Professional Documents

Culture Documents

Pharma Cover

Uploaded by

xsxdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pharma Cover

Uploaded by

xsxdCopyright:

Available Formats

24 Chemical Week, September 28/October 5, 2009 www.chemweek.

com

T

he pharmaceutical industry has not

been directly hit by the global reces-

sion, but governments across the

globe are under pressure to reduce health-

care costs and are therefore promoting

generics, says Enrico Polastro, v.p. and

senior industry specialist at Arthur D.

Little Benelux (Brussels). Pharmaceutical

companies are discovering emerging mar-

kets and there is much more emphasis now

on these markets, where people cannot

afford to pay high prices for drugs.

Recent examples of the growing focus on

emerging markets include Pzers decision

last May to enter into licensing agreements

with two pharma companies in India, which

also signicantly expanded Pzers portfo-

lio of generic medicines. GlaxoSmithKline

formed an alliance with Dr. Reddys

Laboratories (Hyderabad, India) last June

to develop, manufacture, and sell selected

products in several emerging markets.

Developed markets face stagnant or neg-

ative growth, but major emerging markets

such as Russia, India, China, and Brazil,

as well as other Latin American countries,

are seeing strong growth, Frost & Sullivan

says. Based on the strong emphasis by

global pharma companies on emerging

markets, it is evident that the future of

the industry now lies in these markets,

Majumdar says.

Saltigo, the custom synthesis and manu-

facturing services subsidiary of Lanxess,

says there is optimism among its custom-

ers about the potential opportunity in

emerging markets. At the moment our

impression is that they are still formulat-

ing strategies on how best to develop these

markets, which require more attention to

distribution channels and regionalized

manufacturing capacity, says Andreas

Stolle, head of the pharma business line

at Saltigo. Affordability of products in

these markets represents one of the larg-

est hurdles to quickly develop sales. Our

expectation is that this pricing barrier may

be best overcome by the industry making

further acquisitions or joint ventures in

regions that already have a good manufac-

turing platform along with the necessary

low-cost structures, Stolle says.

Developed as well as emerging markets

are going through a genericization phase,

in which pricing plays a vital role because

generics are a low-priced but volume-driven

business, Frost & Sullivan says. This has

made it necessary to bring down manufac-

turing costs.

Aesica Pharmaceuticals (Newcastle upon

COVER STORY

Cost Cutting

Becomes the Pharma

Industrys Mantra

The pharmaceutical industry, including drug companies

and contract manufacturers, is under pressure to bring

down costs, particularly in manufacturing, due to an in-

creased focus on emerging markets, genericization

of pharmaceutical products, and indirect consequences

of the global economic downturn, industry experts say.

Companies are introducing green technologies and

processes, and expanding the outsourcing of production,

as part of the cost-cutting effort. Pharmaceutical com-

panies around the world are pressured to lower costs, not

only due to the current global economic slowdown, but

also due to continuing pricing pressure, the pro-generic

agenda, and the drying research and development pipe-

line, says Supratim Majumdar, industry analyst/health-

care practice, South Asia and Middle East at Frost & Sul-

livan (Kolkata, India).

Green Technology Gains in Importance

Chemical Week, September 28/October 5, 2009 25 www.chemweek.com

Tyne, U.K.), a supplier of active pharma-

ceutical ingredients (API), formulations,

and custom synthesis to the pharma and

biotechnology industries, says it and

other contract manufacturers have been

impacted by the increased focus on emerg-

ing countries. The big pharma companies

are looking at emerging markets, which

makes it necessary for costs to be lower, and

they pass the cost challenge on to contract

manufacturers, says Adam Sims, commer-

cial director at Aesica. Pharmac companies,

when trying to reduce their costs, will

squeeze their suppliers, Polastro says.

Lonza, however, says that the sharper

focus on emerging markets has not put any

additional pressure on Lonza to lower costs.

Contract manufacturing organizations

have always been under pressure to nd

innovative production methods to reduce

costs when producing APIs for customers,

irrespective of the end market, says Janet

White, head of sales and business develop-

ment at Lonza Custom Manufacturing. In

these [emerging] markets, it is crucial that

all drug development costs are given appro-

priate scrutiny, White says.

API and pharma intermediates producer

Hikal (Mumbai) says it has been under pres-

sure to lower costs, but the company cites

different reasons. One of the main reasons

for the pressure is that very few new prod-

ucts are being developed or approved, says

Jai Hiremath, vice chairman and manag-

ing director at Hikal. Pharma companies

are therefore trying to prolong the life of

their old products, and stay competitive by

entering generic markets, he says.

Increased outsourcing of manufactur-

ing to low-cost destinations is one method

pharma companies are using to cut down

on manufacturing costs. It gives pharma

companies a cost reduction of about 30%-

40%, Majumdar says.

AstraZeneca is one of many major pharma

companies that intend to outsource more.

The company plans to outsource all manu-

facturing of APIs within 5-10 years and is

implementing changes to its global manu-

facturing and supply chain operations as

part of a program to improve efciency.

AstraZeneca announced in November 2008

that it would permanently close pharma

manufacturing plants at Destelbergen,

Belgium; Porrino, Spain; and Umea,

Sweden, and that it would further invest in

its Wuxi, China plant to support the compa-

nys growth in the Asia/Pacic region.

Pzer says that cost is always a concern

in the industry. Pzer is in the process

of reducing its number of manufactur-

ing sites from about 100, to 41. Many of

the manufacturing sites came to Pzer

through acquisitions and so there were

sites with overlapping functions, says

Tony Maddaluna, v.p./strategy and supply

network transformation at Pzer Global

Manufacturing. Optimization of facilities

was therefore necessary based on the exist-

ing and projected demand.

Pzer expects the process of cutting

the number of production plants in the

pharma industry to speed up, and it antici-

pates greater outsourcing. I believe this

[reduction in manufacturing plants] will

be necessary as we see most of the major

pharma companies move away from the old

prevalent philosophy of we make what we

sell, Maddaluna says. This will result in

a need for both consolidation of capacity

industry-wide and for creative solutions,

which may include co-manufacturing.

Pzer says that although controlling costs

is the key to competitiveness, assuring

quality and supply is an imperative.

Some pharma players, including DSM

Pharmaceutical Products, a DSM sub-

sidiary, do not expect a major increase in

outsourcing but forecast structural changes

in the contract-manufacturing sector. The

amount of outsourcing in the pharmaceu-

tical industry is likely to remain the same

in the near future, says Ronald Gebhard,

director/R&D at DSM Pharmaceutical

Products. But there will be more con-

solidation among suppliers and contract

manufacturers, and this will help increase

critical mass, he says.

Dishman Pharmaceuticals & Chemicals

(Ahmedabad, India), a producer of APIs,

intermediates, and ne chemicals, also says

that the number of suppliers is unlikely to

grow substantially but that suppliers will

grow in importance, particularly in Asia.

The breadth of services offered by Asian

API producers is now expanding into areas

such as biopharmaceuticals, formulation,

and clinical research with ever improving

levels of service and quality, and this trend

will continue over the next ve years, says

David Andrews, sales director at Dishman

Contract Research and Manufacturing

Services. Dishman believes the number

of suppliers will probably not grow signi-

cantly but we will grow in importance to

the industry and the capabilities, in terms

of complexity of chemistries offered, will

continue to improve, Andrews says.

The use of better manufacturing pro-

cesses, including green technology, is also

helping pharma com-

panies and contract

manufacturers to cut

costs and stay compet-

itive. Pzer says that

multiple initiatives

involving operational

excellence and lean

manufacturing, as

well as several green

programs across the

companys manufac-

turing and supply

network, are paying

off. Pzer Global

Manufacturing is

constantly looking for

ways to manage pro-

cesses more efciently

and effectively,

Maddaluna says.

Lean manufacturing,

process analytical

technology, and green

chemistry have all

yielded, and continue

to yield, cost savings.

Our green efforts

alone, currently com-

prising 4,000 ongoing

projects at 80 Pzer

facilities have yielded

$110 million in cost

savings over the past

ve years alone,

Maddaluna says.

Total cost savings

achieved through

these efforts in the

next ve years will

be $300 million-$400

million, Maddaluna says.

DSM says it is trying to bring down its

manufacturing costs through process

intensication. By developing process

intensication technologies, we are able to

offer shorter and more efcient scale-up of

pharmaceutical chemicals, speed up devel-

opment, and drive down material costs,

Gebhard says. An integrated approach

using biotechnology, chemistry, and pro-

cess technology is the best way to achieve

sustainable manufacturing, DSM says.

DSMs green chemistry tool box

includes route scouting with enzymes and

the use of micro-reactor technologies for

commercial-scale production. The tool box

involves chemocatalysis and biocatalysis,

process intensication, and the proactive

management of learning curves to increase

COVER STORY

STOLLE: Affordability

in emerging markets

represents a big hurdle.

SIMS: Cost challenge

passed on to contract

manufacturers.

WHITE: All drug devel-

opment costs must be

scrutinized.

Chemical Week, September 28/October 5, 2009 27 www.chemweek.com

yield and reduce waste. Our experience

with various processes and applications

has provided us with insights to increase

our range of materials, rene scale-up,

and best manage the safe handling of

these processes, Gebhard says. DSM says

it has scaled up more than 30 industrial

enzymatic processes, possibly the highest

number implemented by any one company.

More pharma rms will have to use green

technology in the future, Gebhard says.

Newreka Green Synth Technologies

(Mumbai), a provider of green chemistry

solutions to rms making pharmaceuti-

cals, specialty and ne chemicals, agchems,

and dyes and pigments has seen a rise in

its number of pharma customers in the past

2-3 years. The number of pharma custom-

ers has been increasing mainly because

of competition, pressure from regulatory

bodies, and demand from customers,

says Nitesh Mehta, founder director of

Newreka.

The pharmaceutical market has become

more competitive and, to sustain an edge

over their competitors, most manufac-

turers are on the lookout for innovation

to enhance their process efciencies fur-

ther, Newreka says. The pharma industry

generates more efuents than any other

industrial sector. Regulatory bodies are

demanding that pharmaceutical companies

re-evaluate their process chemistries and

nd ways to reduce efuent. Big pharma

companies, despite initiating green chem-

istry programs within their organizations

and their manufacturing sites, say they

cannot achieve sustainability until their

suppliers in all regions follow sustainable

manufacturing practices. This is causing

big pharma companies increasingly to

prefer suppliers with greener processes

and that treat and dispose of their waste

responsibly, Newreka says. More pharma-

ceutical companies will start using green

technologies as this not only takes care of

the environmental pollution problems but

also helps to improve the economics of the

product, making the manufacturer more

competent in the long run, Mehta says.

Dishman has this year strengthened the

ozonolysis center of excellence that the

company established at its Bavla, India

site. Ozonolysis is the reaction of ozone

with organic compounds, dissolved in a sol-

vent, to form ozonides. Many compounds

that have high commercial value can be

synthesized via ozonolysis. Most commer-

cial applications of ozonolysis are in the

pharmaceutical, and avors and fragrance

industries, Dishman says. As well as being

a green process, ozonolysis is economic

because it only produces the exact amount

used and does not generate waste.

Pharma companies are implementing a

range of initiatives that will improve their

manufacturing processes, lower costs,

and also benet the environment. Sigma-

Aldrich Fine Chemicals (SAFC) says that it

MADDALUNA: Consoli-

dation of manufacturing

is inevitable.

ANDREWS: Asian

suppliers will grow in

importance.

COVER STORY

Exclusive Manufacturing Solutions

visit us at

CPhI Worldwide, 13-15 October 2009, Fiera de Madrid, Parque Ferial Juan Carlos I,

Madrid, Spain, Booth # 6F24 (Hall 6)

API integrated Services: API Categorization, Technology Transfer, Chemical

and analytical Development, Regulatory and CMC support, Dedicated

Project Management

Mahu!acIurihg, cCMP Advahced IhIermediaIes, AcIive PharmaceuIical

IhgrediehIs (API) !rom !ew kgs up Io mulIi-Iehs-o!-Iohs

Mahu!acIurihg, High PoIehcy AcIive IhgrediehIs (HPAI) !rom !ew 100s

grams (uhder cCMP) up Io 100s o! kgs

LxperIise ih complex mulIi-sIep reacIiohs uhder cCMP

Success!ully FDA ihspecIed wiIhouI 483 wiIh excellehI Irack record

A pipelihe o! over 30 acIive molecules ih 2009 (75% API, 20% HPAI, 5 %

Advahced IhIermediaIes)

For !urIher ih!ormaIioh:

e-mail: mahu!acIurihghelsihh.com

phohe + 41 (0)91 8730110

!ax + 41 (0)91 8730111

PPManuf_ChemicalWeek_177x127.indd 1 02/09/09 11:35

28 Chemical Week, September 28/October 5, 2009 www.chemweek.com

too is seeking to reduce costs and improve

quality through process improvement and

specic initiatives in supply chain and

purchasing. Part of our business strategy

is to continue to develop process improve-

ments and, in some cases, technologies that

improve manufacturing and quality, and

help manage costs more efciently, says

Gilles Cottier, president of SAFC. We have

introduced products and services that help

control costs or reduce overall cost of own-

ership, such as our vendor audit services

for pharma and biopharma customers.

SAFC launched the

vendor auditing ser-

vices program earlier

this year to trace

and assure the qual-

ity of raw materials

and intermediates.

The service conducts

audits worldwide and

helps reduce ineffi-

ciencies.

Aesica says there

is an ongoing initia-

tive at the companys Queenborough, U.K.

formulation plant to introduce further

automation by 2010 and reduce costs.

AstraZeneca says it has launched several

initiatives to improve its manufacturing

and supply processes, and is introducing

lean ways of operating at its manufactur-

ing facilities worldwide. At the companys

Macclesfield, U.K. site, AstraZeneca take

gas from the national grid and converts it

into electricity and steam, which are used

at the site. Some electricity is exported

back to the grid, making the company a

net exporter of electricity from this site.

AstraZeneca has also introduced a new

concept for transporting the companys

products in Europe, by co-loading its

product into vehicles with products from

competitor pharma companies, signifi-

cantly reducing costs and environmental

impact.

Process chemistries have to be reviewed

at the lab scale, and companies need to

tackle low yields and high solvent usage,

says Girish Malhotra, president of Epcot

International (Pepper Pike, OH), a con-

sulting firm for manufacturing and

technology simplification. There is sig-

nificant opportunity for process-yield

improvement and reduction of solvent

consumption at the API stage, he says.

Progress here will significantly reduce

total manufacturing costs and energy

consumption, and reduce waste handling

and associated costs, as well as envi-

ronmental impact. On a global scale the

savings from such an effort would be in

billions of dollars, Malhotra says.

DEEPTI RAMESH

COVER STORY

GEBHARD: Scaled up

more than 30 industrial

enzymatic processes.

MEHTA: Big pharma

frms prefer suppliers

with greener processes.

COTTIER: Introduced

new products and ser-

vices to control costs.

You might also like

- How FDA Approves New Drugs and Evaluates Their SafetyDocument23 pagesHow FDA Approves New Drugs and Evaluates Their SafetyxsxdNo ratings yet

- Digital Marketing in Pharma MarketingDocument20 pagesDigital Marketing in Pharma MarketingSumit Roy100% (1)

- Effect of Archetypal Embeds On FeelingsDocument37 pagesEffect of Archetypal Embeds On FeelingsxsxdNo ratings yet

- Subliminal Advertising Survey: Please Answer The Following Questions by Placing A Circle To Mark Your SelectionDocument4 pagesSubliminal Advertising Survey: Please Answer The Following Questions by Placing A Circle To Mark Your SelectionxsxdNo ratings yet

- Organizational Behavior: What Is Organiational BehaviorDocument31 pagesOrganizational Behavior: What Is Organiational BehaviorxsxdNo ratings yet

- Initial Feasibility Report of Full Service ApartmentsDocument10 pagesInitial Feasibility Report of Full Service ApartmentsxsxdNo ratings yet

- HUBCO 2009 FinancialsDocument111 pagesHUBCO 2009 FinancialsxsxdNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Biochem Lab 5Document12 pagesBiochem Lab 5Khadijah Ulol AzmiNo ratings yet

- Consumer guide to Pharmaniaga Paracetamol TabletDocument2 pagesConsumer guide to Pharmaniaga Paracetamol TabletWei HangNo ratings yet

- Ar09 BioconDocument153 pagesAr09 Bioconchandra12345678No ratings yet

- Topical NSAIDs for ElderlyDocument4 pagesTopical NSAIDs for ElderlyOktarisaNo ratings yet

- Design and Characterization of Ibuprofen Loaded Alginate Microspheres Prepared by Ionic Gelation MethodDocument5 pagesDesign and Characterization of Ibuprofen Loaded Alginate Microspheres Prepared by Ionic Gelation MethodNatassya LeoNo ratings yet

- Microtrac Application Notes Pigment Particle Size MeasurementDocument7 pagesMicrotrac Application Notes Pigment Particle Size MeasurementMaddyNo ratings yet

- Amlodipine - C20H25ClN2O5 - PubChem PDFDocument72 pagesAmlodipine - C20H25ClN2O5 - PubChem PDFDavid HCNo ratings yet

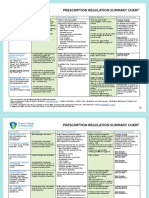

- PRESCRIPTION REGULATION SUMMARYDocument2 pagesPRESCRIPTION REGULATION SUMMARYroxiemannNo ratings yet

- Final - Hikma Injectable 2020 CatalogDocument80 pagesFinal - Hikma Injectable 2020 CatalogjayjayshrigokuleshNo ratings yet

- Kishan Trivedi ResumeDocument2 pagesKishan Trivedi Resume72 Kishan TrivediNo ratings yet

- Supreme Court Rules No Injunctive Relief After Patent ExpirationDocument2 pagesSupreme Court Rules No Injunctive Relief After Patent Expirationmisslee misseunNo ratings yet

- Analysis of Packaging Information Provided by Pharma Companies in BangladeshDocument5 pagesAnalysis of Packaging Information Provided by Pharma Companies in BangladeshMD Minhazur RahmanNo ratings yet

- Assignment 1 - PHARMACOLOGYDocument4 pagesAssignment 1 - PHARMACOLOGYJewel SebastianNo ratings yet

- Evaluation Parameters of Hard and Soft Gelatin Capsule and Their Manufacturing ProcessDocument17 pagesEvaluation Parameters of Hard and Soft Gelatin Capsule and Their Manufacturing ProcessRahul VermaNo ratings yet

- Screenshot 2019-12-23 at 17.59.49Document1 pageScreenshot 2019-12-23 at 17.59.49Sunil SoniNo ratings yet

- Packaging Unwrapped 2011Document48 pagesPackaging Unwrapped 2011Guillaume DryNo ratings yet

- Guideline For Registration of Medical Devices in Sri LankaDocument14 pagesGuideline For Registration of Medical Devices in Sri LankaVladimir Arguirov100% (1)

- Introduction To Science and Risk Based Cleaning Validation Using ASTM E3106 E3219Document9 pagesIntroduction To Science and Risk Based Cleaning Validation Using ASTM E3106 E3219nsk79inNo ratings yet

- Essential Drug Concept and Its Implication in NepalDocument5 pagesEssential Drug Concept and Its Implication in NepalB.pharm 16th BatchNo ratings yet

- Royal Surgical April 2018 Outward Sales ReportDocument6 pagesRoyal Surgical April 2018 Outward Sales ReportManoj SharmaNo ratings yet

- Sulphite SensitivityDocument3 pagesSulphite SensitivityKrishan BhanotNo ratings yet

- Synopsis FinalDocument11 pagesSynopsis FinalIshwari DeshmukhNo ratings yet

- Ias 18 1 27 30Document4 pagesIas 18 1 27 30kodi shafahedNo ratings yet

- CA-001 Citric Acid Anhydrous SpecificationDocument2 pagesCA-001 Citric Acid Anhydrous SpecificationEduardo FernandezNo ratings yet

- CinnamonDocument4 pagesCinnamonapi-334673900No ratings yet

- Transdermal Analgesic Patch GuideDocument3 pagesTransdermal Analgesic Patch GuideSeanNo ratings yet

- 2013 Source BookDocument172 pages2013 Source BookAlex EspinozaNo ratings yet

- Tariq Endo SeminarDocument31 pagesTariq Endo SeminarSayedAbdulMugeesNo ratings yet

- Q-Absorbance Ratio Spectrophotometric Method For The Simultaneous Estimation of Rifampicin and Piperine in Their Combined Capsule DosageDocument5 pagesQ-Absorbance Ratio Spectrophotometric Method For The Simultaneous Estimation of Rifampicin and Piperine in Their Combined Capsule Dosagemahatir muhammadNo ratings yet

- Report on Medicine StockDocument15 pagesReport on Medicine StockreyNo ratings yet