Professional Documents

Culture Documents

Belgia en

Uploaded by

Maria DogaruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Belgia en

Uploaded by

Maria DogaruCopyright:

Available Formats

Overall trends in taxation

Structure and development of tax revenues Belgium belongs to the group of EU countries with the highest tax levels, alongside the Nordic countries, Austria, France and Italy. Although it has slightly declined over time, the tax-to-GDP ratio (2010: 43.9 %) is the third highest in the EU, after Denmark and Sweden, and significantly above the EU average (2010: 35.6 %). The structure of the Belgian tax system, in terms of the share of revenue raised by the broad categories of taxes, has remained relatively stable since 2000. A far-reaching tax reform of direct taxation that was gradually implemented in the first half of the last decade, reduced PIT revenue, expressed as % of GDP, from 13.4 % in 2002 to 12.4 %, in 2006. The structure is however still characterised by a relatively high share of direct taxes in GDP (3 rd highest in the EU), reflecting a broad reliance on personal and corporate income taxes, and social security contributions (6th highest in the EU). By contrast, with 13.3 %, the share of indirect taxes is just below the EU average (EU-27 13.5 %). Following the 2002 corporate tax reform and a favourable business cycle, the share of corporate tax revenue had significantly increased until 2006. A reduction in the tax base of corporations due to the ACE system and the unfavourable economic conditions since 2008 seem to have reversed this trend. The subsequent introduction or increase of several tax expenditures put the personal income tax revenues on a downward trend since 2003. The tax reform was complemented by successive targeted reductions in employers' social security contributions. Since 2007, the trend of SSC is reversed. Belgium is a federal state with a large fiscal autonomy for the regions. This translates into varying specific tax legislations across regions, e.g. registration duties, inheritance and estate taxes. While the revenue level of the federal state is on the decline since the turn of the century, the revenues from the regions have remained relatively stable over time. Regions benefited from the buoyant real estate markets. A larger share of tax revenue has also been allocated to the Social Security Funds. Keeping relatively stable until 2002, the overall tax burden declined almost continuously between 2003 and 2007. (by 1.3 percentage points), notably owing to a drop in revenues from corporate and personal income taxes, and SSC contributions, linked to the income tax reform, successive targeted reductions and the introduction of the ACE system in 2005. Since 2008, an increasing trend of the tax-to-GDP ratio is masked by the economic cycle. Taxation of consumption, labour and capital; environmental taxation The implicit tax rate on consumption increased in 2010 due to improved economic conditions compared to 2009. At 21.4 %, it was just above the EU average (EU-27 21.3 %), as for most of the last decade. As a percentage of GDP, VAT and excise duties collection are at the lower end in the EU at respectively 7.1 % and 2.2 % (EU average: 7.6 % and 3.2 %). Despite noticeable labour taxation reforms, Belgium still imposes relatively heavy taxes on labour with an implicit tax rate of 42.5 %, the second highest in the EU. Targeted rebates in employers' social contributions were used as the main instrument to reduce labour costs. The 2000 2006 reform programme paved the way for easing the tax burden on labour and led to a decrease in the ITR by 1.3 percentage points between 2004 and 2006. The ITR on labour has been relatively stable since 2006, although it has declined in 2009 due to the economic slowdown. However, the ITR on labour does not take into account wage subsidies, which have been increasingly used over the past five years and should reduce the ITR further by 3 percentage points over the 2002-2009.(See Valenduc (2011). The ITR on capital increased from 29.5 % in 2000 to 32.8 % in 2006, after which it declined to 29.5 % in 2010. This reflects on one side the gradual increase on the household side since 2000, explained in part by the boom in the real estate market that has resulted in an increase of registration duties. In 2010, taxes on stocks of capital/wealth amounted to 3.7 % of GDP. This level is relatively stable since the second half of the period concerned and is the third highest value in the EU. After a gradual decrease during most of the period, the ITR on corporations has significantly dropped since 2008 due to the lagged effect of the introduction of the ACE system and the economic slowdown, which put the ITR on capital on a declining path. Revenues from environmental taxation have declined in percentage of GDP since 2005. In 2010 environmental tax revenue amounted to 2.1 % of GDP, below the EU average (2.6 %). Revenues from energy taxation are the lowest in the EU (1.3 % compared to an EU average of 2.0 %). Current topics and prospects; policy orientation Bringing the public debt on a declining path remains a priority for the government in order to prepare the public finances for the budgetary impact of an ageing population. In spite of a steady decline between 1999 and 2007, the debt to GDP ratio remains well above the EU average and has been rising again since 2008 due to the economic slowdown and massive support to the financial sector. The initial 2012 budget, based on a growth forecast of

1.6 %, with a provision accounting for a drop of the growth rate to 0,8 %, was expected to bring the deficit just below 3 % through a combined effort of the federal government (2.4 %) and the regions (0.4 %). The bulk of the effort is generated by lowering public expenditure (42 %). Additional tax revenues account for 34 % of total effort, the fight for fraud would account for 24 %. A revised budget will be passed to the Parliament in April. It includes an additional consolidation package of 2 billions, with most of it on the spending sides. On the tax side, it includes an increase in excise duties on tobacco. The federal government agreed on raising new revenues mainly in the area of capital taxation. Since 1 January the withholding tax on interest and dividends rose from 15 % to 21 %, and a solidarity charge of 4 % is introduced on the share of financial income exceeding 20 020. The tax on financial transactions rose by 30 %. In addition, the 2012 budget introduces a tax on the conversion of bearer shares. In the field of company taxation, the budget lowers the cap to 3 % for the notional interest deduction for 2012 to 2014, with a possibility for renegotiating as of 2015, and increases the base for taxation of company cars (catalogue value) both for the company and for the user of the car. Company car taxation also takes into account car-specific CO2 emission levels. The federal budget identifies specific activities and sectors for raising additional revenue. VAT on digital television is raised from 12 % to 21 %. Mortgage interest deductions under the personal income tax scheme on the federal level will disappear as of 2014 as competence will pass on to the regions. As of 2013, the tax-free share of low and middle incomes will be raised by 200 and social contributions are lowered for the first three employees hired by medium-sized enterprises. Tax expenditure cuts in the PIT include the abolishment of federal subsidies for environmental cars and energy saving investments, which will only partly be replaced by regional subsidies. Finally, the government expect to raise revenues by stepping up the fight against fiscal and social fraud and focusing on risk sectors through a strengthening of fraud fighting authorities, increased cooperation between fiscal and social control authorities and the introduction of an automatic procedure to check fiscal and social debts in the field of inheritance taxation. Main features of the tax system Personal income tax There are four categories of income: financial, real estate, professional (including labour income) and other various income. In principle, the general rates are applied to global income, but there are exceptions, e.g. in relation to financial income, income from private pension arrangements and other various income. In practice, the basis for taxation at the marginal rate consists of (deemed) property and professional income. Spouses are taxed separately, although a marital quotient exists: 30 % of the higher income is transferred to the lower one, provided it does not exceed 9 470. A major reform was implemented in 20002006, introducing changes in brackets, rates, deductions and exemptions as well as a tax credit for low income earners. For wage earners, the income tax credit was changed into a reduction in employees SSC starting from 1st January 2005 and a new tax credit for low income workers was introduced from income year 2011 onwards. There are currently 5 brackets (beside the basic allowance) between 25 and 50 % and a municipal surcharge up to 9 % (7.4 % on average). Within certain limits, regions have the option to levy additional surcharges or to grant tax reductions. Since January 2012, the withholding tax rate is 21 % for most interest income (excluding ordinary savings accounts) as well as for a large part of dividend income, with an extra levy of 4 % via the PIT return for interest and dividend income above 20 020. Taxation of private capital gains is almost non-existent (except for those on some capitalisation vehicles), interest on ordinary saving accounts is exempt up to 1 830 and pension savings enjoy a special regime resulting in negative effective rates, as in other EU countries. Corporate taxation Companies in Belgium and the subsidiaries of foreign companies are subject to a fixed tax rate of 33.99 % (3 % crisis surcharge included) regardless of the origin and the destination of the profits. There is no tax consolidation of companies. Under certain conditions, a special scheme applies to SMEs having an assessed income lower than 322 500: a tax rate of 24.98 % is applied on the part from 0 to 25 000, 31.93 % on the part of 25 000 to 90 000 and 35.54 % on the remaining part up to 322 500 (all including the 3 % crisis surcharge). An allowance for corporate equity (ACE), referred to as 'notional interest on corporate capital', was introduced in 2006 to stimulate the self-financing capability of companies. The tax-free presumptive rate of return on equity applied under the ACE system is based on the rate of 10-year government bonds (OLO 10) with a cap of 3 % as of 2012 (3.5% for SMEs). In 2011, the rate was 3.425 % (3.925 % for SMEs). A tax-free reserve for new investments financed by retained earnings exists for SMEs benefiting from reduced rates. VAT and excise duties There are four VAT rates. The standard rate has remained unchanged at 21 % since 1996. A reduced 6 % rate applies to public housing, refurbishment of old housing, food, water, pharmaceuticals, animals, art and publications and some labour intensive services; the 2009 recovery plan also includes the above -mentioned

temporary reduction of the VAT rate to 6 % for a maximum amount of 50 000 on invoices of newly constructed private dwellings. An intermediate rate of 12 % applies to a limited number of transactions and, since 1st January 2010, to food in restaurants and catering services. A zero rate applies to newspapers and certain weeklies. Excise duties in a strict sense yield relatively low revenue in Belgium, but this is supplemented by above average levels of other taxes on products. Wealth and transaction taxes There are no wealth taxes. Other transaction taxes are generally levied at the regional level. Social contributions The social security system is financed by contributions from employees and employers as well as by government subsidies. The amounts are calculated based on the gross salary (including bonuses, benefits in kind, etc). The standard rate is approximately 13 % for employees and 35 % for employers but there are rebates for low wage earners and some target groups.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Behavioural Finance - Quo VadisDocument15 pagesBehavioural Finance - Quo VadisMaria Dogaru100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Analiza TehnicaDocument25 pagesAnaliza TehnicaMaria DogaruNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Lista VerbeDocument5 pagesLista VerbeMaria DogaruNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- SP Belgium en PDFDocument80 pagesSP Belgium en PDFMaria DogaruNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Verbe GermanaDocument26 pagesVerbe GermanaMaria DogaruNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Disertatie 2006 PDFDocument37 pagesDisertatie 2006 PDFMaria DogaruNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Final PPT UmppDocument13 pagesFinal PPT UmppDhritiman PanigrahiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- BADB1014 Assignment 1 With Cover PageDocument3 pagesBADB1014 Assignment 1 With Cover PageLogaa UthyasuriyanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Covid-19 Impact on Philippine Banking IndustryDocument6 pagesCovid-19 Impact on Philippine Banking IndustryHiyakishu SanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- SCR Banking KMDDocument25 pagesSCR Banking KMDamitguptaujjNo ratings yet

- Ñasque Filed A Complaint For Payment of Sum of Money and Damages Against RespondentsDocument9 pagesÑasque Filed A Complaint For Payment of Sum of Money and Damages Against RespondentsSherleen Anne Agtina DamianNo ratings yet

- Income Tax CalcDocument7 pagesIncome Tax Calckarthik.ragu9101No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Buslaw Reviewer Guide QuestionsDocument9 pagesBuslaw Reviewer Guide QuestionsFrances Alandra SorianoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- CFS PracticeDocument10 pagesCFS Practicehafeez azizNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- NCLC Brief (Hyperlinks)Document44 pagesNCLC Brief (Hyperlinks)Chesss44No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Local Funds Management and UtilizationDocument89 pagesLocal Funds Management and UtilizationJennylyn Favila Magdadaro100% (7)

- Domondon Tax Q&ADocument54 pagesDomondon Tax Q&AHelena Herrera0% (1)

- Chapter 3Document20 pagesChapter 3Nguyên BùiNo ratings yet

- David Capital Partners, LLC - 2013 Q4 Macro Commentary FINAL-1Document6 pagesDavid Capital Partners, LLC - 2013 Q4 Macro Commentary FINAL-1AAOI2No ratings yet

- Rule 131-133Document20 pagesRule 131-133Natasha MilitarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hire Purchase PDFDocument12 pagesHire Purchase PDFliamNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Wealth Management: Submitted By: Nandita Singh Rini Sinha NamitaDocument9 pagesWealth Management: Submitted By: Nandita Singh Rini Sinha Namitasinha_rini80No ratings yet

- Property Sales Agreement TemplateDocument3 pagesProperty Sales Agreement TemplateAnonymous 7vC1ljNo ratings yet

- San Beda College of Law: Corporate ActsDocument8 pagesSan Beda College of Law: Corporate ActsMarton Emile DesalesNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- PAS 7 Statement of Cash FlowsDocument14 pagesPAS 7 Statement of Cash FlowsBritnys NimNo ratings yet

- Secured Transactions Flow Chart (Collateral)Document10 pagesSecured Transactions Flow Chart (Collateral)Kathleen Alcantara94% (16)

- Lavoie (2014) - New FoundationsDocument660 pagesLavoie (2014) - New FoundationsDaisy Pereira100% (1)

- The Pensford Letter - 9.4.12Document5 pagesThe Pensford Letter - 9.4.12Pensford FinancialNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Big Bank Business: The Ethics and Social Responsibility of The Finance IndustryDocument2 pagesBig Bank Business: The Ethics and Social Responsibility of The Finance IndustryFaculty of the ProfessionsNo ratings yet

- PercentageDocument4 pagesPercentagesamdhathriNo ratings yet

- Functions & Power - Suruhanjaya Syarikat Malaysia (SSM)Document1 pageFunctions & Power - Suruhanjaya Syarikat Malaysia (SSM)Khairun NisyaNo ratings yet

- Chapter 12Document6 pagesChapter 12Marki Mendina100% (3)

- CIRAPS 5-year strategic plan for livestock farmersDocument40 pagesCIRAPS 5-year strategic plan for livestock farmersantiedu1957No ratings yet

- Heavy Engineeiring Coporation at A Glance: Public Sector Undertaking IndiaDocument19 pagesHeavy Engineeiring Coporation at A Glance: Public Sector Undertaking IndiaNitish Kumar TiwaryNo ratings yet

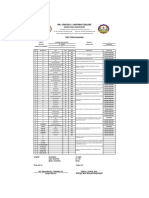

- Dr. Carlos S. Lanting College Test Item AnalysisDocument1 pageDr. Carlos S. Lanting College Test Item AnalysisEdna Grace Abrera TerragoNo ratings yet

- Sample Sub Contract AgreementDocument3 pagesSample Sub Contract Agreementcmmak50% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)