Professional Documents

Culture Documents

10 - Different Types of Bonds

Uploaded by

Naeem GulCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 - Different Types of Bonds

Uploaded by

Naeem GulCopyright:

Available Formats

Different Types of Bonds A bond is a debt security that is run by the government or an agency.

Following are some of the main types of bonds: 1) Corporate Bonds - These are issued by large corporations and have higher yields because there is a higher risk of a company defaulting as compared to government bonds. 2) Government Bonds - These are the bonds issued by government in its own currency. They are usually referred to as risk-free bonds. Bonds issued by national governments in foreign currencies are referred to as sovereign bonds. 3) Zero-Coupon Bonds - This is a type of bond that does not pay interest and sold at a lower than par value. For example, a zero-coupon bond with a $10,000 par value and 20 years to maturity is trading at $2,000; you will be paying $2,000 today for a bond that will be worth $10,000 in 20 years. 4) Junk Bonds - Also known as a "high-yield bonds", they are rated lower because of high default risk. 5) Convertible Bond - This gives the holder the right to convert it into common shares of the issuer at some fixed ratio in a particular date. They have a coupon payment. 6) Inflation-indexed (or inflation-linked) Bond - It provides protection against inflation, and is designed to cut out the inflation risk of an investment. 7) Foreign Currency Bond - This is issued by an issuer in a currency other than its national currency. 8) Extendible and Retractable Bonds - They have more than one maturity date. Extendable bonds allow the holder to extend its initial maturity at a specific date or dates. Characteristics of Bonds Bonds are known as fixed income or fixed interest securities because the interest payments are fixed in advance and paid on a regular schedule. Following are the main characteristics of bonds: 1) A bond is a type of security that gives the holder a financial claim on the issuing company. When you invest in bonds, you are loaning money to the issuer, and you are entitled to receive regular interest payments as well as the full return of your principle at a maturity date. 2) Bonds in general are considered less risky than stocks because they carry the promise of returning the face value of the security to the holder at maturity.

3) Most bonds pay a fixed rate of interest income until they mature. 4) There are many different types of bonds such as government bonds, foreign currency bond, etc. Corporate bonds usually offer higher yields; Government bonds are usually referred to as risk-free bonds; Convertible bond gives the holder the right to convert it into common stocks of the issuer within specified time after issuance. Why Invest in Bonds? Bonds are very similar to bank loan. Investing in bonds means that you are loaning your money to a corporation or government. Bonds are debt, whereas stocks are equity. If you buy stocks, you will become an owner in a corporation. Investors can choose to invest in short, medium or long term bonds. Longer-term bonds (with maturities of 10 years or more) tend to pay higher interest rates because they have greater risk than short-term bonds (with maturities of less than four years). Why invest in bonds? There are many benefits to buying bonds, such as the follows: 1) Investing in bonds is safer than other types of investment like stocks and shares. 2) Bonds have higher and guaranteed rate of return, with fixed interest payments. 3) Most bonds issued by governments (state or local) are exempt from federal income taxes. 4) Bond portfolios can provide stability of principal value. 5) Another advantage is that they are subject to rating systems. A bond rated 'AAA', which is the highest grade, is likely to be repaid on time and in full. 6) Bonds are very liquid and easy to sell. Advantages of Convertible Bond Issue Convertible bonds are company-issued bonds that can be converted into shares at some point in the future. This type of investment can offer many benefits/advantages such as the follows: 1) A convertible bond offers interest, known as a yield, to investors. The longer you hold the bond, the higher your yield rate will be. Such interest is paid to the investor even if the share price does not rise. If the share price on the market goes up, the bond also rises. 2) A convertible bond protects investor from a major loss during the market downturn.

3) Convertible bond gives investors more flexibility. If the company succeeds, you can convert the bonds into stocks that are valued higher than the bond. 4) This type of investment can protect you against market fluctuations, while at the same time providing annual gains. They are less volatile than common stocks. 5) An advantage for the issuing company is that it can offer the bond at a lower coupon rate than it would have to pay on a straight bond. Advantages and Disadvantages of Debentures The Advantages of Debentures are as follows: 1) The holders of the debentures are entitled to a fixed rate of interest. It can be presented as "5% Debenture". 2) Debentures are for those who want a safe and secure income as they are guaranteed payments with high interest rates. 3) They have priority over other unsecured creditors when it comes to debt repayment. The Disadvantages of Debentures are: 1) Unlike ordinary shares, debenture holders are not considered the owners of the company. They are long term loan capital and holders will have no right to vote at the annual general meeting. 2) Debentures are more secure than stocks, but will lead to a lower rate of theoretical return. 3) It is a type of debt instrument which is not secured by collateral (or physical asset). In case of bankruptcy, the bond holders are given priority over the debenture holders. Features of Debentures Debenture is a type of debt instrument issued to anyone who lend money to a company for a specified term and interest rate. In general, debentures have the following important features: 1) Debenture holders are not the owners of the company. They are considered the creditors of the corporation or in other words, the company borrow money from them through issuing debenture. 2) No voting rights. The debenture-holder is not a shareholder and cannot vote in the company's general meetings.

3) Fixed rate of interest. A debenture with a fixed charge has a fixed rate of interest. It can be presented as "10% Debenture". They are always unsecured and earns a fixed rate of interest but has no share of the profit. 4) Compulsory payment of interest. The interest on debenture is payable irrespective of whether there are profits made or not. 5) Redeemable and Irredeemable. A redeemable debenture is the one which is to be repaid within a maturity period, while Irredeemable or Non-redeemable debentures cannot be redeemed in the life time of the company and only repayable upon the liquidation of the corporation.

You might also like

- Introduction To Bond MarketDocument37 pagesIntroduction To Bond MarketRupesh N JaniNo ratings yet

- The Bond Market Structure and FunctionDocument3 pagesThe Bond Market Structure and Functionkshah_semcomNo ratings yet

- Key Financial System RolesDocument2 pagesKey Financial System RolesLinusChinNo ratings yet

- Lecture 5 PDFDocument90 pagesLecture 5 PDFsyingNo ratings yet

- Presentation Insurance PPTDocument11 pagesPresentation Insurance PPTshuchiNo ratings yet

- EBT Market: Bonds-Types and CharacteristicsDocument25 pagesEBT Market: Bonds-Types and CharacteristicsKristen HicksNo ratings yet

- Lecture 4 (Interest Rate and Bond Valuation)Document54 pagesLecture 4 (Interest Rate and Bond Valuation)Christy Ho100% (1)

- Warrants and Convertible Debentures ExplainedDocument15 pagesWarrants and Convertible Debentures ExplainedC K SachcchitNo ratings yet

- Portfolio ManagementDocument42 pagesPortfolio ManagementPrudhvinadh KopparapuNo ratings yet

- Asset Backed SecuritiesDocument179 pagesAsset Backed SecuritiesShivani NidhiNo ratings yet

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDocument43 pagesCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajNo ratings yet

- Asset AllocationDocument27 pagesAsset AllocationLomyna YapNo ratings yet

- Capital MarketDocument15 pagesCapital Marketरजनीश कुमारNo ratings yet

- Derivatives Management GuideDocument62 pagesDerivatives Management Guidesubakarthi100% (1)

- Capital Market in TanzaniaDocument11 pagesCapital Market in TanzaniaJohnBenardNo ratings yet

- Risk and ReturnDocument43 pagesRisk and ReturnAbubakar OthmanNo ratings yet

- CAPITAL ALLOWANCES GUIDEDocument4 pagesCAPITAL ALLOWANCES GUIDEAr BobNo ratings yet

- Asset Classes and Financial InstrumentsDocument33 pagesAsset Classes and Financial Instrumentskaylakshmi8314No ratings yet

- Guide to Understanding Mutual Fund Risks & RewardsDocument8 pagesGuide to Understanding Mutual Fund Risks & RewardsSAURABHNo ratings yet

- Financial Intermediaries ExplainedDocument11 pagesFinancial Intermediaries ExplainedrachealllNo ratings yet

- Bond Prices and Yields: Multiple Choice QuestionsDocument55 pagesBond Prices and Yields: Multiple Choice QuestionsLuciana Fischmann100% (1)

- Bond & Stock ValuationDocument37 pagesBond & Stock ValuationSara KarenNo ratings yet

- Introduction To DerivativesDocument14 pagesIntroduction To Derivativesking410No ratings yet

- Risk and The Required Rate of ReturnDocument31 pagesRisk and The Required Rate of Returngellie villarinNo ratings yet

- Emerging trends in global marketsDocument54 pagesEmerging trends in global marketsChandan AgarwalNo ratings yet

- What Is A "Derivative" ?Document4 pagesWhat Is A "Derivative" ?RAHULNo ratings yet

- Macro Economic Policy, Monetary and Fiscal PolicyDocument48 pagesMacro Economic Policy, Monetary and Fiscal Policysujata dawadiNo ratings yet

- Efficient Market TheoryDocument3 pagesEfficient Market TheoryVinay KushwahaaNo ratings yet

- Financial Markets and Institutions 1Document29 pagesFinancial Markets and Institutions 1Hamza Iqbal100% (1)

- The Global Market Investment Decision: Chapter 3Document35 pagesThe Global Market Investment Decision: Chapter 3Esraa AhmedNo ratings yet

- Portfolio ManagementDocument40 pagesPortfolio ManagementSayaliRewaleNo ratings yet

- Conduct of Monetary Policy Goal and TargetsDocument12 pagesConduct of Monetary Policy Goal and TargetsSumra KhanNo ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- 46370bosfinal p2 cp6 PDFDocument85 pages46370bosfinal p2 cp6 PDFgouri khanduallNo ratings yet

- FX Risk Management Transaction Exposure: Slide 1Document55 pagesFX Risk Management Transaction Exposure: Slide 1prakashputtuNo ratings yet

- CONVERTIBLE BONDS EXPLAINEDDocument3 pagesCONVERTIBLE BONDS EXPLAINEDRocking LadNo ratings yet

- 7.4 Options - Pricing Model - Black ScholesDocument36 pages7.4 Options - Pricing Model - Black ScholesSiva SankarNo ratings yet

- Derivatives Markets: Futures, Options & SwapsDocument20 pagesDerivatives Markets: Futures, Options & SwapsPatrick Earl T. PintacNo ratings yet

- Insider Trading: Laws and CasesDocument24 pagesInsider Trading: Laws and CasesharshitNo ratings yet

- Foreign Exchange Risk ManagementDocument12 pagesForeign Exchange Risk ManagementDinesh KumarNo ratings yet

- Untitled 1Document3 pagesUntitled 1cesar_mayonte_montaNo ratings yet

- Security Analysis: Chapter - 1Document47 pagesSecurity Analysis: Chapter - 1Harsh GuptaNo ratings yet

- The International Financial Environment: Multinational Corporation (MNC)Document30 pagesThe International Financial Environment: Multinational Corporation (MNC)FarhanAwaisiNo ratings yet

- Investement Analysis and Portfolio Management Chapter 6Document12 pagesInvestement Analysis and Portfolio Management Chapter 6Oumer ShaffiNo ratings yet

- Interest Rates and Bond Valuation QDocument6 pagesInterest Rates and Bond Valuation QJoana Ann ImpelidoNo ratings yet

- Bond Portfolio StrategiesDocument32 pagesBond Portfolio StrategiesSwati VermaNo ratings yet

- Monetary Policy: Aira Mae Nueva Jhessanie PinedaDocument43 pagesMonetary Policy: Aira Mae Nueva Jhessanie PinedaMAWIIINo ratings yet

- Chap 3 Fixed Income SecuritiesDocument45 pagesChap 3 Fixed Income SecuritiesHABTAMU TULU0% (1)

- Bond ConceptsDocument35 pagesBond ConceptsRaghu NayakNo ratings yet

- Warrants and Convertible SecuritiesDocument2 pagesWarrants and Convertible Securitiesalbert.lumadedeNo ratings yet

- Pricing Decisions - MCQsDocument26 pagesPricing Decisions - MCQsMaxwell;No ratings yet

- Primarry and Secondary MarketDocument7 pagesPrimarry and Secondary MarketDiyaNo ratings yet

- Euro Bond Market & TypesDocument2 pagesEuro Bond Market & TypesVikram Kaintura100% (1)

- Capital StructureDocument55 pagesCapital Structurekartik avhadNo ratings yet

- The Valuation of Long Term SecuritiesDocument62 pagesThe Valuation of Long Term SecuritiesAnees ur Rehman100% (1)

- MBODocument22 pagesMBOKanika Chauhan100% (1)

- Bond ValuationDocument29 pagesBond ValuationNur Al AhadNo ratings yet

- Bonds and Stocks (Math of Investment)Document2 pagesBonds and Stocks (Math of Investment)RCNo ratings yet

- Valuation of Debt and EquityDocument8 pagesValuation of Debt and EquityhelloNo ratings yet

- Assignment IN Macroeconomics: Submitted By: Jastine Quiel G. EusebioDocument12 pagesAssignment IN Macroeconomics: Submitted By: Jastine Quiel G. EusebioJhaz EusebioNo ratings yet

- Economic DefinedDocument2 pagesEconomic DefinedNaeem GulNo ratings yet

- Creditors and Debt GovernanceDocument23 pagesCreditors and Debt GovernanceNaeem GulNo ratings yet

- CSR ReportDocument10 pagesCSR ReportNaeem GulNo ratings yet

- IGC3 Guidance and Information For Accredited Course Providers and Candidates NEW v3 131212 Rew122201316910Document0 pagesIGC3 Guidance and Information For Accredited Course Providers and Candidates NEW v3 131212 Rew122201316910AsimNo ratings yet

- Internship Report - Student's Pack V2.3Document10 pagesInternship Report - Student's Pack V2.3Naeem GulNo ratings yet

- Modren Trends in Operation ManagementDocument9 pagesModren Trends in Operation ManagementNaeem GulNo ratings yet

- System of Government in the American PeriodDocument11 pagesSystem of Government in the American PeriodDominique BacolodNo ratings yet

- BISU COMELEC Requests Permission for Upcoming SSG ElectionDocument2 pagesBISU COMELEC Requests Permission for Upcoming SSG ElectionDanes GuhitingNo ratings yet

- Tanveer SethiDocument13 pagesTanveer SethiRoshni SethiNo ratings yet

- Routing Slip: Document Tracking SystemDocument8 pagesRouting Slip: Document Tracking SystemJeffrey Arligue ArroyoNo ratings yet

- Right to Life and Duty to Investigate Under ICCPRDocument16 pagesRight to Life and Duty to Investigate Under ICCPRRosedemaeBolongaitaNo ratings yet

- Construction Agreement 2Document2 pagesConstruction Agreement 2Aeron Dave LopezNo ratings yet

- 8 Types of Failure in A ChristianDocument7 pages8 Types of Failure in A ChristianKarl Jason JosolNo ratings yet

- But I Was Never There!: Feel As Though You Left EgyptDocument4 pagesBut I Was Never There!: Feel As Though You Left Egyptoutdash2No ratings yet

- Succession in General: A. Universal - This Is Very Catchy-It Involves The Entire Estate or Fractional or Aliquot orDocument9 pagesSuccession in General: A. Universal - This Is Very Catchy-It Involves The Entire Estate or Fractional or Aliquot orMYANo ratings yet

- Connections: Mls To Sw1Document12 pagesConnections: Mls To Sw1gautamdipendra968No ratings yet

- Legal Framework Supporting Public LibrariesDocument2 pagesLegal Framework Supporting Public LibrariesJaden CallanganNo ratings yet

- Business Practices of Cooperatives: Principles and Philosophies of CooperativismDocument32 pagesBusiness Practices of Cooperatives: Principles and Philosophies of CooperativismJaneth TugadeNo ratings yet

- Dr. M. Kochar vs. Ispita SealDocument2 pagesDr. M. Kochar vs. Ispita SealSipun SahooNo ratings yet

- Major League Baseball v. CristDocument1 pageMajor League Baseball v. CristReid MurtaughNo ratings yet

- The Magnificent-Equity ValuationDocument70 pagesThe Magnificent-Equity ValuationMohit TewaryNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDocument35 pagesSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltoncravingcoarctdbw6wNo ratings yet

- Sirat AsriDocument58 pagesSirat AsriAbbasabbasiNo ratings yet

- TL01 Behold Terra LibraDocument15 pagesTL01 Behold Terra LibraKeyProphet100% (1)

- ETB STD Application Form (Sch9) - DTT - EngDocument3 pagesETB STD Application Form (Sch9) - DTT - Engunnamed90No ratings yet

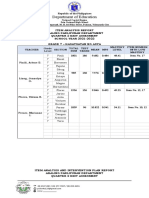

- Item Analysis Repost Sy2022Document4 pagesItem Analysis Repost Sy2022mjeduriaNo ratings yet

- Labour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Document5 pagesLabour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Seher BhatiaNo ratings yet

- Pdic 2Document6 pagesPdic 2jeams vidalNo ratings yet

- G.O.MS - No. 578 Dt. 31-12-1999Document2 pagesG.O.MS - No. 578 Dt. 31-12-1999gangaraju88% (17)

- Rabbi Isaac Elchanan Theological Seminary - The Benjamin and Rose Berger CJF Torah To-Go Series - Sivan 5774Document48 pagesRabbi Isaac Elchanan Theological Seminary - The Benjamin and Rose Berger CJF Torah To-Go Series - Sivan 5774outdash2No ratings yet

- ADR R.A. 9285 CasesDocument9 pagesADR R.A. 9285 CasesAure ReidNo ratings yet

- Indian Air Force AFCAT Application Form: Personal InformationDocument3 pagesIndian Air Force AFCAT Application Form: Personal InformationSagar SharmaNo ratings yet

- LR Procedure Hook ReleaseDocument4 pagesLR Procedure Hook Releasefredy2212No ratings yet

- C - Indemnity BondDocument1 pageC - Indemnity BondAmit KumarNo ratings yet

- Ptu Question PapersDocument2 pagesPtu Question PapersChandan Kumar BanerjeeNo ratings yet

- Islamic Mangement Vs Conventional ManagementDocument18 pagesIslamic Mangement Vs Conventional Managementlick100% (1)