Professional Documents

Culture Documents

AFI3692 Consolidation Q1

Uploaded by

Theresa WatersOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFI3692 Consolidation Q1

Uploaded by

Theresa WatersCopyright:

Available Formats

QUESTION 4 MINUTES)

20

MARKS

(30

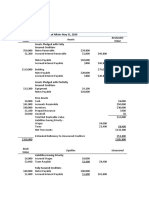

The following abridged financial statements of two related companies for the years ending 31 December 20x9, are presented to you: STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER 20X9 Pepper Ltd Assets Non-current assets Equipment Investment in Salt Ltd 400 000 ordinary shares @ fair value (Cost: R695 000) Deferred tax Current Assets Inventory Current account: Salt Ltd Better bank Trade Receivables Total Assets EQUITY AND LIABILITIES Share capital and reserves Share capital: Ordinary shares (issued @ R1 each) Retained earnings Mark-to-market reserve Shareholders interest Current liabilities Trade and other payables Better bank Current account: Pepper Ltd R 900 000 Salt Ltd R 450 000

715 000 15 000

40 000

400 000 75 000 990 000 3 095 000

300 000 70 000 700 000 1 560 000

1 000 000 1 100 000 20 000 2 120 000 900 000 75 000 3 095 000

500 000 540 000 1 040 000 450 000 70 000 1 560 000

STATEMENT OF PROFIT AND LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 20X9 Pepper Ltd Salt Ltd R R 20x9 20x9 Sales 900 000 600 000 Cost of sales (200 000) (300 000) Gross profit 700 000 300 000 Less expenses (100 000) (180 000) Profit for the year before tax 600 000 120 000 Taxation (100 000) (80 000) Profit for the year 500 000 40 000 Other comprehensive income

Items that will not be reclassified to profit and loss Mark-to-market reserve Other comprehensive income for the year TOTAL COMPREHENSIVE INCOME FOR THE YEAR

20 000 20 000 520 000

40 000

EXTRACT FROM THE STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 20X9 Mark-tomarket reserve Pepper Ltd Balance at 1 January 20x9 Profit for the year Other comprehensive income for the year Balance at 31 December 20x9 ADDITIONAL INFORMATION: Pepper Ltd obtained the interest in Salt Ltd on 1 January 20x6 when Salt Ltd's retained earnings amounted to R350 000. The share capital has remained unchanged since that date. The parties agreed that they will open bank accounts at Better bank and that both entities will issue guarantees to the bank for any overdraft that the other party might incur. Since 1 January 20x8, Pepper Ltd bought some of its inventory from Salt Ltd at cost plus 25%. Intragroup-sales between Pepper Ltd and salt Ltd were as follows: a. 20x8 b. 20x9 R 300 000 R 200 000 Retained earnings

Pepper Ltd 600 000 500 000 1 100 000

Salt Ltd 500 000 40 000 540 000

20 000 20 000

Pepper Ltd had the following inventory bought from Salt Ltd on hand at: a. 31 December 20x8 b. 31 December 20x9 R 100 000 R 150 000

Pepper Ltd classifies the investment in the subsidiary as a financial asset at fair value through other comprehensive income in terms of IFRS 9. Changes in fair value are recognised in other comprehensive income and accumulated in equity through the mark-tomarket reserve. It is the entity's policy to measure any non-controlling interests in an acquiree at their proportionate share of the acquiree's identifiable net assets. Assume that the identifiable assets acquired and the liabilities assumed at acquisition date are shown at their acquisition-date fair values, as determined in terms of IFRS 3.

On 28 December 20x9 the accountant of Salt Ltd asked Pepper Ltd to transfer R 5 000 into Salt's account at Better bank. He omitted to record the transfer in Salt's ledger. The corporate tax rate is 28%.

REQUIRED: Prepare the statement of financial position as at 31 December 20x9 in the group financial statements of Pepper Ltd and subsidiary to comply with International Financial Reporting Standards (IFRS). (20) Comparative figures are not required. QUESTION 4 MINUTES) 20 MARKS (30

The following abridged financial statements of two related companies for the years ending 31 December 20x8 and 20x9, are presented to you: STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER Assets Non-current assets Equipment Gross carry amount Accumulated depreciation Investment in Saw Ltd 350 000 ordinary shares @ cost Current assets Inventory Current account Paw Ltd VAT control account Trade receivables EQUITY AND LIABILITIES Share capital and reserves Share capital: Ordinary shares of R2 each General reserve Retained earnings Total equity Current liabilities Trade and other payables Deferred tax SARS taxation account Current account Saw Ltd Paw Ltd 20x9 R 3 300 000 2 100 000 2 500 000 400 000 1 200 000 790 000 190 000 95 000 505 000 4 090 000 Saw Ltd 20x9 R 1 450 000 1 450 000 1 900 000 450 000 1 337 000 300 000 55 000 70 000 912 000 2787 000

2 000 000 350 000 830 000 3 180 000 910 000 775 000 20 000 70 000 45 000

1 000 000 400 000 854 000 2 254 000 533 000 332 000 5 000 196 000 -

4 090 000

2 787 000

STATEMENT OF PROFIT AND LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 20X9 PAW Ltd Saw Ltd R R Sales 2 000 000 2 000 000 Cost of sales 1 600 000 1 000 000 Gross profit 400 000 1 000 000 Less expenses 150 000 300 000 Profit for before tax 250 000 700 000 Taxation 70 000 196 000 Profit after tax 180 000 504 000 Other comprehensive income Items that will not be reclassified to profit and loss Other comprehensive income for the year TOTAL COMPREHENSIVE INCOME FOR THE YEAR 180 000 504 0000

EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 20X9 General reserve Retained earnings Paw Ltd Saw Ltd Paw Ltd Saw Ltd Balance at 1 January 20x9 300 000 300 000 700 000 450 000 Changes in equity for 20x9 Profit for the year 180 000 504 000 Transfer to general reserve 50 000 100 000 (50 000) (100 000) Balance at 31 December 20x9 350 000 400 000 830 000 854 000

ADDITIONAL INFORMATION: Paw Ltd obtained the interest in Saw Ltd on 1 January 20x6 when Saw Ltd's retained profit and general reserve amounted to R350 000 and R100 000, respectively. The share capital has remained unchanged since that date. The parties agreed that Paw Ltd will buy all its merchandise from Saw Ltd at the same price at which Saw Ltd sells to all its customers. Paw Ltd has a lucrative contract with the Limpopo Province Roads Department and is able to mark up the goods purchased from Saw Ltd by 25% to arrive at their selling price. Inventory is bought by Paw Ltd from Saw Ltd at cost plus 25%. Paw Ltd had the following inventory bought from Saw Ltd on hand: 31 December 20x8 21 December 20x9 R100 000 R200 000

Intra-group sales for the 20x9 year amounts to R1 600 000.

It is the entity's policy to measure any non-controlling interests in an acquiree at their proportionate share of the acquiree's identifiable net assets. Assume that the identifiable assets acquired and the liabilities assumed at acquisition date are shown at their acquisition date fair values, as determined in terms of IFRS 3. On 23 December 20x9, Saw Ltd despatched goods at a selling price of R10 000 to Paw Ltd. Due to a strike by the truck drivers, the goods only arrived at Paw Ltd on 8 January 20x10. The corporate tax rate is 28%.

REQUIRED: Provide the pro forma consolidation journal entries to prepare the group financial statements of Paw Ltd and its subsidiaries at 31 December 20x9. The on acquisition date pro forma journal is not required. (20)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Corporate Finance Math SheetDocument19 pagesCorporate Finance Math Sheetmweaveruga100% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Bubble and Bee Organic - TemplateDocument7 pagesBubble and Bee Organic - TemplateAkanksha SaxenaNo ratings yet

- Solution Manual For Financial Accounting 9th Edition by LibbyDocument33 pagesSolution Manual For Financial Accounting 9th Edition by Libbya84964899460% (5)

- Republic Planters V AganaDocument11 pagesRepublic Planters V Aganania_artemis3414No ratings yet

- Financial Accounting - All QsDocument21 pagesFinancial Accounting - All QsJulioNo ratings yet

- Correction of ErrorsDocument119 pagesCorrection of ErrorsKevin James Sedurifa Oledan100% (1)

- UE-Caloocan Comprehensive Exam Reviewer Subjects CoverageDocument124 pagesUE-Caloocan Comprehensive Exam Reviewer Subjects CoverageCamille CastroNo ratings yet

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Chapter 11: Error Correction Cash/Accrual and Single EntryDocument27 pagesChapter 11: Error Correction Cash/Accrual and Single EntryYoshidaNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- Understanding Key Corporate Accounting ConceptsDocument18 pagesUnderstanding Key Corporate Accounting ConceptsAimae Inot MalinaoNo ratings yet

- FK Kuliah 1 Laporan KeuanganDocument21 pagesFK Kuliah 1 Laporan KeuanganGrace HerlisNo ratings yet

- Akm 2 TGL 15 MeiDocument20 pagesAkm 2 TGL 15 MeiIkhsan RamadhanNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- Analysis of Financial State MentDocument13 pagesAnalysis of Financial State MentAbdul RehmanNo ratings yet

- To Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDocument51 pagesTo Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDavid MorganNo ratings yet

- Chapter 5Document42 pagesChapter 5Annalyn MolinaNo ratings yet

- Objective of EPSDocument9 pagesObjective of EPSSuryansh GuptaNo ratings yet

- Pfizer Exam Solution ManualDocument25 pagesPfizer Exam Solution ManualDiego AguirreNo ratings yet

- Topic 5 - Dividend PolicyDocument5 pagesTopic 5 - Dividend PolicyZURINA ABDUL KADIRNo ratings yet

- Chapter 4Document28 pagesChapter 4Shibly SadikNo ratings yet

- 2.3.1 Financial Statement PresentationDocument10 pages2.3.1 Financial Statement PresentationRichard Jr RjNo ratings yet

- Kieso17e ch13 Solutions ManualDocument89 pagesKieso17e ch13 Solutions ManualMoheeb HaddadNo ratings yet

- CombinepdfDocument208 pagesCombinepdfH. TэлмэнNo ratings yet

- BUS 230A Exam 1 Spreadsheets-2Document40 pagesBUS 230A Exam 1 Spreadsheets-2fasanoj5211No ratings yet

- AUDIT OF LIABILITIESDocument46 pagesAUDIT OF LIABILITIESDan Andrei BongoNo ratings yet

- Book Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596Document2 pagesBook Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596FirdaNo ratings yet

- 04 Quiz 1 - Ca2Document8 pages04 Quiz 1 - Ca2Jen DeloyNo ratings yet

- IntermediateDocument139 pagesIntermediateabdulramani mbwanaNo ratings yet

- FA2e Chapter12 Solutions ManualDocument78 pagesFA2e Chapter12 Solutions Manual齐瀚飞No ratings yet