Professional Documents

Culture Documents

Case28notes 000

Uploaded by

Refger RgwseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case28notes 000

Uploaded by

Refger RgwseCopyright:

Available Formats

Case #28 JetBlue Airways IPO

Synopsis and Objectives This case examines the April 2002, decision of JetBlue management to price the initial public offering of JetBlue stock during one of the worst periods in airline history. The case outlines JetBlues innovative strategy and the associated strong financial performance over its initial two years. The task is to value the stock and take a position on whether the current $25$26 per share filing range is appropriate. The case is designed to showcase corporate valuation using discounted cash flow and peer-company market multiples. The case provides opportunities for: Review the institutional aspects of the equity issuance transaction. Explore the costs and benefits associated with public share offerings. Develop an appreciation for the challenges of valuing unseasoned firms. Hone corporate valuation skills, particularly using market multiples. Evaluate the received explanations of various finance anomalies, such as the IPO underpricing phenomenon.

Suggested Questions 1. What are the advantages and disadvantages of going public? 2. What different approaches can be used to value JetBlues shares? 3. At what price would you recommend that JetBlue offer their shares?

Pros of multiples: *Convenient *Reflects what the market is willing to pay for a comparable firm *Particularly helpful when firm is not in steady state Cons of multiples: *Ignores need to make explicit assumptions regarding long-term profitability and growth

*Subject to market misvaluation *Subject to accounting distortions *A relative (rather than absolute) valuation measure *Difficulty in identifying comparables *Meaningless with negative values *Denominator may be more cyclical than numerator

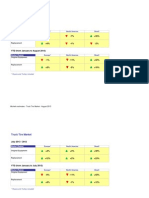

JETBLUE AIRWAYS IPO VALUATION Aggregate Pre-IPO Demand for JetBlue Shares

Aggregate Share Demand (Millions of shares)

MM Shares

200 180 160 140 120 100 80 60 40 20 0 4/1/02 4/2/02 4/3/02 4/4/02 4/5/02 4/8/02 4/9/02 4/10/02 4/11/02

Total Shares Offered: Initial Filing Range: Revised Filing Range: Offer Price:

5.9MM $22 - $24 $25 - $26 $27.00

Road show

Offering Size: 5.9 MM Shares

Global Institutions

MS Retail

JETBLUE AIRWAYS IPO VALUATION Share Demand and Allocation Summary

Indication (millions)

Allocation (millions)

Allocation/Indication

Institutions Morgan Stanley retail Merrill Lynch retail Raymond James retail UBS retail Selling Group retail Directed Program (friends and family) Total

144,828 35,000 28,000 2,600 4,000 300 630 215,358

4,819 653 313 165 143 25 605 6,722

3.3% 1.9% 1.1% 6.3% 3.6% 8.3% 96.0% 3.1%

Evidence on IPO Underpricing Winners Curse. Uninformed investors demand rationed for good firms and not for poor firms due to informed investors participation in only good IPOs. Underpricing gives uninformed investors normal return.1 Evidence: In countries where share allocation is transparent (e.g., Singapore and Finland) investors receive more shares of overpriced offerings such that average profits are zero.2 Monopsony. Small number of underwriters following any particular industry allow for potential monopsony profits.3 Evidence: In support, the severe average underpricing of 1980 was concentrated wholly among a few regional underwriters within the petroleum industry.4 Against support, underwriters that take themselves public tend to underprice themselves.5 Lawsuit Avoidance. To avoid litigation for misrepresenting stock to shareholders, firms/underwriters discount initial price. Evidence: In support, offerings before the Securities Act of 1933 (which holds companies responsible for misrepresentation) tend to be less underpriced than offerings after 1933.6 However, firms that are sued following their IPO tend to be just as underpriced as firms that are not sued.7 Reputation. Firms better able to access capital markets in future if leave a good taste in investors mouth.8

Kevin Rock, Why New Issues Are Underpriced, Journal of Financial Economics, 15 (1986), 187-

212. Francis Koh and Terry Walter, A Direct Test of Rock's Model of the Pricing of Unseasoned Issues, Journal of Financial Economics, 23 (1989), 251-272; and Matti Keloharju, The Winner's Curse, Legal Liability, and the Long-Run Price Performance of Initial Public Offerings in Finland, Journal of Financial Economics, 34 (1993), 251-277. 3 David Baron, A Model of the Demand for Investment Banking Advice and Distribution Services for New Issues, Journal of Finance, 37 (1982), 955-976. 4 Jay Ritter, The Hot Issue Market of 1980, Journal of Business, 57 (1984), 215-240. 5 Chris Muscarella and Michael Vetsuypens, A Simple Test of Barons's Model of IPO Underpricing, Journal of Financial Economics, 24 (1989), 125-135. 6 Seha Tinic, Anatomy of Initial Public Offerings of Common Stock, Journal of Finance, 43 (1988), 789-822. 7 Philip Drake and Michael Vetsuypens, IPO Underpricing and Insurance Against Legal Liability , Financial Management, 22 (1993), 64-73. 8 Franklin Allen and Gerald Faulhaber, Signaling by Underpricing in the IPO Market , Journal of Financial Economics, 23 (1989), 303-323; Thomas Chemmanur, The Pricing of IPOs: A Dynamic Model With Information Production, Journal of Finance, 48 (1993), 285-304; Mark Grinblatt and Chuan-Yang Hwang, Signaling and the Pricing of New Issues, Journal of Finance, 44 (1989), 393-420; and Ivo Welch, Seasoned Offerings, Imitation Costs and the Underwriting of IPOs, Journal of Finance 44 (1989), 421449.

2

Evidence: Little empirical support has been found for a relationship between underpricing and subsequent offerings.9 Censored distribution. Underwriters correctly price on average, but stock stabilization efforts remove the left-hand side of non-stabilized first-day distribution of returns leading to average positive performance. Evidence: A disproportionate number of IPOs have first-day returns of zero. IPOs with first-day returns of zero tend to experience negative returns over first month, suggesting they are temporarily held above their true value.10 Bandwagon. If investors pay attention to IPO demand of other investors, bandwagon effects can create excessive demand for some offerings.11

Narasimhan Jegadeesh, Mark Weinstein, and Ivo Welch, An Empirical Investigation of IPO Returns and Subsequent Equity Offerings, Journal of Financial Economics, 34 (1990), 153-176; and Roni Michaely and Wayne Shaw, The Pricing of Initial Public Offerings: Tests of A dverse Selection and Signaling Theories, Review of Financial Studies, 7 (1994), 279-313. 10 Judith Ruud, Underwriter Price Support and the IPO Underpricing Puzzle , Journal of Financial Economics, 34 (1993), 135-151. 11 Ivo Welch, Sequential Sales, Learning, and Cascades, Journal of Finance, 47 (1992), 695-732.

You might also like

- Jet BlueDocument3 pagesJet BlueDamian AriasNo ratings yet

- Contemporary Issues in Finance: A Review On IPO InvestmentsDocument15 pagesContemporary Issues in Finance: A Review On IPO InvestmentsSugeetha SattiyanNo ratings yet

- Mergers, Acquisitions, and Corporate RestructuringsFrom EverandMergers, Acquisitions, and Corporate RestructuringsRating: 4 out of 5 stars4/5 (1)

- Baker and Wurgler - Market Timing and CSDocument33 pagesBaker and Wurgler - Market Timing and CSIvana JovanovskaNo ratings yet

- Investment Opportunities and Market Reaction To Capital Expenditure DecisionsDocument20 pagesInvestment Opportunities and Market Reaction To Capital Expenditure DecisionsMichelle MirandaNo ratings yet

- Contemporary Issues in Finance - A Review On IPO InvestementsDocument13 pagesContemporary Issues in Finance - A Review On IPO InvestementsSugeetha SattiyanNo ratings yet

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- The Case of Discount Dividend-Reinvestment and Stock - Purchase PlansDocument29 pagesThe Case of Discount Dividend-Reinvestment and Stock - Purchase Plansrooos123No ratings yet

- All About Bonds, Bond Mutual Funds, and Bond ETFs, 3rd EditionFrom EverandAll About Bonds, Bond Mutual Funds, and Bond ETFs, 3rd EditionRating: 4.5 out of 5 stars4.5/5 (3)

- Financial Management - Grinblatt and TitmanDocument68 pagesFinancial Management - Grinblatt and TitmanLuis Daniel Malavé RojasNo ratings yet

- Value Investing: From Graham to Buffett and BeyondFrom EverandValue Investing: From Graham to Buffett and BeyondRating: 4 out of 5 stars4/5 (24)

- Investing in Junk Bonds: Inside the High Yield Debt MarketFrom EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketRating: 3 out of 5 stars3/5 (1)

- Chapter 1Document34 pagesChapter 1sahumonikaNo ratings yet

- The Conceptual Foundations of Investing: A Short Book of Need-to-Know EssentialsFrom EverandThe Conceptual Foundations of Investing: A Short Book of Need-to-Know EssentialsNo ratings yet

- The Valuation of Distressed CompaniesDocument22 pagesThe Valuation of Distressed Companiessanjiv30100% (1)

- Morgan Stanley - Market ShareDocument57 pagesMorgan Stanley - Market ShareelvisgonzalesarceNo ratings yet

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Factors Influencing Corporate Dividend DDocument19 pagesFactors Influencing Corporate Dividend DDhiazvi SebayangNo ratings yet

- Let's Make A Deal - A Practical Framework For Assessing M&a ActivityDocument26 pagesLet's Make A Deal - A Practical Framework For Assessing M&a Activitypjs15100% (1)

- Seasoned Equity Offerings and The Cost of Market Timing: Eric DucaDocument53 pagesSeasoned Equity Offerings and The Cost of Market Timing: Eric DucaJennifer KelleyNo ratings yet

- Kaplan Stromberg VC Contracts REStud2003Document35 pagesKaplan Stromberg VC Contracts REStud2003Anastasia SobolevaNo ratings yet

- Aydogan Alti 2006Document30 pagesAydogan Alti 2006i_jibran2834No ratings yet

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingFrom EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingNo ratings yet

- Towards An Optimal IPO Mechanism: Risk and Financial ManagementDocument14 pagesTowards An Optimal IPO Mechanism: Risk and Financial ManagementJuliany HelenNo ratings yet

- The Seven Percent Solution 1Document28 pagesThe Seven Percent Solution 1Raj Kumar AgrawalNo ratings yet

- SSRN Id4730746Document72 pagesSSRN Id4730746rochdi.keffalaNo ratings yet

- There Are Several Interpretations of The PhraseDocument3 pagesThere Are Several Interpretations of The PhraseManish KalshettyNo ratings yet

- Financial Contracting Theory Meets The Real World: An Empirical Analysis of Venture Capital ContractsDocument35 pagesFinancial Contracting Theory Meets The Real World: An Empirical Analysis of Venture Capital ContractsHamid TalaiNo ratings yet

- Financial InnovationDocument16 pagesFinancial InnovationKuldeep BatraNo ratings yet

- Ebitda Vs Cash Flow PDFDocument51 pagesEbitda Vs Cash Flow PDFGiancarlo JaramilloNo ratings yet

- Alti On Timing and Capital Structure 2006 JF PDFDocument30 pagesAlti On Timing and Capital Structure 2006 JF PDFRyal GiggsNo ratings yet

- SERIES 7 EXAM STUDY GUIDE + TEST BANKFrom EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKRating: 2.5 out of 5 stars2.5/5 (3)

- Valuation: Measuring and Managing the Value of CompaniesFrom EverandValuation: Measuring and Managing the Value of CompaniesRating: 3 out of 5 stars3/5 (1)

- 3017 Tutorial 7 SolutionsDocument3 pages3017 Tutorial 7 SolutionsNguyễn HảiNo ratings yet

- Vanderhart Et Al 2003 Stock Selection Strategies in Emerging MarketsDocument28 pagesVanderhart Et Al 2003 Stock Selection Strategies in Emerging MarketsSepehr EskandariNo ratings yet

- Full Paper VALUATION OF TARGET FIRMS IN MERGERS AND ACQUISITIONS A CASE STUDY ON MERGERDocument19 pagesFull Paper VALUATION OF TARGET FIRMS IN MERGERS AND ACQUISITIONS A CASE STUDY ON MERGERPaul GhanimehNo ratings yet

- Corporate FinanceDocument13 pagesCorporate FinanceNguyễn Thanh LâmNo ratings yet

- Series 65 Exam Study Guide 2022 + Test BankFrom EverandSeries 65 Exam Study Guide 2022 + Test BankRating: 5 out of 5 stars5/5 (1)

- Measuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachFrom EverandMeasuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachNo ratings yet

- Saunders Notes PDFDocument162 pagesSaunders Notes PDFJana Kryzl DibdibNo ratings yet

- Market Valuation of Real EstateDocument8 pagesMarket Valuation of Real EstateHUbert FabianowskiNo ratings yet

- Alex Navab - Overview of Private EquityDocument21 pagesAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- Analyzing the Fair Market Value of Assets and the Stakeholders' Investment DecisionsFrom EverandAnalyzing the Fair Market Value of Assets and the Stakeholders' Investment DecisionsNo ratings yet

- Dividend Policy and Market MovementsDocument40 pagesDividend Policy and Market MovementsHoàng NamNo ratings yet

- JurnalDocument12 pagesJurnalWishnu Okky Pranadi TirtaNo ratings yet

- Teaching Notes-FMI-342 PDFDocument162 pagesTeaching Notes-FMI-342 PDFArun PatelNo ratings yet

- JetBlue Airways IPO ValuationDocument15 pagesJetBlue Airways IPO ValuationThossapron Apinyapanja0% (2)

- Investment Strategy Based On Gearing RatioDocument11 pagesInvestment Strategy Based On Gearing RatiomanmeetNo ratings yet

- Review of Reading ON Gains From M&A Around The World: New Evidence Article in Winter 2010 Edition of Financial ManagementDocument14 pagesReview of Reading ON Gains From M&A Around The World: New Evidence Article in Winter 2010 Edition of Financial ManagementmathspvNo ratings yet

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoFrom EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoNo ratings yet

- Michael Mauboussin - Surge in The Urge To Merge, M&a Trends & Analysis 1-12-10Document15 pagesMichael Mauboussin - Surge in The Urge To Merge, M&a Trends & Analysis 1-12-10Phaedrus34No ratings yet

- Short-Term Price Effects of Stock Repurchases in Turkish Capital MarketsDocument15 pagesShort-Term Price Effects of Stock Repurchases in Turkish Capital MarketsAnonymous ed8Y8fCxkSNo ratings yet

- 36 F00074Document9 pages36 F00074Fatima SyedaNo ratings yet

- Lead Lag Relationship Between Rating of A Company and Performance of The Company On Investor's WealthDocument6 pagesLead Lag Relationship Between Rating of A Company and Performance of The Company On Investor's WealthMohammadimran ShaikhNo ratings yet

- The 2008 Balance Sheet of The Washington Post Company Shows Average ShareholdersDocument14 pagesThe 2008 Balance Sheet of The Washington Post Company Shows Average ShareholdersRefger RgwseNo ratings yet

- Michelin Truck Markets August 2013Document20 pagesMichelin Truck Markets August 2013Refger RgwseNo ratings yet

- Net Working Capital and Cash FlowsDocument3 pagesNet Working Capital and Cash FlowsRefger RgwseNo ratings yet

- ACCY121BudgetingPracticeQuiz13MYCOPY 000 PDFDocument13 pagesACCY121BudgetingPracticeQuiz13MYCOPY 000 PDFRefger RgwseNo ratings yet

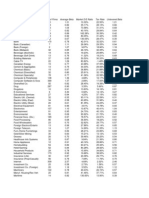

- Industry Name Number of Firms Average Beta Market D/E Ratio Tax Rate Unlevered BetaDocument4 pagesIndustry Name Number of Firms Average Beta Market D/E Ratio Tax Rate Unlevered BetaRefger RgwseNo ratings yet

- Brand Revamping ..Taj Mahal TeaDocument22 pagesBrand Revamping ..Taj Mahal TeaAmey Mairal100% (1)

- IGU Annual Report 2019Document66 pagesIGU Annual Report 2019SD HAWKNo ratings yet

- Total Gadha-Profit and LossDocument14 pagesTotal Gadha-Profit and LossSaket Shahi100% (1)

- Case Study of The Gap, Inc.Document6 pagesCase Study of The Gap, Inc.nioriatti8924No ratings yet

- RRDocument14 pagesRRpathakshirishNo ratings yet

- Oil India Tender For MODUDocument253 pagesOil India Tender For MODUagarwal.rmNo ratings yet

- Bioethanol HandbookDocument187 pagesBioethanol HandbookRaka Fajar NugrohoNo ratings yet

- Discussion TextDocument2 pagesDiscussion TextElmo Widi Nugraha0% (2)

- A Comparative Study On Sale Under TPA, 1882 and Sale Under Sales of Goods Act, 193Document19 pagesA Comparative Study On Sale Under TPA, 1882 and Sale Under Sales of Goods Act, 193Mr WebiNo ratings yet

- Financial InstrumentsDocument93 pagesFinancial InstrumentsLuisa Janelle BoquirenNo ratings yet

- The Myth of Manipulation The Economics of Minimum WageDocument65 pagesThe Myth of Manipulation The Economics of Minimum WageAndrew Joliet100% (1)

- Gmail - RedBus Ticket - TG3H69555254Document2 pagesGmail - RedBus Ticket - TG3H69555254priyanktiwariNo ratings yet

- Binary Option Strategy That WorksDocument25 pagesBinary Option Strategy That Worksfrankolett100% (2)

- Annual Equivalent MethodDocument6 pagesAnnual Equivalent Methodutcm77100% (1)

- History of Money: 1. Early Money 3. Paper Money - Carrying Around Large Quantities ofDocument6 pagesHistory of Money: 1. Early Money 3. Paper Money - Carrying Around Large Quantities ofDivine Grace JasaNo ratings yet

- Heyokha Brothers Investment Report 3Q 2015 GeneralDocument11 pagesHeyokha Brothers Investment Report 3Q 2015 GeneralEdgar BrownNo ratings yet

- Project AppraisalDocument2 pagesProject AppraisalMaha FayyazNo ratings yet

- Macroeconomic Theories of Inflation PDFDocument4 pagesMacroeconomic Theories of Inflation PDFBushra Nauman100% (1)

- Accounting I.com 2Document4 pagesAccounting I.com 2Saqlain KazmiNo ratings yet

- Proficiency TestDocument5 pagesProficiency TestElena SomovaNo ratings yet

- Gov Acc Quiz 11, BeltranDocument3 pagesGov Acc Quiz 11, BeltranbruuhhhhNo ratings yet

- Inflation and Financial InformDocument9 pagesInflation and Financial Informbenedikt thurnherNo ratings yet

- 8508 QuestionsDocument3 pages8508 QuestionsHassan MalikNo ratings yet

- Activity Based Costing Spring 2023 With ThoeryDocument12 pagesActivity Based Costing Spring 2023 With ThoeryHafsah AnwarNo ratings yet

- Agreement For The Sale of ScrapDocument4 pagesAgreement For The Sale of ScrapMhilet57% (23)

- 2020 W Island AveDocument42 pages2020 W Island Aveassistant_sccNo ratings yet

- Statement: World Information Technology and Services AllianceDocument7 pagesStatement: World Information Technology and Services AllianceSubramanian Senthil KumarNo ratings yet

- Peugeot 308 Specifications Brochure PDFDocument12 pagesPeugeot 308 Specifications Brochure PDFLuis PanaoNo ratings yet

- HHDocument6 pagesHHJoyce BusaNo ratings yet

- Nibco Pro-Press CatalogDocument68 pagesNibco Pro-Press Catalogtmurray3342No ratings yet