Professional Documents

Culture Documents

OKZ Unaudited Results For HY Ended 30 Sept 13

Uploaded by

Business Daily ZimbabweOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OKZ Unaudited Results For HY Ended 30 Sept 13

Uploaded by

Business Daily ZimbabweCopyright:

Available Formats

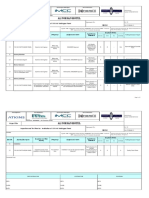

UNAUDITED ABRIDGED FINANCIAL RESULTS FOR SIX MONTHS ENDED 30 SEPTEMBER 2013

REGISTERED OFFICE: OK House, 7 Ramon Road, Graniteside, P.O. Box 3081, Harare, Zimbabwe. Tel: +263 4 757 311/9. Telefax: +263 4 757 028/39 Email: ok@okzim.co.zw

Revenue up 5.4% to $243.6 million EBITDA up 4.8% to $9.6 million Profit for the period stable at $4.8 million Earnings per share 0.43 cents versus 0.47 cents in prior year Interim dividend of 0.20 cents per share

CHAIRMAN'S STATEMENT The general economic slowdown, reported on at the end of the last financial year, worsened in the current reporting period. Post-election uncertainty over policy direction coupled with very low foreign direct investment inflows resulted in increased liquidity constraints. Additionally, the economy has been adversely affected by reduced manufacturing capacity utilisation, low prices on exported commodities and increased unemployment. Prices of goods and services have remained stable as indicated by the year-on-year inflation of 0.86% reported at the end of September.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 30 Sep 2013 US$ Unaudited 243,622,804 1,222,763 (203,626,914) (15,991,054) (2,554,754) (405,000) (15,725,517) (11,439) 6,530,889 (1,698,031) 4,832,858 30 Sep 2012 US$ Unaudited 231,184,483 (2,676,505) (188,899,348) (13,744,477) (1,912,609) (360,000) (16,729,479) (395,382) 6,466,683 (1,607,137) 4,859,546

Financing activities Dividend paid Increase in borrowings Proceeds from share options exercised (Increase)/decrease in short-term loan Net financing (utilised)/raised Increase/(decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the period Cash and cash equivalents at the end of the period

(4,506,600) 2,500,000 1,749,369 (23,024) (280,255) 267,524 15,625,203 15,892,727

(3,523,237) 5,000,000 363,576 36,108 1,876,447 (4,105,581) 11,723,422 7,617,841

Revenue Changes in trade inventories Merchandise and consumables used Employee benefit expense Depreciation expense Share option expense Net operating expenses Finance costs Profit before taxation Taxation (note 4) Profit for the period Other comprehensive income Fair value adjustment on available for sale equity investments Total comprehensive income for the period Weighted average number of ordinary shares in issue:

8 4,832,866

2,674 4,862,220

1,129,243,008 1,034,549,512 0.43 0.43 5.67 0.47 0.47 4.79

Share performance - cents : attributable earnings basis For the reasons previously reported, we continue to import most products although we : headline earnings basis support the local manufacturers and suppliers wherever good quality and competi: net asset value tively priced local products are available. Imported goods are procured and sold in the main in United States Dollars and pricing is therefore largely unaffected by fluctuations in the South African Rand. CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT Operating in the environment outlined above, the Group achieved limited growth in revenue but returned profits virtually identical to those reported this time last year. Whilst the gross margin held, operating costs increased, in part due to expansion initiatives (including the setting up of a financial services operation) which required more employees to man the additional facilities. Returns from these facilities will be realised later in the year. Two new shops were opened since the start of the current financial year, namely OK Wynne Street and OK Chitungwiza. The OK Express branch at Rezende Street was closed on the 31st July as its dimensions were sub-optimal for provision of the offering expected by the customer. Bon Marche Eastlea relocated to a larger store in the same business centre, a move which has resulted in increased sales through that branch. GROUP PERFORMANCE Revenue generated for the half year grew by 5.4% to $243.6 million from $231.2 million for the same period in the prior year. Profit before tax was $ 6.5 million compared to $ 6.5 million in the prior year, while profit after tax was stable at $4.8 million. Controls over shrinkage have continued to improve which assisted the Group in maintaining the gross margin at the same level as in the prior year. Total operating expenses increased by 5.9% to $34.7 million from $32.8 million in the prior year. The increase in overheads was partly as a result of escalating employment and occupancy costs as well as security charges. Depreciation expenses continue to increase as new equipment is installed in refurbished branches and as new shops are opened. Security measures to combat shrinkage are continually enhanced. DIVIDEND The Directors have declared an interim dividend of 0.20 cents per share payable on or about the 14th January 2014. OUTLOOK To enhance brand strength and improve sales growth, the Group will embark on full-scope refurbishment work at OK Waterfalls, OK Houghton Park and OK Bindura and will carry out limited work at OK Gweru and OK Mutare. Two new OK stores will be opened during 2013 at Hwange and Mabvuku. The Board, management and staff will continue in their efforts, in a difficult operating environment, to reward the continued loyalty and support of our shareholders, suppliers and customers. D B Lake Chairman 14 November 2013 DIVIDEND ANNOUNCEMENT NOTICE is hereby given that on 14 November 2013 the Board of Directors declared an interim dividend (number 17) of 0.20 cents per share payable out of the profits of the Group for the half year ended 30 September 2013. The dividend will be payable on or about 14 January 2014 in United States Dollars to shareholders registered in the books of the Group at the close of business on 20 December 2013. The share register of the Group will be closed from 21 December 2013 to 26 December 2013, both dates inclusive. By order of the Board H Nharingo Group Secretary Cash generated from operating activities Cash generated from trading (note 6) Working capital changes Cash generated from operating activities Net finance income/(costs) Taxation paid Net cash generated from operating activities Cash utilised in investment activities to maintain operations : Replacement of property, plant and equipment Proceeds from disposal of property, plant and equipment Investment to expand operations Additions to property, plant and equipment Decrease/(increase) in loans and other investments Net cash invested 30 Sep 2013 US$ Unaudited 49,627,580 400,000 252,536 50,280,116

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY 6 months to 6 months to 30 Sep 30 Sep 2013 2012 US$ US$ Unaudited Unaudited Shareholders' equity at the beginning of the period 56,390,405 47,514,911 Issue of shares 6,953,662 363,576 Recognition of share based payments 405,000 360,000 Translation reserve utilised through assets disposal Dividend paid (4,506,600) (3,523,237) Total comprehensive income for the period 4,832,866 4,862,220 Shareholders' equity at the end of the period 64,075,333 49,577,470

12 months to 31 March 2013 US$ Audited 47,514,911 399,047 656,976 (41,483) (5,600,017) 13,460,971 56,390,405

Assets Non-current assets Property, plant and equipment Goodwill Investments and other noncurrent assets Current assets Inventories Trade and other receivables Short-term loans Cash and cash equivalents Total assets Equity and liabilities Capital and reserves Issued share capital Share premium Share based payment reserve Investment reserve Revaluation reserve Non-distributable reserve Retained earnings Non-current liabilities Deferred taxation Long-term borrowings Current liabilities Trade and other payables Short-term borrowings Current tax liabilities Total equity and liabilities

30 Sep 2012 US$ Unaudited 42,005,495 400,000 238,045 42,643,540

31 March 2013 US$ Audited 45,952,028 400,000 252,606 46,604,634

SUPPLEMENTARY INFORMATION 1 Basis of preparation Statement of compliance The interim financial results have been prepared in accordance with International Financial Reporting Standards and in the manner required by the Companies Act. (Chapter 24.03). 2 Currency of reporting The Financial Statements are presented in the United States Dollars, which is the functional currency of the Group. 3 Significant accounting policies The principal accounting policies of the Group are consistent, in all material respects, with those adopted in the previous year. 6 months to 30 Sep 2013 US$ 1,309,020 39,271 4,872 344,868 1,698,031 2,000,000 2,500,000 4,500,000 6 months to 30 Sep 2012 US$ 939,616 28,188 2,081 637,252 1,607,137 5,000,000 5,000,000 10,000,000

47,845,901 45,115,504 49,166,820 8,176,490 8,943,228 4,875,322 48,076 44,886 25,052 15,892,727 7,617,841 15,625,203 71,963,194 61,721,459 69,692,397 122,243,310 104,364,999 116,297,031

115,464 26,084,452 2,414,501 54,050 5,626,819 9,820,399 19,959,648 64,075,333 6,762,009 2,000,000 8,762,009

103,783 18,739,683 2,778,608 39,604 4,565,238 9,861,882 13,488,672 49,577,470 5,439,283 5,000,000 10,439,283

103,841 19,142,413 2,009,501 54,042 5,626,819 9,820,399 19,633,390 56,390,405 6,417,141 6,417,141

4 Taxation Current income tax - Standard - Aids levy Withholding tax Deferred taxation movement Total 5 Borrowings Long-term Short-term

45,617,145 38,081,497 45,467,855 2,500,000 5,000,000 7,000,000 1,288,823 1,266,749 1,021,630 49,405,968 44,348,246 53,489,485 122,243,310 104,364,999 116,297,031

Investec Africa Frontier Private Equity Fund (IAFPEF) exercised their right to convert the $5 million loan to equity at the agreed price of 6.3 cents per share on 1 April 2013. The conversion yielded 79 365 079 shares of US$0.0001 each. The loan was disclosed as long-term in prior year. 6 Cash generated from trading Profit before taxation Adjusted for`: Finance costs Share option costs Employee share participation costs Depreciation expense Finance income Profit on sale of property, plant and equipment 6,530,889 11,439 405,000 92,860 2,554,754 (35,314) (23,094) 9,536,534 7 Capital expenditure 8 Capital commitments Authorised but not contracted for 6,275,838 11,671,046 6,466,683 395,382 360,000 1,912,609 (12,483) (5,904) 9,116,287 7,348,941 9,514,829

CONSOLIDATED STATEMENT OF CASH FLOWS

6 months to 30 Sep 2013 US$ Unaudited 9,536,534 (1,719,526) 7,817,008 23,875 (1,085,970) 6,754,913

6 months to 30 Sep 2012 US$ Unaudited 9,116,287 (6,429,750) 2,686,537 (382,899) (971,959) 1,331,679

(1,882,035) 68,626 (4,393,803) 78 (6,207,134)

(6,160,581) 40,484 (1,188,360) (5,250) (7,313,707)

9 Going concern The Directors have reviewed the prospects of the Group and are satisfied that the Group is a going concern and therefore continue to apply the going concern assumption in the preparation of these Financial Statements.

DIRECTORS: D. B. Lake (Chairman), V. W. Zireva* (Chief Executive Officer), A. R. Katsande* (Chief Operating Officer), A. E. Siyavora* (Finance Director), W. N. Alexander, F. T. Kembo, H. Nkala, M. T. Rukuni, M. Tapera, R. van Solt, M. C. Jennings (Alternate) *Executive

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Letter of Demand - Khosa V Minister of Defence and OthersDocument6 pagesLetter of Demand - Khosa V Minister of Defence and OthersMail and Guardian100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ramaphosa Integrity CommissionDocument3 pagesRamaphosa Integrity CommissionJanice HealingNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Zimbabwe Monetary Policy February 2019Document3 pagesZimbabwe Monetary Policy February 2019Business Daily ZimbabweNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- CONDOLENCE SUPPLEMENT: High Profile Deaths Rise As Covid-19 Surges in ZimbabweDocument16 pagesCONDOLENCE SUPPLEMENT: High Profile Deaths Rise As Covid-19 Surges in ZimbabweBusiness Daily ZimbabweNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Public Debt DocumentDocument5 pagesPublic Debt DocumentBusiness Daily ZimbabweNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- SA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsDocument176 pagesSA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsBusiness Daily Zimbabwe67% (3)

- Final Report To ParliamentDocument10 pagesFinal Report To ParliamentBusiness Daily ZimbabweNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- HZ - Final Response To Fedex Re SuspensionDocument9 pagesHZ - Final Response To Fedex Re SuspensionNtombi MlangeniNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Contributing Towards Ending Poverty in Zimbabwe - Monthly UpdateDocument4 pagesContributing Towards Ending Poverty in Zimbabwe - Monthly UpdateBusiness Daily ZimbabweNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Omega Sibanda Linked Company Fights ChildlineDocument49 pagesOmega Sibanda Linked Company Fights ChildlineBusiness Daily ZimbabweNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Fifa Law 11 OffsideDocument37 pagesFifa Law 11 OffsideBusiness Daily ZimbabweNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Fifa Law 11 OffsideDocument37 pagesFifa Law 11 OffsideBusiness Daily ZimbabweNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- In Defence of Zimbabwe Medical ProfessionDocument2 pagesIn Defence of Zimbabwe Medical ProfessionBusiness Daily ZimbabweNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Vacancies With AIDS HealthCare Foundation - Mpilo and ParirenyatwaDocument1 pageVacancies With AIDS HealthCare Foundation - Mpilo and ParirenyatwaBusiness Daily Zimbabwe100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Competition Commission Prosecutes Banks Currency Traders For CollusionDocument2 pagesCompetition Commission Prosecutes Banks Currency Traders For CollusionBusiness Daily ZimbabweNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Zimbabwe Industrial Revolution Plan: For The Church Created by Hannington MubaiwaDocument20 pagesThe Zimbabwe Industrial Revolution Plan: For The Church Created by Hannington MubaiwaBusiness Daily ZimbabweNo ratings yet

- Simbisa BrandsDocument2 pagesSimbisa BrandsBusiness Daily Zimbabwe100% (1)

- Zimbabwe 2017 Monetary Policy Statement FinalDocument80 pagesZimbabwe 2017 Monetary Policy Statement FinalBusiness Daily Zimbabwe100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 2016 LGE ResultsDocument16 pages2016 LGE ResultsBusiness Daily ZimbabweNo ratings yet

- Zimbabwe Bond Notes ProgrammeDocument2 pagesZimbabwe Bond Notes ProgrammeBusiness Daily Zimbabwe100% (1)

- Jessie Fungayi Majome Vs ZBC The Constitutional Court JudgementDocument16 pagesJessie Fungayi Majome Vs ZBC The Constitutional Court JudgementJessie Fungayi MajomeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Zimbabwe Economic Update ReportDocument36 pagesZimbabwe Economic Update ReportBusiness Daily Zimbabwe100% (1)

- Mujuru Party Manifesto - Full TextDocument2 pagesMujuru Party Manifesto - Full TextBusiness Daily ZimbabweNo ratings yet

- Newsletter August For MailingDocument4 pagesNewsletter August For MailingBusiness Daily ZimbabweNo ratings yet

- Results Summary - All Ballots: Party Name Ward PR DC 40%Document10 pagesResults Summary - All Ballots: Party Name Ward PR DC 40%Business Daily ZimbabweNo ratings yet

- RBZ Monetary Policy Statement January 2016Document99 pagesRBZ Monetary Policy Statement January 2016Business Daily ZimbabweNo ratings yet

- Zimbabwe's Draft Computer Crime and Cybercrime Bill Laymans Draft July 2013Document28 pagesZimbabwe's Draft Computer Crime and Cybercrime Bill Laymans Draft July 2013Business Daily ZimbabweNo ratings yet

- Zimbabwe 2015 Mid-Term Fiscal PolicyDocument274 pagesZimbabwe 2015 Mid-Term Fiscal PolicyBusiness Daily Zimbabwe100% (1)

- Lovemore Majaivana and The Township Music of ZimbabweDocument38 pagesLovemore Majaivana and The Township Music of ZimbabweBusiness Daily ZimbabweNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Zimbabwe 2015 Mid-Term Fiscal PolicyDocument274 pagesZimbabwe 2015 Mid-Term Fiscal PolicyBusiness Daily Zimbabwe100% (1)

- Immanuel Sangcate ResumeDocument2 pagesImmanuel Sangcate ResumeNonjTreborTendenillaToltolNo ratings yet

- Metro Manila Development Authority v. Viron Transportation Co., Inc., G.R. No. 170656Document2 pagesMetro Manila Development Authority v. Viron Transportation Co., Inc., G.R. No. 170656catrina lobatonNo ratings yet

- Raquana Neptune 5S English A SBA CXCDocument15 pagesRaquana Neptune 5S English A SBA CXCraquan neptuneNo ratings yet

- Term Paper On Police CorruptionDocument7 pagesTerm Paper On Police Corruptionafdtzvbex100% (1)

- Parliamentary CommunicationsDocument41 pagesParliamentary CommunicationsGurprit KindraNo ratings yet

- Leon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3Document3 pagesLeon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3WCTV Digital TeamNo ratings yet

- Cignal: Residential Service Application FormDocument10 pagesCignal: Residential Service Application FormJUDGE MARLON JAY MONEVANo ratings yet

- Philippine Constitution Articles XIV and XV on Education, Culture, Science and SportsDocument9 pagesPhilippine Constitution Articles XIV and XV on Education, Culture, Science and SportsBern TolentinoNo ratings yet

- Title VII - Amendments: El Paso Animal ServicesDocument22 pagesTitle VII - Amendments: El Paso Animal ServicesJim ParkerNo ratings yet

- Salary Loan Application FormDocument2 pagesSalary Loan Application FormRyan PangaluanNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Receipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Document6 pagesReceipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Jenipher Carlos HosannaNo ratings yet

- ISPS Code Awareness TrainingDocument57 pagesISPS Code Awareness Trainingdiegocely700615100% (1)

- CSRF 1 (CPF) FormDocument4 pagesCSRF 1 (CPF) FormJack Lee100% (1)

- Term Paper FinalDocument16 pagesTerm Paper FinalItisha JainNo ratings yet

- General and Subsidiary Ledgers ExplainedDocument57 pagesGeneral and Subsidiary Ledgers ExplainedSavage NicoNo ratings yet

- CH 9.intl - Ind RelnDocument25 pagesCH 9.intl - Ind RelnAnoushkaNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document3 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!iam pruthvi tradingNo ratings yet

- Camshaft Precision Color, Florian Ion PETRESCUDocument88 pagesCamshaft Precision Color, Florian Ion PETRESCUPetrescu FlorianNo ratings yet

- Size:: A Free PDF Pattern From Zoe'S Sozowhatdoyouknow' BlogDocument7 pagesSize:: A Free PDF Pattern From Zoe'S Sozowhatdoyouknow' Blogahcen saididjNo ratings yet

- INTERNATIONAL ACCOUNTING FINAL TEST 2020Document8 pagesINTERNATIONAL ACCOUNTING FINAL TEST 2020Faisel MohamedNo ratings yet

- Cat Come Back Stories - Pisi Vino InapoiDocument20 pagesCat Come Back Stories - Pisi Vino InapoiNicoletaNo ratings yet

- John William Draper - History of America Civil War (Vol I)Document584 pagesJohn William Draper - History of America Civil War (Vol I)JSilvaNo ratings yet

- Stress Analysis and Evaluation of A Rectangular Pressure VesselDocument10 pagesStress Analysis and Evaluation of A Rectangular Pressure Vesselmatodelanus100% (1)

- DTCP DCR IiDocument252 pagesDTCP DCR IiCharles Samuel100% (1)

- Module 7 - Current and Long-Term LiabilitiesDocument23 pagesModule 7 - Current and Long-Term LiabilitiesElizabethNo ratings yet

- Oracle Application Express Installation Guide PDFDocument221 pagesOracle Application Express Installation Guide PDFmarcosperez81No ratings yet

- 1 Air India Statutory Corporation vs. United Labour Union, AIR 1997 SC 645Document2 pages1 Air India Statutory Corporation vs. United Labour Union, AIR 1997 SC 645BaViNo ratings yet

- San Miguel CorpDocument6 pagesSan Miguel CorpMonster BebeNo ratings yet

- Itp Installation of 11kv HV Switchgear Rev.00Document2 pagesItp Installation of 11kv HV Switchgear Rev.00syed fazluddin100% (1)

- AAC Technologies LTD (Ticker 2018) : Why Are AAC's Reported Profit Margins Higher AND Smoother Than Apple's? Part I (Full Report)Document43 pagesAAC Technologies LTD (Ticker 2018) : Why Are AAC's Reported Profit Margins Higher AND Smoother Than Apple's? Part I (Full Report)gothamcityresearch72% (18)