Professional Documents

Culture Documents

Budget 1

Uploaded by

nikhiljeswaninjOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 1

Uploaded by

nikhiljeswaninjCopyright:

Available Formats

Highlights of Budget 2013-14

Page 1 of 14 An insight into the fine print by INMACS (M: 9811040004 | vinodjain@inmacs.com ) INMACS MANAGEMENT SERVICES LIMITED Global Business Square, Building No. 32, Sector 44, Institutional Area, Gurgaon, Haryana, India 909, Chiranjiv Tower, 43, Nehru Place, New Delhi 110019 | Ph: 011-2622 3712, 6933, 8410

DIRECT TAXES

1. Capital Gain on Agricultural Land Amendment The Definition of Agricultural Land under the definition of Capital Asset has been modified to exclude a. Land Situated within a municipality, notified area committee, town area committee, cantonment board of a population not less than 10,000 b. Any area within a distance measured aerially:Distance measured aerially from Having Population any municipality or cantonment board Within 2 Kms 10,001 1,00,000 Within 6 Kms 1,00,001 10,00,000 Within 8 Kms 10,00,001 or More Impact a. The agricultural land within aforesaid limits will be subject to Tax on Capital Gains at the time of transfer. b. The existing practice of notifying the distance has been dispensed with. c. The distance is to be measured aerially. 2. Raising the limit of percentage of eligible premium for life insurance policies of persons with disability or disease Under the existing provisions contained in clause (10D) of section 10, any sum received under a life insurance policy, including the sum allocated by way of bonus on such policy, is exempt, subject to the condition that the premium paid for such policy does not exceed ten per cent of the actual capital sum assured. The above Limit of 10% has been raised to 15% in respect of persons with disability of severe disability (in terms of Section 80DDB). Similar relief has been provided under Section 80C for the premium paid by such persons on such policies. 3. Taxation of Securitisation Trusts Section 161 of the Income-tax Act provides that in case of a trust if its income consists of or includes profits and gains of business then income of such trust shall be taxed at the maximum marginal rate in the hands of trust. In order to facilitate the process of securitization, the following provisions are proposed:a. Income of Securitisation trusts regulated by SEBI / RBI will be exempted from taxation. b. The Income distribution to investors will be taxed:i. If the investor is Individual or HUF @ 25% ii. In any other Case @ 30% c. Distributed Income will be exempt in the Hands of the Investor

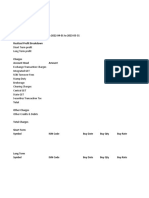

4. Buy Back of Unlisted Shares : Additional Income Tax Amendment a. In terms of proposed Section 115 QA, amount paid by an unlisted company to its shareholders shall be subjected to a special tax on the amounts so paid as reduced by the amount received by the company as consideration for the shares. b. The Tax is payable at the rate of 20% by the company resorting to buy back. c. No Tax shall be payable in the hands of recipient. Impact: a. Additional Income Tax @ 20% payable by unlisted companies on Buy Back of Shares. b. Capital Gain Tax in the hands of recipient is exempted, under proposed Section 10 (34A). 5. Investment Allowance The assesse, being a company engaged in the business of manufacture, investing a sum of more than Rs. 100 Crore in new Plant & Machinery during April 1, 2013 to March 31, 2015, then the assesse shall be allowed a deduction by way of Investment allowance @ 15%. The Plant & Machinery excludes computers, vehicles, ships or aircrafts, office appliances & other specified assets and also excludes plant & machinery on which 100% depreciation or deduction is allowed under the act. 6. Commodities Transaction Tax (CTT) A new Tax, i.e. Commodities Transaction Tax (CTT) has been introduced on sale of Commodities Derivative @ 0.01% payable by the seller except where underlying asset is an agricultural commodity. 7. Securities Transaction Tax (STT) Change in Stock S. No. Nature of Payable by Existing Rates Proposed Rates taxable (in per cent) (in per cent) securities transaction Delivery based Purchaser 0.1 Nil purchase of 1. units of an equity oriented fund entered into in a recognised stock exchange Delivery based Seller 0.1 0.001 sale of units of 2. an equity oriented fund entered into in a recognized stock exchange Sale of a futures in 0.017 0.01 securities 3. Sale of a unit of an equity oriented fund to the mutual fund Seller 0.25 0.001

4.

8. Profit on Transfer of Immovable Property held as Stock in Trade (SIT) Amendment a. In case of Land and Building held as SIT the sale consideration received or the value as per circle rate adopted for the purpose of Stamp Duty, whichever is higher will be considered for arriving at profit from sale of such immovable property. b. The Circle rate, for this purpose will be considered as the rate applicable at the time of agreement to sell & not at the time of registration of transfer, provided amount of consideration or part thereof was paid at the time of such agreement by other than the cost on or before the date of agreement. Impact a. Currently the Circle Rate for the purpose of Stamp Duty is considered only for arriving at capital gain, when land or building, being a capital asset is sold by the assesse, for the purpose of computation of capital gain tax. b. In case of Sale of Stock in Trade (SIT) this provision was so far not applicable 9. Taxability of immovable property received for inadequate consideration When an immovable property has been received by an Individual or HUF for inadequate consideration, i.e. a consideration less than the circle rate (Stamp Duty Value), the difference between the Stamp Duty value and Actual Consideration received will be taxable in the hands of such Individual or HUF. 10. Rajiv Gandhi Equity Saving Scheme The Deduction of 50% of the amount invested in Equity Shares by a new retail investor was allowed as a deduction, subject to Maximum of Rs. 25,000. In terms of the Amendment such deduction will be available to the new investor even for investment in listed units of an equity oriented mutual funds. The Investment based deduction will be available for 3 (three) consecutive assessment years. The Maximum limit of Gross Taxable Income of the assesse also has been enhanced from Rs. 10 Lacs to Rs. 15 Lacs.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- FII Party On ST Won't Last Long As Worries Remain: HE Conomic ImesDocument1 pageFII Party On ST Won't Last Long As Worries Remain: HE Conomic ImesnikhiljeswaninjNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- UAE CosmeticsDocument12 pagesUAE CosmeticsnikhiljeswaninjNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Of Shows in The Industrial Communications MixDocument3 pagesOf Shows in The Industrial Communications MixnikhiljeswaninjNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Fin GlossaryDocument1 pageFin GlossarynikhiljeswaninjNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Domestic Stock MarketsDocument10 pagesDomestic Stock MarketsnikhiljeswaninjNo ratings yet

- Financial Markets: Industry Research CellDocument10 pagesFinancial Markets: Industry Research CellnikhiljeswaninjNo ratings yet

- Deed of Conveyance by A Lunatic Through His Legal Guardian or ManagerDocument2 pagesDeed of Conveyance by A Lunatic Through His Legal Guardian or ManagerSudeep SharmaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- B (Notification No.22 Leg. - 2014) Punjab ApartmentDocument16 pagesB (Notification No.22 Leg. - 2014) Punjab ApartmentAumFormlessNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Jaka Investments Corporation vs. Commissioner of InternalDocument28 pagesJaka Investments Corporation vs. Commissioner of InternalHeidiNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Invoice 15443680250 TaxSaverDocument3 pagesInvoice 15443680250 TaxSavervenkatesh subbaiyaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 6 TaxDocument17 pagesChapter 6 TaxAngelika OlarteNo ratings yet

- Schedule of Charges and Interest Rates PDFDocument5 pagesSchedule of Charges and Interest Rates PDFAjju PodilaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 32 Etcherla Auction NoteDocument15 pages32 Etcherla Auction Notepandu123456No ratings yet

- Bir Ruling (Da-042-04)Document3 pagesBir Ruling (Da-042-04)E ENo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- TaxBuddy CG TemplateDocument10 pagesTaxBuddy CG TemplateShivam Ji VarshneyNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Requirements For Tax Declaration Transfer of OwnershipDocument4 pagesRequirements For Tax Declaration Transfer of OwnershipcarmanvernonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Wealth Management Yung KeeDocument3 pagesWealth Management Yung KeeEsther OuNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Respondentia Bond: Form No. 9Document1 pageRespondentia Bond: Form No. 9Sudeep SharmaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tax Issues in M A PDFDocument56 pagesTax Issues in M A PDFKhushboo GuptaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 14 - Municipal TaxesDocument16 pages14 - Municipal TaxesbharthiaeNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Industrial Policy APDocument6 pagesIndustrial Policy APapi-3711789No ratings yet

- Stamp Duties Imposed by The Act of Congress of July 1, 1862Document9 pagesStamp Duties Imposed by The Act of Congress of July 1, 1862Mike SmithNo ratings yet

- Oakwood MGT Services V CIR (CTA 7989, Aug 8, 2013)Document17 pagesOakwood MGT Services V CIR (CTA 7989, Aug 8, 2013)Firenze PHNo ratings yet

- OCA Circular No. 168-2023-ADocument3 pagesOCA Circular No. 168-2023-ANigel MascardoNo ratings yet

- Transfer of SharesDocument12 pagesTransfer of SharesromaNo ratings yet

- Takaful Myclick Motor PDS V1Document3 pagesTakaful Myclick Motor PDS V1Ahmad FikriNo ratings yet

- Note On Registration of Loan AgreementDocument2 pagesNote On Registration of Loan AgreementAhona MukherjeeNo ratings yet

- Tax Treaty Forms 0901 SeriesDocument16 pagesTax Treaty Forms 0901 SeriesgoldagigiNo ratings yet

- RR 04-08 (Sale of RP)Document7 pagesRR 04-08 (Sale of RP)joefieNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- JRCDocument16 pagesJRCSanjay SharmaNo ratings yet

- Case For Odd GroupsDocument2 pagesCase For Odd GroupsBrennan BarnettNo ratings yet

- Mergers and Acquisitions Country Report PhilippinesDocument12 pagesMergers and Acquisitions Country Report PhilippinesErika PinedaNo ratings yet

- Rajguru Nagar PalikaDocument26 pagesRajguru Nagar PalikaDevesh YadavNo ratings yet

- As Per AP State FinanceDocument2 pagesAs Per AP State FinanceamumiyaNo ratings yet

- Conveyance & Deemed ConveyanceDocument37 pagesConveyance & Deemed Conveyancenikita karwaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)