Negotiation and Selling SkillsDocument18 pagesNegotiation and Selling SkillsTanvi JuikarNo ratings yet

- Prepare Financial Statements From Trial Balance in ExcelDocument5 pagesPrepare Financial Statements From Trial Balance in ExcelShania FordeNo ratings yet

- Strategic Financial Management - Investment Appraisal - RCF, PP, DPP, TVM, ARR - Dayana MasturaDocument23 pagesStrategic Financial Management - Investment Appraisal - RCF, PP, DPP, TVM, ARR - Dayana MasturaDayana MasturaNo ratings yet

- Diario de Trading - Live Trading RoomDocument683 pagesDiario de Trading - Live Trading RoomAlexisNo ratings yet

- Overview of Financial Management and The Financial EnvironmentDocument27 pagesOverview of Financial Management and The Financial EnvironmentsoochwelfareNo ratings yet

- Joe Malvasio Completes 40 Years of Experience Working As A Reputable Real Estate Lender For Borrowers in The USDocument4 pagesJoe Malvasio Completes 40 Years of Experience Working As A Reputable Real Estate Lender For Borrowers in The USPR.comNo ratings yet

- Equity market strategies and risksDocument5 pagesEquity market strategies and risksTrần Phương AnhNo ratings yet

- Philippine Management Review 2020, Vol. 27, 17-36Document20 pagesPhilippine Management Review 2020, Vol. 27, 17-36stephen_palmer_uy6978No ratings yet

- Ind As 33 Material For VC 26 28 August 2021Document69 pagesInd As 33 Material For VC 26 28 August 2021Khawaish MittalNo ratings yet

- Crowd FundingDocument22 pagesCrowd Fundingshital_vyas1987No ratings yet

- Ey frd42856 08 02 2022Document83 pagesEy frd42856 08 02 2022Shri Ramanujar Dhaya AaraamudhamNo ratings yet

- Bond Pricing Formula ExplainedDocument46 pagesBond Pricing Formula ExplainedSmita100% (1)

- Secondary Markets ExplainedDocument27 pagesSecondary Markets ExplainedNhi VõNo ratings yet

- Semi Final Exam EntrepDocument3 pagesSemi Final Exam EntrepEricson C UngriaNo ratings yet

- Inputs For Synthetic Rating Estimation Please Read The Special Cases Worksheet (See Below) Before You Use This SpreadsheetDocument4 pagesInputs For Synthetic Rating Estimation Please Read The Special Cases Worksheet (See Below) Before You Use This SpreadsheetHicham NassitNo ratings yet

- Notes For Week 2Document3 pagesNotes For Week 2algokar999No ratings yet

- IA2 06 - Handout - 1 PDFDocument5 pagesIA2 06 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Pattern, Price and Time - Using Gann TheoryDocument29 pagesPattern, Price and Time - Using Gann TheoryRohitOhri44% (9)

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet