Professional Documents

Culture Documents

GSIS

Uploaded by

santasantitaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSIS

Uploaded by

santasantitaCopyright:

Available Formats

I. What is GSIS?

The GSIS is a social insurance institution created under Commonwealth Act Number 186 that was passed on November 14, 1936, and later amended under Republic Act No. 8291 dated June 24, 1997. To secure the future of all employees of the Philippine government, it provides and administers a pension fund that has the following social security benefits: compulsory life insurance, optional life insurance, retirement benefits, and disability benefits for work-related accidents and death benefits. II. Purpose of GSIS? The GSIS provides social security coverage to employees in the public sector. It officially started its operations in May 31, 1937 with life insurance program as its only business and was transformed into a more comprehensive social insurance scheme in 1951 with the addition of old-age, invalidity and survivors benefits. The GSIS also administers the Employees Compensation Program, which provides for work-related social security benefits for the public sector and the General Insurance Fund, which provides non-life coverage for all properties with government insurable interest. GSIS, as designed in its charter, is a social insurance institution under a defined benefit scheme. It insures its members against the occurrence of certain contingencies in exchange for their monthly premium contributions. In addition, the GSIS is entrusted with the administration of the General Insurance Fund by virtue of R.A. 656 of the Property Insurance Law. It provides comprehensive insurance coverage to assets and properties that have government insurable interests.

3. III. Membership Compulsory Membership Except members of the Armed Forces of the Philippines and the Philippine National Police, subject to the condition that they must settle first their financial obligation with the GSIS, and contractuals who have no employer and employee relationship with the agencies they serve, all government personnel, whether elective or appointive, irrespective of status of appointment, provided they are receiving fixed monthly compensation and have not reached the mandatory retirement age of 65 years, are compulsorily covered as members of the GSIS and shall be required to pay contributions. However, employees who have reached the retirement age of 65 or more shall also be covered, subject to the following rules: 1. An elective official who at the time of election to public office is below 65 years of age and will be 65 years or more at the end of his term of office, including the period/s of his re-election to public office thereafter without interruption. 2. Appointive officials who, before reaching the mandatory age of 65, are appointed to government position by the President of the Republic of the Philippines and shall remain in government service at age beyond 65. Contractual employees including casuals and other employees with an employee-government agency relationship are also compulsorily covered, provided they are receiving fixed monthly compensation and rendering the required number of working hours for the month. Classes of Membership (By Type and By Status) A. Type of members: 1. Regular Members are those employed by the government of the Republic of the Philippines, national or local, legislative bodies, government-owned and controlled corporations (GOCC) with original charters, government financial institutions (GFIs), except uniformed personnel of the Armed Forces of the Philippines, the Philippine National Police, Bureau of Jail Management and Penology (BJMP) and Bureau of Fire Protection (BFP), who are required by law to remit regular monthly contributions to the GSIS. 2. Special Members are constitutional commissioners, members of the judiciary, including those with equivalent ranks, who are required by law to remit regular monthly contributions for life insurance policies to the GSIS in order to answer for their life insurance benefits defined under RA 8291.

4. B. Status of membership: 1. Active member refers to a member of the GSIS, whether regular or special, who is still in the government service and together with the government agency to which he belongs, is required to pay the monthly contribution. 2. Inactive member a member who is separated from the service either by resignation, retirement, disability, dismissal from the service, retrenchment or, who is deemed retired from the service under this Act. Effect of Separation from the Service. A member separated from the service shall continue to be a member, and shall be entitled to whatever benefits he has qualified to in the event of any contingency compensable under this Act.

5. IV. Computation of the Amount of Contribution GSIS is, first and foremost, a social insurance institution. As such, and consistent with the nature of insurance, it provides protection to its members and their families against the occurrence of certain contingencies such as death, disability, separation, unemployment or retirement on the basis of their monthly compensation. In return, the law obligates and compels its members and their agencies to remit, every month and without delay, premium contributions in proportion to their monthly compensation. The GSIS mandate, therefore, to provide the necessary protection is indispensably linked with the monthly premium obligations of its members and their agencies. Accordingly, the benefits a member receives must correspond to the contributions received by the System on his behalf. To put it simply, by compelling the remittance of premiums in return for a defined protection, the law is simply restating the common principle in equity which states that what you get is what you paid for. For Regular Members Employees Share (Member) Employers Share (Government) 9% of Actual Monthly Salary 12% of Actual Monthly Salary For Special Members The Special Member shall pay the required life insurance premiums of 3% of the fixed monthly compensation for both employees and government agencys share.

6. V. Remittance of Contribution to GSIS 1. Each government agency shall remit directly to the GSIS the employees and government agencys contributions within the first Ten (10) days of the calendar month following the month to which the contributions apply. The remittance by the government agency of the contributions to the GSIS shall take priority over and above the payment of any and all obligations, except salaries and wages of its employees. 2. The government agency shall also deduct from the fixed monthly compensation of the employee the loan amortizations (consolidated loans, policy loan, emergency loan, housing loan, and other loans), premium payments (optional, pre-need and other non-life insurance) and other amounts due the GSIS. 3. The said amounts shall be remitted to the GSIS within the first Ten (10) days of the calendar month following the month when the deductions were effected, accompanied by supporting lists in the form prescribed by the GSIS. 4. The member has the corresponding responsibility to ensure that the required premium contributions and other amounts due the GSIS that were deducted from his compensation are promptly remitted to GSIS.

7. VI. Penalty for Late Remittances For the Agencies The following penalties are imposed on an agency if it fails to remit loan amortizations within 30 days from the time it received a billing notice from GSIS: 1. Agency pays not less than two percent (2%) interest per month on unremitted collections computed from the due date and until the time GSIS receives the payments 2. The head of your agency including the finance officer, cashier and other officials who failed to remit to GSIS the loan amortizations will face administrative and criminal charges and if convicted by the court, will be imprisoned from one to five years and be fined with amount ofP10,000.00 to P20,000.00 3. Those convicted for failure to remit loan amortizations will pay the surcharges and interests incurred from the unpaid loans of all the agencys members For the Members The following are the consequences on the members for refusing to pay their loan amortizations on time: 1. Annual dividend privileges are cancelled 2. All unpaid loans, including interests and surcharges, will be deducted from the proceeds of the loans and the claims that will be due the member especially their retirement claims.

8. VII. Benefits Provided under GSIS and Procedures of Claims in It Separation Benefits The Separation benefit is given to employees who have not reached the retirement age (60) but have been separated from the service. The benefit can be in the form of cash payment or cash payment and pension. 1. For members with at least 3 years but less than 15 years of service: A cash payment equivalent to one hundred percent (100%) of the AMC for every year of service the member has paid contributions (creditable service), but not less than twelve thousand pesos ( P 12,000 ), payable upon reaching age 60, or upon his separation if he is already 60 years of age at the time of separation. 2. For members with at least 15 years of service and less than age 60 upon separation: a. A cash payment equivalent to eighteen (18) times the BMP payable at the time of resignation or separation. b. An old-age pension benefit equal to the BMP, payable monthly for life upon reaching the age of 60. 3. Reckoning Date of Separation of Uniformed PNP, BJMP and BFP Personnel shall be February 1, 1996. The computation of benefit shall be based on their basic monthly salary (premium-based) when they ceased to be members of the GSIS. Processing of Separation Benefit of Members Who Died While Their Claims are Being Processed If the member dies during the pendency of his claim for separation benefit and he has rendered at least 15 years of creditable service, his legal heirs shall be entitled to receive cash payment equivalent to eighteen (18) times the basic monthly pension, plus accrued BMP, if any, up to the date of death of the member. Thereafter, the primary beneficiaries shall be entitled to survivorship pension. If the member dies during the pendency of his claim for separation benefit and he has rendered less than 15 years of creditable service, his legal heirs shall be entitled to cash payment equivalent to one hundred percent (100%) of AMC for each year of creditable service, but not less than Twelve Thousand Pesos (P12,000.00). Unemployment Benefits Unemployment benefit is paid when a permanent government employee who has paid the required 12 months integrated contributions is involuntarily separated from the service as a result of the abolition of his office or position usually resulting from reorganization. The benefit is in the form of monthly cash payments equivalent to 50%

9. of the average monthly compensation (AMC). The unemployment benefit shall be paid in accordance with the following schedule. 1. If the contributions have been made for a period of 1 year but less than 3 years, the benefit duration is for 2 months. 2. If the contributions have been made for a period of 3 or more years but less than 6 years, the benefit duration is for 3 months. 3. If the contributions have been made for a period of 6 years or more but less than 9 years, the benefit duration is for 4 months. 4. If the contributions have been made for a period of 9 years or more but less than 11 years, the benefit duration is for 5 months. 5. If the contributions have been made for a period of 11 years or more but less than 15 years, the benefit duration is for 6 months. Those entitled to more than two (2) months of Unemployment Benefits shall initially receive two (2) monthly payments. A seven-day (7-day) waiting period shall be imposed on succeeding monthly payments to determine whether the separated member has found gainful employment either in the public or private sector. In cases of reemployment, all accumulated unemployment benefit paid to the employee during his/her entire membership with the GSIS shall be deducted without interest from the separation or retirement benefits, as the case maybe, to which the member may be entitled to upon his voluntary resignation, separation or retirement. Retirement Benefits A member who has reached the age of 60 years and who has at least 15 years of creditable service rendered may retire from active service and receive the retirement benefits, provided the member is not receiving a monthly pension from permanent total disability. The retirement benefit consists of a monthly pension which is computed based on years of creditable service and AMC for the last 3 years. A retiring member has the following options: 1. Five (5) year lump sum equivalent to sixty (60) months of the BMP, subject to qualification requirements, less all outstanding obligations of the member in accordance with the CLIP, plus an old-age pension benefit equal to the BMP payable for life, starting on the first day of the month following the expiration of the five year guaranteed period; 2. A cash payment benefit equivalent to eighteen (18) times of the BMP, subject to qualification requirements, less all outstanding obligations of the member in accordance with the CLIP, plus monthly pension for life payable on the first month following the date of retirement; Change of retirement benefit option from eighteen (18) months cash payment plus immediate pension to five (5) year lump sum, or vice versa, shall not be allowed. Conversion in the mode of retirement from R.A. No. 8291 to any other retirement laws 10. and vice versa administered by the GSIS shall not be allowed. Those who became GSIS members prior to the implementation of this Act shall have the option to retire under PD 1146, RA 660, or RA 1616, subject to eligibility. Processing of Retirement Benefits of Qualified Members Who Died While their Claims are Being Processed a. If the deceased member opted for five year lump sum benefit as indicated in his/her claim for retirement application, his legal heirs shall be entitled to five- year lump sum benefit equivalent to sixty (60) months basic monthly pension (BMP). However, the survivorship pension to qualified primary beneficiaries, if any, shall be granted after the end of the 5-year guaranteed period, but filing of claim for survivorship benefit should be done before the end of the 4-year prescription period. b. If the deceased member opted for immediate pension as indicated in his/her claim for retirement benefit his legal heirs shall be entitled to retirement benefits equivalent to eighteen (18) months of BMP, plus accrued pension, if any, up to the date of death of the retiree. The corresponding survivorship pension shall be paid to the qualified primary beneficiaries, if any, and shall be computed from the date of death of the retiree, subject to filing of claim. c. In case the deceased member failed to indicate in his/her retirement option, it shall be computed as if he/she opted for immediate pension. d. The proceeds of retirement benefits shall be paid and distributed to the legal heirs in accordance with the law on succession under the Civil Code of the Philippines. Effects of Re-Employment When a retired/separated member is re-employed or reinstated in the service, his/her

previous services credited at the time of his/her retirement/separation for which a corresponding benefit had been awarded, shall be excluded in the computation of service. In effect, he/she shall be considered a new entrant. However, for those who retired prior to the enactment of RA 8291, the previous services of a retired/separated member may be added in the computation of his creditable services (subject to premium-based policy) upon subsequent retirement under RA 8291 only when both conditions are met: a. the retiree re-entered government service before June 24, 1997; b. the total amount of benefit previously received, if any, including the prescribed interest was refunded to GSIS on or before March 2, 2006 Computation of Total Service and Creditable Service Total Length of Service (TLS) is the number of years in government service regardless of status of employment, with or without premium contributions. 11. For purposes of computing the total length of service under part-time status of employment, services shall be converted to their full-time equivalent using forty-hour week and fifty two-week a year as basis. The computation of creditable service for the purpose of determining the amount of benefits payable shall include the period or periods of service with the required premium contributions. Computation of Average Monthly Compensation (AMC) The AMC shall be computed on the basis of the average salary of the member for the last 36 months of creditable service immediately preceding his retirement or separation. The basis for computing the AMC of a separated or retired member requesting for computation of benefits shall be the prevailing policy on AMC at the time the claim is being processed. Computation of Revalued Monthly Compensation = AMC plus Seven Hundred Pesos (P700.00) As a general rule, the BMP shall only be computed for those members or dependents/heirs of members who are eligible to receive benefits under this law. The formula for computing BMP shall be: BMP = RAMC x (2.5% x RCS), but in no case shall it exceed 90% of the AMC of the member. Adjustment/Increase in Pension Periodic adjustments of the monthly pension of all existing pensioners shall be done on the basis of what is sustainable and prudent for the GSIS as recommended by its Actuary and approved by the Board. Policies Affecting Pension Administration Regardless of the date of retirement, the monthly pension shall commence on the 1st day of the month following the month of retirement. Annual Renewal of Active Status (ARAS) of Old Age and Survivorship Pensioners are required on their birth month every year. If they dont renew: a. There will be suspension of payment of monthly pension b. Non-entitlement to cash gift if status is suspended at the time of declaration c. Non-entitlement to pension increase if status is suspended at the time of declaration

12. Disability Benefits Disability refers to any loss or impairment of the normal functions of the physical and/or mental faculties of a member, which permanently or temporarily prevents him to continue with his work or engage in any other gainful occupation resulting in the loss of income. The actual loss of income shall refer to the number of days when a member went on leave of absence without pay (LWOP) reckoned immediately from the date of commencement of disability and for the duration of entitlement thereto, based on medical evaluation. Any LWOP incurred after the duration of entitlement to the benefit shall not be compensable. Any disability or injury as a result of, or due to grave misconduct, participation in riots, gross and inexcusable negligence, under the influence of drugs or alcohol or willful intention to injure or kill himself or another, shall not be compensable. If the member has two or more different contingencies during the same period of benefit entitlement, he shall be compensated only once for the overlapping periods. All injuries, disabilities, illnesses and all other infirmities compensable under PD 626 shall not be compensable under this Act. Permanent Total Disability (PTD) PTD are disabilities due to injury or disease causing complete, irreversible and permanent incapacity that will permanently disable a member to work or to engage in any gainful occupation resulting to loss of income. a. complete loss of sight for both eyes; b. loss of two limbs at or above the ankle or wrists; c. permanent complete paralysis of two limbs; and d. brain injury resulting in incurable imbecility or insanity. e. such other cases as may be determined and approved by the GSIS A member who becomes permanently and totally disabled shall be entitled to the PTD benefits when: a. he/she is in the service at the time of disability; or b. if separated from the service, he has paid at least thirty six (36) months contributions within the five year (5) period immediately preceding his/her disability; or has paid a total of at least one hundred eighty (180) months contributions prior to his/her disability; Provided, however, that the following conditions shall be met: he/she is gainfully employed prior to the commencement of disability resulting in loss of income as evidenced by any incontrovertible proof thereof; he/she is not a registered member of any social insurance institution; and

13. he/she is not receiving any other pension either from GSIS or another local or foreign institution or organization In addition to the monthly income benefits for life, a cash payment equivalent to eighteen (18) times his/her basic monthly pension (BMP), shall be paid to a member who was in the service at the time of his/her permanent total disability and who has paid a total of one hundred eighty (180) monthly contributions. A separated member who has at least three (3) years of service and becomes permanently and totally disabled but has not paid a total of at least one hundred eighty (180) monthly contributions prior to his/her disability shall be entitled only to cash payment equivalent to one hundred percent (100%) of his/her average monthly compensation for each year of service with paid contributions but not less than twelve thousand pesos (P12,000.00). Permanent Partial Disability (PPD) PPD arises due to the complete and permanent loss of the use of any of the following resulting to the disability to work for a limited period of time. Such injuries include those on any finger, toe, one arm, one hand, one foot, one leg, ears, hearing of ears, sight of one eye, and such other cases as may be determined and approved by the GSIS A member whose disability is partial shall be entitled to the PPD benefit when: a. he/she is in the service at the time of disability; or b. if separated from the service, he has paid at least thirty six (36) months contributions within the five year (5) period immediately preceding his/her disability; or has paid a total of at least one hundred eighty (180) months contributions prior to his/her disability; Provided, however, that the following conditions shall be met: he/she is gainfully employed prior to the commencement of disability resulting in loss of income as evidenced by any incontrovertible proof thereof; he/she is not a registered member of any social insurance institution; he/she is not receiving any other pension either from GSIS or another local or foreign institution or organization The period of entitlement to PPD benefit shall be determined after due medical evaluation; but such period of entitlement to the benefit shall not exceed 12 months for the same contingency. Only the leave of absence/s without pay incurred during the period of entitlement, duly certified by the authorized officer of the agency where he is employed, shall be compensable. The amount of PPD benefit shall be computed

by dividing the BMP by 30 days and multiplying the quotient by the number of compensable calendar days of leave of absence without pay (LWOP). 14. Temporary Total Disability (TTD) TTD accrues or arises when the impaired physical and/or mental faculties can be rehabilitated and/or restored to their normal functions, but such disability shall result in temporary incapacity to work or to engage in any gainful occupation. The temporary total disability benefit is in the form of a daily benefit equivalent to 75% of his current daily compensation for the duration of the disability starting on the 4th day of disability but not to exceed 120 days. For more extensive cases, duration may be extended up to a maximum of 240 days. Minimum benefit is P 70.00 per day while the maximum is P 340.00 per day. A member shall be entitled to the TTD benefit when: a. he/she is in the service at the time of disability; or b. if separated from the service, he has paid at least thirty six (36) months contributions within the five year (5) period immediately preceding his/her disability; or has paid a total of at least one hundred eighty (180) months contributions prior to his/her disability; Provided, however, that the following conditions shall be met: he/she is gainfully employed prior to the commencement of disability resulting in loss of income as evidenced by any incontrovertible proof thereof; he/she is not a registered member of any social insurance institution; and he/she is not receiving any other pension either from GSIS or another local or foreign institution or organization The period of entitlement to TTD benefit shall be determined after due medical evaluation and proof of actual loss of work resulting in loss of income by way of the incurred actual number of days of leave of absence/s without pay duly certified by the authorized officer of the agency where he is employed; but such period of entitlement to the benefit shall not exceed 120 days in one calendar year. However, if the disability requires more extensive treatment that lasts beyond 120 days, the payment of the TTD may be extended by the GSIS but not to exceed a total of 240 days. Only the leave of absence/s without pay incurred during the period of entitlement shall be compensable. Entitlement, however, shall start from the fourth day of the disability. The amount of TTD benefit shall be computed by multiplying 75% of the daily salary of the member by the number of days of disability based on the medical evaluation but not to exceed 240 days for the same contingency. However, the computed daily salary shall not be less than seventy pesos (P70.00) but not to exceed P340.00 per day.

15. Any applicable disability benefit shall be suspended when he/she: a. is re-employed; or b. recovers from his/her disability as determined by the GSIS, whose decision shall be final and binding; or c. fails to present himself for medical examination when required by GSIS; or d. is receiving any other pension either from GSIS or another local or foreign institution or organization. Notice and Filing of Claims and Other Documents Required A written notice of sickness or injury shall be given by a member or anybody in his/her behalf within one (1) month from the date of the occurrence of the contingency. If the member is in the service, the notice shall be given to the GSIS; if separated from the service, the member shall notify the GSIS directly. The notice must contain the following information: a. Name and address of the member; b. His/her agency if in the government or employer if in the private sector; c. Date and nature of sickness or injury; d. Place of confinement; and e. Any other pertinent information that may be required by the GSIS. Periodic Medical Report The disabled member, except those with permanent partial disability, shall submit annual medical reports on his/her impairment, duly certified by his/her attending physician, and/or submit himself/herself to annual medical and physical examination. If he/she fails to comply with this requirement, the payment of his/her benefit shall be suspended and shall be resumed only upon his/her compliance thereto provided that, he/she is found still entitled to the benefits. The benefit corresponding to the period of suspension shall also be paid. Forfeiture of Disability Benefits All the foregoing provisions notwithstanding, any member who is enjoying disability benefits shall automatically forfeit his/her right to the continued enjoyment thereof if he/she refuses or deliberately fails to: a. have himself/herself medically treated by a physician when required by the GSIS; or b. take the prescribed medications ; or c. have himself/herself confined in a hospital without justifiable reason, when such confinement is required by the GSIS; or d. avail himself/herself of such rehabilitation facilities as may be duly recommended by the GSIS and made available for him/her; or e. Observe such precautionary and /or preventive measures as prescribed by a physician or expressly required of him/her to prevent the aggravation or continuance of his/her disability.

16. However, upon compliance with the requirements, his/her benefits shall be resumed if he/she is still qualified. Survivorship Benefits The benefits payable to the surviving qualified beneficiaries of the deceased member or pensioner who are either: 1. Primary the legitimate spouse, until he/she remarries and the dependent children. In this regard, dependent children shall be the legitimate, legitimated and/or legally adopted child, including any illegitimate child, who is below 18 years of age, unmarried, not gainfully employed, or being more than 18 years of age but incapacitated and incapable of selfsupport due to mental or physical incapacity acquired prior to age of majority. 2. Secondary are the dependent parents and legitimate descendants. The primary and secondary beneficiaries, except dependent children, shall be entitled to applicable survivorship benefits, subject to the following: a. not engaged in any gainful occupation as defined in Sec 2 (p) of RA 8291; b. the surviving spouse and the deceased member were living together as husband and wife; c. not gainfully engaged in a business or economic activity (self- employed); d. employed/engaged in a business or economic activity but receiving income less than the minimum compensation of government employees. e. not receiving any other pension from the GSIS or another local or foreign institution or organization; and f. In the case of the dependent spouse, payment of the basic survivorship pension shall discontinue when he remarries, cohabits, or engages in common-law relationship. The foregoing conditions, except the last one, must be present immediately preceding the death of the member or pensioner. The beneficiaries/legal heirs of the deceased members are entitled to receive either one of the following survivorship benefits: 1. Survivorship pension consisting of: a. the basic survivorship pension which is fifty percent (50%) of the BMP; and b. the dependent childrens pension equivalent to 10% of the BMP for each child but not to exceed fifty percent (50%) of the BMP. 2. Cash payment equivalent to eighteen (18) months BMP; 3. Cash payment equivalent to one hundred percent (100%) of the AMC for every year of service with paid contributions but not less than Twelve Thousand Pesos (P12,000.00). If at the time of death, a member was in the service and has rendered at least fifteen (15) years of creditable service:

17. a. his primary beneficiaries shall receive the survivorship pension and cash payment equivalent to 18 x the BMP; or b. in the absence of primary beneficiaries, his secondary beneficiaries shall receive the cash payment equivalent to 18 x the BMP; or c. in the absence of secondary beneficiaries, the legal heirs shall receive the cash payment equivalent to 18 x the BMP. If at the time of death, the member was in the service with less than fifteen (15) years of creditable service; his primary beneficiaries shall receive the cash payment equivalent to 100% of the AMC for every year of creditable service. On the other hand, primary beneficiaries of inactive members: a. Who have at least 15 years of creditable service shall receive the survivorship pension only. b. Who have at least 3 years but less than 15 years of creditable service and were less than 60 years old at the time of death shall receive the cash payment equivalent to 100% of the AMC for every year of creditable service, but not less than P12,000.00. c. Who have less than 15 years of creditable service but were at least 60 years old at the time of separation and have received the corresponding separation benefit, shall not be entitled to survivorship benefits. However, if the member has not received yet his separation benefit within four years after his/her separation, the primary beneficiaries shall receive the cash benefit equivalent to 100% of the inactive members AMC for every year of creditable service, but not less than P12,000.00. The survivorship benefits shall be paid as follows: a. When the dependent spouse is the only survivor, he shall receive the basic survivorship pension; b. When only the dependent children are the survivors, they shall be entitled only to the dependent childrens pension equivalent to 10% of the BMP for every dependent child, not exceeding five (5), counted from the youngest and without substitution; c. When the survivors are the dependent spouse and the dependent children, the dependent spouse shall receive the basic survivorship pension for life or until he remarries or cohabits, and the dependent children shall receive the dependent childrens pension. d. When the dependent spouse and dependent children are already receiving the basic survivorship pension and dependent childrens pension, respectively, any subsequent death, emancipation or disqualification of any one of them shall not entitle the other beneficiaries to the forfeited share. e. In the absence of a natural guardian, the guardian de facto of dependent children, as well as the physically or mentally incapacitated dependent children, must file a Petition for Guardianship to be able to claim the survivorship benefits on behalf of the dependent children.

18. f. When the pensioner dies within the 5-year period after receiving the five-year lump sum, the survivorship pension shall be paid only after the end of the said five-year period. However, filing of claim for survivorship benefit should be done before the end of the 4-year prescription period. Funeral Benefits The funeral benefit, in the amount P20,000, (for uniformed members of the PNP, BJMP and BFP, the amount of funeral benefit is fixed at P10,000.00) is intended to defray the expenses incident to the burial and funeral of the deceased member, pensioner, or retiree under RA 660, RA 1616, PD 1146, and RA 8291. It is payable to the members of the family of the deceased, in the order which they appear: 1. Legitimate spouse 2. Legitimate child who spent for the funeral services, or 3. any other person who can show unquestionable proof of his having borne the funeral expenses of the deceased. Conditions for entitlement are as follows: 1. Active member or 2. A member who has been separated from the service but who is entitled to future separation or retirement benefit; or 3. A member who is an old age pensioner or 4. A retiree who at the time of his retirement was of pensionable age under RA 8291 but who opted to retire under RA 1616; or 5. A member who retired under RA 1616 prior to the effectivity of RA 8291 with at least 20 years of service, regardless of age To avail P20,000 funeral benefit, and if claimant is the legal spouse, present: 1. Original copy of Death Certificate of the member from NSO. 2. Original copy of Marriage Contract from NSO 3. Two valid ID (original to be shown, photocopy to be submitted) 4. Original copy of NSO certified Birth Certificate of the claimant (if there will be claims for death and survivorship benefits). If not registered, may apply for late registration. If claimant is other than the legal spouse (Application will be accepted only if the legal spouse is already deceased. In this case, priority is given to legitimate children): 1. Original copy of Death Certificate of the member from NSO. 2. GSIS Affidavit of Funeral Expense Form 3. Original & Xerox copy of Official Receipt under the claimants name or if a Funeral Plan was used, a Certification from the memorial service provider that the plan was availed of. 4. Two valid IDs (original to be shown, photocopy to be submitted) 5. Birth certificate of the claimant or valid ID (issued by the government) indicating his/her date of birth.

19. Claimants birth certificate is not required if the claimant is a GSIS member or pensioner. Life Insurance Benefits Type 1. Life Endowment Policy (LEP) = Compulsory 1. Maturity benefits, which is the face amount payable to the member upon maturity of the policy. 2. Cash Surrender Value, which are earned values during the term of the insurance payable to the member when he is separated from the service before maturity date of the policy or when he is considered as a case of PTD. 3. Permanent Total Disability 4. Death Benefit, which is the face value of the policy payable to designated beneficiary/beneficiaries or legal heirs, in the absence of the former, upon the death of a member. 5. Accidental Death Benefit (ADB) is an additional benefit equivalent to the amount of Death Benefit when the member dies by accident. In this connection, proof must be presented to sufficiently establish that the cause of the members death is accidental. The right to present sufficient proof to show that death was accidental shall prescribe if the claim for ADB is filed four (4) years after the death of the member. 6. Sickness Income Benefit is a purely employer-based contribution benefit. Sickness must be listed /considered an "occupational disease"; or even if not listed as one, it must be shown that the risk of contracting the sickness is increased by the working conditions. List of Occupational Diseases (under PD626) Papilloma of the bladder Cataract Deafness Decompression sickness Caisson disease Aeroembolism Poisoning Pneumoconiosis Poisoning by cadmium Viral hepatitis Leukemia and lymphoma Cerebro-vascular accidents Cancer of the lungs, liver and brain Cardio-vascular diseases Pneumonia Hernia Bronchial asthma Osteoarthritis Viral encephalitis Peptic ulcer Pulmonary tuberculosis Viral hepatitis Essential hypertension Asbestosis Malaria and schistosomiasis Dermatitis due to irritants and sensitizers Diseases caused by abnormalities in temperature and humidity Cancer, epithellomatous or ulceration of the skin or of the corneal surface of the eye

20. Cancer of the stomach and other lymphatic and blood forming vessels, nasal cavities and sinuses Infections: Anthrax, Brucellosis, Glanders, Rabies, Tuberculosis, Tularemia, Weill's disease, Q Fever or equine encephalomyelitis, Mite dermatitis Vascular disturbance in the upper extremities due to continuous vibration from pneumatic tools or power drills, riveting machines or hammers Ionizing radiation disease, inflammation, ulceration or malignant disease of the skin or

subcutaneous tissues of the bones or leukemia or anemia of the aplastic type due to X-rays, ionizing particles, radium or other radioactive substances Acute radiation syndrome: Chronic radiation syndrome and Glass blower's cataract. 7. Annual Dividend, a policyholder is entitled to dividends subject to the guidelines as approved by the GSIS Board. This is not a guaranteed benefit. Type 2. Enhanced Endowment Policy (ELP) = Compulsory 1. Termination Value, the policy earns a Termination Value during the life of the policy computed from the percentage of life insurance premiums actually remitted and paid to GSIS. Termination value is equivalent to a percentage of monthly life insurance premiums as determined by the GSIS, due and paid in full, either by direct remittance or through an APL facility. The accumulated termination value will grow at such rate as determined by the Actuary. The termination value shall be paid to the member upon his separation from the government service less all indebtedness of the member with the GSIS in accordance with CLIP. 2. Death Benefit equivalent to the latest annual salary multiplied by amount of insurance (AOI) factor which is 1.5 or 18 times the current monthly salary of the member or as determined by the GSIS, payable to the legal heirs, less all outstanding obligations of the member in accordance with the CLIP. 3. Annual Dividend, a policyholder is entitled to dividends subject to the guidelines as approved by the GSIS Board. This is not a guaranteed benefit. Type 3. Policy Loan = Optional This is a loan program that lets you borrow from the seed money or cash value of your life insurance. It is a loan program which you can avail from your GSIS life insurance policy, LEP and ELP. A member has an option to avail of an additional life insurance without any limit to his life insurance coverage. When availing of the Optional Policy Loan, a member can choose to either pay it through monthly amortization or have it count against his optional policy life contract. The Policy Loan bears an interest of 8% compounded annually. A member who has been insured for at least one year may be granted the Policy Loan. The availing member must also have updated premium payments and has an active policy to be eligible under this loan product. 21. Personal Insurance My Shield Personal Accident Insurance My Shield is the lowest insurance premium rate against personal accident in the market today with about P40 for every P50,000 annual coverage. You can have a minimum coverage of P50,000 to a maximum of P5 million. Age is not a factor when availing of My Shield. It covers all active GSIS members, their dependents and even immediate relatives brothers, sisters - aged 3 to 80 years old. Retirees, pensioners and their immediate families can also avail of My Shield. My Shield also has medical reimbursement features for expenses incurred within 52 weeks from the date of the accident. It allows you to claim 10% of your total insurance to a maximum of P50,000 for medical expenses due to an accident. If the insured dies due to an accident, the beneficiaries can claim 100% of total insurance coverage. The same benefit applies if the insured dies due to an accident within 180 days after the date of the mishap. Unprovoked murder is covered, and beneficiaries can claim 50% of the Principal Sum but not to exceed Php50,000.00. Each injury which results in dismemberment also has corresponding claims. For example, loss of both hands and feet pays the insured 100% insurance coverage while loss of one eye pays 50% of the principal sum. A comprehensive coverage is also offered for Permanent Total Disability. The GSIS will pay 1% of the principal sum per month for 100 months but less of any amount paid or payable under My Shield as a result of the same accident. Home Shield Fire Insurance Any type of residence, even a commercial establishment, can be insured with Home Shield if the named owner is an active member of the GSIS or their immediate family spouses, children, parents, brothers and sisters. Likewise, properties of retirees and pensioners and their immediate family can also get a Home Shield Fire Insurance. Premium rate for this insurance is one of the lowest in the market at P640 for every P1 million of annual coverage against fire. Different rates, however, are applied based on the location of the property. GSIS has a zoning system for its Home Shield Fire Insurance premium rate as follows: Zone 1 at 0.08% rate covers Metro Manila, Metro Cebu, SBMA Area, Clark Development Corporation and all export processing zones and industrial parks. While Zone 2 at 0.188% are all areas not covered by Zone 1. Other protection against earthquake, typhoon or flood can also be availed for an additional rate of only 0.04%. On top of the low premium rates, GSIS offers 20% owners discount to all qualified assureds. Another unique feature of Home Shield is that premium can be paid in full or installment basis in cash or by just issuing post-dated checks. Documentation required: 1. Transfer of Certificate of Title (TCT), and/ or Tax Declaration or a copy of the Articles of Incorporation for corporate properties 2. Birth certificates and marriage contracts as proof of relationship for the extended and immediate family of active members

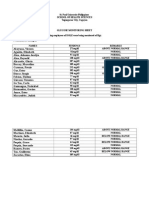

22. Auto Shield Car Insurance Private and commercial vehicles owned, leased or loaned by active GSIS members and their immediate relatives can be covered by a comprehensive annual insurance worth P846,000 by paying only a premium of P9,508 - by far the lowest and most affordable vehicle insurance to date. Unlike other car insurance that considers the age of the vehicle, Auto Shield insures vehicles as long as they are in good running condition. Coverage of Auto Shield is allinclusive since it covers the following: loss/own damage of vehicle, comprehensive third party liability, property damage, excess bodily harm, liability to insured passenger and unnamed driver. Documentation required: 1. Duly accomplished Auto Shield Application Form 2. Photocopy of Certificate of Registration (CR) 3. Latest Official Receipt (OR) from LTO 4. Photocopy of previous motor vehicle policy insurance 5. Retiree number for retired employee and pensioner 6. Copy of Bank Financing for Mortgaged Unit 7. Photocopy of Sales Invoice 8. Any documentary proof of relationship with active GSIS member Service Loans A member can apply for these loans using the GSIS Wireless Automated Processing System (GW@PS) kiosk installed in all GSIS servicing offices and select government offices nationwide. Consolidated Loan A member who has been in government service for at least 10 years can avail of a Conso-Loan equivalent to 10 months of their monthly salary. The minimum creditable years in service a member has to have to qualify is 20 months, with the Conso-Loan proceeds equivalent to three months of his monthly salary. The gross loan amount shall be a multiple of the basic monthly salary (BMS), depending on the members accumulated record of creditable service (RCS), to wit: RCS Maximum Loan Amount Less than 20 months None 20 months or more 3 BMS 40 months or more 4 BMS 5 years or more 7 BMS 10 years or more 10 BMS The Conso-Loan is a consolidation of five different loan products into one Salary Loan, Restructured Salary Loan, Enhanced Salary Loan, Emergency Loan Assistance, and Summer One-Month Salary Loan. By availing of the ConsoLoan, you automatically fully settle your obligations from these loans.

23. You likewise receive an automatic condonation from the outstanding penalties or surcharges incurred from the abovementioned loans. Thus, the Conso-Loan provides you with the opportunity to restore your status as a member in good standing and lower your monthly amortization, especially if you are experiencing difficulty in paying your loans and have incurred arrears, penalties, and surcharges. The privilege of having the penalties condoned can be enjoyed only during the first availment of the Conso-Loan. The Conso-Loan is renewable as long as there are proceeds available. The loan is payable in six years. The loan will be charged a minimal rate of 12% based on diminishing balance. Emergency Loan The GSIS extends support to members affected by natural calamities with this affordable loan program. This is payable in three years or 36 equal monthly installments at an interest rate of six percent per annum. If an emergency loan is renewed, the balance of the outstanding loan will be deducted from the proceeds of the new loan. To qualify for the emergency loan, the memberapplicant must be: a bona fide employee of the government office within the declared calamity area; be in active service and not on leave of absence without pay; has no pending criminal or administrative charges; has no arrearages in the payment of mandatory social insurance contributions; and has no loan that has been declared in default. In addition, the agency of the member-applicant must not be suspended due to non-payment and non-remittance of premiums and loans. For a calamity-hit area, it must be declared in a state of calamity by its Sangguniang Panlalawigan/Panglungsod and approved by the GSIS Board of Trustees before members working in government offices in the said area become eligible for the Emergency Loan. Cash Advance As the name suggests, the P10,000-Cash Advance Loan offers a substantial amount of P10,000 (less service charge) at reasonable terms that will come in handy for any member. If the availing member still has an outstanding balance from the old P5,000- Cash Advance Loan, it will be deducted from the proceeds of the new loan. The loan bears an interest rate of 12 percent payable in three years. A member can avail of the P10,000-Cash Advance Loan only once. To qualify for the P10,000-Cash Advance Loan, a member must have at least three correct premium for personal and government share within the last six months prior to application of the loan. Ancillary Benefits Inflation Adjustment of Pensions Periodic adjustments of the monthly pension of all pensioners, including those allowing survivorship benefits, shall be done on the basis of what is sustainable and prudent for the GSIS as recommended by its Actuary and approved by the President & General Manager and the Board.

24. Christmas Cash Gift for Pensioners A one-month pension up to a pre-determined maximum amount is usually given to all pensioners during the Christmas season. Cash Benefits An annual dividend may be granted to all members of the GSIS whose life insurance is in force for at least one (1) year, based on the records submitted by the employer. A Dividend Allocation Formula shall be determined and circularized by the GSIS for this purpose. Loan Privileges These are financial assistance/loans available to members at low interest rates such as salary loan equivalent to a maximum of eight months salary of the member payable in one, two, three or four years, policy loan equivalent to 50% of the life insurance cash value (for LEP policies) or 90% of the termination value (for ELP policies), housing loan, subject to the paying capacity of the member. Exemption from Tax It is the policy of the State that the actuarial solvency of the funds of the GSIS shall be preserved and maintained at all times and that contribution rates necessary to sustain the benefits it provides to its members shall be kept as low as possible in order not to burden them and their employers. Taxes imposed on the GSIS tend to impair the actuarial solvency of its funds and increase the contribution rate necessary to sustain benefits it provides. Accordingly, notwithstanding any laws to the contrary, the GSIS, its assets, revenues including all accruals thereto, and benefits paid, is exempted from all taxes, assessments, fees, charges of all kinds.

You might also like

- ARD's QuestionnaireDocument2 pagesARD's QuestionnairesantasantitaNo ratings yet

- DishonestyDocument2 pagesDishonestysantasantitaNo ratings yet

- 1ST SetDocument53 pages1ST SetMyra De Guzman PalattaoNo ratings yet

- Transparency and Accountability: Managing' To Reduce Corruption Involving The StaffDocument24 pagesTransparency and Accountability: Managing' To Reduce Corruption Involving The StaffsantasantitaNo ratings yet

- Edward Kenneth Ngo TeDocument41 pagesEdward Kenneth Ngo TesantasantitaNo ratings yet

- Atty. Sixto Rodriguez JRDocument1 pageAtty. Sixto Rodriguez JRsantasantitaNo ratings yet

- PolcaseDocument243 pagesPolcasesantasantitaNo ratings yet

- Health EducationDocument7 pagesHealth EducationsantasantitaNo ratings yet

- School HymnDocument1 pageSchool Hymnsantasantita100% (1)

- PolcaseDocument243 pagesPolcasesantasantitaNo ratings yet

- Philippines Labor Dispute on Illegal DismissalDocument6 pagesPhilippines Labor Dispute on Illegal DismissalsantasantitaNo ratings yet

- 4 Ethics Social ResponsibilityDocument23 pages4 Ethics Social ResponsibilitysantasantitaNo ratings yet

- WomanDocument1 pageWomansantasantitaNo ratings yet

- WomanDocument1 pageWomansantasantitaNo ratings yet

- Case 1Document65 pagesCase 1santasantitaNo ratings yet

- GlucoseDocument2 pagesGlucosesantasantitaNo ratings yet

- Punctuation: This Is Mine. Come and Get MeDocument12 pagesPunctuation: This Is Mine. Come and Get MesantasantitaNo ratings yet

- Classification of DiabetesDocument2 pagesClassification of DiabetessantasantitaNo ratings yet

- BMI MONITORING OF ST PAUL UNIVERSITY PHILIPPINES EMPLOYEESDocument2 pagesBMI MONITORING OF ST PAUL UNIVERSITY PHILIPPINES EMPLOYEESsantasantitaNo ratings yet

- Types of Communication in The WorkplaceDocument32 pagesTypes of Communication in The Workplacesantasantita100% (2)

- Civil Law CasesDocument222 pagesCivil Law CasessantasantitaNo ratings yet

- 10 Laws For The CommunityDocument2 pages10 Laws For The CommunitysantasantitaNo ratings yet

- People of CambodiaDocument3 pagesPeople of CambodiasantasantitaNo ratings yet

- Health EducationDocument7 pagesHealth EducationsantasantitaNo ratings yet

- Ecg MachineDocument8 pagesEcg MachinesantasantitaNo ratings yet

- Balance Sheet StatementDocument8 pagesBalance Sheet StatementsantasantitaNo ratings yet

- CambodiaDocument11 pagesCambodiasantasantitaNo ratings yet

- Tax 2 CasesDocument48 pagesTax 2 CasessantasantitaNo ratings yet

- Classification of DiabetesDocument2 pagesClassification of DiabetessantasantitaNo ratings yet

- Belongings and Underpayment of Wages Against Petitioner. Petitioner Offered To Amicably Settle The Money Claims ofDocument20 pagesBelongings and Underpayment of Wages Against Petitioner. Petitioner Offered To Amicably Settle The Money Claims ofsantasantitaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1099msc PDFDocument13 pages1099msc PDFAdam SNo ratings yet

- Description: Tags: Employers HandbookDocument26 pagesDescription: Tags: Employers Handbookanon-26282No ratings yet

- Rosario Brothers v. OpleDocument7 pagesRosario Brothers v. OpleDNAANo ratings yet

- SSS Denies Total Permanent Disability Benefits Despite Progressed IllnessDocument2 pagesSSS Denies Total Permanent Disability Benefits Despite Progressed IllnessLeah Marie Sernal100% (2)

- IRS Publication 15 - 2009Document70 pagesIRS Publication 15 - 2009Wayne Schulz100% (11)

- Lundberg Proposed Amendment To SB2787 (013336)Document17 pagesLundberg Proposed Amendment To SB2787 (013336)USA TODAY NetworkNo ratings yet

- Angela Stark 3-21-10 Omar TRNSCRPTDocument15 pagesAngela Stark 3-21-10 Omar TRNSCRPTB-Nicole Williams100% (7)

- How To Complete The Tax Declaration With The French Tax Office (Officials)Document5 pagesHow To Complete The Tax Declaration With The French Tax Office (Officials)ChrisNo ratings yet

- HCM Training Manual 8.18.09Document251 pagesHCM Training Manual 8.18.09Ryan Steil100% (1)

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- PWC Indonesian Pocket Tax Book 2022Document114 pagesPWC Indonesian Pocket Tax Book 2022Daniel William LegawaNo ratings yet

- Time Inconsistency and Retirement Planning-Caliendo-2013Document5 pagesTime Inconsistency and Retirement Planning-Caliendo-2013BrijNo ratings yet

- Instructions For Forms W-2 and W-3: Pager/SgmlDocument12 pagesInstructions For Forms W-2 and W-3: Pager/SgmlIRSNo ratings yet

- Periodic Interest - A Blog, by Thomas H SpittersDocument222 pagesPeriodic Interest - A Blog, by Thomas H SpittersThomas H. SpittersNo ratings yet

- Make You New IdDocument153 pagesMake You New IdJUAN RAMON83% (6)

- Cerulli Report - Targeting The Affluent and The Emerging AffluentDocument25 pagesCerulli Report - Targeting The Affluent and The Emerging AffluentJoin RiotNo ratings yet

- Public Pensions: Emerging TrendsDocument2 pagesPublic Pensions: Emerging TrendsThe Council of State GovernmentsNo ratings yet

- Retire HappyDocument266 pagesRetire HappyEdsel Llave100% (3)

- Missing Money Update - Mark Skidmore & Catherine Austin Fitts (May 2020)Document18 pagesMissing Money Update - Mark Skidmore & Catherine Austin Fitts (May 2020)Cambiador de MundoNo ratings yet

- Gapayao v. FuloDocument18 pagesGapayao v. FuloColeen Ricaforte LuminariasNo ratings yet

- Dycaico v. Social Security SystemDocument1 pageDycaico v. Social Security Systemtoni_mlpNo ratings yet

- State Grant FormDocument7 pagesState Grant FormEatmorbananasNo ratings yet

- Turning 18 GuideDocument9 pagesTurning 18 GuideMark ReinhardtNo ratings yet

- Ministry of Labour IndonesiaDocument17 pagesMinistry of Labour Indonesiaamnasul2No ratings yet

- Cost Control During Detailed EngineeringDocument13 pagesCost Control During Detailed EngineeringBasit AnwarNo ratings yet

- Employer-Employee Relationship CasesDocument114 pagesEmployer-Employee Relationship CasesChesza MarieNo ratings yet

- The Case of The Brazilian Fiscal Responsibility Law: Rules, Results and ChallengesDocument44 pagesThe Case of The Brazilian Fiscal Responsibility Law: Rules, Results and ChallengesandremonoNo ratings yet

- Gertrude McCall v. Bernard Shapiro, Commissioner, Connecticut Welfare Department, 416 F.2d 246, 2d Cir. (1969)Document7 pagesGertrude McCall v. Bernard Shapiro, Commissioner, Connecticut Welfare Department, 416 F.2d 246, 2d Cir. (1969)Scribd Government DocsNo ratings yet

- Eccd ApplicationFormDocument2 pagesEccd ApplicationFormKatrina GambleNo ratings yet

- US Internal Revenue Service: I1040gi - 2006Document87 pagesUS Internal Revenue Service: I1040gi - 2006IRS100% (1)