Professional Documents

Culture Documents

Finman Notes 8272013

Uploaded by

Ram NgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finman Notes 8272013

Uploaded by

Ram NgCopyright:

Available Formats

Markets - the place where the exchange of goods and services takes place at a mutually agreed price or value

- affected by internal and external factors - a price discovery mechanism and intermediation process Financial Markets - venue for exchange between suppliers of capital and users of capital. Users may be suppliers and suppliers may be users of capital. - financial intermediary (banks, stock market, insurance companies, investment banks, etc.) - capital formation process - reduces cost of information and research - users (spenders) and providers (savers) of capital congregate Savers: (you help in capital formation) - putting money to banks - individuals, businesses Spenders: - individuals, businesses, governments, other entities Financial intermediation has costs (interest payments) Structures Capital Market - where long-term capital funds in debt and equity are transacted ex. Debt Capital (Bond payables), Stock market (public offerings of corporations) Money Market - where short-term capital is obtained (over-the-counter) ex. Consumer loans, credit cards, micro-finance Debt Market (domestic and foreign), Equities market (stocks), Derivatives Market (Futures, Forwards and Options) Futures - contract by which you can fix with a provider funds based from future deliveries at an agreed price (commodity futures)

Derivative instruments are for hedging - take a position now (buying or selling now to anticipate price differences in the future) for speculation of future prices for arbitrage - taking advantage of price differences in different markets Sell short - sell something you don't have right now Options - exercising an option by paying a percentage of the total price right now, having the right but not the obligation to exercise the option (not the same as down payment) External factors that drive the behavior of financial markets - environmental factors e.g. political/regulatory environment, economic, social, technological (PREST) -Global issues (geopolitics), International finance & trade (capital & fund transfers, international trade), Government intervention (government fiscal policy e.g. taxation & government spending, government monetary policy e.g. interest managed by central bank, FX, inflation) ---> BSP manage bank reserve requirements to affect interest rates Industry factors - rivalry among firms, threat of new entrants, threat of substitutes, bargaining power of buyers, and bargaining power of the suppliers Impact of Factors on Financial markets - risks. returns and cash flows, liquidity, etc. Financial management objective - minimize risk and maximize return Tangibles and Intangibles Components of Goodwill (future earning power) - Brand equity, future earning potential, market dominance, location, track record, organizational capital, human/intellectual capital

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Midterm 3 AnswersDocument7 pagesMidterm 3 AnswersDuc TranNo ratings yet

- Sn53sup 20170531 001 2200147134Document3 pagesSn53sup 20170531 001 2200147134Henry LowNo ratings yet

- Financial Markets and Institutions 7th Edition Mishkin Test BankDocument36 pagesFinancial Markets and Institutions 7th Edition Mishkin Test Bankrosiegarzamel6100% (21)

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- Remaining PagesDocument40 pagesRemaining PagesNitish Pandey0% (1)

- Amanuel MekonnenDocument121 pagesAmanuel MekonnenKalayu KirosNo ratings yet

- C1 Free Problem Solving Session Nov 2019 - Set 5Document6 pagesC1 Free Problem Solving Session Nov 2019 - Set 5JMwaipNo ratings yet

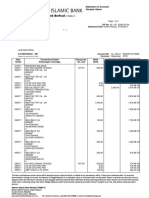

- Account Number Customer Id Account Currency Opening Balance Closing BalanceDocument1 pageAccount Number Customer Id Account Currency Opening Balance Closing Balancemohammad1jamalNo ratings yet

- Op Transaction History 29!03!2018Document2 pagesOp Transaction History 29!03!2018Avinash GuptaNo ratings yet

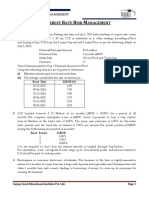

- Interest Rate Risk Management PDFDocument2 pagesInterest Rate Risk Management PDFHARSHALRAVALNo ratings yet

- Investment Banking: Presentation OnDocument56 pagesInvestment Banking: Presentation OnPradeep BandiNo ratings yet

- 2021 07 10 EOD File ChangeDocument22 pages2021 07 10 EOD File Changelalit bhandariNo ratings yet

- Financial Accounting Assignment 1 PDFDocument26 pagesFinancial Accounting Assignment 1 PDFUmair MughalNo ratings yet

- Partnership: Useful LinksDocument15 pagesPartnership: Useful LinkskittuNo ratings yet

- Print ChallanDocument1 pagePrint ChallanSameer AsifNo ratings yet

- Monthly Statement: This Month's SummaryDocument4 pagesMonthly Statement: This Month's SummaryRavi WaghmareNo ratings yet

- Varanasi DCCB Par 31.03.2023Document28 pagesVaranasi DCCB Par 31.03.2023Anuj Kumar SinghNo ratings yet

- Cuomo Mining Corporation A Public Company Whose Stock Trades On PDFDocument2 pagesCuomo Mining Corporation A Public Company Whose Stock Trades On PDFTaimur TechnologistNo ratings yet

- Audit PointsDocument37 pagesAudit PointsRajaniseer SrinivasanNo ratings yet

- Mercantile Bar Review Material 1Document209 pagesMercantile Bar Review Material 1shintaronikoNo ratings yet

- Trefi PresentationDocument16 pagesTrefi PresentationLuis Miguel Garrido MarroquinNo ratings yet

- Worksheet 8 - Comparing QuantitiesDocument5 pagesWorksheet 8 - Comparing QuantitiesRosy RaiNo ratings yet

- RWJ Chapter 1 - EUDocument17 pagesRWJ Chapter 1 - EULokkhi BowNo ratings yet

- Kerrisdale Capital Prime Office REIT AG ReportDocument19 pagesKerrisdale Capital Prime Office REIT AG ReportCanadianValueNo ratings yet

- Bridge Course in EconomicsDocument17 pagesBridge Course in EconomicsProfessor Tarun DasNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- Chapter 5 - Effects of InflationDocument19 pagesChapter 5 - Effects of InflationTanveer Ahmed HakroNo ratings yet

- 2012 Kcse Business Paper 2Document2 pages2012 Kcse Business Paper 2Lubanga JuliusNo ratings yet

- Currency Converter: EUR/ZAR DetailsDocument1 pageCurrency Converter: EUR/ZAR DetailsNombeko MbavaNo ratings yet