Professional Documents

Culture Documents

Coal Bad Methane Pakistan

Uploaded by

muki10Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coal Bad Methane Pakistan

Uploaded by

muki10Copyright:

Available Formats

United States Environmental Protection Agency

Office of Air and Radiation 6207-J

EPA-430-N-00-004

Fall 2007

A publication of the Coalbed Methane Outreach Program (CMOP)

www.epa.gov/coalbed

Coal Mine Methane Ownership Issues

NEWS: Power Plant Uses Ventilation Air as Fuel

s interest in unconventional energy resources and greenhouse gas emissions increases, recovery and utilization of coal mine methane (CMM) is ex panding. In the U.S. and many other countries, however, industry lacks a uniform legal framework governing CMM ownership. As a result, a number of ownership conditions can serve as barriers to project development. The ques tion of who owns or has rights to the methane adsorbed to a particular coal estate does not have a straightforward answer. In most cases, a coal lease holder does not have automatic rights to CMM and must work with the gas lease holder, the surface owner, the government, or a combina tion of the three to resolve the issue.

see CMM OWNERSHIP, page 2

n Australia, the first power plant in the world using coal mine ventilation air methane (VAM) as the primary fuel is in full operation at the West Cliff Col liery of BHP Billiton. Use of this extremely lean fuel is made possible by a patented combination of emission control and steam cycle technologies. The solution is developed by MEGTEC Systems, owned by U.S. based company SEQUA Corp. The plant, which con verts the energy of coal mine VAM into electricity, offi cially opened on September 14. For additional infor mation, please view the official press release at http:// bhpbilliton.com/bb/investorsMedia/news/2007/ nswPremierMorrisIemmaOpensWorldfirstPowerGenerationProjectAtBhpBillitonsWestCliffMine.jsp

In this issue

1 1 1 2 5 Coal Mine Methane Ownership Issues News: Power Plant Uses Ventilation Air as Fuel U.S. Coal Mine Methane Conference Methane to Markets Coal Companies Hope to Receive Carbon Credits for Methane Reductions CBM/CMM News

U.S. Coal Mine Methane Conference

On-Site Registration Still Available

he 1st Annual U.S. Coal Mine Methane Conference will be held in St. Louis, Missouri, September 25-27. The 2007 Conference will feature experts on methane gas recovery from both government and industry sharing the latest in technology, methods, and legal issues of CMM recovery through project-based examples and case studies. The theme of this year's event is Innovative Developments in CMM Project Opportunities in the U.S. and around the world.

11 Upcoming Events

Access documents electronically from the Documents, Tools, and Resources pages on our Web site at www.epa.gov/coalbed To subscribe to CBM Extra and CBM Notes, please go to our website

http://www.epa.gov/cmop/mailinglist.html

The agenda is posted on the conference website (http:// www.epa.gov/cmop/cmm_conference.html). Day one will cover case studies of U.S. projects and technologies. Day two will focus on international case studies, policy, regulatory, and finance Issues. The third day is reserved for field visits. **ONLINE REGISTRATION WILL CLOSE AT 5 PM (EST) ON WEDNESDAY SEPTEMBER 19th** After this time, registration will be available on-site. If you have any questions, please contact Jim Marshall (jmarshall@ravenridge.com) at 970-256-2654. EPA thanks our sponsors for their generous support.

and register for our mailing list. You will be added within two weeks.

Fall 2007 Page 2

CMM Ownership from page 1

This article summarizes the CMM ownership conditions in the U.S. and the obstacles they present for project devel opment. The first section discusses CMM resources and rights on lands controlled by the U.S. Government the case in several western states. The second section re views the situation on private lands such as in much of the eastern U.S. where ownership of the mineral re sources is governed by state laws. Each of the two sections analyzes the ownership procedures and rules that govern both the relationship between the surface and subsurface owners and the relationship between two or more subsur face resource owners. Federal Lands and the Split Estate When most of the western U.S. was being settled, the 1909 and 1910 Coal Acts were passed requiring home steads to accept federal government reservations of any underlying coal estate, including rights to enter and develop it. Soon after, the 1914 Mineral Lands Act reserved the oil and gas estate as well as several other mineral estates for the federal government. As a result, today the U.S. Bureau of Land Management (BLM) manages 700 million acres of subsurface mineral estate. Multiple Subsurface Resources The coal and mineral acts were followed by the Mineral Leasing Act of 1920 (MLA), which clarified that federallyowned coalbed methane (CBM) is developed under an oil and gas lease not a coal lease. As a result, today a de veloper on federal lands must hold a gas lease in order to put a CBM or CMM resource to beneficial use. If a com pany holding a coal lease wants to utilize its CMM emis sions, for example, it must follow the federal leasing proce dures in place for conventional natural gas as prescribed by the BLM. These procedures involve nominating the area of interest for lease and then following competitive leasing procedures. The gas resource is leased to the highest bid der that agrees to the conditions of the tender. Generally, utilization and/or sales of CMM requires a valid gas lease, regardless of end use. If the leased gas is used by the mine or mine company, used for power produc tion, or sold to another party, gas royalties must be paid to the BLM. If no lease is held for the gas, it may only be vented to the atmosphere for safety purposes as set out by the Mine Safety and Health Administration (MSHA). The federal government has waived the gas lease and royalty requirements in the past if it deems the use of CMM as beneficial to the government. For example, utilization of

M2M Expo Registration is Live

he Registration page for the Methane to Markets Partnership Expo is live. To register for the event, you can visit the M2M website (www.methanetomarkets.org/expo), click on the registration link in the side bar, and enter your infor mation as directed. In addition, several other Expo pages have been updated. First, the Location and Travel Info page now includes more information and assistance to secure a Chinese travel visa. Second, the Accommodations page offers access to a hotel reservation form for Expo attendees to make arrangements at the China World hotel. Third, full exhibitor and sponsorship in formation, including an exhibitor kit and exhibitor floor plan, is available on the Sponsors page. Fourth, a detailed draft agenda for the Expo is now available for download. The Partnership Expo, which will take place Oc tober 30 to November 1, 2007 in Beijing, China, is the premier international forum for promoting methane recovery and use project opportunities and technolo gies. Join the international methane community and: Showcase project opportunities and technolo gies; Meet with potential project partners and financi ers; Learn about the latest technologies and ser vices; and Explore key technical, policy, and financial is sues

For information about becoming a Sponsor of the Expo, please visit http:// www.methanetomarkets.org/expo/sponsors.htm For more information about the Partnership, please visit www.epa.gov/methanetomarkets.

Fall 2007 Page 3

CMM to fuel a coal drying system will increase the value of the coal, thus increasing the royalty the government may obtain from coal sales. This use would be considered a benefit to the government and could be negotiated without a gas lease in place. Any uses not considered a benefit to the government are prohibited in the absence of a gas lease supplementary to the coal lease. A split estate arises in the event that gas rights are leased to an entity other than the mining company. When this happens, situation-specific arrangements have to be made in order to accommodate both lessees. In the case of a mine in New Mexico, CBM operators were awarded gas leases in the same coal seam that a coal operator is now mining underground. Therefore, the CBM operators have the right to produce the gas released by mining. This arrangement can result in problematic even prohibitive conflicts. In the case of this mine, a private agreement be tween the coal and CBM operators has been made to ac commodate both parties. Some attempts at clarification have been made by BLM in areas where ownership conflicts frequently arise. One such example is the establishment of the Conflict Ad ministration Zone (CAZ) in the Powder River Basin (PRB) in Wyoming and Montana. In 2000, BLM drafted Memo

randum 2000-081 setting out policy goals to deal with the conflicts frequently occurring between the large surface mines in the area and the CBM operators. In 2003, BLM issued a second memo (Memorandum 2003-053) to es tablish CAZs and to optimize the production of both coal and CBM on federal lands by reducing methane liberation during surface mining. The CAZ typically covers areas in the PRB that BLM considers vulnerable to conflict between CBM and coal development. The CAZ includes areas west of existing surface coal mines where coal will be mined within the next 10 years and where CBM develop ment is underway or anticipated. Each CAZ is reviewed annually to adjust its boundary. Once the CAZ is identified, the CBM lessees or opera tors are notified that their oil and gas lease is within the CAZ and informed of future mining activities. BLM re

quires the proper and timely development of leased re sources, the prevention of waste, and proper abandon ment of wells. BLM may offer a royalty rate reduction to oil and gas lessees and allow wells to be drilled on smaller acre centers to facilitate uninterrupted coal mining opera tions. To qualify for a royalty rate reduction the oil and gas lessee must agree to the following: ` Expedite CBM production in a manner that will maximize the recovery of the resource before re quired abandonment; and ` Cease production operations and abandon wells and facilities at BLMs request prior to the com mencement of mining operations in the area of the CBM wells. Another attempt to maximize utilization of federal min

erals is currently underway in the North Fork of the Gunni son River Valley in Western Colorado where federally owned coal and gas is managed by BLM and the federally owned surface is managed by the United States Forest Service (USFS). BLM established the Paonia-Somerset Known Recoverable Coal Resource Area (KRCRA). Within the KRCRA, coal and oil and gas leasing is man aged consistent with land use plans and lease terms with exceptions as follows: ` Where the overburden above the B-Seam of the Mesa Verde coals is less than 3,500 feet, the re sources will be managed primarily for the explora tion and development of the coal resource. ` Under no circumstances will the BLM approve any oil and gas operations that compromise maximum economic coal recovery or the safety of under ground mining operations. Surface / Subsurface Depending on the specific location of a coal estate, the overlying surface estate can be controlled by BLM, USFS, private land owners, state land owners, or another

www.epa.gov/coalbed www.methanetomarkets.org

Fall 2007 Page 4

Federal agency. When the surface rights and subsurface rights are owned by different parties, it results in a different sort of a split estate situation. According to BLM, mineral rights are considered to be the dominant estate, or take precedence over, other rights associated with the property, including those associated with owning the surface. How ever, the mineral owner must show due regard for the in terests of the surface estate owner and occupy only those portions of the surface that are reasonably necessary to develop the mineral estate. (BLM, nd). MLA protects sur face owners in the case of a surface and mineral split es tate; the miner must compensate the surface owner for damages while the surface owner must provide the min eral lessee the right to enter and use the surface of leased lands (McBride, 2006). Additionally, if industry expresses interest in a gas lease on lands where the surface is managed by another agency, such as the USFS, BLM is required to obtain ap proval and recommendations from that surface managing agency (SMA) prior to placing the lands on a competitive lease sale notice. An SMA may need to prepare or update an environmental document, which may require additional time. An agency such as the USFS will consider issues such as habitat, endangered species, and effects on water resources on the lease. Private Lands When the western U.S. was being homestead, the eastern U.S. was already under private ownership. As disputes between coal, gas, and surface owners devel oped, various state laws were established to govern CMM and CBM ownership. In 1992, the Energy Policy Act pres

sured states to resolve legal uncertainties over CBM own ership and rights to develop. Where possible, common law rules are generally followed. Today, when interpreting deeds, contracts, and leases, the goal is to implement the intentions of the parties, using evidence where necessary. When split estate property is involved, a number of issues must be considered to accommodate all parties. One con sideration is whether the activities of either the surface or various mineral estates cause reasonable or unreasonable interference for the other estate(s) and if such activities are necessary or incidental. Multiple Subsurface Resources Case law resolution is required where the deed or lease is silent on key issues concerning allocation of multi ple subsurface resources. For example, in the Wyoming Supreme Court case Newman v. RAG Wyoming Land Co. the value associated with the production of CBM was un known to the parties in 1974 when the coal deed was signed. As a result, the parties had no intent at all with regard to CBM. The court determined that the right to ven tilate gas, which is an essential element of the right to mine, is not equivalent to ownership (Heiss, 2002). For the CBM to have been granted in the deed, the court stated that the mineral must be one that "may be mined or ex tracted in association" with the coal or "in conjunction with coal mining operations (Ibid). This case looked to the U.S. Supreme Court ruling of Amoco Production Co. v. Southern Ute Indian Tribe, 526 U.S. 865 (1999) which ulti mately determined that CBM was not reserved with the coal estate on federal lands. Similar cases have occurred in other states as well. In Pennsylvania, U.S. Steel Corp. v. Hoge determined that the coal estate includes the gas, as hydrofracturing for CBM recovery would render the coal seam unmineable. In Alabama, CBM rights are also held by the coal owner as decided in Rayburn v. USX Corp. and NCNB Texas

see CMM OWNERSHIP, page 7

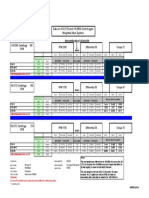

Summary Table of CBM/CMM Ownership

State Alabama Illinois Federal Lands Kentucky Montana Pennsylvania Virginia

Ownership is decided on a case specific basis considering language of deed and original intent of parties In coal seam or mine void only

Coal Lessee

Gas Lessee

Comment

West Virginia

Wyoming

One issue that Methane to Markets Coal Subcommittee members have identified as a critical obstacle to project investment and development is uncertainty about CMM ownership in various partner countries, including the United States. Without a clear understanding of who owns CMM and how the rights to its profitable utilization can be obtained, projects may be viewed as too risky to gain support from the investor community. In response, CMOP is developing a draft White Paper intended to provide an overview of CMM ownership issues in Partner countries. The final version of the White Paper will be posted on the M2M and CMOP Web sites (http://www.methanetomarkets.org and http://www.epa.gov/ coalbed, respectively).

Fall 2007 Page 5

Coal Companies Hope to Receive Carbon Credits for Methane Reductions

ethane is a major greenhouse gas (GHG), sec ond in global impact only to carbon dioxide. Un derground coal mining is one of the largest sources of methane emissions in the U.S. Each year, un derground coal mining in the U.S. liberates 2.4 million ton nes of coal mine methane (CMM). Of that, less than 30% is recovered and used (U.S.EPA, 2007b). The global benefit of CMM reductions can be equated to reductions of carbon dioxide from sources such as automobiles. For example, every thousand tonnes of CMM emissions elimi nated each year is equivalent to 21,000 tonnes of CO2, or to the removal of 4,600 automobiles from the road. One of the barriers to CMM recovery and utilization project development is cost. Drainage, collection, and utilization systems are complex and expensive to install. Two coal mines have improved the cost equation, how ever, by signing on to earn money for CMM emissions they are keeping out of the atmosphere. Jim Walter Re sources and PinnOak Resources have joined a voluntary greenhouse gas reduction trading program to turn their avoided emissions into carbon credits. The example they set may encourage other coal mining companies to follow suit and may bring new projects on line that would other wise have not gone forward. Turning Avoided Emissions into Revenue Jim Walter Resources (JWR), through Black Warrior Methane (BWM), has been collecting CMM in advance of underground operations since 1983. The original intent was to degas the Blue Creek Coal mine sufficiently to al low underground mining without requiring a massive (and economically undesirable) conventional ventilation effort. It was quickly discovered that in addition to accomplishing this task, BWMs operations could produce a market qual ity product in the form of virtually pure methane gas. Today, JWR is one of the leaders in CMM drainage in the U.S. and around the world. According to EPA data, the company sells an average of 27 million cubic feet per day of pipeline quality gas from three mines, preventing 5.5

million metric tons of CO2 equivalent (MMTCO2e) from being emitted into the atmosphere each year (U.S.EPA, 2007a). Besides the benefit of increased mine safety, the posi tive economic effects of successful degassing on the min ing operations are: ` Greatly reduced delays on the face ` More widely spaced ventilating shafts and fans ` Lower fan horsepower ` Smaller and cheaper ventilation constructions un derground In an interview with Chuck Dixon, Vice President of Engineering at JWR (retired), published in the Fall 2006 CBM Extra, Dixon said that the people at Jim Walter con sider themselves business people that happen to be min ing coal. JWR used its business acumen to turn a neces sary cost item to the Mining Division into a successful profit center. JWR applied this same can-do attitude to wards turning a potent GHG to an environmental and fi nancial asset. As a first step, in December 2006, JWR joined the Chicago Climate Exchange (CCX). As a lead ing producer and exporter of metallurgical coal, steam coal, furnace and foundry coke, and other coal-based products, JWR was the first coal company to join CCX. With the Sloss Coke Plant as part of its corporate fam ily, JWR is an emitting company with an emission reduc tion requirement. Even with the reduction commitment and given the restrictions above, JWR recognized a viable business opportunity and joined CCX, concluding that the economics of producing methane reductions eligible for CCX offsets are attractive. PinnOak became the second coal company member of CCX and is currently implementing methane reduction practices at least two of its properties. PinnOak Re

sources is an entrepreneurial coal mining and energy re sources group with annual production capacity in excess

If you don't receive our weekly email updates, CBM Notes, go to www.epa.gov/cmop/experts/update.html to sign-up now!

Fall 2007 Page 6

of 7 million tons of high quality, low volatile metallurgical coal. Selling GHG Emissions The trading program of which Jim Walter Resources and PinnOak Resources have become members is the Chicago Climate Exchange (CCX), North Americas only voluntary, legally binding greenhouse gas reduction and trading program for emission sources and offset projects. CCX members who emit GHGs make a voluntary but bind ing commitment to reduce their emissions by 6% against an established baseline from 2007 through 2010. Any member company that is able to reduce its emissions fur ther than the required level may sell its surplus as allowances to other member companies that miss their targets or to financial institutions that trade carbon credits on the CCX or bank the allowances for future trad ing. Carbon credits can also be earned through direct offset projects, such as methane collection from landfills, farm livestock waste, and coal mines. Typically, offset provid ers generate few if any direct emis sions yet provide a source for carbon credits. CCX is not the only game in town. In todays market, U.S. coal companies that want to commoditize their CMM emission reductions do not have to look far for other options. For example, at least five carbon trading companies will attend, spon sor, or speak at EPAs upcoming U.S. CMM Conference in St. Louis, Missouri. GE/AES GHG Services, Ecosecurities, Camco International, 3 Phases Energy, and Blue Source are all competing to find active and abandoned coal mines that can host a methane reduction project - and create avoided emissions. Even traditional energy companies such as DTE Energy are becoming major market players. Of course, several hurdles must be overcome before a CMM reduction project can be successfully registered as an offset. First, a coal mine must demonstrate clear gas ownership rights and environmental regulations compli ance. Second, a coal mine must carefully calculate the amount of emissions is has prevented from entering the atmosphere by using an approved offsets methodology. Some traders keep their methodology confidential while others such as GE/AES publish their version for public consumption. Still others use a third party methodology like the one being prepared by EPAs Climate Leaders, an industry-government voluntary partnership that works with companies to develop long-term comprehensive climate change strategies for its members. Finally, protocol dic tates that a third party must verify these calculations as sound and accurate.

CCX Price and Volume History 2004-2007

Conclusion Since the CCX opened, both price and volume have been steadily increasing, as illustrated in the figure above. It is likely that as carbon credits become more actively traded on commodity exchanges in the near future, the value of those credits will continue to increase. This could serve as an added incentive for coal mines to develop more CMM recovery and utilization projects in the future. This could also provide an additional revenue stream for

What do you want to know about?

If you have suggestions or requests for future CBM Extra content, please drop us a line.

Jemelkova.Barbora@epa.gov or Somers.Jayne@epa.gov

Fall 2007 Page 7

otherwise marginally profitable projects. Ultimately, this development along with many others - will contribute towards a reduction in GHG emissions. References

U.S.EPA (2007a): Identifying Opportunities for Methane Recovery at U.S. Coal Mines: Profiles of Selected Gassy Underground Coal Mines 2001-2005 (In Press). U.S.EPA (2007b): Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2005. EPA 430-R-07-002, April.

What do you want to know about?

If you have suggestions or requests for future CBM Extra content, please drop us a line.

Jemelkova.Barbora@epa.gov or Somers.Jayne@epa.gov

commencing operations; to other laws requiring compensa tion for any damages or lost agricultural production value CMM Ownership from page 4 on surface lands. In Alaska, Illinois, Montana, Oklahoma, National Bank, N.A. v. West. In both Kentucky and Vir Pennsylvania, and Wyoming, the law requires surface own ginia, legal precedent dictates that the coal rights are only for the coal, with no rights to CBM. In Illinois, CBM in coal ers and mineral operators to develop an agreement be tween them to provide for all damages. In Tennessee, the seams or mine voids is controlled by the coal estate (Flanery, 2007). In Montana, Carbon County v. Union Re- surface owner must notify the mineral operator of damages within three years of the damage, such as lost income or serve Coal Co. determined the oil and gas owner had the market value of crops destroyed, and may bring an action right to recover CBM yet the coal owner had rights to ex tract and capture gas incident to safety obligations in actual in court to determine compensation. South Dakota law is similar; however, the time period is two years for notifica mining. tion and compensation is determined based on a formula mutually decided upon by involved parties. North Dakota The Circuit Court of McDowell County, West Virginia determined in Energy Development Corporation v. Moss et also requires the mineral developer and surface owner to agree on compensation terms; however, if the surface al., Civil Action No. 98-C-173 (W. Va. Cir. June19, 2002) owner rejects the developers offer, the surface owner may that a conventional oil and gas lease, such as the ones at take the developer to court (OGAP, 2005). issue, containing the phrase all oil and gas, with nothing further, does not grant a lessee the right to extract coalbed methane from the lessors coal seams. The court deter Conclusion mined that the intent of the parties at the time the leases As unconventional energy resources become more were signed governed the interpretation of the leases. attractive, ownership issues between the various estates Surface / Subsurface In instances where surface ownership is private and subsurface mineral rights are leased or owned separately, a number of states have enacted surface owner protection or damage compensation laws. These laws vary from noti fication requirements, as in Wyoming, where oil and gas operators must provide surface owners with 5 days notice prior to staking or surveying and 30 days notice prior to involved with CMM and CBM will increase. In the absence of a federal stance on the ownership of CMM, resolutions such as the establishment of CAZs in the PRB and the KRCRA in Colorado, legally tested cases within each state, and private resolutions between coal mines and gas devel opers will be necessary to address this barrier to CMM pro ject development. Countries with disruptive ownership consee CMM OWNERSHIP, page 10

Fall 2007 Page 8

CBM/CMM News

NDRC Approves the First CBM Commercial Development Pass- port --- Panzhuang CBM cooperative project is approved to enter the initial stage of commercial development. On July 11, 2007, the China Na tional Development and Reform Commission (NDRC) notified China United Coalbed Methane Corpora tion, Ltds (CUCBM) and Asian American Gas, Inc. (AAGI, the parent company of Sino-American Energy Inc.) that the Coalbed Methane Re sources Development Plan in Panzhuang, Jincheng Shanxi prov ince is in line with Chinas policies governing the CBM industry and is listed in the national Eleventh FiveYear Plan. NDRC also approved the initial stage of the Panzhuang CBM Resources Development Plan, with an annual capacity of 500 million cu bic meters. AAGI is the first foreign company to obtain NDRCs approval for CBM commercial development in the last twenty years. Previous out put for the six gas wells reached 300,000 m/day, and the highest gas output for a single well reached 70,000 m/day. Sino-American En ergy Inc. and its Chinese partners are now preparing for the initial stage of CBM commercial development in Panzhuang. For more information, the full press release is available on the AAGI website http:// www.asianamericangas.com/web/ news.asp?lang=E&id=68&pid=283 Caterpillar Generator Sets Se- lected to Support Additional Coal Methane Projects in Shanxi, China The Sihe Coal Mine in Jincheng city, Shanxi Province, China, is the site of the worlds largest coal meth

ane power plant. When fully opera tional the project will employ 60 Cat erpillar methane-gas-powered gen erator sets to create 120 megawatts of power. Following the success of this project, Caterpillar has been se lected to provide an additional 31 methane-gas-powered generator sets to produce 54 megawatts of power at the Cheng Zhuang and Mei Gan Shi coal mines in the same city in Shanxi Province. The 3500 series genera tors used in these projects are pro duced at Caterpillar's Large Engine Center in Lafayette, Indiana. The Shanxi Jincheng Anthracite Coal Mining Group Co., Ltd. is the project developer for all three coal methane power plants. Caterpillar will work closely with its dealer WesTrac China Limited on product commis sioning and ongoing support for these projects. Methane gas found in coal seams can be highly volatile and it is a major cause of underground explo sions. Historically the CMM has been vented into the atmosphere. By cap turing the previously vented methane gas and converting it into electricity, the Caterpillar generator sets will sig nificantly reduce greenhouse gas emissions, improve mine safety and increase the capacity of the local power grid. More information is available at: http://www.cat.com/cda/ components/fullArticle? m=8703&x=7&id=598832 China Launches Largest Coalbed Methane Liquefying Project China has launched a coalbed methane liquefaction project that boasts the country's largest daily pro duction capacity. The project, based in Qinshui Basin, North China's Shanxi Province, is expected to pro duce one million cubic meters of liq

uefied coalbed methane daily when put into operation next January, said a manager of China United Coalbed Methane Corp Ltd (CUCBM), the de veloper of the project. The production lines will be completed at the end of this year. The annual output is ex pected to reach 150,000 tons and the annual sales may hit 200 million cu bic meters, the manager said. The CUCBM manager said that Hong Kong-listed China Leason Investment Group Co Ltd signed a liquefied coalbed methane purchasing contract with the company in Beijing earlier this month. Coal mine methane is usually removed during mining in or der to avoid gas explosion accidents. A proper use of the gas would not only make the best use of resources, but also help reduce greenhouse gas emissions. CUCBM, held by China National Petroleum Corporation and China National Coal Group Corp, is the only company entitled to cooper ate with foreign companies to exploit coalbed methane resources. Its coalbed methane drills make up to 85 percent of the nation's total. It has signed 21 production sharing con tracts with 10 overseas companies, with a total foreign investment of US$119 million. For more informa tion, see the China Daily August 12, 2007 http://www.chinadaily.com.cn/ bizchina/2007-08/12/ content_6022821.htm India Proclaims First Coalbed Methane Sale Great Eastern Energy Corp., a London-based company involved in the exploration, development and production of coal bed methane (CBM), said it has made India's first sale of CBM. The sale is for both industrial use and compressed natu ral gas for vehicles in Asansol, West Bengal, 125 miles northwest of Cal

Fall 2007 Page 9

cutta. The company said it is receiv ing $13-15/Mcf for the gas. Great Eastern has drilled 23 pro duction wells and plans to drill 80 more in phases over 3 years. It holds a CBM license on 210 sq km in the Raniganj coal field in West Bengal, where consulting engineers esti mated original gas in place at 1.92 trillion cubic feet (Tcf). For more in formation, go to http:// www.newswire.ca/en/releases/ archive/July2007/16/c6636.html Cathay Oil & Gas Ltd. Acquires Rights to Pakistan Coal/Coalbed Methane and will Participate in Joint Countrywide Natural Resource Exploration Project Cathay Oil & Gas Ltd. has ac quired the exclusive rights to coal bed methane and groundwater in the Pakistan province of Sindh, estimated at up to 21 Tcf of recoverable natural gas. In addition, Cathay Oil and Gas Ltd is part of a consortium of entities including Pakistan and U.S. Govern ment organizations and academic groups that will conduct a multi-year countrywide aerial and land based exploration program. Pending fund ing, Cathay will have the right to de velop additional natural resource dis coveries including coal, coal bed methane, oil, and minerals. Cathay is currently in advanced discussions with potential funders. Cathay has signed a six year exclusive right to explore for and develop the coal and associated coalbed methane (CBM) and water resources in the province of Sindh. With this contract, Cathay controls one of the largest known coal resources in the world containing over 10% of the world's total coal re serves, more than 175 billion tons as defined by the USGS. The Thar coals are known to be the western exten sion of the coals in the Cambay Basin

in India, which have reserves of some 13 Tcf of coalbed methane gas. Ca thay's area of interest covers some 135,000 square kilometers (roughly 50,000 square miles). The USGS has estimated that the Thar coal field, roughly 20% of Cathay's license, is comparable to the Powder River Ba sin of the western United States, and may contain up to 36 Tcf of coalbed methane with up to 21 Tcf potentially recoverable. Unlike China, where foreign companies must partner with the state-owned China United Coal Bed Methane on a 60% company / 40% CUCBM ratio, under the unified jurisdiction in Pakistan, Cathay owns 100% of the rights and has no re quirement to production share with any company. Cathay has also nego tiated regulations and royalty agree ments for CBM with the Sindh Gov ernment. For more information, see Cathy Oil & Gas Ltd. (press release) August 8, 2007 http://www.marketwire.com/mw/ release.do?id=758815 Gazprom Successfully Completes CBM Pilot Study in Kuzbass In early June 2007, Gazprom Russias biggest company and the worlds largest natural gas producer announced the successful completion of a pilot coalbed methane (CBM) production project in the Taldinskaya area of Kuzbass Basin. The project, located in the Kemerovo Oblast, aims to provide a reliable gas supply to the Kuzbass region while improving safety at coal mines. The availability of gas in the area will also assist in reducing the ecological footprint of the industrial region. The first phase of the project included engineering design and infrastructure develop ment. Pilot wells were constructed, and they are currently in opera tion. During 2007-2008 the project participants plan to implement a sec

ond phase of the project, which will focus on addressing the lack of a regulatory framework for CBM pro duction. Gazprom plans to begin supplying gas to customers in the second half of 2009. Gazprom and the Kemerovo Oblast Administration inked the agreement for the CBM production project in May 2003. The Kuzbass basin is favorable to CBM develop ment because of its well-developed infrastructure and proximity to the Kemerovo Oblasts large industrial centers. Gazprom estimates CBM reserves in Russia of 49 trillion cubic meters (Tcm) with 13 Tcm located in the Kuzbass region. In the first quar ter of 2007 Gazprom and Siberian Coal Energy Company (SUEK) an nounced their intention to combine their electricity and coal opera tions. If successful, the merger would combine Russias largest gas pro ducer with the countrys largest coal producer. SUEK produces about 30 percent of domestic coal and about 20 percent of exported coal for power generation. See the Gazprom press release for more information: http://www.gazprom.com/eng/ news/2007/07/24659.shtml New Company Develops Methodology for CMM Projects On July 25, 2007, GE AES Greenhouse Gas Services, LLC (GGS) a new joint venture company formed between AES and GE Finan cial Services published a methodol ogy to provide guidance in calculating emission reductions from the capture and destruction of coal mine methane (CMM). GGS will use the methodol ogy to create methane emission re ductions through investment in pro jects and to participate in emission

see CBM/CMM NEWS, page 10

Fall 2007 Page 10

CMM Ownership from page 7

ditions can learn from others who have found success. Initiatives such as the Methane to Markets Partnership provide an ideal forum for the trans fer of knowledge and experience. References

BLM (nd): Solid Minerals Coal, U.S. Department of the Interior, Bureau of Land Manage ment, Solid Minerals Group, http://www.blm.gov/nhp/300/wo320/coal.htm BLM (nd): U.S. Department of the Interior, Bureau of Land Management, Best Management Practices, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/ best_management_practices/split_estate.html Dyer and Taylor (2005): Methane Leasing on Federal Lands, 2nd Western States Coal Mine Methane Recovery and Utilization Workshop, Grand Junction, Colorado, presented by Desty Dyer of BLM and Ryan Taylor of USFS. Flanery (2007): Coalbed Methane Legal Issues in 2007, North American Coalbed Methane Forum 2007, Pittsburgh, Pennsylvania, presented by Sharon O. Flanery. Heiss (2002): Mineral Reservation Interpreted by Wyoming Supreme Court to Include Coalbed Methane. Rocky Mountain Mineral Law Foundation Mineral Law Newsletter. Volume XIX, Number 4, 2002. McBride (2006): Legal and Regulatory Issues Affecting Ownership & Development of Coalbed Methane, 7th Annual SRI CBM Conference, Denver, Colorado, presented by Law rence G. McBride. OGAP (2005): Oil and Gas at Your Door? A Landowners Guide to Oil and Gas Develop ment, Second Edition, Oil and Gas Accountability Project, July 2005, Available online: http://www.earthworksaction.org/pubs/LOguide2005book.pdf USDA (2005): Chapter 8: Response to Comments, Dry Fork Federal Coal Lease-byApplication, August 2005.

CMOP Contacts

Address inquiries about the Coalbed Methane Extra or about the USEPA Coalbed Methane Outreach Program to: Pamela Franklin Phone: 202-343-9476 E-mail: franklin.pamela@epa.gov Barbora Jemelkova Phone: 202-343-9899 E-mail: jemelkova.barbora@epa.gov Jayne Somers Phone: 202-343-9896 E-mail: somers.jayne@epa.gov Our mailing address is: US Environmental Protection Agency Coalbed Methane Outreach Program, 6207J 1200 Pennsylvania Avenue, NW Washington, DC 20460 Visit our Web site at:

www.epa.gov/coalbed www.methanetomarkets.org

CBM/CMM News from page 9

credit transactions within a market that it is helping to cre ate. A GGS standard of practice was also published to lay out the rules for creating, verifying, marketing, and auditing the entire process.

souri, from September25-27, 2007. You can access more conference information on our website: http://www.epa.gov/cmop/cmm_conference.html. BP Formalizes Plans To Explore For Coalbed Methane

The coalbed methane exploration that British Petro leum has talked about undertaking in southeastern British The methodology references international standards Columbia, to the alarm of some Montana officials, is now a including: ISO14064-2: 2006 GHG Project Standard; formal proposal. British Petroleum has asked the provincial UNFCC consolidated methodologies for coal mine methane government to grant a permit for exploration in the British ACM0008 v.3; WRI/WBSCD GHG Projects Protocol; and Columbia side of the Flathead River basin and in the prov the IPCC Guidelines for National Greenhouse Gas Invento ince's Elk River drainage. The transboundary Flathead ries. GGSs standards address issues that are unique to River system extends into Montana, and a fork of the sys the U.S. economy and standards of practice while main tem serves as Glacier National Park's western boundary. taining the rigor of the international standards. The GGS Montana officials have expressed concern that coal-bed methodologies incorporate guidelines for determining base methane work north of the border could lead to environ line emissions, and stringent monitoring protocols for me mental harm, particularly to a stateside area valued for its tering and measuring flow that conform to commonly ac recreational opportunities and for wildlife that include en cepted standards developed by third parties such as the dangered or threatened species, including grizzly bears, Society of Mechanical Engineers (SME) and the American lynx and bull trout. Sen. Max Baucus, D-Mont., recently Petroleum Institute (API). called on BP to halt plans for coal-bed methane work north of the border. For more information, see: Associated Press The President of GGS will present on this topic at August 9, 2007 EPAs U.S. CMM Conference taking place in St. Louis, Mis http://www.kxmb.com/News/151371.asp

Fall 2007 Page 11

Upcoming CBM/CMM Events

Coal Marketing Days

20-21 September 2007 Omni William Penn Hotel Pittsburgh, PA Contact: James Gillies Phone: 781-860-6110 Email: james_gillies@platts.com

North American Coalbed Methane Forum

30-31 October, 2007 Lakeview Resort Morgantown, West Virginia Email: khaminian@mail.wvu.edu

China Coal & Mining Expo 2007

69 November, 2007 National Agricultural Exhibition Hall Beijing, China Phone: 852-2881-5889 Website: http://www.chinaminingcoal.com/2007/ index.php

USEPA Coalbed Methane Outreach Program U.S. Coal Mine Methane Conference

25-27 September 2007 Millennium Hotel St. Louis, MO Contact: Mr. Jim Marshall Email: jmarshall@ravenridge.com Website: http://www.epa.gov/coalbed

9th Annual Unconventional Gas Conference

14-16 November 2007 Telus Convention Center Calgary, Alberta Phone: 403-770-2698 Email: conference@emc2events.com Website: http://www.csugconference.ca/

2007 Rocky Mountain Unconventional Gas Conf.

10-12 October 2007 South Dakota School of Mines and Technology Rapid City, SD Phone: 605-394-2693 Website: http://www.sdsmt.edu/learn/professional

Commonwealth of Virginia Energy & Sustainability (COVES) Conference

16-18 October, 2007 Virginia Military Institute Lexington, VA Phone: 540-464-7740 Email: bangja@vmi.edu Website: http://www.energyvacon.org/

Managing the Social and Environmental Consequences of Coal Mining in India: 1st International Conference

19-21 November 2007 New Delhi, India Phone: +91 326 2206372 Email: s_gurdeep2001@yahoo.com Website: http://www.mining.unsw.edu.au/

2008 AAPG Annual Convention

20-23 April 2008

San Antonio, Texas,

Call for Abstracts Deadline: September 27, 2007

Program themes include Hydrocarbons from Shale &

Coal

Website: http://www.aapg.org/sanantonio/

Methane to Markets Partnership Expo

30 October 1 November 2007 China World Hotel Beijing, China Website: http://www.methanetomarkets.org/expo

If you don't receive our weekly email updates, CBM Notes, go to www.epa.gov/cmop/experts/update.html to sign-up now!

You might also like

- Advanced Reservoir and Production Engineering for Coal Bed MethaneFrom EverandAdvanced Reservoir and Production Engineering for Coal Bed MethaneRating: 1 out of 5 stars1/5 (1)

- Valve Face BurningDocument2 pagesValve Face BurningMomina AliNo ratings yet

- Template EbcrDocument7 pagesTemplate EbcrNoraNo ratings yet

- h06263 Chap 01Document76 pagesh06263 Chap 01Pedro Pablo VillegasNo ratings yet

- Supreme CourtDocument13 pagesSupreme CourtJus EneroNo ratings yet

- Coal We Can't Wait Report - 0Document8 pagesCoal We Can't Wait Report - 0The Wilderness SocietyNo ratings yet

- By Adv. Jatin Kumar: in Pari Delicto?Document3 pagesBy Adv. Jatin Kumar: in Pari Delicto?divyaniNo ratings yet

- Research Paper On Coal Bed MethaneDocument7 pagesResearch Paper On Coal Bed Methaneefjk5y50100% (1)

- Dissertation Topics in Oil and Gas LawDocument4 pagesDissertation Topics in Oil and Gas LawPayPeopleToWritePapersWestValleyCity100% (1)

- PNB Ruling on Case Involving IEI, MMIC Contract DisputeDocument26 pagesPNB Ruling on Case Involving IEI, MMIC Contract DisputeMarie ChuNo ratings yet

- 07-13-06 Carlos Herrera Descalzi Testimony US SenateDocument11 pages07-13-06 Carlos Herrera Descalzi Testimony US Senateredio9990No ratings yet

- PNB Appeals Ruling Against It in Industrial Enterprises CaseDocument610 pagesPNB Appeals Ruling Against It in Industrial Enterprises CaseKL MuñozNo ratings yet

- UW Board of Regents Discusses Landed Property and Royalty vs Rent DistinctionDocument14 pagesUW Board of Regents Discusses Landed Property and Royalty vs Rent DistinctionBlasNo ratings yet

- United States Court of Appeals, First CircuitDocument10 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- Central Oil Company v. M/V Lamma-Forest, 821 F.2d 48, 1st Cir. (1987)Document6 pagesCentral Oil Company v. M/V Lamma-Forest, 821 F.2d 48, 1st Cir. (1987)Scribd Government DocsNo ratings yet

- Buckeye Power Light CompanyDocument0 pagesBuckeye Power Light CompanybalamaestroNo ratings yet

- Policy Brief 3Document1 pagePolicy Brief 3api-310190319No ratings yet

- Cal Berkeley-Pramanik-Sergent-Leventhal-1AC-2AC-1AR-Northwestern-Round4Document42 pagesCal Berkeley-Pramanik-Sergent-Leventhal-1AC-2AC-1AR-Northwestern-Round4Ben CrossanNo ratings yet

- The Economics of Coal Leasing On Federal Lands:: Ensuring A Fair Return To TaxpayersDocument34 pagesThe Economics of Coal Leasing On Federal Lands:: Ensuring A Fair Return To TaxpayersEd ZNo ratings yet

- Us Oil Gas Law Selective Research GuideDocument4 pagesUs Oil Gas Law Selective Research GuideMarcelo Mardones OsorioNo ratings yet

- Cleaning Up Bunker Fuels. But at What Cost?: January 2010Document4 pagesCleaning Up Bunker Fuels. But at What Cost?: January 2010api-25890976No ratings yet

- Greenpeace On The NDADocument4 pagesGreenpeace On The NDAAwlakiNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument10 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- ART - F5 - PWR - PRB Coal Users Group Industry KnowledgeDocument4 pagesART - F5 - PWR - PRB Coal Users Group Industry KnowledgeGothandaraman Muthu ManickamNo ratings yet

- Coal Bed Methane GasDocument10 pagesCoal Bed Methane GasErrol SmytheNo ratings yet

- Walls v. Midland Carbon Co., 254 U.S. 300 (1920)Document13 pagesWalls v. Midland Carbon Co., 254 U.S. 300 (1920)Scribd Government DocsNo ratings yet

- Corridor of Power - China's Trans-Burma Oil and Gas PipelinesDocument51 pagesCorridor of Power - China's Trans-Burma Oil and Gas PipelinesPugh Jutta100% (1)

- Yemen Gas To Power Options Report PDFDocument59 pagesYemen Gas To Power Options Report PDFmardiradNo ratings yet

- Take or Pay Clause in Gas ContractsDocument23 pagesTake or Pay Clause in Gas ContractsJosé ConstanteNo ratings yet

- Infrastructure Act Fracking in Focus: Reading ThreeDocument7 pagesInfrastructure Act Fracking in Focus: Reading ThreeAzyan Mohamed IbrahimNo ratings yet

- Taxpayers Lose Billions as Methane Waste Goes UncheckedDocument2 pagesTaxpayers Lose Billions as Methane Waste Goes UncheckedMenteMasterNo ratings yet

- Chevron Romania Exploration and Production SRL Operates in United Kingdom.Document37 pagesChevron Romania Exploration and Production SRL Operates in United Kingdom.LeonNo ratings yet

- Policy Analysis - CMSPA 2015Document8 pagesPolicy Analysis - CMSPA 2015Anilabh GuheyNo ratings yet

- Dissertation Cronje PJMDocument248 pagesDissertation Cronje PJMMark WestNo ratings yet

- United States v. Portland Cement Company of Utah, A Utah Corporation, 293 F.2d 826, 10th Cir. (1961)Document6 pagesUnited States v. Portland Cement Company of Utah, A Utah Corporation, 293 F.2d 826, 10th Cir. (1961)Scribd Government DocsNo ratings yet

- Gathering, Measurement, and Processing: An Overview of The Upstream, Midstream, and Downstream Segments of Our IndustryDocument27 pagesGathering, Measurement, and Processing: An Overview of The Upstream, Midstream, and Downstream Segments of Our IndustryvrajakisoriDasiNo ratings yet

- Osmium,: The Densest Metal KnownDocument1 pageOsmium,: The Densest Metal KnownwaganacletoNo ratings yet

- Alliance of CSOs Statement On AmeriDocument4 pagesAlliance of CSOs Statement On AmeriFuaad DodooNo ratings yet

- David Versus Goliath: Pipelines, Landowners, and The Pressing Need For Law ReformDocument15 pagesDavid Versus Goliath: Pipelines, Landowners, and The Pressing Need For Law ReformAnonymous mv84nhzNo ratings yet

- Patrick R. McDonald and James P. Rode v. Kinder-Morgan, Inc., Formerly Known As KN Energy, Inc., 287 F.3d 992, 10th Cir. (2002)Document10 pagesPatrick R. McDonald and James P. Rode v. Kinder-Morgan, Inc., Formerly Known As KN Energy, Inc., 287 F.3d 992, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- Brown Laws DigestsDocument11 pagesBrown Laws DigestsIrish MartinezNo ratings yet

- Captive Coal Mining FinalDocument22 pagesCaptive Coal Mining FinalAnand RawatNo ratings yet

- Industrial Enterprises Vs CADocument5 pagesIndustrial Enterprises Vs CALennart ReyesNo ratings yet

- Iogcc Model Statute and Fieldwide Unitization ReferencesDocument162 pagesIogcc Model Statute and Fieldwide Unitization ReferencesFoggers ArturoNo ratings yet

- Special Institute On Mine Closure, Financial Assurance and Final ReclamationDocument15 pagesSpecial Institute On Mine Closure, Financial Assurance and Final ReclamationUjjwayinee BiswasNo ratings yet

- Mulga Coal Company, Inc. v. United States, 825 F.2d 1547, 11th Cir. (1987)Document5 pagesMulga Coal Company, Inc. v. United States, 825 F.2d 1547, 11th Cir. (1987)Scribd Government DocsNo ratings yet

- Production sharing contracts explainedDocument2 pagesProduction sharing contracts explainedErnest First GroupNo ratings yet

- Opening of The LNG Market in MexicoDocument16 pagesOpening of The LNG Market in MexicothawdarNo ratings yet

- Decoupling For DistributorsDocument16 pagesDecoupling For DistributorsPauloNo ratings yet

- Yemen LNG Igu WGC 2006Document12 pagesYemen LNG Igu WGC 2006Rohit RoyNo ratings yet

- IGCC Newspaper Articles Report SummaryDocument4 pagesIGCC Newspaper Articles Report SummaryR.NandakumarNo ratings yet

- Out To Sea: The Dismal Economics of Offshore WindDocument30 pagesOut To Sea: The Dismal Economics of Offshore WindManhattan InstituteNo ratings yet

- 824 F.2d 223 1987-1 Trade Cases 67,626: United States Court of Appeals, Third CircuitDocument15 pages824 F.2d 223 1987-1 Trade Cases 67,626: United States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Digest - Industrial Enterprises, Inc. vs. CADocument2 pagesDigest - Industrial Enterprises, Inc. vs. CAPaul Vincent CunananNo ratings yet

- Top 8 Reasons To Oppose Risky Carbon PipelinesDocument7 pagesTop 8 Reasons To Oppose Risky Carbon PipelineshefflingerNo ratings yet

- Six Energy RecommendationsDocument10 pagesSix Energy RecommendationsRaj HaramatmanNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument9 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Wind and Water Power Program: New England and Northeast Look To The Horizon and Beyond, For Offshore WindDocument20 pagesWind and Water Power Program: New England and Northeast Look To The Horizon and Beyond, For Offshore WindNortheast Wind Resource Center (NWRC)No ratings yet

- Alberta Oil and Gas Crown Rights AdministrationDocument30 pagesAlberta Oil and Gas Crown Rights AdministrationDarren TongNo ratings yet

- Mechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaDocument20 pagesMechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaTilo ObashNo ratings yet

- The Fight Over Using Natural Gas for Transportation: AntagonistsFrom EverandThe Fight Over Using Natural Gas for Transportation: AntagonistsRating: 5 out of 5 stars5/5 (1)

- Thermal Shock Corrosion of Valve SteelsDocument13 pagesThermal Shock Corrosion of Valve Steelsmuki10No ratings yet

- Lead-Free Comparison of AlloysDocument11 pagesLead-Free Comparison of Alloysmuki10No ratings yet

- Wear Mechanism of Exhaust ValveDocument8 pagesWear Mechanism of Exhaust Valvemuki10No ratings yet

- Yogesh Aghav 2Document7 pagesYogesh Aghav 2pranjalbaruah8No ratings yet

- Nodal Analysis for Improving Gas Lift Wells ProductionDocument10 pagesNodal Analysis for Improving Gas Lift Wells ProductionSeth CheathamNo ratings yet

- Wear Behaviour of Engine ValveDocument5 pagesWear Behaviour of Engine Valvemuki10No ratings yet

- Transient Thermal Analysis of Engine Exhaust ValveDocument20 pagesTransient Thermal Analysis of Engine Exhaust Valvemuki10No ratings yet

- Technical Data Sheet: Persang Alloy Industries Pvt. LTDDocument2 pagesTechnical Data Sheet: Persang Alloy Industries Pvt. LTDmuki10No ratings yet

- SAC305 Lead Free Electrolytic Wave Solder Product Bulletin: Metallic Resources, IncDocument2 pagesSAC305 Lead Free Electrolytic Wave Solder Product Bulletin: Metallic Resources, Incmuki10No ratings yet

- 7-Failure Analysis of InternalDocument9 pages7-Failure Analysis of Internalrajeshsrajan1974No ratings yet

- Gas Lift Paper ResearchDocument15 pagesGas Lift Paper Researchmuki10No ratings yet

- Understanding Valve Design and AlloysDocument6 pagesUnderstanding Valve Design and Alloysmuki10No ratings yet

- Wear and Wear Mechanism Simulation of Heavy-Duty Engine Intake Valve and Seat InsertsDocument13 pagesWear and Wear Mechanism Simulation of Heavy-Duty Engine Intake Valve and Seat Insertsmuki10No ratings yet

- Combating automotive engine valve recession through testing and modelingDocument4 pagesCombating automotive engine valve recession through testing and modelingmuki10100% (1)

- Engine Combustion Deposit PDFDocument16 pagesEngine Combustion Deposit PDFMomina AliNo ratings yet

- SAC 305 Bar Solder Data SheetDocument2 pagesSAC 305 Bar Solder Data Sheetmuki10No ratings yet

- Effects of High Temperature On The Microstructure of Engine ValvesDocument5 pagesEffects of High Temperature On The Microstructure of Engine ValvesMomina AliNo ratings yet

- Gas Lift Paper 1Document12 pagesGas Lift Paper 1muki10No ratings yet

- Ultrapure K100LD Bar SolderDocument2 pagesUltrapure K100LD Bar Soldermuki10No ratings yet

- SAC ALLOY 305 MaterialDocument2 pagesSAC ALLOY 305 Materialmuki10No ratings yet

- Add To Study GuideDocument16 pagesAdd To Study Guidemuki10No ratings yet

- SAC ALLOY 305 MaterialDocument2 pagesSAC ALLOY 305 Materialmuki10No ratings yet

- Technical Data Sheet: Persang Alloy Industries Pvt. LTDDocument2 pagesTechnical Data Sheet: Persang Alloy Industries Pvt. LTDmuki10No ratings yet

- CNG Blasts Kill Two, Injure 10 in Peshawar, NowsheraDocument3 pagesCNG Blasts Kill Two, Injure 10 in Peshawar, Nowsheramuki10No ratings yet

- Wellbore Cleanout ReportDocument2 pagesWellbore Cleanout Reportmuki10No ratings yet

- Reference LetterDocument2 pagesReference Lettermuki10No ratings yet

- Demister EfficiencyDocument9 pagesDemister EfficiencyHastelloy MonelNo ratings yet

- Metal Foam Heat ExchangerDocument16 pagesMetal Foam Heat Exchangermuki10No ratings yet

- ME4Document12 pagesME4muki10No ratings yet

- GE - Oil Sheen Detection, An Alternative To On-Line PPM AnalyzersDocument2 pagesGE - Oil Sheen Detection, An Alternative To On-Line PPM AnalyzersjorgegppNo ratings yet

- Cooling System Exhaust System: RadiatorDocument2 pagesCooling System Exhaust System: RadiatorMd ShNo ratings yet

- 9701 s12 QP 11 PDFDocument16 pages9701 s12 QP 11 PDFHubbak KhanNo ratings yet

- H. Bateman, A. Erdélyi Et Al. - Higher Transcendental Functions 3 (1955, McGraw-Hill)Document310 pagesH. Bateman, A. Erdélyi Et Al. - Higher Transcendental Functions 3 (1955, McGraw-Hill)ITALO HERRERA MOYANo ratings yet

- Indian Oil Corporation Limited: Bhubaneswar Divisional OfficeDocument3 pagesIndian Oil Corporation Limited: Bhubaneswar Divisional OfficeBinay SahooNo ratings yet

- Tec Relay 52GDocument3 pagesTec Relay 52Gimmer nainggolanNo ratings yet

- Kingspan Spectrum™: Premium Organic Coating SystemDocument4 pagesKingspan Spectrum™: Premium Organic Coating SystemNikolaNo ratings yet

- 37th APSDC Scientific PresentationsDocument7 pages37th APSDC Scientific PresentationsSatyendra KumarNo ratings yet

- Appendix C: Time Value of MoneyDocument15 pagesAppendix C: Time Value of MoneyrockerNo ratings yet

- SDE1 V1 G2 H18 L P2 M8 - SpecificationsDocument1 pageSDE1 V1 G2 H18 L P2 M8 - SpecificationsCleverson SoaresNo ratings yet

- PDLAMMPS - made easy: An introductionDocument8 pagesPDLAMMPS - made easy: An introductionSaeed AbdNo ratings yet

- Presentation 123Document13 pagesPresentation 123Harishitha ManivannanNo ratings yet

- Finals-Insurance Week 5Document19 pagesFinals-Insurance Week 5Ryan ChristianNo ratings yet

- IotDocument88 pagesIotLalithyaNo ratings yet

- Diagram "From-To" Pada Optimasi Tata Letak Berorientasi Proses (Process Layout)Document17 pagesDiagram "From-To" Pada Optimasi Tata Letak Berorientasi Proses (Process Layout)Febrian Satrio WicaksonoNo ratings yet

- HS-2172 Vs HS-5500 Test ComparisonDocument1 pageHS-2172 Vs HS-5500 Test ComparisonRicardo VillarNo ratings yet

- Specifications Sheet ReddyDocument4 pagesSpecifications Sheet ReddyHenry CruzNo ratings yet

- Synopsis - AVR Based Realtime Online Scada With Smart Electrical Grid Automation Using Ethernet 2016Document19 pagesSynopsis - AVR Based Realtime Online Scada With Smart Electrical Grid Automation Using Ethernet 2016AmAnDeepSinghNo ratings yet

- Qualtrics Ebook Employee Lifecycle Feedback Apj - q8uL5iqE4wt2ReEuvbnIwfG4f5XuMyLtWvNFYuM5Document18 pagesQualtrics Ebook Employee Lifecycle Feedback Apj - q8uL5iqE4wt2ReEuvbnIwfG4f5XuMyLtWvNFYuM5RajNo ratings yet

- Applying Value Engineering to Improve Quality and Reduce Costs of Ready-Mixed ConcreteDocument15 pagesApplying Value Engineering to Improve Quality and Reduce Costs of Ready-Mixed ConcreteayyishNo ratings yet

- News Writing April 2019Document39 pagesNews Writing April 2019Primrose EmeryNo ratings yet

- Maya Keyboard ShortcutsDocument0 pagesMaya Keyboard ShortcutsDaryl Gomez TimatimNo ratings yet

- Director's Report Highlights Record Wheat Production in IndiaDocument80 pagesDirector's Report Highlights Record Wheat Production in Indiakamlesh tiwariNo ratings yet

- Principle Harmony RhythmDocument16 pagesPrinciple Harmony RhythmRosalinda PanopioNo ratings yet

- Mycbseguide: Cbse Class 10 Social Science Sample Paper - 08 (MCQ Based)Document10 pagesMycbseguide: Cbse Class 10 Social Science Sample Paper - 08 (MCQ Based)Abdul MuqsitNo ratings yet

- Ca2Document8 pagesCa2ChandraNo ratings yet

- Jual Sokkia SET 350X Total Station - Harga, Spesifikasi Dan ReviewDocument5 pagesJual Sokkia SET 350X Total Station - Harga, Spesifikasi Dan Reviewbramsalwa2676No ratings yet

- Abb 60 PVS-TLDocument4 pagesAbb 60 PVS-TLNelson Jesus Calva HernandezNo ratings yet