Professional Documents

Culture Documents

Revision Pack 2009-10

Uploaded by

Tosin YusufCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision Pack 2009-10

Uploaded by

Tosin YusufCopyright:

Available Formats

1

The University of Birmingham College of Social Sciences The Birmingham Business School Department of Accounting and Finance Accounting Theory (07 !7"# Self Test $uestions 00%&'0 (evision )ac* The self test questions attached have all examination. Some of the questions have been slightly modified to reflect better the different approach to be taken in the forthcoming summer 2010 examination. The changes affect mainly part (b of the question! "here applicable. #lease take note. The questions and topic areas are listed belo". Students handing in their ans"ers on $onday 2% &pril at 1pm ('( 1)) "ill receive typed ans"ers to all the questions. $uestion *arsa" #+, San .iego #+, ,ardiff #+, 0stanbul #+, 1uestion 10 Stockholm +td Topic -conomic income /eplacement cost accounting ,ash flo" reporting .eprival value accounting ,onceptual frame"ork .epreciation

+arsa, )-C . /conomic 0ncome *arsa" plc is a company formed to invest capital in shares and irredeemable interest bearing securities. &s at the beginning of its first financial year it had 2100!000 invested "hich "as expected to earn an annual cash return of 210!000 receivable at the end of the financial year in line "ith an expected interest rate of 10 per cent per annum. The interest rate "as as expected for the year but the actual cash inflo" turned out to be 210!)00. &s at the end of the financial year! expectations also changed. 3uture annual cash inflo"s "ere expected to be 211!000 and the rate of interest increased to 12 per cent per annum on the last day of the financial year and "as expected to remain at this level for the foreseeable future. (e1uired2 (a ,alculate the ex ante and ex post measures of (icks4 economic income numbers one and t"o! including both ex post versions. 3'4 mar*s5 (b -xplain the critique of (icks4 economic income numbers as proposed by #aish (1567 . 3'' mar*s5 3 6 mar*s in total5

(Turn over#

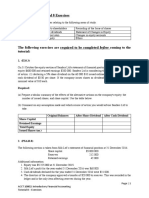

8 San Diego )-C . (eplacement cost accounting San .iego plc manufactures compressed air machine tools and its draft financial statements for the financial year ended 80 &pril 2007! prepared on an historical cost basis! "ere as follo"s9 0ncome statement for the year ended 80 &pril 2007 2000s /evenues ,ost of sales (opening inventory ; 21)2!000 <ross profit =perating expenses .epreciation9 >uildings #lant and machinery /etained earnings for the year >alance sheet as at 80 &pril 2007 2000s ?on;current assets >uildings #lant and machinery ,urrent assets 0nventory (bought on average at 81 @anuary 2007 prices Trade receivables ,ash and cash equivalents ,urrent liabilities Trade payables -quity =rdinary share capital /etained earnings 20% 1:2 %2 :10 11% 25: 1!%6: )00 1!16: 1!%6: 2000s :70 500 1!870 2000s 2!:2% 1!:)) 561 %00 20 100 620 2)1

(Turn over#

: &fter a long period of stability! prices during the financial year changed significantly as detailed by the price indices belo"9 #rice index >uildings #lant and machinery 0nventory <eneral prices 1 $ay 2006 100 100 100 100 81 =ctober 2006 10% 112 117 110 80 &pril 2007 112 12: 18% 120

The directors are concerned about the impact of these price changes on their business and have asked the financial accountant to prepare a set of financial statements using replacement cost accounting. The directors "ish to maintain intact the operating capability of the firm defined as the replacement cost of its tangible non;current and current assets. (e1uired2 (a #repare a set of financial statements on a replacement cost basis for the year ending 80 &pril 2007. ,osts in the income statement are to be charged at average replacement cost. #rovide a full analysis of realised and unrealised holding gains. A*ork to the nearest 21!000.B 3'6 mar*s5 (b =ne of the directors claims that the holding gains calculated using replacement cost accounting are not Creal4 because they do not take into account changes in the general price index. -xplain and illustrate numerically this criticism using the example of San .iego plc4s plant and machinery assets. 3'0 mar*s5 3 6 mar*s in total5

(Turn over#

) Cardiff )-C . Cash flo, reporting ,ardiff plc had the follo"ing balance sheet as at 1 &pril 2006 in "hich all the assets and liabilities "ere stated at their net realisable values (?/Ds 9 >alance sheet as at 1 &pril 2006 2000s ?on;current assets +and and buildings #lant and machinery $otor vehicles ,urrent assets 3inished goods inventory *ork in progress inventory Trade receivables ,ash and cash equivalents ,urrent liabilities Trade payables Tax payable Total assets less current liabilities ?on;current liabilities >ank loan -quity =rdinary share capital /etained earnings 8% 2) )% 52 %1 :8 2)2 %1 151 )65 100 :65 2)0 225 :65 2000s 2000s 110 182 1:% 877

The company is considering a complete change to its existing business activities and the directors need to kno" the resources available to the company to implement quickly such a change. They have requested the financial accountant to prepare a set of financial statements for the financial year ending 81 $arch 2007 on a cash flo" reporting basis. /elevant transactions for the year "ere summarised as follo"s9 Transaction ,ash received from trade receivables ,ash paid to trade payables =perating expenses paid 0nterest paid Tax paid Tax provided for the year ending 81 $arch 2007 /eceipt of cash from increase in bank loan (Turn over# 2000s )1% :11 )0 12 2) 1) 20

% &s at 81 $arch 2007! the ?/Ds of the assets and liabilities "ere as follo"s9 .etail +and and buildings #lant and machinery $otor vehicles 3inished goods inventory *ork in progress inventory Trade receivables Trade payables ,ash and cash equivalents 2000s 120 10% 125 :: 111 65 :2 71

The directors consider that the plant and machinery and the "ork in progress inventory are not readily realisable assets. (e1uired2 (a #repare the follo"ing cash flo" reporting statements for the year ended 81 $arch 20079 statement of realised cash flo"E statement of realisable earningsE statement of financial position and the statement of changes in financial position. 3'6 mar*s5 (b & discussion document issued by the 0nstitute of ,hartered &ccountants of Scotland (0,&S $aking ,orporate /eports Daluable (1577 stated9 *e advocate the use of net realisable value as a relevant basis for helping to appraise an entity4s financial "ealth. *hat does the discussion document consider to be the principal merits of this basis of valuationF 3'0 mar*s5 3 6 mar*s in total5

(Turn over#

6 0stan7ul )-C . Deprival value accounting 0stanbul plc manufactures vacuum cleaners and is considering the introduction of the deprival value basis of accounting into its financial statements. (o"ever! before making a final decision! the company "ishes to test the potential effect of this ne" system of valuation on four of its typical assets as detailed belo". Daluation >asis &ye 2 Dalue in use (D0' ?et realisable value (?/D /eplacement cost (/, (e1uired2 (a ,alculate the deprival value of each of the typical assets. A4 mar*s5 100!00 0 )0!000 7)!000 &sset Type >ee 2 1% 1)0 1:2 ,ee 2 20!000 1!000 :%!000 .ee 2 100 1!)00 2!)00

(b #rovide reasoned suggestions! based upon the relationships among the valuation bases provided! as to the possible nature of each of the asset types in the table above. 3" mar*s5 (c =ne of the directors of 0stanbul plc has suggested that the company should use fair values in its financial statements because this valuation basis may be reconciled to the deprival value basis. -valuate this suggestion. 3'8 mar*s5 3 6 mar*s in total5

7 $uestion '0 C0t is possible to identify a number of roles or purposes for accounting theories in general! and for conceptual frame"orks in particular. 0f a theory or frame"ork could be stated in terms that "ere sufficiently rigorous and comprehensive! it could determine the structure and content of actual financial statements. 0t could thus s"eep aside the corpus of legislative requirements! accounting standards and other authoritative pronouncements! established procedures and subsidiary semi; authoritative guidelines that currently determine the structure and content of financial statements and that "e kno" as generally accepted accounting practice (<&&# . 0n practice! none of the theories and frame"orks developed by standard;setters! academics or others have achieved this condition.4 /utherford! >. &. (2000 &n 0ntroduction to $odern 3inancial /eporting Theory! );%. (e1uired2 -xplain and discuss the above quotation "ith reference to the 3&S>4s conceptual frame"ork proGect. 3 6mar*s5

Stoc*holm -imited & Depreciation Stockholm +td has purchased an item of machinery "ith an initial cost of 2100!000. The machine is expected to provide services for five years and to have a scrap value of 210!000 at the end of that time. &t the end of the third year of its life the machine "ill require a maGor overhaul costing 280!000 "hich "ill prolong its life to the end of the fifth year. &s a result! the accounting policy of Stockholm +td is to add the overhaul cost to the initial asset value "hen the asset is first brought into use. The firm estimates that its cost of capital is 20 per cent per annum. (e1uired2 (a ,alculate the net book value of the machinery as at the end of the third year of its useful economic life both "ith and "ithout taking into account the cost of capital of Stockholm +td. 3' mar*s5 (b C.epreciation is thus the "orsening of cash prospects.4 (>axter! 15619 )8 -xplain this comment in the light of the calculations in (a above. 3'8 mar*s5 3 6 mar*s in total5

You might also like

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroNo ratings yet

- Acc 501 Midterm Solved Papers Long Questions SolvedDocument34 pagesAcc 501 Midterm Solved Papers Long Questions SolvedAbbas Jafri33% (3)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Sainsbury Report Final - MergedDocument38 pagesSainsbury Report Final - MergedTosin Yusuf100% (1)

- 126 Resource MAFA May 1996 May 2001Document267 pages126 Resource MAFA May 1996 May 2001Erwin Labayog MedinaNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument14 pagesUniversity of Mauritius: Faculty of Law and ManagementKlaus MikaelsonNo ratings yet

- Capital-Budgeting Principles and TechniquesDocument14 pagesCapital-Budgeting Principles and TechniquesPradeep HemachandranNo ratings yet

- MCA CONTINUOUS ASSESSMENT INTERNAL TEST- I REGULATIONS – 2009 I SEMESTER (2011-2014) MC9215 ACCOUNTING AND FINANCIAL MANAGEMENTDocument5 pagesMCA CONTINUOUS ASSESSMENT INTERNAL TEST- I REGULATIONS – 2009 I SEMESTER (2011-2014) MC9215 ACCOUNTING AND FINANCIAL MANAGEMENTanglrNo ratings yet

- Ryan International SchoolDocument1 pageRyan International SchoolSidhantNo ratings yet

- Financial Analysis 105-115Document10 pagesFinancial Analysis 105-115deshpandep33No ratings yet

- AssignmentDocument7 pagesAssignmentsmmehedih008No ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanNo ratings yet

- FM11 Financial management accounting assignment solutionsDocument3 pagesFM11 Financial management accounting assignment solutionsA Kaur MarwahNo ratings yet

- CHAPTER 10 Plant Assets and Intangibles: Objective 1: Measure The Cost of A Plant AssetDocument9 pagesCHAPTER 10 Plant Assets and Intangibles: Objective 1: Measure The Cost of A Plant AssetAhmed RawyNo ratings yet

- Total Assets 524,600 ? ? 220,111Document2 pagesTotal Assets 524,600 ? ? 220,111Saranya VillaNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- Cost ReconcillationDocument6 pagesCost ReconcillationmahendrabpatelNo ratings yet

- Concept Questions: NPV and Capital BudgetingDocument23 pagesConcept Questions: NPV and Capital BudgetingGianni Stifano P.No ratings yet

- Cash Flow Reporting Statements for CFR LtdDocument8 pagesCash Flow Reporting Statements for CFR LtdTosin YusufNo ratings yet

- Financial Ratios for Capital Structure and Risk AssessmentDocument17 pagesFinancial Ratios for Capital Structure and Risk Assessmentsamuel_dwumfourNo ratings yet

- Chapter 07, 08, 09 Non Current AssetsDocument8 pagesChapter 07, 08, 09 Non Current Assetsali_sattar15No ratings yet

- Cash Flow Estimation & Risk AnalysisDocument6 pagesCash Flow Estimation & Risk AnalysisShreenivasan K AnanthanNo ratings yet

- Case Study Analysis of Cost of Capital and Working Capital FinancingDocument13 pagesCase Study Analysis of Cost of Capital and Working Capital FinancingJyotiGhanchiNo ratings yet

- Chap 004 G HanniDocument14 pagesChap 004 G Hannipeachrose12No ratings yet

- Consolidated Statement of Financial Position with Intra-Group AdjustmentsDocument17 pagesConsolidated Statement of Financial Position with Intra-Group Adjustmentssamuel_dwumfourNo ratings yet

- Solution To The CIAP Requirement For Brazil: Sap AgDocument17 pagesSolution To The CIAP Requirement For Brazil: Sap AgRod Don PerinaNo ratings yet

- Yonus Brother GroupeDocument15 pagesYonus Brother Groupeasadkabir23No ratings yet

- ABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysisDocument16 pagesABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysissamuel_dwumfourNo ratings yet

- Finance Past PaperDocument6 pagesFinance Past PaperNikki ZhuNo ratings yet

- Assign 3 - Sem 2 11-12 - RevisedDocument5 pagesAssign 3 - Sem 2 11-12 - RevisedNaly BergNo ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- CXC Principles of Accounts Past Paper Jan 2009Document8 pagesCXC Principles of Accounts Past Paper Jan 2009ArcherAcs83% (6)

- Daily Processing: Unit ContentsDocument37 pagesDaily Processing: Unit Contentsfab10moura32No ratings yet

- Engineering Economy Jan 2014Document2 pagesEngineering Economy Jan 2014Prasad C MNo ratings yet

- Leach TB Chap09 Ed3Document8 pagesLeach TB Chap09 Ed3bia070386No ratings yet

- American Chemical CorporationDocument8 pagesAmerican Chemical CorporationAnastasiaNo ratings yet

- GF520 Unit5 Assignment With CorrectionsDocument13 pagesGF520 Unit5 Assignment With CorrectionsPriscilla Morales100% (3)

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanNo ratings yet

- Example LTD Question OnlyDocument5 pagesExample LTD Question OnlyTosin YusufNo ratings yet

- Guidelines For BUDGET PreparationDocument8 pagesGuidelines For BUDGET Preparationsheer2_98No ratings yet

- Capital Budgeting MethodsDocument6 pagesCapital Budgeting MethodsMaria TariqNo ratings yet

- The Initial Data For Electroputere Is Presented BelowDocument3 pagesThe Initial Data For Electroputere Is Presented BelowAmelia ButanNo ratings yet

- Financial Management & Control FinalDocument25 pagesFinancial Management & Control FinalAnees Ur RehmanNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Lockheed Tri Star and Capital Budgeting Case Analysis: ProfessorDocument8 pagesLockheed Tri Star and Capital Budgeting Case Analysis: ProfessorlicservernoidaNo ratings yet

- Assingment 1Document5 pagesAssingment 1Suzana IthnainNo ratings yet

- C05 Revenue Recognition - Percentage Completion AccountingDocument16 pagesC05 Revenue Recognition - Percentage Completion AccountingBrooke CarterNo ratings yet

- Instructions: All Questions Carry Equal MarksDocument2 pagesInstructions: All Questions Carry Equal Marksnisarg_No ratings yet

- Exam For Managerial AccountingDocument8 pagesExam For Managerial Accountingសារុន កែវវរលក្ខណ៍No ratings yet

- MGT Chapter 03 - AnswerDocument10 pagesMGT Chapter 03 - Answerlooter198No ratings yet

- Industry Profile: A Study On "Working Capital Management"Document7 pagesIndustry Profile: A Study On "Working Capital Management"Gopi KrishnaNo ratings yet

- OPTIONS ANALYSISDocument10 pagesOPTIONS ANALYSISWaleed MinhasNo ratings yet

- Small Business AccountingDocument5 pagesSmall Business AccountingSDaroosterNo ratings yet

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryFrom EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryFrom EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- E Tray Flyer ENGDocument2 pagesE Tray Flyer ENGTosin YusufNo ratings yet

- Example LTD Question OnlyDocument5 pagesExample LTD Question OnlyTosin YusufNo ratings yet

- Year 7 Transition Challenges and JobsDocument2 pagesYear 7 Transition Challenges and JobsTosin YusufNo ratings yet

- E Tray Flyer ENGDocument2 pagesE Tray Flyer ENGTosin YusufNo ratings yet

- Deprival Value Lecture NotesDocument7 pagesDeprival Value Lecture NotesTosin YusufNo ratings yet

- Reconciliation Between Economic and Accounting IncomeDocument8 pagesReconciliation Between Economic and Accounting IncomeTosin YusufNo ratings yet

- Contract Lecture 4 - Terms of A Contract PDFDocument6 pagesContract Lecture 4 - Terms of A Contract PDFTosin YusufNo ratings yet

- Fee Assessment Questionaire - NEWDocument6 pagesFee Assessment Questionaire - NEWTosin YusufNo ratings yet

- Assessment CentreDocument2 pagesAssessment CentreTosin YusufNo ratings yet

- Module Outline 2009-10Document8 pagesModule Outline 2009-10Tosin YusufNo ratings yet

- Contract Law Lecture 3 - Discharge and Remedies PowerPointDocument55 pagesContract Law Lecture 3 - Discharge and Remedies PowerPointTosin YusufNo ratings yet

- Depreciation - Methods and CalculationsDocument18 pagesDepreciation - Methods and CalculationsTosin YusufNo ratings yet

- Contract Law Lecture 4 - Terms of A Contract (PowerPoint)Document39 pagesContract Law Lecture 4 - Terms of A Contract (PowerPoint)Tosin YusufNo ratings yet

- Replacement Cost AccountingDocument8 pagesReplacement Cost AccountingTosin YusufNo ratings yet

- Introduction To Financial Accounting TheoryDocument13 pagesIntroduction To Financial Accounting TheoryTosin YusufNo ratings yet

- Historical Cost AccountingDocument9 pagesHistorical Cost AccountingTosin YusufNo ratings yet

- Basic Issues in DepreciationDocument2 pagesBasic Issues in DepreciationTosin YusufNo ratings yet

- Collins LTD Question OnlyDocument1 pageCollins LTD Question OnlyTosin YusufNo ratings yet

- Cash Flow Reporting Statements for CFR LtdDocument8 pagesCash Flow Reporting Statements for CFR LtdTosin YusufNo ratings yet

- 2009-10 Term Time Self Test Questions OnlyDocument8 pages2009-10 Term Time Self Test Questions OnlyTosin YusufNo ratings yet

- Economic IncomeDocument18 pagesEconomic IncomeTosin YusufNo ratings yet

- CCA Lecture NotesDocument10 pagesCCA Lecture NotesTosin YusufNo ratings yet

- ABJ Study Guide 2009-10Document63 pagesABJ Study Guide 2009-10Tosin YusufNo ratings yet

- Essay A Essay B: Totals $569,000 $386,000Document4 pagesEssay A Essay B: Totals $569,000 $386,000Tosin YusufNo ratings yet

- IFRS Monopoly Risks and DrawbacksDocument56 pagesIFRS Monopoly Risks and DrawbacksTosin YusufNo ratings yet

- Tesco (2012) Merged MergedDocument45 pagesTesco (2012) Merged MergedTosin YusufNo ratings yet

- Winter Exam 2012 Questions Only Formatted Final1Document11 pagesWinter Exam 2012 Questions Only Formatted Final1Tosin YusufNo ratings yet

- XBRL Solving Real-World ProblemsDocument18 pagesXBRL Solving Real-World ProblemsTosin YusufNo ratings yet

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinNo ratings yet

- Applying Strategy through Cost SystemsDocument22 pagesApplying Strategy through Cost SystemsYoong Ying0% (1)

- Module 3 - Valuation of SecuritiesDocument4 pagesModule 3 - Valuation of SecuritiesEthics BAENo ratings yet

- Governanace Chapter 15Document4 pagesGovernanace Chapter 15Loreen TonettNo ratings yet

- PT Questions (S2021) Class ExercisesDocument19 pagesPT Questions (S2021) Class ExercisesNavhin MichealNo ratings yet

- Corporate Compliance and Financial Profile of WAY ONNET GROUP PTE LTD (199605877H)Document6 pagesCorporate Compliance and Financial Profile of WAY ONNET GROUP PTE LTD (199605877H)qinyuanzhouNo ratings yet

- ONE - 20230425184825 - EN ONE 2022 Annual Report VFDocument227 pagesONE - 20230425184825 - EN ONE 2022 Annual Report VFmariusbuharu18No ratings yet

- VINAYAK KONDAL AI & Finance Report CBRDocument7 pagesVINAYAK KONDAL AI & Finance Report CBRvinayakNo ratings yet

- Aec 203 Activitieswk5Document12 pagesAec 203 Activitieswk5Lorenz Joy Ogatis BertoNo ratings yet

- SS&C GlobeOp - FA ModuleDocument34 pagesSS&C GlobeOp - FA ModuleAnil Dube100% (1)

- ACCO 20053 Lecture Notes 5 - Accounting For ReceivablesDocument6 pagesACCO 20053 Lecture Notes 5 - Accounting For ReceivablesVincent Luigil AlceraNo ratings yet

- Jawaban Kuis Uph Debt InvestmentDocument3 pagesJawaban Kuis Uph Debt InvestmentSagita RajagukgukNo ratings yet

- Midterm Test - Code 36 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 36 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Project Report of Financial Analysis of Blue Star and HitachiDocument16 pagesProject Report of Financial Analysis of Blue Star and HitachiAman VermaNo ratings yet

- SEC Advisory On Retail TradeDocument2 pagesSEC Advisory On Retail TradeRhows BuergoNo ratings yet

- Updates in Philippine Accounting StandardsDocument7 pagesUpdates in Philippine Accounting Standardshot reddragon1123No ratings yet

- Handbook Setting Up Your Business in Flanders Update Jan 2018Document44 pagesHandbook Setting Up Your Business in Flanders Update Jan 2018Harish KumarNo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- Solved David A Cpa For A Large Accounting Firm Often WorksDocument1 pageSolved David A Cpa For A Large Accounting Firm Often WorksAnbu jaromiaNo ratings yet

- Nhà quản lý có lý trí và nhà đầu tư thiếu lý tríDocument18 pagesNhà quản lý có lý trí và nhà đầu tư thiếu lý tríTuyết Anh ChuNo ratings yet

- Eastern condiments performance in Kerala and KarnatakaDocument10 pagesEastern condiments performance in Kerala and KarnatakaArka Bose0% (1)

- Finance Dossier FinalDocument90 pagesFinance Dossier FinalHarsh GandhiNo ratings yet

- SBR Notes by Ali Amir 20-21Document68 pagesSBR Notes by Ali Amir 20-21Mensur Ćuprija100% (1)

- Affidavit of Undertaking - P. ClaveriaDocument2 pagesAffidavit of Undertaking - P. ClaveriaJonah CruzadaNo ratings yet

- CEO Morning - 20200820 PDFDocument22 pagesCEO Morning - 20200820 PDFChin Lip SohNo ratings yet

- Chapter 15 - Property, Plant, and EquipmentDocument3 pagesChapter 15 - Property, Plant, and EquipmentFerb CruzadaNo ratings yet

- A. B. C. D. E. F. G. H. I.: Exclusions From Gross IncomeDocument15 pagesA. B. C. D. E. F. G. H. I.: Exclusions From Gross IncomeNoo NooooNo ratings yet

- Why BPCDocument42 pagesWhy BPCJay BocagoNo ratings yet

- BB SIR QUESTION BANK DT May 22Document216 pagesBB SIR QUESTION BANK DT May 22Srushti AgarwalNo ratings yet

- SUMMARY For INTERMEDIATE ACCOUNTING 2 PDFDocument20 pagesSUMMARY For INTERMEDIATE ACCOUNTING 2 PDFArtisan100% (1)