Professional Documents

Culture Documents

TVM - Essay on Time Value of Money

Uploaded by

Arun Kumar AnalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TVM - Essay on Time Value of Money

Uploaded by

Arun Kumar AnalaCopyright:

Available Formats

Assignment Essay on Time Value of Money

Table of Contents

Time Value of Money .............................................................................................................................. 1 Time Value of Money Applications ......................................................................................................... 1 Discount and Interest Rate Components ................................................................................................ 3 Interest rate in determining future value ............................................................................................... 3 Conclusion ............................................................................................................................................... 4

Time Value of Money

One might know that time is one of the most valuable assets in our lives. In the financial world the value of money is linked to time, primarily because investors expect progressive returns on their cash over periods of time, and they always compare the return from certain investments with the going or average returns in the market. Inflation on other hand erodes the purchasing power of money causing future value of one rupee to be less than the present value of a rupee. This essay will examine time value of money and the applications that determine successes or failures. After defining the applications that generalize time value of money, an explanation will be offered regarding the components of interest rates by expanding on the concept that interest rate equates the future value of money with present value.

Time Value of Money Applications

Capital markets are markets "where people, companies, and governments with more funds than they need (because they save some of their income) transfer those funds to people, companies, or governments who have a shortage of funds (because they spend more than their income)". The two major capital markets are stock and bond markets. Capital markets promote economic efficiency by moving funds from those who do not have an immediate need for it to those who do. Individuals or companies will put money at risk if the return on the intended investment is greater than the return of holding risk-free assets. An example of this would be those that invest in real estate or purchase stocks and bonds. Those that invest want the stock, bond, or real estate to grow in value or appreciate. An example of this concept would be if an individual or company invested an amount saved over the course of a year. While investing may be riskier, these individuals hope that the investment will yield a greater return than leaving the money in a savings account drawing nominal interest. In this example the companies that issue the stocks or bonds have spending needs that exceeds their income so the company will finance their spending needs by issuing securities in the

capital markets. This is a method of direct finance because the "companies borrowed directly by issuing securities to investors in the capital markets". Opposite of direct financing is indirect financing which involves a "financial intermediary between the borrower and the investor". Banks would be an example of the intermediary because they may loan out money that an individual or company has left in a savings account. The capital marketplace could not exist without these intermediaries as they are what help create strong economies. Stocks and bonds are commonly called securities "because they both represent obligations on the part of issuers to provide purchasers with expected or stated returns on the funds invested or loaned". In the primary market firms issue securities and sell them initially to the public. When a company needs capital to expand a plant, develop products, acquire another firm, or pursue other business opportunities, it may make a stock or bond offering which gives investors the opportunity to purchase ownership shares in the firm and to take part in its future growth in exchange for providing current capital. Netscape and Yahoo! are examples of companies that have grown because of a stock offering in the primary market called initial public offering. Government agencies will also use primary markets to raise funds by issuing bonds. Treasury bonds to finance part of the budget deficit as well as state and local governments will issue municipal bonds to finance long-term capital projects in a community. A long-term capital project might be building a new school or park. Secondary markets consist of a "collection of places where previously issued shares of stock and bonds are traded among owners other than the issuing firms". A corporate security that represents the ownership or debt of a company is a stock or bond. The basic form of ownership in a business is the common stock. Purchasers of common stock expect to be paid dividends and/or capital gains that result from the increases in the value of the stock they hold. The value of the stock sold on either par value or no-par value cannot be confused with two other types of stock value, market and book value. The par value of a stock is an arbitrary value for the stock designated by the company. Since par value is arbitrary, most companies will issue no-par value stock. Market value of stock is the price the stock is currently selling at and book value is determined by subtracting the company's liabilities, including the value of any preferred stock it has issued, from its assets. The net figure is then divided by the number of shares of common stock resulting in the book value. Another form of stock issued by corporations is preferred stock. Preferred stock owners receive preference in payment of dividends. Unlike common stock holders who may lose money if a company fails, preferred stock holders will receive money if a company fails because preferred stock holders receive payment before any claim by common stockholders. Bonds are another way for a corporation to receive financing. In selling bonds, corporations obtain long-term debt capital. Bondholders have a claim on corporations assets should that corporation fail which must be satisfied prior to any claims that a preferred stockholder or common stockholder be satisfied. The three categories of securities that are used for the valuation and reporting on financial statements of corporations are trading securities, available for sale securities, and held to maturity securities. Trading securities are those securities that are "bought and held primarily for sale in the

near term to generate income on short-term price differences". Available-for-sale securities may be sold, and held-to-maturity securities are considered debt securities that the investor intends to or could hold on to until maturity. In examining other securities of a corporation one must also look at temporary investments or those securities that are held by a company that are readily marketable and intended to be converted into cash usually within a year or an operating cycle. If an investment does not meet both of the mentioned criteria, the investment is called a long-term investment. Long-term investments in available-for-sale securities are reported at fair value, and investments in common stock are accounted for under the equity method is reported at equity. Ensuring compliance and fairness in trading securities is a governmental agency known as the Securities and Exchange Board of India (SEBI). According the SEBI website (2013) the mission of the agency is "to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto" . The SEBI has oversight of those that participate in trading securities. This oversight ensures that important, relevant market-related information is shared so that securities can be traded fairly to help eliminate fraud.

Discount and Interest Rate Components

Interest rate is the cost of borrowing and is usually expressed as an annual percentage of the principal. While interest rates move the value of money forward in time, the discount rates move the value of money backward in time. Therefore, the discount rate is an interest rate used to convert the future value of money to an equivalent present value. Interest rate includes the real rate of interest and a premium for the expected rate of inflation. Real interest is the interest charged for compensating the lender for borrowing money. Real interest rate is determined by the supply and demand for loanable funds. Generally, strong demand for fund leads to higher interest rates, while increased supply leads to lower interest rates. The inflation premium of the interest rate is to compensate the investor for erosion in purchasing power of money over time due to inflationary effects. In other words, the inflation premium is necessary because the purchasing power of a rupee today is higher than it will be tomorrow, since rising prices will diminish the value of that rupee. In addition to real interest and inflation components, interest rates should be adjusted for the risk factor. Because future is uncertain and risk increases with time, a premium for risk will compensate the investor for the decrease of the value of money over time.

Interest rate in determining future value

Future value is the "value of an amount that is allowed to grow at a given interest rate over a period of time". Therefore, the future value consists of the original amount of money invested and the return in the form of interest. The general formula for computing future value is FV = PV(1 + i)n, where FV is the future value, PV is the present value, i is the interest rate, and n is the number of periods. In the formula, i represent the interest rate per period, not the annual interest rate.

Discount rate in determining present value To calculate present value, a discount rate must be determined that takes in consideration how much risk is associated with a project or an investment. High risk means high discount rate while low risk means a low discount rate. The formula for computing present value is derived from the future value formula, therefore, PV = FV / [(1+i)n].

Conclusion

Time value of money is the basic concept applied by various governmental, financial and investment institutions and companies in valuing securities and capital investments. Prices of bonds are determined by using discount rates, time to maturity and face value. Banks use the time value of money principle in calculating annuities on home loans based on interest rates, present value of principal and amortization period. Pension and other fixed income funds also determine annuities based on the time value of money. Individuals and families have to consider Time Value of Money in deciding how to invest for retirement or college expenses, whether or not to buy on credit or save up for major purchases, when to purchase a house and how much to pay for it, etc. Decisions about taking equity out of their homes to pay off debts or to purchase items should be based on opportunity cost and time value of money. Time value of money serves as the foundation of finance and the way of life. Any individual that has a goal to prosper in the future needs to always make sure on the weight of everything. Being knowledgeable of savings and investing is very important. It is a valuable tool in building a successful company as well as in building a sound financial basis for a family.

You might also like

- Success StoriesDocument255 pagesSuccess Storiesflaquitoquerio125100% (10)

- ProfitGrabber Action Guide v6Document136 pagesProfitGrabber Action Guide v6ObrienFinancialNo ratings yet

- Operational ManagementDocument7 pagesOperational ManagementSabbir_07No ratings yet

- Profit Maximization and Wealth MaximizationDocument4 pagesProfit Maximization and Wealth MaximizationUvasre Sundar100% (3)

- Newspaper Headlines VocabularyDocument7 pagesNewspaper Headlines VocabularyJM RamirezNo ratings yet

- Government Spending Theories Lecture NotesDocument6 pagesGovernment Spending Theories Lecture NotesrichelNo ratings yet

- Cost ConceptsDocument24 pagesCost ConceptsAshish MathewNo ratings yet

- Ch01 11HullFundamentals6thEdDocument233 pagesCh01 11HullFundamentals6thEdKaralyos-Szénási PéterNo ratings yet

- JFINEX Accomplishment Report 1st Semester 2022 2023Document20 pagesJFINEX Accomplishment Report 1st Semester 2022 2023Jelwin BautistaNo ratings yet

- Chapter 2Document5 pagesChapter 2Sundaramani SaranNo ratings yet

- Strategic Investment Decision FrameworkDocument12 pagesStrategic Investment Decision FrameworkDeepti TripathiNo ratings yet

- Ch-4 Risk and Return-LatestDocument168 pagesCh-4 Risk and Return-Latestshakilhm0% (2)

- CoalAsia 66 LowresDocument122 pagesCoalAsia 66 LowresDery Oktory NofendraNo ratings yet

- Summary of Decision TheoryDocument15 pagesSummary of Decision TheoryРичард ГарсияNo ratings yet

- Revised Thesis ON BIRDocument15 pagesRevised Thesis ON BIRStephanie Dulay SierraNo ratings yet

- Module Chapter 5 CSR 2021Document14 pagesModule Chapter 5 CSR 2021Rhod Jasper EspañolaNo ratings yet

- Chapter5 NewDocument49 pagesChapter5 Newarturobravo100% (2)

- CASE StudyDocument26 pagesCASE Studyjerah may100% (1)

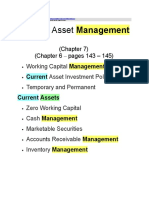

- Asset-Management Chapter 5Document5 pagesAsset-Management Chapter 5kaylee dela cruzNo ratings yet

- Risk and Return Chapter 5Document55 pagesRisk and Return Chapter 5sundas younasNo ratings yet

- Reflection PaperDocument3 pagesReflection Paper061200150% (2)

- (PHILO) Presentation Chapters17-19 JT SianaDocument52 pages(PHILO) Presentation Chapters17-19 JT SianaJennifer Tuazon-Siana100% (1)

- Toyota Product RecallDocument1 pageToyota Product RecallJunegil FabularNo ratings yet

- Chapter 2Document9 pagesChapter 2royette ladicaNo ratings yet

- Lesson: 7 Cost of CapitalDocument22 pagesLesson: 7 Cost of CapitalEshaan ChadhaNo ratings yet

- Introduction to Managerial Finance and Financial GoalsDocument3 pagesIntroduction to Managerial Finance and Financial GoalsBai Nilo100% (2)

- Challenges of Sole Proprietorship BusinessesDocument20 pagesChallenges of Sole Proprietorship BusinessesIvy CoronelNo ratings yet

- Impact of Cash Management on Profitability & Sustainability of Food RetailersDocument7 pagesImpact of Cash Management on Profitability & Sustainability of Food RetailersLhea Tomas Bicera-AlcantaraNo ratings yet

- Name: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1Document2 pagesName: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1DianeNo ratings yet

- Cost of CapitalDocument44 pagesCost of CapitalSubia Hasan50% (4)

- Business Ethics Chapter 6Document24 pagesBusiness Ethics Chapter 6nakarsha0% (1)

- Budget and Human BehaviourDocument61 pagesBudget and Human BehaviourSyarifah Rifka AlydrusNo ratings yet

- Introduction To Investment Decision in Financial Management (Open Compatibility)Document5 pagesIntroduction To Investment Decision in Financial Management (Open Compatibility)karl markxNo ratings yet

- Qualityand CompetitivenessDocument2 pagesQualityand CompetitivenessBianca Mae De QuirozNo ratings yet

- What Is The Role of An Entrepreneur in Economic DevelopmentDocument4 pagesWhat Is The Role of An Entrepreneur in Economic DevelopmentKapil VatsNo ratings yet

- Responsibility and Transfer Pricing Solving: Answer: PDocument3 pagesResponsibility and Transfer Pricing Solving: Answer: PPhielle MarilenNo ratings yet

- Ojt Journal 1Document11 pagesOjt Journal 1Gerald F. SalasNo ratings yet

- CSRDocument3 pagesCSRDalrymple CasballedoNo ratings yet

- Abs CBN Ratio AnalysisDocument2 pagesAbs CBN Ratio AnalysisMarjorie Fronda TumbaliNo ratings yet

- Pricing & Output DecisionDocument22 pagesPricing & Output DecisionJeremiah Edison Caraga Nicart, CPANo ratings yet

- Mott MacDonald Case Study AnalysisDocument18 pagesMott MacDonald Case Study AnalysisIrah Dania MontesclarosNo ratings yet

- Bullets For Chapter 4 C&CDocument4 pagesBullets For Chapter 4 C&Cgeofrey gepitulanNo ratings yet

- 10.chapter 1 (Introduction To Investments) PDFDocument41 pages10.chapter 1 (Introduction To Investments) PDFEswari Devi100% (1)

- Problem and Answer - Uas AfDocument10 pagesProblem and Answer - Uas AfPatrickNo ratings yet

- Chapter 8 Capital Market TheoryDocument23 pagesChapter 8 Capital Market TheoryEmijiano Ronquillo100% (1)

- Principles of CreditDocument16 pagesPrinciples of CreditRonnel Aldin Fernando80% (5)

- International Flow FundsDocument13 pagesInternational Flow Fundspagal larkiNo ratings yet

- Managerial Accounting FoundationsDocument49 pagesManagerial Accounting FoundationsSyed Atiq TurabiNo ratings yet

- Chapter 1Document28 pagesChapter 1Adhi WirayanaNo ratings yet

- MGRL Corner 4e - PPT - CH 01 - IEDocument29 pagesMGRL Corner 4e - PPT - CH 01 - IEDitaNo ratings yet

- Credit and Collection: Chapter 6 - Credit Decision MakingDocument51 pagesCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataNo ratings yet

- Current Asset Management Chapter SummaryDocument14 pagesCurrent Asset Management Chapter SummaryLokamNo ratings yet

- Cash Flow Statement PreparationDocument6 pagesCash Flow Statement PreparationKrystal Guile DagatanNo ratings yet

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeeNo ratings yet

- Sources of FinanceDocument26 pagesSources of Financevyasgautam28No ratings yet

- Lesson 1 Introduction PDFDocument5 pagesLesson 1 Introduction PDFAngelita Dela cruzNo ratings yet

- Go-Kart Tire Production ExamDocument4 pagesGo-Kart Tire Production ExamCheick Omar CompaoreNo ratings yet

- Gross Income Chapter SummaryDocument11 pagesGross Income Chapter SummaryharpyNo ratings yet

- Chapter 4-Time Value of MoneyDocument23 pagesChapter 4-Time Value of MoneyMoraya P. CacliniNo ratings yet

- Impact of TRAIN Law on SME Pricing StrategiesDocument48 pagesImpact of TRAIN Law on SME Pricing StrategiesAlvin ViajeNo ratings yet

- Managerial EcononicsDocument7 pagesManagerial Econonicsjay1ar1guyenaNo ratings yet

- Income Taxation Exclusions and Gross IncomeDocument6 pagesIncome Taxation Exclusions and Gross IncomeJane TuazonNo ratings yet

- Ritika Finance 2Document8 pagesRitika Finance 2Yash goyalNo ratings yet

- The Role of Financial ManagementDocument21 pagesThe Role of Financial ManagementAsAd MaanNo ratings yet

- Off Balance Sheet FinancingDocument25 pagesOff Balance Sheet FinancingAhsan MEHMOODNo ratings yet

- Other Comprehensive IncomeDocument5 pagesOther Comprehensive Incometikki0219No ratings yet

- Aleksandre Zibzibadze - International Business Confirmation PaperDocument81 pagesAleksandre Zibzibadze - International Business Confirmation PaperAlexander ZibzibadzeNo ratings yet

- The Global Economic Crisis and The Nigerian Financial SystemDocument35 pagesThe Global Economic Crisis and The Nigerian Financial SystemKing JoeNo ratings yet

- Fixed Income Analyst Jan 2023Document2 pagesFixed Income Analyst Jan 2023FransNo ratings yet

- AMORTIZATIONDocument10 pagesAMORTIZATIONManuella RyanNo ratings yet

- 1211Document201 pages1211Angel CapellanNo ratings yet

- Algorithmic Trading: and The Future of InvestingDocument29 pagesAlgorithmic Trading: and The Future of InvestingutsavNo ratings yet

- The Future of Common Stocks Benjamin Graham PDFDocument8 pagesThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalNo ratings yet

- PD WakalahDocument22 pagesPD WakalahDavid CartellaNo ratings yet

- Week 5 Lecture Handout - Sols TemplateDocument3 pagesWeek 5 Lecture Handout - Sols TemplateRavinesh PrasadNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument22 pagesChapter 3 - Financial Statement AnalysisReyes JonahNo ratings yet

- Muthoottu NCD PDFDocument244 pagesMuthoottu NCD PDFvivekrajbhilai5850No ratings yet

- Indonesia GCI ReportDocument2 pagesIndonesia GCI ReportmisterchestNo ratings yet

- Ma2 Project Screening Projec Ranking and Capital RationingDocument11 pagesMa2 Project Screening Projec Ranking and Capital RationingMangoStarr Aibelle Vegas100% (1)

- TUGAS MANAJEMEN STRATEGIDocument8 pagesTUGAS MANAJEMEN STRATEGIDani Yustiardi MunarsoNo ratings yet

- Ganje M FINC600 Week 5 Due Feb 9Document6 pagesGanje M FINC600 Week 5 Due Feb 9Nafis HasanNo ratings yet

- AFA QuizDocument15 pagesAFA QuizNoelia Mc DonaldNo ratings yet

- East West University: Final Assignment + Term PaperDocument5 pagesEast West University: Final Assignment + Term PaperHossain Mohamod IbrahimNo ratings yet

- Global Construction Paints and Coatings PDFDocument384 pagesGlobal Construction Paints and Coatings PDFSunny JoonNo ratings yet

- Fera and Fema: Submitted To: Prof. Anant AmdekarDocument40 pagesFera and Fema: Submitted To: Prof. Anant AmdekarhasbicNo ratings yet

- Diya 1Document4 pagesDiya 1Vipul I PanchasarNo ratings yet

- Tudy On Comparative Study Analysis On Mutual Fund Investments Kotak and Axis BankDocument95 pagesTudy On Comparative Study Analysis On Mutual Fund Investments Kotak and Axis BankRahul SNo ratings yet

- Soal Latihan Penilaian SahamDocument6 pagesSoal Latihan Penilaian SahamAchmad Syafi'iNo ratings yet

- C C 2021 Cfa® E: Ritical Oncepts For The XamDocument6 pagesC C 2021 Cfa® E: Ritical Oncepts For The XamGonzaloNo ratings yet