Professional Documents

Culture Documents

Single Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.

Uploaded by

api-25890856Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Single Barrier Reverse Convertible On AXA SA Coupon 11.5% P.A.

Uploaded by

api-25890856Copyright:

Available Formats

Single Barrier Reverse Convertible on AXA SA

Coupon 11.5% p.a.; 6 Months; EUR; Barrier at 80%

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 18.08.2009 Client pays EUR 1000 (Denomination)

Rating: Fitch A

Underlying AXA SA On 18.02.2010 Client receiv es 5.75% in fine (11.5% p.a.) Coupon

Bbg Ticker CS FP Equity

Payment Date 18.08.2009 PLUS

Valuation Date 15.02.2010

Maturity 18.02.2010 Scenario 1: if the Final Fixing Lev el is above the Barrier Level

Strike Level EUR 15.95 (100%)

The Investor will receive a Cash Settlement equal to the Denomination

Barrier Level EUR 12.76 (80%)

EU Saving Tax Option Premium Component 5.18% (10.37% p.a.)

Scenario 2: if the Final Fixing Lev el is at or below the Barrier Level

Interest Component 0.57% (1.13% p.a.)

Details Physical Settlement European Barrier The Investor will receive a predefined round number (i.e. Conversion

Conversion Ratio 62.7 Ratio) of the Underlying per Denomination.

ISIN CH0103367584

Valoren 10336758

SIX Symbol not listed

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________

AXA SA is an insurance company which also provides related financial services. The Company offers life and non-life insurance, reinsurance, savings and

pension products, and asset management services. AXA operates in both domestic and international markets.

Opportunities______________________________________________________________ Risks__________________________________________________________________________

1. A guaranteed Coupon of 5.75% in fine (11.5% p.a.) 1. Maximum yield is limited to 5.75% in fine (11.5% p.a.)

2. Protection against 20% drop in Underlying's price 2. Exposure to v olatility changes

3. Barrier is only observ ed on the Final Fixing Date

4. Low er v olatility than direct equity exposure

5. Secondary market as liquid as a share

Best case scenario_________________________________________________________ Worst case scenario___________________________________________________________

The Underlying is abov e the Barrier on the Final Fixing Date The Underlying closes at or below the Barrier Lev el on the Final Fixing Date

Redemption: Denomination + Coupon of 5.75% in fine (11.5% p.a.) Redemption: Underlying + Coupon of 5.75% in fine (11.5% p.a.)

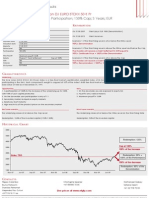

Historical Chart

40 importer depuis la deuxieme feuille

Redemption: 100% and a Coupon of 5.75% in fine (11.5% p.a.)

35

30

25

20

Strike: EUR 15.95 (100% of Spot Reference)

15 Barrier: EUR 12.76 (80% of Strike Level) 20% Protection

10

5

Redemption: 62.7 shares and a Coupon of 5.75% in fine (11.5% p.a.)

0

Jun-06 Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09

Contacts

Filippo Colombo Christ ophe Spanier Nat hanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No respo nsibility is taken fo r the co rrectness o f this info rmatio n. The financial

instruments mentio ned in this do cument are derivative instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by

the Swiss Financial M arket Superviso ry A utho rity FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investo rs are highly reco mmended to ask their financial adviso r fo r advice specifically fo cused o n the Investo r´s financial

situatio n; the info rmatio n co ntained in this do cument do es no t substitute such advice. This publicatio n do es no t co nstitute a simplified pro spectus pursuant to art. 5 CISA , o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de o f Obligatio ns. The relevant pro duct

do cumentatio n can be o btained directly at EFG Financial P ro ducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapo re, the USA , US perso ns, and the United Kingdo m (the issuance is subject t

law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial pro ducts triggers

co sts and fees. EFG Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the liquidity

o f the financial pro ducts. © EFG Financial P ro ducts A G A ll rights reserved.

You might also like

- How Trade, The WTO and The Financial Crisis Reinforce EachDocument10 pagesHow Trade, The WTO and The Financial Crisis Reinforce Eachapi-25890856No ratings yet

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25890856No ratings yet

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856No ratings yet

- NullDocument1 pageNullapi-25890856No ratings yet

- NullDocument1 pageNullapi-25890856No ratings yet

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- BCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJDocument3 pagesBCD CFK K'F I Molar'Qp Iqa - o Kap'Ebkhbpqo PPB VMI 'eJUMMO W Of'e HQN RU UMM NNNN P Ibp) BcdcmK'e TTTKBCDCMK'LJapi-25890856100% (2)

- NullDocument4 pagesNullapi-25890856No ratings yet

- Single Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%Document1 pageSingle Barrier Reverse Convertible On COMPAGNIE de SAINT-GOBAIN Coupon 11.4%api-25890856100% (2)

- Multi Chance Reverse Convertible On RIO TINTO PLC, GAZPROM andDocument1 pageMulti Chance Reverse Convertible On RIO TINTO PLC, GAZPROM andapi-25890856100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Markets: The Structure of The Three Types of Financial Market, and The Role of Government BondsDocument23 pagesFinancial Markets: The Structure of The Three Types of Financial Market, and The Role of Government BondsJoseph Maltby-SmithNo ratings yet

- 50h 50l 15c Rachit Jain Crossover StrategyDocument5 pages50h 50l 15c Rachit Jain Crossover StrategyKarthick AnnamalaiNo ratings yet

- Foreign Exchange Spot MarketsDocument41 pagesForeign Exchange Spot MarketsVikku AgarwalNo ratings yet

- Components of Capital StructureDocument3 pagesComponents of Capital StructureNahidul Islam IUNo ratings yet

- Chapter 6-Revenue-Class 11th-Microeconomics-Study Notes CBSEDocument1 pageChapter 6-Revenue-Class 11th-Microeconomics-Study Notes CBSEPhototronixNo ratings yet

- Business Finance EssayDocument2 pagesBusiness Finance EssayAlex Langkwenta100% (1)

- Company Analysis and Stock ValuationDocument37 pagesCompany Analysis and Stock ValuationHãmèéž MughalNo ratings yet

- Rico Auto Industries Stock Upgrade to Buy (Rs46Document2 pagesRico Auto Industries Stock Upgrade to Buy (Rs46ajd.nanthakumarNo ratings yet

- Risk Analysis, Real Options, and Capital BudgetingDocument40 pagesRisk Analysis, Real Options, and Capital BudgetingANKIT AGARWALNo ratings yet

- Industrial Credit and Investment Corporation of India BankDocument9 pagesIndustrial Credit and Investment Corporation of India Banksumitshuklas144No ratings yet

- Moorad Choudhry Anthology: Reader's Guide: January 2020Document33 pagesMoorad Choudhry Anthology: Reader's Guide: January 2020Mr ThyNo ratings yet

- Godfrey Mbonu - Acct564 Week1 Homework.Document2 pagesGodfrey Mbonu - Acct564 Week1 Homework.PetraNo ratings yet

- Burger King Holdings, Inc. To Be Acquired by 3G CapitalDocument6 pagesBurger King Holdings, Inc. To Be Acquired by 3G CapitalSam HamadehNo ratings yet

- FM AppleDocument12 pagesFM AppleREJISH MATHEWNo ratings yet

- Kkrrafton Developers Limited: CIN: L70100GJ1992PLC017815Document63 pagesKkrrafton Developers Limited: CIN: L70100GJ1992PLC017815Contra Value BetsNo ratings yet

- How To Make Money in Day TradingDocument136 pagesHow To Make Money in Day Tradingahmet50% (2)

- Return of The Quants - Risk-Based InvestingDocument13 pagesReturn of The Quants - Risk-Based InvestingdoncalpeNo ratings yet

- SyllabusDocument2 pagesSyllabusDedi SupiyadiNo ratings yet

- A Study On Performance Analysis of Equities Write To Banking SectorDocument65 pagesA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaNo ratings yet

- A Comparison of Active and Passive Portfolio ManagementDocument23 pagesA Comparison of Active and Passive Portfolio ManagementHoang HaNo ratings yet

- Asset Management RatiosDocument5 pagesAsset Management RatiosJhon Ray RabaraNo ratings yet

- Advanced Financial Accounting 7e (Baker Lembre King) .Chap009Document74 pagesAdvanced Financial Accounting 7e (Baker Lembre King) .Chap009low profileNo ratings yet

- Chapter 2 Capital Structure and Financial LeverageDocument59 pagesChapter 2 Capital Structure and Financial Leverageabdirahman mohamedNo ratings yet

- LT Foods-Q4 FY21-RU-LKPDocument8 pagesLT Foods-Q4 FY21-RU-LKPP VinayakamNo ratings yet

- Solution Manual For Fundamentals of Corporate Finance Ross Westerfield Jordan Roberts 8th Canadian EditionDocument36 pagesSolution Manual For Fundamentals of Corporate Finance Ross Westerfield Jordan Roberts 8th Canadian Editioneulapierce3akg100% (29)

- Structuring Venture Capital and Private Equity (2016) - Detailed Table of ContentsDocument11 pagesStructuring Venture Capital and Private Equity (2016) - Detailed Table of ContentspyrosriderNo ratings yet

- Various Investment AvenuesDocument59 pagesVarious Investment Avenuesagarwal_vinay85315088% (8)

- Phân Kì RSI 2 4 6 8Document4 pagesPhân Kì RSI 2 4 6 8peter tradeNo ratings yet

- FINN3222 - Final Exam Review SolutionsDocument5 pagesFINN3222 - Final Exam Review Solutionsangelbear2577No ratings yet

- Ch. 15 - Capital Structure & LeverageDocument45 pagesCh. 15 - Capital Structure & LeverageLara FloresNo ratings yet